Global Commercial Floor Cleaning Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

4.73 Billion

2024

2032

USD

2.50 Billion

USD

4.73 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 4.73 Billion | |

|

|

|

|

What is the Global Commercial Floor Cleaning Equipment Market Size and Growth Rate?

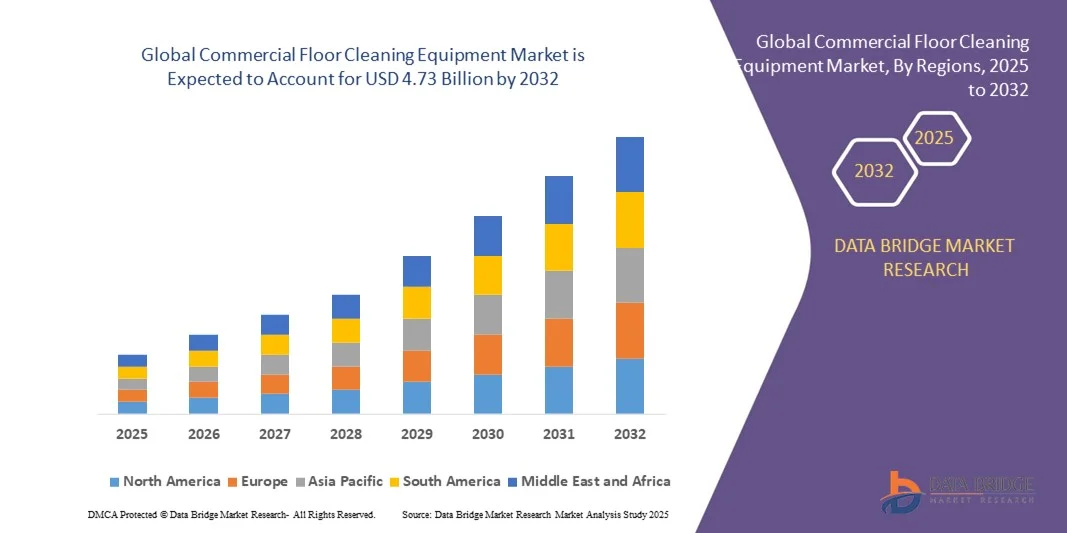

- The global commercial floor cleaning equipment market size was valued at USD 2.5 billion in 2024 and is expected to reach USD 4.73 billion by 2032, at a CAGR of 8.30% during the forecast period

- The growing demand of the electric machines, rising applications from different industry such as food and beverages, commercial building and others, growth of the healthcare industry across the globe, stringent government regulations, increased demand for effective cleaning tools such as floor, surface, furniture and carpet cleaners has resulted from rapid growth in the infrastructure sector, rapid expansion of the hospitality sector worldwide are some of the major as well as vital factors which will likely to augment the growth of the commercial floor cleaning equipment market in the projected timeframe

What are the Major Takeaways of Commercial Floor Cleaning Equipment Market?

- Rapid development of the commercial sector along with rising usages of flooring material such as stones, rubber material, natural wood which will further contribute by generating immense opportunities that will led to the growth of the commercial floor cleaning equipment market in the above-mentioned projected timeframe

- North America dominated the commercial floor cleaning equipment market with the largest revenue share of 42.25% in 2024, driven by high adoption of advanced cleaning technologies and increasing awareness of hygiene standards in commercial and industrial sectors

- The Asia-Pacific commercial floor cleaning equipment market is poised to grow at the fastest CAGR of 9.32% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increased awareness of hygiene in commercial spaces across countries such as China, Japan, and India

- The Ride-On Scrubbers segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their high efficiency, ability to clean large commercial and industrial areas quickly, and reduced labor requirements

Report Scope and Commercial Floor Cleaning Equipment Market Segmentation

|

Attributes |

Commercial Floor Cleaning Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Commercial Floor Cleaning Equipment Market?

Automation and Smart Technology Integration

- A major and rapidly evolving trend in the global commercial floor cleaning equipment market is the incorporation of advanced automation technologies, including AI-driven cleaning algorithms, autonomous navigation, and integration with smart facility management systems. These technologies are significantly improving operational efficiency, precision, and ease of use for both commercial and industrial cleaning applications

- For instance, autonomous scrubbers and sweepers from leading manufacturers such as Tennant and Nilfisk can be programmed to clean large floor areas without human intervention, optimizing routes, detecting obstacles, and adjusting cleaning intensity based on floor conditions

- AI integration enables predictive maintenance, real-time performance monitoring, and optimized cleaning schedules, reducing downtime and labor costs. Smart sensors and IoT connectivity allow managers to track equipment usage, cleaning frequency, and consumable levels remotely, ensuring consistent hygiene standards

- Integration with building management systems facilitates centralized control of multiple units, allowing facility managers to coordinate cleaning tasks alongside other operations such as HVAC and lighting

- The adoption of robotics and connected systems is reshaping expectations for commercial cleaning, encouraging manufacturers to develop smart, autonomous, and energy-efficient equipment

- Demand for commercial floor cleaning equipment with automation, connectivity, and data-driven features is growing rapidly across offices, hospitals, airports, and retail spaces, as organizations prioritize efficiency, sustainability, and operational transparency

What are the Key Drivers of Commercial Floor Cleaning Equipment Market?

- The increasing need for labor efficiency, stringent hygiene regulations, and rising adoption of automated cleaning solutions in commercial and industrial spaces are primary drivers of market growth

- For instance, in 2024, Nilfisk introduced its AI-enabled autonomous scrubbers capable of navigating complex indoor layouts, reducing labor dependency, and ensuring consistent cleaning results, illustrating industry efforts to modernize operations

- Growing concerns about sanitation and health, particularly in healthcare, hospitality, and public facilities, are boosting demand for commercial-grade cleaning equipment with advanced features such as UV sterilization, wet/dry cleaning, and touchless operation

- Facility managers increasingly seek equipment that integrates with IoT-enabled monitoring systems, enabling data analytics for cleaning performance, consumable usage, and maintenance scheduling

- The flexibility of programmable and autonomous units, remote management through mobile applications, and the reduction in operational labor costs are key factors driving adoption. Growing awareness of eco-friendly cleaning solutions and energy-efficient equipment further supports market expansion

Which Factor is Challenging the Growth of the Commercial Floor Cleaning Equipment Market?

- High initial investment costs, technical complexity, and the need for specialized maintenance are major barriers to widespread adoption of advanced commercial floor cleaning equipment

- Some facilities, particularly small businesses or budget-conscious organizations, may prefer conventional manual cleaning tools due to affordability and simplicity, limiting market penetration

- Concerns regarding equipment reliability in complex environments, software glitches, or integration issues with existing building management systems can reduce confidence among potential buyers

- Addressing these challenges through cost-effective models, user-friendly interfaces, comprehensive training, and reliable after-sales support is crucial for accelerating adoption. Manufacturers are increasingly focusing on hybrid solutions combining autonomous and operator-assisted features to bridge the gap

- While prices for smart and automated equipment are gradually decreasing, perceived cost and complexity may continue to limit adoption in certain regions or smaller commercial establishments

- Enhancing affordability, improving software reliability, and educating customers on long-term operational savings will be vital for sustained growth in the Commercial Floor Cleaning Equipment market

How is the Commercial Floor Cleaning Equipment Market Segmented?

The market is segmented on the basis of product, methods, and type.

- By Product

On the basis of product, the commercial floor cleaning equipment market is segmented into Ride-On Scrubbers, Walk Behind Scrubbers, Vacuum Cleaners, Cordless Electric Brooms, Robocleaners, Steam Cleaners, Hard Floor Cleaners, and Others. The Ride-On Scrubbers segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their high efficiency, ability to clean large commercial and industrial areas quickly, and reduced labor requirements. Ride-On Scrubbers are particularly preferred in airports, malls, hospitals, and manufacturing facilities where maintaining hygiene at scale is critical.

The Robocleaner segment is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by automation trends, AI-based navigation, and the rising adoption of autonomous cleaning solutions in offices, hotels, and large retail spaces. Robocleaners provide hands-free operation, programmable schedules, and energy-efficient cleaning, which enhances operational convenience and labor cost savings.

- By Methods

On the basis of methods, the commercial floor cleaning equipment market is segmented into Mopping, Scrubbing, Spray Cleaning, Buffing, Burnishing, and Others. The Scrubbing method accounted for the largest market revenue share of 42.7% in 2024, attributed to its effectiveness in removing tough dirt, stains, and debris from commercial and industrial flooring. Scrubbing is widely used in high-traffic areas such as airports, hospitals, and retail stores, ensuring consistent cleanliness and hygiene standards.

The Mopping segment is projected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by increased demand for eco-friendly, low-water, and semi-automated mopping systems that are suitable for smaller spaces and residential-commercial hybrid setups. Modern mopping solutions integrated with automation and robotics allow facility managers to maintain floors efficiently while minimizing manual labor and operational costs.

- By Type

On the basis of type, the commercial floor cleaning equipment market is segmented into Semi-Automated and Full-Automated equipment. The Semi-Automated segment dominated the market with a revenue share of 55% in 2024, primarily due to its affordability, operational flexibility, and suitability across small to medium-sized commercial facilities. Semi-automated units are widely used in offices, schools, and hospitals, offering an ideal balance between cost-effectiveness and enhanced cleaning efficiency.

The Full-Automated segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, driven by the rising adoption of AI-enabled autonomous scrubbers, Robocleaners, and ride-on scrubbers capable of independent navigation and optimized cleaning routines. Full-automated equipment reduces labor dependency, ensures consistent cleaning quality, and integrates with facility management systems, positioning it as the preferred solution for large-scale, high-traffic commercial spaces.

Which Region Holds the Largest Share of the Commercial Floor Cleaning Equipment Market?

- North America dominated the commercial floor cleaning equipment market with the largest revenue share of 42.25% in 2024, driven by high adoption of advanced cleaning technologies and increasing awareness of hygiene standards in commercial and industrial sectors

- Consumers and businesses in the region highly value efficiency, automation, and labor-saving features offered by Commercial Floor Cleaning Equipments such as ride-on scrubbers, robotic cleaners, and vacuum systems

- This widespread adoption is further supported by substantial investments in commercial infrastructure, technologically skilled workforce, and stringent cleanliness regulations in sectors such as healthcare, hospitality, and retail, establishing Commercial Floor Cleaning Equipments as a preferred solution for large-scale cleaning operations

U.S. Commercial Floor Cleaning Equipment Market Insight

The U.S. commercial floor cleaning equipment market captured the largest revenue share of 69% in 2024 within North America, fueled by increasing automation in commercial cleaning and the growing demand for robotic and semi-automated floor cleaning solutions. The preference for energy-efficient and low-labor solutions, combined with rising adoption of AI-enabled systems, is further propelling market growth. Integration with digital facility management systems and IoT connectivity is enhancing operational efficiency, supporting widespread adoption in offices, hospitals, malls, and industrial facilities.

Europe Commercial Floor Cleaning Equipment Market Insight

The Europe commercial floor cleaning equipment market is projected to expand at a substantial CAGR during the forecast period, driven by regulations emphasizing workplace hygiene and the increasing focus on sustainability and energy efficiency. Urbanization and growth in commercial infrastructure, alongside the adoption of robotic and automated cleaning systems, are encouraging market expansion. The region is witnessing significant growth across hospitality, healthcare, and retail sectors, with Commercial Floor Cleaning Equipments being integrated into both new construction and renovation projects.

U.K. Commercial Floor Cleaning Equipment Market Insight

The U.K. commercial floor cleaning equipment market is anticipated to grow at a noteworthy CAGR, driven by heightened hygiene standards and growing demand for automated cleaning in hospitals, hotels, and large commercial spaces. The U.K.’s strong industrial and commercial infrastructure, along with advanced retail and facility management systems, supports increasing adoption of semi-automated and robotic cleaning solutions.

Germany Commercial Floor Cleaning Equipment Market Insight

The Germany commercial floor cleaning equipment market is expected to expand at a considerable CAGR, fueled by the adoption of energy-efficient, eco-friendly, and technologically advanced cleaning equipment. Germany’s robust industrial and commercial infrastructure, combined with an emphasis on automation and sustainability, promotes the use of ride-on scrubbers, robotic cleaners, and other advanced cleaning systems. Integration with facility management and IoT-enabled monitoring further drives market growth.

Which Region is the Fastest Growing Region in the Commercial Floor Cleaning Equipment Market?

The Asia-Pacific commercial floor cleaning equipment market is poised to grow at the fastest CAGR of 9.32% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increased awareness of hygiene in commercial spaces across countries such as China, Japan, and India. Growing investments in smart buildings, hotels, and healthcare facilities, alongside government initiatives promoting automation and digitalization, are accelerating adoption. Moreover, APAC’s emergence as a manufacturing hub for semi-automated and robotic cleaning equipment is increasing affordability and availability, expanding the market to a wider customer base.

Japan Commercial Floor Cleaning Equipment Market Insight

The Japan market is gaining momentum due to high technological adoption, advanced commercial infrastructure, and demand for efficient and labor-saving cleaning solutions. The integration of robotic and AI-enabled cleaners with facility management systems supports operational efficiency in hospitals, offices, and hotels.

China Commercial Floor Cleaning Equipment Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by urbanization, increasing investment in commercial facilities, and rising demand for automated cleaning solutions. Government initiatives promoting smart city development and technological adoption in commercial spaces, along with strong domestic manufacturing of cleaning equipment, are key factors propelling market growth in China.

Which are the Top Companies in Commercial Floor Cleaning Equipment Market?

The commercial floor cleaning equipment industry is primarily led by well-established companies, including:

- Nilfisk Group (Denmark)

- Kärcher India (India)

- Tennant Company (U.S.)

- Hako GmbH (Germany)

- EUREKA S.p.A. (Italy)

- Intelligent Cleaning Equipment (Cayman Islands)

- COMAC S.p.A. (Italy)

- Fimap S.p.A. (Italy)

- Minuteman International (U.S.)

- Rawlins (U.K.)

- Nassco (U.S.)

- Bortek Industries, Inc. (U.S.)

- Clemas & Co Limited (U.K.)

- Tornado Industries (U.S.)

- WIESE USA (U.S.)

- Electrolux Professional AB (Sweden)

- Heritage Maintenance Products, LLC (U.S.)

- Rubbermaid Commercial Products (U.S.)

- Techtronic Industries Co. Ltd. (Hong Kong)

- 3M (U.S.)

- Weiler Abrasives (U.S.)

What are the Recent Developments in Global Commercial Floor Cleaning Equipment Market?

- In September 2025, MOVA showcased its latest lineup at IFA 2025, featuring the Sirius 60, Zeus 60, and Mobius 60 robot vacuums. These models integrate innovative technologies such as robotic arms, AI-powered lifting, MopSwap™ pads, and live-water roller systems, aimed at redefining robot vacuum and floorcare solutions. This launch highlights MOVA’s commitment to advancing automated cleaning technology

- In September 2025, Dyson announced two major innovations scheduled for early 2026, namely the Dyson Clean+Wash Hygiene wet and dry cleaner and the Dyson Spot+Scrub AI Robot Vacuum. These devices feature advanced functionalities including a denser microfibre roller, self-cleaning wet roller, and AI-powered stain detection, offering a transformative approach to floor cleaning. This underscores Dyson’s focus on intelligent and efficient floorcare solutions

- In September 2025, Tineco unveiled its next-generation smart cleaning innovations at IFA 2025 with the Fuman "Scientist" series of floor cleaners. The models are equipped with magnetic-sensing dynamic quick drying, ultra-thin 11cm bodies, AI navigation, and cyber-futuristic design elements, combining technology with aesthetics. This reflects Tineco’s vision for advanced, user-friendly, and futuristic floor cleaning systems

- In April 2025, Tennant Company launched the X6 ROVR, a mid-sized autonomous floor scrubber designed for large and complex areas. Capable of cleaning up to 75,000 square feet per cycle, this machine marks a significant step forward in autonomous cleaning efficiency and productivity. This release demonstrates Tennant’s leadership in industrial and commercial cleaning solutions

- In May 2024, Nilfisk Group collaborated with LionsBot to develop a new autonomous cleaning machine targeting small to medium-sized spaces such as retailers, kindergartens, and clinics. This product is designed to enhance efficiency and reliability in daily cleaning operations. The launch emphasizes Nilfisk’s dedication to practical, intelligent cleaning solutions for diverse environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.