Global Competent Cells Market

Market Size in USD Billion

CAGR :

%

USD

2.24 Billion

USD

4.85 Billion

2024

2032

USD

2.24 Billion

USD

4.85 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 4.85 Billion | |

|

|

|

|

Competent Cells Market Size

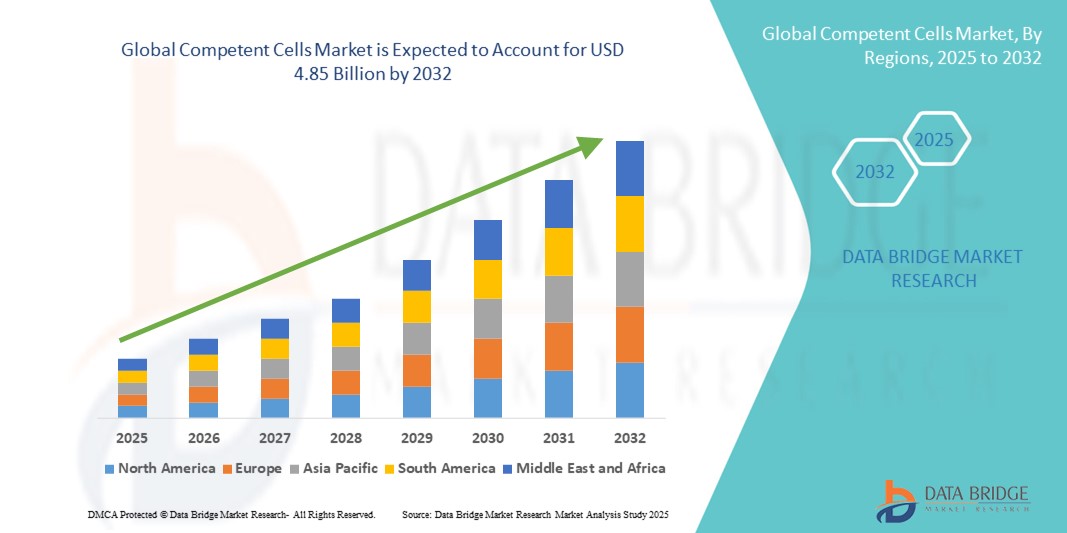

- The global competent cells market size was valued at USD 2.24 billion in 2024 and is expected to reach USD 4.85 Billion by 2032, at a CAGR of 10.11% during the forecast period

- The market growth is largely fueled by the expanding field of molecular biology and genetic engineering, where competent cells are essential tools for gene cloning, protein expression, and transformation protocols

- Furthermore, rising research activities in drug development, synthetic biology, and personalized medicine are increasing the demand for high-efficiency competent cells across academic, pharmaceutical, and biotechnology sectors. These converging factors are accelerating the uptake of competent cell solutions, thereby significantly boosting the industry's growth

Competent Cells Market Analysis

- Competent cells, which are specially treated bacterial cells capable of uptaking foreign DNA through transformation, are critical tools in genetic engineering, molecular cloning, and recombinant protein production across various research and industrial applications

- The escalating demand for competent cells is primarily fueled by the surge in biotechnology research, growing adoption of synthetic biology techniques, and rising investments in pharmaceutical R&D for drug discovery and development

- North America dominated the competent cells market with the largest revenue share of 39.2% in 2024, characterized by advanced biotechnology infrastructure, strong academic and research funding, and the presence of leading life sciences companies, with the U.S. showing significant growth in genetic transformation-based research and biomanufacturing applications

- Asia-Pacific is expected to be the fastest growing region in the competent cells market during the forecast period due to expanding biotech sectors in countries such as China and India, government initiatives promoting genomic research, and increasing demand for recombinant therapeutics

- Chemically competent cells segment dominated the competent cells market with a market share of 47% in 2024, driven by their cost-effectiveness, ease of use, and wide applicability in routine cloning procedures in academic and commercial laboratories

Report Scope and Competent Cells Market Segmentation

|

Attributes |

Competent Cells Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Competent Cells Market Trends

“Growing Preference for High-Efficiency and Ready-to-Use Cells”

- A significant and accelerating trend in the global competent cells market is the rising demand for high-efficiency, ready-to-use competent cells, driven by the increasing complexity and precision requirements of molecular biology and synthetic biology applications. These advanced cells offer superior transformation efficiency, streamlined workflows, and reduced time in experimental setups

- For instance, companies such as Thermo Fisher Scientific and Merck KGaA offer chemically and electrocompetent cells with ultra-high transformation efficiencies, ideal for applications such as library construction, protein expression, and site-directed mutagenesis

- Pre-formulated, single-use competent cells reduce the variability and complexity associated with in-house preparation, improving experimental reproducibility and saving valuable lab time. In addition, proprietary formulations such as Lucigen’s “Endura ElectroCompetent Cells” are tailored for large plasmid stability and high-fidelity cloning, meeting the evolving needs of genomic researchers

- With the advancement of synthetic biology and the growing popularity of CRISPR/Cas9 gene editing, demand is shifting toward highly specialized competent cells that support complex manipulation of genetic material, including multiplex editing and expression of toxic genes

- Furthermore, integration with automation-friendly formats such as multi-well plates and robotic-compatible packaging caters to the growing trend of high-throughput screening and laboratory automation. This trend is reshaping expectations for competent cell performance and reliability, particularly in commercial biotech and academic institutions

- As laboratories seek more efficient and consistent transformation tools, manufacturers are innovating with enhanced cell formulations that reduce preparation time while maximizing transformation yield, accelerating research timelines and improving reproducibility in gene cloning and protein expression workflows

Competent Cells Market Dynamics

Driver

“Surging Demand from Genetic Engineering and Biotech Research”

- The increasing adoption of molecular cloning, gene editing, and recombinant protein production in pharmaceutical, academic, and industrial biotech sectors is a key driver of the competent cells market. These cells form a foundational element in workflows involving DNA manipulation and are vital to a broad range of applications, from vaccine development to synthetic biology

- For instance, in March 2024, Takara Bio launched a new range of high-performance chemically competent cells optimized for complex plasmid transformation and CRISPR workflows, further illustrating the growing demand for application-specific cell lines

- As the global biotechnology sector expands and research into gene therapies, personalized medicine, and antibody production intensifies, the need for reliable, high-efficiency competent cells is rising. Academic institutions and biotech startups increasingly rely on these cells for high-throughput cloning, vector design, and pathway engineering

- Moreover, the growing availability of user-friendly transformation kits and automation-compatible competent cells is reducing technical barriers, allowing broader adoption among small labs and startups, particularly in emerging markets

- With robust product pipelines in pharmaceutical R&D and rising government support for genomics and biotech innovation, competent cells are becoming indispensable for efficient and scalable genetic manipulation processes

Restraint/Challenge

“Stability Issues and Cost Constraints in Specialized Applications”

- Despite their advantages, competent cells face challenges such as limited shelf stability and the high cost of ultra-competent or application-specific strains, which can hinder adoption in budget-conscious research environments

- For instance, some strains optimized for high transformation efficiency or complex DNA constructs require stringent storage and handling conditions, such as ultra-low temperatures, which are not feasible for all laboratories, particularly in developing regions

- In addition, while ready-to-use competent cells offer convenience and consistency, they are generally more expensive than in-house cell preparation methods, creating a cost barrier for small-scale researchers or institutions with limited funding

- Regulatory concerns over genetically modified organisms (GMOs) can also pose hurdles in certain regions, especially for strains engineered for antibiotic resistance or industrial use. Researchers may encounter delays due to compliance with biosafety and environmental regulations, especially when scaling up from bench to commercial production

- Overcoming these challenges will require innovation in stabilizing formulations, cost-effective production strategies, and expanded regulatory clarity. Companies focusing on offering economical, long-lasting, and highly efficient competent cells are such asly to gain competitive advantages in this evolving market landscape

Competent Cells Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the competent cells market is segmented into chemically competent cells and electrocompetent cells. The chemically competent cells segment dominated the market with the largest revenue share of 47% in 2024, driven by their widespread use in routine molecular biology procedures such as plasmid transformation and cloning. These cells are favored in academic and research laboratories due to their cost-effectiveness, ease of preparation, and compatibility with various transformation protocols.

Electrocompetent cells are anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their superior transformation efficiency and growing application in complex genetic engineering, including large plasmid transformation and difficult-to-clone sequences. Their utility in high-throughput and precision-demanding workflows, particularly in synthetic biology and pharmaceutical development, supports this accelerated growth.

- By Application

On the basis of application, the competent cells market is segmented into protein expression, cloning, biotechnology, and other applications. The cloning segment held the largest market revenue share in 2024, attributed to its foundational role in genetic engineering, recombinant DNA technology, and plasmid amplification workflows. Academic and commercial laboratories extensively use competent cells in DNA cloning for functional genomics, library construction, and gene synthesis.

The protein expression segment is expected to witness the highest CAGR from 2025 to 2032 due to increasing demand for recombinant proteins in pharmaceuticals, diagnostics, and industrial enzymes. The need for high-yield and reliable expression systems is driving the use of competent cells specifically engineered for protein expression, such as BL21(DE3) strains.

- By End User

On the basis of end user, the competent cells market is segmented into pharmaceutical and biotechnology companies, academic research institutes, and contract research organizations (CROs). Pharmaceutical and biotechnology companies accounted for the largest market share in 2024, owing to their extensive use of competent cells in drug discovery, gene therapy development, and biologics production. Their demand is sustained by investments in R&D, production of recombinant proteins, and expansion of gene-based therapeutics.

Academic research institutes are projected to grow at the fastest pace during the forecast period, driven by increasing funding in life sciences, the adoption of CRISPR technologies, and the proliferation of genomics research across educational institutions globally. The growth of academic biotechnology programs and government-supported research initiatives further contribute to this trend.

Competent Cells Market Regional Analysis

- North America dominated the competent cells market with the largest revenue share of 39.2% in 2024, characterized by advanced biotechnology infrastructure, strong academic and research funding, and the presence of leading life sciences companies, with the U.S. showing significant growth in genetic transformation-based research and biomanufacturing applications

- The region’s academic institutions and CROs are major consumers of competent cells, owing to their extensive use in molecular cloning, gene expression, and genetic engineering projects

- This widespread adoption is further supported by strong government funding for genomics research, a highly skilled scientific workforce, and the increasing application of recombinant technologies in drug development, making North America a key hub for competent cell innovations and commercial use

U.S. Competent Cells Market Insight

The U.S. competent cells market captured the largest revenue share of 79% in 2024 within North America, fueled by the country’s leadership in biotechnology research and pharmaceutical innovation. Academic institutions, biotech firms, and pharmaceutical companies consistently drive demand for high-efficiency transformation cells in applications such as genetic cloning, protein expression, and gene therapy research. The presence of leading life sciences companies and advanced research infrastructure, combined with strong funding for molecular biology and synthetic biology projects, continues to propel the market forward.

Europe Competent Cells Market Insight

The Europe competent cells market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing investment in genomics research and biopharmaceutical development. Strict regulatory frameworks and a strong emphasis on scientific research are pushing the demand for reliable and efficient transformation tools. The region is witnessing increased use of competent cells in gene expression studies and recombinant protein production across academic and commercial research institutions. Integration of competent cells in biotechnological innovations and industrial processes is also gaining momentum in both developed and emerging European countries.

U.K. Competent Cells Market Insight

The U.K. competent cells market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country's strong biosciences sector and government-supported R&D initiatives. With numerous academic institutions and research hubs focusing on genetic engineering and synthetic biology, there is consistent demand for high-performance competent cells. The growth is further supported by collaborations between universities and biotech startups, and by a focus on innovation in life sciences and personalized medicine.

Germany Competent Cells Market Insight

The Germany competent cells market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's leadership in scientific research, industrial biotechnology, and pharmaceutical development. Germany’s emphasis on innovation and precision makes it a strong consumer of advanced transformation tools, especially in protein expression and synthetic biology. The presence of globally recognized research institutes and industrial biomanufacturers is reinforcing the demand for high-efficiency competent cells across various applications.

Asia-Pacific Competent Cells Market Insight

The Asia-Pacific competent cells market is poised to grow at the fastest CAGR of 23.2% during the forecast period of 2025 to 2032, driven by a surge in molecular biology research, biotechnology investments, and academic activity in countries such as China, Japan, and India. Government initiatives promoting life sciences and expanding biotech infrastructure are key contributors. The region’s rising demand for cost-effective and high-performance competent cells across pharmaceutical, agricultural, and academic sectors is rapidly broadening the consumer base.

Japan Competent Cells Market Insight

The Japan competent cells market is gaining momentum due to the country’s strong research orientation, advanced life sciences sector, and high emphasis on quality and innovation. Japanese laboratories and biotech firms increasingly utilize competent cells for cloning and recombinant protein production. As Japan continues to invest in personalized medicine and genomic technologies, the integration of competent cells into research workflows is expected to deepen, particularly in therapeutic development and academic genetics studies.

India Competent Cells Market Insight

The India competent cells market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to expanding research institutions, a growing pharmaceutical industry, and strong demand for cost-efficient molecular biology tools. India’s rise as a biotechnology hub, supported by government-backed programs and private investments, is driving the need for reliable and high-efficiency competent cells. Domestic production capabilities and increasing academic participation in molecular biology and genetic engineering are further fueling market growth across the country.

Competent Cells Market Share

The competent cells industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Promega Corporation (U.S.)

- Takara Bio Inc. (Japan)

- New England Biolabs (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Transgen Biotech Co., LTD (China)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Zymo Research Corporation (U.S.)

- QIAGEN (Netherlands)

- GenScript (U.S.)

- OriGene Technologies, Inc. (U.S.)

- HiMedia Laboratories (India)

- Avantor, Inc. (U.S.)

- Scarab Genomics, LLC (U.S.)

- LGC Biosearch Technologies (U.S.)

- Cytek Biosciences (U.S.)

- Enzynomics Co. Ltd. (South Korea)

- Klee GmbH (Germany)

- NZYTech (Portugal)

What are the Recent Developments in Global Competent Cells Market?

- In April 2023, Thermo Fisher Scientific Inc. expanded its portfolio of chemically competent cells with the launch of One Shot MAX Efficiency DH5α-T1R Competent Cells, offering ultra-high transformation efficiency for cloning difficult DNA sequences. This development addresses researchers' growing needs for consistent and high-yield cloning results, reflecting Thermo Fisher's ongoing commitment to advancing molecular biology tools with user-friendly, high-performance solutions

- In March 2023, Merck KGaA (MilliporeSigma) introduced a new range of electrocompetent cells under its Novagen brand, engineered for high-throughput applications in protein expression and synthetic biology. These cells are optimized for large plasmid uptake and difficult-to-clone genes, providing a valuable tool for biotech and academic researchers. The launch reinforces Merck’s strategic focus on facilitating precision and scalability in genetic engineering

- In February 2023, Takara Bio Inc. announced the release of HST08 Premium Competent Cells, specifically designed for high-efficiency cloning and library construction. This product was developed in response to increasing demand from pharmaceutical and biotech companies for reliable transformation systems in gene therapy and vaccine research. Takara’s expansion in competent cells strengthens its product line aimed at supporting advanced genomic applications

- In February 2023, Lucigen (a division of LGC Biosearch Technologies) launched its E. cloni® Supreme Electrocompetent Cells, offering high transformation efficiency for next-generation sequencing (NGS) and synthetic biology applications. The cells were developed to enhance the construction of large libraries and improve representation in complex workflows, illustrating Lucigen’s focus on supporting advanced genomic discovery tools

- In January 2023, Agilent Technologies Inc. expanded its competent cell offerings with new SureVector Compatible Cells tailored for seamless integration into Agilent’s cloning and assembly workflows. This update enables faster project timelines and improved transformation success, particularly for synthetic biology applications. Agilent’s move emphasizes its commitment to workflow integration and end-to-end molecular biology solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.