Global Compressor Oil Market

Market Size in USD Billion

CAGR :

%

USD

13.70 Billion

USD

18.46 Billion

2024

2032

USD

13.70 Billion

USD

18.46 Billion

2024

2032

| 2025 –2032 | |

| USD 13.70 Billion | |

| USD 18.46 Billion | |

|

|

|

|

Compressor Oil Market Size

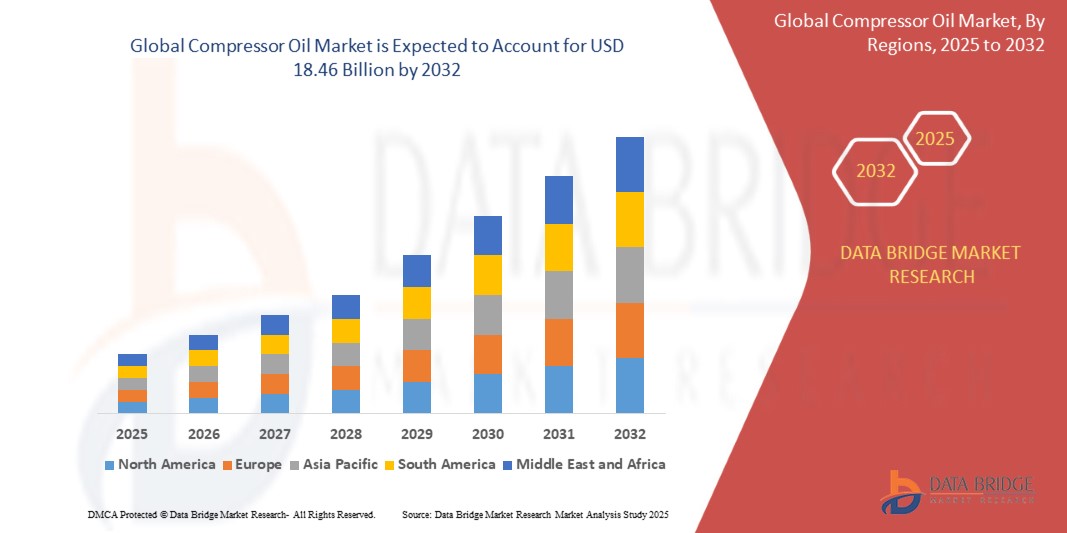

- The global compressor oil market was valued at USD 13.70 billion in 2024 and is expected to reach USD 18.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.80%, primarily driven by rising industrialization and infrastructure development

- This growth is driven by increasing demand for energy-efficient lubricants and stringent environmental regulations promoting sustainable solutions

Compressor Oil Market Analysis

- Compressor Oil has gained widespread acceptance due to its high thermal stability, superior lubrication properties, and extended equipment life, driving demand in manufacturing, power generation, and automotive applications. Its ability to reduce friction, enhance energy efficiency, and prevent wear and tear has reinforced its significance across multiple industries

- The market is primarily driven by increasing industrialization, rising demand for synthetic and bio-based lubricants, and strict environmental regulations promoting energy-efficient solutions. In addition, advancements in high-performance compressor oil formulations, improved additive technologies, and the shift towards low-viscosity lubricants are accelerating industry growth

- For instance, in North America and Europe, demand for compressor oil has surged due to the adoption of synthetic lubricants in industrial machinery, supported by stringent energy efficiency and emission control regulations

- Globally, compressor oil continues to be a critical component in the lubricant industry, with innovations such as nanotechnology-based lubricants, biodegradable compressor oil, and advanced anti-wear additives driving market expansion and ensuring long-term sustainability

Report Scope and Compressor Oil Market Segmentation

|

Attributes |

Compressor Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Compressor Oil Market Trends

“Growing Demand for Synthetic and Bio-Based Compressor Oils in Industrial Applications”

- The increasing shift toward high-performance lubricants is driving the adoption of synthetic and bio-based compressor oils in manufacturing, power generation, and automotive industries, as they offer enhanced thermal stability, oxidation resistance, and longer service life

- Stringent environmental regulations promoting low-emission and energy-efficient lubricants are accelerating the demand for eco-friendly alternatives to conventional mineral-based compressor oils, particularly in high-load and high-temperature applications

- Advancements in additive technologies, biodegradable formulations, and nanotechnology-infused compressor oils are improving lubrication efficiency, wear protection, and overall machinery performance, making them a preferred choice for industrial applications

For instance,

- In February 2024, ExxonMobil introduced a next-generation synthetic compressor oil designed to improve efficiency and reduce maintenance costs in industrial air compressors

- In November 2023, TotalEnergies launched a biodegradable compressor oil to support sustainable manufacturing practices in compliance with European environmental standards

- In August 2023, the Indian government announced incentives for industries adopting bio-based lubricants, encouraging wider adoption of environmentally friendly compressor oils

- As industries continue to prioritize efficiency, sustainability, and equipment longevity, synthetic and bio-based compressor oils will play a vital role in enhancing performance while meeting regulatory and environmental standards

Compressor Oil Market Dynamics

Driver

“Increasing Demand for Energy-Efficient Compressor Oils in Industrial Machinery”

- The rising focus on energy efficiency and reduced operational costs is driving the adoption of high-performance compressor oils in manufacturing, construction, and power generation industries, ensuring optimal compressor performance and lower energy consumption

- Industries are increasingly investing in synthetic and semi-synthetic compressor oils, which offer longer service life, enhanced wear protection, and superior thermal stability, reducing maintenance costs and downtime

- Stringent regulations on emissions and industrial energy consumption are encouraging the use of low-viscosity, high-performance lubricants, improving compressor efficiency and reducing environmental impact

For instance,

- In March 2024, Chevron introduced an advanced synthetic compressor oil designed to improve energy efficiency and extend equipment lifespan in industrial applications

- In December 2023, Shell launched a next-generation compressor oil formulated for high-load air compressors, reducing carbon footprint and operating costs

- In September 2023, the European Commission announced new incentives for industries adopting energy-efficient lubricants, boosting demand for advanced compressor oils

- As industries prioritize sustainability and operational efficiency, energy-efficient compressor oils will play a crucial role in reducing energy consumption, improving equipment longevity, and supporting global sustainability initiatives

Opportunity

“Rising Demand for High-Performance Compressor Oils in Renewable Energy Applications”

- The global transition toward renewable energy sources is driving the adoption of high-performance compressor oils in wind turbines, solar power plants, and hydroelectric facilities, ensuring optimal equipment efficiency and longevity

- Compressor Oils with superior oxidation resistance, thermal stability, and low volatility are essential for minimizing wear and tear in renewable energy systems, reducing maintenance costs and downtime

- Government policies and investments in clean energy infrastructure are accelerating the demand for advanced lubricants, including synthetic and bio-based compressor oils, to enhance the performance and sustainability of renewable energy systems

For instance,

- In February 2024, Siemens Gamesa partnered with a lubricant manufacturer to develop next-generation compressor oils for wind turbine gearboxes, improving operational efficiency and durability

- In November 2023, the U.S. Department of Energy introduced new funding initiatives to support the use of high-performance lubricants in renewable energy applications, driving innovation in compressor oils

- In August 2023, Vestas announced the integration of bio-based compressor oils in its offshore wind farms, reducing environmental impact while enhancing turbine efficiency

- As global renewable energy capacity expands, compressor oils will play a vital role in ensuring the reliability and efficiency of sustainable energy systems, contributing to a greener and more energy-efficient future

Restraint/Challenge

“Fluctuating Raw Material Prices Impacting Compressor Oil Market Growth”

- The volatility in crude oil prices and base oil supply disruptions significantly affect the cost and availability of compressor oils, leading to pricing instability for manufacturers and end-users

- Geopolitical tensions, supply chain disruptions, and fluctuating demand for petroleum-based products contribute to uncertainty in raw material procurement, impacting production costs and market competitiveness

- The shift towards bio-based and synthetic compressor oils, while promising for sustainability, often involves higher production costs and limited raw material availability, further challenging price stability in the market

For instance,

- In January 2024, global lubricant manufacturers, including Shell and ExxonMobil, announced price hikes for compressor oils due to rising crude oil costs and supply chain disruptions

- Mitigating price fluctuations through supply chain diversification, alternative raw material sourcing, and technological advancements in lubricant formulations will be essential for ensuring market stability and long-term growth in the compressor oil industry

Compressor Oil Market Scope

The market is segmented on the basis of compressor type, base oil type, applications, and end- user.

|

Segmentation |

Sub-Segmentation |

|

By Compressor Type |

|

|

By Base Oil Type |

|

|

By Applications |

|

|

By End-User |

|

Compressor Oil Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Compressor Oil Market”

- Growing industrialization and infrastructure development are driving the widespread adoption of compressor oil in industries such as manufacturing, construction, oil & gas, and power generation across the region

- China, Japan, and India lead in compressor oil production and consumption, supported by abundant raw material availability, increasing investments in industrial automation, and rising demand for energy-efficient solutions

- The presence of key industry players and ongoing advancements in compressor oil formulations, such as high-performance synthetic and bio-based oils, further strengthens Asia-Pacific’s dominance in the market

For instance,

- In March 2024, the Indian government launched new incentives for industrial energy efficiency, boosting demand for advanced compressor oils in manufacturing and power sectors

- With continued advancements in compressor oil technology and expanding applications across diverse industries, Asia-Pacific will maintain its dominant position, driving innovation, efficiency, and sustainability in the global Compressor Oil industry

“North America is projected to register the Highest Growth Rate”

- Rising demand for energy-efficient lubricants, government initiatives for sustainable solutions, and technological advancements in compressor oil formulations are driving market expansion across the region

- Countries such as the U.S. and Canada are implementing strict environmental regulations, promoting eco-friendly lubricants in industrial machinery, power generation, and automotive sectors, leading to higher adoption of advanced compressor oils

- The increasing shift toward synthetic and bio-based compressor oils, along with rising investments in R&D for enhanced performance and extended equipment life, is further accelerating market growth

For instance,

- In February 2024, the U.S. Environmental Protection Agency (EPA) introduced new standards promoting the use of biodegradable and energy-efficient lubricants, boosting demand for compressor oils in manufacturing and transportation industries

- As North America continues to prioritize industrial efficiency and sustainability, the compressor oil market in the region is expected to witness the highest growth rate, driving innovation, regulatory compliance, and eco-friendly advancements in the global lubricant industry

Compressor Oil Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Shell (U.K.)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c. (U.K.)

- Chevron Corporation (U.S.)

- TotalEnergies (France)

- China Petrochemical Corporation (Sinopec) (China)

- LUKOIL (Russia)

- Indian Oil Corporation Ltd (India)

- FUCHS (Germany)

- Idemitsu Kosan Co., Ltd. (Japan)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Dow (U.S.)

- Croda International Plc (U.K.)

- SASOL (South Africa)

- Phillips 66 Company (U.S.)

- Calumet, Inc. (U.S.)

- Morris Lubricants (U.K.)

- Penrite Oil (Australia)

- Valvoline (U.S.)

- LIQUI MOLY GmbH (Germany)

- Bharat Petroleum Corporation Limited (India)

- Amalie Oil Co (U.S.)

Latest Developments in Global Compressor Oil Market

- In February 2025, Shell plc announced the purchase of 1,495,840 shares for cancellation under its share buyback program, executed across multiple platforms including the London Stock Exchange (LSE), Chi-X, BATS, XAMS, and CBOE DXE. The buyback, managed by Natixis until April 2025, is part of Shell’s strategic capital allocation plan, aimed at optimizing liquidity and minimizing market impact. This move underscores Shell’s strong cash flow position, potentially enhancing earnings per share for investors

- In February 2025, Chevron confirmed plans to reduce its workforce by 15% to 20%, impacting approximately 6,830 to 9,100 jobs, as part of a company-wide restructuring initiative. The layoffs, affecting its workforce of over 45,000 employees, are aimed at enhancing efficiency, centralization, and overall business performance. According to Vice Chairman Mark Nelson, these changes will strengthen Chevron’s long-term competitiveness, with the reductions set to be completed by the end of 2026. This restructuring move highlights Chevron’s focus on operational optimization amid evolving industry challenges

- In May 2023, Saudi Aramco Base Oil Company Luberef signed a Memorandum of Understanding (MOU) with APAR Industries Limited to establish a Compressor Oil/White Oil plant at LubeHub in Saudi Arabia. The project is expected to support the localization of specialty oil products, aligning with Saudi Arabia’s vision for industrial self-sufficiency. This collaboration reflects Luberef’s commitment to expanding its specialty lubricants portfolio and strengthening regional supply chains

- In November 2022, Valvoline introduced Valcomp Compressor Oil Synth 68, a fully synthetic, PAO-based compressor oil specifically designed for rotary and reciprocating air compressors. The oil incorporates advanced additives to enhance anti-corrosion, anti-oxidation, and anti-foam properties, ensuring long-lasting protection and efficiency. This launch highlights Valvoline’s dedication to innovative lubrication solutions for industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Compressor Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Compressor Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Compressor Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.