Global Conductive And Anti Static Plastics For Evs

Market Size in USD Billion

CAGR :

%

USD

9.28 Billion

USD

15.60 Billion

2024

2032

USD

9.28 Billion

USD

15.60 Billion

2024

2032

| 2025 –2032 | |

| USD 9.28 Billion | |

| USD 15.60 Billion | |

|

|

|

|

Conductive and Anti-Static Plastics for EVs Market Size

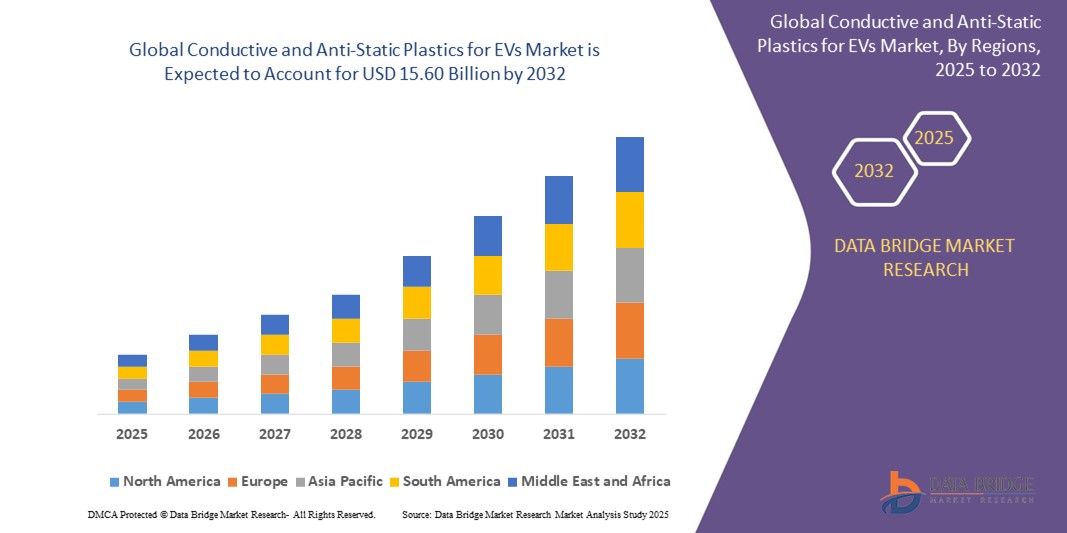

- The global conductive and anti-static plastics for EVs market size was valued at USD 9.28 billion in 2024 and is expected to reach USD 15.60 billion by 2032, at a CAGR of 6.70% during the forecast period

- Market growth is primarily driven by increasing adoption of connected automotive technologies and advancements in electric vehicle manufacturing, leading to higher demand for conductive and anti-static plastic materials in various EV components

- In addition, rising focus on improving vehicle safety, electromagnetic interference (EMI) shielding, and durability of EV parts is boosting the demand for advanced conductive and anti-static plastics, accelerating market expansion

Conductive and Anti-Static Plastics for EVs Market Analysis

- Conductive and Anti-Static Plastics play a crucial role in the EV industry by providing essential functionalities such as EMI shielding, static dissipation, and electrical conductivity, which are vital for the safety and performance of electric vehicles

- The market growth is propelled by increasing production of electric vehicles worldwide, stringent regulations related to vehicle safety and emissions, and rising investments in automotive innovation

- Furthermore, the shift towards lightweight and high-performance materials to enhance EV efficiency and battery life is contributing to the escalating demand for these specialized plastics in applications such as battery enclosures, powertrain components, and interior/exterior parts

- Asia-Pacific dominates the conductive and anti-static plastics for EVs market with the largest revenue share of 42.25% in 2024, driven by rapid industrialization, urbanization, and rising adoption of electric vehicles across countries such as China, Japan, and India

- North America is emerging as the fastest-growing region in the conductive and anti-static plastics for EVs market, fueled by accelerating electric vehicle (EV) adoption and a strong commitment to automotive innovation

- The acrylonitrile butadiene styrene (ABS) segment dominated the market with the largest revenue share of 36.5% in 2024, driven rising integration of electronic features within EV interiors-such as touchscreens, sensor-rich dashboards, and infotainment hubs-is driving the use of ABS plastics with anti-static properties

Report Scope and Conductive and Anti-Static Plastics for EVs Market Segmentation

|

Attributes |

Conductive And Anti-Static Plastics For EVs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Conductive and Anti-Static Plastics for EVs Market Trends

“Rising Integration of Lightweight and High-Performance Materials in EV Manufacturing”

- A key trend reshaping the global conductive and anti-static plastics for EVs market is the increasing demand for lightweight, durable, and high-performance polymers in electric vehicle production. As EV manufacturers aim to improve battery efficiency and driving range, the substitution of metals with advanced thermoplastics has become a strategic imperative

- For instance, polycarbonate (PC) and polyamide (PA) are gaining traction due to their superior mechanical strength, thermal stability, and electromagnetic shielding capabilities. These materials are being extensively used in battery enclosures, interior trim, and powertrain components to reduce overall vehicle weight while maintaining structural integrity

- The focus on sustainability and recyclability is also prompting OEMs to adopt conductive and anti-static plastics, which support safer EV battery systems by mitigating electrostatic discharge (ESD) and electromagnetic interference (EMI). This is critical for maintaining electronic component integrity and passenger safety

- Automotive OEMs such as Tesla, BYD, and Ford are increasingly collaborating with material science companies to co-develop innovative plastic solutions that meet strict performance, safety, and environmental standards in EV applications

- The trend reflects a growing alignment between material innovation and electric mobility goals, reinforcing the importance of conductive and anti-static plastics in future vehicle architectures

Conductive and Anti-Static Plastics for EVs Market Dynamics

Driver

“Increased EV Adoption and Demand for Efficient Battery Systems”

- The surging global adoption of electric vehicles is significantly driving demand for conductive and anti-static plastics, particularly in applications such as battery packs, EMI shielding, and interior modules. Lightweight plastic materials support vehicle range and energy efficiency and address evolving thermal management and safety requirements

- For instance, in March 2024, Premix announced plans to build a production plant in the U.S. to manufacture electrically conductive polymers, a move backed by $80 million in government funding. This initiative underlines the growing importance of localized, high-performance material production for EV systems

- Conductive plastics help in protecting sensitive electronic components from ESD and EMI, both of which are critical in battery management systems and control units of EVs. Their adoption reduces vehicle weight, enhances design flexibility, and improves energy efficiency—factors crucial to EV success

- As countries roll out stringent CO₂ regulations and electrification mandates, OEMs are compelled to seek innovative materials that deliver on performance without compromising safety or cost-efficiency

- This shift toward material-led innovation in EVs is a significant growth driver for the conductive and anti-static plastics market, positioning it as a key enabler in the green mobility transition

Restraint/Challenge

“Material Cost Volatility and Processing Complexity”

- Despite their performance benefits, conductive and anti-static plastics often come at a higher cost compared to traditional polymers, posing challenges for cost-sensitive automotive applications, particularly in price-conscious EV segments

- The integration of additives such as carbon black, carbon nanotubes, and metal fibers to impart conductivity increases raw material and processing costs. Moreover, manufacturing complexities such as maintaining uniform conductivity and achieving desired mechanical properties across large-scale production runs can hinder widespread adoption

- For instance, while Kafrit Industries expanded its reach by acquiring Delta Kunststoffe AG in December 2023 to enhance its technical compound capabilities, the need for specialized production infrastructure remains a key barrier for many smaller players

- In addition, recyclability and material compatibility with other EV components require careful engineering, limiting the use of some high-performance plastics in cost-optimized EV models

- Overcoming these challenges will require strategic investments in R&D, economies of scale, and the development of cost-efficient processing technologies to expand the applicability of these materials across broader EV categories

- As the market matures, achieving a balance between performance, cost, and scalability will be essential for sustaining long-term growth in the conductive and anti-static plastics for EVs sector

Conductive and Anti-Static Plastics for EVs Market Scope

The market is segmented on the basis of material type and application.

- By Material Type

On the basis of material type, the conductive and anti-static plastics for EVs market is segmented into polycarbonate (PC), polyamide (PA), polybutylene terephthalate (PBT), acrylonitrile butadiene styrene (ABS), and other materials. The acrylonitrile butadiene styrene (ABS) segment dominated the market with the largest revenue share of 36.5% in 2024, driven rising integration of electronic features within EV interiors-such as touchscreens, sensor-rich dashboards, and infotainment hubs-is driving the use of ABS plastics with anti-static properties.

The polyamide (PA) segment is expected to witness the fastest growth rate of 7.89% from 2025 to 2032, owing to its superior thermal resistance, mechanical strength, and suitability for under-the-hood applications. The rising focus on EV powertrain efficiency and safety is fueling the demand for PA-based conductive plastics in advanced engineering designs.

- By Application

On the basis of application, the market is segmented into battery enclosures, EMI shielding components, interior & exterior components, powertrain systems, and other applications. The battery enclosures segment held the largest market revenue share of 33.65% in 2024, driven by the escalating production of electric vehicles and the need for lightweight, durable, and heat-resistant materials. Conductive and anti-static plastics are preferred in battery housings to prevent electrical hazards and manage thermal events.

The EMI shielding components segment is expected to register the fastest CAGR of 7.89% from 2025 to 2032, fueled by the increasing integration of electronic systems in EVs and the critical need to shield these systems from electromagnetic interference. Enhanced vehicle connectivity and autonomous features are accelerating demand for effective EMI shielding solutions.

Conductive and Anti-Static Plastics for EVs Market Regional Analysis

- Asia-Pacific dominates the conductive and anti-static plastics For EVs market with the largest revenue share of 42.25% in 2024, driven by rapid industrialization, urbanization, and rising adoption of electric vehicles across countries such as China, Japan, and India

- Increasing government initiatives to promote EV manufacturing, coupled with the expanding middle-class population and growing investments in advanced materials for EV components, are accelerating market growth

- The presence of numerous manufacturing hubs and growing consumer awareness about sustainability further reinforce Asia-Pacific’s leading position in the conductive and anti-static plastics For EVs market

North America Conductive and Anti-Static Plastics for EVs Market Insight

North America is emerging as the fastest-growing region in the conductive and anti-static plastics for EVs market, fueled by accelerating electric vehicle (EV) adoption and a strong commitment to automotive innovation. The region benefits from robust government incentives, advanced manufacturing infrastructure, and increasing investments in clean energy and sustainable transportation. The growing emphasis on lightweight materials and electromagnetic interference (EMI) protection in EVs is leading to heightened demand for conductive and anti-static plastics across battery components, powertrain systems, and interior parts. In addition, strategic partnerships between automakers and material science companies are enabling rapid development and deployment of high-performance plastic solutions tailored for next-generation EV platforms.

U.S. Conductive and Anti-Static Plastics for EVs Market Insight

U.S. market holds the largest revenue share and plays a pivotal role in the growth of conductive and anti-static plastics for EVs. The swift adoption of electric vehicles, combined with the country’s focus on sustainability and clean energy, has propelled demand for high-performance materials. The presence of innovation centers and collaborations between automotive manufacturers and material suppliers further drive the development of specialized plastics optimized for EV applications such as battery enclosures and EMI shielding. The increasing popularity of smart electric vehicles and support from government policies contribute significantly to market expansion in the U.S.

Europe Conductive and Anti-Static Plastics for EVs Market Insight

Europe shows strong growth potential in this market, supported by stringent vehicle emission regulations that compel automakers to shift toward electric mobility. The region’s commitment to sustainability and the growing preference for eco-friendly materials in automotive manufacturing encourage the adoption of conductive and anti-static plastics. Countries such as Germany, France, and the U.K. are leading the charge, driven by regulatory frameworks and consumer demand for cleaner transportation. Germany, in particular, benefits from its well-established automotive industry, which focuses heavily on innovation and sustainability, propelling the use of advanced plastics in EV battery and powertrain systems.

U.K. Conductive and Anti-Static Plastics for EVs Market Insight

The U.K. conductive and anti-static plastics for EVs market is expected to witness significant growth at a notable CAGR during the forecast period, driven by increasing adoption of electric vehicles and the country’s strong focus on reducing carbon emissions. Government initiatives promoting sustainable transportation and investments in EV infrastructure are encouraging automakers and suppliers to incorporate advanced materials such as conductive and anti-static plastics in vehicle components. In addition, rising consumer awareness about vehicle safety, performance, and environmental impact is fostering demand for these specialized plastics. The U.K.’s established automotive sector and commitment to innovation are expected to further boost market expansion.

Germany Conductive and Anti-Static Plastics for EVs Market Insight

The Germany conductive and anti-static plastics for EVs market is projected to grow at a considerable CAGR over the forecast period, supported by the country’s leadership in automotive manufacturing and its strong emphasis on green technology. Growing awareness of vehicle safety, efficiency, and sustainability is driving demand for conductive and anti-static plastics, particularly in EV battery enclosures, powertrain systems, and EMI shielding components. Germany’s advanced infrastructure and focus on research and development facilitate the integration of these materials into next-generation electric vehicles. Furthermore, consumer preference for high-performance, eco-friendly automotive components aligns well with the adoption of conductive and anti-static plastics in the region.

Japan Conductive and Anti-Static Plastics for EVs Market Insight

Japan’s conductive and anti-static plastics market for EVs is steadily expanding due to the country’s strong technological foundation and high standards for safety and reliability. The aging population’s need for secure and easy-to-use vehicle components, coupled with Japan’s leadership in EV technology, supports increased adoption of these materials. The integration of conductive plastics in battery management and electromagnetic interference (EMI) shielding is critical in Japanese EV design, helping to improve vehicle performance and safety.

China Conductive and Anti-Static Plastics for EVs Market Insight

China stands out as the largest market within the Asia-Pacific region, owing to its expansive electric vehicle production and rapidly growing domestic demand. Government initiatives that support electric mobility and domestic manufacturing create a favorable environment for the growth of conductive and anti-static plastics. China’s ability to produce cost-effective materials combined with widespread adoption of EVs in residential and commercial sectors significantly propels the market. The country’s emphasis on smart manufacturing and sustainability further drives innovation and expansion in this space.

Conductive and Anti-Static Plastics for EVs Market Share

The conductive and anti-static plastics for Evs industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Covestro AG (Germany)

- Celanese Corporation (U.S.)

- DuPont (U.S.)

- LANXESS (Germany)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- LG Chem (South Korea)

- Solvay (Belgium)

- SABIC (Saudi Arabia)

- DSM (Netherlands)

- Teijin Aramid B.V. (Netherlands)

- Avient (U.S.)

- Eastman Chemical Company (U.S.)

- Arkema (France)

- Toray Industries Inc. (Japan)

- Kureha Corporation (Japan)

- Dow (U.S.)

- TPC Group (U.S.)

- Formosa Plastics Corporation, U.S.A. (U.S.)

- ZEON Corporation (Japan)

- China Petrochemical Corporation (China)

- Borealis AG (Austria)

- Versalis S.p.A. (Italy)

Latest Developments in Global Conductive and Anti-Static Plastics for EVs Market

- In February 2025, IPG, a global leader in packaging and protective solutions, introduced its latest U.S. brand, Plastic Sheeting, available in Ultra and Performance film variants. This innovative product is transparent, tear-resistant, and engineered for superior surface protection during renovations, repairs, and industrial tasks. This launch marks IPG’s strategic entry into the high-performance plastic sheeting market in North America

- In March 2024, Premix unveiled plans to establish a new manufacturing facility in the U.S., near Charlotte, dedicated to producing electrically conductive polymers. The company, known for its critical role during the COVID-19 pandemic, received approximately USD 80 million in government funding to support the expansion. This development positions Premix to meet the growing demand for conductive materials in North America

- In December 2023, Kafrit Industries expanded its international footprint by acquiring Delta Kunststoffe AG, a top-tier German manufacturer of conductive and technical compounds, additives, and color masterbatches. The acquisition strengthens Kafrit’s product portfolio while enhancing synergies and operational capacity across Europe. This move reinforces Kafrit's strategic focus on scaling capabilities and diversifying its market presence

- In November 2023, Parker Hannifin’s Chomerics Division launched CHO-SEAL 6750, a low-durometer, fluorosilicone-based conductive elastomer. Infused with nickel-graphite, the material offers robust EMI shielding, high thermal resistance, and exceptional chemical durability, making it ideal for flexible and resilient protection in electronic components. This introduction advances Parker Hannifin’s position in the EMI shielding solutions market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.