Global Contactless Payment Market

Market Size in USD Billion

CAGR :

%

USD

15.74 Billion

USD

36.79 Billion

2024

2032

USD

15.74 Billion

USD

36.79 Billion

2024

2032

| 2025 –2032 | |

| USD 15.74 Billion | |

| USD 36.79 Billion | |

|

|

|

|

Contactless Payment Market Size

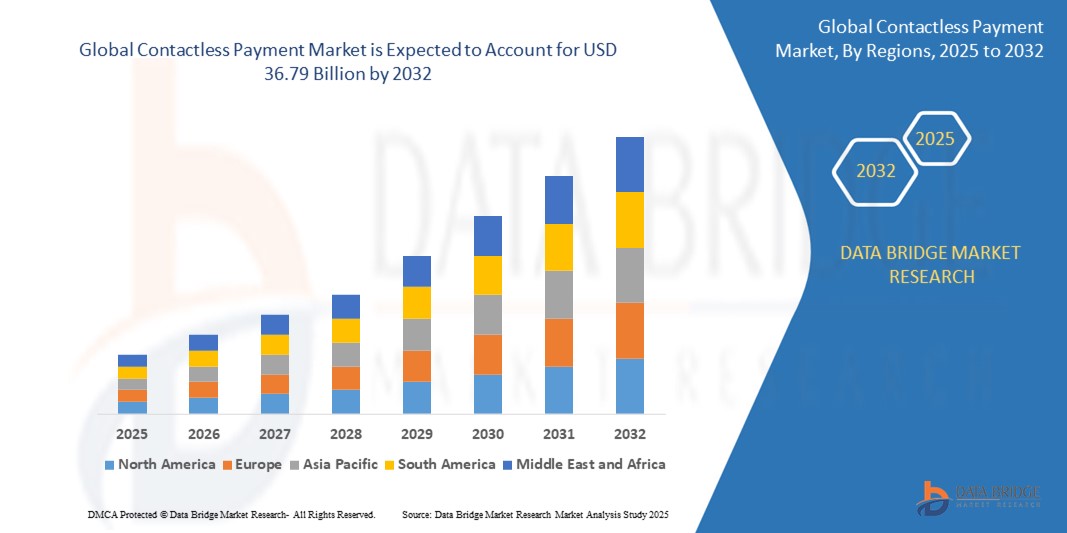

- The global contactless payment market was valued at USD 15.74 billion in 2024 and is expected to reach USD 36.79 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by technology innovation

- This growth is driven by factors such as enhanced NFC technology and cloud-based payment solutions

Contactless Payment Market Analysis

- Contactless payment is a secure method for processing transactions using debit cards, credit cards, key fobs, smartphones, and other devices. These payments are commonly accepted at nearby locations. The technology enabling contactless payments involves an embedded integrated circuit chip and antenna. This allows transactions to be completed without requiring a PIN input

- The growth of the contactless payment market is primarily driven by increasing consumer preference for fast and secure transactions, widespread adoption of smartphones and mobile wallets, and advancements in NFC technology

- Contactless payment solutions enable businesses and consumers to conduct transactions quickly, reduce checkout times, and enhance payment security through tokenization and encryption. These solutions often include features such as NFC-based tap-to-pay, biometric authentication, mobile wallet integration, and real-time transaction monitoring

- For instance, leading financial institutions and payment solution providers such as Visa, Mastercard, and Apple Pay have expanded their contactless payment offerings to support a broader range of transactions, including transit systems, retail, and online payments

- The contactless payment market is poised for continuous expansion, driven by increasing digital payment adoption, advancements in biometric security, and regulatory support for cashless economies. As businesses and consumers continue to embrace digital-first payment methods, the demand for innovative and secure contactless payment solutions will continue to grow

Report Scope and Contactless Payment Market Segmentation

|

Attributes |

Contactless Payment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Contactless Payment Market Trends

“Increasing Adoption of QR Code-Based Contactless Payments”

- One prominent trend in the global contactless payment market is the increasing adoption of QR code-based contactless payments

- This trend is driven by the need for cost-effective, accessible, and scalable payment solutions that do not require specialized hardware such as NFC-enabled POS terminals. QR code payments offer businesses and consumers a simple and convenient method for transactions using just a smartphone camera and an internet connection

- For instance, major payment providers such as Alipay, WeChat Pay, and PayPal have expanded their QR code payment services to support seamless transactions across retail, transportation, and peer-to-peer payments, addressing the rising demand for frictionless digital payments

- In addition, the shift toward mobile-first payment ecosystems and the integration of QR code technology into digital wallets are expected to accelerate, making contactless payments more inclusive, especially for small businesses and cash-driven economies

- As competition intensifies, payment providers will continue to enhance QR code-based payment solutions by offering better security, AI-driven fraud detection, and deeper integration with e-commerce and banking platforms. The widespread adoption of QR code payments will drive market growth, reinforcing their role as a key component of the global contactless payment ecosystem

Contactless Payment Market Dynamics

Driver

“Rising Adoption of Digital Payment Platforms”

- The rising adoption of digital payment platforms is a major driver of growth in the contactless payment market. As consumers and businesses increasingly shift toward cashless transactions, the demand for secure, fast, and seamless digital payment solutions has surged, positioning digital payment platforms as a key enabler of contactless transactions

- This shift is particularly evident in sectors such as retail, e-commerce, transportation, and hospitality, where quick and secure payment processing is essential for enhancing customer experience and operational efficiency

- With businesses seeking to modernize their payment systems and cater to evolving consumer preferences, the need for integrated, user-friendly payment platforms that support contactless transactions has become essential

- Organizations are increasingly adopting mobile wallets, fintech payment solutions, and online banking platforms to facilitate contactless transactions, enhance security, and improve financial accessibility

- These platforms offer benefits such as real-time transaction monitoring, fraud detection, and seamless cross-border payments, further driving adoption

For instance,

- Leading digital payment providers such as PayPal, Square, and Stripe have expanded their contactless payment capabilities by integrating NFC, QR codes, and biometric authentication to meet the growing demand for seamless digital transactions

- Companies such as Google Pay, Apple Pay, and Samsung Pay continue to enhance their platforms by incorporating AI-driven fraud detection and real-time transaction analytics, ensuring both security and user convenience

- As the reliance on digital payments continues to grow, fueled by regulatory support for cashless economies, advancements in fintech, and consumer demand for convenience, the contactless payment market is expected to experience sustained growth, reinforcing the role of digital payment platforms in shaping the future of financial transactions

Opportunity

“Rising Demand for Mobile and Wearable Payment Devices”

- The rising demand for mobile and wearable payment devices presents a significant opportunity in the contactless payment market. As consumers increasingly adopt smartphones, smartwatches, and other wearable devices for everyday transactions, the need for payment solutions that integrate seamlessly with these technologies is growing

- Mobile and wearable payment devices are gaining popularity due to their convenience, security, and speed, enabling users to make transactions with a simple tap. These devices eliminate the need for physical cards or cash, making them particularly appealing for tech-savvy consumers and those seeking frictionless payment experiences

- The widespread use of NFC-enabled smartphones and smartwatches has accelerated the shift toward contactless payments, driving demand for payment platforms that support mobile wallets and wearable payment solutions. Businesses and financial institutions are capitalizing on this trend by expanding their digital payment offerings to cater to the increasing use of these devices

For instance,

- Companies such as Apple, Samsung, and Garmin have enhanced their wearable payment capabilities, enabling users to complete transactions using devices such as the Apple Watch, Samsung Galaxy Watch, and Garmin Pay-enabled smartwatches

- Payment providers such as Visa and Mastercard have partnered with tech companies to expand contactless payment support for mobile and wearable devices, ensuring seamless and secure transactions across different industries

- As the adoption of mobile and wearable payment devices continues to grow, investments in advanced security features, biometric authentication, and enhanced payment integrations will increase. This trend will drive innovation in the contactless payment market, positioning mobile and wearable payments as a key component of the future digital economy

Restraint/Challenge

“High Cost of Deploying Technologies”

- The high cost of deploying technologies presents a significant challenge for the adoption of mobile and wearable payment devices in the contactless payment market. Businesses and financial institutions often face substantial investment requirements for upgrading infrastructure, integrating payment systems, and ensuring compliance with security standards

- Implementing mobile and wearable payment solutions requires specialized hardware, NFC-enabled devices, and advanced security measures such as encryption and biometric authentication. These costs make it difficult for small businesses and developing markets to adopt and support these payment methods effectively

- In addition, the rapid evolution of payment technologies demands continuous upgrades to stay aligned with security protocols, compatibility standards, and consumer expectations. This constant need for innovation increases operational expenses and slows widespread adoption among businesses with limited financial and technological resources

For instance,

- Businesses in emerging markets may struggle to implement mobile and wearable payment solutions due to high initial costs, leading to reliance on traditional payment methods rather than investing in advanced digital payment infrastructure

- As competition in the contactless payment market intensifies, the high cost of deploying technologies may slow the adoption of mobile and wearable payments, particularly in regions with limited financial resources and technological expertise. This challenge could hinder market growth, especially for small businesses that lack the capital to invest in modern contactless payment solutions

Contactless Payment Market Scope

The market is segmented on the basis of technology, payment mode, component, operational frequency, transaction models, and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Payment Mode |

|

|

By Component |

|

|

By Operational Frequency

|

|

|

By Transaction Models |

|

|

By Vertical |

|

Contactless Payment Market Regional Analysis

“Europe is the Dominant Region in the Contactless Payment Market”

- Europe dominates the Contactless Payment market, driven by the high penetration of smartphones, advancements in smart chip technology, and the increasing adoption of near-field communication (NFC) technology. The region's well-established digital payment infrastructure and strong regulatory support further contribute to its market leadership

- The U.K. holds a significant share due to its well-developed banking sector, increasing consumer preference for digital wallets such as Apple Pay, Google Pay, and PayPal, and the growing adoption of contactless cards across retail, transportation, and hospitality industries

- The increasing demand for secure and seamless payment methods, along with government initiatives promoting cashless transactions, continues to accelerate the adoption of contactless payments across Europe

- In addition, the presence of leading payment solution providers and fintech companies in the region, such as Worldline, Ingenico, and SumUp, further strengthens the market by continuously innovating and expanding their offerings

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Contactless Payment market, driven by rapid adoption of mobile and digital payment solutions. The increasing smartphone penetration and rising preference for digital wallets in countries such as China, India, and Japan are fueling market expansion

- China leads the region with the widespread use of QR code-based payments and mobile wallets such as Alipay and WeChat Pay, while India’s government-led initiatives such as Digital India and UPI adoption have significantly contributed to the growth of contactless transactions

- Asia-Pacific’s growth is further supported by the increasing number of market players offering cost-effective and innovative payment solutions, creating a highly competitive landscape

- The region’s expanding e-commerce sector, growing fintech investments, and the rising demand for faster, more secure transactions make Asia-Pacific a key market for contactless payment providers looking to expand their global footprint

Contactless Payment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thales (France)

- Infineon Technologies AG (Germany)

- Gemalto N.V. (Netherlands)

- Infineon Technologies AG (Germany)

- Ingenico Group S.A. (France)

- Wirecard AG (Germany)

- Verifone Systems, Inc. (U.S.)

- Giesecke+Devrient GmbH (Germany)

- IDEMIA France SAS (France)

- On Track Innovations Ltd. (Israel)

- Identiv, Inc. (U.S.)

- CPI Card Group Inc. (U.S.)

- Bitel Co., Ltd. (South Korea)

- Setomatic Systems (U.S.)

- Valitor hf. (Iceland)

- PAX Global Technology Limited (Hong Kong)

- MYPINPAD Ltd. ((U.K.))

- Mobeewave Inc. (Canada)

- Alcineo (France)

- Castles Technology Co., Ltd. (Taiwan)

- SumUp Limited (U.K.)

- PayCore (Turkey)

Latest Developments in Global Contactless Payment Market

- In October 2024, Tappy Technologies announced the launch of world's first fitness and payment ring, integrating fitness tracking with network card tokenization for contactless payments. Unveiled at Hong Kong Fintech Week 2024, this innovation strengthens Tappy’s position in the wearable payment market by combining health and financial technology. The introduction of multifunctional wearable payments is expected to accelerate market growth by appealing to tech-savvy consumers seeking seamless, secure, and health-integrated payment solutions

- In March 2024, IndusInd Bank launched 'Indus PayWear,' India's first all-in-one tokenizable contactless payment wearables for both debit and credit cards, exclusively on Mastercard, with plans to expand to other networks. This innovation strengthens IndusInd Bank’s position in the contactless payment market by enhancing consumer convenience and security. The introduction of wearable payment solutions is expected to drive market adoption, catering to the growing demand for seamless and secure digital transactions in India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.