Global Contract Packaging Market

Market Size in USD Million

CAGR :

%

USD

87.61 Million

USD

189.17 Million

2025

2033

USD

87.61 Million

USD

189.17 Million

2025

2033

| 2026 –2033 | |

| USD 87.61 Million | |

| USD 189.17 Million | |

|

|

|

|

What is the Global Contract Packaging Market Size and Growth Rate?

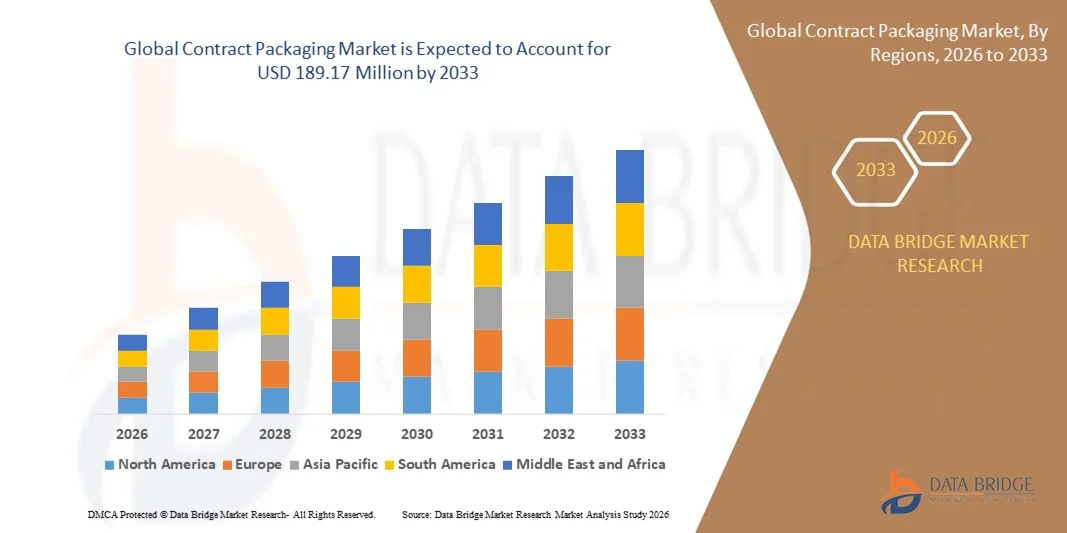

- The global contract packaging market size was valued at USD 87.61 million in 2025 and is expected to reach USD 189.17 million by 2033, at a CAGR of 10.10% during the forecast period

- Improvements in medical sciences and additions to medicines already available for numerous diseases and deficiencies along with motivating more manufacturers to prefer contract package over in-house packaging activities which will further contribute by generating massive opportunities that will lead to the growth of the contract packaging market in the above mentioned projected timeframe

What are the Major Takeaways of Contract Packaging Market?

- Increasing demand from the e-commerce industry, rising need for latest technology and innovative packaging, growing number of population across the globe, rapid urbanization has led to the demand for packed and ready-to-eat food, high growth in the alcoholic and non-alcoholic beverage industry which employs closures, caps, bottles, cans, and the pouch, services are provided in various shapes and sizes for both liquid and rigid products are some of the major as well as vital factors which will likely to augment the growth of the contract packaging market

- North America dominated the contract packaging market with the largest revenue share of 41.8% in 2025, driven by strong demand for packaged and convenience foods, advanced production technologies, and the presence of key global contract packaging service providers

- The Asia-Pacific region is projected to witness the fastest growth rate of 10.62% from 2026 to 2033, driven by urbanization, rising disposable incomes, and surging demand for convenience foods

- The Bottles segment dominated the market with the largest revenue share of 38.5% in 2025, driven by its extensive use across food & beverages, pharmaceuticals, and personal care products for secure, convenient, and leak-proof packaging

Report Scope and Contract Packaging Market Segmentation

|

Attributes |

Contract Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Contract Packaging Market?

Rising Adoption of Sustainable, Efficient, and Customizable Packaging Solutions

- The contract packaging market is experiencing a pronounced shift toward sustainability, operational efficiency, and consumer-centric innovations, driven by the increasing global emphasis on eco-friendly packaging, regulatory compliance, and circular economy practices. Companies are adopting recyclable, biodegradable, and easy-to-handle materials to reduce environmental impact while enhancing functionality

- For instance, Amcor plc and Mondi Group have launched recyclable mono-material films and modular packaging systems for pharmaceuticals, personal care, and food applications. These solutions maintain product integrity, improve shelf life, and simplify post-consumer recycling processes

- Rising consumer demand for convenient, lightweight, and easy-to-open packaging is driving the need for innovative contract packaging solutions that offer usability without compromising safety or quality. This is especially evident in ready-to-eat foods, nutraceuticals, and healthcare products

- Manufacturers are integrating automation, precision filling, and tamper-evident sealing technologies to enhance operational efficiency and product consistency. These innovations also boost aesthetic appeal and brand differentiation in the competitive market

- The increasing importance of eco-friendly branding, carbon footprint reduction, and compliance with global regulations, including Extended Producer Responsibility (EPR) and the EU Packaging and Packaging Waste Directive (PPWD), is accelerating the adoption of sustainable contract packaging solutions

- As industries continue to prioritize sustainability, efficiency, and consumer convenience, the integration of automated systems, recyclable materials, and flexible packaging formats will remain the defining trend shaping the Contract Packaging market globally

What are the Key Drivers of Contract Packaging Market?

- Growing demand for ready-to-eat, packaged, and convenience foods is a key driver for the contract packaging market. Consumers are increasingly seeking packaging that ensures freshness, ease of use, and safety, particularly in sectors such as dairy, snacks, and frozen foods

- For instance, Sealed Air Corporation reported increasing adoption of its Cryovac packaging solutions among leading food brands in 2025, fueled by the surge in packaged food demand across North America and Europe

- Sustainability initiatives and environmental consciousness are encouraging contract packaging providers to develop recyclable, compostable, and biodegradable materials. Brands are investing in mono-material or polyolefin-based structures to reduce waste and simplify recycling processes

- Technological advancements in automation, precision filling, and packaging materials have improved operational efficiency, product safety, and durability, making contract packaging suitable across diverse industries, from food and beverages to pharmaceuticals and cosmetics

- The expansion of e-commerce and home delivery services is further increasing the need for secure, durable, and tamper-evident packaging, supporting market growth in user-centric and consumer-friendly packaging solutions

- With continuous innovations in material technology, process automation, and sustainability-driven packaging formats, the Contract Packaging market is poised for robust global growth over the coming years

Which Factor is Challenging the Growth of the Contract Packaging Market?

- High costs associated with sustainable, automated, and multi-layered packaging solutions pose a significant challenge for market expansion. Specialized resins, machinery, and automation technologies increase production complexity and investment requirements

- For instance, smaller packaging service providers in Asia-Pacific and Europe have reported difficulties in competing with larger multinational providers due to cost disparities with conventional packaging solutions

- Regulatory variations and recyclability restrictions across regions hinder uniform adoption. Differences in waste management systems, especially across the U.S., EU, and Asia, create challenges for standardizing sustainable contract packaging solutions

- Technical constraints, such as maintaining barrier protection, durability, and product integrity while using eco-friendly materials, limit scalability. Providers must balance sustainability with operational efficiency and product quality

- Volatility in raw material prices, particularly for biodegradable or specialty polymers, adds financial risk, reducing margins and discouraging smaller players from large-scale adoption of sustainable solutions

- To address these challenges, leading players are investing in R&D, strategic partnerships, and automated packaging technologies that optimize efficiency and lower production costs. Standardized recycling frameworks and scalable sustainable materials are expected to ease barriers and drive long-term market growth

How is the Contract Packaging Market Segmented?

The market is segmented on the basis of product, service, end user, and type.

- By Product

On the basis of product, the contract packaging market is segmented into Bottles, Bags and Pouches, Sachets and Stick Packs, Boxes and Cartons, Blisters and Clamshells, Vials and Ampoules, Flow Wraps, and Others. The Bottles segment dominated the market with the largest revenue share of 38.5% in 2025, driven by its extensive use across food & beverages, pharmaceuticals, and personal care products for secure, convenient, and leak-proof packaging. Bottles’ compatibility with automated filling and sealing systems, along with their recyclability, has further enhanced adoption among manufacturers.

The Bags and Pouches segment is projected to register the fastest CAGR from 2026 to 2033, fueled by growing demand for lightweight, resealable, and flexible packaging in ready-to-eat foods, nutraceuticals, and consumer goods, aligning with the rising focus on convenience, sustainability, and e-commerce-friendly formats.

- By Service

On the basis of service, the market is categorized into Bottling and Filling, Bagging/Pouching, Lot/Batch and Date Coding, Boxing and Cartoning, Wrapping and Bundling, Labelling, Clamshells and Blisters, and Others. Bottling and Filling dominated with the largest revenue share of 34.2% in 2025, attributed to high adoption in food, beverage, and pharmaceutical sectors for efficient production and consistent product quality.

Labelling and Wrapping services are expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for branding, product differentiation, tamper-evidence, and regulatory compliance across global markets. These services are critical for enhancing operational efficiency and improving consumer experience.

- By End User

On the basis of end user, the contract packaging market is segmented into Food and Beverages, Pharmaceuticals, Cosmetics, Agriculture, Personal Care, and Others. The Food and Beverages segment dominated the market with the largest revenue share of 41.7% in 2025, driven by the surge in ready-to-eat foods, beverages, and packaged meals that require secure, hygienic, and easy-to-use packaging solutions.

The Pharmaceuticals segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for tamper-evident, sterile, and dosage-compliant packaging, such as vials, ampoules, and blister packs, aligning with stringent regulatory requirements and growing healthcare consumption.

- By Type

On the basis of type, the market is categorized into Primary Packaging, Secondary Packaging, and Tertiary Packaging. The Primary Packaging segment dominated the market with the largest revenue share of 46.1% in 2025, owing to its direct contact with products and critical role in maintaining safety, hygiene, and shelf life.

Secondary Packaging is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for branded cartons, boxes, and bundles that facilitate storage, transportation, and retail display, particularly in food, beverage, and cosmetic industries. Packaging innovations emphasizing sustainability and consumer convenience are further supporting growth in this segment.

Which Region Holds the Largest Share of the Contract Packaging Market?

- North America dominated the contract packaging market with the largest revenue share of 41.8% in 2025, driven by strong demand for packaged and convenience foods, advanced production technologies, and the presence of key global contract packaging service providers. The region’s emphasis on recyclable, high-performance, and consumer-friendly packaging solutions is fostering widespread adoption across food, pharmaceutical, and personal care sectors

- The region benefits from strict regulatory frameworks, including the U.S. Food and Drug Administration (FDA) and Canadian Food Inspection Agency (CFIA), which mandate food safety, barrier protection, and sustainable packaging practices

- Continuous innovations in automated bottling, filling, and labelling systems, alongside eco-friendly film and carton solutions, are reinforcing North America’s leadership in the global contract packaging market

U.S. Contract Packaging Market Insight

The U.S. accounted for the largest share within North America in 2025, supported by rising packaged food consumption, healthcare supplies, and personal care products. Consumer preference for tamper-evident, resealable, and user-friendly packaging is driving the adoption of advanced contract packaging solutions. Leading companies such as Berry Global Inc. (U.S.) and Amcor plc (Australia/U.S. operations) are investing in sustainable PE- and PET-based packaging to meet regulatory and sustainability goals. E-commerce penetration is further fueling demand for secure, convenient, and durable packaging formats.

Canada Contract Packaging Market Insight

Canada remains a key contributor in North America due to its robust food processing sector, advanced recycling infrastructure, and government initiatives aimed at eliminating single-use plastics by 2030. Demand is particularly strong in dairy, bakery, and packaged meat sectors, where easy-to-use and recyclable packaging enhances product safety and shelf life. Canadian firms are increasingly aligning packaging solutions with Extended Producer Responsibility (EPR) programs to promote sustainability.

Asia-Pacific Contract Packaging Market Insight

The Asia-Pacific region is projected to witness the fastest growth rate of 10.62% from 2026 to 2033, driven by urbanization, rising disposable incomes, and surging demand for convenience foods. Countries such as China, India, Japan, and South Korea are experiencing increased consumption of packaged and ready-to-eat meals, creating strong opportunities for contract packaging providers. Local and international manufacturers are investing in recyclable, biodegradable, and polyolefin-based films to meet international sustainability standards. Cost-effective production and evolving consumer preferences make Asia-Pacific a dynamic and rapidly expanding market globally.

China Contract Packaging Market Insight

China is emerging as a central player in Asia-Pacific, supported by its large-scale manufacturing ecosystem, significant food exports, and emphasis on sustainable packaging technologies. Investments in PET- and polyethylene-based easy-peel films, along with biodegradable and mono-material solutions, are gaining traction to comply with the government’s green packaging policies. The country’s growth is reinforced by rising domestic demand and increasing exports of packaged foods and pharmaceuticals.

India Contract Packaging Market Insight

India is witnessing rapid growth in contract packaging, driven by the expansion of food processing, FMCG, and pharmaceutical sectors. Initiatives such as “Make in India” and bans on single-use plastics are encouraging adoption of recyclable, lightweight, and resealable packaging alternatives. The growing retail and e-commerce infrastructure further supports market expansion, with local producers innovating cost-effective solutions for mass-market applications.

Europe Contract Packaging Market Insight

Europe is experiencing steady growth, supported by strict environmental regulations and adoption of mono-material recyclable packaging under the EU Packaging and Packaging Waste Directive (PPWD). Countries including Germany, France, and the U.K. are leading sustainable packaging innovations. Emphasis on circular economy practices and investments in advanced recycling systems is fostering long-term market stability.

Germany Contract Packaging Market Insight

Germany leads Europe due to its strong manufacturing base, stringent sustainability standards, and growing demand for recyclable packaging. PET- and PE-based mono-material packaging adoption is rising, improving recyclability and reducing waste. Germany’s focus on green packaging aligns with EU climate goals, positioning it as a key innovation hub.

U.K. Contract Packaging Market Insight

The U.K. market is expanding steadily with high demand for convenient, premium, and sustainable packaging formats. Flexibility in post-Brexit packaging regulations allows domestic firms to innovate with recyclable and compostable materials. Growth is driven by food delivery, pharmaceutical, and personal care sectors, supported by lightweight, resealable, and transparent packaging solutions.

Which are the Top Companies in Contract Packaging Market?

The contract packaging industry is primarily led by well-established companies, including:

- Sonoco Products Company (U.S.)

- CCL Industries (Canada)

- DHL International GmbH (Germany)

- Stamar Packaging (U.S.)

- Jones Healthcare Group (U.S.)

- Aaron Thomas Company, Inc. (U.S.)

- Multi‑Pack Solutions LLC (U.S.)

- PHARMA TECH INDUSTRIES (U.S.)

- Reed‑Lane (U.K.)

- Sharp (Japan)

- Unicep (U.S.)

- Green Sustainable Packaging (U.S.)

- Complete Co‑packing Services Limited (U.K.)

- Q a S Copak Ltd (U.K.)

- Summit Packaging Solutions (U.S.)

- GPA Global (U.S.)

- AmeriPac (U.S.)

- Nulogy Corporation (Canada)

- Kelly Products Incorporated (U.S.)

- Deufol (U.S.)

What are the Recent Developments in Global Contract Packaging Market?

- In March 2024, PoppyPac, a U.K.-based flexible packaging contract manufacturer, invested USD 675,000 in a new facility to add filling lines and increase production capacity following a contract win with an existing customer, enabling them to meet growing market demand. The company also recruited additional operators, team leaders, and engineers to support the expansion. This strategic investment aims to drive sustainability-focused growth and expand operations into new markets, including India, MENA countries, and the U.S., positioning PoppyPac for long-term market leadership

- In October 2023, Sharp acquired Berkshire Sterile Manufacturing (BSM), strengthening its capabilities in the biopharmaceutical sector and enabling the company to offer fully integrated small-to-medium scale sterile injectable services. This acquisition supports the increasing demand for sterile injectables, particularly for rare and orphan diseases, and enhances Sharp’s competitive position in the contract packaging and pharmaceutical services market

- In September 2023, Kinaxia Logistics Ltd. expanded its contract packing operations by enlarging its cleanroom facilities at Trafford Park, Manchester, UK, adding two new cleanrooms to a total of three, covering 5,000 sq ft. The cleanrooms are equipped with advanced air filtration systems to ensure a controlled environment for packing food, beverage, and pharmaceutical products. In addition, the implementation of Nulogy cloud-based software allows real-time monitoring of production efficiency, enhancing scalability and operational performance

- In August 2022, Summit Packaging Solutions opened a new 276,000-square-foot Operations Center of Excellence in Northern Kentucky, representing a capital investment of USD 18.3 million. The facility expansion strengthens the company’s production capacity and service capabilities, enabling it to meet increasing demand for contract packaging solutions across multiple industries while supporting operational efficiency and market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Contract Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Contract Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Contract Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.