Global Cooler Box Market

Market Size in USD Billion

CAGR :

%

USD

9.62 Billion

USD

19.67 Billion

2025

2033

USD

9.62 Billion

USD

19.67 Billion

2025

2033

| 2026 –2033 | |

| USD 9.62 Billion | |

| USD 19.67 Billion | |

|

|

|

|

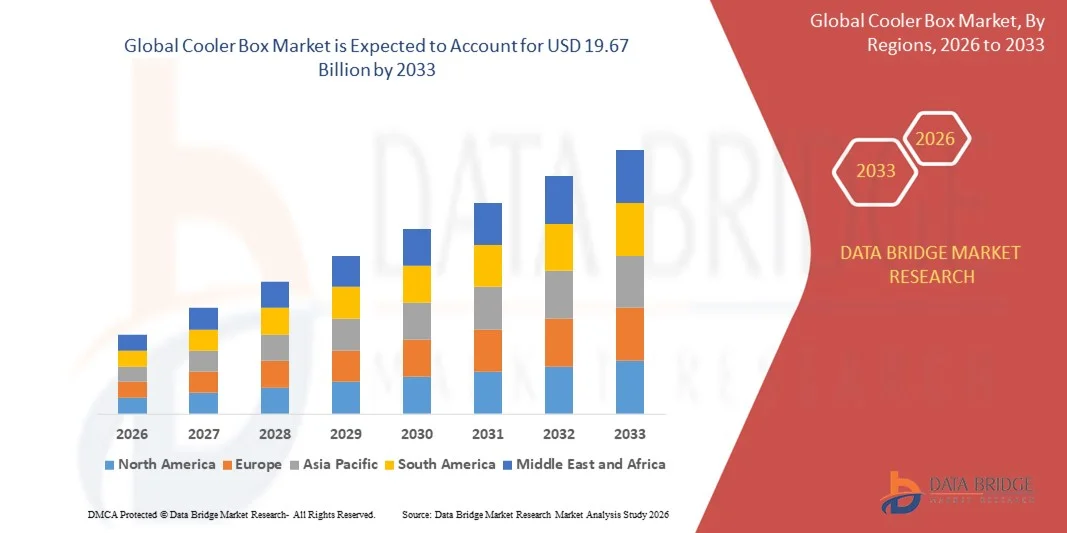

What is the Global Cooler Box Market Size and Growth Rate?

- The global cooler box market size was valued at USD 9.62 billion in 2025 and is expected to reach USD 19.67 billion by 2033, at a CAGR of 9.35% during the forecast period

- The increase in need for temperature control to prevent food loss and potential health hazards acts as one of the major factors driving the growth of cooler box market. The rise in the pharmaceutical industry along with ongoing COVID-19 vaccination drives accelerates the cooler box market growth

- The presence of stringent temperature control requirements in pharmaceutical industry and growth in international food trade due to trade liberalization further influence the cooler box market

What are the Major Takeaways of Cooler Box Market?

- The high usage for the transportation of processed and fresh fruits, vegetables, dairy products and other perishable food products, growth in population, rapid urbanization, change in lifestyle and research and development activities positively affect the cooler box market

- Furthermore, increase in demand for insulated packaging, technological advancements and growth in organized retail sector extends profitable opportunities to the cooler box market players

- Asia-Pacific dominated the cooler box market with a 42.5% revenue share in 2025, driven by rising adoption of advanced insulated boxes for pharmaceuticals, perishable foods, outdoor recreation, and cold-chain logistics across China, Japan, India, South Korea, and Australia

- North America is projected to register the fastest CAGR of 8.7% from 2026 to 2033, driven by rising demand for reusable, high-performance, and eco-friendly cooler boxes in the U.S. and Canada

- The Reusable segment dominated the market with a revenue share of 67.3% in 2025, driven by its durability, long-term cost efficiency, and strong adoption across pharmaceuticals, outdoor recreation, and cold-chain logistics

Report Scope and Cooler Box Market Segmentation

|

Attributes |

Cooler Box Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cooler Box Market?

Rising Adoption of High-Performance, Energy-Efficient, and Temperature-Stable Cooler Boxes

- The cooler box market is witnessing strong growth toward high-performance, long-duration, and temperature-stable cold-chain solutions, including boxes with enhanced insulation, phase-change materials (PCM), and sustainable polymers to improve cooling efficiency and durability

- Manufacturers are introducing multi-purpose cooler boxes designed for pharmaceutical transport, outdoor recreation, food delivery, and industrial cold-chain logistics, supporting broader applications across healthcare, retail, and travel industries

- Consumers and enterprises are increasingly choosing lightweight, portable, eco-friendly, and high-insulation cooling solutions, replacing traditional ice chests and low-performance plastic boxes

- For instance, companies such as Sonoco ThermoSafe, va-Q-tec, Cold Chain Technologies, Sofrigam, and Igloo have expanded their cold-chain portfolios by introducing advanced insulated boxes with PCM packs, longer hold times, and recyclable materials

- Rising awareness of vaccine safety, temperature-controlled logistics, outdoor activities, and perishable food transport is accelerating global adoption

- As industries continue to demand sustainable, reliable, and multi-utility cooling solutions, Cooler Boxes are expected to remain central to innovation within the global cold-chain packaging and outdoor equipment market

What are the Key Drivers of Cooler Box Market?

- Rising global demand for temperature-controlled transport, outdoor recreation products, and medical cold-chain solutions is driving widespread adoption of cooler boxes

- For instance, in 2025, companies such as Sonoco ThermoSafe, va-Q-tec, and Cold Chain Technologies expanded their insulated container lines used in vaccine distribution, biopharma shipments, outdoor travel, and last-mile food delivery

- Increasing awareness of food safety, pharmaceutical stability, and high-performance insulation is boosting demand across the U.S., Europe, Asia-Pacific, and emerging markets

- Advancements in rotomolding, PCM technology, vacuum insulation panels (VIPs), and recyclable polymers have improved cooling duration, strength, and energy efficiency

- Rising preference for eco-friendly, reusable, non-toxic, and lightweight cooler boxes is further supporting market expansion amid sustainability-focused purchasing trends

- With ongoing R&D, new product launches, strategic collaborations, and global distribution expansions, the Cooler Box market is positioned to maintain robust growth during the forecast period

Which Factor is Challenging the Growth of the Cooler Box Market?

- High manufacturing costs associated with PCM technology, VIP insulation, rotomolded structures, and premium-grade polymers limit affordability in cost-sensitive regions

- For instance, during 2024–2025, fluctuations in raw material availability, polymer resin prices, and global supply-chain disruptions affected production volumes for multiple companies

- Strict regulatory standards for pharmaceutical cold-chain compliance, temperature validation, and packaging certifications add operational complexities

- Limited awareness about high-performance cooler boxes in developing markets restricts adoption in medical, logistics, and outdoor applications

- Strong competition from low-cost traditional ice boxes and basic insulated containers creates pressure on pricing and differentiation

- Companies are addressing these challenges by focusing on cost-efficient materials, scalable manufacturing, regulatory alignment, and end-user education to enhance the global adoption of high-quality Cooler Boxes

How is the Cooler Box Market Segmented?

The market is segmented on the basis of type, raw material, and end use.

- By Type

On the basis of type, the cooler box market is segmented into Reusable and Disposable. The Reusable segment dominated the market with a revenue share of 67.3% in 2025, driven by its durability, long-term cost efficiency, and strong adoption across pharmaceuticals, outdoor recreation, and cold-chain logistics. Reusable cooler boxes—especially those made with high-density materials, rotomolded bodies, and advanced insulation—are preferred for vaccine transport, food delivery, and industrial applications due to their long cooling duration and reduced environmental impact. Their reusability lowers lifecycle costs, enhances sustainability compliance, and supports large-scale usage among hospitals, logistics providers, and outdoor consumers.

The Disposable segment is projected to register the fastest CAGR from 2026 to 2033, supported by rising demand for single-use solutions in last-mile delivery, emergency shipments, and short-duration temperature-sensitive transport. Growth in meal-kit services, e-commerce grocery, and pharmaceutical sampling is further accelerating adoption of lightweight disposable cooler boxes.

- By Raw Material

On the basis of raw material, the cooler box market is segmented into PU Foam, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Expanded Polypropylene (EPP), and Others. The PU Foam segment dominated the market with a 41.5% revenue share in 2025, owing to its superior insulation efficiency, long temperature retention, and widespread use in medical, research, and food transportation. PU foam provides high thermal resistance and structural stability, making it the preferred material for advanced cold-chain and pharmaceutical-grade cooler boxes. EPS and XPS are also used extensively due to affordability and lightweight construction but remain more suitable for consumer-grade and disposable systems.

The Expanded Polypropylene (EPP) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for lightweight, shock-resistant, recyclable, and reusable cooling solutions. Increasing adoption of EPP in vaccine transport, biopharma shipments, and eco-friendly packaging is contributing significantly to its rapid expansion.

- By End Use

On the basis of end use, the cooler box market is segmented into Pharmaceuticals and Food & Beverages. The Pharmaceuticals segment dominated the market with a revenue share of 58.9% in 2025, supported by the surge in vaccine distribution, biologics transport, clinical trial shipments, and temperature-sensitive pharmaceutical logistics. High standards for thermal stability, cold-chain integrity, and regulatory compliance drive strong demand for advanced cooler boxes incorporating PCM packs, VIP panels, and high-performance insulation.

The Food & Beverages segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for chilled food delivery, seafood transport, outdoor recreation, meal-kit services, and premium insulated solutions for beverages. E-commerce penetration, fast-moving delivery services, and increasing consumer preference for fresh, temperature-controlled food products further accelerate adoption across households and commercial users.

Which Region Holds the Largest Share of the Cooler Box Market?

- Asia-Pacific dominated the cooler box market with a 42.5% revenue share in 2025, driven by rising adoption of advanced insulated boxes for pharmaceuticals, perishable foods, outdoor recreation, and cold-chain logistics across China, Japan, India, South Korea, and Australia. Strong participation in vaccination programs, e-commerce grocery deliveries, and outdoor leisure activities supports widespread adoption

- Leading manufacturers are investing in vacuum insulation panels (VIPs), phase-change materials (PCM), rotomolded containers, and eco-friendly polymers to improve thermal retention, durability, and portability. Government support for vaccine logistics, temperature-controlled transport, and sustainable packaging further strengthens market leadership

- Rapid urbanization, rising disposable incomes, and increased awareness of food safety, vaccine efficacy, and cold-chain efficiency fuel sustained regional growth

China Cooler Box Market Insight

China is the largest contributor in Asia-Pacific, supported by advanced manufacturing of insulated boxes, strong PCM and VIP infrastructure, and high domestic demand in healthcare and food delivery. Growth in refrigerated transport, pharmaceutical logistics, and outdoor activity usage is driving adoption. Companies are investing in R&D, sustainable materials, and advanced cooling technologies to strengthen both domestic consumption and export capabilities.

Japan Cooler Box Market Insight

Japan shows steady growth, driven by increasing demand for high-performance, reusable cooler boxes for pharmaceutical shipments, perishable foods, and leisure activities. Innovation in lightweight insulation, temperature control, and recyclable materials continues to attract consumers and institutional buyers. Regulatory support for healthcare logistics and high retail penetration further drive market adoption.

India Cooler Box Market Insight

India is witnessing rapid expansion, fueled by rising awareness of vaccine safety, cold-chain food delivery, and outdoor recreational use. Demand for affordable, durable, and portable cooler boxes is increasing across urban and semi-urban areas. Growth in e-commerce platforms, wellness trends, and disposable income supports strong adoption among households and commercial users.

South Korea Cooler Box Market Insight

South Korea contributes significantly due to rising interest in advanced temperature-stable solutions for pharmaceuticals, chilled foods, and outdoor activities. Social media influence, wellness trends, and lifestyle awareness are driving demand for premium and multifunctional cooler boxes. Innovation in product design, portability, and eco-friendly materials enhances adoption.

North America Cooler Box Market Insight

North America is projected to register the fastest CAGR of 8.7% from 2026 to 2033, driven by rising demand for reusable, high-performance, and eco-friendly cooler boxes in the U.S. and Canada. Growth in pharmaceutical cold-chain logistics, outdoor recreation, meal-kit deliveries, and last-mile e-commerce is boosting adoption. Manufacturers are focusing on premium insulation, PCM packs, and recyclable polymers to meet consumer expectations. Increasing awareness of sustainability, convenience, and temperature-sensitive transport requirements is further accelerating market penetration across urban and suburban regions.

Which are the Top Companies in Cooler Box Market?

The cooler box industry is primarily led by well-established companies, including:

- Sonoco ThermoSafe (U.S.)

- Igloo Products Corp. (U.S.)

- YETI COOLERS, LLC (U.S.)

- Nilkamal Ltd. (India)

- B Medical Systems (Switzerland)

- BLOWKINGS India (India)

- IsoNova (–)

- Eurobox Logistics (Germany)

- Softbox (UK)

- va-Q-tec (Germany)

- Cold Chain Technologies (U.S.)

- Sofrigam (France)

- FEURER Group GmbH (Germany)

- Coldchain Controls (Netherlands)

- Apex International (Netherlands)

What are the Recent Developments in Global Cooler Box Market?

- In April 2025, Coleman entered the premium cooler segment with the launch of its Pro Cooler line, offering a range of hard-sided and soft coolers engineered for durability, portability, and affordability, and designed to compete with high-end brands such as YETI and RTIC. The Pro series uses materials that are 15–30% lighter than traditional rotomolded coolers while maintaining comparable ice retention and ruggedness. Backed by a 10-year warranty and tested under extreme conditions, this launch positions Coleman as a value-driven disruptor in the outdoor and recreational cooler market, appealing to performance-focused yet cost-conscious consumers

- In March 2025, Ninja expanded its outdoor product portfolio with the FrostVault Wheeled Cooler, an upgraded version of its original design featuring all-terrain wheels, carry handles, and enhanced portability for outdoor use. Available in 28L, 42L, and 61L sizes, it integrates premium ice retention technology and a dry goods drawer capable of maintaining food-safe temperatures for days. Priced at $349.99, the launch positions Ninja as a serious contender in the high-performance cooler segment, combining functional innovation with a value-driven design

- In October 2024, Igloo partnered with Minecraft to release two exclusive cooler and drinkware collections, marking its first collaboration with the globally popular video game franchise. The initiative includes a limited-edition blind box release of 150 collectible coolers and a nine-piece lineup featuring iconic Minecraft characters. By merging gaming culture with outdoor utility, this launch strengthens Igloo’s brand relevance and expands its appeal among younger, digitally native consumers, reinforcing its creative leadership in the cooler box market

- In February 2023, Moosejaw launched its Cooler Collection exclusively for Walmart, introducing six rugged, high-performance cooler models priced between USD 99 and USD 249. The collection includes hard-sided Ice Fort coolers and soft-sided Chilladilla variants, all featuring recycled materials, antimicrobial interiors, and leakproof seals. By combining sustainability, affordability, and functionality, Moosejaw strategically positioned itself to serve both casual and serious outdoor consumers, reinforcing its value-driven approach in the competitive cooler box market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cooler Box Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cooler Box Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cooler Box Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.