Global Corrugated Board Packaging Market

Market Size in USD Billion

CAGR :

%

USD

134.70 Billion

USD

217.96 Billion

2022

2030

USD

134.70 Billion

USD

217.96 Billion

2022

2030

| 2023 –2030 | |

| USD 134.70 Billion | |

| USD 217.96 Billion | |

|

|

|

|

Corrugated Board Packaging Market Analysis and Size

The global corrugated market is expanding as public awareness of issues such as the environment grows. People are willing to contribute to sustainability, improving the quality of life while helping to save the environment and create a better society. People are adopting working standards that encourage online purchases of everything from small items, such as milk, to large ones, such as gifts. Since e-commerce relies on great packaging that is product-safe and gentle, the corrugated board packaging market will be the one to be dependent upon.

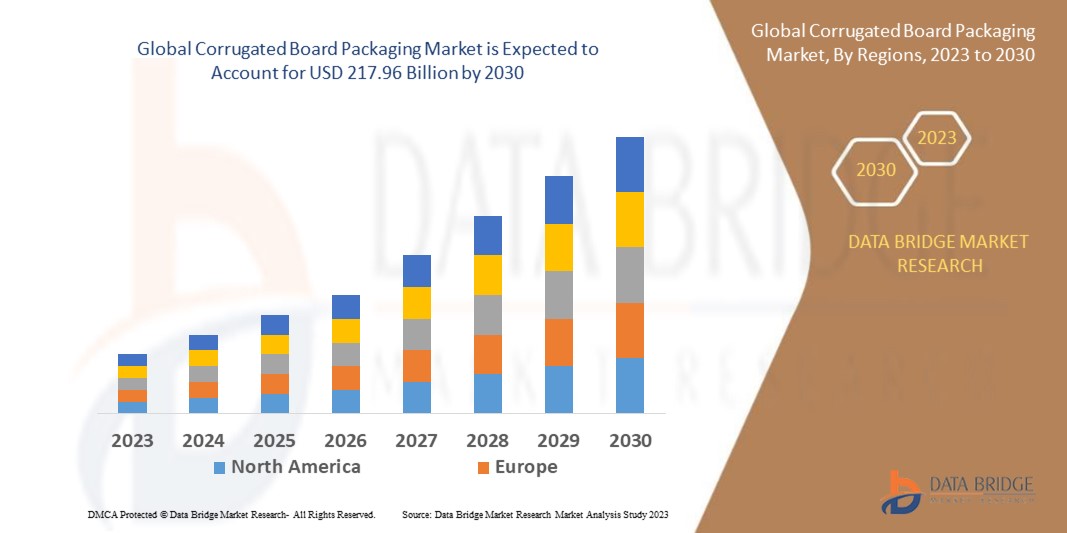

Data bridge market research analyses that the corrugated board packaging market, valued at USD 134.7 billion in 2022, will reach USD 217.96 billion by 2030, growing at a CAGR of 6.2% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Corrugated Board Packaging Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Raw Material (Linerboard and Medium), Style (Slotted Box, Telescopes, Folders, Trays, Sheets, Fanfold, Die Cut Bliss and Die Cut Interiors), Grade (Unbleached Test liner, White-Top Test liner, Unbleached Kraft liner, White-Top Kraft liner, Waste-Based Fluting, and Semi-Chemical Fluting), End-Use (Processed Foods, Healthcare, Beverages, Chemicals, Textiles, Personal Care, Electrical Goods, Vehicle Parts, Glassware and Ceramics, Wood and Timber Products, Household Care, Fruits and Vegetables, Paper Products, Tobacco and Other) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

International Paper (U.S.), Mondi (U.K.), Smurfit Kappa (Ireland), Cascades inc. (Canada), WestRock Company (U.S.), Oji Holdings Corporation (U.S.), Packaging Corporation of America (U.S.), Sealed Air (U.S.), Rengo Co., Ltd. (Japan), DS Smith (U.K.), NIPPON PAPER INDUSTRIES CO., LTD. (Japan), Georgia-Pacific (U.S.), Neway Packaging (U.S.), Arabian Packaging Co L.L.C. (U.A.E), Wertheimer Box Corp. (U.S.), Klabin S.A. (Brazil), Klingele Paper and Packaging S.E. and Co. K.G. (Germany), B Smith Packaging Ltd (U.K.) |

|

Market Opportunities |

|

Market Definition

Corrugated board packaging is a packaging product that successfully preserves, protects, and transports various goods. With its advantages, such as biodegradability, lightweight, and recyclability, corrugated board packaging is increasingly used. Along with more than 80% recycled material, corrugated board packaging includes fresh fibers from sustainably managed forests. Paperboard makes packaging suitable for various products such as food, medicines, equipment, and other goods. Heavy-duty layered paper sheets are folded, cut, and shaped into corrugated packaging to make food packaging boxes, cardboard boxes, juice boxes, milk cartons, and other items.

Corrugated Board Packaging Market Dynamics

Drivers

- Growing consumer awareness of environmentally friendly packaging is driving the market growth

Packaging made of corrugated boxes can be made more easily from recycled materials or composted waste. Consumers, especially millennials, are becoming more conscious of how food production, packaging, and waste affect the environment. A survey found that 59% of millennials believe packaging should be environmentally friendly throughout the entire value chain. The growth of the corrugated board packaging market is positively impacted by consumer demand for environmentally friendly packaging solutions for processed foods.

- Corrugated board packaging boosts market growth by providing protection and durability while being transported

Products made of corrugated board are intended to provide the highest level of protection for fragile, large, bulky, or high-value products during storage and transportation. The packaging product is strengthened by the corrugated board layers, making it more durable than ordinary cardboard. Corrugated cardboard uses a variety of liners, including Kraft liners, test liners, and chip linear, to provide strength. The product's transit cushion is made of corrugated paperboard. Wood and metal packaging are replaced with corrugated board packaging because it is natural, cost-effective, and 100% renewable. Corrugated board packaging comes in various forms, including single-phase, single-wall, double-wall, triple-wall, and others.

Opportunities

- Increased demand from the food, beverage and personal care industries will drive market growth

Given people's busy lifestyles, there is an increase in the demand for convenience foods. Companies often use corrugated board packaging to give customers better results because it repels moisture and endures lengthy shipping times. The demand is fuelled by processed foods, such as bread, meat products, and other perishable goods, which require these packaging materials to be used only once. The toughness and durability of corrugated board packaging are highly required. Corrugated boxes can also be customized to the right size for the products. Corrugated board packaging protects personal care products from contamination and other harm. Rigid packaging is crucial for the personal care industry because it allows customers to express their preferences for lifestyle or appearance.

Restraints/Challenges

- Rising raw material prices and the availability of inexpensive substitutes hamper the growth of the market

The availability of low-cost alternatives to corrugated packaging restricts the market's growth. Stretch and shrink wrap, reusable plastic packaging, and intermediate bulk packaging containers outperform corrugated packaging in terms of aesthetics, cost-effectiveness, and durability. This indicates that these alternatives' availability limits the demand for corrugated packaging. In addition, rising raw material costs limit the demand for goods made of corrugated packaging.

This corrugated board packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the corrugated board packaging market, contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2022, the remaining interest in GRUPO Gondi was purchased by Westrock Co., A U.S.-based manufacturer of containerboard and packaging, for USD 970 billion plus the assumption of debt. GRUPO Gondi runs nine corrugated packaging plants, four paper mills, and six high graphic plants throughout Mexico. After the transaction was completed, the company had reportedly further strengthened its position in the expanding Latin American markets.

- In 2022, Menasha packaging company, L.L.C., a Menasha corporation subsidiary, announced the signing of a contract to buy the assets of color-box, a Georgia-Pacific, L.L.C. business unit. Early summer 2022 is the anticipated completion date for the acquisition. Like Menasha packaging, color-box is a corrugated packaging manufacturer focusing on high-graphic boxes. This partnership will help the business's geographic reach and give its clients more graphic, design, and structural packaging options.

- In 2021, International paper decided to divest Turkey's corrugated packaging business. Mondi Group and international paper were the parties to the agreement. This agreement was made between the companies to serve the market and give them an advantage. The packaging industry will experience growth in the market.

- In 2021, Mondi launched a selection of environmentally friendly corrugated packaging options for online grocery delivery services throughout Europe. Seven new packaging solutions meet the demand for new delivery packaging solutions. During Covid, the company introduced a new product for delivery purposes. These products will feed the delivery market.

Global Corrugated Board Packaging Market Scope

The corrugated board packaging market is segmented on the basis of raw material, style, grade, and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw Material

- Linerboard

- Medium

Style

- Slotted Box

- Telescopes

- Folders

- Trays

- Sheets

- Fanfold

- Die Cut Bliss

- Die Cut Interiors

Grade

- Unbleached Test liner

- White-Top Test liner

- Unbleached Kraft liner

- White-Top Kraft liner

- Waste-Based Fluting

- Semi-Chemical Fluting

End-Use

- Processed Foods

- Healthcare

- Beverages

- Chemicals

- Textiles

- Personal Care

- Electrical Goods

- Vehicle Parts

- Glassware and Ceramics

- Wood and Timber Products

- Household Care

- Fruits and Vegetables

- Paper Products

- Tobacco

- Other

Corrugated Board Packaging Market Regional Analysis/Insights

The corrugated board packaging market is analysed and market size insights and trends are provided by country, raw material, style, grade, and end use, as referenced above.

The countries covered in the corrugated board packaging market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

Asia-Pacific dominates the market and will continue to flourish its trend of dominance during the forecast period. The major factors attributable to the region's dominance are easy processing techniques, improved efficiencies, and easier usage of corrugated box packaging in the industry in China, with the growing demand for processed foods and beverages.

North America is expected to showcase the highest growth rate during the forecast period owing to the growing demand for fresh food and beverages, home and personal products, and growth of the e-commerce industry and others, which have led to a regular progression in corrugated packaging. The U.S. dominates the North American region due to the growing awareness among consumers regarding using environment-friendly products.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Corrugated Board Packaging Market Share Analysis

The corrugated board packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to corrugated board packaging market.

Some of the major players operating in the corrugated board packaging market are:

- International Paper (U.S.)

- Mondi (U.K.)

- Smurfit Kappa (Ireland)

- Cascades Inc. (Canada)

- WestRock Company (U.S.)

- Oji Holdings Corporation (U.S.)

- Packaging Corporation of America (U.S.)

- Sealed Air (U.S.)

- Rengo Co., Ltd. (Japan)

- DS Smith (U.K.)

- NIPPON PAPER INDUSTRIES CO., LTD. (Japan)

- Georgia-Pacific (U.S.)

- Neway Packaging (U.S.)

- Arabian Packaging Co L.L.C. (U.A.E)

- Wertheimer Box Corp. (U.S.)

- Klabin S.A. (Brazil)

- Klingele Paper and Packaging S.E. and Co. K.G. (Germany)

- B Smith Packaging Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrugated Board Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrugated Board Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrugated Board Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.