Global Corrugated Box Making Machine Market

Market Size in USD billion

CAGR :

%

USD

2.28 billion

USD

3.21 billion

2024

2032

USD

2.28 billion

USD

3.21 billion

2024

2032

| 2025 –2032 | |

| USD 2.28 billion | |

| USD 3.21 billion | |

|

|

|

|

What is the Global Corrugated Box Making Machine Market Size and Growth Rate?

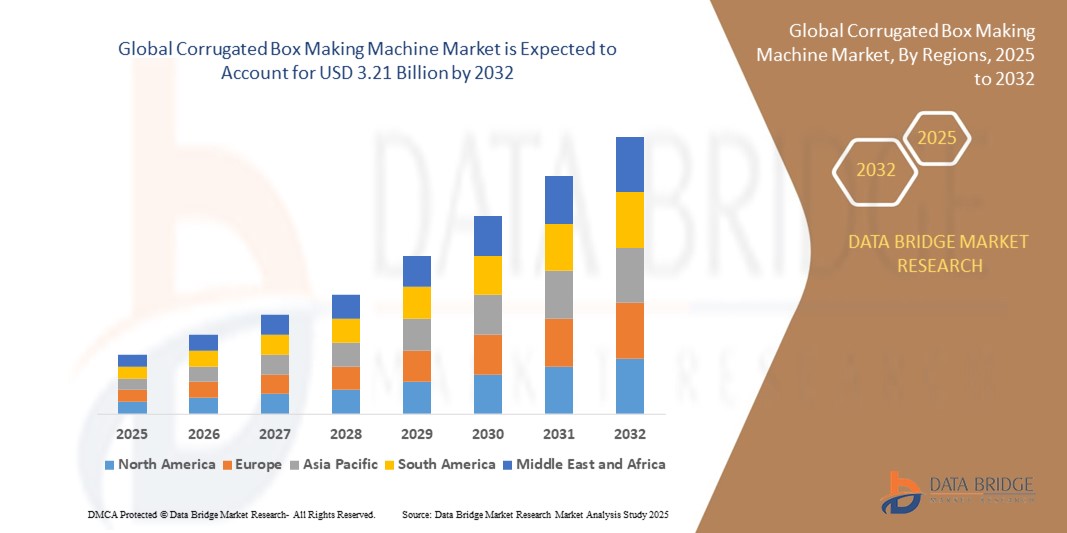

- The global corrugated box making machine market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 3.21 billion by 2032, at a CAGR of 4.40% during the forecast period

- Market growth is primarily driven by the surge in e-commerce, retail packaging demand, and the increasing need for cost-effective, sustainable, and customizable corrugated packaging solutions across industries

- In addition, rapid advancements in automated box making technology, rising focus on on-demand production, and growing emphasis on reducing packaging waste are significantly contributing to market expansion

What are the Major Takeaways of Corrugated Box Making Machine Market?

- Corrugated Box Making Machines, essential for producing corrugated boxes and cartons, play a critical role in addressing the packaging demands of e-commerce, FMCG, food & beverage, and logistics sectors, owing to their ability to deliver high-speed, cost-efficient, and customizable packaging solutions

- The rising need for sustainable packaging, coupled with growing global trade, increased demand for lightweight yet durable packaging, and technological advancements in digital printing and automation, are collectively fueling the growth of the corrugated box making machine market

- Asia-Pacific dominated the corrugated box making machine market with the largest revenue share of 41.7% in 2024, driven by the region’s booming e-commerce sector, rapid industrialization, and rising demand for sustainable packaging solutions across various industries

- North America corrugated box making machine market is projected to grow at the fastest CAGR of 5.6% from 2025 to 2032, fueled by the region's increasing demand for sustainable, efficient, and customizable packaging, particularly within e-commerce and retail sectors

- The Automatic segment dominated the corrugated box making machine market with the largest revenue share of 49.6% in 2024, driven by the increasing demand for high-speed, precise, and labor-efficient packaging solutions across industries

Report Scope and Corrugated Box Making Machine Market Segmentation

|

Attributes |

Corrugated Box Making Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Corrugated Box Making Machine Market?

“Automation and Smart Integration Transforming Corrugated Box Production”

- A prominent trend reshaping the global corrugated box making machine market is the rising adoption of automation, IoT, and smart integration technologies to enhance production efficiency, reduce labor dependency, and meet the growing demand for sustainable, customizable packaging solutions

- Leading manufacturers are incorporating real-time monitoring, AI-driven diagnostics, and predictive maintenance features into their corrugated box machines, ensuring minimal downtime and optimized performance. For instance, Bobst Group SA has introduced smart machine systems that provide remote performance monitoring and automated production adjustments to maximize output efficiency

- The integration of digital printing technology into corrugated box production lines is also gaining traction, offering faster turnaround times, reduced waste, and the ability to produce personalized, short-run packaging with high-quality graphics, essential for e-commerce and retail sectors

- Companies are further investing in machines capable of handling recyclable and lightweight materials to align with global sustainability goals. Smart systems that optimize material usage, minimize waste, and support circular economy initiatives are becoming standard across production facilities

- The shift toward intelligent, automated corrugated box making machines is enabling manufacturers to meet market demands for agility, customization, and eco-friendly packaging, while also reducing operational costs and improving quality control

- This technology-driven transformation is expected to significantly enhance production capabilities, positioning automated corrugated box making machines as a cornerstone of modern, sustainable packaging operations

What are the Key Drivers of Corrugated Box Making Machine Market?

- The escalating demand for corrugated packaging, fueled by the booming e-commerce sector, growing sustainability mandates, and the need for lightweight, durable shipping solutions, is a primary driver of the corrugated box making machine market

- For instance, in February 2024, Mitsubishi Heavy Industries announced advancements in high-speed, automated corrugated box production lines to address the surging global need for sustainable, efficient packaging solutions, particularly for online retail and logistics industries

- The rising focus on sustainable packaging materials, coupled with increasing consumer and regulatory pressures to reduce plastic usage, is accelerating the adoption of corrugated box solutions, subsequently boosting machine demand

- Manufacturers are seeking flexible, high-speed machines capable of producing custom-sized boxes on demand, reducing excess material usage, and supporting more efficient logistics operations

- Furthermore, the integration of smart technologies, such as IoT-enabled monitoring, energy-efficient systems, and digital printing capabilities, is enhancing machine performance, lowering production costs, and driving market growth

- As packaging becomes a key differentiator in product presentation and sustainability efforts, demand for advanced corrugated box making machines that deliver quality, efficiency, and eco-friendly output continues to rise across industries including e-commerce, food & beverage, consumer goods, and pharmaceuticals

Which Factor is challenging the Growth of the Corrugated Box Making Machine Market?

- High initial capital investment and operational costs associated with advanced, automated corrugated box making machines present a significant challenge, particularly for small and medium-sized enterprises (SMEs) and manufacturers in emerging markets

- For instance, while leading players such as Fosber Spa and Packsize International offer state-of-the-art, high-speed machines with smart features, the substantial upfront costs and complex maintenance requirements may limit adoption among cost-sensitive businesses

- In addition, supply chain disruptions, particularly in the availability of critical components such as electronics, motors, and control systems, can delay machine production and increase lead times, affecting overall market growth

- A shortage of skilled technicians capable of operating and maintaining these sophisticated machines, especially in developing regions, further impedes adoption and optimal utilization

- Moreover, smaller packaging firms often face challenges in justifying the ROI of expensive automated systems compared to traditional, lower-cost alternatives, especially when production volumes fluctuate

- To overcome these challenges, industry players must focus on developing cost-effective, modular, and scalable corrugated box making machines, along with providing comprehensive training and after-sales support to ensure broader market penetration and sustained growth

How is the Corrugated Box Making Machine Market Segmented?

The market is segmented on the basis of technology type, material type, and end-user.

• By Technology Type

On the basis of technology type, the corrugated box making machine market is segmented into Manual, Semi-Automatic, and Automatic. The Automatic segment dominated the Corrugated Box Making Machine market with the largest revenue share of 49.6% in 2024, driven by the increasing demand for high-speed, precise, and labor-efficient packaging solutions across industries. Automatic machines offer consistent performance, minimal human intervention, and enhanced production capacity, making them the preferred choice for large-scale manufacturers seeking operational efficiency and reduced downtime.

The Semi-Automatic segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand from small and medium-sized enterprises (SMEs) that seek a balance between automation benefits and cost-effectiveness. Semi-automatic machines offer improved productivity over manual processes while remaining accessible for businesses with moderate production volumes.

• By Material Type

On the basis of material type, the corrugated box making machine market is segmented into Standalone and Integrated. The Integrated segment accounted for the largest market revenue share of 56.3% in 2024, attributed to the growing preference for end-to-end, fully integrated systems that combine cutting, printing, and box forming processes within a single production line. Integrated machines enhance workflow efficiency, reduce manual handling, and support the production of customized, on-demand packaging solutions, particularly for high-volume operations in the e-commerce and retail sectors.

The Standalone segment is expected to register the fastest CAGR from 2025 to 2032, driven by the need for flexible, modular machinery that can be added to existing production lines or customized for specific packaging formats. Standalone machines offer operational versatility, making them ideal for manufacturers with varied packaging requirements or limited space.

• By End-User

On the basis of end-user, the corrugated box making machine market is segmented into Packaging, Food & Beverages, Retail & E-commerce, Electrical & Electronics, Pharmaceuticals, and Others. The Retail & E-commerce segment dominated the market with the largest revenue share of 41.8% in 2024, driven by the exponential growth of online shopping and the need for efficient, customizable, and sustainable packaging solutions to support high-frequency shipping and delivery operations. E-commerce players are investing in advanced corrugated box making machines to meet consumer expectations for protective, eco-friendly, and branded packaging.

The Pharmaceuticals segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for secure, tamper-evident, and eco-conscious packaging for medicines, medical devices, and health products. Corrugated boxes are widely adopted in the pharmaceutical sector for their protective properties and compliance with strict packaging standards.

Which Region Holds the Largest Share of the Corrugated Box Making Machine Market?

- Asia-Pacific dominated the corrugated box making machine market with the largest revenue share of 41.7% in 2024, driven by the region’s booming e-commerce sector, rapid industrialization, and rising demand for sustainable packaging solutions across various industries

- Countries such as China, India, and Japan are at the forefront due to strong manufacturing capabilities, technological advancements, and growing investments in automation and packaging infrastructure

- In addition, the increasing emphasis on cost-efficient, eco-friendly, and customizable corrugated packaging is propelling the demand for corrugated box making machines across the region, particularly within retail, food & beverage, and electronics sectors

China Corrugated Box Making Machine Market Insight

The China corrugated box making machine market accounted for the largest revenue share within Asia-Pacific in 2024, supported by the country’s dominant role in global manufacturing, growing export activities, and rising domestic demand for durable, eco-conscious packaging. China’s push towards automation in the packaging sector, coupled with government support for smart manufacturing initiatives, is accelerating the adoption of advanced Corrugated Box Making Machines. The market also benefits from strong demand in e-commerce, electronics, and food & beverage industries.tT

India Corrugated Box Making Machine Market Insight

The India corrugated box making machine market is witnessing robust growth, driven by the country’s rapidly expanding e-commerce sector, increasing consumer goods production, and the government’s focus on promoting sustainable packaging solutions. As Indian manufacturers seek efficient, high-speed machinery to meet growing packaging demands, the adoption of technologically advanced Corrugated Box Making Machines is accelerating. Furthermore, rising environmental awareness and demand for recyclable materials are further supporting market expansion in India.

Japan Corrugated Box Making Machine Market Insight

The Japan corrugated box making machine market is experiencing steady growth, attributed to the country’s emphasis on precision engineering, automation, and high-quality packaging standards. Japanese manufacturers are investing in advanced Corrugated Box Making Machines to meet the evolving needs of industries such as electronics, pharmaceuticals, and retail. The country’s focus on sustainable packaging and space-efficient solutions also drives the demand for innovative, compact corrugated packaging machinery.

Which Region is the Fastest Growing Region in the Corrugated Box Making Machine Market?

North America corrugated box making machine market is projected to grow at the fastest CAGR of 5.6% from 2025 to 2032, fueled by the region's increasing demand for sustainable, efficient, and customizable packaging, particularly within e-commerce and retail sectors. The growing preference for automation, advanced printing capabilities, and eco-friendly production processes is driving the adoption of Corrugated Box Making Machines in both the U.S. and Canada.

U.S. Corrugated Box Making Machine Market Insight

U.S. corrugated box making machine market accounted for the largest revenue share within North America in 2024, driven by the booming e-commerce sector, growing focus on sustainable packaging, and the need for high-speed, flexible production lines. U.S. manufacturers are increasingly adopting automated corrugated box making machines to reduce production costs, enhance packaging quality, and meet the growing demand for eco-conscious, customized corrugated boxes.

Canada Corrugated Box Making Machine Market Insight

The Canada corrugated box making machine market is poised for notable growth, supported by the country’s emphasis on sustainable packaging practices, rising demand from the food & beverage and consumer goods industries, and increasing investment in advanced manufacturing technologies. The market benefits from growing cross-border trade, e-commerce expansion, and a rising focus on recyclable, durable packaging solutions.

Which are the Top Companies in Corrugated Box Making Machine Market?

The corrugated box making machine industry is primarily led by well-established companies, including:

- ACME Machinery Co. Pvt. Ltd. (India)

- Bobst Group SA (Switzerland)

- EMBA Machinery AB (Sweden)

- Fosber Spa (Italy)

- ISOWA Corporation (Japan)

- KOLBUS GmbH (Germany)

- Mitsubishi Heavy Industries (Japan)

- Packsize International (U.S.)

- Saro Packaging Machine Industries Ltd. (India)

- Serpa Packaging Solutions (U.S.)

- Sanghia Print Young International Industry (India)

- Hebei Shangli Carton Equipment (China)

- Shink Machine Mfg. (Taiwan)

- Wenzhou Zhongke Packaging Machinery (China)

- Zemat Technology Group (Poland)

What are the Recent Developments in Global Corrugated Box Making Machine Market?

- In October 2024, BOBST announced its strategic expansion in India by establishing a new manufacturing facility dedicated to serving the corrugated packaging sector. This move aligns with the company’s localization strategy and aims to strengthen its footprint in the rapidly growing Indian market, supporting increased demand for high-performance corrugated machinery

- In May 2024, BOBST introduced the latest version of its flatbed die-cutter, the MASTERCUT 165 PER, engineered to efficiently process both corrugated boards and folding cartons. This technological advancement is designed to optimize precision, productivity, and quality in corrugated packaging production, reinforcing BOBST’s reputation for innovation in the industry

- In March 2024, India's largest Corrugated Packaging Machinery Expo was held in New Delhi, organized by ICPMA and Futurex Group, bringing together over 300 exhibitors and 800 brands. The event showcased cutting-edge technologies, machinery, and innovations, reflecting the sector’s accelerating growth and positioning India as a key player in the global corrugated packaging market

- In September 2023, International Paper announced the official opening of its new corrugated packaging facility in Atglen, Pennsylvania, with an investment of USD 100 million, creating over 100 manufacturing jobs. This facility enhances the company’s production capabilities for industries such as e-commerce, food & beverage, and shipping, while also contributing to regional economic development

- In September 2023, International Paper, the American pulp and paper leader, confirmed the launch of a state-of-the-art corrugated packaging plant in the U.S., aimed at boosting production for key sectors including e-commerce, food & beverage, and logistics. This expansion strengthens the company’s ability to meet rising demand for sustainable, high-quality corrugated packaging solutions across the North American market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Corrugated Box Making Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Corrugated Box Making Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Corrugated Box Making Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.