Global Cosmetic Applicator Foam Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

2.84 Billion

2024

2032

USD

1.27 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.27 Billion | |

| USD 2.84 Billion | |

|

|

|

|

What is the Global Cosmetic Applicator Foam Market Size and Growth Rate?

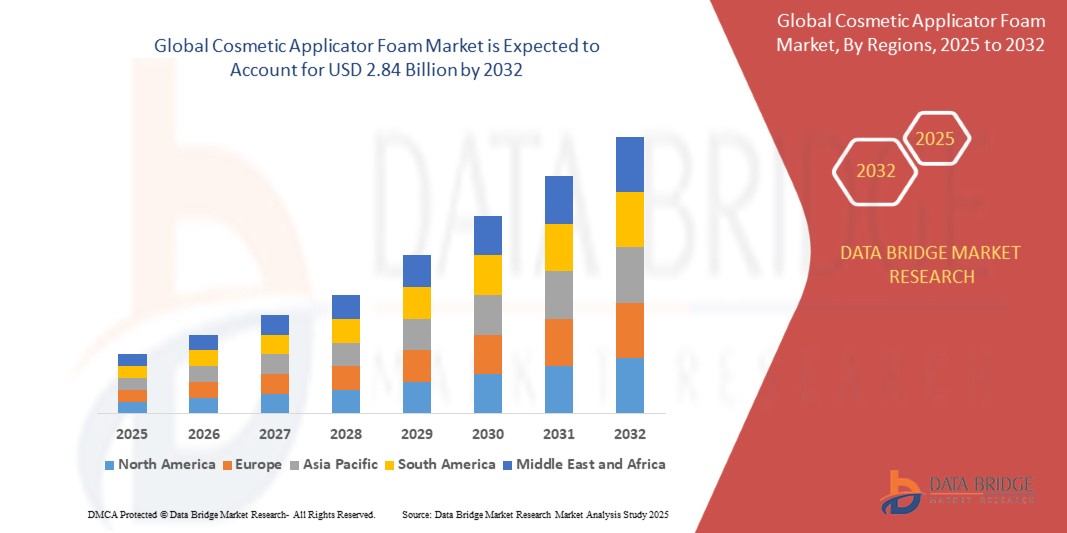

- The global cosmetic applicator foam market size was valued at USD 1.27 billion in 2024 and is expected to reach USD 2.84 billion by 2032, at a CAGR of 10.60% during the forecast period

- The cosmetic applicator foam market is witnessing notable expansion, propelled by several pivotal factors. A significant driver of this growth is the rising demand for high-quality beauty and personal care products, which has increased the need for effective and versatile applicators such as sponges and brushes

- These applicators rely on advanced foam materials to meet the evolving needs of consumers. As preferences shift toward more precise and seamless makeup applications, there is a growing emphasis on the performance and quality of these foam-based tool

- This shift is fueling market expansion as both consumers and professionals seek out applicators that offer superior results and enhance the overall beauty experience. In addition, innovations in foam technology are contributing to the development of more efficient and user-friendly products, further driving the market forward

What are the Major Takeaways of Cosmetic Applicator Foam Market?

- With consumers increasingly seeking high-quality beauty products to enhance their appearance, the demand for effective applicators such as foam-based sponges and brushes rises accordingly

- These applicators play a crucial role in the application and blending of cosmetics, making them essential tools in the beauty regimen. The industry's growth is further supported by trends toward professional-grade products and innovations that improve the efficiency and effectiveness of makeup applications, thereby driving the market for specialized foam applicators

- North America dominated the cosmetic applicator foam market with the largest revenue share of 41.3% in 2024, driven by the region’s well-established cosmetics industry, high consumer spending on personal care products, and strong demand for advanced beauty tools

- Asia-Pacific is projected to grow at the fastest CAGR of 15.1% from 2025 to 2032, driven by expanding middle-class populations, rising beauty consciousness, and increasing local cosmetic manufacturing in countries such as China, India, South Korea, and Japan

- The PU segment dominated the cosmetic applicator foam market with the largest revenue share of 48.6% in 2024, owing to its lightweight texture, softness, and excellent absorption characteristics, making it a preferred material across a broad range of cosmetic applications including foundation blending and skincare

Report Scope and Cosmetic Applicator Foam Market Segmentation

|

Attributes |

Cosmetic Applicator Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Cosmetic Applicator Foam Market?

“Eco-Friendly and Biodegradable Material Innovations”

- A key emerging trend in the cosmetic applicator foam market is the growing shift towards sustainable, biodegradable, and plant-based foam materials, driven by increasing environmental concerns and consumer demand for green beauty solutions

- For instance, in 2024, L’Oréal announced its plan to integrate bio-based applicator foams across several product lines, significantly reducing reliance on petroleum-based polymers and enhancing its sustainable packaging initiatives

- Manufacturers are increasingly investing in innovative foam technologies, such as cellulose-based and sugarcane-derived foams, which are soft, skin-safe, and suitable for various cosmetic formulations. These new materials aim to maintain product performance while offering improved environmental profiles

- In addition, there’s a noticeable rise in recyclable and compostable applicator formats, especially in compact powders, foundation cushions, and skincare sponges. Consumers are actively seeking cruelty-free and eco-conscious options that align with their beauty values

- Companies such as Taiki Group and Porex are leading this shift by introducing biodegradable applicators that do not compromise texture, durability, or user experience. Their innovations are helping brands reposition products with eco-labeled credentials

- As sustainability continues to dominate the cosmetics industry, the market is expected to accelerate the adoption of eco-foams, reshaping the future of product development and packaging across global markets

What are the Key Drivers of Cosmetic Applicator Foam Market?

- The increasing focus on hygiene, convenience, and product effectiveness in skincare and cosmetic applications is a major driver for the growth of the cosmetic applicator foam market

- For instance, in 2023, Estée Lauder reported a surge in sales of cosmetic compacts featuring anti-bacterial polyurethane foams, indicating consumer preference for clean, skin-friendly applicators

- Rising global demand for precision application tools for makeup products such as foundations, concealers, and serums has prompted manufacturers to design ergonomic, multifunctional foams that improve user control and finish

- The expansion of e-commerce beauty platforms and influencer marketing is amplifying the visibility of customized and branded foam applicators, thus driving brand differentiation and consumer engagement

- Furthermore, the rise in premium cosmetics and personalized beauty is pushing brands to include high-quality, soft-touch applicator foams that enhance the luxury perception and user experience of the product

- Technological advancements in foam engineering—such as open-cell structures, memory foams, and dual-layer composites—are enabling superior performance, supporting greater adoption across cosmetics and skincare categories

Which Factor is challenging the Growth of the Cosmetic Applicator Foam Market?

- One major challenge facing the market is the environmental concern associated with non-biodegradable polyurethane and synthetic foams, which are widely used but not easily recyclable

- For instance, a 2022 sustainability audit by UFP Technologies revealed that over 70% of global cosmetic applicators end up in landfills due to mixed-material construction and lack of end-of-life disposal options

- In addition, volatile raw material prices for polymers such as polyether and polyester can impact production costs, especially for companies relying on imported materials or custom blends

- Another barrier is the rising scrutiny on cosmetic waste and packaging, with regulatory authorities and eco-conscious consumers pressing brands to move away from single-use and chemically treated foams

- In some cases, natural alternatives such as sponges made from konjac or cotton may not match the performance, softness, or durability of synthetic foams, presenting trade-offs in product formulation

- To overcome these hurdles, industry players must invest in sustainable innovation, improve recycling infrastructure, and explore circular packaging strategies to maintain long-term consumer trust and regulatory compliance

How is the Cosmetic Applicator Foam Market Segmented?

The market is segmented on the basis of material type and shape.

• By Material Type

On the basis of material type, the cosmetic applicator foam market is segmented into PU (Polyurethane), Polyvinyl Alcohol (PVA), Latex, and Silicone. The PU segment dominated the Cosmetic Applicator Foam market with the largest revenue share of 48.6% in 2024, owing to its lightweight texture, softness, and excellent absorption characteristics, making it a preferred material across a broad range of cosmetic applications including foundation blending and skincare. PU foam is widely used due to its affordability and ability to offer both smooth application and durability.

The silicone segment is anticipated to witness the fastest CAGR of 19.4% from 2025 to 2032, driven by growing consumer demand for non-absorbent, easy-to-clean, and reusable applicators. Silicone applicators minimize product wastage and are especially favored in skincare and liquid foundation applications, where hygiene and product retention are critical.

• By Shape

On the basis of shape, the cosmetic applicator foam market is segmented into Egg-shaped Sponges, Cosmetic Wedges, Silicone Sponges, Round Disc Sponges, and Others. The egg-shaped sponge segment held the largest revenue share of 38.7% in 2024, driven by its versatility, ergonomic design, and ability to provide smooth, streak-free makeup application. The shape allows precise control for both broad and targeted coverage, making it a favorite among professional makeup artists and consumers asuch as.

The cosmetic wedges segment is expected to register the fastest growth rate of 18.1% from 2025 to 2032, fueled by its cost-effectiveness, single-use hygiene appeal, and widespread use in both retail cosmetic packaging and professional beauty salons. These wedges are particularly popular in makeup trials, salons, and travel kits due to their compact form and disposal convenience.

Which Region Holds the Largest Share of the Cosmetic Applicator Foam Market?

- North America dominated the cosmetic applicator foam market with the largest revenue share of 41.3% in 2024, driven by the region’s well-established cosmetics industry, high consumer spending on personal care products, and strong demand for advanced beauty tools

- Consumers in North America exhibit a high preference for premium beauty products and hygienic, performance-driven applicators, especially those made of PU and latex-free foam materials. The rise of influencer marketing and clean beauty trends further boosts the usage of cosmetic foam applicators in this region

- The regional market benefits from robust innovation, with leading cosmetic brands introducing customized and sustainable foam applicators, supporting growth across retail and professional salon channels

U.S. Cosmetic Applicator Foam Market Insight

The U.S. cosmetic applicator foam market held the largest revenue share in 2024 within North America, attributed to the dominance of global beauty giants, extensive consumer awareness, and fast adoption of product innovations. The country’s rising demand for eco-friendly, cruelty-free applicators and latex-free materials has encouraged manufacturers to adopt advanced PU blends and biodegradable foams. In addition, growing e-commerce penetration and strong social media influence are accelerating product visibility and consumer demand across all age groups.

Europe Cosmetic Applicator Foam Market Insight

The Europe cosmetic applicator foam market is expected to grow at a steady CAGR over the forecast period, driven by increasing demand for sustainable and dermatologically-tested beauty tools. With the rise of clean beauty standards and EU-wide environmental regulations, manufacturers are increasingly investing in bio-based foams and recyclable materials. Major beauty brands in Europe are incorporating high-quality foam applicators in skincare, foundation, and cosmetic compacts to cater to rising consumer expectations.

U.K. Cosmetic Applicator Foam Market Insight

The U.K. market is projected to grow consistently, propelled by a surge in demand for high-performance and eco-conscious applicators in both premium and mass-market cosmetic segments. Growing awareness of product hygiene, combined with a trend toward sustainable packaging and applicators, is reshaping product offerings. Retailers are also expanding private-label cosmetic lines featuring innovative foam applicators to meet consumer interest in value-added beauty tools.

Germany Cosmetic Applicator Foam Market Insight

Germany’s market is set to expand, fueled by increasing preferences for technologically advanced, skin-safe applicators, especially among premium skincare and pharmaceutical-grade cosmetic users. Germany’s strong emphasis on product quality, testing, and sustainability encourages the adoption of advanced foam materials. Foam manufacturers are partnering with local and global brands to develop customized, high-durability applicators that meet strict EU standards.

Which Region is the Fastest Growing in the Cosmetic Applicator Foam Market?

Asia-Pacific is projected to grow at the fastest CAGR of 15.1% from 2025 to 2032, driven by expanding middle-class populations, rising beauty consciousness, and increasing local cosmetic manufacturing in countries such as China, India, South Korea, and Japan. The region benefits from an affordable supply chain for foam components and growing demand for beauty sponges and compact applicators in both retail and direct-to-consumer segments. The increasing popularity of K-beauty and J-beauty products further boosts the need for high-quality applicators in the region.

Japan Cosmetic Applicator Foam Market Insight

Japan’s market is thriving due to its reputation for high-tech beauty tools, precision design, and minimalist packaging. Japanese consumers value soft, skin-friendly foam applicators for gentle skincare routines. The country’s advanced R&D capabilities and consumer preference for compact, portable, and high-performing applicators contribute significantly to regional growth.

China Cosmetic Applicator Foam Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, supported by rapid urbanization, growing beauty spending, and domestic production capabilities. As a global hub for cosmetics manufacturing, China is witnessing a boom in demand for affordable, yet effective applicator foams, with both global and local brands expanding their presence. The rise of live-commerce, celebrity beauty endorsements, and local innovation is fueling fast market expansion.

Which are the Top Companies in Cosmetic Applicator Foam Market?

The cosmetic applicator foam industry is primarily led by well-established companies, including:

- Dow (U.S.)

- BASF SE (Germany)

- Huntsman International LLC (U.S.)

- Armacell (Germany)

- UFP Technologies, Inc. (U.S.)

- INOAC CORPORATION (Japan)

- FXI (U.S.)

- Fritz Nauer AG (Switzerland)

- FoamPartner Group (Switzerland)

- Woodbridge (Canada)

- General Plastics Manufacturing Company (U.S.)

- Wisconsin Foam Products (U.S.)

- KTT Enterprises (U.S.)

- LUXAIRE CUSHION COMPANY (U.S.)

- TAIKI GROUP (Japan)

- Porex (U.S.)

- Reilly Foam Corporation (U.S.)

- Estée Lauder Inc (U.S.)

- L’Oréal Paris (France)

- NEW AVON COMPANY (U.S.)

- Beauty Bakerie Cosmetics Brand (U.S.)

What are the Recent Developments in Global Cosmetic Applicator Foam Market?

- In March 2025, Method, a personal care brand renowned for its eco-conscious approach, made its retail debut at Ulta Beauty. The brand introduced a new line of body and hair mists, including two exclusive Dream Foam fragrances—Dark Cherry + Raspberry and French Vanilla + Coconut—available at over 1,400 Ulta Beauty stores across the U.S. and online. This launch also marked Method’s entry into a new product category, expanding its fragrance portfolio and strengthening its retail presence

- In October 2024, Superga Beauty, Cosmogen, and GBC collaborated to develop innovative formulation and application solutions in response to evolving consumer expectations around fragrances. The perfume industry, which experienced significant growth post-pandemic—+21% in 2021 and +15% in 2022—has been reshaped by younger consumers, especially Gen Z, who view fragrances as tools for self-expression, wellness, and confidence. This alliance aims to better align with modern fragrance consumption trends and values

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cosmetic Applicator Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cosmetic Applicator Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cosmetic Applicator Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.