Global Cosmetic Pipette Market

Market Size in USD Billion

CAGR :

%

USD

11.97 Billion

USD

28.00 Billion

2024

2032

USD

11.97 Billion

USD

28.00 Billion

2024

2032

| 2025 –2032 | |

| USD 11.97 Billion | |

| USD 28.00 Billion | |

|

|

|

|

Cosmetic Pipette Market Size

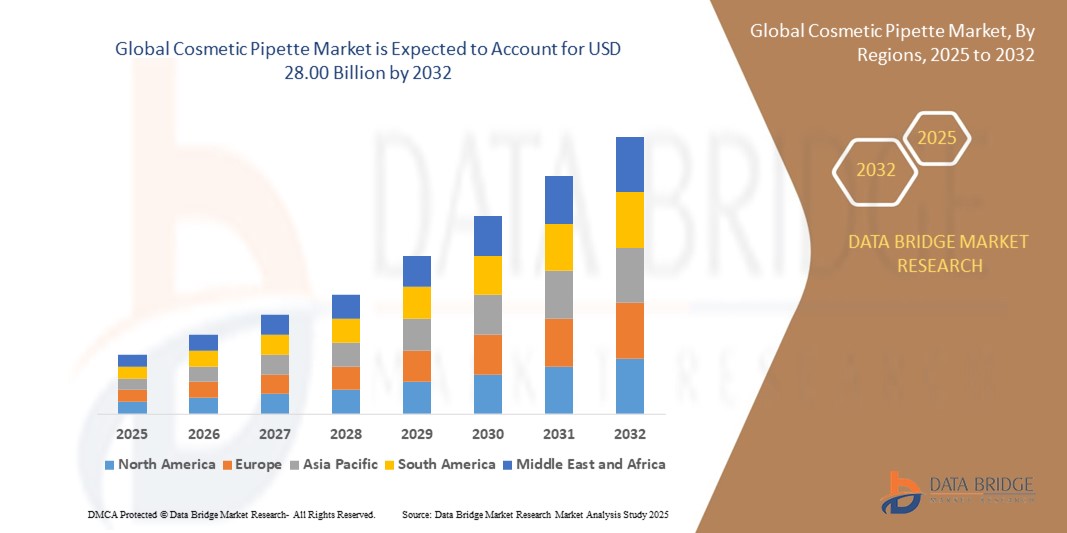

- The global cosmetic pipette market size was valued at USD 11.97 billion in 2024 and is expected to reach USD 28.00 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is primarily driven by increasing demand for precise and hygienic product dispensing in the beauty and skincare industry, particularly for serums, oils, and other high-viscosity formulations

- In addition, rising consumer inclination toward premium, sustainable, and easy-to-use packaging solutions is encouraging cosmetic brands to adopt pipettes, making them a preferred choice for modern cosmetic packaging. These factors are collectively propelling the adoption of cosmetic pipettes and significantly contributing to the market's expansion

Cosmetic Pipette Market Analysis

- Cosmetic pipettes, designed for precise and hygienic dispensing of skincare and beauty formulations, are becoming essential in the cosmetics industry, particularly for serums, oils, and other high-value liquid products, due to their controlled dosage delivery and premium consumer experience

- The increasing demand for cosmetic pipettes is primarily driven by the rise in luxury and personalized skincare trends, growing consumer preference for hygienic, sustainable, and user-friendly packaging, and the need to preserve the integrity of sensitive formulations

- Europe dominated the cosmetic pipette market with the largest revenue share of 38.1% in 2024, fueled by the region’s established cosmetic manufacturing hubs, stringent sustainability regulations, and strong demand for premium skincare solutions, with France and Germany emerging as key markets

- Asia-Pacific is expected to be the fastest growing region in the cosmetic pipette market during the forecast period, driven by rapid expansion of the beauty industry and increasing disposable income in countries such as China, South Korea, and Japan

- Glass pipette segment dominated the cosmetic pipette market with a market share of 49.4% in 2024, owing to its superior compatibility with active ingredients, premium aesthetic appeal, and strong alignment with eco-conscious packaging trends

Report Scope and Cosmetic Pipette Market Segmentation

|

Attributes |

Cosmetic Pipette Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Pipette Market Trends

Sustainable and Precision-Driven Packaging Solutions

- A prominent and accelerating trend in the global cosmetic pipette market is the growing demand for sustainable, hygienic, and precision-based packaging formats, especially in skincare and serum applications where accurate dosage and ingredient preservation are critical

- For instance, L’Oréal and Estée Lauder have introduced recyclable glass pipette packaging for high-value serums, aligning with their sustainability commitments while enhancing user experience through controlled application

- Cosmetic pipettes offer precise dispensing, especially valuable for potent formulations such as vitamin C, retinol, and peptides, where dosage control is essential to prevent skin irritation and ensure efficacy

- Packaging innovations now include UV-protective and airtight pipettes to extend shelf life and protect product integrity, especially in organic and active-rich cosmetic lines

- The combination of premium aesthetics and functionality has made pipettes a popular choice among luxury and clean beauty brands, driving demand for eco-friendly materials such as recyclable glass and biodegradable dropper components

- This growing preference for precise, eco-conscious, and user-friendly dispensing solutions is redefining cosmetic packaging expectations and driving continuous innovation in the pipette segment

Cosmetic Pipette Market Dynamics

Driver

Rising Demand for Premium Skincare and Hygienic Dispensing

- The increasing global demand for high-performance and premium skincare products, combined with growing emphasis on hygiene and user control, is a major driver for the adoption of cosmetic pipettes

- For instance, in March 2024, Virospack launched new sustainable pipette solutions designed for organic and clean beauty brands, offering controlled dispensing, contamination prevention, and recyclable components

- Cosmetic pipettes enable precise and mess-free application of active formulations, helping consumers reduce product waste while enhancing perceived product quality and brand value

- As consumers become more educated on ingredient efficacy and product safety, packaging that supports secure storage and accurate usage has become essential, particularly in high-end skincare and treatment lines

- In addition, direct-to-consumer skincare brands and luxury cosmetic companies are increasingly integrating pipette packaging to differentiate their offerings and meet rising demand for minimal-contact application and premium presentation

Restraint/Challenge

Sustainability and Cost Challenges in Emerging Markets

- Despite rising popularity, the cosmetic pipette market faces challenges related to material sustainability, high production costs, and adoption barriers in price-sensitive regions

- Glass pipettes, although favored for their eco-friendliness and compatibility, are heavier, more fragile, and expensive to manufacture and ship compared to plastic alternatives, limiting use among smaller brands and in emerging economies

- For instance, fully recyclable pipette solutions featuring glass stems and metal-free droppers can significantly increase packaging costs, discouraging adoption in markets where affordability remains a key purchasing factor

- Compliance with stringent packaging regulations, especially in Europe, also presents hurdles for manufacturers lacking access to sustainable material innovation or advanced manufacturing capabilities

- Addressing these issues requires investment in cost-effective sustainable materials, broader recycling infrastructure, and brand education efforts to communicate the long-term value and environmental benefits of pipette-based packaging solutions

Cosmetic Pipette Market Scope

The market is segmented on the basis of material type, neck diameter, technology, overshell screw, button type, pipette length, applicator, dropper type, dosage capacity, product category, and end user.

- By Material Type

On the basis of material type, the cosmetic pipette market is segmented into glass pipette and plastic pipette. The glass pipette segment dominated the market with the largest market revenue share of 49.4% in 2024, driven by its chemical compatibility, premium appearance, and consumer preference for eco-friendly, recyclable packaging. Glass pipettes are widely used in high-end skincare serums and oils where product stability and visual appeal are prioritized.

The plastic pipette segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its lightweight, break-resistant nature and cost-effectiveness. Plastic pipettes are increasingly adopted in mass-market and travel-friendly cosmetic lines, especially in emerging economies with rising skincare adoption.

- By Neck Diameter

On the basis of neck diameter, the cosmetic pipette market is segmented into Europa 5, GCMI 18/410, GCMI 20/410, GCMI 20/415, GCMI 22/410, GCMI 24/410, and GCMI 28/410. The GCMI 20/410 segment dominated the market with the largest revenue share in 2024, owing to its compatibility with standard cosmetic bottles and broad usage across skincare products.

The GCMI 24/410 segment is expected to witness the fastest growth rate from 2025 to 2032 due to increased demand for larger volume pipettes in hair care and foundation products requiring higher dose applications.

- By Technology

On the basis of technology, the cosmetic pipette market is segmented into airless dropper and atmospheric dropper. The atmospheric dropper segment held the largest revenue share in 2024, supported by its simple mechanism, lower cost, and compatibility with a wide variety of formulations.

The airless dropper segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its growing popularity in clean beauty for preventing contamination and maintaining formulation efficacy without preservatives.

- By Overshell Screw

On the basis of overshell screw, the cosmetic pipette market is segmented into plastic screw cap and metal screw cap. The plastic screw cap segment dominated the market in 2024, driven by its flexibility, color customization options, and suitability for mass production.

The metal screw cap segment is projected to grow at the highest CAGR, owing to its use in luxury cosmetic packaging for its sleek appearance, enhanced durability, and alignment with premium branding.

- By Button Type

On the basis of button type, the cosmetic pipette market is segmented into tetine bulb and push button. The tetine bulb segment held the largest revenue share in 2024, favored for its ease of use, wide availability, and consumer familiarity with traditional dropper designs.

The push button segment is anticipated to witness the fastest growth from 2025 to 2032, as brands seek more precise, controlled dispensing mechanisms in clinical and high-efficacy skincare formulations.

- By Pipette Length

On the basis of pipette length, the cosmetic pipette market is segmented into less than 3 cm, 3 cm to 5 cm, and above 5 cm. The 3 cm to 5 cm segment dominated the market in 2024 due to its suitability for standard cosmetic bottle sizes ranging from 15 ml to 30 ml, particularly for facial serums and oils.

The above 5 cm segment is expected to witness the fastest growth during forecast period, supported by the increasing use of larger volume bottles in hair serums and foundation products requiring higher application quantities.

- By Applicator

On the basis of applicator, the cosmetic pipette market is segmented into with applicator and without applicator. The with applicator segment held the largest market share in 2024, as consumers prefer integrated solutions that allow for precise, hygienic, and effortless application.

The without applicator segment is expected to grow steadily during forecast period, driven by the demand for customizable and refillable packaging solutions among sustainable and niche cosmetic brands.

- By Dropper Type

On the basis of dropper type, the cosmetic pipette market is segmented into standard dropper and customized dropper. The standard dropper segment led the market with the largest revenue share in 2024, due to its mass production benefits, affordability, and widespread compatibility across multiple product types.

The customized dropper segment is anticipated to witness the fastest CAGR, as brands increasingly seek unique and branded dispensing formats to differentiate their offerings in competitive premium skincare markets.

- By Dosage Capacity

On the basis of dosage capacity, the cosmetic pipette market is segmented into 0.15 ml, 0.35 ml, 0.5 ml, 1 ml, and others. The 0.5 ml segment dominated the market in 2024, driven by its widespread application in facial serums and actives that require consistent and moderate dosing.

The 1 ml segment is expected to grow at the fastest rate during forecast period, supported by increasing use in body care, hair care, and larger dose skincare treatments that demand higher volume dispensing.

- By Product Category

On the basis of product category, the cosmetic pipette market is segmented into oil, serums, liquid foundations, and others. The serum segment held the largest market share in 2024, due to the growing popularity of active-rich skincare routines and the necessity of precise application for product efficacy.

The liquid foundations segment is anticipated to witness the fastest growth during forecast period, as pipette-based dispensing gains popularity for its precision and hygienic application in lightweight, buildable foundation formulas.

- By End User

On the basis of end user, the cosmetic pipette market is segmented into hair care, make up, and skin care. The skin care segment dominated the market in 2024 with the largest revenue share, fueled by the increasing demand for serums, oils, and anti-aging treatments requiring accurate dosing.

The hair care segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer interest in scalp care products and concentrated hair growth solutions that benefit from spot treatment using pipettes.

Cosmetic Pipette Market Regional Analysis

- Europe dominated the cosmetic pipette market with the largest revenue share of 38.1% in 2024, fueled by the region’s established cosmetic manufacturing hubs, stringent sustainability regulations, and strong demand for premium skincare solutions, with France and Germany emerging as key markets

- Consumers in the region prioritize eco-friendly, precise, and hygienic packaging solutions, with pipettes being widely adopted for serums, oils, and concentrated skincare treatments across both mass and luxury segments

- This strong market presence is further supported by the region’s emphasis on clean beauty, innovation in sustainable materials, and the preference for high-end packaging aesthetics, establishing cosmetic pipettes as a preferred dispensing solution across key European markets

U.K. Cosmetic Pipette Market Insight

The U.K. cosmetic pipette market is anticipated to grow at a notable CAGR during the forecast period, driven by consumer preference for precise, mess-free application and a growing demand for high-efficacy skincare products. Pipettes are widely used in niche and natural beauty segments, particularly in vitamin C serums, anti-aging treatments, and essential oil blends. The country's well-developed beauty and personal care retail sector, combined with increasing online product discovery and ethical beauty trends, supports the rapid uptake of pipette-based packaging among both startups and heritage brands.

Germany Cosmetic Pipette Market Insight

The Germany cosmetic pipette market is expected to expand steadily, underpinned by strong consumer focus on product quality, clean application, and sustainable materials. Germany’s skincare industry places high value on technical formulation and pharmaceutical-grade packaging, making pipettes an ideal dispensing choice. Glass pipettes, in particular, are increasingly used in dermocosmetic and organic skincare products, favored for their inert nature and ability to maintain product stability. Germany’s commitment to eco-innovation and advanced manufacturing techniques continues to support market expansion.

U.S. Cosmetic Pipette Market Insight

The U.S. cosmetic pipette market captured a significant revenue share in 2024 within North America, driven by increasing consumer demand for premium skincare, clean beauty formulations, and hygienic, precision-based packaging. Pipettes have become a staple in products such as facial serums, oils, and vitamin-based treatments, offering convenience and control over dosage. The rise of direct-to-consumer brands, along with a strong e-commerce ecosystem and a growing preference for personalized skincare routines, continues to propel the market. In addition, the emphasis on product integrity and contamination-free application supports the integration of pipettes in both luxury and mid-tier product lines.

Asia-Pacific Cosmetic Pipette Market Insight

The Asia-Pacific cosmetic pipette market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, supported by surging demand for skincare innovations, increasing disposable incomes, and the widespread popularity of K-beauty and J-beauty routines. Countries such as China, South Korea, and India are witnessing a sharp rise in skincare product consumption, particularly serums and concentrated actives, where pipettes provide hygienic and precise application. Government support for domestic cosmetic production, rising awareness of personal grooming, and rapid e-commerce expansion are major factors fostering the widespread use of pipette packaging in both local and international brands.

Japan Cosmetic Pipette Market Insight

The Japan cosmetic pipette market is gaining momentum due to a strong cultural emphasis on advanced skincare, functionality, and product quality. Pipettes are highly favored in the application of essences, serums, and specialty anti-aging treatments that require precise dosing and minimal contamination. The integration of pipettes with sleek, premium packaging designs resonates well with Japan’s beauty aesthetic. Moreover, the country’s aging population is driving demand for targeted solutions that offer ease of use, safety, and hygiene, further enhancing pipette adoption in both residential and professional skincare settings.

India Cosmetic Pipette Market Insight

The India cosmetic pipette market is expanding rapidly, driven by a fast-growing middle-class population, rising skincare awareness, and a flourishing ecosystem of indigenous beauty brands. Pipettes are increasingly found in ayurvedic serums, facial oils, and herbal elixirs, offering consumers a premium experience through precise dispensing. The “Made in India” initiative and growing local production capabilities have made pipette-based packaging more accessible and cost-effective. Furthermore, the digital beauty revolution and demand for hygienic, portable packaging are helping India solidify its position as a key growth driver within the Asia-Pacific cosmetic pipette market.

Cosmetic Pipette Market Share

The cosmetic pipette industry is primarily led by well-established companies, including:

- Comar LLC (U.S.)

- FH Packaging Inc. (U.S.)

- RTN Applicator Company LLC (U.S.)

- yellopackaging (China)

- Virospack (Spain)

- LUMSON S.p.A (Italy)

- HCP Packaging (U.S.)

- DWK Life Sciences (U.S.)

- Taiwan K. K. Corporation (Taiwan)

- Yonwoo CO., Ltd (South Korea)

- FusionPKG (U.S.)

- Quadpack (Spain)

- PUMTECH (South Korea)

- Adelphi Group (U.K.)

- SONE Products (U.K.)

- Hamilton Company (U.S.)

- Denville Scientific, Inc (U.S.)

- Eppendorf AG (Germany)

- Sarstedt AG (Germany)

What are the Recent Developments in Global Cosmetic Pipette Market?

- In June 2025, Shellworks, a UK-based sustainable packaging innovator, introduced the world’s first fully home-compostable cosmetic pipette made from Vivomer, a proprietary plant-based material. Designed to decompose entirely as a single unit, this launch addresses the long-standing recyclability challenges posed by traditional multi-material droppers, signaling a significant advancement in sustainable cosmetic packaging

- In June 2024, Vetroplas Packaging Ltd unveiled the Tokyo auto-loading pipette dropper, specially designed for 15 ml and 30 ml glass bottles. Featuring a soft-touch silicone bulb and compatibility with up to 90% recycled glass, the dropper combines sustainability and high-end aesthetics, reinforcing the brand’s commitment to eco-conscious and functional beauty packaging

- In May 2024, Aptar Beauty launched the NeoDropper, a high-precision cosmetic pipette tailored for serums and active skincare formulations. The product emphasizes micro-dosage control and enhanced formula protection, aligning with growing consumer demand for personalized skincare and the safe delivery of potent ingredients

- In February 2024, APackaging Group introduced the Infinity Dropper, a fully recyclable all-plastic cosmetic pipette solution aimed at reducing environmental impact. This innovation reflects the company’s strategic pivot toward sustainability while maintaining performance and style in packaging design

- In June 2025, Lumson S.p.A. launched ALU DROP and ALU DROP TOUCH, two aluminum push-button pipettes with standard 20/400 necks. Engineered for precise and repeatable dosage, the products cater to premium skincare brands focused on delivering both functional efficacy and upscale appeal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cosmetic Pipette Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cosmetic Pipette Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cosmetic Pipette Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.