Global Cpap Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

9.34 Billion

2024

2032

USD

4.92 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 9.34 Billion | |

|

|

|

|

CPAP Devices Market Size

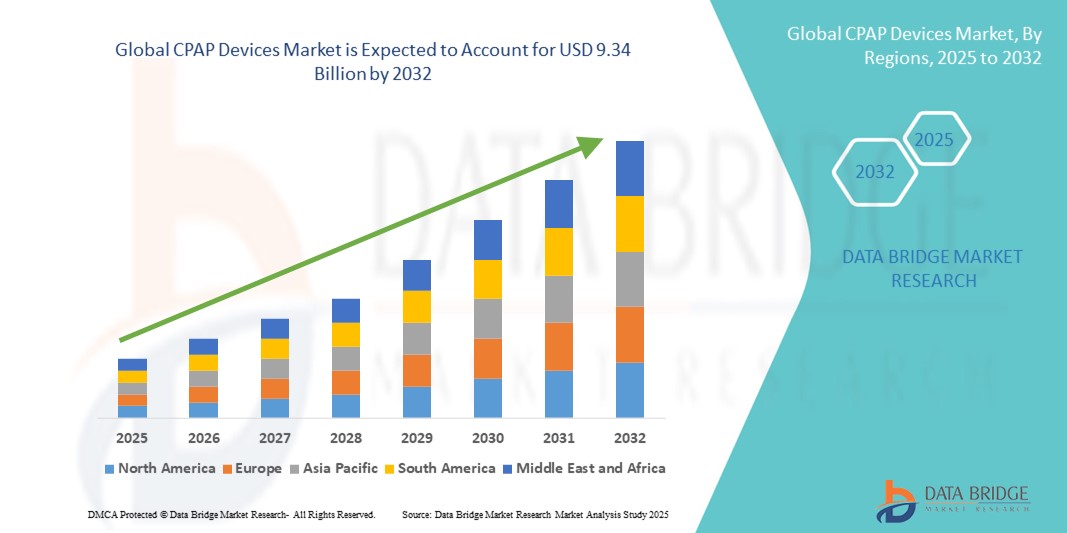

- The global CPAP devices market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 9.34 billion by 2032, at a CAGR of 8.33% during the forecast period

- The market growth is largely driven by the increasing prevalence of sleep apnea and rising awareness of sleep disorders, coupled with improved diagnostic capabilities and therapeutic solutions across developed and emerging economies

- Furthermore, the growing elderly population, along with advancements in portable and auto-adjusting CPAP technology, is enhancing patient compliance and clinical outcomes. These converging factors are driving wider adoption of CPAP devices in both clinical and homecare settings, significantly boosting the industry's growth

CPAP Devices Market Analysis

- CPAP devices, designed to maintain continuous positive airway pressure for patients with obstructive sleep apnea (OSA), have become integral to respiratory care and sleep disorder management in both clinical and homecare environments due to their non-invasive nature, enhanced therapeutic outcomes, and growing user awareness

- The rising prevalence of OSA, coupled with increasing diagnosis rates and growing awareness of the health risks associated with untreated sleep apnea such as cardiovascular diseases and diabetes is the primary driver behind the escalating demand for CPAP devices.

- North America dominated the CPAP devices market with the largest revenue share of 39% in 2024, attributed to robust healthcare infrastructure, high awareness levels, favorable reimbursement policies, and the presence of key medical device manufacturers, with the U.S. leading in home-based sleep therapy adoption and telehealth-driven CPAP monitoring solutions

- Asia-Pacific is expected to be the fastest growing region in the CPAP devices market during the forecast period due to expanding healthcare access, growing sleep apnea screening initiatives, and rising healthcare expenditure

- CPAP device segment dominated the CPAP devices market with a market share of 62.8% in 2024, driven by its rising adoption for long-term obstructive sleep apnea management and continuous technological advancements improving treatment efficacy and patient comfort

Report Scope and CPAP Devices Market Segmentation

|

Attributes |

CPAP Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CPAP Devices Market Trends

“Technological Advancements and Connectivity Enhancing Patient Compliance”

- A significant and accelerating trend in the global CPAP devices market is the growing integration of wireless connectivity, AI-driven analytics, and cloud-based platforms aimed at improving treatment adherence and personalization for patients with obstructive sleep apnea (OSA)

- For instance, ResMed’s AirSense 11 and Philips’ DreamStation series offer smartphone compatibility and cloud connectivity, enabling remote monitoring, real-time data sharing with healthcare providers, and daily therapy insights for patients

- AI capabilities in modern CPAP devices support auto-adjusting pressure settings based on breathing patterns and offer personalized feedback, enhancing the effectiveness of therapy and improving long-term compliance

- In addition, features such as heated humidification, quiet operation, and ergonomic mask design are being increasingly adopted to boost patient comfort and convenience, particularly in home-based settings

- The integration of CPAP systems into digital health ecosystems facilitates better communication between patients and clinicians, allowing timely intervention and adjustments to therapy. This trend is expanding access to quality sleep apnea management beyond traditional hospital settings

- Consequently, companies such as BMC Medical and 3B Medical are introducing technologically advanced, AI-powered, and portable CPAP solutions, catering to the growing demand for intelligent, user-centric respiratory care systems across global markets

CPAP Devices Market Dynamics

Driver

“Rising Prevalence of Sleep Apnea and Growing Demand for Home-Based Treatment”

- The increasing prevalence of obstructive sleep apnea (OSA) globally, driven by risk factors such as obesity, aging populations, and sedentary lifestyles, is a major factor propelling the demand for CPAP devices

- For instance, the American Academy of Sleep Medicine estimates that approximately 25 million adults in the United States suffer from OSA, creating a significant need for effective and accessible treatment solutions

- The shift toward home-based care, accelerated by the COVID-19 pandemic, has amplified the demand for compact, user-friendly CPAP devices that support remote therapy and monitoring, reducing the need for frequent clinical visits

- In addition, expanding insurance coverage, favorable reimbursement policies, and the integration of telehealth platforms are further supporting the widespread adoption of CPAP therapy in both developed and emerging markets

Restraint/Challenge

“Patient Discomfort and Low Adherence Rates Remain a Barrier”

- Despite their clinical effectiveness, CPAP devices face challenges related to user discomfort, including issues with mask fit, airflow sensation, and noise, which contribute to poor adherence and therapy discontinuation

- High dropout rates within the initial weeks of therapy, particularly among first-time users, pose a significant challenge to treatment outcomes and market expansion

- For instance, studies indicate that a notable percentage of patients either abandon therapy or fail to achieve optimal compliance, limiting the overall impact of CPAP treatment

- To address these issues, manufacturers are focusing on improving comfort through innovations such as pressure relief features, quieter motors, and customized mask options. Companies such as ResMed and Fisher & Paykel Healthcare continue to invest in user-centric design improvements

- Furthermore, the relatively high cost of advanced CPAP devices and limited awareness in low-income regions restrict broader adoption. Overcoming these barriers will be essential through education, affordability initiatives, and development of more intuitive, comfortable, and cost-effective CPAP solutions

CPAP Devices Market Scope

The market is segmented on the basis of product type, modality, and end user.

- By Product Type

On the basis of product type, the CPAP devices market is segmented into CPAP devices and consumables. The CPAP devices segment dominated the market with the largest revenue share of 62.8% in 2024, driven by the increasing number of patients diagnosed with obstructive sleep apnea and the rising demand for non-invasive treatment options. These devices are essential in maintaining airway patency during sleep and are widely prescribed as first-line therapy. The availability of technologically advanced and auto-adjusting CPAP machines has further strengthened the growth of this segment.

The consumables segment, which includes masks, filters, and tubing, is anticipated to witness the fastest growth from 2025 to 2032 due to the recurring nature of their usage and replacement. Increased awareness about hygiene, comfort, and proper fit among CPAP users, along with the growing preference for disposable components, is fueling segment growth. Frequent replacements and innovations in mask design are expected to sustain demand across homecare and clinical settings.

- By Modality

On the basis of modality, the CPAP devices market is segmented into standalone and portable devices. The standalone segment accounted for the largest revenue share of 58.6% in 2024, attributed to its extensive use in clinical environments and for patients requiring consistent pressure therapy. Standalone CPAP systems are known for their reliability and functionality, making them a preferred choice for patients who sleep in a fixed location or require minimal device mobility.

The portable segment is expected to register the fastest CAGR from 2025 to 2032, driven by the rising demand for compact, travel-friendly devices, especially among frequent travelers and working professionals. Technological improvements have enabled the development of lightweight and battery-operated CPAP machines that offer similar performance to conventional devices, expanding their usage in both domestic and international markets.

- By End User

On the basis of end user, the CPAP devices market is segmented into home care, hospitals, private clinics, and others. The home care segment dominated the market with the largest revenue share of 49.8% in 2024, owing to the increasing trend of home-based healthcare and growing patient preference for personalized, at-home sleep therapy. The integration of smart connectivity and remote monitoring features has made it easier for patients to adhere to prescribed therapy at home.

The hospitals segment is anticipated to experience notable growth during the forecast period due to the increasing number of inpatient sleep studies and the use of CPAP devices for acute respiratory management. Hospitals continue to serve as essential settings for diagnosis, titration, and initial therapy, particularly for patients with complex sleep or respiratory disorders.

CPAP Devices Market Regional Analysis

- North America dominated the CPAP devices market with the largest revenue share of 39% in 2024, attributed to robust healthcare infrastructure, high awareness levels, favorable reimbursement policies, and the presence of key medical device manufacturers, with the U.S. leading in home-based sleep therapy adoption and telehealth-driven CPAP monitoring solutions

- Consumers in the region benefit from favorable reimbursement policies, increased awareness about the health risks of untreated sleep disorders, and access to advanced CPAP technologies with integrated monitoring and telehealth support

- This widespread adoption is further supported by the presence of leading medical device manufacturers, rising obesity rates, and a growing emphasis on early diagnosis and long-term sleep apnea management, establishing CPAP devices as a critical component of respiratory care in both clinical and home settings

U.S. CPAP Devices Market Insight

The U.S. CPAP devices market captured the largest revenue share of 80.2% in 2024 within North America, fueled by a high prevalence of obstructive sleep apnea (OSA) and widespread awareness of its health implications. Strong reimbursement structures, growing use of home-based sleep therapy, and increasing integration of CPAP devices with digital health platforms are accelerating market growth. The popularity of auto-adjusting and connected devices, supported by major players such as ResMed and Philips, continues to drive patient adherence and innovation across the segment.

Europe CPAP Devices Market Insight

The Europe CPAP devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising diagnosis rates of sleep disorders and growing geriatric populations. Government-led healthcare initiatives and favorable reimbursement policies are encouraging adoption across both hospital and home care settings. In addition, increasing focus on non-invasive treatment options, combined with rising awareness campaigns for sleep apnea, is supporting growth across key countries including Germany, France, and the U.K.

U.K. CPAP Devices Market Insight

The U.K. CPAP devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased awareness of sleep-related health risks and a shift toward home-based care. The National Health Service (NHS) and private clinics are increasingly prescribing CPAP therapy for OSA, while a surge in digital health tools is improving compliance and remote monitoring. Rising obesity rates and technological innovation are further contributing to CPAP device uptake across residential and clinical settings.

Germany CPAP Devices Market Insight

The Germany CPAP devices market is expected to expand at a considerable CAGR during the forecast period, fueled by strong demand for technologically advanced and energy-efficient medical equipment. Germany’s high healthcare spending and focus on preventative care are promoting widespread adoption of CPAP therapy. A robust hospital infrastructure and growing preference for telehealth-enabled devices are further strengthening the homecare segment, with patients and providers asuch as favoring intelligent and user-friendly CPAP systems.

Asia-Pacific CPAP Devices Market Insight

The Asia-Pacific CPAP devices market is poised to grow at the fastest CAGR of 23.1% during the forecast period of 2025 to 2032, driven by rising incidences of OSA, expanding healthcare access, and increasing awareness of sleep health. Countries such as China, Japan, and India are experiencing rapid adoption of CPAP therapy due to urbanization, lifestyle changes, and the growing availability of cost-effective and portable devices. Local manufacturing and rising government investments in digital healthcare infrastructure are also propelling market expansion.

Japan CPAP Devices Market Insight

The Japan CPAP devices market is gaining momentum due to the country’s aging population, high awareness of sleep apnea, and strong focus on technological innovation. The use of compact, auto-adjusting, and cloud-connected devices is rising as healthcare providers emphasize early diagnosis and long-term management of sleep disorders. Integration of CPAP systems into telehealth services and growing demand for personalized, home-based treatment options are driving steady growth in the Japanese market.

India CPAP Devices Market Insight

The India CPAP devices market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rising sleep disorder diagnoses, increased affordability of CPAP machines, and an expanding middle-class population. Strong demand for home-based therapy, combined with the government’s push for digital health solutions and smart city initiatives, is supporting rapid market expansion. Domestic manufacturing and e-commerce availability of affordable CPAP devices are also fueling adoption in both urban and semi-urban areas.

CPAP Devices Market Share

The CPAP devices industry is primarily led by well-established companies, including:

- ResMed (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Drive DeVilbiss International (U.S.)

- BMC (China)

- React Health (U.S.)

- Baird Respiratory (Sweden)

- Transcend, Inc. (U.S.)

- Armstrong Medical Ltd (U.K.)

- Nidek Medical India (India)

- Narang Medical Limited (India)

- Morpheus Healthcare (India)

- Löwenstein Medical SE & Co. KG (Germany)

- The HomeCare Medical Ltd. (China)

- Hunan Beyond Medical Technology Co., Ltd. (China)

- S Technomed (P) Ltd (India)

- BPL Medical Technologies (India)

- Breas Medical AB (Sweden)

- Acare Technology Co., Ltd. (Taiwan)

What are the Recent Developments in Global CPAP Devices Market?

- In May 2023, ResMed Inc., a global leader in digital health and sleep apnea solutions, launched its next-generation AirSense 11 CPAP device across multiple international markets. Equipped with personal therapy assistant tools, over-the-air updates, and enhanced digital connectivity, the AirSense 11 aims to improve patient adherence and streamline clinical support. This development reinforces ResMed’s focus on user-centric innovation and digital health integration in CPAP therapy

- In April 2023, Koninklijke Philips N.V. introduced an upgraded DreamStation Go portable CPAP device with extended battery life and enhanced connectivity features. Designed for active users who require flexible, travel-friendly therapy, the new model supports seamless integration with the DreamMapper app, allowing patients and clinicians to monitor therapy progress remotely. This launch highlights Philips’ commitment to advancing mobility and convenience in sleep apnea management

- In March 2023, Fisher & Paykel Healthcare Corporation Limited expanded its CPAP product portfolio with the introduction of the F&P Evora Full, a full-face CPAP mask featuring minimal-contact headgear and dynamic support technology. This mask is designed to improve comfort and ease of use for patients while maintaining an effective seal. The development underscores the company’s ongoing efforts to address patient comfort and improve therapy outcomes through innovative design

- In February 2023, BMC Medical Co., Ltd., a rising player in the respiratory care space, launched its G3 Series Auto CPAP device equipped with intelligent pressure adjustment, iCode data tracking, and a user-friendly interface. The launch of this smart-enabled device strengthens BMC Medical’s global presence and reflects the market's shift toward data-driven and AI-supported sleep therapy solutions

- In January 2023, 3B Medical, Inc. unveiled Luna G3 BiPAP and Auto CPAP systems with advanced humidification, Wi-Fi and cellular connectivity, and quiet motor design. These devices cater to both home care and clinical users, offering real-time data transmission and enhanced comfort features. This development highlights 3B Medical’s strategy to provide comprehensive, technologically advanced solutions that improve both patient experience and clinical efficiency in the CPAP segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS AND DIAGNOSIS OF SLEEP APNEA

5.1.2 GROWING ELDERLY POPULATION WITH SUSCEPTIBILITY TO SLEEP DISORDERS

5.1.3 INTEGRATION OF CPAP DEVICES WITH TELEMEDICINE PLATFORMS

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COSTS OF CPAP DEVICES AND RELATED ACCESSORIES

5.2.2 SIDE EFFECTS AND DISCOMFORT ASSOCIATED WITH THE USE OF CPAP DEVICES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN HEALTHCARE FACILITIES AND SERVICES IN EMERGING ECONOMIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS TO IMPROVE DEVICE FUNCTIONALITY

5.3.3 FAVORABLE INSURANCE REIMBURSEMENT POLICIES AND COVERAGE

5.4 CHALLENGES

5.4.1 STRINGENT AND COMPLEX REGULATIONS ACROSS VARIOUS REGIONS

5.4.2 STIFF COMPETITION FROM ALTERNATIVE THERAPIES

6 GLOBAL CPAP DEVICES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 CPAP DEVICE

6.3 CONSUMABLE

7 GLOBAL CPAP DEVICES MARKET, BY MODALITY

7.1 OVERVIEW

7.2 STANDALONE

7.3 PORTABLE

8 GLOBAL CPAP DEVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 HOME CARE

8.3 HOSPITALS

8.4 PRIVATE CLINICS

8.5 OTHERS

9 GLOBAL CPAP DEVICES MARKET, BY REGION

9.1 OVERVIEW

9.2 NORTH AMERICA

9.2.1 U.S.

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 U.K.

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 SWITZERLAND

9.3.7 NETHERLANDS

9.3.8 RUSSIA

9.3.9 BELGIUM

9.3.10 TURKEY

9.3.11 REST OF EUROPE

9.4 ASIA-PACIFIC

9.4.1 CHINA

9.4.2 JAPAN

9.4.3 INDIA

9.4.4 SOUTH KOREA

9.4.5 AUSTRALIA

9.4.6 SINGAPORE

9.4.7 MALAYSIA

9.4.8 THAILAND

9.4.9 INDONESIA

9.4.10 PHILIPPINES

9.4.11 REST OF ASIA-PACIFIC

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 SAUDI ARABIA

9.6.3 U.A.E.

9.6.4 ISRAEL

9.6.5 EGYPT

9.6.6 REST OF MIDDLE EAST AND AFRICA

10 GLOBAL CPAP DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 RESMED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 KONINKLIJKE PHILIPS N.V.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 FISHER & PAYKEL HEALTHCARE LIMITED

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 DRIVE DEVILBISS INTERNATIONAL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 BMC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ACARE TECHNOLOGY CO LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 ARMSTRONG MEDICAL LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 BPL MEDICAL TECHNOLOGIES

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BREAS MEDICAL AB

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 EVOX GROUP OF COMPANIES

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 HUNAN BEYOND MEDICAL TECHNOLOGY CO., LTD.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LOWENSTEIN MEDICAL SE AND CO. KG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 MORPHEUS HEALTHCARE

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 NARANG MEDICAL LIMITED

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 NIDEK MEDICAL INDIA

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 REACT HEALTH

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENTS

12.17 SS TECHNOMED (P) LTD

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TRANSCEND, INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 THE HOMECARE MEDICAL LTD.

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 GLOBAL CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 2 GLOBAL CPAP DEVICE IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 GLOBAL CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL CONSUMABLE IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL STANDALONE IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL PORTABLE IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL HOME CARE IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL HOSPITALS IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL PRIVATE CLINICS IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL OTHERS IN CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL CPAP DEVICES MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 NORTH AMERICA CPAP DEVICES MARKET, BY COUNTRY,2022-2031 (USD THOUSAND)

TABLE 17 NORTH AMERICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 NORTH AMERICA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 NORTH AMERICA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 20 NORTH AMERICA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 NORTH AMERICA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 22 NORTH AMERICA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 23 U.S. CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 U.S. CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 U.S. CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 26 U.S. CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 27 U.S. CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 28 U.S. CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 29 CANADA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 CANADA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 CANADA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 32 CANADA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 33 CANADA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 34 CANADA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 35 MEXICO CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 MEXICO CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 MEXICO CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 38 MEXICO CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 39 MEXICO CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 40 MEXICO CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE CPAP DEVICES MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 48 GERMANY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 GERMANY CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 GERMANY CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 51 GERMANY CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 GERMANY CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 53 GERMANY CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 54 U.K. CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 U.K. CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 U.K. CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 57 U.K. CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 U.K. CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 59 U.K. CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 60 FRANCE CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 FRANCE CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 FRANCE CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 63 FRANCE CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 FRANCE CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 65 FRANCE CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 66 ITALY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 ITALY CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 ITALY CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 69 ITALY CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 ITALY CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 71 ITALY CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 72 SPAIN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 SPAIN CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 SPAIN CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 75 SPAIN CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 SPAIN CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 77 SPAIN CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 78 SWITZERLAND CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 81 SWITZERLAND CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 SWITZERLAND CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 83 SWITZERLAND CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 84 NETHERLANDS CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 NETHERLANDS CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 NETHERLANDS CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 87 NETHERLANDS CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 NETHERLANDS CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 89 NETHERLANDS CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 90 RUSSIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 RUSSIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 RUSSIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 93 RUSSIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 RUSSIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 95 RUSSIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 96 BELGIUM CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 BELGIUM CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 BELGIUM CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 99 BELGIUM CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 BELGIUM CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 101 BELGIUM CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 102 TURKEY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 TURKEY CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 TURKEY CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 105 TURKEY CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 TURKEY CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 107 TURKEY CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 108 REST OF EUROPE CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC CPAP DEVICES MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 ASIA-PACIFIC CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 ASIA-PACIFIC CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 ASIA-PACIFIC CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 116 CHINA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 CHINA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 CHINA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 119 CHINA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 CHINA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 121 CHINA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 122 JAPAN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 123 JAPAN CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 JAPAN CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 125 JAPAN CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 JAPAN CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 127 JAPAN CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 128 INDIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 INDIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 INDIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 131 INDIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 INDIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 133 INDIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 134 SOUTH KOREA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 SOUTH KOREA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 SOUTH KOREA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 137 SOUTH KOREA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 SOUTH KOREA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 139 SOUTH KOREA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 140 AUSTRALIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 AUSTRALIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 AUSTRALIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 143 AUSTRALIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 AUSTRALIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 145 AUSTRALIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 146 SINGAPORE CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 SINGAPORE CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SINGAPORE CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 149 SINGAPORE CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SINGAPORE CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 151 SINGAPORE CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 152 MALAYSIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 MALAYSIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 MALAYSIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 155 MALAYSIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 MALAYSIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 157 MALAYSIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 158 THAILAND CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 THAILAND CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 THAILAND CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 161 THAILAND CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 THAILAND CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 163 THAILAND CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 164 INDONESIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 INDONESIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 INDONESIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 167 INDONESIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 INDONESIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 169 INDONESIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 170 PHILIPPINES CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 PHILIPPINES CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 PHILIPPINES CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 173 PHILIPPINES CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 PHILIPPINES CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 175 PHILIPPINES CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 176 REST OF ASIA-PACIFIC CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 SOUTH AMERICA CPAP DEVICES MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 178 SOUTH AMERICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 SOUTH AMERICA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 SOUTH AMERICA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 181 SOUTH AMERICA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 SOUTH AMERICA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 183 SOUTH AMERICA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 184 BRAZIL CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 BRAZIL CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 186 BRAZIL CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 187 BRAZIL CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 BRAZIL CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 189 BRAZIL CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 190 ARGENTINA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 ARGENTINA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 ARGENTINA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 193 ARGENTINA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 ARGENTINA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 195 ARGENTINA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 196 REST OF SOUTH AMERICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CPAP DEVICES MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 198 MIDDLE EAST AND AFRICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 MIDDLE EAST AND AFRICA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 201 MIDDLE EAST AND AFRICA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 MIDDLE EAST AND AFRICA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 203 MIDDLE EAST AND AFRICA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 204 SOUTH AFRICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 205 SOUTH AFRICA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 206 SOUTH AFRICA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 207 SOUTH AFRICA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 SOUTH AFRICA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 209 SOUTH AFRICA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 210 SAUDI ARABIA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 SAUDI ARABIA CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 SAUDI ARABIA CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 213 SAUDI ARABIA CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 SAUDI ARABIA CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 215 SAUDI ARABIA CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 216 U.A.E. CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 U.A.E. CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 U.A.E. CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 219 U.A.E. CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 U.A.E. CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 221 U.A.E. CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 222 ISRAEL CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 ISRAEL CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 ISRAEL CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 225 ISRAEL CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 ISRAEL CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 227 ISRAEL CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 228 EGYPT CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 EGYPT CPAP DEVICE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 EGYPT CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2022-2031 (USD THOUSAND)

TABLE 231 EGYPT CONSUMABLE IN CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 EGYPT CPAP DEVICES MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 233 EGYPT CPAP DEVICES MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 234 REST OF MIDDLE EAST AND AFRICA CPAP DEVICES MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 GLOBAL CPAP DEVICES MARKET

FIGURE 2 GLOBAL CPAP DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CPAP DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CPAP DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CPAP DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CPAP DEVICES MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL CPAP DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL CPAP DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL CPAP DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 GLOBAL CPAP DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL CPAP DEVICES MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL CPAP DEVICES MARKET, AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 REGIONAL REVENUE, KEY PLAYERS, PATENT ANALYSIS AND R&D EXPENDITURE

FIGURE 15 TWO SEGMENTS COMPRISE THE GLOBAL CPAP DEVICES MARKET, BY PRODUCT TYPE

FIGURE 16 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS IS EXPECTED TO DRIVE THE GLOBAL CPAP DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 17 THE CPAP DEVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL CPAP DEVICES MARKET IN 2024 AND 2031

FIGURE 18 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR GLOBAL CPAP DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 19 MARKET OVERVIEW

FIGURE 20 GLOBAL CPAP DEVICES MARKET: BY PRODUCT TYPE, 2023

FIGURE 21 GLOBAL CPAP DEVICES MARKET: BY PRODUCT TYPE, 2024-2031 (USD THOUSAND)

FIGURE 22 GLOBAL CPAP DEVICES MARKET: BY PRODUCT TYPE, CAGR (2024-2031)

FIGURE 23 GLOBAL CPAP DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL CPAP DEVICES MARKET: BY MODALITY, 2023

FIGURE 25 GLOBAL CPAP DEVICES MARKET: BY MODALITY, 2024-2031 (USD THOUSAND)

FIGURE 26 GLOBAL CPAP DEVICES MARKET: BY MODALITY, CAGR (2024-2031)

FIGURE 27 GLOBAL CPAP DEVICES MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 28 GLOBAL CPAP DEVICES MARKET: BY END USER, 2023

FIGURE 29 GLOBAL CPAP DEVICES MARKET: BY END USER, 2024-2031 (USD THOUSAND)

FIGURE 30 GLOBAL CPAP DEVICES MARKET: BY END USER, CAGR (2024-2031)

FIGURE 31 GLOBAL CPAP DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 GLOBAL CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 33 NORTH AMERICA CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 34 EUROPE CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 35 ASIA-PACIFIC CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 36 SOUTH AMERICA CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 37 MIDDLE EAST AND AFRICA CPAP DEVICES MARKET: SNAPSHOT (2023)

FIGURE 38 GLOBAL CPAP DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 39 ASIA-PACIFC CPAP DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 40 EUROPE CPAP DEVICES MARKET: COMPANY SHARE 2023 (%)

FIGURE 41 NORTH AMERICA CPAP DEVICES MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.