Global Cpg Oligonucleotide Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

1.45 Billion

USD

2.51 Billion

2024

2032

USD

1.45 Billion

USD

2.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 2.51 Billion | |

|

|

|

|

CpG Oligonucleotide Therapeutics Market Size

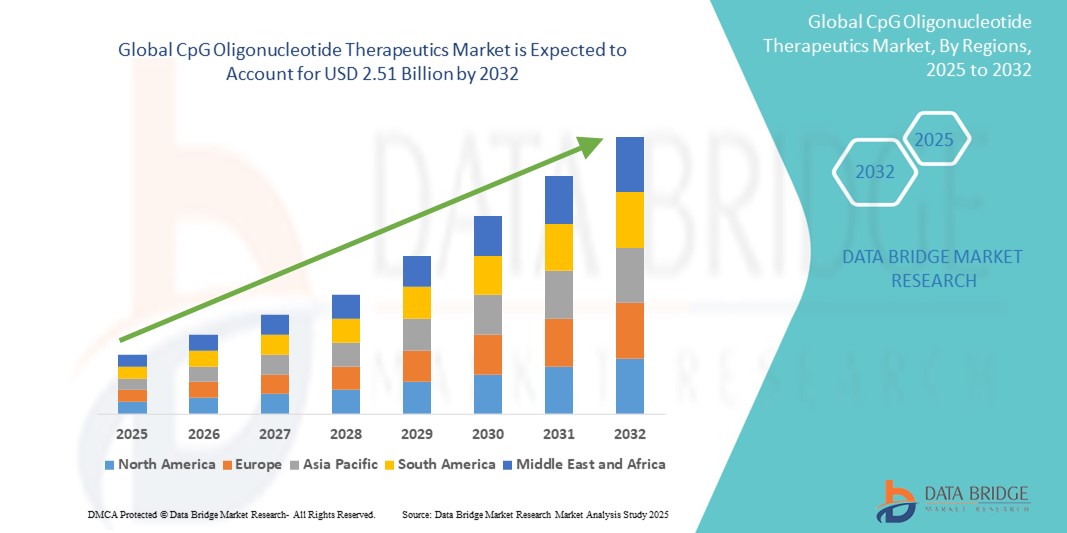

- The global CpG oligonucleotide therapeutics market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.51 billion by 2032, at a CAGR of 7.09% during the forecast period

- The market growth is primarily driven by the increasing demand for precision immunotherapies, rising prevalence of cancer and infectious diseases, and advancements in synthetic oligonucleotide chemistry that enhance immunostimulatory potential

- Furthermore, expanding R&D investments and clinical trials in immuno-oncology, along with strategic collaborations between biotech firms and pharmaceutical companies, are reinforcing the adoption of CpG oligonucleotide-based therapies. These dynamics are accelerating clinical development and commercialization, thereby propelling market expansion

CpG Oligonucleotide Therapeutics Market Analysis

- CpG oligonucleotides, acting as synthetic immunostimulatory agents that activate Toll-like receptor 9 (TLR9), are emerging as critical components in modern immunotherapy strategies, particularly in oncology and vaccine adjuvant development due to their ability to enhance innate and adaptive immune responses

- The growing demand for CpG oligonucleotide therapeutics is primarily fueled by the increasing prevalence of cancer, rising interest in personalized medicine, and ongoing advancements in oligonucleotide synthesis technologies enabling greater stability and efficacy

- North America dominated the CpG oligonucleotide therapeutics market with the largest revenue share of 43% in 2024, characterized by strong biopharmaceutical R&D ecosystem, robust clinical trial activity, and significant funding from both private and public sectors, especially in the U.S., which is witnessing a surge in immunotherapy-based oncology pipelines and CpG-adjuvanted vaccine initiatives

- Asia-Pacific is expected to be the fastest growing region in the CpG Oligonucleotide Therapeutics market during the forecast period due to expanding biotechnology sectors, increasing government funding for immunological research, and growing patient access to advanced therapies

- Oncology segment dominated the CpG oligonucleotide therapeutics market with a market share of 45.5% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and CpG Oligonucleotide Therapeutics Market Segmentation

|

Attributes |

CpG Oligonucleotide Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

CpG Oligonucleotide Therapeutics Market Trends

“Advancing Precision Immunotherapy Through Synthetic Immunostimulants”

- A significant and accelerating trend in the global CpG oligonucleotide therapeutics market is the advancement of synthetic DNA-based immunostimulants for precision immunotherapy, particularly in oncology and infectious disease treatment. CpG oligonucleotides, through Toll-such as receptor 9 (TLR9) activation, are being integrated into targeted therapeutic regimens to enhance immune activation and improve clinical outcomes

- For instance, Dynavax’s CpG 1018 is used as a key adjuvant in approved and investigational vaccines, demonstrating the expanding application of CpG oligonucleotides in both preventive and therapeutic immunology. Similarly, companies such as Checkmate Pharmaceuticals have advanced CpG-based cancer immunotherapies into late-stage clinical trials, highlighting their potential in combination with checkpoint inhibitors

- Recent innovations include structural optimization of CpG sequences to improve stability, reduce toxicity, and target specific immune pathways. Novel delivery systems such as nanoparticles and liposomes are being developed to ensure effective delivery to immune cells, further increasing therapeutic precision and minimizing off-target effects

- The integration of CpG oligonucleotides into personalized medicine platforms is also gaining traction. Through biomarker-driven approaches, researchers aim to identify patients most likely to benefit from CpG-based interventions, particularly in tumors with low immunogenicity

- This trend toward more specific, potent, and personalized immunotherapeutic solutions is reshaping the clinical development strategies of biotech firms. Companies such as Genevant Sciences and Idera Pharmaceuticals are focusing on RNA-based delivery and targeted immune activation strategies involving CpG motifs to create differentiated products

- The demand for CpG oligonucleotide therapeutics is accelerating across oncology, vaccine adjuvants, and chronic infectious disease areas, driven by the global need for safer, more effective immunomodulatory treatments that harness innate immunity without excessive systemic activation

CpG Oligonucleotide Therapeutics Market Dynamics

Driver

“Rising Demand for Precision Immunotherapies and Vaccine Adjuvants”

- The increasing global burden of cancer and infectious diseases, along with growing demand for targeted immunotherapies, is a significant driver fueling the growth of the CpG oligonucleotide therapeutics market

- For instance, in 2023, Dynavax Technologies expanded its CpG 1018 adjuvant partnerships to support various vaccine programs, demonstrating the rising industry reliance on CpG oligonucleotides for enhancing immune responses. Such collaborations and clinical advancements are accelerating the therapeutic and prophylactic adoption of CpG oligos globally

- As researchers and pharmaceutical companies seek to enhance immune modulation while minimizing systemic toxicity, CpG oligonucleotides offer a highly selective approach through Toll-like receptor 9 (TLR9) activation, enabling effective stimulation of innate and adaptive immune systems

- Furthermore, the growing emphasis on personalized medicine and immuno-oncology is positioning CpG oligonucleotides as essential agents in combination therapies, particularly with immune checkpoint inhibitors, cancer vaccines, and CAR-T cell platforms

- The ability of CpG oligonucleotides to act as both standalone immunostimulants and synergistic agents in multimodal treatments makes them attractive candidates for next-generation immunotherapy development. Increasing clinical trial activity, especially in the U.S. and Europe, and expanding biotech investment in synthetic oligonucleotide platforms are key factors propelling the market forward

Restraint/Challenge

“Safety Concerns and Regulatory Compliance Hurdle”

- Despite promising therapeutic potential, CpG oligonucleotide-based treatments face notable challenges related to safety concerns, particularly the risk of localized and systemic inflammatory reactions, such as injection site irritation and cytokine storms, which can limit dosage levels and patient compliance

- For instance, early-phase clinical trials have reported occurrences of flu-like symptoms, injection site inflammation, and transient lymphopenia following CpG oligo administration, which has prompted more cautious dose escalation and monitoring protocols in ongoing studies

- Addressing these safety concerns requires precise sequence optimization, improved delivery mechanisms (such as, nanoparticles, liposomes), and the development of localized or controlled-release formulations to minimize off-target immune activation

- In addition, navigating the complex and evolving regulatory environment for nucleic acid-based therapies presents a significant hurdle. Agencies such as the FDA and EMA demand extensive preclinical and clinical safety data, and CpG-based therapeutics—being immunomodulators—are subject to stringent scrutiny due to their potential to overstimulate the immune system

- The lack of standardized regulatory pathways for synthetic oligonucleotides, coupled with high manufacturing and validation costs, can delay product approvals and discourage smaller biotech firms from entering the market

CpG Oligonucleotide Therapeutics Market Scope

The market is segmented on the basis of therapy type, application, route of administration, and end user.

- By Therapy Type

On the basis of therapy type, the market is segmented into antisense oligonucleotides, RNA interference therapeutics, aptamers, CpG oligonucleotides, guide RNA, and others. The antisense oligonucleotides segment dominated the market with the largest market revenue share in 2024, driven by their widespread use in gene silencing and targeted mRNA modulation. Their clinical success in treating genetic disorders and strong pipeline presence across various therapeutic areas significantly contribute to this leadership.

The CpG oligonucleotides segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in cancer immunotherapy and vaccine adjuvant applications. The unique ability of CpG motifs to activate TLR9 and enhance immune responses makes them promising candidates for both standalone and combination therapies in immuno-oncology and infectious diseases.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, neurological disorders, genetic disorders, and others. The oncology segment held the largest market revenue share of around 45.5% in 2024, due to the increasing use of CpG oligonucleotides in cancer immunotherapy, particularly as adjuvants and immune response modulators in combination with checkpoint inhibitors. The strong clinical pipeline in solid tumors and hematologic cancers further drives segment dominance.

The infectious diseases segment is expected to exhibit robust growth through 2032, as CpG motifs gain traction as vaccine adjuvants to enhance immunogenicity, especially in emerging infectious disease platforms such as COVID-19, influenza, and RSV.

- By Route Of Administration

On the basis of route of administration, the market is categorized into subcutaneous, intravenous, intramuscular, and others. The intravenous (IV) segment accounted for the largest market share in 2024, driven by its widespread use in systemic delivery of CpG-based immunotherapies for oncology and chronic infections. IV delivery ensures rapid bioavailability and controlled immune activation, which is critical in clinical trial protocols.

The subcutaneous route is expected to witness the fastest CAGR from 2025 to 2032, owing to its patient-friendly administration and increasing adoption in self-administered immunotherapies and vaccine regimens

- By End User

On the basis of end user, the market is segmented into hospitals, research institutes, and others. The hospitals segment dominated the market with a revenue share in 2024, as most CpG-based therapies are currently administered in clinical settings under medical supervision, especially for cancer and advanced infectious disease cases. The growing number of hospital-based trials and immunotherapy programs also supports this segment’s lead.

The research institutes segment is projected to grow significantly during the forecast period, driven by increased preclinical research and funding for immune pathway modulation and vaccine adjuvant development using CpG oligonucleotides.

CpG Oligonucleotide Therapeutics Market Regional Analysis

- North America dominated the CpG oligonucleotide therapeutics market with the largest revenue share of 43% in 2024, driven by strong biopharmaceutical R&D ecosystem, robust clinical trial activity, and significant funding from both private and public sectors

- The region's leadership is supported by a high number of ongoing clinical trials, strong regulatory support for innovative immunotherapies, and increasing demand for targeted treatments in oncology and infectious diseases

- Further contributing to this dominance are favorable reimbursement frameworks, growing academic and industry collaborations, and a rising focus on personalized medicine. These factors collectively position North America as the primary hub for research, development, and early adoption of CpG oligonucleotide therapeutics across both clinical and commercial settings

U.S. CpG Oligonucleotide Therapeutics Market Insight

The U.S. CpG oligonucleotide therapeutics market captured the largest revenue share in North America in 2024, driven by the country's leadership in immunotherapy R&D and advanced biomanufacturing capabilities. High clinical trial activity for CpG-based cancer and vaccine therapies, along with strong support from organizations such as the NIH and FDA, contribute to the rapid development and commercialization of these treatments. The presence of key biotechnology players and increasing collaborations between academic institutions and industry further support market expansion across oncology and infectious disease segments.

Europe CpG Oligonucleotide Therapeutics Market Insight

The Europe CpG oligonucleotide therapeutics market is projected to expand at a substantial CAGR during the forecast period, supported by robust regulatory frameworks, increasing R&D funding, and strong demand for immuno-oncology solutions. The region’s focus on biologics and advanced therapeutics, along with growing public health investments, is driving adoption. Clinical research hubs in Germany, France, and the Netherlands are increasingly participating in CpG-based trials, positioning Europe as a key contributor to global therapeutic innovation.

U.K. CpG Oligonucleotide Therapeutics Market Insight

The U.K. CpG oligonucleotide therapeutics market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, spurred by rising interest in immunotherapy and genetic medicine. The country’s strong academic ecosystem, supported by institutions such as Oxford and Imperial College London, is accelerating CpG-related research, especially in oncology and rare infectious diseases. The U.K.’s regulatory agility and funding through entities such as Innovate UK are further encouraging biotechnology firms to explore CpG-based treatments.

Germany CpG Oligonucleotide Therapeutics Market Insight

The Germany CpG oligonucleotide therapeutics market is expected to expand at a considerable CAGR from 2025 to 2032, supported by a well-established pharmaceutical manufacturing base and emphasis on R&D. Germany’s reputation for scientific excellence and public-private partnerships is facilitating the development of novel CpG immunotherapies. Demand is also rising for CpG adjuvants in vaccine development, especially in the wake of heightened infectious disease preparedness and biopharma innovation initiatives.

Asia-Pacific CpG Oligonucleotide Therapeutics Market Insight

The Asia-Pacific CpG oligonucleotide therapeutics market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing government investments in healthcare innovation, rising prevalence of cancer and infectious diseases, and expanding clinical trial infrastructure in countries such as China, Japan, and India. The region's rapidly evolving biotech ecosystem and strategic focus on affordable immunotherapy options are accelerating the uptake of CpG-based technologies in both therapeutic and vaccine applications.

Japan CpG Oligonucleotide Therapeutics Market Insight

The Japan CpG oligonucleotide therapeutics market is gaining traction due to the country’s focus on precision medicine and innovation in cancer treatment. Japan’s regulatory support for fast-track approvals and investment in RNA/DNA-based therapies are contributing to the growth of CpG oligonucleotide use. In addition, the nation’s aging population and high cancer incidence are fueling demand for advanced immunotherapies with strong safety and efficacy profiles

India CpG Oligonucleotide Therapeutics Market Insight

The India CpG oligonucleotide therapeutics market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by growing cancer incidence, increasing clinical research activity, and expansion of domestic biotech capabilities. Government-backed programs promoting biotech innovation and local manufacturing are making CpG-based therapies more accessible. India’s emergence as a hub for vaccine development, including adjuvant research, positions it as a key player in the regional CpG therapeutics landscape

CpG Oligonucleotide Therapeutics Market Share

The CpG oligonucleotide therapeutics industry is primarily led by well-established companies, including:

- Dynavax Technologies (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- GENEVANT SCIENCES (Canada)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca U.K.)

- AbbVie Inc. (U.S.)

- Moderna, Inc. (U.S.)

- BioNTech SE (Germany)

- SBI Biotech Co., Ltd. (Japan)

- InvivoGen (France)

- Oligo Factory (U.S.)

- Nitto Denko Corporation (Japan)

- TriLink BioTechnologies, LLC (U.S.)

- Alnylam Pharmaceuticals, Inc. (U.S.)

What are the Recent Developments in Global CpG Oligonucleotide Therapeutics Market?

- In February 2024, Dynavax Technologies Corporation expanded its global CpG 1018 supply agreements through a new strategic collaboration with Valneva SE to support development of advanced combination vaccines. This partnership underscores the growing importance of CpG-based adjuvants in next-generation immunizations and reinforces Dynavax’s leadership in scalable, TLR9-targeting immunostimulants designed for broad infectious disease prevention. The expansion marks a pivotal step in addressing global vaccine demands with highly immunogenic platforms

- In December 2023, Checkmate Pharmaceuticals, a subsidiary of Regeneron, reported promising results from its Phase 2 clinical trial evaluating CMP-001, a CpG-A oligonucleotide delivered via virus-like particles in combination with pembrolizumab (Keytruda) for advanced melanoma. The positive immunologic and clinical responses in checkpoint inhibitor-refractory patients demonstrate the synergistic potential of CpG oligonucleotides in reactivating anti-tumor immunity and expanding therapeutic options for resistant cancers

- In October 2023, Idera Pharmaceuticals resumed development of its CpG-based candidate IMO-2125 (tilsotolimod) through preclinical reformulation efforts aimed at improving safety and targeted delivery. This decision followed an earlier trial halt and reflects a renewed commitment to leveraging CpG immunomodulators in niche oncology indications. Idera’s continued innovation showcases the challenges and evolving strategies in optimizing CpG delivery technologies

- In September 2023, Genevant Sciences and Takeda Pharmaceutical Company entered into a licensing agreement for the development of novel CpG oligonucleotide delivery systems using lipid nanoparticle (LNP) platforms. This alliance is aimed at enhancing the delivery precision of TLR9 agonists and mitigating off-target effects—addressing a critical challenge in CpG-based therapeutics. The agreement demonstrates growing investment in RNA/DNA delivery platforms to improve therapeutic outcomes

- In July 2023, researchers at the National Cancer Institute (NCI) published a study detailing the enhanced tumor suppression achieved by combining CpG oligonucleotides with radiation therapy in a murine colorectal cancer model. The findings underscore the potential of CpG motifs to amplify immune-mediated tumor destruction when integrated with traditional cancer modalities, offering a promising avenue for future clinical translation in solid tumors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.