Global Crows Feet Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.42 Billion

2025

2033

USD

2.50 Billion

USD

3.42 Billion

2025

2033

| 2026 –2033 | |

| USD 2.50 Billion | |

| USD 3.42 Billion | |

|

|

|

|

Crow`s Feet Treatment Market Size

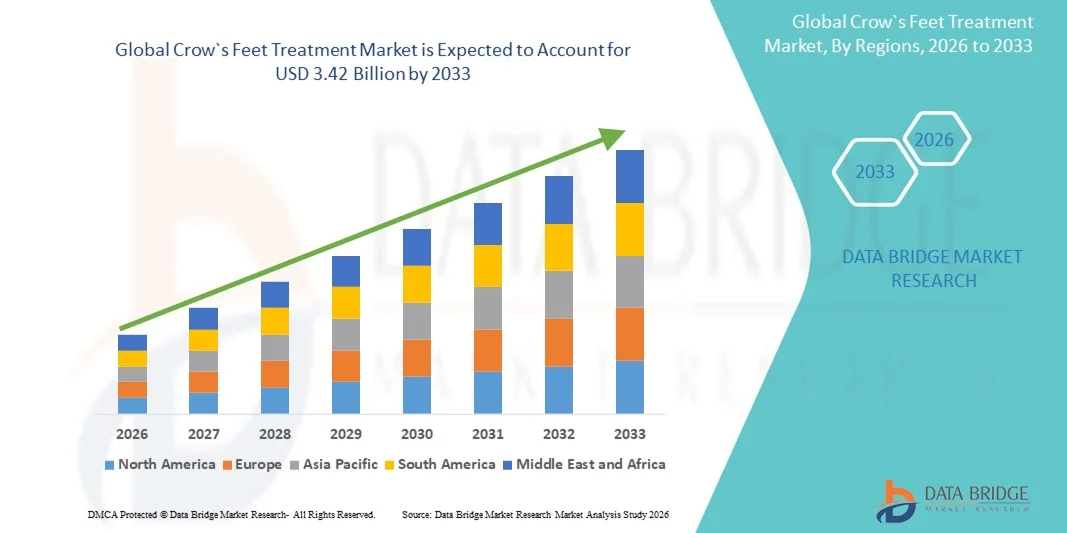

- The global Crow`s Feet treatment market size was valued at USD 2.50 billion in 2025 and is expected to reach USD 3.42 billion by 2033, at a CAGR of 4.00% during the forecast period

- The market growth is largely fueled by the rising demand for anti-aging and cosmetic procedures, along with advancements in minimally invasive treatments such as botulinum toxin injections, dermal fillers, and topical formulations

- Furthermore, increasing awareness among consumers about facial aesthetics and the desire for non-surgical, effective solutions to reduce fine lines around the eyes is driving market adoption. These converging factors are accelerating the uptake of Crow’s Feet treatment solutions, thereby significantly boosting the industry’s growth

Crow`s Feet Treatment Market Analysis

- Crow’s Feet treatment, including botulinum toxin injections, dermal fillers, and topical anti-aging solutions, is increasingly a vital component of cosmetic dermatology and aesthetic medicine due to its effectiveness in reducing fine lines and wrinkles, minimally invasive nature, and ability to provide fast, visible results

- The escalating demand for Crow’s Feet treatment is primarily fueled by growing awareness of facial aesthetics, rising disposable incomes, increasing focus on anti-aging solutions, and a preference for non-surgical cosmetic procedures

- North America dominated the Crow’s Feet treatment market with the largest revenue share of 40.5% in 2025, characterized by early adoption of cosmetic procedures, high consumer spending, and the presence of leading aesthetic and pharmaceutical companies, with the U.S. experiencing substantial growth in minimally invasive treatments, driven by innovations in botulinum toxin formulations and injectable technologies

- Asia-Pacific is expected to be the fastest growing region in the Crow’s Feet treatment market during the forecast period due to increasing urbanization, rising awareness of aesthetic treatments, and growing disposable incomes among the middle class

- Botulinum toxin dominated the Crow’s Feet treatment market with a market share of 47.9% in 2025, driven by their proven efficacy, popularity among consumers, and strong clinical adoption in both dermatology clinics and aesthetic centers

Report Scope and Crow`s Feet Treatment Market Segmentation

|

Attributes |

Crow`s Feet Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Crow`s Feet Treatment Market Trends

Rising Adoption of Minimally Invasive Cosmetic Procedures

- A significant and accelerating trend in the global Crow’s Feet treatment market is the increasing preference for minimally invasive procedures such as botulinum toxin injections and dermal fillers, driven by their fast, visible results and reduced recovery time

- For instance, botulinum toxin injections are increasingly administered in dermatology clinics and medical spas, allowing patients to achieve noticeable reduction in fine lines around the eyes within days

- Advanced formulations and delivery techniques are enabling more precise and longer-lasting outcomes, encouraging repeated adoption and higher patient satisfaction. For instance, new micro-injection devices improve dosing accuracy while reducing discomfort and bruising

- The seamless integration of aesthetic treatments with personalized consultation platforms and digital booking systems facilitates better patient management and treatment tracking. Through such platforms, consumers can schedule appointments, receive reminders, and track results in a unified system

- This trend towards safer, quicker, and more effective Crow’s Feet treatment procedures is fundamentally reshaping consumer expectations for cosmetic solutions. Consequently, companies are developing advanced injectable solutions with improved longevity and minimal downtime

- The demand for Crow’s Feet treatment that combines efficacy, convenience, and minimally invasive approaches is growing rapidly across both clinics and medical spas, as consumers increasingly prioritize aesthetic outcomes with minimal recovery

- Increasing collaboration between aesthetic brands and beauty influencers is amplifying consumer awareness and trust in Crow’s Feet treatment options. For instance, social media campaigns showcasing before-and-after results are boosting treatment adoption

- Teleconsultation and virtual assessment platforms are emerging as complementary tools, enabling patients to receive preliminary treatment guidance remotely. For instance, dermatology apps now allow facial analysis to recommend tailored Crow’s Feet treatment plans

Crow`s Feet Treatment Market Dynamics

Driver

Growing Demand Due to Rising Awareness and Anti-Aging Focus

- The increasing focus on facial aesthetics, along with rising awareness about anti-aging solutions, is a significant driver for the heightened demand for Crow’s Feet treatment

- For instance, in April 2025, a leading dermatology clinic introduced customized botulinum toxin treatment plans, highlighting the importance of personalized cosmetic care in anti-aging strategies

- As consumers become more conscious of aging signs and seek minimally invasive solutions, Crow’s Feet treatments offer effective reduction of wrinkles and fine lines without surgery

- Furthermore, the rising popularity of non-surgical cosmetic procedures and social media-driven aesthetic trends are making Crow’s Feet treatment an integral part of beauty routines

- The convenience of quick procedures, limited downtime, and easy follow-up sessions are key factors propelling the adoption of Crow’s Feet treatment in both urban and semi-urban regions. The trend towards professional aesthetic services and greater accessibility further contributes to market growth

- Increasing investment by dermatology clinics in advanced treatment technologies, such as precision injectors and pain-reducing devices, is enhancing treatment appeal. For instance, clinics are promoting more comfortable procedures to attract first-time users

- Rising interest in combination treatments, such as pairing Crow’s Feet injections with skin rejuvenation therapies, is creating opportunities for multi-service aesthetic packages. For instance, spas offer bundled treatments to maximize anti-aging outcomes and patient satisfaction

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Concerns surrounding potential side effects, including mild bruising, swelling, or allergic reactions, pose a significant challenge to broader market adoption of Crow’s Feet treatment

- For instance, reports of temporary eyelid drooping or skin irritation following botulinum toxin injections make some consumers hesitant to undergo treatment

- Addressing these concerns through proper clinical protocols, qualified practitioners, and patient education is crucial for building trust and encouraging adoption. For instance, certified aesthetic clinics emphasize training and safety measures in their marketing communications

- In addition, regulatory hurdles in different regions, including approvals for new injectable formulations and procedural guidelines, can delay product launches or expansion

- Overcoming these challenges through enhanced safety protocols, consumer awareness programs, and compliance with international aesthetic regulations will be vital for sustained market growth

- Limited accessibility to certified professionals in emerging markets can restrict treatment adoption despite growing demand. For instance, some regions lack clinics trained to administer advanced botulinum toxin procedures safely

- High treatment costs in premium segments may deter price-sensitive consumers, impacting overall market penetration. For instance, combined pricing of multiple anti-aging treatments can make Crow’s Feet treatment less affordable in developing economies

Crow`s Feet Treatment Market Scope

The market is segmented on the basis of treatment, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Crow’s Feet treatment market is segmented into topical creams, chemical peels, botulinum toxin (Botox), laser resurfacing, dermal fillers, and others. The botulinum toxin (Botox) segment dominated the market with the largest market revenue share of 47.9% in 2025, driven by its proven efficacy in reducing fine lines and wrinkles around the eyes. Patients often prefer Botox due to its minimally invasive nature, quick procedure time, and noticeable results within days. The high adoption is also fueled by widespread availability at dermatology and cosmetic clinics, as well as strong marketing by aesthetic brands. Continuous advancements in formulation and injection techniques are enhancing precision and patient comfort, further consolidating Botox as the leading treatment. In addition, repeat treatments and brand loyalty contribute significantly to its dominance in the market.

The dermal fillers segment is anticipated to witness the fastest growth rate of 12% from 2026 to 2033, fueled by the rising popularity of non-surgical facial rejuvenation procedures. Dermal fillers provide immediate volume restoration and smoothing effects, complementing Botox treatments for enhanced aesthetic outcomes. Their growth is also supported by increasing availability in medical spas and aesthetic clinics, as well as advancements in filler formulations that improve longevity and safety. Consumers seeking combination therapies often prefer dermal fillers alongside Botox or laser treatments to achieve comprehensive anti-aging effects. The aesthetic versatility and minimally invasive nature make dermal fillers highly attractive, particularly among younger demographics seeking early intervention.

- By Dosage

On the basis of dosage, the Crow’s Feet treatment market is segmented into creams, injections, and others. The injections segment dominated the market with the largest revenue share of 50% in 2025, due to the high prevalence of botulinum toxin and dermal filler applications, which require injectable delivery for efficacy. Injections offer targeted treatment with precise dosing, ensuring optimal wrinkle reduction around the eyes. The dominance is supported by dermatologist preference, high patient satisfaction, and strong adoption in clinics and medical spas. Repeated treatment cycles also ensure steady revenue contribution from this segment.

The creams segment is expected to witness the fastest growth rate of 13% from 2026 to 2033, driven by increasing demand for at-home anti-aging solutions and preventive care. Topical creams are non-invasive, easily accessible, and often incorporated into daily skincare routines, making them popular among younger consumers and first-time users. Advances in active ingredients and formulations, such as peptides and hyaluronic acid, are enhancing effectiveness and stimulating adoption. The affordability and convenience of creams further support growth, particularly in regions with limited access to clinics or injectable treatments.

- By Route of Administration

On the basis of route of administration, the Crow’s Feet treatment market is segmented into topical, intravenous, and others. The topical segment dominated the market with the largest market share of 42–44% in 2025, owing to widespread adoption of creams, serums, and lotions. Topical administration is safe, non-invasive, and convenient. Daily use for preventive and mild wrinkle reduction enhances consumer appeal. High availability in retail stores and online platforms supports sales. Continuous innovation in formulations sustains dominance. Consumers often prefer topical solutions as the first step before moving to injections or advanced procedures.

The intravenous segment is expected to witness the fastest growth rate of 14% from 2026 to 2033, fueled by emerging cosmetic infusion therapies and advanced injectable solutions administered under clinical supervision. Intravenous treatments provide rapid absorption and enhanced efficacy. Adoption is growing in high-end medical spas and aesthetic clinics. Targeted therapies offer improved anti-aging results compared to topical options. Increasing disposable income and willingness to invest in premium treatments are key growth drivers. Enhanced training of practitioners and marketing of luxurious treatment experiences accelerate uptake.

- By End-Users

On the basis of end-users, the Crow’s Feet treatment market is segmented into dermatology clinics, beauty clinics, hospitals, and others. The dermatology clinic segment dominated the market with the largest revenue share of 48% in 2025, as these clinics are equipped for Botox, dermal fillers, and laser treatments. Clinics provide professional consultation and high-quality care. Brand partnerships and marketing campaigns strengthen adoption. Patients trust dermatologists for safe and effective procedures. Repeated visits for maintenance ensure steady revenue. Availability of advanced technologies enhances service quality. Dermatology clinics remain the preferred choice for serious aesthetic consumers.

The beauty clinic segment is expected to witness the fastest growth rate of 15% from 2026 to 2033, fueled by the increasing number of aesthetic salons and medical spas offering minimally invasive treatments. Beauty clinics attract younger consumers seeking preventive or cosmetic enhancements. Flexible pricing and treatment packages encourage multiple service adoption. Growing urbanization and awareness of non-surgical treatments support market growth. Convenient locations and marketing via social media increase consumer footfall. Expansion of clinic networks and skilled staff training accelerate adoption. Combination services and loyalty programs further drive segment growth.

- By Distribution Channel

On the basis of distribution channel, the Crow’s Feet treatment market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment dominated the market with the largest revenue share of 46% in 2025, due to the availability of creams, serums, and OTC treatment products. Retail channels offer convenience, accessibility, and trusted purchase points. Non-invasive topical solutions drive high sales. Brand promotions and product bundling enhance visibility. Repeat purchases contribute to revenue stability. Retail pharmacies remain the primary choice for first-time users and preventive care consumers.

The online pharmacy segment is expected to witness the fastest growth rate of 16% from 2026 to 2033, driven by e-commerce penetration and rising preference for home delivery. Consumers enjoy discreet purchasing and wide product variety. Social media marketing and influencer endorsements accelerate adoption. Growth is supported by convenience, competitive pricing, and access to international brands. Online consultations and virtual skincare guidance complement product adoption. Younger, tech-savvy consumers contribute significantly to segment growth. Increasing trust in online platforms further boosts the popularity of this distribution channel.

Crow`s Feet Treatment Market Regional Analysis

- North America dominated the Crow’s Feet treatment market with the largest revenue share of 40.5% in 2025, characterized by early adoption of cosmetic procedures, high consumer spending, and the presence of leading aesthetic and pharmaceutical companies, with the U.S. experiencing substantial growth in minimally invasive treatments, driven by innovations in botulinum toxin formulations and injectable technologies

- Consumers in the region highly value the effectiveness, quick results, and safety offered by treatments such as botulinum toxin injections, dermal fillers, and laser therapies

- This widespread adoption is further supported by high disposable incomes, strong presence of dermatology and aesthetic clinics, and a preference for professional cosmetic services, establishing Crow’s Feet treatment as a favored solution for both preventive and corrective facial aesthetics

U.S. Crow`s Feet Treatment Market Insight

The U.S. Crow’s Feet treatment market captured the largest revenue share of 82% in 2025 within North America, fueled by increasing awareness of aesthetic procedures and high demand for minimally invasive anti-aging solutions. Consumers are increasingly prioritizing treatments such as botulinum toxin injections and dermal fillers to reduce fine lines around the eyes. The growing preference for clinic-based cosmetic procedures, combined with a strong presence of dermatology and medical spa networks, further propels the Crow’s Feet treatment market. Moreover, the integration of personalized aesthetic plans and advanced injection techniques is significantly contributing to the market's expansion.

Europe Crow’s Feet Treatment Market Insight

The Europe Crow’s Feet treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of anti-aging solutions and the preference for non-surgical cosmetic procedures. The increase in urbanization, coupled with high disposable incomes, is fostering the adoption of Crow’s Feet treatment. European consumers are drawn to the convenience, effectiveness, and quick recovery offered by Botox, dermal fillers, and laser treatments. The region is witnessing significant growth across dermatology clinics, beauty clinics, and medical spas, with treatments being incorporated into both new patient programs and follow-up maintenance cycles.

U.K. Crow’s Feet Treatment Market Insight

The U.K. Crow’s Feet treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of cosmetic awareness and a desire for youthful appearance. In addition, concerns regarding aging signs and facial aesthetics are encouraging both men and women to seek professional treatments. The U.K.’s strong dermatology infrastructure, alongside its advanced e-commerce and retail network for topical and OTC anti-aging products, is expected to continue to stimulate market growth.

Germany Crow’s Feet Treatment Market Insight

The Germany Crow’s Feet treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of cosmetic dermatology and growing demand for advanced, minimally invasive anti-aging solutions. Germany’s well-developed healthcare infrastructure and focus on innovation promote the adoption of Botox, dermal fillers, and laser-based treatments. Integration of aesthetic procedures with advanced patient management systems is also becoming prevalent, with a strong preference for safe, effective, and clinically supervised solutions aligning with local consumer expectations.

Asia-Pacific Crow’s Feet Treatment Market Insight

The Asia-Pacific Crow’s Feet treatment market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing awareness of anti-aging solutions in countries such as China, Japan, and India. The region’s rising inclination towards minimally invasive cosmetic treatments, supported by expanding dermatology clinic networks and medical spas, is driving adoption. Furthermore, affordability and availability of a wide range of treatments, alongside social media influence on beauty trends, are contributing to the rapid market growth.

Japan Crow’s Feet Treatment Market Insight

The Japan Crow’s Feet treatment market is gaining momentum due to the country’s strong cosmetic culture, high awareness of anti-aging procedures, and rapid urbanization. Japanese consumers place a high value on safety, convenience, and visible results, driving demand for Botox, dermal fillers, and laser therapies. The integration of treatments with professional consultation services and skincare routines is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for easier-to-use, minimally invasive anti-aging solutions in both residential and professional aesthetic segments.

India Crow’s Feet Treatment Market Insight

The India Crow’s Feet treatment market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding middle class, rising disposable incomes, and growing awareness of cosmetic procedures. India is emerging as a significant market for aesthetic dermatology services, with Botox and dermal fillers becoming increasingly popular in dermatology clinics, beauty clinics, and medical spas. Government initiatives promoting health and wellness, along with affordable treatment options and strong domestic aesthetic service providers, are key factors propelling market growth in India.

Crow`s Feet Treatment Market Share

The Crow`s Feet Treatment industry is primarily led by well-established companies, including:

- GALDERMA (Switzerland)

- Merz North America, Inc. (U.S.)

- REVANCE (U.S.)

- Ipsen Biopharmaceuticals, Inc. (France)

- TEOXANE (Switzerland)

- Suneva Medical, Inc. (U.S.)

- Sinclair Pharma plc (U.K.)

- Medytox, Inc. (South Korea)

- Daewoong Pharmaceutical Co., Ltd. (South Korea)

- Croma Pharma (Austria)

- Bloomage BioTechnology Corporation Limited (China)

- SciVision Biotech Inc. (Taiwan)

- Prollenium Medical Technologies Inc. (Canada)

- LG Life Sciences (South Korea)

- Anika Therapeutics, Inc. (U.S.)

- HUGEL Aesthetics (South Korea)

- Sientra, Inc. (U.S.)

- BioPlus Co., Ltd. (South Korea)

- Hugel, Inc. (South Korea)

What are the Recent Developments in Global Crow`s Feet Treatment Market?

- In January 2025, At IMCAS 2025, Galderma presented Phase IIIb RELAX study data showing that a single dose of RelabotulinumtoxinA gave a rapid Day‑1 onset, lasted beyond six months, and achieved high patient satisfaction even up to 12 months post-treatment — reinforcing its long-term aesthetic benefits

- In October 2024, At the ASDS 2024 Annual Meeting, Galderma presented READY‑4 data showing that repeated injections of RelabotulinumtoxinA over ~12 months maintained both safety and efficacy for crow’s feet and frown lines. Less than 20% of participants reported mild or moderate adverse events, and patient satisfaction remained high across multiple treatment cycles

- In July 2024, Galderma’s ready-to-use neuromodulator Relfydess™ (RelabotulinumtoxinA) received a positive regulatory decision in Europe, marking its first approval for both crow’s feet and frown lines. This makes it the first liquid neuromodulator approved in Europe for these two indications simultaneously

- In January 2024, Galderma announced positive topline results from its Phase III READY‑3 trial of RelabotulinumtoxinA, showing significant improvement in both frown lines and crow’s feet when treated either alone or simultaneously. The study also demonstrated a long duration of effect and high patient satisfaction, reinforcing the potential of this ready‑to‑use liquid neuromodulator

- In November 2023, Galderma released results from two Phase IIIb trials of RelabotulinumtoxinA, reinforcing its rapid onset of action and durable efficacy. Treatment was well tolerated with no serious related adverse events

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.