Global Curative Therapies Market

Market Size in USD Billion

CAGR :

%

USD

21.53 Billion

USD

39.86 Billion

2025

2033

USD

21.53 Billion

USD

39.86 Billion

2025

2033

| 2026 –2033 | |

| USD 21.53 Billion | |

| USD 39.86 Billion | |

|

|

|

|

Curative Therapies Market Size

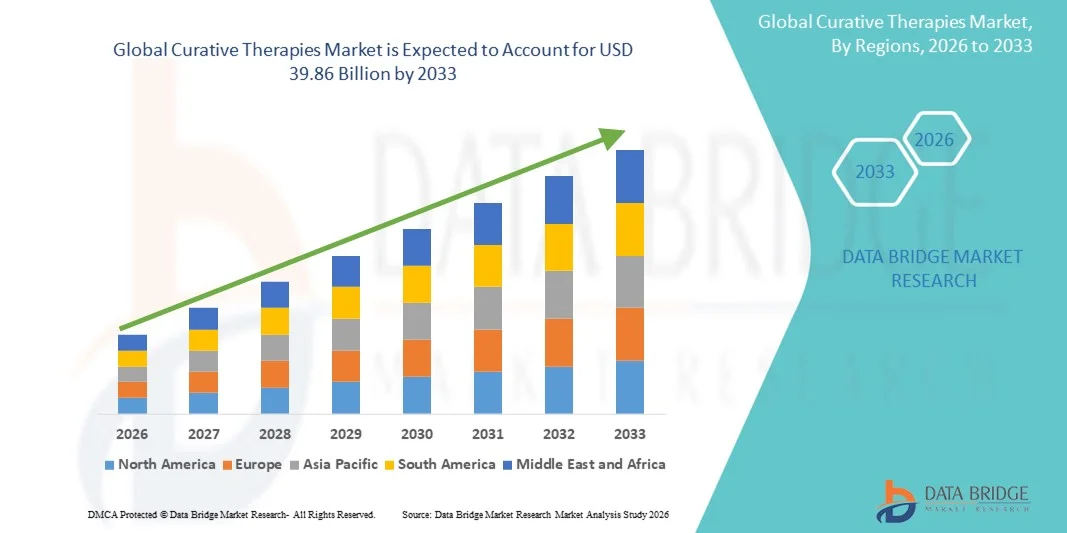

- The global curative therapies market size was valued at USD 21.53 billion in 2025 and is expected to reach USD 39.86 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market expansion is primarily driven by rapid advancements in cell, gene, and regenerative therapy platforms, enabling long-term and often permanent disease correction across a wide range of chronic and rare conditions

- In addition, rising demand for transformative, outcome-based treatments and increasing investment in next-generation biomedical innovation are positioning curative therapies as a preferred solution over traditional management-focused approaches. These converging forces are accelerating adoption and significantly strengthening the industry's growth trajectory

Curative Therapies Market Analysis

- Curative therapies, encompassing gene therapies, cell therapies, and regenerative medicine solutions, are becoming central to next-generation healthcare due to their ability to target the root cause of diseases, offer long-term remission, and potentially provide permanent cures across rare, genetic, and chronic conditions

- The accelerating demand for curative therapies is primarily fueled by rising prevalence of complex diseases, expanding clinical success rates, strong R&D pipelines, and increasing preference for one-time, high-value treatments over traditional chronic care

- North America dominated the curative therapies market with the largest revenue share of 46.8% in 2025, supported by advanced biotechnology infrastructure, strong funding availability, favorable regulatory pathways, and early adoption of cutting-edge gene and cell therapy products in the U.S., where rapid growth is driven by approvals, expanding manufacturing capacity, and robust investment from biotech innovators

- Asia-Pacific is expected to be the fastest-growing region in the curative therapies market during the forecast period owing to expanding healthcare modernization, rising biotechnology investments, and increasing clinical trial activity in countries such as China, Japan, and South Korea

- Gene therapy segment dominated the curative therapies market with a market share of 38.5% in 2025, driven by its strong clinical momentum, expanding approvals for genetic disorders, and increasing adoption of viral vector-based platforms enabling precise, long-lasting therapeutic outcomes

Report Scope and Curative Therapies Market Segmentation

|

Attributes |

Curative Therapies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Curative Therapies Market Trends

Accelerated Adoption Through AI-Driven Precision and Advanced Genomic Integration

- A significant and accelerating trend in the global curative therapies market is the deepening integration of artificial intelligence (AI) and advanced genomic technologies, enabling highly precise diagnosis, patient stratification, and therapy design across gene and cell therapy platforms

- For instance, AI-supported genomic analysis platforms used by companies such as Deep Genomics and Tempus enable rapid identification of mutation targets and therapy response profiles, improving the speed and accuracy of curative therapy development

- AI integration in curative therapies enables capabilities such as predicting off-target effects, optimizing vector design, and enhancing cell-function monitoring. For instance, several gene editing platforms now utilize AI models to refine gRNA selection and significantly reduce unintended edits during CRISPR-based interventions

- The seamless integration of AI, genomic sequencing, and molecular engineering tools facilitates centralized control across discovery workflows, manufacturing processes, and safety analytics, creating a unified and automated therapeutic development ecosystem

- This trend toward more intelligent, predictive, and interconnected therapy-design frameworks is fundamentally reshaping expectations for precision medicine in curative treatments. Consequently, companies such as Beam Therapeutics and Sangamo are advancing AI-enabled editing workflows to improve therapeutic accuracy and long-term safety

- The demand for curative therapies supported by AI-driven design, optimized patient matching, and enhanced genomic insights is growing rapidly across rare disease, oncology, and chronic condition segments, as healthcare systems increasingly prioritize durable and transformative treatment outcomes

Curative Therapies Market Dynamics

Driver

Growing Demand Driven by Rising Disease Burden and Advancements in Regenerative Medicine

- The increasing prevalence of rare genetic disorders, oncology cases, and chronic degenerative conditions, combined with rapid progress in gene and cell therapy technologies, is a significant driver accelerating demand for curative therapies

- For instance, in April 2025, Bluebird Bio expanded its lentiviral vector-based manufacturing initiative to support next-generation curative therapies, highlighting how key companies are investing in scalable platforms to meet rising patient needs

- As patients and healthcare providers increasingly seek treatments that offer long-term remission or potential cures, curative therapies provide compelling advantages through targeted intervention, durable efficacy, and reduced lifetime treatment burden

- Furthermore, the growing adoption of regenerative medicine and the rising acceptance of one-time, outcome-based therapies are making curative solutions an integral part of future healthcare, supported by improving reimbursement frameworks and clinical data

- The clinical success of gene replacement, gene editing, and autologous cell therapies, along with expanding commercial infrastructure for vector manufacturing, is propelling adoption across both developed and emerging markets. The increasing availability of decentralized treatment centers and streamlined regulatory programs further contributes to market growth

Restraint/Challenge

High Treatment Costs and Regulatory Complexity Hurdle

- Concerns surrounding the extremely high cost of curative therapies, coupled with complex regulatory pathways and long approval timelines, pose significant challenges to broader global adoption

- For instance, several approved gene therapies have faced slow uptake due to affordability issues and payer hesitancy, creating barriers for patients despite strong clinical efficacy

- Addressing these challenges through value-based reimbursement models, efficient regulatory harmonization, and innovative payment frameworks is crucial for improving patient access and system-level acceptance. Companies such as Novartis and Orchard Therapeutics emphasize outcomes-based payment structures and long-term follow-ups to mitigate payer concerns

- In addition, the technical complexity of manufacturing viral vectors and engineered cells can significantly increase production costs and limit scalability, particularly for smaller biotech organizations or resource-constrained regions. Advanced GMP facility requirements and specialized workforce needs add further constraints

- While manufacturing technologies are steadily improving, the perceived premium pricing and logistical difficulties associated with curative therapies can hinder widespread availability, especially in low- and middle-income markets or in health systems with strict budget limits

- Overcoming these challenges through capacity expansion, regulatory streamlining, cost-optimized production, and broader payer engagement will be vital for enabling wider adoption and sustaining long-term market growth

Curative Therapies Market Scope

The market is segmented on the basis of type, applications, end-users, and distribution channel.

- By Type

On the basis of types, the global curative therapies market is segmented into gene therapy, genetically re-engineering cells, and biology-modifying drug. The gene therapy segment dominated the market with the largest market revenue share of 38.5% in 2025, driven by its strong clinical success in treating rare genetic disorders and its expanding approvals across global regulatory agencies. Gene therapy’s ability to offer long-term or potentially permanent correction of defective genes has positioned it as the most transformative modality within curative treatment. The growing adoption of AAV and lentiviral vectors has significantly improved targeting precision and minimized safety concerns, further expanding clinical uptake. Increasing investments from biotechnology companies, along with strategic collaborations for vector manufacturing, continue to reinforce this segment's leadership. The rising number of commercial therapies addressing hemoglobinopathies, retinal conditions, and metabolic disorders strongly boosts its dominance across major markets.

The genetically re-engineering cells segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for CAR-T therapies, genome-edited cell therapies, and stem-cell engineering solutions. Advancements in CRISPR, base editing, and multiplexed gene editing have significantly enhanced the precision and therapeutic potential of engineered cell treatments. This segment is seeing strong adoption in oncology due to its ability to deliver personalized, targeted immune responses with high curative potential. Increasing investments from biopharma companies and academic–industry partnerships are accelerating pipeline development across multiple therapeutic areas. The emergence of allogeneic “off-the-shelf” cell therapies is further improving scalability and reducing treatment costs. The rapid expansion of automated and closed-system cell manufacturing platforms is expected to propel continued growth throughout the forecast period.

- By Applications

On the basis of applications, the global curative therapies market is segmented into chemotherapy or radiation therapy for cancer, dialysis treatment for kidney failure, cast for a broken limb, antibiotics for bacterial infections, surgery for appendicitis, and others. The chemotherapy or radiation therapy for cancer segment dominated the market in 2025, driven by its long-standing clinical acceptance and its role as the cornerstone of curative-intent cancer treatment worldwide. Despite rapid advances in modern therapies, these modalities remain critical due to their ability to treat a wide range of cancers at various stages. Technological improvements such as proton therapy, stereotactic body radiation therapy, and AI-guided delivery systems have significantly improved treatment precision and outcomes. The large global cancer burden and well-established treatment protocols continue to support widespread utilization in both developed and emerging regions. Chemotherapy and radiation therapy are frequently combined with new curative treatment modalities, enhancing overall survival rates and strengthening their dominance. Their accessibility and integration into standard oncology care ensure sustained demand across all major healthcare systems.

The antibiotics for bacterial infections segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing global incidence of bacterial infections and rising concerns surrounding antimicrobial resistance. Newer classes of antibiotics and precision-targeted antimicrobial peptides are driving innovation and addressing drug-resistant pathogens more effectively. Enhanced diagnostic tools enabling rapid pathogen identification are supporting earlier treatment and expanding the use of curative antibiotic therapies. Governments and global health organizations are increasing funding for antimicrobial R&D, accelerating development pipelines for next-generation curative antibiotics. The segment also benefits from strong hospital demand and its critical role in preventing complications in acute infections. Rising awareness of timely antibiotic intervention, combined with access to improved therapeutics, is expected to accelerate adoption during the forecast period.

- By End-Users

On the basis of end-users, the global curative therapies market is segmented into clinic, hospital, and others. The hospital segment dominated the market with the largest market revenue share in 2025, driven by the need for advanced clinical infrastructure to administer complex curative therapies such as gene therapy infusions, CAR-T cell treatments, and high-precision radiation interventions. Hospitals maintain specialized care units, GMP-compliant handling facilities, and multidisciplinary clinical teams essential for delivering high-risk, high-value curative treatments. Their integration with advanced diagnostics, molecular testing, and acute care services further enhances treatment outcomes. Strong reimbursement support for hospital-based administration of curative therapies also contributes to the segment’s global dominance. High patient throughput and the availability of highly skilled medical professionals ensure that hospitals remain the primary centers for administering curative therapies. Increasing establishment of dedicated cell and gene therapy centers further strengthens their leadership position.

The clinic segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rapid decentralization of healthcare delivery and the emergence of specialized outpatient centers offering advanced treatments. Technological improvements enabling less invasive procedures and shorter post-treatment monitoring periods are making clinics suitable for select gene and regenerative therapy applications. Clinics offer greater convenience, reduced costs, and faster patient access compared to hospital settings, driving patient preference across many regions. The rise of ambulatory oncology centers and regenerative medicine clinics is expanding availability of curative therapies at outpatient levels. For instance, next-generation engineered cell therapies under development require fewer hours of monitoring, supporting clinic-based implementation. Increased private investment in outpatient infrastructure and remote patient management tools is expected to boost segment growth significantly.

- By Distribution Channel

On the basis of distribution channel, the global curative therapies market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment held the largest market revenue share in 2025, driven by its role in managing and dispensing high-value, highly sensitive curative therapies requiring specialized storage, preparation, and handling conditions. Hospital pharmacies oversee distribution of gene and cell therapies administered within inpatient or specialized clinical settings, ensuring compliance with strict regulatory guidelines. Their advanced cold-chain capabilities, coordination with clinical teams, and integration with digital medical records make them central to curative therapy delivery. These pharmacies also manage complex reimbursement processes for costly therapies, strengthening their importance in treatment workflows. Increasing expansion of hospital-based specialty pharmacies is further enhancing their capacity to handle advanced biologics. The segment’s dominance is reinforced by the growing volume of curative therapies administered exclusively within hospital environments.

The online pharmacy segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising digitalization of healthcare and increasing patient preference for home-based access to medications. While advanced curative therapies are administered in clinical settings, online pharmacies are playing a growing role in distributing supportive drugs, biologically-modifying agents, and post-treatment medications. Enhanced telemedicine integration and cloud-based prescription management systems facilitate seamless ordering and therapy monitoring. Patients benefit from faster access, competitive pricing, and convenient home delivery, driving strong adoption across regions. Regulatory support for e-pharmacy operations is expanding, enabling safer and more transparent digital distribution workflows. The shift toward remote patient care and chronic disease management is expected to significantly accelerate online pharmacy growth during the forecast period.

Curative Therapies Market Regional Analysis

- North America dominated the curative therapies market with the largest revenue share of 46.8% in 2025, supported by advanced biotechnology infrastructure, strong funding availability, favorable regulatory pathways, and early adoption of cutting-edge gene and cell therapy products in the U.S., where rapid growth is driven by approvals, expanding manufacturing capacity, and robust investment from biotech innovators

- The region benefits from well-established biotech clusters, substantial R&D investments, and the presence of leading therapy developers, which collectively support rapid innovation and early patient access

- Healthcare providers and patients in North America increasingly value curative treatment options that offer long-term disease resolution rather than chronic management, fueling strong demand across oncology, rare diseases, and genetic disorders

U.S. Curative Therapies Market Insight

The U.S. curative therapies market captured the largest revenue share within North America in 2025, fueled by rapid adoption of gene and cell therapies and strong federal support for breakthrough biomedical innovation. Patients and healthcare systems are increasingly prioritizing long-term or permanent treatment solutions over chronic disease management, accelerating the shift toward curative modalities. The presence of advanced genomic testing networks and leading biopharmaceutical companies further strengthens the country’s dominance. In addition, robust clinical trial activity, coupled with streamlined FDA pathways such as RMAT and Breakthrough Therapy Designation, is propelling faster commercialization. Widespread insurance coverage for high-value curative therapies is also contributing to strong market uptake.

Europe Curative Therapies Market Insight

The Europe curative therapies market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent regulatory frameworks that favor high-quality clinical evidence and patient safety. Rising incidence of genetic, oncological, and rare disorders is stimulating the adoption of curative interventions across the region. The demand for precision medicine, combined with EU-funded genomic initiatives, is contributing to consistent market expansion. In addition, European consumers and healthcare systems value therapies that reduce long-term treatment burdens and improve quality of life. The region is witnessing increased integration of curative therapies across hospitals, specialty clinics, and advanced research centers.

U.K. Curative Therapies Market Insight

The U.K. curative therapies market is anticipated to grow at a notable CAGR, driven by the country’s strong biotechnology ecosystem and its strategic focus on genomic medicine. The adoption of curative therapies is rising as providers and patients increasingly shift toward one-time treatments that minimize lifetime healthcare costs. The UK's regulatory agility—strengthened through MHRA reforms—supports faster assessment and approval of cutting-edge therapies. Heightened awareness of rare diseases, along with strong NHS-led initiatives in precision diagnostics, is further accelerating market growth. Investments in advanced therapy manufacturing hubs are positioning the U.K. as a regional leader.

Germany Curative Therapies Market Insight

The Germany curative therapies market is expected to record considerable growth during the forecast period, driven by rising awareness of genetic disorders and increasing demand for advanced therapeutic solutions. Germany’s strong medical infrastructure and emphasis on innovation support rapid adoption of cell therapies, gene therapies, and biologically engineered treatments. The country’s focus on quality, data security, and patient outcomes aligns closely with the nature of curative therapies, promoting trust among consumers. Growing partnerships between biotech firms and research universities are fueling the development pipeline. In addition, Germany's reimbursement environment is gradually adapting to accommodate high-value curative interventions.

Asia-Pacific Curative Therapies Market Insight

The Asia-Pacific curative therapies market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing healthcare investment, expanding biotechnology capabilities, and rising diagnosis rates of chronic and rare diseases. Countries such as China, Japan, South Korea, and India are rapidly advancing precision medicine initiatives, boosting adoption of gene and cell-based therapies. Government-led digital health and genomic programs are accelerating clinical deployment of curative treatments. As APAC evolves into a manufacturing hub for biologics, therapy affordability is improving across the region. Growing medical tourism and demand for advanced treatment options are further strengthening market momentum.

Japan Curative Therapies Market Insight

The Japan curative therapies market is gaining traction due to the country’s deep-rooted technological sophistication and strong cultural emphasis on medical advancement. The adoption of curative treatments is rising as Japan faces increasing incidences of age-related and genetic disorders. Streamlined approval pathways, such as Japan’s pioneering conditional approval system for regenerative medicine, are facilitating early access to innovative therapies. Integration of curative treatments into smart hospitals and connected healthcare systems is further propelling growth. In addition, Japan’s aging population is driving demand for long-lasting, minimally burdensome treatment solutions.

India Curative Therapies Market Insight

The India curative therapies market accounted for one of the largest shares in the Asia-Pacific region in 2025, supported by the country’s growing middle class, expanding healthcare infrastructure, and rising awareness of precision medicine. Gene therapy, cell therapy, and targeted biologics are gaining popularity across oncology, rare diseases, and inherited conditions. Strong government initiatives such as Ayushman Bharat, Make in India biotech programs, and rapid digital health adoption are accelerating market penetration. India’s emerging domestic manufacturing ecosystem and affordable clinical trial environment make it a competitive hub for curative therapy development. Increasing adoption across private hospitals, specialty clinics, and diagnostic centers is driving sustained market growth.

Curative Therapies Market Share

The Curative Therapies industry is primarily led by well-established companies, including:

- Editas Medicine (U.S.)

- Intellia Therapeutics, Inc. (U.S.)

- CRISPR Therapeutics AG (Switzerland)

- Sangamo Therapeutics, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- bluebird bio, Inc. (U.S.)

- Sarepta Therapeutics, Inc. (U.S.)

- Allogene Therapeutics, Inc. (U.S.)

- Ultragenyx Pharmaceutical Inc. (U.S.)

- Beam Therapeutics, Inc. (U.S.)

- MeiraGTx Holdings plc (U.K.)

- Rocket Pharmaceuticals, Inc. (U.S.)

- 4D Molecular Therapeutics, Inc. (U.S.)

- Abeona Therapeutics, Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- uniQure (Netherlands)

- Krystal Biotech, Inc. (U.S.)

- Iovance Biotherapeutics, Inc. (U.S.)

- Atara Biotherapeutics, Inc. (U.S.)

What are the Recent Developments in Global Curative Therapies Market?

- In March 2025, The FDA approved Encelto™ (revakinagene taroretcel-lwey), an allogeneic encapsulated cell-based therapy for macular telangiectasia type 2 (MacTel), which uses implanted cells to deliver a neurotrophic factor (CNTF) to the retina, offering the first—and only approved long-term treatment for this rare degenerative eye disorder

- In January 2024, The FDA approved Casgevy (exa-cel) for transfusion-dependent β-thalassemia (TDT), expanding its indication to a second severe genetic blood disorder and giving thousands more patients access to a one-time, potentially curative gene therapy

- In February 2024, The European Commission granted conditional marketing authorization to Casgevy for both SCD and TDT, making it the first CRISPR/Cas9 gene-edited therapy approved in Europe, underlining strong regulatory momentum for genome-editing treatments

- In February 2024, The FDA granted accelerated approval to Lifileucel (Amtagvi®), a tumor-infiltrating lymphocyte (TIL) therapy, for previously treated unresectable or metastatic melanoma, representing a milestone as the first approved one-time cellular therapy for a solid tumor

- In December 2023, The FDA approved Casgevy™, the first-ever CRISPR/Cas9-based gene-editing therapy in the U.S., for the treatment of sickle cell disease (SCD) in patients aged 12 years and older, marking a historic leap for genome editing as a curative modality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.