Global Data Center Networking Market

Market Size in USD Billion

CAGR :

%

USD

31.15 Billion

USD

75.59 Billion

2024

2032

USD

31.15 Billion

USD

75.59 Billion

2024

2032

| 2025 –2032 | |

| USD 31.15 Billion | |

| USD 75.59 Billion | |

|

|

|

|

Data Center Networking Market Size

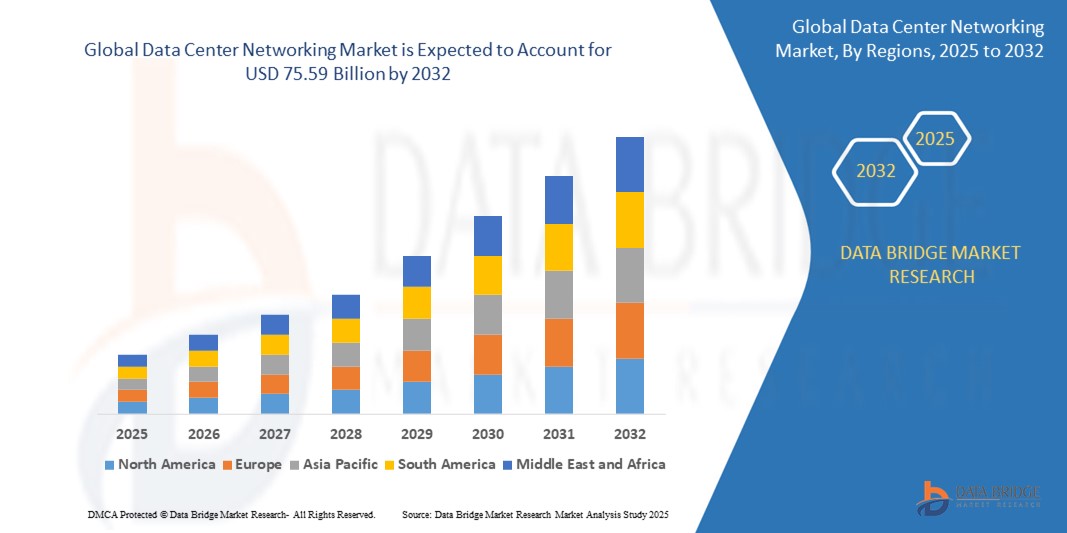

- The global data center networking market size was valued at USD 31.15 billion in 2024 and is expected to reach USD 75.59 billion by 2032, at a CAGR of 11.72% during the forecast period

- The market growth is primarily driven by the surging demand for hyperscale and edge data centers, spurred by rapid digital transformation, cloud adoption, and AI/ML workload proliferation across enterprises and industries

- In addition, the deployment of 5G networks, expansion of Internet of Things (IoT) devices, and rising adoption of software-defined networking (SDN) and network function virtualization (NFV) are enhancing network agility, scalability, and automation within modern data centers

- Moreover, technological innovations in high-speed Ethernet switching (e.g., 400G, 800G), AI-powered traffic management, and real-time network monitoring are significantly optimizing data center performance and energy efficiency. These factors are collectively propelling the growth of the data center networking market, cementing its role as a backbone of the digital economy

Data Center Networking Market Analysis

- Data Center Networking solutions, which encompass switching, routing, load balancing, and network virtualization, are becoming vital in modern digital infrastructure due to their role in ensuring high-speed data transfer, minimizing latency, and enabling seamless communication within and across data centers

- The accelerating demand for Data Center Networking is primarily fueled by the rapid growth of cloud computing, proliferation of data-intensive applications (AI, IoT, Big Data), increasing adoption of hybrid and multi-cloud strategies, and the need for scalable, secure, and efficient network architecture

- North America dominates the Data Center Networking market, accounting for a market share of 35.9% in 2025, supported by the strong presence of hyperscale data centers, robust digital transformation initiatives, and significant investments by tech giants such as Google, Amazon, and Microsoft. The United States leads the region due to its well-established IT ecosystem and ongoing deployment of advanced networking technologies such as 400G/800G Ethernet and SDN

- Asia-Pacific is expected to be the fastest-growing region, with a projected CAGR of 13.8% during the forecast period, driven by expanding internet penetration, increasing number of data centers, and growing digital economies—particularly in China, India, Japan, and Southeast Asia. National initiatives such as India’s Digital India and China's New Infrastructure plan are further boosting regional growth

- The hardware segment is projected to dominate the Data Center Networking market in 2025, capturing a market share of approximately 46.7%. This dominance is driven by their scalability, high bandwidth capacity, and essential role in supporting next-gen workloads and traffic management in cloud and edge data centers. Ethernet switches are preferred for their cost-efficiency, flexibility, and support for high-speed connectivity in modern data center environments.

Report Scope and Data Center Networking Market Segmentation

|

Attributes |

Data Center Networking Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Networking Market Trends

“AI-Driven Network Automation and Hyperscale Infrastructure Evolution”

- A dominant and rapidly evolving trend in the global Data Center Networking market is the adoption of artificial intelligence (AI) and machine learning (ML) to automate network operations, enhance traffic flow analysis, and enable predictive failure detection. AI-driven network management platforms are improving performance, reliability, and operational efficiency across large-scale data centers

- Leading technology providers such as Cisco, Juniper Networks, and Arista Networks are deploying intent-based networking systems and AI-powered analytics tools that proactively manage bandwidth allocation, detect anomalies, and support self-healing capabilities in software-defined data centers

- The shift toward hyperscale data centers is accelerating, driven by cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. These facilities rely on high-capacity, low-latency networking infrastructure to support massive compute and storage demands while ensuring high availability and resilience

- The rise of edge computing and 5G networks is driving demand for decentralized, low-latency networking architectures. Data center networking solutions are evolving to support distributed edge sites with enhanced data transfer capabilities and scalable topologies for latency-sensitive applications such as autonomous vehicles, AR/VR, and industrial IoT

- Network virtualization technologies, including Software-Defined Networking (SDN) and Network Function Virtualization (NFV), are being rapidly adopted to decouple hardware from control functions. This transformation enables more agile, programmable networks that can scale dynamically with workload demands

- Real-time telemetry, IoT integration, and intent-based automation are enabling network administrators to gain deep visibility into traffic patterns, anticipate congestion, and proactively adjust configurations to maintain optimal performance and security

- Innovations in high-speed Ethernet (400G/800G) and silicon photonics are transforming core and spine-leaf data center architectures, reducing latency, power consumption, and physical space requirements. Vendors such as Broadcom and Intel are leading this shift with next-gen chipsets and transceivers

- Government incentives and initiatives focused on digital transformation, cloud migration, and smart infrastructure development, especially in North America, Europe, and Asia-Pacific, are further driving investment in next-generation data center networking solutions

Energy Storage Optimization Market Dynamics

Driver

“Increasing Demand for Scalable, High-Performance Network Infrastructure in the Digital Economy”

- The exponential growth in cloud computing, artificial intelligence (AI), machine learning (ML), and data-heavy applications is a major driver accelerating the demand for advanced data center networking solutions. Enterprises, hyperscalers, and colocation providers are prioritizing scalable, low-latency, and secure network architectures to support global digital transformation

- For instance, in February 2024, Cisco Systems launched its AI-native Nexus 9000 series switches, designed to optimize performance for AI/ML workloads in modern data centers. These solutions support 800G Ethernet and integrate real-time telemetry to deliver enhanced operational efficiency and visibility

- The widespread rollout of 5G infrastructure and edge computing is further driving the need for agile, high-bandwidth networking solutions to ensure ultra-low latency, real-time data processing, and dynamic workload distribution across distributed data centers

- Growing enterprise adoption of multi-cloud and hybrid IT environments is boosting demand for software-defined networking (SDN), network function virtualization (NFV), and cloud-native network orchestration platforms that offer flexibility, automation, and centralized control

- Surging demand for video streaming, online gaming, virtual collaboration, and IoT-enabled applications is compelling data center operators to invest in high-performance networking solutions capable of handling massive, concurrent data flows with minimal downtime

Restraint/Challenge

“High Infrastructure Costs and Integration Complexities in Modern Data Center Networks”

- The significant capital expenditure required for deploying next-generation data center networking infrastructure, including 400G/800G Ethernet, advanced switches, and optical interconnects, presents a substantial barrier, especially for small and mid-sized enterprises

- For instance, upgrading from 100G to 400G Ethernet can involve not only costly hardware changes but also increased power and cooling demands, raising total cost of ownership and operational expenditure

- Integration of new networking technologies with legacy systems remains a key technical challenge. Many organizations struggle to harmonize older network architectures with software-defined and virtualized environments, leading to delays, security risks, and operational inefficiencies

- Network complexity is further intensified by the growing use of multi-vendor equipment and hybrid IT models, making it difficult to maintain interoperability, performance consistency, and end-to-end visibility

- Shortage of skilled professionals in data center network automation, SDN, and AI-driven network orchestration is also limiting the pace of adoption and digital transformation, particularly in developing regions

- To overcome these challenges, industry stakeholders are focusing on training programs, open networking standards, and the development of simplified, modular networking solutions that lower entry barriers and accelerate infrastructure modernization

Data Center Networking Market Scope

The market is segmented on the basis components and end use.

By Component

On the basis of component, the data center networking market is segmented into hardware, software, and service. The Hardware segment dominates the largest market revenue share in 2025, driven by the high demand for networking switches, routers, cables, and storage area networks (SANs) that form the backbone of modern data centers. These components are preferred for their performance reliability, scalability, and ability to support growing data workloads and low-latency requirements

The Software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of Software-Defined Networking (SDN), network virtualization, and intent-based networking platforms. Rising demand for automation, centralized management, and predictive analytics in complex data center environments is accelerating the deployment of advanced software solutions

• By End User

On the basis of end user, the data center networking market is segmented into telecommunications, government, colocation, defense, retail, media and entertainment, BFSI, healthcare, manufacturing, education, and others. The Telecommunications segment held the largest market revenue share in 2025, owing to the sector’s heavy reliance on robust and scalable network infrastructure to support 5G, IoT, and cloud-based service delivery. Networking solutions are increasingly deployed by telecom providers to enhance bandwidth, reduce latency, and ensure uninterrupted service availability

The Healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the digitization of health records, adoption of telemedicine, and use of AI-driven diagnostics. Networking systems in this segment are enabling secure, high-speed data transmission across distributed hospital networks and cloud-hosted health platforms

Data Center Networking Regional Analysis

- North America dominates the data center networking market with the largest revenue share of 35.9% in 2025, driven by widespread adoption of advanced networking infrastructure in hyperscale and enterprise data centers.

- The region’s growth is fueled by increasing demand for high-speed data transmission, cloud computing expansion, and the deployment of 5G and edge computing technologies requiring robust network connectivity.

- Strong investments in AI-driven network management, government initiatives supporting digital infrastructure, and the presence of major networking hardware and software vendors further bolster North America’s leadership in the global data center networking market

U.S. Data Center Networking Market Insight

The U.S. Data Center Networking market captured the largest revenue share of 79% within North America in 2025, driven by significant investments in hyperscale data centers, cloud infrastructure expansion, and the adoption of high-speed networking technologies such as 400G Ethernet. Federal initiatives promoting digital infrastructure development and cybersecurity enhancements are accelerating deployment. In addition, growing demand for edge computing and AI workloads is driving advanced network upgrades and software-defined networking (SDN) solutions

Europe Data Center Networking Market Insight

The European Data Center Networking market is projected to expand at a robust CAGR throughout the forecast period, supported by the EU’s digital transformation agenda and data sovereignty regulations. Investments in green data centers and sustainable network solutions align with stringent energy efficiency and carbon reduction goals. Increased focus on cross-border data flow, 5G rollout, and cloud adoption across sectors boosts demand for scalable, secure, and high-performance networking infrastructure

U.K. Data Center Networking Market Insight

The U.K. Data Center Networking market is anticipated to grow significantly during the forecast period, driven by rapid cloud adoption, the rise of colocation facilities, and government-backed initiatives to enhance digital connectivity. The country’s commitment to net-zero emissions by 2050 is fueling investments in energy-efficient data center networks. Innovation in software-defined infrastructure and edge data centers to support IoT and 5G deployments further strengthens market growth

Germany Data Center Networking Market Insight

The German Data Center Networking market is expected to grow steadily, supported by Germany’s leadership in Industry 4.0 and the expansion of smart manufacturing requiring robust network infrastructure. The adoption of network virtualization, automation, and AI-enabled monitoring tools in data centers enhances operational efficiency. Government policies promoting digital infrastructure and renewable energy integration also encourage the development of energy-efficient networking solutions

Asia-Pacific Data Center Networking Market Insight

The Asia-Pacific Data Center Networking market is poised to register the fastest CAGR of over 25% in 2025, fueled by rapid digitalization, urbanization, and the rise of cloud service providers in countries such as China, India, Japan, and South Korea. Expanding hyperscale data centers, government investments in smart city projects, and the rollout of 5G networks are driving demand for high-capacity, low-latency networking equipment. Domestic manufacturers and technology innovation are accelerating adoption of SDN and network function virtualization (NFV) technologies

Japan Data Center Networking Market Insight

The Japan Data Center Networking market is gaining momentum due to its advanced technology ecosystem, focus on disaster-resilient infrastructure, and growing need for edge computing to support IoT and AI applications. Government initiatives to modernize telecommunications infrastructure and integrate 5G with data centers bolster demand. High investments in software-defined and automated networking solutions contribute to increased network agility and efficiency

China Data Center Networking Market Insight

The China Data Center Networking market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by aggressive government policies promoting digital infrastructure and data sovereignty. Massive investments in hyperscale and edge data centers, combined with China’s dominance in network hardware manufacturing, support cost-effective network deployments. National initiatives such as the “New Infrastructure” plan and carbon neutrality goals by 2060 further accelerate demand for intelligent, energy-efficient networking technologies across enterprises, cloud providers, and telecom operators

Data Center Networking Market Share

The data center networking industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Arista Networks, Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Microsoft (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Dell Inc. (U.S.)

- Avaya Inc. (U.S.)

- Extreme Networks (U.S.)

- VMware, Inc. (U.S.)

- ALE International (France)

- Intel Corporation (U.S.)

- Equinix, Inc. (U.S.)

- Curvature (U.S.)

- Pluribus Networks (U.S.)

- Apstra (U.S.)

- Broadcom (U.S.)

- Rahi Systems (U.S.)

- NEC Corporation (Japan)

- IBM (U.S.)

Latest Developments in Global Data Center Networking Market

- In March 2024, Arista Networks introduced Arista Etherlink, a standards-based Ethernet solution tailored to Al tasks. Using Al-optimized Arista EOS, Etherlink provides efficient Al infrastructure and makes its use possible from a few thousand to a hundred thousand XPUs in both one- and two-tier network topologies

- In March 2024, NVIDIA introduced the new X800 series of switches that includes the Quantum-X800 InfiniBand and Spectrum-X800 Ethernet switches; these switches provide 800Gb/s speeds and become class-leading for both Al and GPU computing. Many companies use these switches to improve Al, cloud, and high-performance computing capabilities

- In June 2023, Cisco Systems Inc., a leading software company, announced the launch of a full-stack observability platform. This new offering brings data together from different domains, such as networking, application, and others

- In December 2022, Edgecore Networks Corporation, a Taiwan-based provider of open networking products and solutions, launched the EPS200 Series, an open network solution specifically designed and manufactured for enterprises in data center networking architecture. It enables the connection of servers, storage devices, and network switches all packed in a rack

- In December 2022, Arista Networks, Inc. introduced eight high-end data center switches that are specifically designed and manufactured to meet the requirements of individual organizations supporting as high as 800G bandwidth. The company launched three new switches in its existing 7060X5 series, while the other five were added in 7050X4 data-center leaf switches

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.