Global De Extinction Biotech And Conservation Genomics Market

Market Size in USD Million

CAGR :

%

USD

198.00 Million

USD

807.00 Million

2024

2032

USD

198.00 Million

USD

807.00 Million

2024

2032

| 2025 –2032 | |

| USD 198.00 Million | |

| USD 807.00 Million | |

|

|

|

|

De-Extinction Biotech & Conservation Genomics Market Size

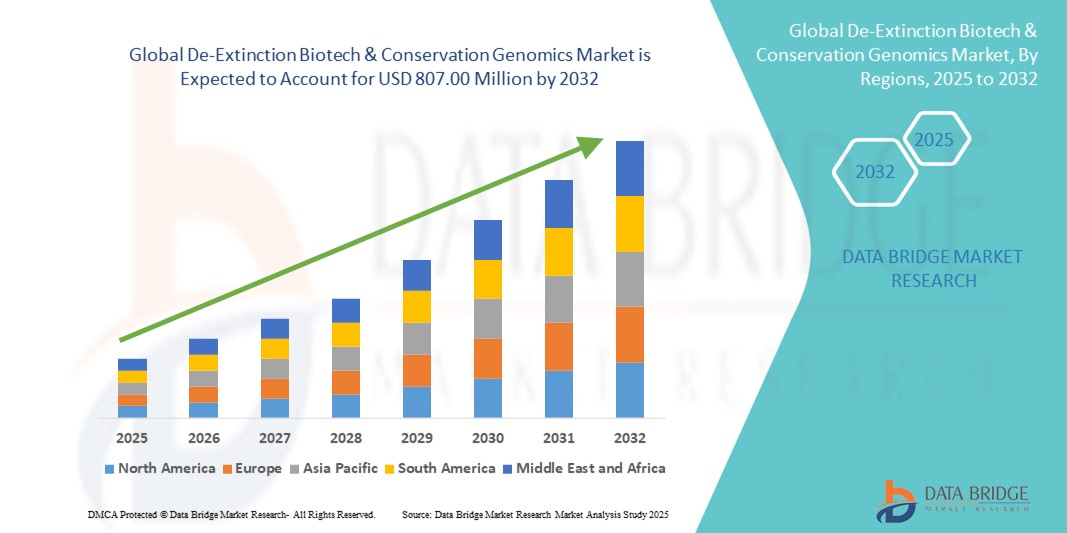

- The global de-extinction biotech & conservation genomics market size was valued at USD 198.00 million in 2024 and is expected to reach USD 807.00 million by 2032, at a CAGR of 19.20% during the forecast period

- The market growth is largely fueled by advancements in genome editing, synthetic biology, and reproductive technologies, enabling more precise, cost-effective, and scalable approaches to species restoration and genetic rescue

- Furthermore, increasing governmental, academic, and philanthropic investment in biodiversity conservation, coupled with rising public awareness of ecological restoration, is positioning de-extinction biotech and conservation genomics as transformative tools for addressing biodiversity loss. These converging factors are accelerating research-to-field implementation, thereby significantly boosting the industry's growth

De-Extinction Biotech & Conservation Genomics Market Analysis

- De-extinction biotech and conservation genomics, encompassing genome editing, cloning, and advanced reproductive technologies, are emerging as pivotal tools in biodiversity restoration and species preservation, enabling the revival of extinct species proxies and the genetic rescue of critically endangered populations through precise genomic interventions and ecosystem rebalancing

- The accelerating demand for these solutions is primarily fueled by rapid advancements in CRISPR and synthetic biology, increasing threats of biodiversity loss, and a growing global commitment to ecological restoration as part of climate resilience and conservation strategies

- North America dominated the de-extinction biotech & conservation genomics market with the largest revenue share of 41.8% in 2024, supported by cutting-edge research infrastructure, significant public–private investment, and the active involvement of leading universities, biotech firms, and conservation organizations, with the U.S. spearheading landmark projects in species revival and genomic rescue

- Asia-Pacific is expected to be the fastest growing region in the de-extinction biotech & conservation genomics market during the forecast period due to its rich biodiversity hotspots, increasing regional research collaborations, and rising governmental focus on conservation biotechnology

- The mammal segment dominated the de-extinction biotech & conservation genomics market with a share of 47.3% in 2024, driven by high-profile restoration efforts targeting iconic megafauna species, which attract substantial funding, public attention, and cross-border research partnerships

Report Scope and De-Extinction Biotech & Conservation Genomics Market Segmentation

|

Attributes |

De-Extinction Biotech & Conservation Genomics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

De-Extinction Biotech & Conservation Genomics Market Trends

Precision Restoration Through CRISPR, Synthetic Biology, and AI

- A significant and accelerating trend in the global de-extinction biotech & conservation genomics market is the integration of CRISPR-based gene editing, synthetic biology, and artificial intelligence to enable more precise, efficient, and scalable species restoration and genetic rescue programs. This convergence of technologies is enhancing the ability to edit genomes accurately, predict ecological impacts, and optimize reintroduction strategies

- For instance, Revive & Restore’s “Woolly Mammoth Revival” initiative utilizes CRISPR to insert cold-resistance genes into Asian elephant DNA, while AI-based ecological modelling predicts habitat viability. Similarly, the Lazarus Project applies cloning techniques to revive the gastric-brooding frog, combining genomic sequencing with advanced reproductive technologies

- AI integration enables predictive analytics for species survival, automated genomic annotation, and real-time monitoring of reintroduced populations. For example, some conservation genomics platforms employ machine learning to identify genetic variations linked to disease resistance or climate adaptability, thereby streamlining selective breeding and genome editing strategies

- The seamless linkage between laboratory genomic data, field conservation operations, and AI-driven decision-making platforms allows conservation teams to manage breeding, genetic diversity, and ecological integration through unified systems

- This trend toward intelligent, data-driven, and cross-disciplinary approaches is reshaping expectations for conservation outcomes, driving demand for biotech solutions that combine laboratory precision with ecological insight. Consequently, organizations are developing integrated platforms for species restoration that merge CRISPR editing, reproductive technologies, and AI-based environmental modelling to accelerate conservation timelines

- The demand for precision-driven, AI-assisted de-extinction and conservation genomics solutions is growing rapidly across both public and private sectors, as stakeholders increasingly seek science-based, measurable, and scalable biodiversity restoration strategies

De-Extinction Biotech & Conservation Genomics Market Dynamics

Driver

Rising Biodiversity Loss and Technological Breakthroughs in Genome Editing

- The accelerating rate of biodiversity loss, compounded by climate change, habitat destruction, and emerging diseases, is a significant driver for the growth of de-extinction biotech and conservation genomics

- For instance, in 2024, Colossal Biosciences announced advancements in multiplex CRISPR editing to enable simultaneous insertion of multiple beneficial traits in endangered species, significantly reducing development timelines. Such innovations are expected to accelerate the transition from experimental research to field implementation

- As governments, NGOs, and research institutions intensify efforts to preserve genetic diversity, technologies such as high-throughput sequencing, synthetic genome assembly, and advanced reproductive methods are becoming central to conservation strategies

- Furthermore, the rising global emphasis on climate resilience and ecosystem restoration is positioning de-extinction biotech as a transformative solution to restore lost ecological functions, such as pollination, seed dispersal, or grassland management

- The ability to combine laboratory-based genome editing with field-ready breeding and release programs is attracting strong investment from public, private, and philanthropic sectors, creating new opportunities for innovation and commercialization

Restraint/Challenge

Ethical, Ecological, and Regulatory Complexities

- Ethical debates surrounding species revival ranging from animal welfare concerns to ecological uncertainties pose a significant challenge to market expansion. The potential risks of introducing revived species into modern ecosystems, including unintended ecological consequences, can make regulators cautious and slow to approve large-scale projects

- For instance, critics of high-profile revival projects such as the passenger pigeon and woolly mammoth have raised concerns about diverting resources away from existing endangered species protection efforts

- Addressing these challenges requires transparent ecological risk assessments, robust ethical frameworks, and clear regulatory guidelines for gene-edited or cloned organisms. Organizations such as Revive & Restore are increasingly publishing peer-reviewed environmental impact studies to build public and policymaker confidence

- In addition, the high cost and long timelines of species restoration projects, combined with the complexity of maintaining genetic viability in small founder populations, can be barriers for funding bodies and governments

- Overcoming these challenges will depend on sustained interdisciplinary collaboration, public engagement, regulatory harmonization across countries, and continued technological innovation to reduce costs and improve success rates

De-Extinction Biotech & Conservation Genomics Market Scope

The market is segmented on the basis of species, product & service, technology, and end user.

- By Species

On the basis of species, the global de-extinction biotech & conservation genomics market is segmented into mammals, birds, amphibians & reptiles, plants, invertebrates, and multi-species ecosystem restoration targets. The mammals segment dominated the market with the largest market revenue share of 47.3% in 2024, driven by high-profile restoration projects targeting iconic megafauna such as the woolly mammoth, thylacine, and passenger pigeon proxies. These species often attract significant funding, media attention, and cross-border research collaborations, boosting investment and development in the segment.

The birds segment is anticipated to witness the fastest growth rate of 21.4% from 2025 to 2032, fueled by the increasing application of genomic tools for avian conservation, particularly in island ecosystems where bird extinctions have been prevalent. Advances in avian genome sequencing and reproductive techniques, such as surrogate egg-laying, are expanding restoration possibilities for critically endangered or extinct bird species.

- By Product & Service

On the basis of product & service, the global de-extinction biotech & conservation genomics market is segmented into instruments, consumables & reagents, sequencing & lab services, bioinformatics software & data analysis platforms, sample collection & biobanking, and consulting & implementation services. The sequencing & lab services segment held the largest market revenue share in 2024, driven by the essential role of high-throughput sequencing and advanced laboratory analysis in genome reconstruction, trait identification, and genetic rescue initiatives.

The bioinformatics software & data analysis platforms segment is expected to record the fastest CAGR from 2025 to 2032, owing to the growing reliance on AI-powered analytics, genomic annotation tools, and ecological modelling platforms to design, validate, and monitor de-extinction and conservation genomics projects at scale.

- By Technology

On the basis of technology, the global de-extinction biotech & conservation genomics market is segmented into CRISPR & other gene editing tools, cloning & somatic cell nuclear transfer (SCNT), induced pluripotent & embryonic stem-cell technologies, synthetic biology (genome synthesis), next-generation sequencing (NGS), long-read sequencing, bioinformatics & AI, and assisted reproduction technologies (ART). The CRISPR & other gene editing tools segment dominated the market in 2024, supported by its precision, efficiency, and adaptability in introducing beneficial genetic traits, reconstructing genomes, and correcting deleterious mutations.

The synthetic biology (genome synthesis) segment is expected to grow at the fastest rate during the forecast period, driven by its capacity to design and assemble large, complex genomes from scratch, enabling the revival of species with limited or degraded DNA samples.

- By End User

On the basis of end user, the global de-extinction biotech & conservation genomics market is segmented into conservation NGOs & foundations, academic & government research institutes, biotech & synthetic biology companies, wildlife reserves/zoos & breeding centers, and environmental consultancies. The academic & government research institutes segment accounted for the largest market share in 2024, owing to substantial public research funding, the presence of specialized genomic facilities, and the execution of landmark de-extinction and conservation genomics projects.

The biotech & synthetic biology companies segment is projected to experience the fastest growth from 2025 to 2032, fueled by the rise of commercial ventures aiming to develop marketable technologies, genetic toolkits, and service offerings that can be applied to conservation, ecosystem restoration, and even potential spin-off markets in agriculture and biomedical research.

De-Extinction Biotech & Conservation Genomics Market Regional Analysis

- North America dominated the de-extinction biotech & conservation genomics market with the largest revenue share of 41.8% in 2024, supported by cutting-edge research infrastructure, significant public–private investment, and the active involvement of leading universities, biotech firms, and conservation organizations, with the U.S. spearheading landmark projects in species revival and genomic rescue

- Stakeholders in the region place high value on the precision, scalability, and ecological benefits offered by cutting-edge genome editing, synthetic biology, and reproductive technologies, as well as their integration with AI-driven ecological modelling and conservation planning

- This widespread adoption is further supported by strong philanthropic investment, favorable regulatory environments for research, and a growing public commitment to biodiversity restoration, positioning North America as a global leader in translating de-extinction science from laboratory breakthroughs to real-world conservation outcomes

U.S. De-Extinction Biotech & Conservation Genomics Market Insight

The U.S. de-extinction biotech & conservation genomics market captured the largest revenue share of 81% in 2024 within North America, fueled by its leadership in genome editing, synthetic biology, and advanced reproductive technologies. The country is home to pioneering projects such as woolly mammoth and passenger pigeon revival efforts, driven by collaboration between biotech companies, universities, and conservation NGOs. Strong federal and philanthropic funding, combined with advanced research infrastructure and a culture of scientific innovation, further propels the sector. Moreover, the integration of AI-driven ecological modelling and next-generation sequencing platforms is significantly contributing to project scalability and success rates.

Europe De-Extinction Biotech & Conservation Genomics Market Insight

The Europe de-extinction biotech & conservation genomics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent biodiversity protection laws, active participation in global conservation initiatives, and a growing focus on climate resilience. The EU’s commitment to ecological restoration, alongside public funding programs for biodiversity genomics, is fostering innovation. The region is witnessing increased application of genomic tools across conservation programs, with projects ranging from plant genome restoration to endangered bird genetic rescue, incorporated into both protected area management and rewilding initiatives.

U.K. De-Extinction Biotech & Conservation Genomics Market Insight

The U.K. de-extinction biotech & conservation genomics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by robust academic research in genomics and active engagement in global conservation collaborations. Initiatives targeting the genetic rescue of native species, coupled with advanced biobanking facilities and strong policy support, are encouraging adoption. The country’s growing public interest in conservation, along with well-funded research bodies, positions it as a significant player in developing scalable de-extinction methodologies.

Germany De-Extinction Biotech & Conservation Genomics Market Insight

The Germany de-extinction biotech & conservation genomics market is expected to expand at a considerable CAGR during the forecast period, fueled by its leadership in biotechnology innovation, sustainability-driven policies, and advanced laboratory capabilities. Germany’s strong environmental ethics and emphasis on genetic biodiversity preservation are promoting adoption in both academic and applied conservation projects. The integration of long-read sequencing, AI-based genomic analysis, and assisted reproduction techniques is becoming increasingly prevalent, with a focus on ethical and ecologically responsible restoration strategies.

Asia-Pacific De-Extinction Biotech & Conservation Genomics Market Insight

The Asia-Pacific de-extinction biotech & conservation genomics market is poised to grow at the fastest CAGR of 24% during 2025–2032, driven by rich biodiversity, increasing environmental challenges, and rising investment in conservation genomics in countries such as China, Japan, and India. Government-backed biodiversity programs and growing participation in international research networks are driving adoption. As APAC emerges as a genomic research hub, lower sequencing costs and increased accessibility of advanced editing tools are expanding capabilities for regional species restoration initiatives.

Japan De-Extinction Biotech & Conservation Genomics Market Insight

The Japan de-extinction biotech & conservation genomics market is gaining momentum due to the country’s advanced biotech ecosystem, focus on species preservation, and integration of genomics into environmental policy. Projects involving coral genome preservation, rare bird restoration, and AI-assisted ecological modelling are fueling growth. Moreover, Japan’s demographic trends and technological sophistication are such asly to drive further investment in automated, precision-driven conservation solutions.

India De-Extinction Biotech & Conservation Genomics Market Insight

The India de-extinction biotech & conservation genomics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to its biodiversity-rich ecosystems, rapidly expanding research capacity, and growing government focus on species preservation. India’s involvement in large-scale biodiversity genome mapping, along with cost-effective sequencing capabilities, is enabling both in-situ and ex-situ conservation efforts. Strong collaboration between domestic research institutes and global conservation organizations is accelerating the adoption of genomic technologies for endangered species protection and ecosystem restoration.

De-Extinction Biotech & Conservation Genomics Market Share

The de-extinction biotech & conservation genomics industry is primarily led by well-established companies, including:

- Colossal Biosciences (U.S.)

- Revive & Restore (U.S.)

- San Diego Zoo Wildlife Alliance (U.S.)

- The Frozen Ark Project (U.K.)

- Cryobank America LLC (U.S.)

- The Wild Genomes Project (U.S.)

- Australian Museum Research Institute (Australia)

- Wildlife Conservation Society (U.S.)

- The Nature Conservancy (U.S.)

- World Wildlife Fund (Switzerland)

- International Livestock Research Institute (Kenya)

- National Geographic Society (U.S.)

- Zoos Victoria (Australia)

- Oxford Nanopore Technologies (U.K.)

- Genomics England (U.K.)

- Pacific Biosciences (U.S.)

- Illumina, Inc. (U.S.)

- BGI Genomics Co., Ltd. (China)

- Veritas Genetics (U.S.)

What are the Recent Developments in Global De-Extinction Biotech & Conservation Genomics Market?

- In July 2025, Colossal Biosciences, in partnership with the Ngāi Tahu Research Centre and supported by filmmaker Peter Jackson, announced an ambitious plan to bring back the South Island Giant Moa, a flightless bird that could reach 12 feet in height. The project involves sequencing DNA from preserved moa remains and creating a high-quality reference genome. Scientists will also focus on habitat readiness and ethical considerations for potential reintroduction. This move aims to restore lost ecological roles in New Zealand’s unique environment

- In April 2025, Colossal Biosciences revealed the birth of three genetically engineered wolf pups carrying select traits of the extinct dire wolf. By editing 20 ancient DNA-related genes in gray wolves and implanting embryos into domestic dogs, researchers aim to create animals capable of filling the dire wolf’s ecological niche. While not exact replicas, these hybrids could help balance predator-prey ecosystems. The project demonstrates advancements in precise genome editing and species restoration strategies

- In April 2025, The IUCN Species Survival Commission’s Canid Specialist Group issued a public statement questioning Colossal’s dire wolf claims. Experts stressed that the engineered pups are genetically modified wolves, not true dire wolves or complete ecological substitutes. The group warned that presenting them as de-extinct species risks misleading the public and policymakers. The debate reflects ongoing tensions between scientific innovation, ecological accuracy, and conservation priorities

- In January 2025, Colossal Biosciences secured USD 200 million in Series C funding, raising its valuation to USD 10.2 billion one of the largest funding rounds in biotech history. The investment will accelerate de-extinction projects, particularly the woolly mammoth, Tasmanian tiger, and dodo. Funding will also support development of artificial wombs and advanced genomic tools to scale animal revival efforts. Investors view this as a breakthrough moment for conservation genomics and synthetic biology commercialization

- In February 2025, Argentine biotech firm Kheiron produced the first gene-edited polo horses using CRISPR-Cas9 technology, optimizing muscle composition for explosive performance. While targeted at the sports industry, the achievement highlights the crossover potential of gene-editing techniques in conservation genomics. Similar methods could be used to enhance genetic diversity or revive lost traits in endangered species. This milestone underscores how sports genetics can inform wildlife restoration science

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.