Global Dental Bonding Agents Market

Market Size in USD Billion

CAGR :

%

USD

4.30 Billion

USD

6.21 Billion

2024

2032

USD

4.30 Billion

USD

6.21 Billion

2024

2032

| 2025 –2032 | |

| USD 4.30 Billion | |

| USD 6.21 Billion | |

|

|

|

|

Dental Bonding Agents Market Size

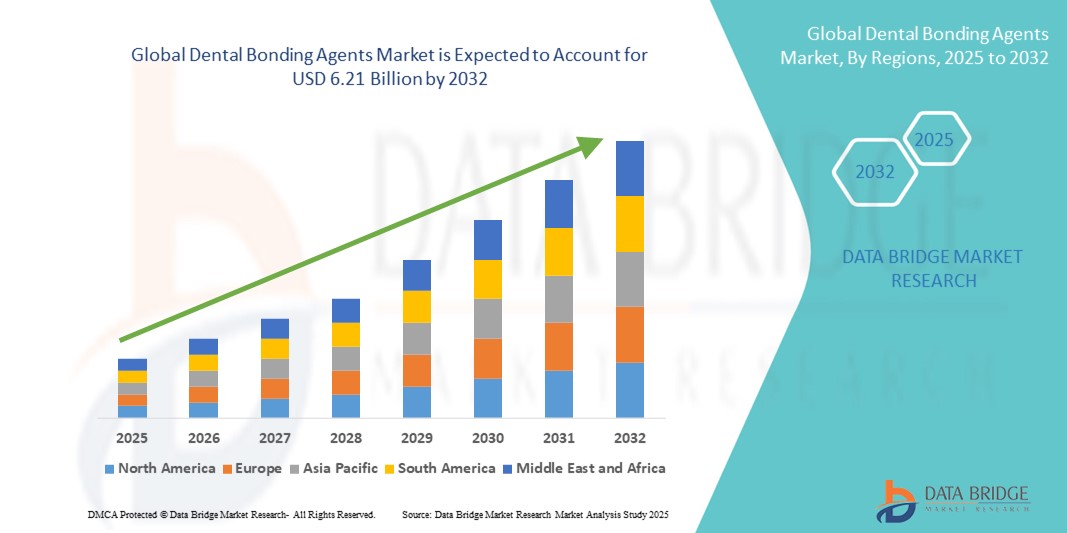

- The global dental bonding agents market size was valued at USD 4.30 billion in 2024 and is expected to reach USD 6.21 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements within dental care technologies, particularly in cosmetic and restorative dentistry, leading to increased digitalization and precision in dental procedures across both hospital and clinical settings

- Furthermore, rising patient demand for minimally invasive, aesthetically pleasing, and durable dental treatments is establishing dental bonding agents as a preferred solution for various dental restorations. These converging factors are accelerating the uptake of Dental Bonding Agents solutions, thereby significantly boosting the industry's growth

Dental Bonding Agents Market Analysis

- Dental bonding agents, also known as dental adhesives, are crucial components in restorative dentistry, offering effective adhesion between dental substrates and restorative materials. These agents are increasingly used in cosmetic and structural procedures across both dental clinics and hospitals due to their enhanced bond strength, biocompatibility, and ease of application

- The growing demand for dental bonding agents is primarily fueled by rising incidences of dental caries, increased aesthetic awareness, and the growing preference for minimally invasive procedures among patients

- North America dominated the dental bonding agents market with the largest revenue share of 37.8% in 2024, attributed to advanced healthcare infrastructure, high dental care spending, and a strong presence of leading market players. The U.S. has witnessed substantial growth in the adoption of dental bonding agents, particularly in cosmetic and restorative dental practices driven by technological advancements and higher patient awareness

- Asia-Pacific is expected to be the fastest-growing region in the dental bonding agents market during the forecast period, with a CAGR of 8.5% from 2025 to 2032, fueled by rising disposable incomes, growing healthcare expenditure, and increasing demand for aesthetic dentistry in countries such as China, India, and Japan

- The self-etch segment dominated the largest market revenue share of 59.4% in 2024, owing to its simplified application process and reduced technique sensitivity, making it a preferred choice among general dentists. Self-etch bonding agents eliminate the need for a separate etching step, thereby saving time and minimizing post-operative sensitivity. These benefits have made them popular in both direct and indirect restorative procedures

Report Scope and Dental Bonding Agents Market Segmentation

|

Attributes |

Dental Bonding Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Bonding Agents Market Trends

Increasing Demand for User-Friendly, Efficient, and High-Performance Bonding Solutions

- A significant and accelerating trend in the global dental bonding agents market is the shift toward high-performance bonding systems that offer simplified application procedures, reduced technique sensitivity, and enhanced adhesion to both enamel and dentin. This innovation is significantly improving workflow efficiency and treatment outcomes for dental professionals

- For instance, universal adhesives like 3M Scotchbond Universal Plus are gaining widespread acceptance for their ability to function in multiple etching modes (self-etch, selective-etch, and total-etch), streamlining the bonding process and reducing chair time

- Manufacturers are increasingly integrating features that improve ease of use, such as one-bottle systems and nanotechnology-enhanced formulations that allow better penetration into dentinal tubules and longer-lasting adhesion. These advancements provide clinicians with more reliable and versatile bonding agents across a wide range of indications

- The growing prevalence of cosmetic and restorative procedures—such as veneers, crowns, and composite restorations—has driven the demand for bonding agents that offer both aesthetic excellence and durability. Patients are increasingly seeking minimally invasive solutions that preserve natural tooth structure while delivering high-end cosmetic results

- In addition, manufacturers are focusing on developing bioactive adhesives that promote remineralization and actively contribute to tooth health beyond mechanical retention. Such features align with modern dentistry's emphasis on preservation and prevention

- The demand for dental bonding agents that are easy to apply, reduce procedural complexity, and ensure long-term performance is rapidly increasing in both developed and emerging markets. Dental professionals and institutions are prioritizing materials that enhance clinical productivity while maintaining safety and efficacy

Dental Bonding Agents Market Dynamics

Driver

Growing Need Due to Rising Demand for Aesthetic and Minimally Invasive Dental Procedures

- The increasing prevalence of dental caries, tooth wear, and aesthetic dental concerns, coupled with the rising popularity of cosmetic and restorative dentistry, is a significant driver for the heightened demand for dental bonding agents

- For instance, in April 2024, Kuraray Noritake Dental Inc. introduced an enhanced version of CLEARFIL Universal Bond Quick, designed to reduce application time while maintaining strong adhesion in both self-etch and total-etch modes. Such innovations by key companies are expected to drive the Dental Bonding Agents industry growth during the forecast period

- As dental professionals and patients seek less invasive alternatives to traditional restorations, bonding agents play a critical role in achieving strong adhesion while preserving more natural tooth structure. These agents also facilitate quick chairside procedures, offering long-term performance and patient satisfaction

- Furthermore, the growing popularity of composite restorations, veneers, and dental sealants—especially among young adults and middle-aged populations—continues to increase the demand for universal and self-etch bonding agents that provide high bond strength, compatibility with various materials, and ease of use

- The convenience of single-bottle systems, enhanced moisture tolerance, and compatibility with both direct and indirect restorations are key factors propelling the adoption of modern dental bonding agents in both clinical and academic settings. The trend towards minimally invasive treatments and growing awareness of oral health in emerging economies further contributes to market growth

Restraint/Challenge

Concerns Regarding Postoperative Sensitivity and High Product Cost

- Concerns surrounding postoperative sensitivity and technique sensitivity associated with some bonding agents pose significant challenges to broader market adoption. In particular, total-etch systems, while effective, require precise technique to avoid pulp irritation and patient discomfort

- For instance, studies published in the Journal of Adhesive Dentistry have highlighted variable performance outcomes based on operator handling and moisture control, leading to inconsistent results in certain cases

- Addressing these concerns through improved formulations, better moisture tolerance, and simplified clinical protocols is crucial for improving user confidence. Companies such as 3M, Ivoclar Vivadent, and Dentsply Sirona continue to invest in research to reduce the risk of sensitivity and improve clinical outcomes

- In addition, the relatively high cost of advanced bonding systems—particularly those incorporating nanotechnology or bioactive ingredients—can act as a barrier for adoption in cost-sensitive regions or smaller dental clinics

- While prices are gradually stabilizing due to competitive pressures, the initial investment in training and products may deter some practitioners, especially in developing regions

- Overcoming these challenges through clinical education, value-based pricing strategies, and product innovation that combines performance with affordability will be vital for sustained growth in the global dental bonding agents market

Dental Bonding Agents Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the dental bonding agents market is segmented into self-etch and total-etch bonding agents. The self-etch segment dominated the largest market revenue share of 59.4% in 2024, owing to its simplified application process and reduced technique sensitivity, making it a preferred choice among general dentists. Self-etch bonding agents eliminate the need for a separate etching step, thereby saving time and minimizing post-operative sensitivity. These benefits have made them popular in both direct and indirect restorative procedures.

The total-etch segment is anticipated to witness the fastest CAGR of 7.3% from 2025 to 2032, driven by its superior bond strength to enamel and widespread use in cosmetic and restorative dental treatments. This technique, although more technique-sensitive, is favored in cases requiring strong, durable adhesion, especially in anterior restorations where esthetics and retention are crucial.

- By End User

On the basis of end user, the dental bonding agents market is segmented into hospitals, dental clinics, ambulatory surgical centers, and others. The dental clinics segment accounted for the largest market share of 48.9% in 2024, driven by the rising number of private practices and the growing preference for outpatient dental treatments. Clinics are equipped to offer a wide range of restorative and cosmetic procedures, where bonding agents are frequently used for composite fillings, veneers, and sealants.

The hospitals segment is expected to witness the fastest growth rate of 8.1% from 2025 to 2032, due to the increasing integration of dental departments in multispecialty hospitals and the rising demand for complex dental surgeries that require high-performance bonding agents. The presence of advanced infrastructure and experienced professionals further enhances hospital adoption.

Dental Bonding Agents Market Regional Analysis

- North America dominated the dental bonding agents market with the largest revenue share of 37.8% in 2024, driven by a high prevalence of dental caries, increasing awareness about oral health, and the widespread availability of advanced dental care facilities

- Consumers in the region are more inclined toward aesthetic dental procedures, fueling demand for high-performance bonding agents

- The growth is further supported by favorable reimbursement policies, well-established dental infrastructure, and technological advancements in dental materials

U.S. Dental Bonding Agents Market Insight

The U.S. dental bonding agents market captured the largest revenue share of 76% in 2024 within North America, owing to a rise in cosmetic dental procedures and strong dental insurance penetration. Increasing consumer preference for minimally invasive restorations and growing awareness of dental hygiene are key contributors. Furthermore, the presence of major players and continuous R&D in dental materials enhance product innovation and adoption.

Europe Dental Bonding Agents Market Insight

The Europe dental bonding agents market is projected to expand at a substantial CAGR throughout the forecast period, driven by the growing geriatric population and rising cases of dental disorders. Government-funded oral health programs and dental tourism—especially in countries like Hungary and Poland—further contribute to market expansion. Demand for biocompatible and long-lasting bonding agents is increasing, especially in restorative and preventive dentistry.

U.K. Dental Bonding Agents Market Insight

The U.K. dental bonding agents market is anticipated to grow at a noteworthy CAGR, fueled by increasing adoption of cosmetic dental treatments and advancements in adhesive technologies. NHS initiatives to improve dental care accessibility and a growing number of private dental clinics are also aiding market growth. Preference for painless, aesthetic restorations supports the demand for innovative dental bonding materials.

Germany Dental Bonding Agents Market Insight

The Germany dental bonding agents market is expected to expand at a considerable CAGR during the forecast period due to a high dental care expenditure per capita. The country’s strong dental product manufacturing base and innovation-driven market approach are encouraging the adoption of next-gen bonding systems. Environmental consciousness among consumers is also boosting demand for fluoride-free and mercury-free bonding formulations.

Asia-Pacific Dental Bonding Agents Market Insight

The Asia-Pacific dental bonding agents market is poised to grow at the fastest CAGR of 8.5% during 2025 to 2032, driven by rapid urbanization, increasing healthcare spending, and improved dental care awareness. Countries such as China, India, and Japan are key markets due to large populations, rising middle-class income, and growing dental tourism. Government initiatives aimed at improving healthcare infrastructure and promoting preventive oral health are expected to further boost market demand.

Japan Dental Bonding Agents Market Insight

The Japan dental bonding agents market is witnessing steady growth driven by its aging population and strong demand for restorative dental procedures. High emphasis on dental aesthetics, coupled with robust public health programs and insurance coverage, supports continued demand for bonding agents. Technological advancements in nano-filled adhesives and dual-cure formulations are also shaping product trends in the region.

China Dental Bonding Agents Market Insight

The China dental bonding agents market accounted for the largest revenue share in Asia Pacific in 2024, thanks to its booming middle class, fast-paced urbanization, and increasing dental care expenditure. Strong domestic manufacturing, rising investments in oral health infrastructure, and growing acceptance of cosmetic dentistry are major growth drivers. Expansion of private dental clinics and supportive government programs further accelerate the market’s momentum.

Dental Bonding Agents Market Share

The dental bonding agents industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Dentsply (U.S.)

- Danaher Corporation (U.S.)

- Ivoclar Vivadent AG (Germany)

- BISCO Dental Products (U.S.)

- VOCO America Inc. (U.S.)

- Pentron Clinical (U.S.)

- Shofu Dental (U.S.)

- Kuraray America, Inc (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Kerr Corporation (U.S.)

Latest Developments in Global Dental Bonding Agents Market

- In June 2025, Dentsply Sirona introduced Prime & Bond active, a next-generation universal bonding agent offering superior moisture tolerance and reduced post-operative sensitivity. Designed for both direct and indirect restorations, it supports all etching techniques and enhances bond strength across a variety of substrates. This product strengthens Dentsply Sirona’s competitive edge in adhesive dentistry and reflects the industry’s shift toward simplified yet highly effective systems

- In May 2025, 3M announced upgrades to its Scotchbond Universal Plus Adhesive, enhancing bond durability and improving enamel etching performance. With a focus on reducing nanoleakage and increasing hydrophilicity, this product is aimed at addressing common clinical failures in adhesive restorations. The development underscores 3M's strategy of integrating material science with clinical efficacy

- In April 2025, GC Corporation expanded its G-Premio BOND distribution across emerging Asia-Pacific markets, particularly targeting India, Vietnam, and Indonesia. This one-component light-cured adhesive, compatible with total-etch, self-etch, and selective etch techniques, is gaining market share due to its versatility and cost-effectiveness

- In February 2025, Kuraray Noritake Dental launched a campaign promoting its best-selling Clearfil Universal Bond Quick, highlighting clinical data that supports its fast application time (under 10 seconds) and effective adhesion under moist conditions. The campaign is focused on expanding its footprint in Europe and Latin America through strategic partnerships with dental distributors

- In January 2025, Ultradent Products Inc. released clinical evaluation results showing enhanced performance of its Peak Universal Bond in pediatric applications. The bonding agent demonstrated high bond strengths on both primary and permanent dentition, which is expected to open new markets in pediatric and community dentistry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.