Global Dental Cad Cam Systems Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

6.75 Billion

2024

2032

USD

4.47 Billion

USD

6.75 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 6.75 Billion | |

|

|

|

|

Dental CAD/CAM Systems Market Size

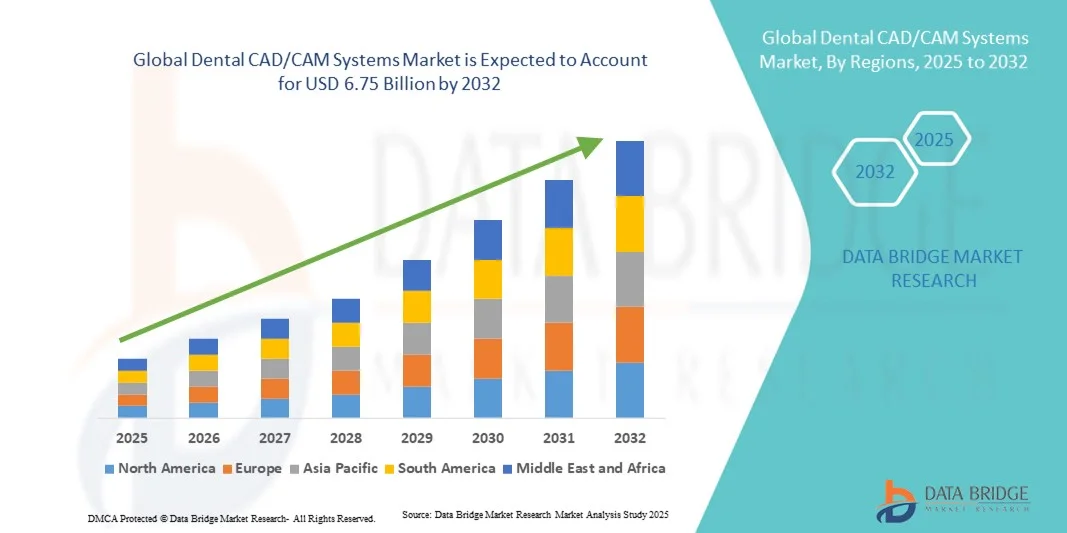

- The global dental CAD/CAM systems market size was valued at USD 4.47 billion in 2024 and is expected to reach USD 6.75 billion by 2032, at a CAGR of 7.11% during the forecast period

- The market growth is largely driven by the rising demand for digital dentistry solutions and advancements in computer-aided design and manufacturing technologies, which enhance precision and efficiency in dental restorations

- Furthermore, the increasing adoption of chairside CAD/CAM systems by dental clinics and laboratories for faster turnaround times and improved patient outcomes is reinforcing their role in modern dental practices. These converging factors are accelerating the integration of digital workflows in dentistry, thereby significantly propelling the market’s expansion

Dental CAD/CAM Systems Market Analysis

- Dental CAD/CAM systems, enabling computer-aided design and manufacturing of dental restorations such as crowns, bridges, and implants, are becoming integral to modern digital dentistry due to their precision, efficiency, and ability to deliver same-day restorations with enhanced aesthetic outcomes

- The rising demand for dental CAD/CAM systems is primarily driven by the increasing shift toward digital workflows, growing prevalence of dental disorders, and heightened patient preference for minimally invasive and customized dental treatments

- North America dominated the dental CAD/CAM systems market with the largest revenue share of 38.9% in 2024, owing to early technological adoption, a strong network of dental professionals, and the presence of major manufacturers advancing digital dentistry solutions

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period, supported by the expansion of dental tourism, growing healthcare expenditure, and rising awareness among dental practitioners regarding the advantages of CAD/CAM technology

- The Laboratory System segment dominated the dental CAD/CAM systems market with a share of 44.6% in 2024, attributed to its widespread use in dental labs for producing precise and durable restorations across multiple capabilities, including crowns and bridges, implant abutments, and full-mouth reconstructions

Report Scope and Dental CAD/CAM Systems Market Segmentation

|

Attributes |

Dental CAD/CAM Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental CAD/CAM Systems Market Trends

Integration of AI and 3D Printing for Precision and Customization

- A significant and accelerating trend in the global dental CAD/CAM systems market is the growing integration of artificial intelligence (AI) and 3D printing technologies, enabling enhanced design precision, material efficiency, and personalized dental restorations for improved clinical outcomes

- For instance, Dentsply Sirona’s Primeprint Solution combines AI-based automation with 3D printing to streamline the production of dental prosthetics and reduce manual intervention in dental laboratories. Similarly, Planmeca has integrated AI algorithms into its CAD software to assist dentists in optimizing restoration design with higher accuracy and reduced turnaround times

- AI integration in dental CAD/CAM systems allows automated error detection, improved design accuracy, and adaptive learning based on previous restoration outcomes. For instance, 3Shape’s AI-driven Dental System uses machine learning to recommend design parameters and enhance workflow efficiency, minimizing technician workload and improving consistency

- The fusion of CAD/CAM and 3D printing facilitates the seamless production of custom restorations directly from digital impressions, reducing fabrication time and material waste. Through integrated digital workflows, dental professionals can design, print, and fit restorations in a single appointment, enhancing patient satisfaction and operational efficiency

- This trend toward intelligent, automated, and highly personalized dental restoration workflows is transforming dental practices worldwide. Consequently, companies such as Amann Girrbach and Straumann are developing advanced CAD/CAM systems integrated with AI-based design tools and 3D printing compatibility to enhance precision and scalability

- The demand for AI-enabled and 3D printing-integrated CAD/CAM solutions is rapidly increasing across dental clinics and laboratories, as practitioners seek greater efficiency, customization, and cost-effectiveness in restorative procedures

Dental CAD/CAM Systems Market Dynamics

Driver

Rising Adoption of Digital Dentistry and Growing Demand for Precision Restorations

- The increasing shift toward digital dentistry and the growing need for accurate, efficient, and aesthetically superior dental restorations are significant drivers of the global dental CAD/CAM systems market

- For instance, in March 2024, Align Technology introduced its iTero Lumina scanner, designed to deliver faster, high-resolution digital impressions that enhance the CAD/CAM design process. Such product advancements by leading companies are expected to drive the market growth in the forecast period

- As dental professionals focus on reducing chair time and improving treatment outcomes, CAD/CAM systems provide digital workflows that enhance precision and enable same-day restorations, offering a substantial upgrade over traditional techniques

- Furthermore, increasing awareness of cosmetic dentistry and the growing geriatric population with restorative dental needs are making CAD/CAM technology a cornerstone of modern dental care, integrating seamlessly with digital scanners and milling units

- The convenience of digital impressions, efficient in-office design, and real-time customization for patients are key factors driving the adoption of CAD/CAM systems in hospitals and dental clinics. The trend toward digitized restorative procedures and the availability of user-friendly software further accelerate market expansion

Restraint/Challenge

High System Cost and Technical Complexity in Implementation

- The high initial investment required for CAD/CAM systems and associated maintenance costs pose a significant restraint to their wider adoption, especially among small and mid-sized dental practices

- For instance, advanced chair-side systems with integrated scanners and milling units can be cost-prohibitive for individual clinics, leading many practitioners to rely on laboratory-based solutions with lower upfront expenses

- In addition, the technical complexity and steep learning curve associated with CAD/CAM software operation create challenges for dental professionals, particularly those transitioning from conventional methods to digital workflows

- While training programs and vendor-led education initiatives are expanding, a lack of skilled personnel in digital dentistry still hinders consistent adoption across developing regions

- Moreover, interoperability issues between different CAD/CAM software and hardware platforms can complicate integration and increase costs for users seeking seamless digital workflows. Although manufacturers are focusing on open-system compatibility, standardization remains a key hurdle

- Overcoming these challenges through cost optimization, user-friendly interfaces, and wider access to digital training programs will be critical to ensuring sustained growth and broader accessibility of dental CAD/CAM technology

Dental CAD/CAM Systems Market Scope

The market is segmented on the basis of type, scale, capabilities, and end users.

- By Type

On the basis of type, the dental CAD/CAM systems market is segmented into chair-side system and laboratory system. The Laboratory System segment dominated the market with the largest revenue share of 44.6% in 2024, driven by its extensive use in dental laboratories for producing highly precise and durable restorations such as crowns, bridges, and implant abutments. These systems are preferred by dental technicians for their ability to handle complex restorations requiring advanced design flexibility and material diversity. Laboratory systems also support large-scale production, which makes them ideal for handling bulk orders with consistent quality. The integration of digital scanners, milling units, and design software in lab setups enhances efficiency and accuracy. In addition, the demand for laboratory systems remains strong due to their compatibility with multiple CAD/CAM materials and their role in ensuring superior fit and aesthetics for dental prosthetics.

The Chair-Side System segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for same-day restorations and improved patient experience. These systems allow dentists to perform scanning, designing, and milling within a single appointment, reducing treatment time and visits. The growing emphasis on patient convenience and minimally invasive treatments is driving adoption among dental clinics globally. Chair-side systems also support real-time customization, improving accuracy and aesthetics. Technological advancements, such as AI-driven design assistance and compact milling units, further make these systems accessible and efficient. The rising availability of integrated chair-side solutions from key players such as Dentsply Sirona and Planmeca continues to strengthen this segment’s expansion.

- By Scale

On the basis of scale, the dental CAD/CAM systems market is segmented into complete system and scanners. The Complete System segment dominated the market in 2024, owing to its comprehensive functionality that includes both hardware and software for designing and manufacturing dental restorations. Complete systems are widely adopted by dental laboratories and large clinics due to their ability to streamline workflows and reduce dependence on external fabrication services. These systems offer seamless integration between digital scanners, milling machines, and design software, improving workflow efficiency and accuracy. Their versatility in handling various materials such as zirconia, lithium disilicate, and resin further enhances their market dominance. The demand for complete systems is also supported by the increasing trend toward full digitalization in dental practices seeking in-house restoration capabilities.

The Scanners segment is expected to register the fastest growth rate during the forecast period, driven by rising adoption of intraoral and desktop scanners in digital dentistry. These devices are increasingly preferred for their non-invasive, accurate, and efficient impression-taking capabilities, replacing traditional mold techniques. The portability and enhanced image resolution of modern scanners facilitate faster diagnosis and design accuracy. For instance, 3Shape and Align Technology have introduced advanced scanners with AI-enabled features to improve user experience and precision. The growing use of digital impressions in orthodontics, prosthodontics, and implantology is further accelerating scanner adoption across clinics and hospitals globally.

- By Capabilities

On the basis of capabilities, the market is segmented into inlays and onlays, veneers, crowns and bridges, implant abutment, fixed partial denture, and full mouth reconstruction. The Crowns and Bridges segment dominated the market with the largest share in 2024, as these restorations represent the most common and essential dental procedures globally. CAD/CAM systems significantly enhance the precision and aesthetic quality of crowns and bridges, reducing turnaround times and ensuring superior fit and durability. The growing demand for aesthetic restorations using materials such as zirconia and lithium disilicate has further boosted this segment. Moreover, dental professionals increasingly rely on CAD/CAM solutions to streamline crown and bridge fabrication and reduce manual labor, leading to greater productivity. Technological advancements in design software and milling units continue to strengthen this segment’s position.

The Implant Abutment segment is projected to be the fastest-growing capability segment from 2025 to 2032, driven by the global rise in dental implant procedures and the need for precision-fit abutments. CAD/CAM systems enable customized implant abutment designs that ensure optimal alignment and aesthetics, improving patient outcomes. The growing aging population and increasing preference for permanent dental restorations are fueling demand for implants, thus boosting CAD/CAM adoption in this domain. In addition, CAD/CAM’s digital precision minimizes human error, enhancing implant success rates. Manufacturers are focusing on developing systems that can integrate with 3D imaging and digital implant planning tools, further supporting growth in this segment.

- By End Users

On the basis of end users, the market is segmented into hospitals, dental clinics, and others. The Dental Clinics segment dominated the global dental CAD/CAM systems market in 2024, owing to the rising adoption of chair-side CAD/CAM technology that allows in-house design and production of restorations. Clinics increasingly prefer digital systems for their efficiency, reduced patient wait times, and improved clinical outcomes. The growing emphasis on patient-centric care, aesthetic restorations, and single-visit treatments has accelerated CAD/CAM integration in dental clinics. Furthermore, continuous innovation in compact and affordable CAD/CAM solutions is enabling small and mid-sized clinics to adopt digital dentistry tools effectively. The segment’s growth is also reinforced by expanding cosmetic and restorative dental procedures worldwide.

The Hospitals segment is anticipated to be the fastest-growing end-user category during the forecast period, driven by the expanding availability of specialized dental departments and integrated oral care units. Hospitals are adopting CAD/CAM systems to enhance procedural accuracy, reduce operational time, and improve patient throughput. For instance, large multi-specialty hospitals in Asia-Pacific and Europe are increasingly equipping dental departments with digital impression and milling systems for comprehensive treatment delivery. The growing focus on advanced prosthodontic and implant procedures, along with government support for healthcare modernization, is further driving CAD/CAM implementation in hospital settings.

Dental CAD/CAM Systems Market Regional Analysis

- North America dominated the dental CAD/CAM systems market with the largest revenue share of 38.9% in 2024, owing to early technological adoption, a strong network of dental professionals, and the presence of major manufacturers advancing digital dentistry solutions

- Dental professionals in the region highly value the precision, workflow efficiency, and aesthetic outcomes provided by CAD/CAM systems, as well as their seamless integration with intraoral scanners, 3D printers, and imaging technologies

- This widespread adoption is further supported by increasing dental expenditures, a high awareness of cosmetic dentistry, and the growing shift toward same-day restorative procedures, positioning North America as a leading hub for digital transformation in dental care

U.S. Dental CAD/CAM Systems Market Insight

The U.S. dental CAD/CAM systems market captured the largest revenue share of around 82% in 2024 within North America, driven by the strong presence of advanced dental infrastructure and early adoption of digital dentistry solutions. The increasing preference for same-day restorations and aesthetic treatments is fueling demand for chair-side CAD/CAM systems among dental clinics. The growing use of intraoral scanners, milling units, and AI-integrated design software is enhancing treatment precision and efficiency. Moreover, the widespread availability of trained professionals and reimbursement support for restorative procedures further boosts market growth. Continuous innovations by leading manufacturers such as Dentsply Sirona and Align Technology are expected to strengthen the U.S. market outlook.

Europe Dental CAD/CAM Systems Market Insight

The Europe dental CAD/CAM systems market is projected to grow at a substantial CAGR during the forecast period, driven by the region’s growing adoption of digital workflows and focus on improving restorative outcomes. Stringent quality regulations and increasing patient demand for aesthetic restorations are accelerating digital system installations across dental clinics and laboratories. The region’s strong dental education ecosystem and government support for healthcare digitalization are fostering adoption. Moreover, the expanding network of dental laboratories equipped with CAD/CAM systems is enhancing production capabilities. The integration of CAD/CAM with 3D printing and imaging technologies is further strengthening Europe’s position as a hub for dental innovation.

U.K. Dental CAD/CAM Systems Market Insight

The U.K. dental CAD/CAM systems market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the country’s increasing focus on digital transformation in dentistry. Rising awareness of cosmetic and restorative treatments, combined with the adoption of chair-side CAD/CAM systems, is driving market expansion. The growing number of private dental clinics investing in digital technologies to improve patient experience and reduce turnaround time is a key factor supporting growth. In addition, the U.K.’s strong healthcare infrastructure and emphasis on precision-driven dental care are encouraging the implementation of CAD/CAM solutions. Partnerships between technology developers and dental service providers are also contributing to market advancement.

Germany Dental CAD/CAM Systems Market Insight

The Germany dental CAD/CAM systems market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s reputation for engineering excellence and emphasis on precision manufacturing. German dental professionals are increasingly adopting digital systems for improved accuracy, productivity, and patient outcomes. The strong presence of leading CAD/CAM manufacturers such as Amann Girrbach and Ivoclar strengthens the domestic market landscape. In addition, Germany’s growing dental tourism sector and focus on high-quality restorations are further fueling adoption. The integration of CAD/CAM with AI-based diagnostics and additive manufacturing technologies is also enhancing efficiency and customization in dental care.

Asia-Pacific Dental CAD/CAM Systems Market Insight

The Asia-Pacific dental CAD/CAM systems market is poised to grow at the fastest CAGR of around 23% from 2025 to 2032, driven by rapid urbanization, expanding dental tourism, and rising healthcare expenditure in countries such as China, Japan, and India. Growing awareness of digital dentistry and an increasing number of dental professionals trained in CAD/CAM technology are fueling adoption. The region’s large patient population and strong government initiatives promoting healthcare modernization are also key growth enablers. Furthermore, local manufacturing of affordable CAD/CAM systems and scanners is improving accessibility. The adoption of digital dental solutions across clinics and labs is expected to accelerate significantly in the coming years.

Japan Dental CAD/CAM Systems Market Insight

The Japan dental CAD/CAM systems market is gaining momentum due to the country’s advanced dental technology ecosystem and increasing preference for precision-based, aesthetic restorations. The market benefits from Japan’s strong manufacturing base and continuous innovation in digital imaging and milling systems. The growing aging population is driving demand for prosthetic and implant-based treatments, where CAD/CAM plays a crucial role in accuracy and customization. Integration with 3D printing and AI-powered design tools is further optimizing workflows. Moreover, dental professionals’ focus on efficiency and minimally invasive procedures is fostering CAD/CAM adoption in both clinics and dental laboratories.

India Dental CAD/CAM Systems Market Insight

The India dental CAD/CAM systems market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid healthcare modernization, a growing middle-class population, and increasing dental tourism. The expansion of private dental clinics and rising awareness of digital restorative solutions are driving strong demand for CAD/CAM systems. Affordable product offerings by domestic and international players are making advanced dental technologies accessible to a wider user base. Furthermore, government initiatives promoting digital healthcare and the development of smart dental labs are accelerating adoption. The country’s robust dental education sector and emphasis on aesthetic dentistry continue to enhance India’s position as a rapidly emerging CAD/CAM market.

Dental CAD/CAM Systems Market Share

The Dental CAD/CAM Systems industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- 3Shape A/S (Denmark)

- Planmeca Oy (Finland)

- Institut Straumann AG (Switzerland)

- Amann Girrbach AG (Austria)

- Ivoclar Vivadent AG (Liechtenstein)

- DGSHAPE Corporation (Japan)

- VITA Zahnfabrik H. Rauter GmbH & Co. KG (Germany)

- Medit Co., Ltd. (South Korea)

- Shining 3D Technology Co., Ltd. (China)

- Zirkonzahn GmbH (Italy)

- VHF camfacture AG (Germany)

- Renishaw plc (U.K.)

- 3M (U.S.)

- Zimmer Biomet (U.S.)

- Envista Holdings Corporation (U.S.)

- Align Technology, Inc. (U.S.)

- Exocad GmbH (Germany)

- GC Corporation (Japan)

- BEGO GmbH & Co. KG (Germany)

What are the Recent Developments in Global Dental CAD/CAM Systems Market?

- In March 2025, Planmeca announced at IDS 2025 three new CAD/CAM-centric products a wireless intraoral scanner, a desktop scanner, and a high-precision 3D printer reinforcing its commitment to fully digital dental workflows spanning scanning to manufacturing for both chair-side and laboratory use

- In February 2025, 3Shape A/S introduced major updates to its Dental System 2024 software, featuring AI-driven crown design tools, enhanced lab workflow automation, cloud licensing, and faster case handling designed to improve precision and efficiency in CAD workflows

- In October 2024, DGSHAPE Corporation (Roland DG) launched the DWX-53D dry milling machine, a 5-axis IoT-enabled desktop solution with improved rigidity, remote monitoring via DGSHAPE CLOUD, and faster zirconia and PMMA processing for labs and clinics

- In January 2024, Amann Girrbach GmbH unveiled the Ceramill Matron a next-generation CAD/CAM milling system with 5-axis machining, automated blank changers, and versatile material compatibility, enabling high-precision digital lab production

- In March 2023, Planmeca Oy showcased an extensive lineup of new CAD/CAM and digital dentistry solutions at IDS 2023, including integrated scanners, software, and milling systems further advancing comprehensive digital chair-side and laboratory workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.