Global Dental Instruments Market

Market Size in USD Million

CAGR :

%

USD

408.27 Million

USD

594.08 Million

2024

2032

USD

408.27 Million

USD

594.08 Million

2024

2032

| 2025 –2032 | |

| USD 408.27 Million | |

| USD 594.08 Million | |

|

|

|

|

Dental Instruments Market Size

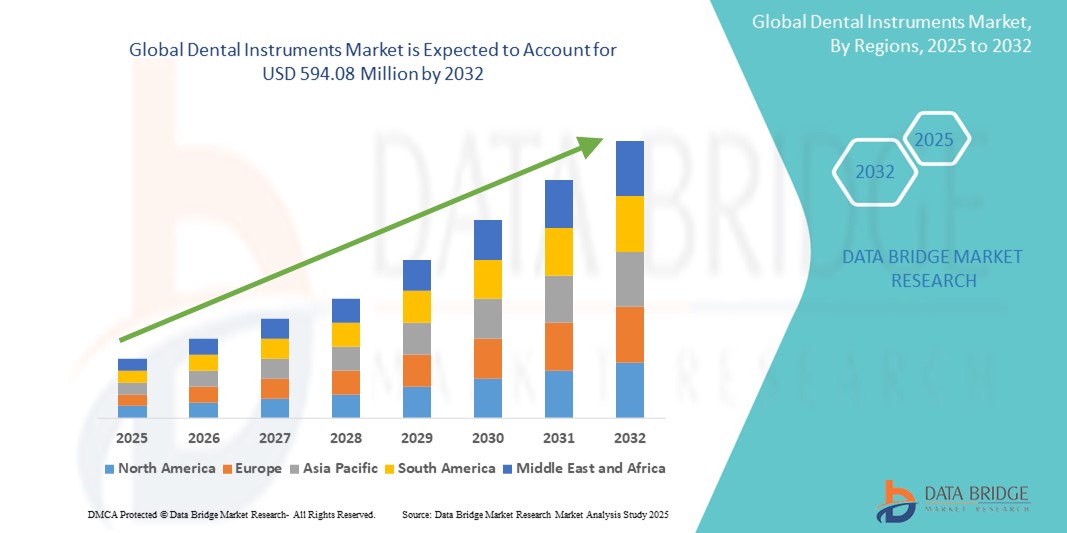

- The global dental instruments market size was valued at USD 408.27 million in 2024 and is expected to reach USD 594.08 million by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by increasing dental disorders, rising demand for cosmetic dentistry, and the growing geriatric population, which has led to higher volumes of dental procedures globally

- Furthermore, advancements in dental technology such as digital diagnostics, laser dentistry, and ergonomic instrument designs are enhancing precision and efficiency for dental professionals. These driving forces are boosting adoption rates across dental clinics, hospitals, and academic institutions, thereby significantly contributing to the expansion of the dental instruments industry

Dental Instruments Market Analysis

- Dental instruments, encompassing a wide range of diagnostic, surgical, and therapeutic tools, are essential components in modern dental practices and hospitals, supporting diverse procedures with precision and reliability due to advancements in ergonomics, materials, and digital integration

- The growing demand for dental instruments is primarily fueled by the increasing prevalence of dental disorders, heightened awareness of oral health, and the surge in cosmetic and restorative dental procedures across both developed and emerging markets.

- North America dominated the dental instruments market with the largest revenue share of 38% in 2024, driven by well-established dental infrastructure, high dental expenditure per capita, and the strong presence of key manufacturers. The U.S., in particular, has experienced consistent growth in instrument adoption, with rising demand from dental service organizations (DSOs) and the integration of digital tools in routine care.

- Asia-Pacific is expected to be the fastest growing region in the dental instruments market during the forecast period due to increasing healthcare investments, expanding dental tourism, and growing awareness of oral health among a rapidly urbanizing population

- Prosthodontic segment dominated the dental instruments market with a market share of 32.9% in 2024, driven by its critical role in dental restorations such as crowns, bridges, and implants, and the rising demand for aesthetic and functional tooth replacements

Report Scope and Dental Instruments Market Segmentation

|

Attributes |

Dental Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Instruments Market Trends

“Digitization and Ergonomic Innovation Transforming Dental Practices”

- A significant and accelerating trend in the global dental instruments market is the integration of digital technologies and ergonomic advancements into traditional dental tools, enhancing procedural accuracy, practitioner comfort, and overall treatment outcomes in clinical and hospital settings

- For instance, leading players such as Dentsply Sirona and NSK are introducing smart dental instruments embedded with digital sensors for real-time feedback, improving operational control during procedures. Similarly, the adoption of digital intraoral scanners and CAD/CAM systems is reducing reliance on manual impressions and enabling more precise restorations

- Digital innovation is also seen in ultrasonic instruments and cordless electric handpieces that offer enhanced mobility, better sterilization compatibility, and improved patient safety. These smart instruments are increasingly becoming a preferred choice among practitioners aiming for minimally invasive, time-efficient, and accurate treatments

- In addition, ergonomically designed handheld instruments crafted with lightweight, autoclavable materials such as titanium and fiber-reinforced polymers are gaining popularity due to their ability to reduce clinician fatigue and improve handling precision

- The growing focus on minimally invasive dentistry is also fueling the demand for fine-tipped surgical tools and flexible endodontic files, which allow dentists to preserve more tooth structure while ensuring effective treatment

- This trend toward digital integration, ergonomic refinement, and minimally invasive instrumentation is reshaping the global dental instruments landscape, with professionals increasingly favoring tools that align with modern, tech-enabled dental workflows

Dental Instruments Market Dynamics

Driver

“Rising Dental Disorders and Aesthetic Dentistry Demand Fueling Growth”

- The increasing global prevalence of oral diseases, coupled with rising demand for aesthetic dental procedures, is a key driver fueling the growth of the dental instruments market

- For instance, the World Health Organization reports that over 3.5 billion people worldwide are affected by oral diseases, prompting significant investments in dental care infrastructure and instruments

- As patient awareness around oral health improves, and the appeal of cosmetic procedures such as implants, veneers, and whitening grows, there is greater demand for precision instruments that support these interventions

- The expanding elderly population globally is further contributing to the demand for restorative dental treatments such as dentures, crowns, and bridges, which require high-quality prosthodontic and surgical instruments

- In parallel, ongoing technological advancements such as electric handpieces with torque control, LED illumination, and smart sterilization alerts are enhancing the performance, safety, and adoption of dental instruments

- Government-supported oral health initiatives and public-private collaborations are boosting access to dental care and driving procurement of advanced instruments in clinics, hospitals, and community centers, especially across developing regions

Restraint/Challenge

“High Cost of Advanced Instruments and Regulatory Compliance Burden”

- One of the major challenges restraining the growth of the dental instruments market is the high cost of advanced instrument systems, which limits accessibility, particularly for small and mid-sized dental practices and institutions in emerging economies

- For instance, high-end digital or laser-integrated instruments often come with significant acquisition and maintenance costs, deterring adoption among budget-conscious healthcare providers

- In addition, the need for regular maintenance, sterilization, and calibration of instruments adds to the total cost of ownership, placing further financial pressure on dental service providers

- Another key constraint is the growing regulatory burden associated with medical device compliance, especially under stringent frameworks such as the U.S. FDA and Europe’s MDR, which demand rigorous testing, certification, and documentation

- Moreover, the shortage of trained dental professionals in some regions affects the proper use and upkeep of technologically advanced tools, potentially leading to underutilization or operational inefficiencies

- Overcoming these challenges through cost-effective innovations, enhanced training programs, and robust regulatory support will be essential for driving broader adoption and long-term growth in the dental instruments market

Dental Instruments Market Scope

The market is segmented on the basis of product, instrument type, end user, and distribution channel.

- By Product

On the basis of product, the dental instruments market is segmented into orthodontic, prosthodontic, perio/oral surgery, hygiene, diagnostic, endodontic, operative, and others. The Prosthodontic segment dominated the market with the largest revenue share of 32.9% in 2024, driven by rising demand for restorative dental procedures such as crowns, bridges, and implants. The growing focus on dental aesthetics and functionality is encouraging the use of advanced prosthodontic tools, particularly in aging populations and patients undergoing cosmetic treatments.

The Orthodontic segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for alignment procedures among teenagers and adults. The popularity of aesthetic orthodontic treatments such as clear aligners and braces, along with advances in minimally invasive techniques, is boosting the adoption of orthodontic instruments in both dental clinics and hospitals.

- By Instrument Type

On the basis of instrument type, the dental instruments market is segmented into examination instruments, cutting instruments, and others. The Cutting Instruments segment held the largest market revenue share in 2024, driven by their widespread use in restorative, surgical, and periodontal procedures. These instruments, including burs, scalers, and elevators, are essential in both routine and complex dental operations, and continued innovations in materials and precision design are enhancing their effectiveness and longevity.

The Examination Instruments segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the increasing volume of routine dental check-ups and diagnostic procedures globally. The demand for ergonomic, sterilizable, and multi-use examination tools is rising, particularly in preventive dentistry practices.

- By End User

On the basis of end user, the dental instruments market is segmented into hospitals, clinics, dental laboratories, scientific research, and others. The Clinics segment dominated the market in 2024, accounting for the largest share due to the high number of dental procedures conducted in private and group dental practices. The rise in cosmetic dentistry, coupled with the growing number of dental practitioners globally, supports this trend.

The Hospitals segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increased investments in healthcare infrastructure and the growing preference for hospital-based surgical dental treatments, particularly in developing nations with improving public healthcare systems.

- By Distribution Channel

On the basis of distribution channel, the dental instruments market is segmented into direct tender, third party distributors, and retail sales. The Direct Tender segment held the largest share of the dental instruments market in 2024, as hospitals and large dental organizations typically procure equipment through bulk purchasing agreements with manufacturers or authorized distributors. This channel ensures reliability, compliance, and cost efficiency, especially in institutional settings.

The Retail Sales segment is expected to grow at the fastest rate during the forecast period, driven by increasing demand for standard dental tools by independent practitioners and the growing popularity of e-commerce platforms offering faster and more accessible procurement options.

Dental Instruments Market Regional Analysis

- North America dominated the dental instruments market with the largest revenue share of 38% in 2024, driven by well-established dental infrastructure, high dental expenditure per capita, and the strong presence of key manufacturers

- Consumers and dental professionals in the region prioritize high-quality, precision instruments that enhance procedural efficiency, support digital workflows, and comply with stringent safety standards, contributing to the strong demand for both general and specialized dental tools

- This dominance is further supported by a growing elderly population requiring restorative care, widespread dental insurance coverage, and the presence of leading market players, positioning North America as a key hub for innovation and adoption in the dental instruments industry

U.S. Dental Instruments Market Insight

The U.S. dental instruments market captured the largest revenue share of 81% in 2024 within North America, fueled by a strong presence of dental professionals, high patient awareness, and substantial investment in advanced dental technologies. The widespread demand for restorative and cosmetic procedures, along with the growing adoption of digital dentistry tools in clinics and hospitals, is accelerating market growth. In addition, robust insurance coverage and government support for oral health programs further contribute to the expansion of the dental instruments industry across the U.S.

Europe Dental Instruments Market Insight

The Europe dental instruments market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing demand for precision instruments in preventive, restorative, and surgical procedures. Strict regulatory frameworks, a focus on sterilization and patient safety, and a rising elderly population requiring prosthodontic care are key market drivers. The region is witnessing growing instrument adoption in both private practices and institutional settings, supported by expanding healthcare budgets and widespread integration of digital technologies in dental practices.

U.K. Dental Instruments Market Insight

The U.K. dental instruments market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing demand for aesthetic dentistry and advanced diagnostic tools. Rising dental tourism, a well-established public and private healthcare system, and continued investments in high-quality dental care equipment are supporting market growth. In addition, a growing emphasis on preventive care and early intervention is boosting demand for diagnostic and hygiene instruments across clinics and community dental centers.

Germany Dental Instruments Market Insight

The Germany dental instruments market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong focus on healthcare innovation and advanced infrastructure. A high concentration of dental manufacturers, coupled with growing demand for ergonomic, durable, and sterilization-compliant instruments, is propelling growth. Furthermore, Germany's emphasis on sustainability and precision engineering aligns with rising demand for high-performance instruments in both general and specialist dentistry.

Asia-Pacific Dental Instruments Market Insight

The Asia-Pacific dental instruments market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rising dental care awareness, increasing disposable incomes, and rapid urbanization in countries such as China, India, and Japan. Government initiatives to strengthen healthcare access and promote oral hygiene are encouraging investments in modern dental infrastructure and equipment. The presence of local manufacturers and cost-effective production capabilities is further expanding the accessibility of advanced dental instruments across the region.

Japan Dental Instruments Market Insight

The Japan dental instruments market is gaining momentum due to its high standard of dental care, strong adoption of digital dentistry, and an aging population requiring frequent oral treatments. The demand for minimally invasive tools and high-precision diagnostic instruments is rising, supported by the integration of digital imaging, CAD/CAM systems, and automated sterilization equipment. Japan's focus on clinical excellence and infection control further drives the adoption of premium dental instruments in both public and private dental facilities.

India Dental Instruments Market Insight

The India dental instruments market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding dental care ecosystem, increasing number of dental clinics, and a growing middle-class population seeking affordable treatment. The government’s support for oral healthcare under national programs and the rise of dental tourism are boosting demand for high-quality yet cost-effective dental instruments. Local manufacturing capabilities and the rising availability of advanced tools in urban and semi-urban centers are further accelerating market growth across India.

Dental Instruments Market Share

The dental instruments industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Envista Holdings (U.S.)

- 3M (U.S.)

- A‑dec (U.S.)

- Planmeca Oy (Finland)

- Straumann Group (Switzerland)

- Zimmer Biomet (U.S.)

- Nobel Biocare (Switzerland)

- GC Corporation (Japan)

- Hu‑Friedy (U.S.)

- Colgate‑Palmolive (U.S.)

- Young Innovations, Inc. (U.S.)

- Biolase Inc. (U.S.)

- Carestream Health Inc. (U.S.)

- Patterson Companies Inc. (U.S.)

- W&H Dentalwerk Bürmoos GmbH (Austria)

- Kaltenbach & Voigt GmbH (KaVo) (Germany)

- Micro‑Méga International Manufactures SA (France)

- Aseptico (U.S.)

- Midmark Corporation (U.S.)

What are the Recent Developments in Global Dental Instruments Market?

- In May 2024, Dentsply Sirona, a global leader in dental technology, introduced its new generation of ergonomic hand instruments under the “SmartLite Pro” series. These instruments are designed for enhanced handling comfort, precision, and improved sterilization compatibility. The innovation reflects the company’s ongoing commitment to advancing dental instrument design to improve practitioner efficiency and patient care in both general and specialized dentistry

- In April 2024, Envista Holdings Corporation, through its KaVo Kerr brand, launched a digital endodontic instrumentation system that combines ultrasonic tools with real-time feedback and cloud-based analytics. This development enhances diagnostic accuracy and procedural safety in root canal treatments. The launch represents Envista’s strategic focus on integrating smart technologies into dental workflows to meet growing demand for minimally invasive and data-driven procedures

- In March 2024, NSK Dental introduced its “Ti-Max Z990L” air turbine handpiece, featuring advanced torque control, LED illumination, and improved grip comfort. Designed for high-speed restorative procedures, the device aligns with growing practitioner demand for durable, high-performance instruments that reduce fatigue and maximize clinical precision. This move reinforces NSK’s leadership in innovation within the global dental instruments landscape

- In February 2024, Institut Straumann AG announced the expansion of its surgical instrument line with new implantology kits designed for faster and more predictable placement. These kits support digital workflows and include tools optimized for guided surgery. The development highlights Straumann’s response to increasing procedural demand in implantology and its emphasis on providing integrated, outcome-focused solutions for dental professionals

- In January 2024, Benco Dental, a major distributor and manufacturer, introduced a cloud-enabled inventory management system specifically for dental instruments. The platform allows clinics to track usage, automate reordering, and ensure compliance with sterilization protocols. This digital advancement addresses the growing need for operational efficiency and regulatory adherence, especially in high-volume practices, marking Benco’s transition into smart dental supply solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.