Global Dental Insurance Market

Market Size in USD Billion

CAGR :

%

USD

172.94 Billion

USD

255.70 Billion

2024

2032

USD

172.94 Billion

USD

255.70 Billion

2024

2032

| 2025 –2032 | |

| USD 172.94 Billion | |

| USD 255.70 Billion | |

|

|

|

|

Dental Insurance Market Analysis

The dental insurance market has seen steady growth, driven by an increasing awareness of the importance of oral health and advancements in dental treatment technologies. As people become more proactive about maintaining oral hygiene, the demand for comprehensive dental insurance plans that cover preventive care, major procedures, and basic treatments has surged. This is further bolstered by the expansion of dental insurance options integrated into broader health insurance policies, making it more accessible to a wider range of consumers. Technological advancements, such as tele-dentistry and digital health platforms, have also transformed how dental services are delivered, contributing to the market's growth by improving patient convenience and care accessibility. Moreover, the development of new dental treatment methods and the use of advanced materials in procedures are encouraging more people to seek insurance coverage to manage the rising costs of dental care. The market is also benefiting from the increased focus by employers on offering dental insurance as part of employee benefits, fostering greater enrollment. With more affordable and tailored plans becoming available, the dental insurance market is expected to continue its upward trajectory, meeting the needs of an increasingly health-conscious population.

Dental Insurance Market Size

The global dental insurance market size was valued at USD 172.94 billion in 2024 and is projected to reach USD 255.70 billion by 2032, with a CAGR of 5.01% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Dental Insurance Market Trends

“Integration of Dental Plans with Comprehensive Health Insurance Policies”

One notable trend in the dental insurance market is the integration of dental plans with comprehensive health insurance policies, creating more holistic healthcare solutions for consumers. This approach makes dental coverage more accessible and encourages individuals to prioritize oral health as part of their overall well-being. For instance, companies such as Delta Dental Plans Association and Cigna Healthcare have been expanding their offerings to include dental benefits as part of broader health insurance packages. This trend is driven by the recognition that oral health is closely linked to general health, with poor dental hygiene contributing to conditions such as cardiovascular disease and diabetes. By bundling dental insurance with health coverage, insurers can provide more value to policyholders, which boosts enrollment and retention rates. The demand for integrated health and dental plans reflects a shift towards preventive and coordinated care, aligning with the growing consumer focus on comprehensive health management.

Report Scope and Dental Insurance Market Segmentation

|

Attributes |

Dental Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Aetna Inc (U.S.), Allianz (Germany), AFLAC INCORPORATED (U.S.), AXA (France), Ameritas Mutual Holding Company (U.S.), Delta Dental Plans Association (U.S.), Cigna Healthcare (U.S.), MetLife Services and Solutions, LLC (U.S.), HDFC ERGO General Insurance Company Limited (India), Humana (U.S.), and United HealthCare Services, Inc (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Insurance Market Definition

Dental insurance is a type of health insurance designed to cover a portion of the costs associated with dental care. It typically includes coverage for preventive services such as routine check-ups and cleanings, as well as basic procedures such as fillings, and major procedures such as crowns, bridges, and orthodontics. Dental insurance plans often come with specific coverage limits, co-pays, and deductibles, and may offer different levels of coverage depending on the type of plan, such as Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), or dental indemnity plans. The goal of dental insurance is to make dental care more affordable and accessible to policyholders by reducing out-of-pocket expenses for various dental treatments and procedures.

Dental Insurance Market Dynamics

Drivers

- Rising Protection of Dental Insurers against Revenue Fluctuations

The rising protection of dental insurers against revenue fluctuations is becoming a significant driver for the dental insurance market. This trend is supported by the implementation of risk management strategies, such as diversified plan offerings and pricing structures that help insurers maintain stable revenues despite seasonal or economic changes. For instance, dental insurers are increasingly using data analytics to better predict trends in claims and adjust premiums accordingly, ensuring profitability even during downturns. This approach helps insurers manage risks related to unexpected surges in demand, such as increased claims following widespread dental health issues or economic recessions. As a result, insurers are more confident in offering dental coverage options that appeal to a larger consumer base, driving the market's growth. The protection mechanisms also help build consumer trust, as policyholders feel reassured that their coverage is sustainable and less likely to be impacted by external market volatility.

- Rising Awareness of Oral Health

Rising awareness of oral health is a major driver for the dental insurance market. Studies have shown that oral health is closely linked to overall health, with poor dental hygiene contributing to serious conditions such as cardiovascular disease and diabetes. This growing understanding has led to an increased focus on preventive care, encouraging consumers to schedule regular dental check-ups and treatments. For instance, a report by the American Dental Association (ADA) highlighted that the number of adults visiting dentists for preventive services increased by over 20% from 2010 to 2020, showcasing a shift toward proactive dental health. Dental insurance plays a vital role in making these services more accessible and affordable, allowing more people to seek early treatments that can prevent costly, extensive procedures in the future. As consumers continue to prioritize oral health, the demand for dental insurance is expected to grow, fueling market expansion and driving innovation in coverage options.

Opportunities

- Rising Research and Development (R&D) Activities

Rising research and development (R&D) activities in the dental sector present a significant market opportunity by fostering the development of advanced dental care technologies and innovative insurance products. Companies are investing heavily in R&D to create more effective treatments, tools, and preventive care solutions that improve patient outcomes and reduce overall dental costs. For instance, advancements in digital dentistry, such as 3D imaging and AI-powered diagnostic tools, are enhancing the precision and efficiency of dental procedures. Insurers that incorporate these technological innovations into their coverage plans can offer more comprehensive policies that address the latest procedures, encouraging more people to enroll. This growing emphasis on R&D also drives the development of new dental insurance products that cover emerging treatments and preventive measures, further boosting the market. The continuous evolution of dental technologies creates opportunities for insurers to expand their offerings and for consumers to access better care.

- Rising Emerging Markets with an Increasing Geriatric Population

Rising emerging markets with an increasing geriatric population base represent a significant market opportunity for the dental insurance industry. Countries such as India, China, and Brazil are experiencing a demographic shift with a growing number of elderly individuals who require specialized dental care. The World Health Organization (WHO) has projected that the global population aged 60 years and over will double by 2050, with a substantial portion residing in emerging economies. This demographic trend is accompanied by an increasing demand for dental services to manage age-related oral health issues such as tooth loss, periodontal disease, and oral cancer. In response, dental insurers can develop tailored plans that cater to the specific needs of older adults, including coverage for preventive treatments, dentures, and periodontal care. For instance, in countries such as India, where the elderly population is rapidly expanding, the growth in dental insurance offerings designed for seniors is expected to drive market expansion and improve access to necessary dental services.

Restraints/Challenges

- High Cost of Premiums

The high cost of premiums is a significant challenge in the dental insurance market, impacting both consumers and providers. Dental insurance plans can be expensive, especially when compared to basic health insurance, leading to affordability issues for many families and individuals. For instance, individuals may face monthly premiums that can be difficult to manage, with family plans often costing even more. These expenses can deter people from purchasing coverage, leaving them vulnerable to high out-of-pocket costs for routine and emergency dental care. Even those who do opt for dental insurance often find that high premiums come with limitations, such as caps on annual benefits and exclusions for major procedures such as orthodontics or dental implants. This challenge creates a barrier to widespread adoption and leads to lower market penetration, limiting access to essential dental care for many and making it a significant hurdle in the growth and expansion of the dental insurance market.

- Reimbursement and Claims Processing Issues

Reimbursement and claims processing issues present a notable challenge in the dental insurance market, contributing to frustrations for both patients and providers. The process of submitting and approving dental insurance claims can be complex, time-consuming, and prone to delays. For instance, a patient who receives a treatment that requires insurance reimbursement may have to wait weeks or even months for their claim to be processed, during which they could face unexpected financial strain. In addition, insurers often reimburse at lower rates than what dental practices charge, leaving patients responsible for the remaining balance out-of-pocket. This discrepancy can create financial burdens and discourage dental practices from accepting insurance altogether, further limiting patient access to covered services. The administrative overhead involved in processing claims also results in higher operational costs for dental providers, potentially leading to an increase in the overall cost of dental care. These challenges make reimbursement and claims processing a significant market hurdle, affecting patient satisfaction and complicating the relationship between dental insurers and healthcare providers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Dental Insurance Market Scope

The market is segmented on the basis of coverage, procedure type, demographics, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

Procedure Type

- Major

- Basic

- Preventive

Demographics

- Senior Citizens

- Adults

- Minors

End-User

- Individuals

- Corporates

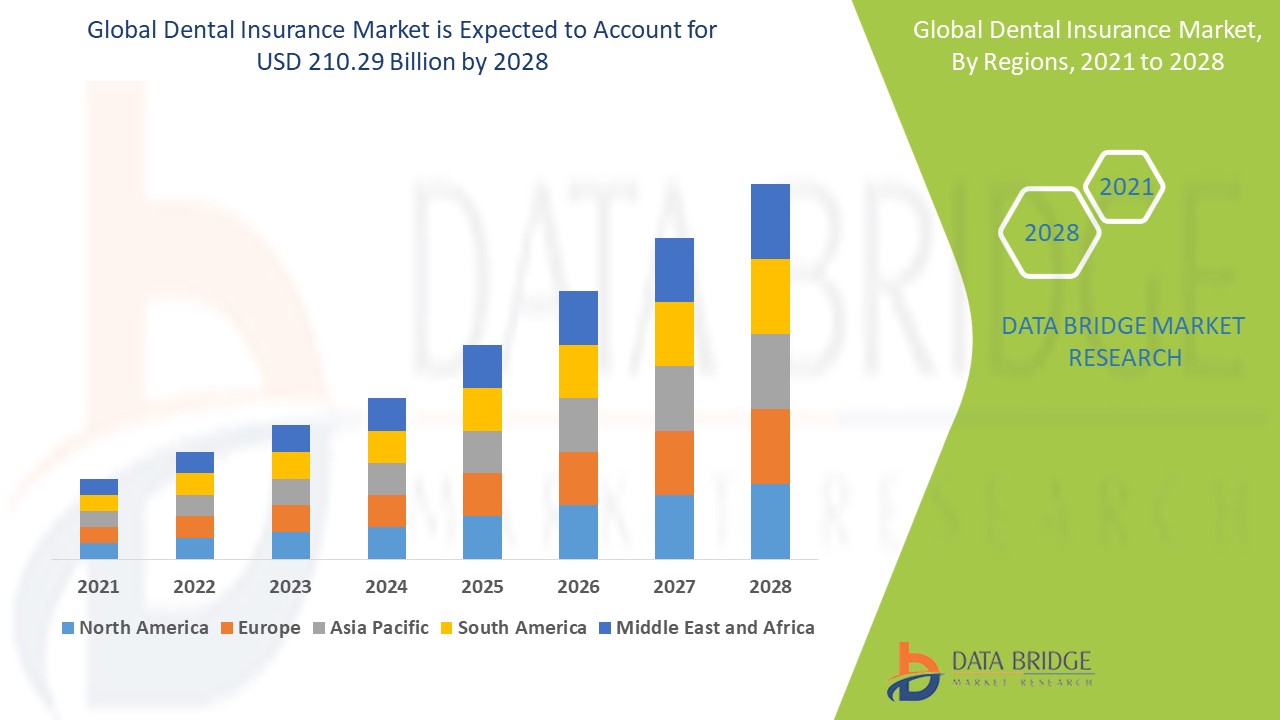

Dental Insurance Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, coverage, procedure type, demographics, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the dental insurance market, supported by a large and relatively affluent population. In the U.S., the significant middle-class demographic has the financial means to afford dental insurance premiums, creating a robust customer base for providers. In addition, many employers in the U.S. include dental insurance in their employee benefits packages, which further promotes widespread coverage among the population. This practice contributes to the high penetration of dental insurance in the region.

Asia-Pacific is expected to witness the highest growth in the dental insurance market over the forecast period. Increasing awareness about the importance of dental health has led to a shift in consumer behavior, with more individuals prioritizing regular dental check-ups and preventive care. This growing emphasis on oral health is fueling the demand for dental insurance to help cover these expenses. As people become more proactive about maintaining their dental hygiene and seeking professional care, dental insurance is becoming a vital part of their healthcare planning in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Dental Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Dental Insurance Market Leaders Operating in the Market Are:

- Aetna Inc (U.S.)

- Allianz (Germany)

- AFLAC INCORPORATED (U.S.)

- AXA (France)

- Ameritas Mutual Holding Company (U.S.)

- Delta Dental Plans Association (U.S.)

- Cigna Healthcare (U.S.)

- MetLife Services and Solutions, LLC (U.S.)

- HDFC ERGO General Insurance Company Limited (India)

- Humana (U.S.)

- United HealthCare Services, Inc (U.S.)

Latest Developments in Dental Insurance Market

- In August 2023, Ameritas introduced a lifetime deductible option on its new group dental plans, ensuring that once policyholders pay their deductible, they won’t need to worry about it again as long as they remain with the same employer

- In December 2022, Bupa partnered with YuLife to enable group clients to include dental insurance as an option for their employees, allowing Bupa’s dental coverage to be integrated within YuLife’s group life insurance policies, catering to both new and existing customers

- In June 2022, Bajaj Allianz teamed up with Allianz Partners to launch the Global Health Care product, providing health coverage worldwide. The product, which offers a wide range of sum insured amounts from USD 100,000 to USD 1,000,000, is available in two plans: the 'Imperial Plan' and the 'Imperial Plus Plan', offering both international and domestic coverage

- In February 2022, UnitedHealthcare partnered with Quip to enhance its virtual dental care services by offering advanced digital tools for remote consultations, improving accessibility and convenience for policyholders

- In January 2022, Aetna expanded its Medicare Advantage Prescription Drug (MAPD) plans to 46 states, adding 83 new counties and providing an additional 1 million Medicare beneficiaries access to its plans. This expansion brought the total number of counties covered to 1,875, reaching 53.2 million Medicare beneficiaries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.