Global Dental Practice Management System Market

Market Size in USD Billion

CAGR :

%

USD

2.22 Billion

USD

4.42 Billion

2025

2033

USD

2.22 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 2.22 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Dental Practice Management System Market Size

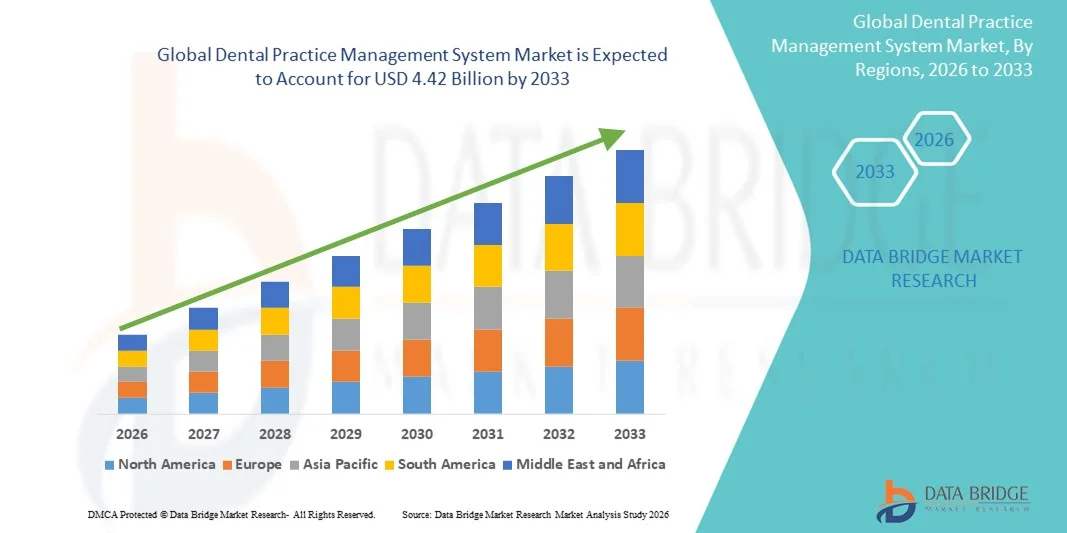

- The global dental practice management system market size was valued at USD 2.22 billion in 2025 and is expected to reach USD 4.42 billion by 2033, at a CAGR of 8.99% during the forecast period

- The market growth is largely driven by increasing digitalization in dental clinics and the rising adoption of software solutions to streamline administrative, clinical, and financial workflows

- Furthermore, growing demand for efficient patient management, appointment scheduling, billing, and electronic health record integration is positioning dental practice management systems as essential tools for modern dental practices. These factors are collectively accelerating the adoption of advanced management solutions, thereby significantly driving market expansion

Dental Practice Management System Market Analysis

- Dental practice management systems (DPMS), offering software solutions to streamline clinical, administrative, and financial workflows in dental clinics, are becoming essential tools for modern dental practices due to their efficiency, patient data management capabilities, and integration with electronic health records and imaging systems

- The rising adoption of DPMS is primarily driven by increasing digitalization in healthcare, growing demand for efficient patient scheduling and billing, and the need for secure, centralized management of dental records

- North America dominated the dental practice management system market with the largest revenue share of 39.2% in 2025, characterized by early adoption of healthcare IT solutions, high awareness among dental professionals, and the presence of major software vendors, with the U.S. witnessing substantial growth in cloud-based DPMS adoption and AI-driven analytics for treatment planning and patient engagement

- Asia-Pacific is expected to be the fastest-growing region in the dental practice management system market during the forecast period due to rising dental healthcare investments, increasing awareness of digital solutions among practitioners, and rapid expansion of dental clinics in urban centers

- Cloud-based segment dominated the dental practice management system market with a market share of 45.8% in 2025, driven by its advantages of remote access, scalability, data security, and reduced IT infrastructure requirements

Report Scope and Dental Practice Management System Market Segmentation

|

Attributes |

Dental Practice Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental Practice Management System Market Trends

Integration of AI and Cloud-Based Solutions

- A significant and accelerating trend in the global dental practice management system market is the increasing integration of artificial intelligence (AI) and cloud-based platforms, enabling automated appointment scheduling, predictive analytics, and treatment planning

- For instance, Denticon cloud-based DPMS allows dental clinics to manage patient records, billing, and imaging data from any device, ensuring real-time access and improved operational efficiency

- AI integration in DPMS facilitates features such as analyzing patient visit trends, predicting no-shows, and providing recommendations for treatment plans, while cloud connectivity allows multiple clinic locations to access centralized data seamlessly

- The integration of DPMS with other dental technologies, such as digital imaging and electronic health records, enables dentists to manage clinical, administrative, and financial workflows from a unified platform, improving overall clinic productivity

- This trend towards intelligent, automated, and cloud-enabled systems is reshaping expectations for dental practice efficiency, with companies such as Curve Dental developing AI-enabled software capable of automated reminders, treatment forecasting, and secure cloud storage

- The demand for dental practice management systems offering AI analytics and cloud-based accessibility is growing rapidly across both small and large dental clinics, as practitioners increasingly prioritize operational efficiency and patient engagement

- Increasing adoption of mobile-enabled DPMS applications allows dentists and staff to access patient information, schedule appointments, and communicate with patients remotely, enhancing flexibility and clinic responsiveness

- The rise of patient-centric solutions integrated into DPMS, such as automated feedback collection and teleconsultation support, is enhancing patient engagement and satisfaction while streamlining practice operations

Dental Practice Management System Market Dynamics

Driver

Rising Demand for Efficient Clinic Management and Digitalization

- The increasing need for streamlined administrative and clinical processes in dental clinics, coupled with the growing adoption of digital healthcare solutions, is a significant driver for DPMS market growth

- For instance, Henry Schein’s Dentrix software introduced integrated AI analytics for appointment scheduling and patient engagement, enhancing clinic efficiency and improving patient satisfaction

- As dental professionals seek to optimize appointment management, billing, and patient records, DPMS provides centralized solutions that reduce manual errors and improve workflow efficiency

- Furthermore, the expansion of cloud-based platforms and mobile applications is making DPMS more accessible and user-friendly, encouraging adoption across clinics of all sizes

- The convenience of automated reminders, treatment tracking, and reporting dashboards are key factors propelling the adoption of DPMS in both individual practices and multi-location dental networks

- Growing awareness of digital dentistry and investments in IT infrastructure further contribute to the rapid adoption of dental practice management systems globally

- Increasing regulatory pressure for accurate digital record-keeping and compliance is encouraging dental clinics to adopt robust DPMS solutions

- Rising competition among dental practices is pushing clinics to implement advanced DPMS to improve operational efficiency, patient retention, and overall service quality

Restraint/Challenge

Data Security Concerns and High Implementation Costs

- Concerns surrounding patient data security and compliance with healthcare regulations, such as HIPAA, pose a significant challenge to broader DPMS adoption

- For instance, reports of data breaches in dental clinics have made some practitioners hesitant to transition from paper-based records to digital management systems

- Ensuring robust encryption, secure authentication protocols, and regular software updates is crucial for building trust among dental professionals and patients

- In addition, the relatively high initial cost of comprehensive DPMS solutions, including licensing fees and training requirements, can hinder adoption, particularly in small or budget-constrained clinics

- While some cloud-based DPMS options have reduced upfront costs, premium features such as AI analytics, integrated imaging, and multi-location management often come at a higher price point

- Overcoming these challenges through enhanced cybersecurity measures, affordable subscription models, and practitioner training will be vital for sustained growth in the global dental practice management system market

- Limited technical expertise among dental staff to manage and utilize advanced DPMS features can slow adoption rates, necessitating targeted training programs

- Integration challenges with legacy systems and third-party dental technologies may create operational inefficiencies, requiring seamless interoperability solutions for successful implementation

Dental Practice Management System Market Scope

The market is segmented on the basis of deployment mode, application, and end use.

- By Deployment Mode

On the basis of deployment mode, the dental practice management system (DPMS) market is segmented into on-premise, web-based, and cloud-based solutions. The cloud-based segment dominated the market with the largest revenue share of 45.8% in 2025, driven by its advantages of remote access, scalability, and reduced IT infrastructure requirements. Dental clinics increasingly prefer cloud-based DPMS due to the flexibility of accessing patient records, scheduling, billing, and imaging data from any location. The centralized storage offered by cloud systems also ensures secure data management and simplifies software updates. Furthermore, cloud-based solutions facilitate multi-location dental networks, improving operational efficiency and collaboration among staff. Cost-effectiveness over the long term, combined with integration capabilities with imaging and EHR systems, further strengthens the adoption of cloud-based DPMS.

The web-based segment is anticipated to witness the fastest growth rate of 22.1% from 2026 to 2033, fueled by the rising need for easy-to-access, browser-based solutions that require minimal installation. Web-based DPMS offers dentists and administrative staff real-time access to patient data, appointments, and billing information from any device with internet connectivity. Its growing popularity is also supported by the increasing adoption of mobile-friendly platforms and remote working models. In addition, web-based systems allow seamless integration with other dental tools and communication platforms, enhancing clinic workflow efficiency. The lower upfront costs and minimal IT maintenance requirements make web-based DPMS an attractive option for small to medium-sized practices.

- By Application

On the basis of application, the market is segmented into patient communication software, invoice/billing software, payment processing software, insurance management, and others. The invoice/billing software segment dominated the market in 2025, capturing the largest revenue share, driven by the critical need for accurate billing, claims management, and financial reporting in dental clinics. Clinics rely heavily on automated billing systems to reduce human errors, manage insurance claims efficiently, and ensure timely payment collection. Integration with other DPMS modules, such as appointment scheduling and patient records, further enhances operational efficiency. The growing complexity of insurance processing and compliance requirements has also boosted demand for advanced billing software. In addition, automated billing systems improve patient transparency and satisfaction by providing clear invoices and payment options.

The patient communication software segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for automated appointment reminders, follow-up notifications, and patient engagement tools. Patient communication software enhances patient experience by reducing missed appointments and improving adherence to treatment schedules. Integration with mobile apps and email/SMS platforms allows clinics to maintain seamless communication with patients. This segment’s growth is further accelerated by rising patient expectations for digital interaction and personalized communication. Clinics leveraging advanced communication software report higher patient retention and improved operational efficiency.

- By End Use

On the basis of end use, the dental practice management system market is segmented into dental clinics, hospitals, and others. The dental clinics segment dominated the market with the largest revenue share of 62% in 2025, driven by the high adoption of DPMS among small and medium-sized clinics for streamlining daily operations. Dental clinics prioritize solutions that integrate scheduling, billing, imaging, and patient management into a single platform to improve operational efficiency. The ease of implementing DPMS in clinics, combined with lower IT overheads compared to hospitals, makes it a preferred end user. In addition, increasing patient volume and regulatory requirements for electronic records are encouraging clinics to adopt robust DPMS solutions. Cloud-based and AI-enabled features further enhance workflow efficiency and patient satisfaction in dental clinics.

The hospitals segment is expected to witness the fastest growth rate of 21.5% from 2026 to 2033, fueled by the increasing integration of dental departments with hospital IT infrastructure and EHR systems. Hospitals require scalable DPMS solutions capable of handling complex workflows, multi-specialty coordination, and high patient volumes. The rising focus on patient-centric care and digital health adoption is driving hospitals to implement comprehensive management systems. Moreover, integration with hospital-wide systems enhances operational efficiency and enables better resource allocation. Growing investments in hospital digitalization and IT infrastructure are further accelerating DPMS adoption in this segment.

Dental Practice Management System Market Regional Analysis

- North America dominated the dental practice management system market with the largest revenue share of 39.2% in 2025, characterized by early adoption of healthcare IT solutions, high awareness among dental professionals, and the presence of major software vendors, with the U.S. witnessing substantial growth in cloud-based DPMS adoption and AI-driven analytics for treatment planning and patient engagement

- Dental clinics and hospitals in the region increasingly prioritize efficient patient management, automated billing, and integrated electronic health records, boosting the adoption of advanced management systems

- This widespread adoption is further supported by high healthcare IT investments, awareness of digital dentistry, and favorable regulations encouraging electronic record-keeping, establishing DPMS as a preferred solution for both small clinics and multi-location dental networks

U.S. Dental Practice Management System Market Insight

The U.S. dental practice management system market captured the largest revenue share of 79% in 2025 within North America, fueled by the rapid adoption of digital dentistry solutions and cloud-based software. Dental clinics increasingly prioritize efficient patient management, automated billing, and integrated electronic health records to improve operational efficiency. The growing trend of multi-location practices and tele-dentistry is further propelling the DPMS industry. Moreover, the integration of AI-enabled analytics, appointment reminders, and mobile-accessible platforms is significantly contributing to market expansion. High healthcare IT investments and a tech-savvy dental workforce continue to drive adoption.

Europe Dental Practice Management System Market Insight

The Europe dental practice management system market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and the increasing need for efficient clinical and administrative operations. Rising digitalization in dental practices, coupled with growing awareness of patient-centric care, is fostering DPMS adoption. European dental clinics are integrating management systems with imaging and EHR platforms to enhance workflow efficiency. The market is experiencing significant growth across private clinics, hospitals, and multi-location practices. In addition, the emphasis on data security and compliance with GDPR regulations is encouraging the implementation of robust DPMS solutions.

U.K. Dental Practice Management System Market Insight

The U.K. dental practice management system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the adoption of cloud-based solutions and the focus on improving patient engagement and clinic efficiency. Growing awareness of digital dentistry and regulatory requirements for electronic record-keeping are encouraging clinics to implement DPMS. The U.K.’s advanced healthcare infrastructure and adoption of tele-dentistry solutions are expected to continue stimulating market growth. In addition, the integration of DPMS with automated billing, appointment scheduling, and patient communication software is further driving demand among both private and hospital-based dental practices.

Germany Dental Practice Management System Market Insight

The Germany dental practice management system market is expected to expand at a considerable CAGR during the forecast period, fueled by the increasing demand for secure, integrated, and technologically advanced solutions in dental practices. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and efficiency, promotes DPMS adoption. Dental clinics are increasingly implementing systems that streamline administrative tasks, patient records, and treatment planning. The integration of cloud-based and AI-enabled features is becoming prevalent, supporting multi-location management and workflow optimization. In addition, strong focus on data privacy and compliance with healthcare regulations aligns with local consumer and practitioner expectations.

Asia-Pacific Dental Practice Management System Market Insight

The Asia-Pacific dental practice management system market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing dental healthcare investments, rapid urbanization, and rising awareness of digital solutions in countries such as China, India, and Japan. The region’s growing inclination toward cloud-based and mobile-accessible DPMS is fueling adoption. Furthermore, government initiatives supporting digital health and tele-dentistry are accelerating market growth. APAC is also witnessing the emergence of domestic DPMS vendors offering affordable, scalable solutions, expanding accessibility for small to medium-sized dental clinics. The rising number of dental clinics and growing patient volumes are further contributing to market expansion.

Japan Dental Practice Management System Market Insight

The Japan dental practice management system market is gaining momentum due to the country’s advanced healthcare technology adoption and focus on patient-centric care. Japanese dental clinics are increasingly leveraging DPMS for efficient scheduling, billing, and integration with electronic health records and imaging systems. The aging population is driving demand for user-friendly, secure, and accessible digital management solutions. In addition, tele-dentistry and AI-enabled analytics for treatment planning are supporting the adoption of advanced DPMS. Integration with other healthcare IT systems is also enhancing clinic efficiency and patient engagement, fueling market growth.

India Dental Practice Management System Market Insight

The India dental practice management system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding dental infrastructure, rising patient awareness, and growing adoption of cloud-based solutions. Dental clinics increasingly prioritize workflow efficiency, patient management, and automated billing through DPMS implementation. The push toward digital health initiatives, tele-dentistry, and affordable subscription-based solutions are key factors propelling market growth. Domestic vendors offering cost-effective and scalable DPMS solutions are further driving adoption across small and medium-sized practices. In addition, increasing urbanization and the rapid rise of dental clinics in metropolitan areas support market expansion.

Dental Practice Management System Market Share

The Dental Practice Management System industry is primarily led by well-established companies, including:

- Open Dental Software (U.S.)

- tab32 (U.S.)

- iDentalSoft (U.S.)

- Dentimax (U.S.)

- CareStack (U.S.)

- Curve Dental (U.S.)

- Planet DDS (U.S.)

- Dentrix (U.S.)

- Henry Schein One (U.S.)

- Patterson Dental (U.S.)

- Carestream Dental (U.S.)

- ACE Dental Software (U.S.)

- ABELDent (Canada)

- ClearDent (Canada)

- NextGen Healthcare (U.S.)

- Dovetail Dental Software (U.S.)

- MOGO (U.S.)

- Software of Excellence (U.K.)

- EagleSoft (U.S.)

What are the Recent Developments in Global Dental Practice Management System Market?

- In August 2025, Henry Schein and Henry Schein One launched “LinkIt,” a seamless digital workflow within the Dentrix practice management software that enables dental teams to connect Dentrix with a range of digital imaging, planning, and design systems, reducing repetitive data entry and streamlining clinical workflows

- In June 2025, Vyne Dental entered an integration agreement with Open Dental Software to enhance interoperability between Vyne’s revenue and billing solutions and the open‑source dental practice management platform, enabling better financial and clinical workflows

- In April 2025, Sensei (Carestream Dental’s practice management brand) announced a strategic integration with DentalMonitoring to bring AI‑powered remote monitoring and 3D visualization capabilities into its Cloud Ortho platform, aimed at streamlining workflows and enhancing patient engagement in orthodontic practices

- In June 2024, tab32, a leading cloud‑based dental practice management platform, partnered with Pearl to integrate Pearl’s AI‑powered disease‑detection capabilities into its system, improving clinical data insights and diagnostic support for dental practices globally

- January 2024, Patient Prism’s AI‑driven growth platform partnered with Curve Dental’s practice management software to provide dental practices with advanced analytics on patient acquisition, engagement, and revenue performance in an integrated digital workflow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.