Global Dental Suction Systems Market

Market Size in USD Million

CAGR :

%

USD

570.91 Million

USD

1,306.23 Million

2025

2033

USD

570.91 Million

USD

1,306.23 Million

2025

2033

| 2026 –2033 | |

| USD 570.91 Million | |

| USD 1,306.23 Million | |

|

|

|

|

Dental Suction Systems Market Size

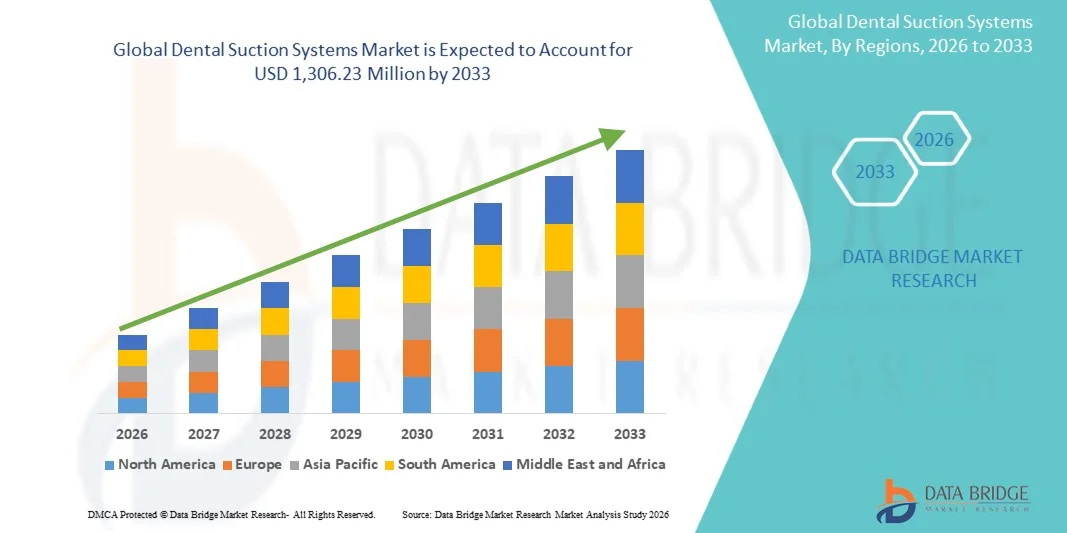

- The global dental suction systems market size was valued at USD 570.91 million in 2025 and is expected to reach USD 1,306.23 million by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced suction technologies in dental clinics and hospitals, supported by rising oral-health awareness, higher procedure volumes, and growing emphasis on infection-control standards within modern dental practices

- Furthermore, technological advancements such as enhanced filtration, noise-reduction, and portable suction units combined with the rising demand for hygienic, reliable, and operator-friendly equipment are positioning dental suction systems as essential components in dental care delivery, thereby accelerating market expansion

Dental Suction Systems Market Analysis

- Dental suction systems, providing effective fluid and aerosol management during dental procedures, are increasingly vital components of modern dental practices across clinics, hospitals, and mobile units due to their role in maintaining hygiene, improving visibility, and supporting efficient chairside workflows

- The escalating demand for dental suction systems is primarily fueled by rising oral-health awareness, growing dental procedure volumes, and a strong shift toward advanced, low-maintenance suction technologies particularly dry suction systems which offer improved efficiency, reduced water usage, and quieter operation

- North America dominated the dental suction systems market with the largest revenue share of 40.1% in 2025, supported by a well-developed dental care infrastructure, high adoption of technologically advanced equipment, and stringent infection-control and amalgam-separation regulations driving equipment upgrades

- Asia-Pacific is expected to be the fastest-growing region in the dental suction systems market during the forecast period, driven by expanding dental clinic networks, increasing disposable incomes, rapid urbanization, and growing investments in oral-health services across emerging economies

- Wet suction systems segment dominated the dental suction systems market with a market share of 57.5% in 2025, attributed to their widespread use in high-volume practices and multi-chair settings, while dry suction systems continue to gain momentum due to their operational efficiency and reduced maintenance needs

Report Scope and Dental Suction Systems Market Segmentation

|

Attributes |

Dental Suction Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental Suction Systems Market Trends

“Rising Adoption of Advanced Dry Suction Systems for Enhanced Efficiency and Hygiene”

- A significant and accelerating trend in the global dental suction systems market is the rapid transition from traditional wet suction systems to advanced dry suction technologies, driven by improved efficiency, reduced water consumption, better aerosol control, and simplified maintenance requirements in both small and multi-chair dental setups

- For instance, brands offering modern dry suction units with oil-free motors and intelligent airflow management enable clinics to operate multiple chairs simultaneously while maintaining strong and stable suction performance, reducing downtime and operational costs

- Dry suction technologies also support enhanced infection-control outcomes by minimizing moisture buildup and improving aerosol evacuation efficiency, addressing major hygiene concerns in dental environments; for instance, certain models feature integrated filtration systems that automatically adjust suction levels to maintain optimal air quality

- The seamless integration of dental suction systems with digital monitoring platforms allows clinicians to track suction pressure, filter status, and system performance in real time, enabling more proactive equipment management and streamlined workflow coordination across the operatory

- This trend toward more efficient, intelligent, and hygienic suction systems is influencing expectations among dental practitioners, encouraging manufacturers to invest in quieter motors, compact designs, and advanced filtration; for instance, companies are introducing smart dry suction units designed for multi-chair clinics with automatic performance regulation capabilities

- The demand for dental suction systems that offer elevated hygiene, low maintenance, and scalable performance is rising rapidly across both developed and emerging markets, as clinics increasingly prioritize operational efficiency, infection control, and consistent treatment quality

Dental Suction Systems Market Dynamics

Driver

“Growing Need for Effective Aerosol Management and Expanding Dental Practice Infrastructure”

- The increasing emphasis on infection control and aerosol management in dental practices, combined with expanding global dental infrastructure, is a significant driver for the rising demand for advanced dental suction systems across clinics, hospitals, and multi-chair dental centers

- For instance, in recent years several manufacturers have introduced upgraded suction technologies featuring enhanced airflow performance and multi-stage filtration systems, supporting clinics in compliance with stricter hygiene standards and promoting safer treatment environments

- As practitioners seek stronger chairside suction and improved operatory cleanliness, dental suction systems offer features such as high-volume evacuation, integrated amalgam separation, and stable negative pressure, positioning them as essential upgrades over older suction models

- Furthermore, the growing popularity of multi-chair clinics and group dental practices is making high-capacity centralized suction systems increasingly indispensable, offering consistent performance across multiple operatories and supporting streamlined practice operations

- The convenience of low-maintenance dry suction systems, improved energy efficiency, and the ability to handle increased procedure volumes are key factors accelerating adoption in both established and emerging dental markets. The trend toward modernizing dental practices and upgrading outdated equipment further contributes to market growth

Restraint/Challenge

“Noise Levels, Maintenance Burden, and Regulatory Compliance Limitations”

- Concerns surrounding high noise output, maintenance challenges, and stringent regulatory compliance requirements pose significant hurdles to broader adoption of dental suction systems, particularly in smaller or cost-sensitive dental practices

- For instance, reports of operational noise from older wet suction models and frequent maintenance requirements associated with moisture buildup and filtration issues have made some clinics hesitant to invest in traditional suction systems

- Addressing these challenges through quieter motor designs, improved filtration systems, and simplified maintenance procedures is crucial for enhancing user confidence. Companies emphasize their noise-reduction engineering and upgraded filtration technologies to reassure potential buyers. In addition, compliance requirements for amalgam separation in several regions add extra installation and maintenance burden for certain clinics

- While newer technologies offer improvements, the higher upfront cost of premium dry suction systems can be a barrier for smaller dental practices, particularly in developing regions where budget constraints may limit investment in advanced infrastructure. Less-expensive units exist, but high-performance systems with intelligent controls or multi-chair capabilities often command a premium price

- While overall costs are decreasing gradually, the perceived expense and compliance burden associated with advanced suction systems can still hinder widespread adoption, especially among clinics with low patient volumes or aging dental equipment

- Overcoming these challenges through noise reduction, better filtration, cost-effective product lines, and clearer regulatory guidance will be vital for sustained market expansion

Dental Suction Systems Market Scope

The market is segmented on the basis of type, system design, component, and end user.

- By Type

On the basis of type, the dental suction systems market is segmented into wet suction systems and dry suction systems. The wet suction systems segment dominated the market with the largest share of 57.5% in 2025, primarily due to its widespread use in both small and mid-sized dental practices where moisture control and continuous suction are essential. Wet systems are valued for their stable performance, reliable fluid management, and lower upfront equipment cost, making them an economical choice for many clinics. Their ability to handle high volumes of aerosols and liquids efficiently contributes to strong adoption in regions with stringent infection-control mandates. In addition, wet systems have long-established familiarity among dental professionals, supporting consistent replacement demand. Their strong service network and compatibility with existing operatory infrastructure further reinforce their dominant position.

The dry suction systems segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the increasing shift toward energy-efficient, low-maintenance solutions in modern dental facilities. Dry systems eliminate water usage, enabling significant reductions in operational costs and supporting sustainability initiatives across dental networks. Their superior suction consistency, quieter operation, and longer equipment lifespan appeal strongly to high-volume practices and multi-chair clinics. With rising focus on infection control and aerosol management, dry systems' capability to prevent cross-contamination and improve hygiene also boosts demand. Technological advancements such as integrated separators and digital monitoring further accelerate the segment’s rapid adoption.

- By System Design

On the basis of system design, the market is segmented into centralized suction systems, unit-mounted suction systems, and portable suction systems. The centralized suction systems segment dominated the market in 2025, owing to its strong presence in multi-chair dental settings, large clinics, and hospitals that require high suction capacity and coordinated performance. Centralized systems allow multiple operatories to run simultaneously, delivering uniform suction power across the facility. Their lower long-term operating costs and ability to accommodate expansion make them a preferred choice for group practices and DSOs (Dental Service Organizations). Centralized configurations also support advanced filtration and separation technologies, aiding in improved infection control. Their durability and reduced noise levels further strengthen market leadership.

The portable suction systems segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for mobility, flexible practice layouts, and point-of-care dental services. Portable units have become increasingly essential in mobile dental vans, community dental camps, emergency clinics, and home-care dentistry, where fixed infrastructure is not available. Their compact design, ease of transportation, and plug-and-use functionality make them ideal for temporary or remote setups. Growing adoption of portable infection-control tools after the COVID-19 era further accelerates market expansion. In addition, advancements enabling higher suction power, longer battery life, and lightweight construction contribute to rapid growth.

- By Component

On the basis of component, the market is segmented into vacuum pumps, separators, filters & traps, hoses & handpieces, consumables, and service & maintenance. The vacuum pumps segment dominated the market with the largest share in 2025, as vacuum pumps serve as the core operational engine of dental suction systems across both wet and dry technologies. High replacement rates, essential maintenance requirements, and advancements in pump efficiency contribute significantly to recurring revenue. Dental facilities prioritize reliable, high-power vacuum pumps to maintain uninterrupted suction during procedures such as surgeries, restorative treatments, and hygiene sessions. Innovations such as oil-free pumps, improved noise reduction, and enhanced airflow performance further strengthen demand. The increasing number of multi-chair dental clinics globally also drives vacuum pump installations.

The service & maintenance segment is projected to grow at the fastest rate from 2026 to 2033, driven by the rising need for routine system calibration, infection-control upkeep, and compliance with safety regulations. As suction systems operate continuously during clinical hours, preventive maintenance becomes essential to avoid downtime and ensure consistent performance. The shift toward value-added service contracts, remote diagnostics, and predictive maintenance technologies supports segment acceleration. In addition, new regulations regarding amalgam separation, aerosol filtration, and sterilization boost service-related spending. The expansion of corporate dental chains globally further increases demand for standardized service programs, fueling rapid growth.

- By End User

On the basis of end user, the market is segmented into dental clinics, hospitals, dental academic & research institutes, dental laboratories, and mobile dental units. The dental clinics segment dominated the market in 2025, supported by the high number of independent practices, group clinics, and dental service organizations that rely heavily on continuous suction for daily procedures. Dental clinics perform the majority of global dental treatments ranging from prophylaxis to surgical extractions—driving strong suction system utilization. The need for reliable chairside suction, aerosol control, and operatory hygiene enhances equipment replacement and upgrade cycles. Growing patient volumes, increasing chair density in clinics, and adoption of advanced dry suction technologies further reinforce dominance. In addition, infection-control compliance requirements make suction systems indispensable for clinics worldwide.

The mobile dental units segment is expected to witness the fastest growth from 2026 to 2033, propelled by expanding outreach programs, public health initiatives, and rural dental care services. Mobile units require compact, energy-efficient, and portable suction systems to support on-site treatment delivery. Governments, NGOs, and private organizations are increasingly investing in mobile dental vans to improve access to oral care in underserved communities. The growing popularity of home-care dentistry and emergency pop-up clinics also contributes to rapid adoption. Technological advancements in lightweight suction devices, battery-operated units, and noise-controlled portable systems further accelerate segment growth.

Dental Suction Systems Market Regional Analysis

- North America dominated the dental suction systems market with the largest revenue share of 40.1% in 2025, supported by a well-developed dental care infrastructure, high adoption of technologically advanced equipment, and stringent infection-control and amalgam-separation regulations driving equipment upgrades

- The region benefits from strong adoption of dry suction systems, driven by increasing emphasis on infection control, aerosol management, and regulatory compliance in dental settings

- In addition, high per-capita dental expenditure, widespread availability of technologically advanced suction equipment, and consistent practice modernization efforts support strong market uptake

U.S. Dental Suction Systems Market Insight

The U.S. dental suction systems market captured the largest revenue share within North America in 2025, driven by the country’s expansive dental care infrastructure and high adoption of technologically advanced suction units. Dental practices increasingly prioritize high-performance systems that enhance infection control, aerosol reduction, and clinical efficiency. The rising number of multi-chair clinics and dental service organizations (DSOs) is further accelerating the shift toward centralized dry suction systems. In addition, stringent regulatory standards for hygiene, waste management, and air quality support consistent market demand. Growing investment in practice modernization, coupled with a strong presence of leading manufacturers, continues to expand the U.S. market.

Europe Dental Suction Systems Market Insight

The Europe dental suction systems market is projected to grow at a substantial CAGR during the forecast period, driven by strict infection control regulations and rising attention to patient and practitioner safety. Increasing modernization of dental practices and adoption of efficient dry suction systems are promoting market growth across the region. European clinics are also focusing on improving aerosol management due to heightened awareness following recent global health concerns. The region’s advancements in eco-friendly and energy-efficient suction technologies further encourage adoption. In addition, widespread renovation of dental facilities and expansion of group practices contribute to steady market growth.

U.K. Dental Suction Systems Market Insight

The U.K. dental suction systems market is anticipated to grow at a noteworthy CAGR, fueled by rising emphasis on hygiene, compliance with strict regulatory guidelines, and the growing number of dental clinics adopting modern suction technologies. The increasing replacement of outdated vacuum systems with oil-free, energy-efficient, and low-noise solutions supports market expansion. Concerns related to aerosol contamination have also prompted clinics to upgrade to more powerful dry suction units. The U.K.’s strong investment in oral healthcare services and the growing popularity of multi-chair dental practices are expected to further stimulate demand for advanced suction systems.

Germany Dental Suction Systems Market Insight

The Germany dental suction systems market is expected to expand at a considerable CAGR, supported by the country's strong technological infrastructure and preference for high-quality, precision-engineered dental equipment. German dental practices prioritize sustainable, energy-efficient, and low-maintenance suction systems, increasing demand for advanced dry and centralized solutions. The market also benefits from the rapid digitalization of dental clinics and the integration of smart monitoring features in suction equipment. In addition, the country’s strong focus on infection control compliance and air management in clinical environments drives continuous system upgrades and replacements.

Asia-Pacific Dental Suction Systems Market Insight

The Asia-Pacific dental suction systems market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, increasing healthcare investments, and expanding access to dental care in countries such as China, Japan, and India. Rising awareness of infection control, coupled with growing adoption of modern dental technologies, is accelerating suction system installations. Government initiatives promoting improved healthcare infrastructure and the increasing number of dental colleges and clinics contribute significantly to growth. The region’s role as a manufacturing hub also enhances affordability, supporting widespread adoption of both wet and dry suction systems.

Japan Dental Suction Systems Market Insight

The Japan dental suction systems market is gaining momentum due to the country's strong technological advancements and demand for high-efficiency clinical equipment. Japan’s dental facilities prioritize quiet, compact, and energy-efficient suction solutions, driving demand for modern dry and unit-mounted systems. The growing number of elderly patients requiring dental care also increases the need for advanced suction equipment in clinics and hospitals. In addition, the high adoption of automated and digitally monitored systems supports market expansion. Integration with broader dental operatory technology further strengthens Japan’s move toward next-generation suction solutions.

India Dental Suction Systems Market Insight

The India dental suction systems market accounted for the largest revenue share in Asia Pacific in 2025, supported by rapid urbanization, rising disposable incomes, and an expanding network of dental clinics. Growing demand for affordable, efficient suction systems especially among small and mid-sized practices is driving strong market growth. The Indian government’s push toward enhanced healthcare infrastructure and the increasing number of dental colleges also boost adoption. Local manufacturing and availability of cost-effective suction solutions further expand market penetration. In addition, heightened awareness of infection control is prompting clinics to shift from basic suction units to higher-performance wet and dry suction systems.

Dental Suction Systems Market Share

The Dental Suction Systems industry is primarily led by well-established companies, including:

- Dürr Dental (Germany)

- CATTANI S.p.A. (Italy)

- ADS Dental System (U.S.)

- DentalEZ, Inc. (U.S.)

- Air Techniques, Inc. (U.S.)

- Metasys Medizintechnik GmbH (Germany)

- Eschmann Technologies Ltd. (U.K.)

- GNATUS Equipamentos Médico Odontológicos Ltda. (Brazil)

- Planmeca Oy (Finland)

- KaVo Dental GmbH (Germany)

- Midmark Corporation (U.S.)

- BPR Swiss GmbH (Switzerland)

- Becker Pumps Australia (Australia)

- Tecno Gaz S.p.A. (Italy)

- Runyes Medical Instrument Co., Ltd. (China)

- MDS Medical Ltd. (U.K.)

- Foshan Gladent Medical Instrument Co., Ltd. (China)

- Nippon Dental (Japan)

- StarDental Systems (U.S.)

What are the Recent Developments in Global Dental Suction Systems Market?

- In July 2025, Renfert introduced its first portable suction unit the SILENT XS, a battery-powered, bagless suction and dust-collection system with H13/HEPA filtration, LED lighting and quiet operation designed for dental offices and in-house labs that need mobility and clean-air control without fixed plumbing

- In August 2024, Henry Schein Dental (or its affiliated distribution channels) expanded its suction product offerings with advanced suction / aerosol-management solutions, matching rising demand for infection control and improved air quality during aerosol-generating dental procedures

- In June 2024, Aseptico debuted the GO Ultra Portable Dental System (AEU-350S) a compact, all-in-one portable dental system with integrated vacuum suction and ultrasonic scaler aimed at mobile dental practices, home-care dentistry, or field clinics, expanding access to dental services beyond traditional clinics

- In March 2024, Dürr Dental launched new suction systems in its “Tyscor” line (models V/VS1 and V/VS4), offering improved performance, quieter operation, and modular design for both dry and wet suction setups reflecting a push toward flexible, scalable suction solutions for different practice sizes

- In June 2023, Dürr Dental formally positioned its Tyscor suction systems as “sustainability-oriented”, highlighting that their radial-technology suction units deliver up to 75% energy savings compared to older blower-based systems, while also offering remote maintenance via cloud-based monitoring a move that reflects growing concern for energy efficiency, environmental impact, and lifecycle costs in dental practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.