Global Dermal Toxicity Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.65 Billion

USD

3.77 Billion

2024

2032

USD

2.65 Billion

USD

3.77 Billion

2024

2032

| 2025 –2032 | |

| USD 2.65 Billion | |

| USD 3.77 Billion | |

|

|

|

|

Dermal Toxicity Testing Market Size

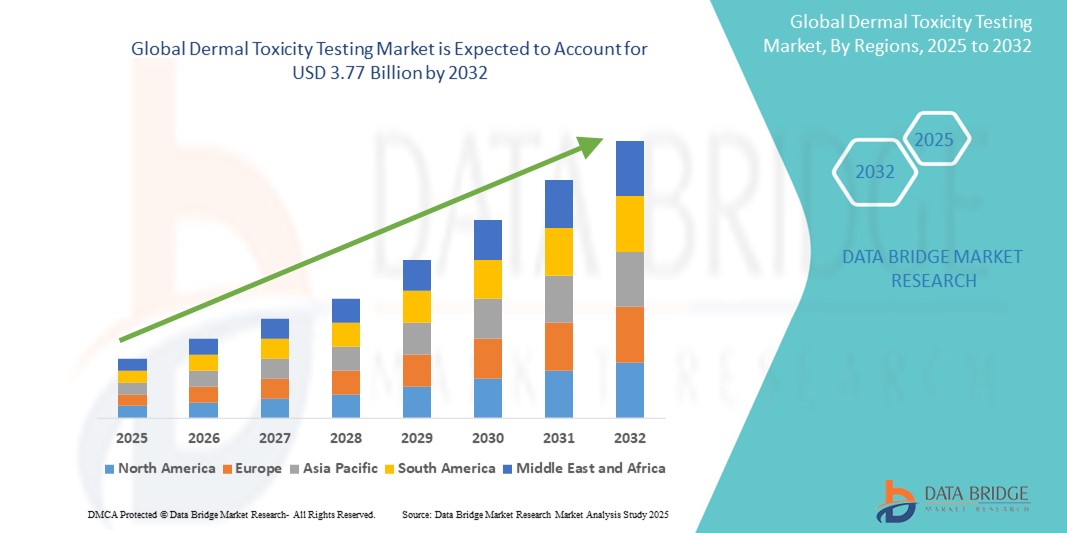

- The global dermal toxicity testing market size was valued at USD 2.65 billion in 2024 and is expected to reach USD 3.77 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing focus on product safety and stringent regulatory guidelines concerning the evaluation of chemicals, cosmetics, and pharmaceuticals, which has led to a rising demand for effective dermal toxicity testing methods across various industries

- Furthermore, the global shift towards alternative, animal-free testing models—such as in vitro and in silico approaches—is accelerating the uptake of Dermal Toxicity Testing solutions, thereby significantly boosting the industry's growth

Dermal Toxicity Testing Market Analysis

- Dermal toxicity testing, which assesses the effects of chemicals, pharmaceuticals, and cosmetics on the skin, is becoming increasingly crucial in modern safety evaluations for both human and environmental health. These tests are integral to product development processes, especially for topical drugs, personal care items, and industrial chemicals, due to their role in identifying skin irritation, corrosion, and sensitization

- The escalating demand for dermal toxicity testing is primarily fueled by stricter global regulatory frameworks, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and OECD guidelines, which mandate safety assessments before product commercialization. Additionally, the growing preference for cruelty-free, non-animal testing methods is driving innovation and uptake in in vitro and in silico dermal toxicity models

- North America dominated the dermal toxicity testing market with the largest revenue share of 39.6% in 2024, due to the region’s advanced healthcare infrastructure, rising awareness of dermatological safety, and robust R&D investments by pharmaceutical and cosmetic companies. The U.S. leads this regional growth with strong adoption of alternative testing methods and government support for reducing animal testing

- Asia-Pacific is expected to be the fastest-growing region in the dermal toxicity testing market during the forecast period, with a projected CAGR of 8.7% from 2025 to 2032, fueled by increasing industrialization, expanding cosmetic markets in countries like China, India, and South Korea, and growing regulatory harmonization aligned with international standards

- The product segment dominated the dermal toxicity testing market with a market revenue share of 64.3% in 2024, driven by the increasing demand for reliable testing kits and consumables used in toxicity analysis. These products are essential for both in-vitro and in-vivo methods, enabling consistent, replicable results for regulatory and research use

Report Scope and Dermal Toxicity Testing Market Segmentation

|

Attributes |

Dermal Toxicity Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dermal Toxicity Testing Market Trends

“Growing Need Due to Rising Safety Regulations and Ethical Testing Demands”

- The increasing awareness around human health safety and the push for regulatory compliance in the pharmaceutical, cosmetics, and chemical industries are significantly driving the demand for dermal toxicity testing

- For instance, in April 2024, Charles River Laboratories announced the expansion of its in-vitro toxicology services to support cosmetic companies adapting to European bans on animal testing. Such strategic moves by key players are expected to propel the Dermal Toxicity Testing industry during the forecast period

- As governments and regulatory agencies globally tighten restrictions on animal testing, dermal toxicity testing alternatives such as in-vitro and in-silico methods are gaining traction for their accuracy, reproducibility, and ethical appeal

- Furthermore, the rising demand for safer consumer products—especially in cosmetics, skincare, and household chemicals—is leading companies to adopt robust skin irritation, sensitization, and corrosion tests early in the product development lifecycle

- Biotech innovations and advanced modeling techniques are improving the efficiency and predictive power of dermal toxicity testing, making it an integral part of safety assessment workflows. As consumer preferences shift toward cruelty-free products, demand for ethical testing continues to surge, driving market growth

Dermal Toxicity Testing Market Dynamics

Driver

“Growing Demand for Alternative Testing Methods and Integrated Technologies”

- A significant and accelerating trend in the global Dermal Toxicity Testing market is the growing emphasis on non-animal testing methods combined with technological advancements in integrated lab automation and data analysis platforms. These shifts are enhancing the accuracy, reproducibility, and regulatory compliance of toxicity assessments

- For instance, microfluidic skin-on-a-chip technologies are being adopted for their ability to simulate human skin responses more precisely than traditional in vivo methods. These innovations are transforming preclinical testing by offering real-time cellular responses to dermal exposures

- Advanced in vitro models—such as 3D reconstructed human epidermis (RhE)—enable high-throughput screening of cosmetic, pharmaceutical, and chemical substances, thereby accelerating product development cycles while aligning with evolving regulatory standards like OECD Test Guidelines

- The automation of dermal toxicity testing workflows, integrated with image analysis software and predictive toxicology algorithms, allows laboratories to streamline data generation, reduce errors, and make faster, data-driven decisions

- Moreover, the increased adoption of cloud-based laboratory information management systems (LIMS) supports centralized monitoring of dermal testing procedures and data sharing across global research teams. This digital transformation of toxicology labs aligns with industry trends toward efficiency, traceability, and transparency in safety assessments

- The shift towards these sophisticated, reliable, and ethical testing technologies is fundamentally reshaping the dermal toxicity testing landscape. As a result, companies such as Labcorp, Charles River, and BioReliance are expanding their offerings to include integrated in vitro solutions, automated testing platforms, and regulatory consulting services tailored to dermal toxicity studies

- The growing demand from cosmetics, pharmaceuticals, and chemical industries for validated, humane, and efficient safety testing protocols is driving the adoption of advanced dermal toxicity testing tools and platforms globally

Restraint/Challenge

“Lack of Standardization and High Cost of Advanced Testing Technologies”

- The absence of universally accepted standards for alternative dermal toxicity tests, particularly in emerging economies, remains a significant barrier to market adoption. Variations in global regulatory frameworks create complexities for multinational companies attempting to standardize testing protocols

- For instance, while the EU’s REACH regulation strongly supports non-animal methods, some regions still mandate or allow traditional in-vivo tests, slowing the global transition toward alternatives

- In addition, the high cost of adopting advanced testing technologies such as 3D tissue models, organ-on-a-chip platforms, and high-throughput screening systems can be prohibitive for small and medium-sized enterprises (SMEs)

- These technologies often require specialized infrastructure, skilled personnel, and validation protocols—raising the financial barrier to entry

- To overcome these challenges, industry stakeholders must advocate for harmonized global testing standards and invest in cost-effective, scalable alternatives. Collaborative efforts between governments, regulatory bodies, and industry players are essential to drive down costs and promote adoption of validated non-animal dermal toxicity testing methods

Dermal Toxicity Testing Market Scope

The dermal toxicity testing market is segmented on the basis of type, testing method, test type, and end user.

- By Type

On the basis of type, the dermal toxicity testing market is segmented into product and services. The product segment dominated the largest market revenue share of 64.3% in 2024, driven by the increasing demand for reliable testing kits and consumables used in toxicity analysis. These products are essential for both in-vitro and in-vivo methods, enabling consistent, replicable results for regulatory and research use.

The services segment is anticipated to witness the fastest growth rate of 10.8% CAGR from 2025 to 2032, attributed to the growing outsourcing trend among cosmetic, pharmaceutical, and chemical companies.

- By Testing Method

On the basis of testing method, the dermal toxicity testing market is segmented into in-vitro testing, in-vivo testing, and in-silico modeling. The in-vitro testing segment accounted for the largest revenue share of 55.6% in 2024 due to increasing global regulatory pressure to reduce animal testing and the widespread acceptance of laboratory-based cellular and tissue-based testing techniques.

The in-silico modeling segment is projected to grow at the fastest CAGR of 12.4% during the forecast period (2025–2032), driven by advancements in computational biology and predictive toxicology.

- By Test Type

On the basis of test type, the dermal toxicity testing market is segmented into skin irritation, skin sensitization, skin corrosion, and phototoxicity tests. The skin irritation segment held the largest market revenue share of 38.9% in 2024, as this is a mandatory screening in the development of topical drugs, cosmetics, and personal care products.

The skin sensitization segment is expected to witness the highest growth with a CAGR of 11.2% over the forecast period due to rising allergic reactions in consumers and strict global safety regulations.

- By End User

On the basis of end user, the dermal toxicity testing market is segmented into healthcare industries, cosmetics & personal care products industry, chemical industry, and others. The cosmetics & personal care products industry dominated the market with a revenue share of 42.7% in 2024, driven by increasing consumer demand for cruelty-free and dermatologically safe products.

The healthcare industries segment is projected to grow at the fastest CAGR of 11.8% between 2025 and 2032 due to increasing clinical research and dermatological drug development requiring strict dermal safety validations.

Dermal Toxicity Testing Market Regional Analysis

- North America dominated the dermal toxicity testing market with the largest revenue share of 39.6% in 2024, driven by the presence of major pharmaceutical and biotechnology companies, advanced research infrastructure, and strong regulatory frameworks supporting non-animal testing methods

- The region continues to prioritize ethical testing practices, with increasing investments in alternative testing technologies

- The U.S. alone accounted for 81% of the North America market in 2024, reflecting the country’s leadership in innovation, adoption of validated in vitro methods, and stringent regulatory oversight

U.S. Dermal Toxicity Testing Market Insight

The U.S. dermal toxicity testing market held 32.1% of the global dermal toxicity testing market in 2024, reflecting strong demand from cosmetics, pharmaceuticals, and chemical industries. Adoption of AI-based toxicity prediction models, microfluidics, and high-throughput screening platforms has positioned the U.S. at the forefront of dermal safety assessments.

Europe Dermal Toxicity Testing Market Insight

The Europe dermal toxicity testing market accounted for 30.4% of the global Dermal Toxicity Testing market revenue in 2024, fueled by regulatory bans on animal testing and widespread use of alternative testing technologies. Countries such as Germany (7.2%), France (5.9%), and the U.K. (6.5%) contributed significantly due to their robust R&D infrastructure and strict compliance with REACH and Cosmetics Regulation (EC) No 1223/2009.

U.K. Dermal Toxicity Testing Market Insight

The U.K. dermal toxicity testing market held a market share of 6.5% in 2024, supported by leading research institutions, public awareness around cruelty-free practices, and strong demand from the cosmetics industry. The trend toward regulatory independence post-Brexit also allows for flexible adoption of innovative methods.

Germany Dermal Toxicity Testing Market Insight

The Germany dermal toxicity testing market captured 7.2% of the global market share in 2024, driven by a well-established regulatory landscape and public investment in biotech innovation. Growth is propelled by demand for eco-friendly, non-animal solutions across the chemical and pharmaceutical sectors.

Asia-Pacific Dermal Toxicity Testing Market Insight

The Asia-Pacific dermal toxicity testing market is projected to grow at the fastest CAGR of 8.75% from 2025 to 2032, with a revenue share of 18.3% in 2024. Increasing regulatory harmonization with global safety standards, expanding R&D capabilities, and the growing cosmetic testing market are boosting regional adoption.

Japan Dermal Toxicity Testing Market Insight

The Japan dermal toxicity testing market accounted for 5.1% of the global market in 2024, with rising demand for accurate, in vitro testing solutions. Japan’s strong emphasis on technological integration and biomedical research supports the development and implementation of sophisticated testing models.

China Dermal Toxicity Testing Market Insight

The China dermal toxicity testing market held the largest share in Asia-Pacific at 7.4% in 2024, reflecting robust manufacturing capabilities and a shift toward cruelty-free product development. Government reforms easing animal testing requirements for imported cosmetics are a key growth accelerator.

Dermal Toxicity Testing Market Share

The dermal toxicity testing industry is primarily led by well-established companies, including:

- QIMA LTD (Hong Kong)

- Charles River Laboratories (U.S.)

- Evotec (Germany)

- MatTek Corporation (U.S.)

- Eurofins Scientific (Luxembourg)

- SGS Group (Switzerland)

- Intertek Group (U.K.)

- Qiagen N.V (Netherlands)

Latest Developments in Global Dermal Toxicity Testing Market

- In August 2024, Azitra, Inc. announced that the U.S. Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application for ATR-04, enabling the initiation of a first-in-human Phase 1/2 clinical trial targeting moderate to severe EGFR inhibitor-associated dermal toxicity

- In March 2022, Virpax has concluded all essential pre-clinical investigations, including assessments for dermal toxicity, for their experimental topical spray analgesic named Epoladerm. This product is designed to address chronic pain linked with knee osteoarthritis, potentially offering relief to affected patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.