Global Diabetic Food Market

Market Size in USD Billion

CAGR :

%

USD

12.11 Billion

USD

19.27 Billion

2024

2032

USD

12.11 Billion

USD

19.27 Billion

2024

2032

| 2025 –2032 | |

| USD 12.11 Billion | |

| USD 19.27 Billion | |

|

|

|

|

Diabetic Food Market Size

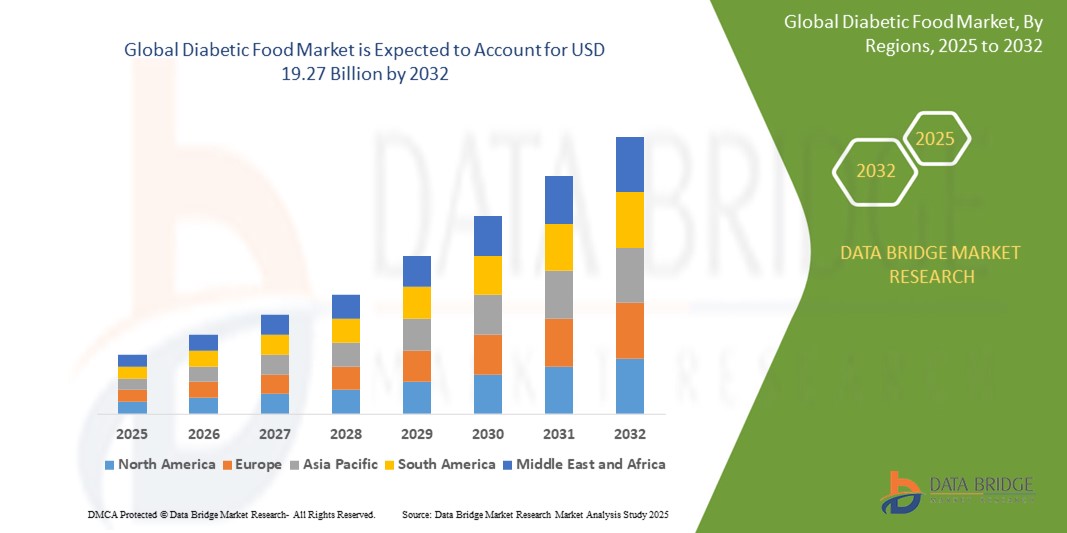

- The global diabetic food market was valued at USD 12.11 billion in 2024 and is expected to reach USD 19.27 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.0%, primarily driven by the increasing awareness of the various health risks associated with diabetes

- This growth is driven by factors such as the rising prevalence of diabetes across the globe, and rising use of artificial sweeteners

Diabetic Food Market Analysis

- The diabetic food market is driven by the rising prevalence of diabetes globally, with increasing awareness about the need for specialized dietary solutions to manage blood sugar levels. The demand for low-glycemic index foods, sugar substitutes, and functional foods fortified with fiber and protein is expanding

- The growing focus on preventive healthcare and dietary management of diabetes is boosting innovation in this sector, leading to the development of sugar-free, low-carb, and plant-based diabetic-friendly products. Additionally, government initiatives promoting diabetes management through lifestyle and nutrition are fueling market growth

- North America, Asia Pacific and Europe are the key regions for the diabetic food market, owing to high diabetes prevalence, well-established health-conscious consumer bases, and stringent regulations on food labeling and claims. These regions also see a strong presence of major food manufacturers launching diabetic-friendly product lines

- For instance, the growth and innovation in the diabetic food market is the increasing adoption of allulose, a natural sugar substitute, in South Korea. Allulose, found in fruits like figs and kiwis, offers a taste similar to table sugar with nearly zero calories. Major South Korean companies, such as Daesang Corp and Samyang Corp, are expanding production to meet the rising demand for healthier, diabetic-friendly alternatives

Report Scope and Diabetic Food Market Segmentation

|

Attributes |

Diabetic Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diabetic Food Market Trends

“Innovations in Sugar Substitutes & Functional Ingredients for Blood Sugar Management”

- A key trend in the diabetic food market is the growing innovation in sugar substitutes and functional ingredients designed to help regulate blood sugar levels effectively

- The development of natural sweeteners such as allulose, monk fruit extract, and stevia is gaining traction, offering consumers alternatives to traditional sugar without spiking glucose levels

- Functional ingredients such as fiber, resistant starch, and plant-based proteins are increasingly incorporated into food formulations to enhance glycemic control and improve overall metabolic health

- For instance, September 2023, Kellogg's launched a diabetic-friendly cereal that combines whole grains with natural sweeteners and added fiber to help maintain balanced blood sugar levels. This innovative product targets consumers seeking nutritious breakfast options that support glycemic control

- These advancements are shaping the diabetic food market, providing more choices for consumers while aligning with the broader health and wellness trend driving demand for nutritious and specialized dietary solutions

Diabetic Food Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Diabetes”

- The increasing global incidence of diabetes and pre-diabetic conditions is significantly boosting the demand for diabetic-friendly food products

- With urbanization, lifestyle changes, and an aging population, more consumers are seeking specialized diets designed to maintain stable blood sugar levels

- Rising health awareness and government-led initiatives encouraging balanced nutrition and disease prevention are driving the development of products with low glycemic indices and functional ingredients

- Innovations in natural sugar substitutes and fiber-enhanced formulations are addressing the dietary needs of diabetic individuals, leading to better glycemic control and overall health outcomes

For instance,

- In July 2022, a report by the American Diabetes Association highlighted a significant uptick in consumer demand for low-glycemic and fiber-rich food products, which spurred major food companies to invest in new product lines tailored for diabetic consumers. This trend has not only broadened the product portfolio across the industry but also accelerated innovation in diabetic-friendly formulations

- In 2023 report by the International Diabetes Federation highlighted that the rapid increase in diabetes cases in countries like India and China is driving consumer demand for low-sugar, low glycemic index foods. In response, local manufacturers have introduced innovative diabetic-friendly product lines, such as fortified snacks and beverages, to cater to this growing market need

- As more consumers shift towards proactive dietary management, the market for diabetic-friendly foods continues to expand, spurring further product development and market growth

Opportunity

“Advancing Diabetic Nutrition with Functional Ingredients & Novel Formulations”

- Innovative product formulations incorporating functional ingredients such as natural fibers, bioactive compounds, and plant-based proteins are enhancing the nutritional profile of diabetic-friendly foods

- These novel ingredients not only help lower the glycemic index but also provide added health benefits, including improved digestion and metabolic control

- Advances in nutritional science are enabling manufacturers to tailor food products specifically for diabetic consumers, optimizing flavor and nutritional content without compromising blood sugar management

For instance,

- In January 2024, a study published in the Journal of Diabetes Science and Technology demonstrated that a newly developed snack bar enriched with natural fibers and bioactive compounds significantly improved postprandial blood sugar levels in diabetic subjects. This breakthrough not only validated the effectiveness of such formulations but also spurred further investment and product development in the diabetic food market

- As consumer demand for healthier options rises, these innovations open new avenues for product diversification and market expansion, ultimately contributing to better health outcomes for diabetic individuals

Restraint/Challenge

“High Production Costs”

- The production of diabetic-friendly food products often involves the use of specialized ingredients such as natural sugar substitutes, high-fiber additives, and low-glycemic formulations, which significantly increase manufacturing costs

- These premium ingredients, along with strict regulatory requirements for health claims and food safety, make diabetic-friendly products more expensive than conventional alternatives, limiting their affordability for a large segment of consumers

- Higher production costs also pose a challenge for small and mid-sized food manufacturers, as they struggle to compete with larger players who have more resources for research, development, and bulk ingredient sourcing

For instance,

- In October 2023, a report by the Food and Agriculture Organization (FAO) highlighted that the cost of natural sweeteners such as monk fruit and stevia is nearly three times higher than refined sugar, making it difficult for manufacturers to offer diabetic-friendly products at competitive prices. This cost disparity restricts widespread adoption, particularly in price-sensitive markets

- The high production costs of diabetic-friendly foods remain a major barrier to market expansion, limiting affordability and accessibility, especially in price-sensitive regions

Diabetic Food Market Scope

The market is segmented on the basis product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Distribution Channel |

|

|

By End User |

|

Diabetic Food Market Regional Analysis

“North America is the Dominant Region in the Diabetic Food Market”

- North America leads the diabetic food market, driven by a high prevalence of diabetes, strong consumer awareness, and an advanced food industry focused on health-oriented innovations

- The U.S. holds a significant share due to increasing demand for low-glycemic, sugar-free, and functional food products, along with government initiatives promoting healthier diets

- The presence of major food manufacturers, continuous product innovation, and well-established regulatory guidelines for diabetic-friendly labeling contribute to market leadership

- In addition to above, the growing preference for plant-based, keto-friendly, and functional foods with blood sugar management benefits continues to drive market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth in the diabetic food market, fueled by rising diabetes cases, increasing health consciousness, and improving dietary habits

- Countries such as India, China, and Japan are key markets due to their large diabetic populations and growing demand for specialized food products catering to blood sugar management

- Japan leads in the development of functional and low-glycemic food innovations, with a strong market for sugar alternatives and diabetic-friendly beverages

- In China and India, rapid urbanization, changing lifestyles, and government-driven health initiatives are encouraging the adoption of diabetic-friendly diets. The expansion of local and international food manufacturers further strengthens the market’s growth potential in the region

Diabetic Food Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nestlé (Switzerland)

- Unilever (U.K)

- THE COCA-COLA COMPANY (U.S.)

- PepsiCo Inc (U.S.)

- Kellogg NA Co. (U.S.)

- Fifty50 Foods, LP. (U.S.)

- Mondelēz International (U.S.)

- Mondelez United Kingdom (U.K.)

- Zen Health Japan (Japan)

- Anhui Elite Industrial Co., Ltd (China)

- Mars Incorporated (U.S.)

- Newtrition Plus Health & Wellness Pvt. Ltd. (India)

- SoSweet (India)

- Britannia Industries (India)

- Dabur (India)

Latest Developments in Global Diabetic Food Market

- In December 2024, Conagra Brands introduced a "GLP-1 Friendly" badge on 26 items in its Healthy Choice frozen meal line. This initiative aims to cater to the dietary needs of individuals using GLP-1 weight-loss drugs like Ozempic and Wegovy, which are prevalent among nearly 15 million U.S. adults managing diabetes and seeking weight loss solutions

- In November 2019, Dr. Reddy's Laboratories decided to enter in the developing industry of nutrients with the recent product launch “Celevida”. This product is proven and tested clinically to help in managing the blood cholesterols and is enriched with fiber and proteins in ample amount. Diabetes is surging as one of the chronic diseases in the recent past in India, region of Asia-Pacific (APAC). With above 75 million sufferers solely in India, Dr. Reddy's is all set to offer the helping hand by its product Celevida

- In May 2019, Whole Biome announced the launch its diabetic food product in 2020. The company later rebranded as Pendulum Co. and specialized in manufacturing medical food products, particularly for individuals with diabetes. As a trusted name in the microbiome industry, Pendulum Co. made significant expansion plans, investing USD 35 million to develop microbial solutions targeting gut microbiome deficiencies in diabetics

- In January 2024, A new service called 'Diabetic Corner' was introduced by Shwapno, one of the largest retail chains in Bangladesh, with the aim of providing consumers with additional facilities and increasing public awareness of diabetes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Diabetic Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diabetic Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diabetic Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.