Global Dialysis Access Treatment Devices Market

Market Size in USD Million

CAGR :

%

USD

549.83 Million

USD

826.69 Million

2025

2033

USD

549.83 Million

USD

826.69 Million

2025

2033

| 2026 –2033 | |

| USD 549.83 Million | |

| USD 826.69 Million | |

|

|

|

|

Dialysis Access Treatment Devices Market Size

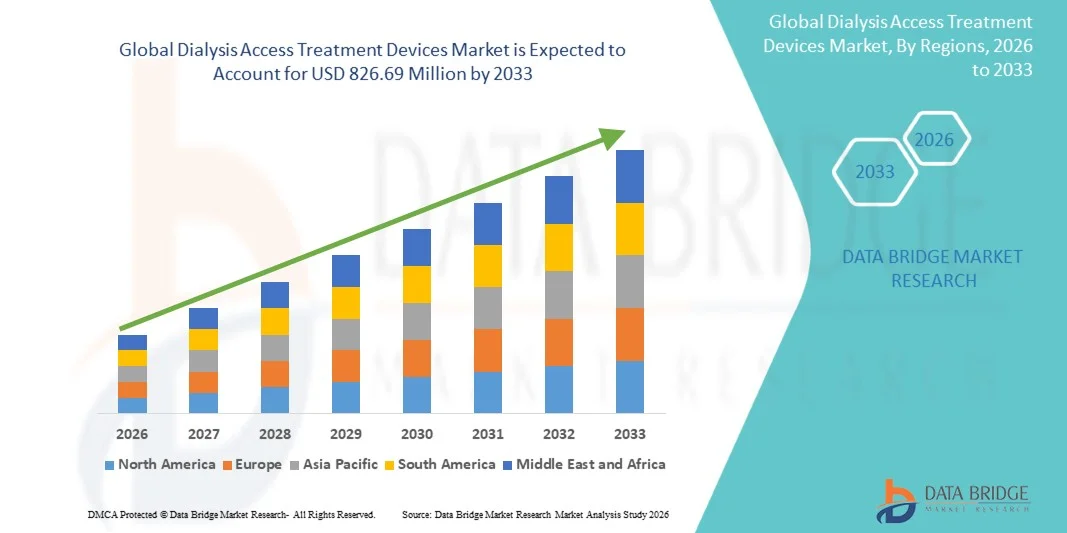

- The global dialysis access treatment devices market size was valued at USD 549.83 million in 2025 and is expected to reach USD 826.69 million by 2033, at a CAGR of 5.23% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), which continues to push the demand for reliable and advanced vascular access solutions for long-term dialysis therapy

- In addition, continuous innovation in minimally invasive devices, rising preference for device-based interventions over surgical procedures, and the growing need for durable, infection-resistant access options are strengthening the market. These combined factors are accelerating global adoption of dialysis access treatment devices and significantly enhancing market expansion

Dialysis Access Treatment Devices Market Analysis

- Dialysis access treatment devices, used to establish and maintain functional vascular access for hemodialysis and peritoneal dialysis, are becoming increasingly critical as global CKD and ESRD prevalence rises, with growing reliance on reliable access solutions that support long-term and repeated treatment sessions across diverse care settings

- The escalating demand for these devices is primarily driven by the expanding dialysis population, increasing incidence of access-related complications, and a strong shift toward minimally invasive interventions that improve patient outcomes, reduce infection risks, and extend access longevity

- North America dominated the dialysis access treatment devices market with the largest revenue share of 38.7% in 2025, supported by high ESRD burden, advanced dialysis infrastructure, and widespread adoption of innovative access maintenance technologies, with the U.S. witnessing strong growth due to increasing demand for durable access options and device-based interventions

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rising ESRD cases, improving healthcare capabilities, growing adoption of home-based dialysis, and increasing government initiatives aimed at expanding dialysis accessibility

- The Hemodialysis segment dominated the dialysis access treatment devices market with a 62.5% share in 2025, driven by its high utilization rate worldwide, strong clinical preference, and continued technological advancements supporting efficient blood purification and sustained vascular access performance

Report Scope and Dialysis Access Treatment Devices Market Segmentation

|

Attributes |

Dialysis Access Treatment Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dialysis Access Treatment Devices Market Trends

“Rising Shift Toward Minimally Invasive and Image-Guided Access Interventions”

- A significant and accelerating trend in the global dialysis access treatment devices market is the rapid shift toward minimally invasive, image-guided procedures such as angioplasty, thrombectomy, and catheter-based interventions to enhance access durability and reduce complications in both hemodialysis and peritoneal dialysis patients

- For instance, brands such as BD and Medtronic offer advanced endovascular solutions including high-pressure balloons and thrombectomy systems that support rapid restoration of vascular access with reduced procedure time and improved patient outcomes

- AI-supported imaging tools in access interventions are enabling improved diagnosis of stenosis, optimized balloon sizing, and better prediction of access failure risks. For instance, emerging platforms are being designed to evaluate flow patterns and detect access dysfunction earlier, supporting proactive clinical decision-making

- The seamless integration of image-guided devices with digital treatment planning software is allowing clinicians to perform access interventions with higher accuracy, predictable results, and lower complication rates, transforming vascular access management

- This trend toward more precise, efficient, and technology-enabled access treatment solutions is reshaping expectations for dialysis care quality and long-term access survival, encouraging industry players to introduce advanced endovascular tools tailored for fragile patient populations

- The demand for minimally invasive, imaging-enabled dialysis access treatment devices is accelerating across both hospital and outpatient dialysis centers, as providers increasingly prioritize faster recovery, reduced hospitalization, and sustained access functionality

Dialysis Access Treatment Devices Market Dynamics

Driver

“Growing Need Due to Surging CKD/ESRD Burden and Expansion of Dialysis Services”

- The rising global burden of chronic kidney disease (CKD) and end-stage renal disease (ESRD), combined with the expanding availability of dialysis services, is a major driver accelerating the demand for dialysis access treatment devices

- For instance, in 2025, BD announced advancements in its endovascular portfolio to support improved treatment of vascular stenosis in dialysis patients, with solutions aimed at enhancing patency and long-term access performance

- As dialysis dependence increases, the need for reliable access maintenance devices—such as angioplasty balloons, catheters, and thrombectomy systems continues to rise, supporting safer and more effective hemodialysis sessions

- Furthermore, the expansion of dialysis networks and the growing adoption of organized renal care models are making advanced access treatment devices integral to improving patient management and treatment efficiency

- The convenience of outpatient access interventions, reduced need for open surgery, and growing clinical preference for rapid device-based solutions are driving widespread utilization of these technologies across both developed and emerging markets

- The growing adoption of home hemodialysis and the rising emphasis on reducing access failure rates further contribute to the surging demand for innovative dialysis access treatment devices globally

Restraint/Challenge

“Infection Risks and Stringent Regulatory Compliance Requirements”

- Persistent concerns regarding infection risks, catheter-related bloodstream infections (CRBSIs), and complications associated with vascular access devices present major challenges to broader market expansion

- For instance, high-profile reports highlighting infection outbreaks in dialysis facilities have heightened caution among providers regarding device selection, sterilization practices, and long-term catheter usage

- Addressing these infection risks through antimicrobial coatings, improved catheter designs, and strict post-procedure protocols is essential for maintaining patient safety and reducing treatment complications. Companies such as Medtronic and Nipro emphasize their advanced design and safety features to mitigate infection concerns

- In addition, stringent regulatory requirements for vascular access devices including safety validation, biocompatibility testing, and long-term performance evaluation can slow product approvals and delay market entry for new technologies

- While innovation continues, the need for compliance with multiple international regulatory frameworks increases development costs and timelines, posing challenges for smaller manufacturers

- Overcoming these barriers through enhanced device safety, robust infection-prevention technologies, and improved regulatory navigation strategies will be crucial for supporting sustained market growth

Dialysis Access Treatment Devices Market Scope

The market is segmented on the basis of treatment, types of dialysis membrane, renal products, disease condition, end user, and application.

- By Treatment

On the basis of treatment, the market is segmented into home hemodialysis, hemodialysis, and peritoneal dialysis. The hemodialysis segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its widespread global adoption and long-standing clinical reliability. Hemodialysis remains the preferred therapy for ESRD patients due to extensive hospital infrastructure and experienced nephrology care teams. The prevalence of diabetes, hypertension, and aging populations continues to expand the eligible patient pool for conventional in-center hemodialysis. Continuous innovation in access catheters, antimicrobial coatings, and biocompatible materials further strengthens segment leadership. Reimbursement support in developed markets also stabilizes procedure volume. These factors collectively reinforce hemodialysis as the largest treatment category.

The home hemodialysis segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing patient preference for home-based care and flexibility in therapy schedules. Advancements in compact and portable machines have significantly reduced operational complexity, enabling safe home use. Healthcare systems are increasingly promoting home modalities to reduce treatment costs and improve patient quality of life. Remote monitoring technologies and virtual training programs have lowered barriers for patient onboarding. The rise in decentralized care models post-COVID has accelerated adoption of home treatments. These factors position home hemodialysis as the fastest-growing treatment segment.

- By Types of Dialysis Membrane

On the basis of membrane type, the market is segmented into synthetic high-flux membranes and unmodified cellulose low-flux membranes. The synthetic high-flux membranes segment dominated the market with the largest share in 2025, supported by their superior clearance of middle-molecule toxins and improved patient outcomes. High-flux technologies are widely preferred in advanced renal care centers, particularly in Europe, Japan, and North America. Research consistently shows improved survival rates and reduced inflammation with high-flux membranes, driving clinical preference. Manufacturers continue to invest in polysulfone and polyethersulfone-based membranes to enhance biocompatibility. The segment also benefits from the growing use of hemodiafiltration systems. These advantages make synthetic high-flux membranes the leading category.

The unmodified cellulose low-flux membranes segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by strong demand in cost-sensitive and developing regions. Low-flux membranes remain a practical choice for centers with limited budgets and basic dialysis infrastructure. The segment benefits from high-volume procurement by public health systems across South Asia, Africa, and Latin America. Improvements in cellulose processing and sterilization have enhanced usability and supply chain reliability. Growing expansion of dialysis services in rural regions also supports demand. These drivers collectively position low-flux membranes as the fastest-growing membrane category.

- By Renal Products

On the basis of renal product type, the market is segmented into blood tubing set and accessories, dialysis machine, hemofilter, endotoxin retention filter, dialyzer, and arterial venous products. The dialyzer segment dominated the market with the largest revenue share in 2025, owing to its role as the essential and most frequently replaced component in all hemodialysis sessions. Dialyzers account for high recurring consumption, creating a stable and large demand base. Manufacturers are continually improving membrane permeability, sterilization methods, and patient biocompatibility, strengthening segment preference. Dialyzers are used across chronic and acute dialysis, supporting high utilization levels. Growing adoption of high-flux dialyzers further supports revenue growth. These combined factors establish dialyzers as the dominant renal product category.

The dialysis machine segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by global investments in dialysis center expansion and modernization. New-generation machines incorporate advanced automation, ultrafiltration control, and real-time patient monitoring, enhancing treatment safety and efficiency. Demand for compact and portable systems is rising with increased adoption of home hemodialysis. Governments across Asia-Pacific and Middle Eastern regions are upgrading renal infrastructure, boosting machine procurement. Integration of digital connectivity and cloud-based analytics further accelerates uptake. These factors make dialysis machines the fastest-growing product category.

- By Disease Condition

On the basis of disease condition, the market is segmented into acute and chronic. The chronic segment dominated the market with the largest share in 2025, primarily due to the rising global incidence of chronic kidney disease (CKD) and long-term progression to ESRD. Patients with chronic renal failure require continuous dialysis for years, generating stable, high-volume demand for vascular access devices. Aging demographics, lifestyle diseases, and higher survival rates of CKD patients further expand the chronic patient population. Chronic dialysis services are well-established in major healthcare systems, supporting consistent access device usage. Long-term treatment cycles also amplify recurring supply demand. These trends reinforce chronic conditions as the dominant segment.

The acute segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the increasing incidence of acute kidney injury (AKI) in intensive care units. Critical conditions such as sepsis, multi-organ failure, and trauma elevate demand for short-term dialysis access. CRRT (continuous renal replacement therapy) adoption is rising in developed and emerging markets, boosting the need for temporary access catheters. Hospitals are expanding ICU capacity and modernizing equipment following global health system upgrades post-pandemic. Early AKI detection and intervention programs are also increasing treatment volume. These factors support the segment's rapid growth.

- By End User

On the basis of end user, the market is segmented into hospitals, home care settings, research laboratories, dialysis centers, and clinics. The dialysis centers segment dominated the market with the largest revenue share in 2025, as these facilities conduct the highest number of dialysis sessions globally. Dedicated dialysis chains maintain continuous procurement cycles for consumables and access devices. Their specialized infrastructure enables efficient, high-volume treatment workflows. Large service providers continue to expand their network footprint, particularly in Asia-Pacific and the Middle East. Stable reimbursement structures in developed markets further support in-center dialysis preference. These dynamics establish dialysis centers as the leading end-user segment.

The home care settings segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption of home-based hemodialysis and peritoneal dialysis. Patients increasingly prefer home modalities for convenience, autonomy, and reduced infection exposure. Advances in portable dialysis machines and safer vascular access devices have improved patient confidence in home treatments. Tele-nephrology platforms and remote monitoring tools support clinical oversight. Government and insurance incentives promoting home care significantly boost transition rates. These factors position home care as the fastest-growing end-user category.

- By Application

On the basis of application, the market is segmented into serum and blood treatment, virus purification, salt removal, drug binding studies, buffer exchange, and other applications. The serum and blood treatment segment dominated the market with the largest share in 2025, as it encompasses the core therapeutic function of dialysis—removal of toxins and fluid regulation. This application demands the highest quantity of access devices, dialyzers, and bloodline sets. The growing global dialysis patient population ensures consistent and recurring product utilization. Advances in high-efficiency membranes and filtration technologies further enhance clinical outcomes, strengthening segment leadership. Healthcare providers prioritize blood purification performance, reinforcing procurement needs. These factors secure dominance for serum and blood treatment applications.

The virus purification segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing deployment of advanced ultrafiltration and nanofiltration membranes in medical and bioprocessing workflows. Biopharmaceutical manufacturing and cell therapy development rely heavily on viral clearance systems, stimulating demand. Post-pandemic biosafety standards have accelerated investments in virus removal technologies across healthcare and research facilities. Rising R&D funding in biologics and vaccine production further contributes to market expansion. Innovations in high-selectivity membranes enhance performance in viral clearance applications. These trends support rapid growth in the virus purification segment.

Dialysis Access Treatment Devices Market Regional Analysis

- North America dominated the dialysis access treatment devices market with the largest revenue share of 38.7% in 2025, supported by high ESRD burden, advanced dialysis infrastructure, and widespread adoption of innovative access maintenance technologies, with the U.S. witnessing strong growth due to increasing demand for durable access options and device-based interventions

- Patients and healthcare providers in the region strongly prefer reliable, high-quality vascular access devices that support consistent treatment outcomes, and this demand is reinforced by well-established dialysis networks and leading nephrology care infrastructure

- The regional market is further supported by favorable reimbursement policies, a growing ESRD patient population, and continuous innovation in catheter materials and dialyzer technologies, positioning North America as a key hub for both treatment volume and technological advancement within the global dialysis access landscape

U.S. Dialysis Access Treatment Devices Market Insight

The U.S. dialysis access treatment devices market captured the largest revenue share within North America in 2025, driven by the country’s large ESRD population and its advanced clinical infrastructure for both hemodialysis and peritoneal dialysis. Providers increasingly seek reliable, durable access solutions that minimize complications and support efficient patient throughput. The rising adoption of image-guided access interventions, along with high demand for endovascular treatment tools, further propels the market. In addition, strong investment in technological innovation and the rapid expansion of outpatient dialysis centers contribute to robust market growth.

Europe Dialysis Access Treatment Devices Market Insight

The Europe dialysis access treatment devices market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing incidence of CKD and growing emphasis on improving vascular access outcomes. The region’s focus on stringent clinical standards, infection control, and the adoption of advanced access devices is fostering steady growth. European healthcare systems are actively investing in minimally invasive access maintenance technologies, promoting improved treatment efficiency. In addition, rising awareness of early access intervention and expanding dialysis infrastructure across both Western and Eastern Europe are contributing to the market’s expansion.

U.K. Dialysis Access Treatment Devices Market Insight

The U.K. dialysis access treatment devices market is anticipated to grow at a noteworthy CAGR, propelled by rising CKD prevalence and the increasing adoption of advanced treatment devices to enhance vascular access durability. Concerns regarding access failure, infection, and treatment delays are encouraging hospitals and dialysis centers to choose high-performance devices for both creation and maintenance of access. The U.K.’s commitment to improving kidney care through modern clinical protocols and digital health integration is expected to stimulate market growth. Growing investments in outpatient dialysis facilities further support adoption of new access technologies.

Germany Dialysis Access Treatment Devices Market Insight

The Germany dialysis access treatment devices market is expected to expand at a considerable CAGR, fueled by rising demand for state-of-the-art renal care solutions and growing emphasis on improving vascular access outcomes. Germany’s strong medical infrastructure and commitment to technological innovation support the uptake of advanced catheters, dialyzers, and endovascular access maintenance devices. Increasing preference for minimally invasive interventions aligns with the country’s focus on patient comfort, safety, and efficiency. The adoption of high-quality vascular access solutions in both public and private healthcare settings is steadily growing.

Asia-Pacific Dialysis Access Treatment Devices Market Insight

The Asia-Pacific dialysis access treatment devices market is poised to grow at the fastest CAGR during the forecast period, driven by the rapid rise in CKD and ESRD cases and expanding access to renal care across China, Japan, and India. Increasing healthcare investments and improvements in dialysis infrastructure are driving adoption of modern access maintenance technologies. The region’s growing shift toward minimally invasive procedures is also supporting market growth. Furthermore, manufacturing advantages and increasing availability of cost-effective devices are expanding accessibility for a broad patient base across APAC.

Japan Dialysis Access Treatment Devices Market Insight

The Japan dialysis access treatment devices market is gaining momentum due to the country’s advanced healthcare ecosystem, high dialysis penetration rate, and demand for precision treatment solutions. Japanese healthcare providers emphasize reliability, safety, and long-term patency in vascular access, driving the adoption of technologically advanced devices. Increasing integration of image-guided interventions and digital monitoring tools is further supporting market growth. As Japan continues to manage a large elderly population with ESRD, the demand for efficient and minimally invasive access treatments is expected to rise significantly.

India Dialysis Access Treatment Devices Market Insight

The India dialysis access treatment devices market accounted for the largest share in Asia-Pacific in 2025, driven by rapid urbanization, a growing CKD patient base, and significant expansion of dialysis service providers. The country’s increasing adoption of both hemodialysis and peritoneal dialysis is fueling demand for reliable vascular access solutions. Rising healthcare investments, government-backed dialysis programs, and the presence of local device manufacturers are further propelling market growth. The growing focus on affordable access maintenance technologies and the expansion of low-cost dialysis centers continue to shape the market in India.

Dialysis Access Treatment Devices Market Share

The Dialysis Access Treatment Devices industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- AngioDynamics, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- Cook (U.S.)

- NxStage Medical, Inc. (U.S.)

- Asahi Kasei Medical Co., Ltd. (Japan)

- NIPRO CORPORATION (Japan)

- B. Braun SE (Germany)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- Rockwell Medical, (U.S.)

- Kawasumi Laboratories, Inc. (Japan)

- GIA Medical (U.S.)

- DaVita Inc. (U.S.)

- Diaverum (Sweden)

- Henry Schein, Inc. (U.S.)

- JMS Co., Ltd. (Japan)

- Quanta Dialysis Technologies (U.K.)

- CVS Health (U.S.)

- Covestro AG (Germany)

What are the Recent Developments in Global Dialysis Access Treatment Devices Market?

- In November 2025, Humacyte presented positive two-year results from its Phase 3 trial of the ATEV (Acellular Tissue Engineered Vessel), demonstrating superior functional patency versus autogenous fistula in female, obese, and diabetic patients a key advance that could reduce reliance on catheters and improve vascular access outcomes for high-risk hemodialysis populations

- In September 2025, PatenSee received U.S. Food and Drug Administration (FDA) Breakthrough Device Designation for its non-contact vascular access (VA) management system for hemodialysis patients an AI-driven optical platform intended to monitor access sites without touch, enabling early detection of stenosis and streamlining vascular access care

- In May 2025, Phraxis announced FDA approval of its EndoForce Connector for endovascular venous anastomosis a novel implant that simplifies creation of arteriovenous grafts (AVGs) by eliminating the need for surgical venous dissection, promising reduced tissue trauma and improved long-term graft performance

- In January 2024, VasQ External Vascular Support (developed by Laminate Medical Technologies) was implanted for the first time in the United States following its FDA De Novo clearance marking a significant milestone for a device designed to support arteriovenous fistulas (AVFs) from the moment of creation, potentially improving fistula success and longevity

- In June 2023, Merit Medical Systems announced acquisition of a major dialysis catheter portfolio including central venous access catheters and the Surfacer Inside-Out Access Catheter System from AngioDynamics and Bluegrass Vascular Technologies, expanding its catheter-based access solutions for dialysis and related therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.