Global Dialysis Machines Market

Market Size in USD Billion

CAGR :

%

USD

18.48 Billion

USD

26.48 Billion

2024

2032

USD

18.48 Billion

USD

26.48 Billion

2024

2032

| 2025 –2032 | |

| USD 18.48 Billion | |

| USD 26.48 Billion | |

|

|

|

|

Dialysis Machines Market Size

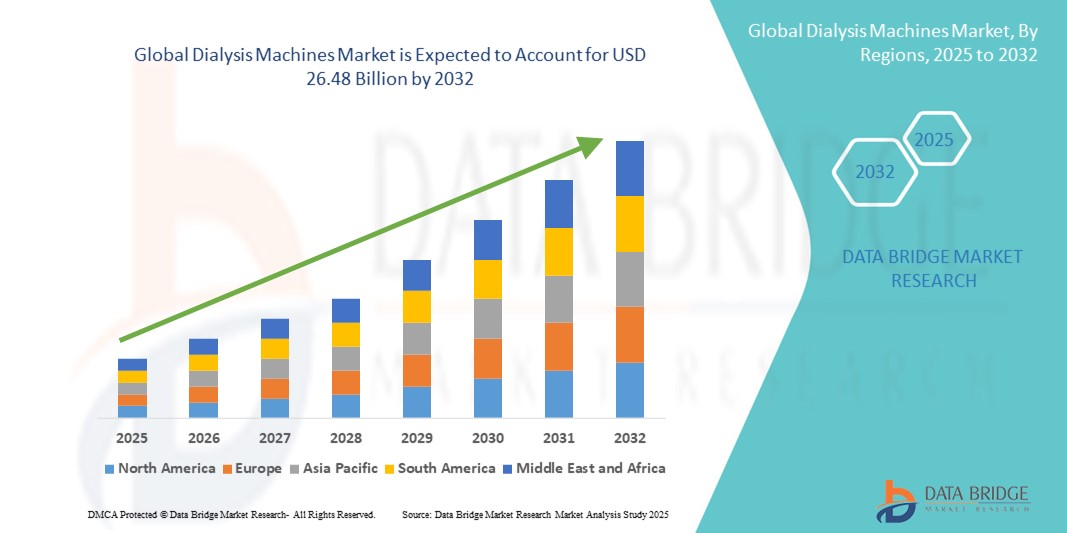

- The global dialysis machines market size was valued at USD 18.48 billion in 2024 and is expected to reach USD 26.48 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic kidney diseases and the rising adoption of home-based dialysis therapies, leading to higher demand for advanced dialysis machines in both clinical and residential settings

- Furthermore, growing patient preference for minimally invasive and personalized treatment options is establishing dialysis machines as essential components in renal care management. These converging factors are accelerating the uptake of dialysis machines, thereby significantly boosting the industry's growth

Dialysis Machines Market Analysis

- Dialysis machines, essential for renal replacement therapy in patients with chronic kidney disease (CKD) and acute kidney injury (AKI), are increasingly critical components in hospital and home healthcare settings due to advancements in automation, real-time monitoring, and user-friendly interfaces

- The escalating demand for dialysis machines is primarily fueled by the rising prevalence of chronic kidney diseases, increasing geriatric population, and growing adoption of home-based dialysis therapies, driving the need for advanced and efficient dialysis solutions

- North America dominated the dialysis machines market with the largest revenue share of 41.5% in 2024, supported by advanced healthcare infrastructure, high disease burden, and widespread insurance coverage, with the U.S. showing strong growth in home hemodialysis and peritoneal dialysis adoption, led by key players such as Baxter International, Fresenius Medical Care, and Nipro Corporation

- Asia-Pacific is expected to be the fastest-growing region in the dialysis machines market during the forecast period due to increasing incidence of chronic kidney disease, rising healthcare expenditure, and growing awareness of home dialysis options

- Conventional Hemodialysis segment dominated the dialysis machines market with a market share of 69.12% in 2024, driven by its established clinical protocols, wide availability in dialysis centers, and strong physician and patient familiarity

Report Scope and Dialysis Machines Market Segmentation

|

Attributes |

Dialysis Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dialysis Machines Market Trends

Advancements in Home-Based and Portable Dialysis Solutions

- A key and accelerating trend in the global dialysis machines market is the development of compact, user-friendly, and home-based dialysis systems, enabling patients to manage treatment with greater convenience and flexibility outside hospital settings

- For instance, Baxter’s HomeChoice Claria system and Fresenius’ 4008S Hemodialysis machine with remote monitoring capabilities allow patients to perform dialysis at home while clinicians can track treatment parameters in real time

- Integration of IoT and digital health technologies in dialysis machines enables features such as automated treatment adjustments, predictive maintenance, and alerts for anomalies in patient health metrics. Some NxStage models utilize connected platforms to provide real-time feedback and treatment optimization, enhancing patient safety

- The adoption of portable and wearable dialysis devices is further promoting decentralized care, reducing hospital visits, and improving quality of life for patients with chronic kidney disease (CKD) and acute kidney injury (AKI)

- This trend towards smarter, connected, and home-capable dialysis systems is reshaping patient expectations and driving innovation, with companies such as Nipro and B. Braun focusing on devices that support remote monitoring, telehealth integration, and patient-centric operation

- The demand for flexible, connected, and home-compatible dialysis machines is growing rapidly across both developed and emerging markets as healthcare providers seek to reduce hospital burden while enhancing patient convenience and adherence to treatment protocols

Dialysis Machines Market Dynamics

Driver

Increasing Prevalence of CKD and Rising Demand for Renal Replacement Therapy

- The rising incidence of chronic kidney disease and end-stage renal disease worldwide, coupled with an aging population, is a major driver for the heightened demand for dialysis machines

- For instance, in 2024, Fresenius Medical Care expanded its home dialysis programs in the U.S. and Europe, highlighting the push to meet growing patient needs through advanced and user-friendly dialysis systems

- Dialysis machines provide essential support for patients requiring hemodialysis or peritoneal dialysis, offering life-saving treatment while reducing complications and hospital dependency

- The increasing availability of home-based dialysis options, combined with advancements in machine automation, real-time monitoring, and remote connectivity, is encouraging wider adoption among patients and healthcare providers

- The global focus on improving patient outcomes, reducing healthcare costs, and expanding treatment accessibility is driving sustained growth for dialysis machines in hospitals, clinics, and home care settings

Restraint/Challenge

High Cost and Infrastructure Limitations in Emerging Markets

- The relatively high cost of advanced dialysis machines and consumables, along with the need for trained personnel and supportive infrastructure, poses challenges to broader adoption, particularly in developing regions

- For instance, although compact and home-use devices are increasing in availability, the upfront investment and recurring maintenance costs can limit access for lower-income populations

- In addition, regulatory requirements, quality certifications, and local healthcare policies vary across countries, creating hurdles for manufacturers seeking to expand into new markets

- While innovations such as portable and automated systems aim to reduce operational complexity, inadequate infrastructure for water treatment and electricity supply in some regions can hinder market penetration

- Overcoming these challenges through cost-effective solutions, infrastructure development, training programs, and supportive government policies will be critical for achieving sustainable growth in the global dialysis machines market

Dialysis Machines Market Scope

The market is segmented on the basis of hemodialysis, peritoneal dialysis, equipment, consumables, disease type, and end user.

- By Hemodialysis Type

On the basis of hemodialysis type, the dialysis machines market is segmented into conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis. The conventional hemodialysis segment dominated the market with the largest market revenue share of 69.12% in 2024, driven by its established clinical protocols, widespread availability, and proven treatment outcomes for end-stage renal disease patients. It is typically performed in specialized centers, providing predictable and safe results. Patients prefer conventional hemodialysis due to its familiarity and integration with hospital monitoring systems. The segment also benefits from extensive maintenance networks for dialysis machines and availability of compatible consumables such as dialyzers and catheters. Hospitals and clinics continue to invest in advanced conventional machines with better filtration efficiency and patient comfort features. Its compatibility with existing healthcare infrastructure reinforces its market leadership.

The nocturnal hemodialysis segment is anticipated to witness the fastest growth during forecast period, driven by the rising adoption of home-based overnight treatments offering extended dialysis sessions. These sessions improve toxin clearance and cardiovascular outcomes. Portable and user-friendly dialysis machines enable safe home use with remote monitoring by clinicians. Patients prefer nocturnal dialysis for greater daytime flexibility and improved quality of life. Manufacturers are developing automated devices with smart monitoring features. Awareness of clinical benefits and increasing support for home dialysis programs further propel this growth.

- By Peritoneal Dialysis Type

On the basis of peritoneal dialysis type, the dialysis machines market is segmented into continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD). CAPD held the largest share in 2024 due to its simplicity and suitability for home use, allowing patients to perform multiple manual fluid exchanges during the day. It provides independence from hospital visits and flexibility in daily routines. CAPD is cost-effective and widely accessible, especially in emerging markets. Training programs for patients and caregivers support safe usage and adherence. Healthcare providers favor CAPD for chronic kidney disease management because of its predictable outcomes. Longstanding market presence and patient familiarity strengthen CAPD adoption.

APD is expected to witness the fastest growth during forecast period, driven by cycler machines performing overnight dialysis automatically. This reduces patient effort, improves adherence, and ensures consistent fluid and toxin removal. Integration with remote monitoring and smart features enhances patient safety. APD appeals to active patients seeking minimal daytime disruption. Compact, user-friendly cyclers facilitate home adoption. Rising awareness, technological innovation, and favorable reimbursement policies in developed regions drive its adoption.

- By Equipment Type

On the basis of equipment type, the dialysis machines market is segmented into dialysis machines, water treatment systems, and others. Dialysis machines accounted for the largest share in 2024, as they are essential for both hemodialysis and peritoneal dialysis. Advanced designs with improved filtration, user-friendly interfaces, and automated monitoring enhance treatment efficiency. Hospitals and clinics rely on these machines for safe, high-volume treatment. Compatibility with diverse consumables further boosts adoption. Continuous R&D ensures regulatory compliance and safety standards. Strong service networks of established manufacturers reinforce dominance.

Water treatment systems are expected to witness the fastest growth during forecast period, due to the critical role of high-purity water in dialysis procedures. Home dialysis adoption, stricter quality standards, and hospital accreditation requirements drive demand. Modular, automated, and energy-efficient systems are increasingly preferred. Manufacturers are innovating to improve system reliability and reduce maintenance. Compliance with regulatory standards ensures patient safety and treatment efficacy. Expansion of home dialysis programs further fuels market growth.

- By Consumables Type

On the basis of consumables type, the dialysis machines market is segmented into dialyzers, catheters, and others. Dialyzers dominated the consumables market in 2024 due to their essential role in filtering waste and excess fluids from the blood. Advanced membranes with high biocompatibility and filtration efficiency improve patient outcomes. Dialyzers are compatible with most hemodialysis machines, facilitating widespread adoption. Rising CKD prevalence drives steady demand. Hospitals and home care settings rely on high-performance dialyzers for effective treatment. Continuous innovation in materials and design reinforces market leadership.

Catheters are expected to witness rapid growth during forecast period, due to increased use in both hemodialysis and peritoneal dialysis. They provide essential vascular or peritoneal access. Home dialysis adoption and minimally invasive procedures contribute to higher demand. Advanced designs with anti-infection coatings and ergonomic features enhance safety and usability. Hospitals and clinics favor high-quality catheters for better patient outcomes. Manufacturers focus on durability, biocompatibility, and ease of use to capture market growth.

- By Disease Type

On the basis of disease type, the dialysis machines market is segmented into chronic and acute. Chronic segment accounted for 81.4% of the market in 2024, driven by rising diabetes and hypertension prevalence. Long-term dialysis needs create consistent demand for machines and consumables. Hospitals and home care providers invest in infrastructure to support CKD patients. Early diagnosis and improved management protocols increase patient survival, expanding treatment volumes. Technological advancements improve patient adherence and clinical outcomes. Favorable reimbursement policies reinforce market dominance.

Acute segment is projected to grow at a CAGR of 6.8% during forecast period, due to increasing incidence in critical care and hospital settings. Rapid initiation of dialysis is essential, driving demand for portable and emergency-ready machines. Consumables such as catheters and dialyzers are in high demand for acute cases. Technological improvements enable timely, safe treatment with remote monitoring. Expansion of ICU facilities and early diagnosis boost adoption. The urgent need for dialysis in acute cases accelerates market growth.

- By End User

On the basis of end user, the dialysis machines market is segmented into hospitals, clinics, ambulatory surgical centers, and home care settings. Hospitals led the market with a revenue share of 42.7% in 2024, providing comprehensive dialysis services including emergency, chronic, and specialized care. Hospitals offer access to advanced machines, skilled professionals, and monitoring systems. Large patient volumes and complex cases require reliable dialysis infrastructure. Continuous investment in water treatment and equipment supports market dominance. Integration of new technologies and adherence to regulatory standards further reinforce hospital share. Hospitals remain the primary care setting for both CKD and AKI patients.

Home care settings are projected to witness the fastest CAGR of 8.4% during forecast period, due to the increasing preference for home-based dialysis. Portable, user-friendly machines and remote monitoring solutions enable safe, convenient treatment. Home dialysis reduces hospital visits and associated costs, improving patient quality of life. Manufacturers focus on compact, automated devices designed for home use. Telehealth support and patient training facilitate adoption. Regulatory and reimbursement initiatives in key regions further accelerate growth.

Dialysis Machines Market Regional Analysis

- North America dominated the dialysis machines market with the largest revenue share of 41.5% in 2024, supported by advanced healthcare infrastructure, high disease burden, and widespread insurance coverage

- Patients and healthcare providers in the region benefit from easy access to modern dialysis centers, advanced equipment, and a wide range of consumables, ensuring effective and safe treatment outcomes

- The market growth is further supported by high healthcare expenditure, strong reimbursement policies, and increasing awareness about home-based dialysis options, making dialysis machines a preferred choice for both hospitals and home care settings

U.S. Dialysis Machines Market Insight

The U.S. dialysis machines market captured the largest revenue share of 80.5% in North America in 2024, driven by the high prevalence of chronic kidney disease and well-established healthcare infrastructure. Hospitals and home care providers are increasingly adopting advanced hemodialysis and peritoneal dialysis systems, improving treatment efficiency and patient outcomes. The growing preference for home dialysis solutions, combined with telemonitoring and automated systems, further propels market growth. Increasing awareness of early-stage CKD management, along with strong reimbursement policies, supports higher adoption rates. Technological advancements, such as portable dialysis machines and smart monitoring, are also expanding treatment options.

Europe Dialysis Machines Market Insight

The Europe dialysis machines market is projected to expand at a substantial CAGR during the forecast period, driven by rising CKD prevalence and stringent healthcare regulations. Investments in modern healthcare infrastructure and the growing adoption of advanced dialysis technologies are fostering market growth. Countries in Europe are increasingly promoting home-based dialysis programs, enhancing patient convenience and reducing hospital dependency. Technological innovations, including automated and portable dialysis machines, support this trend. The market is witnessing increased adoption in hospitals, clinics, and home care settings. Favorable government initiatives and reimbursement schemes further accelerate adoption.

U.K. Dialysis Machines Market Insight

The U.K. dialysis machines market is anticipated to grow at a noteworthy CAGR, fueled by increasing demand for advanced hemodialysis and peritoneal dialysis treatments. Rising CKD prevalence and growing awareness about early intervention are encouraging both hospitals and home care providers to adopt modern machines. The trend toward home dialysis solutions is supported by telehealth monitoring and automated devices. The healthcare system’s focus on patient-centric care and reduced hospital stays contributes to market expansion. Technological integration, including smart monitoring systems, enhances treatment safety and efficiency. Government funding and reimbursement policies further stimulate market growth.

Germany Dialysis Machines Market Insight

The Germany dialysis machines market is expected to expand at a considerable CAGR during the forecast period, driven by rising awareness of kidney health and demand for technologically advanced dialysis solutions. Hospitals and specialty clinics are increasingly investing in high-efficiency hemodialysis machines and peritoneal dialysis cyclers. Adoption of home dialysis programs is rising due to patient convenience and cost-effectiveness. Germany’s well-developed healthcare infrastructure and emphasis on innovation support market growth. Integration with smart monitoring and patient management systems enhances treatment outcomes. Strong regulatory support ensures safety and compliance, further boosting adoption.

Asia-Pacific Dialysis Machines Market Insight

The Asia-Pacific dialysis machines market is poised to grow at the fastest CAGR of 23.8% during the forecast period of 2025 to 2032, driven by increasing CKD prevalence, rapid urbanization, and rising healthcare expenditure in countries such as China, Japan, and India. Growing awareness of early diagnosis and home-based dialysis solutions is promoting adoption. Technological advancements, including portable and automated machines, are enhancing accessibility and patient convenience. Government initiatives supporting telehealth and smart healthcare solutions further accelerate growth. Hospitals, clinics, and home care providers are expanding services to meet rising patient demand. The region’s large patient base and improving affordability of dialysis systems contribute to market expansion.

Japan Dialysis Machines Market Insight

The Japan dialysis machines market is gaining momentum due to the country’s high prevalence of kidney disease and aging population. Advanced hemodialysis and peritoneal dialysis solutions, including automated and portable machines, are increasingly adopted in hospitals and home care settings. Patients are favoring home-based dialysis for convenience and improved quality of life. Integration of dialysis machines with digital health monitoring systems supports better clinical outcomes. The focus on patient safety and adherence to treatment protocols enhances market demand. Government support and reimbursement programs further drive adoption.

India Dialysis Machines Market Insight

The India dialysis machines market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing CKD prevalence, and rising awareness of home dialysis solutions. Hospitals, clinics, and home care providers are increasingly investing in modern hemodialysis and peritoneal dialysis systems. Affordable devices, along with local manufacturing, make dialysis machines accessible to a wider patient base. Government initiatives promoting digital healthcare and telemedicine enhance adoption. Technological advancements, such as portable dialysis units and automated monitoring, improve patient convenience and treatment outcomes. The expanding middle class and rising healthcare spending further propel market growth.

Dialysis Machines Market Share

The dialysis machines industry is primarily led by well-established companies, including:

- Fresenius Medical Care AG & Co. KGaA (Germany)

- DaVita Inc. (U.S.)

- Baxter International Inc. (U.S.)

- B. Braun SE (Germany)

- Nipro Corporation (Japan)

- Medtronic (Ireland)

- Asahi Kasei Corporation (Japan)

- Nikkiso Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- JMS Co., Ltd. (Japan)

- Satellite Healthcare Inc. (U.S.)

- Guangdong Biolight Meditech Co., Ltd. (China)

- Dialife SA (Switzerland)

- Chengdu Wesley Bioscience Technology Co., Ltd. (China)

- Infomed (Switzerland)

- Guangzhou Improve Medical Instruments Co., Ltd. (China)

- Diaverum AB (Sweden)

- U.S. Renal Care, Inc. (U.S.)

What are the Recent Developments in Global Dialysis Machines Market?

- In June 2025, Fresenius Medical Care received FDA 510(k) clearance for the updated version of its 5008X CAREsystem, a hemodiafiltration-capable dialysis machine. This advancement enables the next steps in the company's broader commercialization efforts across the U.S., with a full-scale commercial launch planned for 2026

- In September 2024, Fresenius Medical Care launched the newest version of its home hemodialysis machine, the NxStage Versi HD with GuideMe Software. This enhancement simplifies treatment, increases ease of learning, and improves user experience, highlighting the efficacy and reliability of the NxStage system in delivering safe, high-quality care to patients in the comfort of their homes

- In August 2023, Fresenius Medical Care launched an on-site dialysis program with Sarah Bush Lincoln, a regional health system in Mattoon, Illinois. This partnership delivers care for hemodialysis patients at their local hospital, eliminating the need for patients to travel nearly 100 miles for treatment. The program utilizes the NxStage VersiHD home hemodialysis system, enhancing access to life-sustaining care for rural patients

- In April 2023, Medtronic and DaVita launched Mozarc Medical, an independent new company committed to reshaping kidney health and driving patient-centered technology solutions. Mozarc Medical's focus is on meaningful and innovative kidney health technologies that improve the overall patient experience and increase access to care globally

- In March 2021, Baxter received FDA 510(k) clearance for its AK 98 dialysis machine, designed for intermittent hemodialysis and isolated ultrafiltration treatments of patients with chronic or acute renal failure or fluid overload. The machine is indicated for use on patients with a body weight of 25kg or more

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.