Global Diamond Mining Market

Market Size in USD Billion

CAGR :

%

USD

19.46 Billion

USD

29.63 Billion

2024

2032

USD

19.46 Billion

USD

29.63 Billion

2024

2032

| 2025 –2032 | |

| USD 19.46 Billion | |

| USD 29.63 Billion | |

|

|

|

|

Diamond Mining Market Size

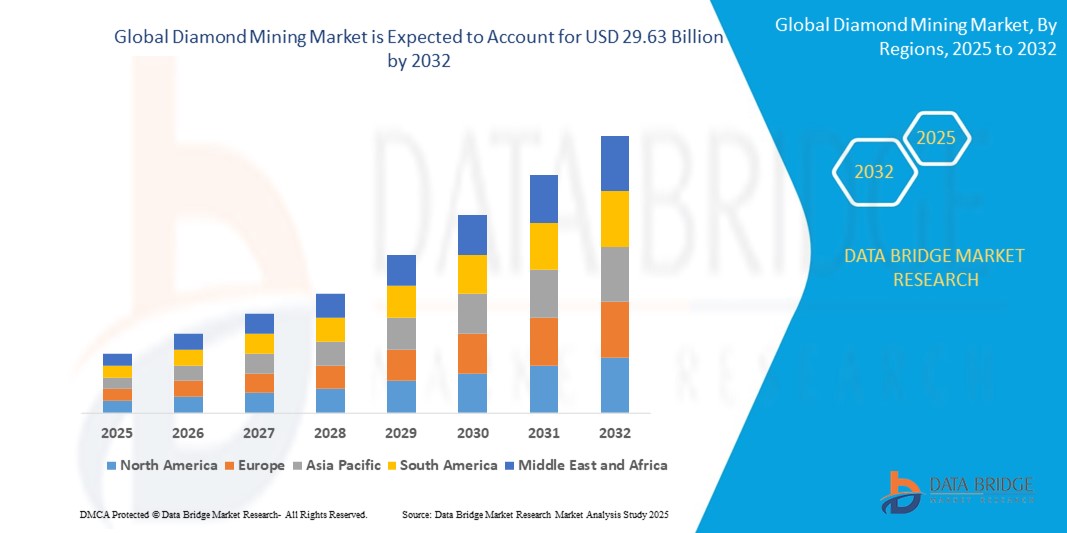

- The global diamond mining market size was valued at USD 19.46 billion in 2024 and is expected to reach USD 29.63 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is driven by sustained global demand for diamond jewelry, particularly in emerging economies with expanding middle-class populations, alongside increasing applications of industrial diamonds in high-tech industries

- Rising consumer preference for ethical and sustainable sourcing, coupled with technological advancements in mining and the growing acceptance of lab-grown diamonds, is reshaping the industry landscape and fueling market expansion

Diamond Mining Market Analysis

- Diamond mining encompasses the exploration, extraction, and processing of natural and synthetic diamonds for use in jewelry, industrial applications, and research, driven by their unique properties such as hardness and thermal conductivity

- The market is propelled by strong demand for diamond jewelry, particularly in emerging markets like China and India, where rising disposable incomes and cultural significance drive consumption. Industrial applications, including cutting tools and high-tech sectors like quantum computing, further bolster demand

- North America holds a significant share of the diamond mining market, driven by industrial applications and established players in the U.S. and Canada, with Canada emerging as a key producer due to Arctic region developments

- Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by high jewelry demand in China and India, rapid urbanization, and increasing investments in synthetic diamond production

- The natural diamonds segment dominated the market with the largest market revenue share of 93.8% in 2024, driven by strong consumer preference for their perceived luxury, rarity, and status as a symbol of enduring value, particularly in jewelry applications

Report Scope and Diamond Mining Market Segmentation

|

Attributes |

Diamond Mining Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Diamond Mining Market Trends

“Enhanced Efficiency through AI and Automation”

- A prominent and accelerating trend in the global diamond mining market is the integration of artificial intelligence (AI) and automation technologies to enhance operational efficiency and productivity. These advancements are transforming traditional mining processes by optimizing exploration, extraction, and sorting operations

- For instance, companies like Rio Tinto and De Beers are leveraging AI-powered systems for geological mapping and data analysis to identify diamond-bearing kimberlite pipes with greater precision. Automated machinery, such as autonomous haul trucks and drilling rigs, is being deployed to improve safety and reduce labor costs in mines like the Ekati mine in Canada

- AI integration enables predictive maintenance of equipment, reducing downtime, and improving resource utilization. For example, AI algorithms analyze real-time data from connected mining equipment to predict potential failures, as seen in Epiroc’s Rig Control System used in diamond mining operations. Additionally, AI-driven sorting systems enhance the accuracy of diamond identification, minimizing waste and improving yield

- The adoption of connected mining solutions, including Internet of Things (IoT) devices and data analytics, allows for real-time monitoring and remote control of operations, fostering a digitally enabled workplace. This trend is evident in De Beers’ TracrTM blockchain platform, which ensures traceability from mine to market

- This shift towards intelligent, automated, and interconnected mining systems is redefining operational standards, enabling companies to meet rising global demand while addressing cost pressures. Firms like Petra Diamonds are investing in automation to streamline processes and maintain competitiveness in a volatile market

- The demand for AI and automation-driven mining solutions is growing across both surface and underground diamond mining operations, as companies prioritize efficiency, safety, and sustainability in response to market dynamics

Diamond Mining Market Dynamics

Driver

“Growing Demand Due to Rising Luxury Consumption and Technological Advancements”

- The increasing global demand for diamond jewelry, fueled by rising disposable incomes and consumer spending on luxury goods, particularly in emerging markets like China and India, is a key driver for the diamond mining market. The growing middle class in these regions is boosting sales of high-end jewelry for weddings and special occasions

- For instance, in 2024, India surpassed China as the second-largest diamond market, driven by a burgeoning middle class and increasing self-purchases by women, as noted by diamond analyst Paul Zimnisky. This trend is expected to continue, with China and India projected to surpass the U.S. in diamond demand by the next decade

- Technological advancements in mining, such as AI-powered sorting, automated machinery, and advanced geophysical exploration tools, are enhancing extraction efficiency and reducing costs, further supporting market growth

- The rising appeal of diamonds as a status symbol and a stable investment asset is attracting both consumers and investors, driving demand for mined diamonds

- The trend towards sustainable and ethical sourcing, supported by regulatory frameworks like the Kimberley Process, is encouraging mining companies to adopt transparent supply chains, further boosting consumer confidence and market growth

Restraint/Challenge

“Concerns Regarding Environmental Impact and High Operational Costs”

- Environmental concerns associated with diamond mining, such as habitat destruction, water pollution, and high carbon emissions, pose significant challenges to market expansion

- Growing consumer awareness of these issues is increasing pressure on mining companies to adopt sustainable practices, which can be costly and complex to implement

- For instance, reports highlighting the ecological impact of mining in regions like Botswana and South Africa have led to stricter regulations and community resistance, complicating operations for companies like De Beers and Rio Tinto

- Addressing these environmental concerns requires investments in sustainable practices, such as land reclamation, water recycling, and renewable energy integration, which can strain profit margins

- High operational costs, driven by labor, equipment, energy, and inflation, are another barrier to profitability

- The rise of lab-grown diamonds, which offer a more affordable and environmentally friendly alternative, is creating competitive pressure on traditional mining companies, particularly in the jewelry segment

- Overcoming these challenges through cost-effective sustainable practices, consumer education on ethical mining, and innovations to reduce operational costs will be critical for sustained market growth

Diamond Mining market Scope

The market is segmented on the basis of type, mining method, and application.

- By Type

On the basis of type, the global diamond mining market is segmented into natural diamonds and synthetic diamonds. The natural diamonds segment dominated the market with the largest market revenue share of 93.8% in 2024, driven by strong consumer preference for their perceived luxury, rarity, and status as a symbol of enduring value, particularly in jewelry applications. Natural diamonds are highly valued for their unique characteristics and traditional appeal in engagement and wedding markets.

The synthetic diamonds segment is anticipated to witness the fastest growth rate of 7.8% from 2025 to 2032, fueled by increasing consumer awareness of ethical and environmental concerns surrounding natural diamond mining, as well as their affordability. Synthetic diamonds, produced via high-pressure high-temperature (HPHT) or chemical vapor deposition (CVD) methods, are gaining traction in both jewelry and industrial applications due to their cost-effectiveness and sustainability.

- By Mining Method

On the basis of mining method, the global diamond mining market is segmented into open pit, underground, alluvial, and marine. The open pit segment held the largest market revenue share of 60% in 2024, driven by its cost-effectiveness and efficiency in extracting near-surface diamond deposits. Open pit mining benefits from technological advancements, such as GPS-guided machinery and automated sorting systems, enhancing productivity in major diamond-producing regions like Botswana, Russia, and Canada.

The underground mining segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the depletion of accessible open pit resources and the need to access deeper, high-quality diamond deposits. Investments in underground mining, such as De Beers’ expansions in Botswana and South Africa, are contributing to its growth, despite higher operational costs.

- By Application

On the basis of application, the global diamond mining market is segmented into jewelry, industrial, and research. The jewelry segment accounted for the largest market revenue share of 70% in 2024, driven by cultural traditions, rising disposable incomes, and growing demand in emerging economies like China and India. The increasing middle-class population and preference for diamond jewelry among millennials and Generation Z further bolster this segment.

The industrial segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the expanding use of diamonds in high-tech applications, such as cutting tools, abrasives, and semiconductors. The growth of synthetic diamonds, which dominate industrial applications due to their affordability and consistent quality, is a key driver for this segment.

Diamond Mining Market Regional Analysis

- North America holds a significant share of the diamond mining market, driven by industrial applications and established players in the U.S. and Canada, with Canada emerging as a key producer due to Arctic region developments

- Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by high jewelry demand in China and India, rapid urbanization, and increasing investments in synthetic diamond production

U.S. Diamond Mining Market Insight

The U.S. diamond mining market held a significant revenue share of 75% in North America in 2024, driven by advanced mining technologies and strong demand for high-quality gemstones. The increasing consumer preference for ethically sourced diamonds, coupled with innovations in synthetic diamond production, is boosting market growth. The integration of automation and AI-driven exploration techniques is further enhancing operational efficiency, while growing interest in sustainable and transparent supply chains is shaping market trends.

Europe Diamond Mining Market Insight

The Europe diamond mining market is projected to grow at a steady CAGR during the forecast period, fueled by stringent regulations on ethical sourcing and rising demand for luxury goods. The region’s focus on sustainability, combined with advancements in diamond extraction technologies, is driving the adoption of environmentally friendly mining practices. European markets, particularly in jewelry retail, are seeing increased demand for traceable diamonds, supporting growth in both natural and lab-grown diamond sectors.

U.K. Diamond Mining Market Insight

The U.K. diamond mining market is expected to expand at a notable CAGR over the forecast period, driven by the growing demand for sustainable and ethically sourced diamonds in the luxury jewelry sector. Consumer awareness of environmental and social issues related to mining, alongside the U.K.’s robust retail and e-commerce infrastructure, is fostering market growth. The adoption of innovative diamond certification processes and lab-grown diamond technologies is further contributing to the market’s expansion.

Germany Diamond Mining Market Insight

The Germany diamond mining market is anticipated to grow at a considerable CAGR during the forecast period, propelled by increasing consumer demand for ethically sourced and eco-conscious diamonds. Germany’s strong industrial base and emphasis on technological innovation support the adoption of advanced diamond mining and processing techniques. The integration of sustainable practices and the rising popularity of lab-grown diamonds align with the country’s focus on environmental responsibility and consumer preferences for transparency.

Asia-Pacific Diamond Mining Market Insight

The Asia-Pacific diamond mining market is expected to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for luxury goods in countries such as China, India, and Japan. Government initiatives promoting sustainable mining practices and technological advancements in diamond extraction are accelerating market growth. The region’s emergence as a hub for diamond processing and jewelry manufacturing further enhances affordability and market accessibility.

Japan Diamond Mining Market Insight

The Japan diamond mining market is gaining traction due to the country’s high demand for luxury goods and its advanced technological infrastructure. The adoption of sustainable mining practices and lab-grown diamonds is driven by Japan’s focus on innovation and environmental consciousness. The integration of diamond mining with advanced technologies, such as AI and IoT for supply chain transparency, is fueling market growth. Japan’s aging population and preference for high-quality, traceable diamonds are also contributing to market expansion.

China Diamond Mining Market Insight

The China diamond mining market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and strong demand for luxury jewelry. China’s position as a major hub for diamond processing and manufacturing, combined with advancements in synthetic diamond production, is propelling market growth. Government initiatives promoting sustainable mining and the availability of affordable, high-quality diamonds from domestic producers are key factors driving the market’s expansion.

Diamond Mining Market Share

The diamond mining industry is primarily led by well-established companies, including:

- Alrosa (Russia)

- De Beers Group (U.K.)

- Rio Tinto (U.K.)

- Petra Diamonds Ltd. (U.K.)

- Lucara Diamond Corp. (Canada)

- Dominion Diamond Mines (Canada)

- Gem Diamonds (U.K.)

- Mountain Province Diamonds (Canada)

- Endiama EP (Angola)

- Diamond Foundry (U.S.)

- Henan Huanghe Whirlwind Co., Ltd. (China)

- Tsodilo Resources Limited (Canada)

What are the Recent Developments in Global Diamond Mining Market?

- In May 2024, Signet Jewelers partnered with De Beers to promote natural diamond jewelry to a new generation of U.S. couples, anticipating a 25% increase in engagements over the next three years. The collaboration leverages Signet’s retail brands and De Beers’ expertise in iconic campaigns, featuring digital content, in-store experiences, and staff training to highlight the rarity and timelessness of natural diamonds. A new marketing campaign will roll out in the third quarter, reinforcing consumer awareness and educating Signet’s 20,000 sales associates on the unique attributes of natural diamonds

- In April 2022, De Beers Group signed two Mineral Investment Contracts (MICs) with the Government of Angola for license areas in north-eastern Angola. This partnership follows substantial reforms in Angola’s diamond sector, enabling De Beers to resume exploration in the country after years of absence. The MICs cover all stages of diamond resource development, from exploration to mining, spanning 35 years. Each concession area is managed by a joint venture between De Beers Group and Endiama, Angola’s state-owned diamond company, with De Beers holding a substantial majority stake

- In March 2022, Rio Tinto completed the acquisition of the remaining 40% stake in the Diavik Diamond Mine, making it the sole owner of the operation. The mine, located 200 km south of the Arctic Circle, is known for producing high-quality Canadian diamonds. This strategic move strengthens Rio Tinto’s control over production, ensuring long-term sustainability and reinforcing its global presence in the diamond mining sector

- In November 2021, Signet Jewelers Limited finalized its acquisition of Diamonds Direct USA Inc. This strategic move expands Signet’s presence in the accessible luxury and bridal diamond segments, integrating Diamonds Direct’s retail network into its operations. The acquisition strengthens Signet’s market position, providing new customer opportunities and enhancing lifetime customer relationships

- In August 2021, KGK Group launched a diamond manufacturing facility in Saurimo, Angola, strengthening its presence in the region’s diamond sector. The facility was inaugurated by Angola’s President João Lourenço, alongside industry leaders and government officials. This expansion aligns with Angola’s diamond beneficiation initiatives, supporting local processing capabilities and employment growth. The factory, equipped with advanced Synova and Galaxy machines, has an installed capacity of 25,000 carats per month, creating 300 jobs, with plans to expand to 800 worker

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Diamond Mining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diamond Mining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diamond Mining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.