Global Dietary Fibers Market

Market Size in USD Billion

CAGR :

%

USD

8.84 Billion

USD

21.73 Billion

2024

2032

USD

8.84 Billion

USD

21.73 Billion

2024

2032

| 2025 –2032 | |

| USD 8.84 Billion | |

| USD 21.73 Billion | |

|

|

|

|

What is the Global Dietary Fibers Market Size and Growth Rate?

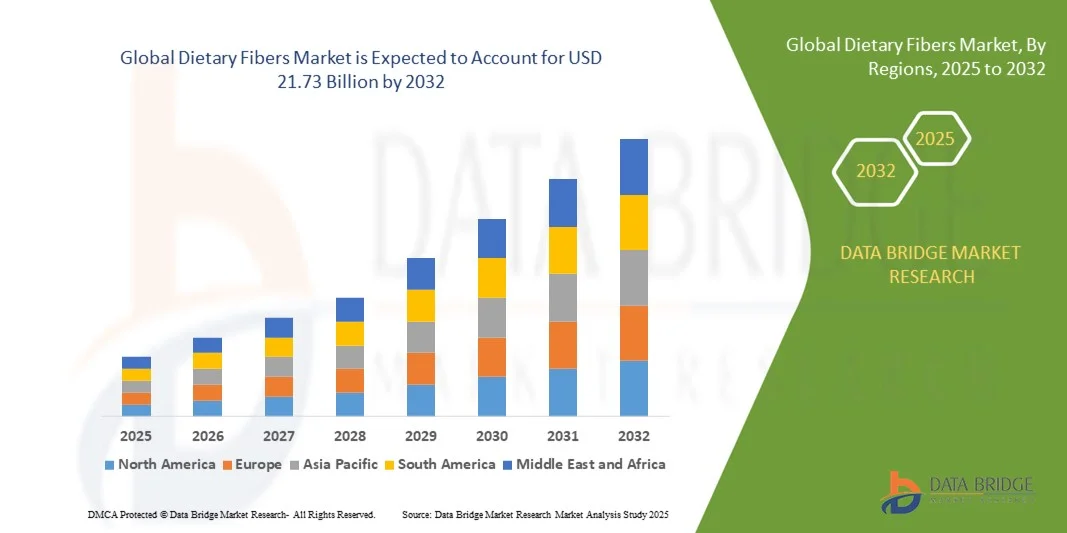

- The global dietary fibers market size was valued at USD 8.84 billion in 2024 and is expected to reach USD 21.73 billion by 2032, at a CAGR of 11.9% during the forecast period

- Major factors that are expected to boost the growth of the dietary fibers market in the forecast period are the health advantages provided by the dietary fibers. Furthermore, the rise in the need for fiber supplements is further anticipated to propel the growth of the dietary fibers market

- On the other hand, saturated water stability and reactivity is further estimated to impede the growth of the dietary fibers market in the timeline period

What are the Major Takeaways of Dietary Fibers Market?

- The rise in the applications of dietary fibers in the form of fortified snacks will further provide potential opportunities for the growth of the dietary fibers market in the coming years. However, the adjustable standards and guidelines across regional governing bodies might further challenge the growth of the dietary fibers market in the near future

- The Asia-Pacific region dominated the dietary fibers market with the largest revenue share of 34.16% in 2024, driven by rising health awareness, increasing disposable incomes, and rapid urbanization across countries such as China, India, and Japan

- The North America Dietary Fibers market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, fueled by growing consumer interest in preventive healthcare, digestive wellness, and weight management

- The plant food segment dominated the dietary fibers market with the largest revenue share of 57.3% in 2024, driven by increasing consumer preference for natural and clean-label ingredients derived from fruits, vegetables, cereals, and legumes

Report Scope and Dietary Fibers Market Segmentation

|

Attributes |

Dietary Fibers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Dietary Fibers Market?

Rising Demand for Functional and Clean-Label Ingredients

- A significant and accelerating trend in the global Dietary Fibers market is the growing preference for functional fibers that support gut health, weight management, and cardiovascular well-being. Consumers increasingly seek dietary fibers that are natural, minimally processed, and aligned with clean-label and plant-based trends

- For instance, soluble fibers such as inulin and resistant starches are being incorporated into beverages, snacks, and dairy alternatives to enhance digestive health, improve satiety, and reduce sugar content. This trend highlights the increasing intersection of nutrition and convenience in daily diets

- Functional fibers are also being combined with prebiotics and probiotics, enabling synergistic health benefits. Product innovations include fiber-enriched cereals, bars, and bakery products that appeal to health-conscious consumers looking for easy ways to meet their daily fiber intake

- The demand for fibers with multiple benefits, such as cholesterol reduction, blood sugar control, and gut microbiota modulation, is driving R&D and product diversification across the global market

- This trend toward functional, clean-label, and multi-benefit fibers is reshaping consumer expectations and driving manufacturers such as Ingredion, Roquette, and DuPont to develop innovative fiber ingredients for diverse applications

- The rising consumer awareness of gut health and holistic nutrition is creating strong growth opportunities across both retail and foodservice sectors

What are the Key Drivers of Dietary Fibers Market?

- The growing awareness of dietary fiber’s role in digestive health, metabolic regulation, and disease prevention is a major driver of market growth. Consumers are increasingly prioritizing products that improve gut health and support overall well-being

- For instance, in 2024, Roquette expanded its prebiotic fiber portfolio to include resistant starches for inclusion in beverages, bakery, and nutritional supplements, targeting health-conscious consumers. This type of product innovation drives market expansion globally

- Rising incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders is fueling demand for fiber-enriched foods and beverages, pushing manufacturers to fortify everyday products with functional fibers

- Furthermore, the surge in vegan, plant-based, and clean-label products is accelerating dietary fiber adoption, as plant-based fibers are perceived as natural, sustainable, and health-promoting

- Convenience-oriented consumption, such as fiber-enriched bars, beverages, and ready-to-eat meals, supports the rapid adoption of dietary fibers in both retail and foodservice sectors, enhancing market penetration

- The increasing emphasis on regulatory approvals and health claims by companies is reinforcing consumer confidence and driving sustained growth in the Dietary Fibers market

Which Factor is Challenging the Growth of the Dietary Fibers Market?

- Challenges related to taste, texture, and product formulation remain significant, as high fiber content can negatively impact sensory attributes, limiting consumer acceptance. Manufacturers must invest in innovative technologies to improve solubility, mouthfeel, and integration in different foods

- For instance, some fiber-enriched bakery and beverage products face complaints regarding grittiness, viscosity, or off-flavors, which can hinder repeat purchases and market penetration

- The relatively high cost of specialty fibers compared to standard ingredients can also deter small manufacturers and price-sensitive consumers, especially in developing regions. While basic fibers such as wheat bran are widely affordable, functional fibers with targeted health benefits command a premium price

- Regulatory challenges, including approvals for novel fiber ingredients and permissible health claims, may slow product launches in some regions. Companies such as DuPont and Cargill focus on compliance and scientific substantiation to overcome these barriers

- Overcoming formulation, cost, and regulatory challenges through product innovation, education, and affordable fiber solutions is crucial for sustained growth and wider adoption across the global dietary fibers market

How is the Dietary Fibers Market Segmented?

The dietary fibers market is segmented on the basis of source, type, application, end use and processing treatment.

- By Source

On the basis of source, the dietary fibers market is segmented into plant food and waste products. The plant food segment dominated the dietary fibers market with the largest revenue share of 57.3% in 2024, driven by increasing consumer preference for natural and clean-label ingredients derived from fruits, vegetables, cereals, and legumes. Manufacturers prioritize plant-derived fibers due to their high nutritional value, functional benefits, and ease of incorporation into a wide variety of food, beverage, and supplement applications.

The waste products segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by sustainability initiatives and the growing adoption of circular economy practices. Fibers extracted from by-products such as fruit peels, vegetable pomace, and cereal husks are gaining traction among eco-conscious consumers and manufacturers aiming to reduce food waste while providing functional benefits such as prebiotic effects, cholesterol reduction, and improved gut health.

- By Type

On the basis of type, the dietary fibers market is segmented into soluble and insoluble fibers. The soluble fiber segment held the largest market revenue share of 62% in 2024, owing to its ability to dissolve in water and provide multiple health benefits such as lowering blood cholesterol, improving glycemic control, and supporting gut microbiota. Soluble fibers are extensively used in beverages, dairy alternatives, and functional foods targeting cardiovascular and metabolic health.

The insoluble fiber segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, driven by increasing consumer awareness about digestive health and the role of insoluble fibers in promoting bowel regularity and preventing constipation. Insoluble fibers are being incorporated into bakery, cereals, and snack products to meet rising demand for convenient, high-fiber solutions in daily diets.

- By Application

On the basis of application, the dietary fibers market is segmented into food, beverages, pharmaceutical and dietary supplements, companion animal nutrition, and others. The food segment dominated the market with a revenue share of 54% in 2024, driven by the growing fortification of bakery, cereals, snacks, and convenience foods with functional fibers. Manufacturers are leveraging dietary fibers to enhance nutritional profiles and meet the demand for healthier, high-fiber diets.

The pharmaceutical and dietary supplements segment is anticipated to witness the fastest CAGR of 18.2% from 2025 to 2032, fueled by increasing consumer focus on preventive health, weight management, and metabolic regulation. Fiber-based nutraceuticals, tablets, and powder formulations are gaining popularity due to their targeted health benefits and convenient delivery formats, making them a key growth driver for the market.

- By End Use

On the basis of end use, the dietary fibers market is segmented into waste management, weight management, cholesterol management, and sugar management. The weight management segment dominated with a market revenue share of 49% in 2024, driven by rising obesity rates, growing health consciousness, and demand for satiety-enhancing foods. Fibers are increasingly being incorporated into bars, beverages, and meal replacements to help reduce caloric intake and improve digestive comfort.

The sugar management segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, fueled by the rising prevalence of diabetes, demand for low-glycemic foods, and the incorporation of soluble fibers in snacks, beverages, and fortified foods to control blood sugar levels. Growing health awareness and government initiatives to combat lifestyle diseases further propel this segment.

- By Processing Treatment

On the basis of processing treatment, the dietary fibers market is segmented into extrusion cooking, canning, grinding, boiling, and frying. The extrusion cooking segment held the largest market revenue share of 41.5% in 2024, driven by its versatility in producing high-fiber breakfast cereals, snacks, and bars with controlled texture, digestibility, and functional properties. Extrusion allows the incorporation of both soluble and insoluble fibers without compromising taste, making it highly favored by manufacturers.

The grinding segment is expected to witness the fastest CAGR of 16.9% from 2025 to 2032, fueled by demand for fine fiber powders suitable for beverages, nutraceuticals, and bakery products. Grinding provides a cost-effective and flexible method for producing high-quality fiber ingredients while maintaining their nutritional and functional properties.

Which Region Holds the Largest Share of the Dietary Fibers Market?

- The Asia-Pacific region dominated the dietary fibers market with the largest revenue share of 34.16% in 2024, driven by rising health awareness, increasing disposable incomes, and rapid urbanization across countries such as China, India, and Japan

- Consumers in the region are increasingly focusing on functional foods, nutraceuticals, and fortified dietary products, which are enriched with fibers to support digestive health, weight management, and metabolic wellness

- The widespread adoption of dietary fiber-enriched products is further supported by government initiatives promoting nutrition, growing e-commerce penetration, and the expanding retail and modern trade networks, establishing Asia-Pacific as a critical market for dietary fibers

China Dietary Fibers Market Insight

The China dietary fibers market captured the largest revenue share of 38% in 2024 within Asia-Pacific, fueled by rapid urbanization, increasing health consciousness, and the expanding middle-class population. Consumers are increasingly seeking functional foods, beverages, and supplements fortified with dietary fibers. The rise of health-focused e-commerce platforms, the growing popularity of low-calorie and high-fiber diets, and government campaigns promoting nutritional awareness are significantly driving market growth. China’s domestic manufacturing capabilities also contribute to the affordability and availability of dietary fiber products, strengthening the country’s leading position in the region.

Japan Dietary Fibers Market Insight

The Japan dietary fibers market is witnessing steady growth due to the country’s aging population, health-conscious consumers, and high adoption of functional foods. Japanese consumers emphasize digestive health, weight management, and nutritional supplementation, driving demand for soluble and insoluble fiber products in food, beverage, and supplement categories. The integration of dietary fibers in traditional and convenient foods, along with government-led nutrition initiatives, supports market expansion. Moreover, Japan’s advanced retail infrastructure and e-commerce platforms enhance product accessibility, boosting consumer adoption.

India Dietary Fibers Market Insight

The India dietary fibers market is expected to expand at a substantial CAGR during the forecast period, driven by increasing disposable incomes, urbanization, and rising awareness about lifestyle-related health issues such as obesity, diabetes, and digestive disorders. The growing popularity of fortified foods, functional beverages, and dietary supplements is propelling fiber demand. Regional initiatives promoting healthier nutrition, coupled with expanding retail networks and online sales channels, are supporting widespread adoption. India’s young population and rising preference for convenient, fiber-enriched food options further contribute to market growth.

Which Region is the Fastest Growing Region in the Dietary Fibers Market?

The North America dietary fibers market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, fueled by growing consumer interest in preventive healthcare, digestive wellness, and weight management. Increasing demand for functional foods, dietary supplements, and fortified beverages is driving adoption. Moreover, health-conscious lifestyles, high disposable incomes, and robust R&D in nutritional products support market expansion. Retailers and manufacturers are introducing innovative fiber-enriched formulations to cater to the rising demand for convenient and health-focused food solutions, ensuring strong growth in North America.

U.S. Dietary Fibers Market Insight

The U.S. dietary fibers market accounted for the largest revenue share of 81% in North America in 2024, driven by rising health awareness, demand for weight management solutions, and increased consumption of functional foods and beverages. Consumers are seeking products that aid digestive health, cholesterol control, and sugar management. The strong presence of dietary supplement manufacturers, innovative product launches, and widespread retail and e-commerce availability are key growth factors. Government-led initiatives on nutrition labeling and consumer education on high-fiber diets further accelerate market adoption in the U.S., making it the fastest-growing market in the region.

Which are the Top Companies in Dietary Fibers Market?

The dietary fibers industry is primarily led by well-established companies, including:

- Ingredion Incorporated (U.S.)

- Grain Processing Corporation (U.S.)

- Grain Millers, Inc. (U.S.)

- Lonza (Switzerland)

- KFSU LTD (Australia)

- Roquette Frères (France)

- DuPont (U.S.)

- ADM (U.S.)

- Tate & Lyle (U.K.)

- J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany)

- Tereos (France)

- CJ CheilJedang Corp. (South Korea)

- Fuji Nihon Seito Corporation (Japan)

- Novagreen Inc. (U.S.)

- Mengzhou Tailijie Co., Ltd. (China)

- Baolingbao Biology Co., Ltd. (China)

- Naturex (France)

- Cargill, Incorporated (U.S.)

- B&D Nutritional Ingredients, Inc. (U.S.)

- Dow (U.S.)

What are the Recent Developments in Global Dietary Fibers Market?

- In February 2023, Azelis, a leading specialty chemicals and food ingredients company, announced a new distribution agreement with Tereos, offering native starches, maltodextrin, gluten, dietary fibers, and other ingredients, strengthening Azelis’ portfolio in sugars, sweeteners, and native starches for the food and animal nutrition markets, supporting its regional growth ambitions

- In March 2022, Tate & Lyle, a prominent provider of food and beverage ingredients and solutions, acquired Quantum Hi-Tech (Guangdong) Biological Co., Ltd, one of China’s leading prebiotic dietary fiber businesses, enhancing its product offerings in prebiotic and functional fiber solutions and expanding its presence in the Asian market

- In April 2022, Ingredion Incorporated acquired Germany-based KaTech, a company providing advanced texture and stabilization solutions to the food and beverage industry, expanding Ingredion’s Food Systems platform with innovative solutions for product formulation, ingredient functionality, and technical support, further strengthening its global footprint

- In March 2021, BENEO established its chicory root fiber manufacturing unit in Chile, expanding production capacity to meet growing global demand and solidifying BENEO’s position in the international dietary fibers market

- In September 2020, Tate & Lyle opened a new Customer Innovation and Collaboration Center in Santiago, Chile, featuring application and rapid prototyping capabilities, allowing its food scientists to collaborate with customers on reducing sugar, fat, and calories while adding fiber to consumer products, driving regional innovation and customer engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIETARY FIBERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIETARY FIBERS MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DIETARY FIBERS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 VALUE CHAIN ANALYSIS

5.3 IMPORT EXPORT ANALYSIS

5.4 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

5.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.6 INDUSTRY TRENS AND FUTURE PERSPECTIVE

6 REGULATORY FRAMEWORK AND GUIDELINES

7 POST COVID IMPACT ANALYSIS

8 GLOBAL DIETARY FIBERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOLUBLE

8.2.1 GUMS

8.2.2 PECTIN

8.2.3 PSYLLIUM

8.2.4 BETA-GLUCANS

8.2.5 OTHERS

8.3 INSOLUBLE

8.3.1 LIGNIN

8.3.2 CELLULOSE

9 GLOBAL DIETARY FIBERS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PEA FIBER

9.3 WHEAT FIBER

9.4 BAMBOO FIBER

9.5 SOY FIBER

9.6 POTATO FIBER

9.7 CITRUS FIBER

9.8 CELLULOSE

9.9 OAT FIBER

9.1 APPLE FIBER

9.11 COCOA FIBER

9.12 ACACIA FIBER

9.13 SUGAR CANE FIBER

9.14 CORN FIBER

9.15 CARROT FIBER

9.16 SUGAR BEET FIBER

9.17 OTHERS

10 GLOBAL DIETARY FIBERS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 FOOD & BEVERAGES, BY TYPE

10.2.1.1. BAKERY

10.2.1.1.1. BAKERY, BY TYPE

10.2.1.1.1.1 BREAD & ROLLS

10.2.1.1.1.2 CAKES & PASTRIES

10.2.1.1.1.3 WAFERS

10.2.1.1.1.4 BISCUIT

10.2.1.1.1.5 COOKIES& CRACKERS

10.2.1.1.1.6 OTHERS

10.2.1.1.2. BAKERY, BY FIBER TYPE

10.2.1.1.2.1 PEA FIBER

10.2.1.1.2.2 WHEAT

10.2.1.1.2.3 BAMBOO FIBER

10.2.1.1.2.4 SOY FIBER

10.2.1.1.2.5 POTATO FIBER

10.2.1.1.2.6 CITRUS FIBER

10.2.1.1.2.7 CELLULOSE

10.2.1.1.2.8 OAT FIBER

10.2.1.1.2.9 APPLE FIBER

10.2.1.1.2.10 COCOA FIBER

10.2.1.1.2.11 ACACIA FIBER

10.2.1.1.2.12 SUGAR CANE FIBER

10.2.1.1.2.13 CORN FIBER

10.2.1.1.2.14 CARROT FIBER

10.2.1.1.2.15 SUGAR BEET FIBER

10.2.1.1.2.16 OTHERS

10.2.1.2. PRECOOKED CEREALS

10.2.1.2.1. PRECOOKED CERELAS, BY FIBER TYPE

10.2.1.2.1.1 PEA FIBER

10.2.1.2.1.2 WHEAT

10.2.1.2.1.3 BAMBOO FIBER

10.2.1.2.1.4 SOY FIBER

10.2.1.2.1.5 POTATO FIBER

10.2.1.2.1.6 CITRUS FIBER

10.2.1.2.1.7 CELLULOSE

10.2.1.2.1.8 OAT FIBER

10.2.1.2.1.9 APPLE FIBER

10.2.1.2.1.10 COCOA FIBER

10.2.1.2.1.11 ACACIA FIBER

10.2.1.2.1.12 SUGAR CANE FIBER

10.2.1.2.1.13 CORN FIBER

10.2.1.2.1.14 CARROT FIBER

10.2.1.2.1.15 SUGAR BEET FIBER

10.2.1.2.1.16 OTHERS

10.2.1.3. MEAT& POULTRY PRODUCTS

10.2.1.3.1. MEAT & POULTRY PRODUCTS, BY TYPE

10.2.1.3.1.1 MEATBALL

10.2.1.3.1.2 BURGERS

10.2.1.3.1.3 SAUSAGES

10.2.1.3.1.4 OTHERS

10.2.1.3.2. MEAT & POULTRY PTODUCTS, BY FIBER TYPE

10.2.1.3.2.1 PEA FIBER

10.2.1.3.2.2 WHEAT

10.2.1.3.2.3 BAMBOO FIBER

10.2.1.3.2.4 SOY FIBER

10.2.1.3.2.5 POTATO FIBER

10.2.1.3.2.6 CITRUS FIBER

10.2.1.3.2.7 CELLULOSE

10.2.1.3.2.8 OAT FIBER

10.2.1.3.2.9 APPLE FIBER

10.2.1.3.2.10 COCOA FIBER

10.2.1.3.2.11 ACACIA FIBER

10.2.1.3.2.12 SUGAR CANE FIBER

10.2.1.3.2.13 CORN FIBER

10.2.1.3.2.14 CARROT FIBER

10.2.1.3.2.15 SUGAR BEET FIBER

10.2.1.3.2.16 OTHERS

10.2.1.3.2.17 OTHERS

10.2.1.4. FISH & SURIMI PRODUCTS

10.2.1.4.1. MEAT & POULTRY PRODUCTS, BY TYPE

10.2.1.4.1.1 FISH STICKS

10.2.1.4.1.2 BURGERS

10.2.1.4.1.3 FISHBALLS

10.2.1.4.1.4 SURIMI PRODUCTS

10.2.1.4.1.5 OTHERS

10.2.1.4.2. MEAT & POULTRY PTODUCTS, BY FIBER TYPE

10.2.1.4.2.1 PEA FIBER

10.2.1.4.2.2 WHEAT

10.2.1.4.2.3 BAMBOO FIBER

10.2.1.4.2.4 SOY FIBER

10.2.1.4.2.5 POTATO FIBER

10.2.1.4.2.6 CITRUS FIBER

10.2.1.4.2.7 CELLULOSE

10.2.1.4.2.8 OAT FIBER

10.2.1.4.2.9 APPLE FIBER

10.2.1.4.2.10 COCOA FIBER

10.2.1.4.2.11 ACACIA FIBER

10.2.1.4.2.12 SUGAR CANE FIBER

10.2.1.4.2.13 CORN FIBER

10.2.1.4.2.14 CARROT FIBER

10.2.1.4.2.15 SUGAR BEET FIBER

10.2.1.4.2.16 OTHERS

10.2.1.5. CONFECTIONERY

10.2.1.5.1. CONFECTIONERY, BY FIBER TYPE

10.2.1.5.1.1 HARD CANDIES

10.2.1.5.1.2 CHEWING GUMS

10.2.1.5.1.3 JELLY

10.2.1.5.1.4 CHCOLATE SYRUPS

10.2.1.5.1.5 OTHERS

10.2.1.5.2. CONFECTIONERY, BY FIBER TYPE

10.2.1.5.2.1 PEA FIBER

10.2.1.5.2.2 WHEAT

10.2.1.5.2.3 BAMBOO FIBER

10.2.1.5.2.4 SOY FIBER

10.2.1.5.2.5 POTATO FIBER

10.2.1.5.2.6 CITRUS FIBER

10.2.1.5.2.7 CELLULOSE

10.2.1.5.2.8 OAT FIBER

10.2.1.5.2.9 APPLE FIBER

10.2.1.5.2.10 COCOA FIBER

10.2.1.5.2.11 ACACIA FIBER

10.2.1.5.2.12 SUGAR CANE FIBER

10.2.1.5.2.13 CORN FIBER

10.2.1.5.2.14 CARROT FIBER

10.2.1.5.2.15 SUGAR BEET FIBER

10.2.1.5.2.16 OTHERS

10.2.1.6. NUTRITION PRODUCTS

10.2.1.6.1. NUTRITION PRODUCTS, BY FIBER TYPE

10.2.1.6.1.1 NUTRION SUPPLEMENTS

10.2.1.6.1.2 NUTRION BARS

10.2.1.6.1.3 OTHERS

10.2.1.6.2. CONFECTIONERY, BY FIBER TYPE

10.2.1.6.2.1 PEA FIBER

10.2.1.6.2.2 WHEAT

10.2.1.6.2.3 BAMBOO FIBER

10.2.1.6.2.4 SOY FIBER

10.2.1.6.2.5 POTATO FIBER

10.2.1.6.2.6 CITRUS FIBER

10.2.1.6.2.7 CELLULOSE

10.2.1.6.2.8 OAT FIBER

10.2.1.6.2.9 APPLE FIBER

10.2.1.6.2.10 COCOA FIBER

10.2.1.6.2.11 ACACIA FIBER

10.2.1.6.2.12 SUGAR CANE FIBER

10.2.1.6.2.13 CORN FIBER

10.2.1.6.2.14 CARROT FIBER

10.2.1.6.2.15 SUGAR BEET FIBER

10.2.1.6.2.16 OTHERS

10.2.1.7. DAIRY PRODUCTS

10.2.1.7.1. DAIRY PRODUCTS, BY FIBER TYPE

10.2.1.7.1.1 QUARK

10.2.1.7.1.2 CHEESE

10.2.1.7.1.3 CHEESE SPREADS

10.2.1.7.1.4 READY TO EAT MILK DESSERTS

10.2.1.7.1.5 YOGURTS

10.2.1.7.1.5.1. REGULAR

10.2.1.7.1.5.2. FROZEN

10.2.1.7.2. OTHERS

10.2.1.7.3. DAIRY PRODUCTS, BY FIBER TYPE

10.2.1.7.4. PEA FIBER

10.2.1.7.5. WHEAT

10.2.1.7.6. BAMBOO FIBER

10.2.1.7.7. SOY FIBER

10.2.1.7.8. POTATO FIBER

10.2.1.7.9. CITRUS FIBER

10.2.1.7.10. CELLULOSE

10.2.1.7.11. OAT FIBER

10.2.1.7.12. APPLE FIBER

10.2.1.7.13. COCOA FIBER

10.2.1.7.14. ACACIA FIBER

10.2.1.7.15. SUGAR CANE FIBER

10.2.1.7.16. CORN FIBER

10.2.1.7.17. CARROT FIBER

10.2.1.7.18. SUGAR BEET FIBER

10.2.1.7.19. OTHERS

10.2.1.8. SANCKS& EXTRUDED SNACKS

10.2.1.8.1. SANCKS& EXTRUDED SNACKS, BY FIBER TYPE

10.2.1.8.2. PEA FIBER

10.2.1.8.3. WHEAT

10.2.1.8.4. BAMBOO FIBER

10.2.1.8.5. SOY FIBER

10.2.1.8.6. POTATO FIBER

10.2.1.8.7. CITRUS FIBER

10.2.1.8.8. CELLULOSE

10.2.1.8.9. OAT FIBER

10.2.1.8.10. APPLE FIBER

10.2.1.8.11. COCOA FIBER

10.2.1.8.12. ACACIA FIBER

10.2.1.8.13. SUGAR CANE FIBER

10.2.1.8.14. CORN FIBER

10.2.1.8.15. CARROT FIBER

10.2.1.8.16. SUGAR BEET FIBER

10.2.1.8.17. OTHERS

10.2.1.9. PASTA & NOODLES

10.2.1.9.1. PASTA & NOODLES, BY FIBER TYPE

10.2.1.9.2. PEA FIBER

10.2.1.9.3. WHEAT

10.2.1.9.4. BAMBOO FIBER

10.2.1.9.5. SOY FIBER

10.2.1.9.6. POTATO FIBER

10.2.1.9.7. CITRUS FIBER

10.2.1.9.8. CELLULOSE

10.2.1.9.9. OAT FIBER

10.2.1.9.10. APPLE FIBER

10.2.1.9.11. COCOA FIBER

10.2.1.9.12. ACACIA FIBER

10.2.1.9.13. SUGAR CANE FIBER

10.2.1.9.14. CORN FIBER

10.2.1.9.15. CARROT FIBER

10.2.1.9.16. SUGAR BEET FIBER

10.2.1.9.17. OTHERS

10.2.1.10. SOUP & SAUCES

10.2.1.10.1. SOUP & SAUCES, BY FIBER TYPE

10.2.1.10.2. PEA FIBER

10.2.1.10.3. WHEAT

10.2.1.10.4. BAMBOO FIBER

10.2.1.10.5. SOY FIBER

10.2.1.10.6. POTATO FIBER

10.2.1.10.7. CITRUS FIBER

10.2.1.10.8. CELLULOSE

10.2.1.10.9. OAT FIBER

10.2.1.10.10. APPLE FIBER

10.2.1.10.11. COCOA FIBER

10.2.1.10.12. ACACIA FIBER

10.2.1.10.13. SUGAR CANE FIBER

10.2.1.10.14. CORN FIBER

10.2.1.10.15. CARROT FIBER

10.2.1.10.16. SUGAR BEET FIBER

10.2.1.10.17. OTHERS

10.2.1.11. SPORTS NUTRITION

10.2.1.11.1. SPORTS NUTRITION, BY FIBER TYPE

10.2.1.11.2. PEA FIBER

10.2.1.11.3. WHEAT

10.2.1.11.4. BAMBOO FIBER

10.2.1.11.5. SOY FIBER

10.2.1.11.6. POTATO FIBER

10.2.1.11.7. CITRUS FIBER

10.2.1.11.8. CELLULOSE

10.2.1.11.9. OAT FIBER

10.2.1.11.10. APPLE FIBER

10.2.1.11.11. COCOA FIBER

10.2.1.11.12. ACACIA FIBER

10.2.1.11.13. SUGAR CANE FIBER

10.2.1.11.14. CORN FIBER

10.2.1.11.15. CARROT FIBER

10.2.1.11.16. SUGAR BEET FIBER

10.2.1.11.17. OTHERS

10.2.1.12. FROZEN & CONVENIENCE FOOD

10.2.1.12.1. FROZEN & CONVENIENCE FOOD, BY FIBER TYPE

10.2.1.12.2. PEA FIBER

10.2.1.12.3. WHEAT

10.2.1.12.4. BAMBOO FIBER

10.2.1.12.5. SOY FIBER

10.2.1.12.6. POTATO FIBER

10.2.1.12.7. CITRUS FIBER

10.2.1.12.8. CELLULOSE

10.2.1.12.9. OAT FIBER

10.2.1.12.10. APPLE FIBER

10.2.1.12.11. COCOA FIBER

10.2.1.12.12. ACACIA FIBER

10.2.1.12.13. SUGAR CANE FIBER

10.2.1.12.14. CORN FIBER

10.2.1.12.15. CARROT FIBER

10.2.1.12.16. SUGAR BEET FIBER

10.2.1.12.17. OTHERS

10.2.1.13. BEVERAGES

10.2.2 BEVERAGES, BY TYPE

10.2.2.1. SOFT DRINKS

10.2.2.2. FRUIT JUICES

10.2.2.3. INSTANT TEA & COFFEE

10.2.2.4. OTHERS

10.2.3 BEVERAGES, BY FIBER TYPE

10.2.3.1. PEA FIBER

10.2.3.2. WHEAT

10.2.3.3. BAMBOO FIBER

10.2.3.4. SOY FIBER

10.2.3.5. POTATO FIBER

10.2.3.6. CITRUS FIBER

10.2.3.7. CELLULOSE

10.2.3.8. OAT FIBER

10.2.3.9. APPLE FIBER

10.2.3.10. COCOA FIBER

10.2.3.11. ACACIA FIBER

10.2.3.12. SUGAR CANE FIBER

10.2.3.13. CORN FIBER

10.2.3.14. CARROT FIBER

10.2.3.15. SUGAR BEET FIBER

10.2.3.16. OTHERS

10.3 ANIMAL FEED

10.3.1 ANIMAL FEED, BY FEED TYPE

10.3.1.1. FOOD GRADE FIBER

10.3.1.2. AQUA FEED

10.3.1.3. SWINE FEED

10.3.1.4. POULTRY FEED

10.3.2 ANIMAL FEED, BY FIBER TYPE

10.3.2.1. PEA FIBER

10.3.2.2. WHEAT

10.3.2.3. BAMBOO FIBER

10.3.2.4. SOY FIBER

10.3.2.5. POTATO FIBER

10.3.2.6. CITRUS FIBER

10.3.2.7. CELLULOSE

10.3.2.8. OAT FIBER

10.3.2.9. APPLE FIBER

10.3.2.10. COCOA FIBER

10.3.2.11. ACACIA FIBER

10.3.2.12. SUGAR CANE FIBER

10.3.2.13. CORN FIBER

10.3.2.14. CARROT FIBER

10.3.2.15. SUGAR BEET FIBER

10.3.2.16. OTHERS

10.4 PHARAMACEUTICAL

10.4.1 PHARMACEUTICAL, BY FIBER TYPE

10.4.1.1. PEA FIBER

10.4.1.2. WHEAT

10.4.1.3. BAMBOO FIBER

10.4.1.4. SOY FIBER

10.4.1.5. POTATO FIBER

10.4.1.6. CITRUS FIBER

10.4.1.7. CELLULOSE

10.4.1.8. OAT FIBER

10.4.1.9. APPLE FIBER

10.4.1.10. COCOA FIBER

10.4.1.11. ACACIA FIBER

10.4.1.12. SUGAR CANE FIBER

10.4.1.13. CORN FIBER

10.4.1.14. CARROT FIBER

10.4.1.15. SUGAR BEET FIBER

10.4.1.16. OTHERS

10.5 OTHERS

11 GLOBAL DIETARY FIBERS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 CEREALS & GRAINS

11.2.1 R

11.2.2 SOY

11.2.3 WHEAT

11.2.4 CORN

11.2.5 BARLEY

11.2.6 MILLET

11.2.7 OAT

11.2.8 RYE

11.2.9 OTHERS

11.3 LEGUMES

11.3.1 BEANS

11.3.2 PEAS

11.3.3 CHICKPEAS

11.3.4 LENTILS

11.3.5 LUPINS

11.3.6 OTHERS

11.4 FRUITS & VEGETABLES

11.4.1 GRAPES

11.4.2 ORANGE

11.4.3 APPLE

11.4.4 COCOA

11.4.5 PINEAPPLE

11.4.6 PEAR

11.4.7 BERRIES

11.4.8 CABBAGE

11.4.9 CAULIFLOWER

11.4.10 LETTUCE

11.4.11 SPINACH

11.4.12 KALE

11.4.13 COLLARD GREEN

11.4.14 BELL PEPPER

11.4.15 GREEN BELL PEPPER

11.4.16 POTATO

11.4.17 SWEET POTATO

11.4.18 SUGAR BEET

11.4.19 CARROT

11.4.20 GUAR

11.4.21 LOCUST BEAN

11.4.22 YAM

11.4.23 GINGER

11.4.24 GARLIC

11.4.25 ACACIA TREE

11.4.26 OTHERS

12 GLOBAL DIETARY FIBERS MARKET, BY GRADE

12.1 OVERVIEW

12.2 30 MICRON

12.3 75 MICRON

12.4 90 MICRON

12.5 200 MICRON

12.6 500 MICRON

12.7 OTHERS

13 GLOBAL DIETARY FIBERS MARKET, BY COLOR

13.1 OVERVIEW

13.2 WHITE

13.3 BEIGE

13.4 LIGHT YELLOW

13.5 CREAM

13.6 BROWN

13.7 OTHERS

14 GLOBAL DIETARY FIBERS MARKET, BY ODOR

14.1 OVERVIEW

14.2 NATURAL FLAVOR/ODOR

14.3 FLAVORLESS

15 GLOBAL DIETARY FIBERS MARKET, BY CATEGORY

15.1 OVERVIEW

15.2 GMO

15.3 NON-GMO

16 GLOBAL DIETARY FIBERS MARKET, BY NATURE

16.1 OVERVIEW

16.2 ORGANIC

16.3 INORGANIC

17 GLOBAL DIETARY FIBERS MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18 GLOBAL DIETARY FIBERS MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 TURKEY

18.2.11 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 UAE

18.5.3 SAUDI ARABIA

18.5.4 KUWAIT

18.5.5 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL DIETARY FIBERS MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL DIETARY FIBERS MARKET, COMPANY PROFILE

20.1 DUPONT

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHICAL PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 INTERFIBER

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHICAL PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 CREAFILL FIBERS CORPORATION

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHICAL PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 HL AGRO PRODUCTS PVT. LTD.

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHICAL PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 ROQUETTE FRÈRES

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHICAL PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 CARGILL, INCORPORATED

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHICAL PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 J. RETTENMAIER & SÖHNE GMBH + CO KG

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHICAL PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 INGREDION INCORPORATED

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHICAL PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 GRAIN PROCESSING CORPORATION

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHICAL PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 UNIPEKTIN INGREDIENTS AG

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHICAL PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 BRENNTAG

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHICAL PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 QINGDAO CPI (ENTERPRISE)INTERNATIONAL CO., LTD.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHICAL PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 UNIQUE SOY PRODUCTS INTERNATIONAL, LLC

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHICAL PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 EMSLAND GROUP

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHICAL PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 AGT FOOD AND INGREDIENTS

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHICAL PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 AVEBE

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHICAL PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 JELU-WERK J. EHRLER GMBH & CO. KG

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHICAL PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 INTERFIBER

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHICAL PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 ROLLIT PRODIMPEX

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHICAL PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 PRORICH AGRO FOODS

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHICAL PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

20.21 CFF GMBH & CO. KG

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHICAL PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

20.22 THE SCOULAR COMPANY

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHICAL PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Global Dietary Fibers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dietary Fibers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dietary Fibers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.