Diethyl Phthalate Market Analysis and Size

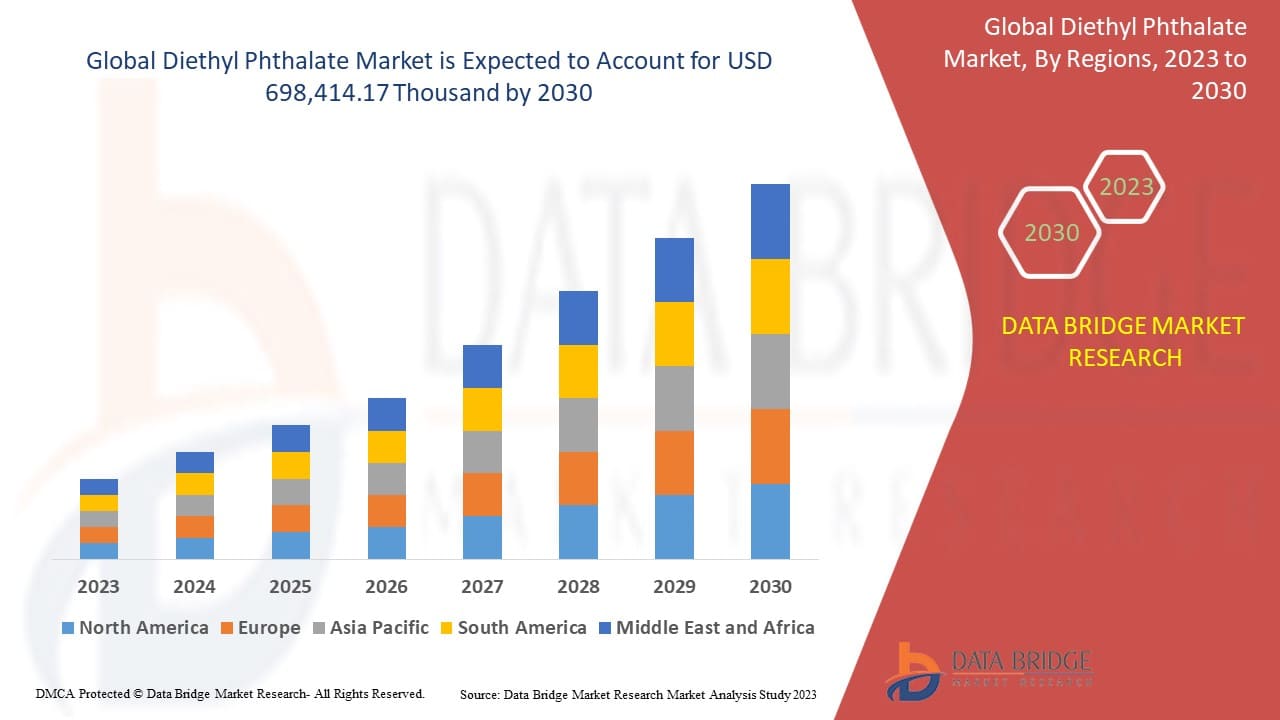

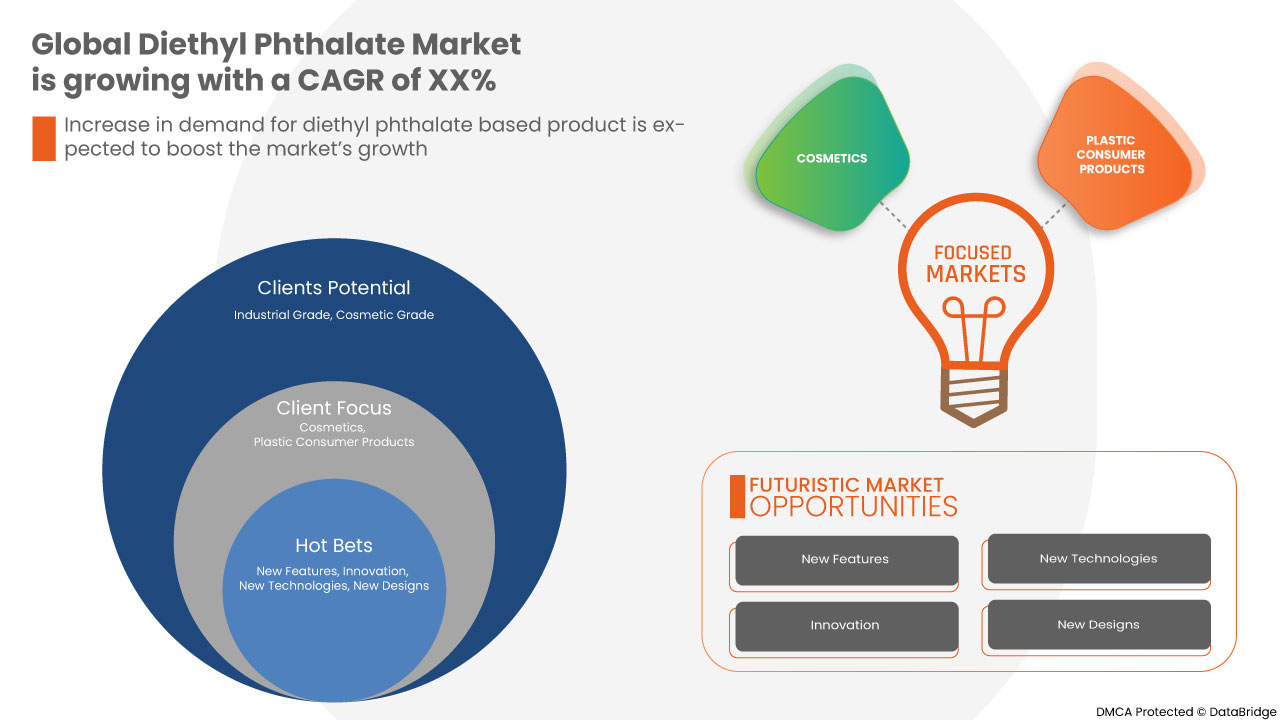

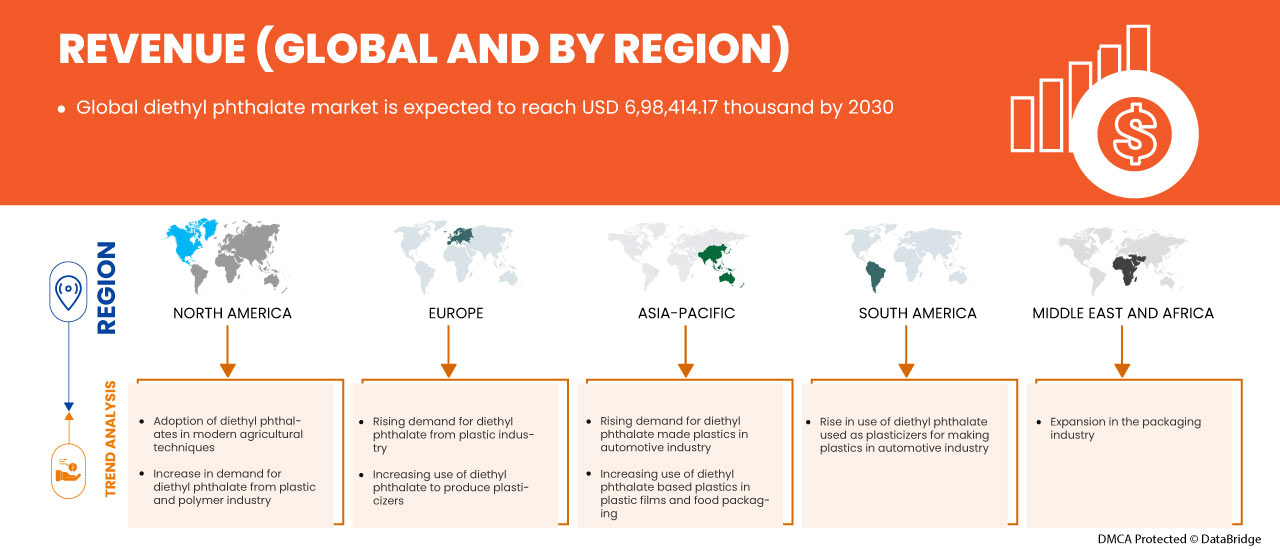

The diethyl phthalate market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 698,414.17 thousand by 2030. The major factor driving the growth of the diethyl phthalate market is the Increasing consumption of cosmetics and personal care products from cosmetic industries and the rising demand for diethyl phthalate from plastic industry.

The diethyl phthalate market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Purity (High Purity (≤99%), and Ultra High Purity (≥99.5%), Type (Industrial Grade, Cosmetic Grade, and Others), Application (Plasticizer, Binder, Cosmetic Ingredient, Solvent, and Alcohol Denaturant), End-User (Packaging, Cosmetic & Personal Care, Plastics & Polymers, Surfactants, Agrochemicals, Paints, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, and Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel, and Rest of the Middle East & Africa. |

|

Market Players Covered |

Thirumalai Chemicals Ltd, I G Petrochemicals Ltd., T.C.I. Chemicals (India) Pvt. Ltd., Indo Nippon Chemical Co., Ltd., Agro Extracts Limited., Maharashtra Aldehydes & Chemicals Ltd., MaaS Pharma Chemicals, Nishant Organics Pvt. Ltd., Spectrum Chemical, LobaChemie Pvt. Ltd., Polynt S.p.A., K.L.J. Group, Demon Chemicals Co., Ltd, PCIPL, West India Chemical International among others. |

Market Definition

Diethyl phthalate is a chemical compound that belongs to the phthalate ester family and is a diethyl ester of phthalic acid. Diethyl phthalate is a colorless liquid that is clear and slightly denser than water. Diethyl phthalate is not easily flammable. In the industry, diethyl phthalate is also known as solvanol. Diethyl phthalate is typically synthesized via the Ald-Ox or Oxo processes. Diethyl phthalate can also be synthesized by reacting phthalic anhydride with ethanol in presence of concentrated sulfuric acid as a catalyst. Diethyl phthalate purity typically ranges from 98% to 99.5%

Diethyl Phthalate Market Dynamics

Drivers

- Increasing consumption of cosmetics and personal care products

The consumption of cosmetic and personal care products have showed a significant rise due to the increasing emphasis between individuals on skin health and personal hygiene. The young generation knows the importance of skin care and have started to use such cosmetics and personal products such as nail polishes, hair sprays, aftershave lotions, cleansers, and shampoos on a large scale. The anti-aging and sun protection products have a high user base because the consumers are becoming aware of the appearance and harmful sunrays. In addition, increasing economy and developing lifestyle have seen rise in spending on personal grooming especially among the women. Such developing cosmetics and personal care products have expanded over the years and the future . In addition, technological advancements in personal products will drive the global diethyl phthalate market in the upcoming years.

- Rising demand for diethyl phthalate from plastic & polymer industry

Diethyl phthalate is used in polymer and plastics industry to make the end product more flexible. Accelerated industrialization, increase in income, changing lifestyle and increased application of polymer based products in day to day life have cause the upsurge of polymer industry. The polymer are used in healthcare, agriculture, clothing, housing, furniture, electronics and construction. A plasticizer or softener is a substance or material incorporated in a material (usually a plastic or elastomer) to increase its flexibility, workability or distensibility. A plasticizer may reduce the melt viscosity, lower the temperature of the second order transition or lower the elastic modulus of the melt.

- Adoption of diethyl phthalates in modern agricultural techniques

Diethyl phthalate is used in agrochemicals to keep away insects and pests from crops. Due to increasing insects attack on crops, the insecticides demand are too rising. Inert ingredients such as diethyl phthalate are utilized in pesticides that are applied to animals for food production. This is turns is expected to drive the use of diethyl phthalate in insecticides and pesticides, which generally adds to the growth of farmer income.

Furthermore, these phthalic acid esters do not only leach from packaging into fertilizers and pesticides, they are also used as a solvent in many pesticides. In modern agriculture, vast use of PVC pipes are being done in agriculture. To make this PVC pipes, diethyl phthalate are used as plasticizers.

Opportunities

- Increasing use of diethyl phthalate to produce plasticizers for automotive industry

In today’s world, there is huge need to decrease weight and fuel usage. Therefore, diethyl phthalates are used in automotive plastics as one of the primary materials. One-third part of an average automotive vehicle is made up of plastic which include dashboards, engine covers, seating, interior wall panels, carburetors, handles, cable insulation, truck bed liners and many others. Polypropylene, polyvinyl chloride, polystyrene, polycarbonate and polyethylene are some of the plastics which are applied in building automotive vehicles. Diethyl phthalate is one of the widely used plasticizers to make these plastics and polymers. They make the plastic more flexible. Moreover, DEP is a biodegradable material and is also used in the manufacturing of automotive parts and tubes used in medical treatment and diagnostics.

- Expansion of the packaging industry

In packaging industry, bubble wrap and plastic films are few of the packaging materials used. To manufacture such materials plasticizers such as diethyl phthalate is effectively used in large quantities. Diethyl phthalate is used as a plasticizer for cellulose ester plastic films and sheets such as photographic, blister packaging, and tape applications and molded and extruded articles. Therefore, the demand of diethyl phthalate will rise in the coming years as the packaging industry expands, which is expected to provide lucrative opportunities for the growth of the global diethyl phthalate market.

Restraints/Challenges

- Availability of alternatives to diethyl phthalates in the market

Diethyl phthalate has been widely used in cosmetics, consumer goods, plastics and polymers and packaging industry. However because of regulations, environmental and health issues there has been rise in availability and use of various substitutes of diethyl phthalate. Epoxidised soybean oil (ESBO) is used as plasticizers and compatibilizers along with diethyl phthalate. ESBO has also found its application as plasticizers in seals for glass jar and also act as stabilizer to decrease UV degradation of polyvinyl chloride. Similarly, Trimellitates have also been used as a substitute to diethyl phthalate which are used in wall coverings, packaging and flooring. In cosmetic products, acetyl tributyl citrate is used as a plasticizer in cosmetic products and in PVC applications.

- Hazards associated with excessive and long term use of diethyl phthalate

Diet is one of the main ways in which diethyl phthalates are consumed by consumers. Food packaging materials such as gloves used during food preparation, and vinyl plastic tools and materials can leak these chemicals into food. Diethyl phthalate when released in water sources, affects the marine life. Therefore, the presence of such harmful toxin in fish and other sea creatures directly harm the human health when these sea food items are consumed. The use of personal care products, vinyl flooring and wall coverings tends to release diethyl phthalate in large quantities. Such daily exposure to chemical can cause detrimental health effects not only to adults but also to children who are in their early growth.

Recent Developments

- In February, Spectrum Chemical Mfg. Corporation Receives GE Distinguished Partner Award for Applied Markets for Second Consecutive Year. This award will help the company to get recognition on larger scale.

- In December, PCIPL gets recommended again for prestigious ISO certification. Process orientation of the company which is so uncommon amongst most of the distribution companies has given us this edge and is helping us not just in our business but also fetching recognition by professional bodies of high repute like TUV SUD.

Diethyl Phthalate Market Scope

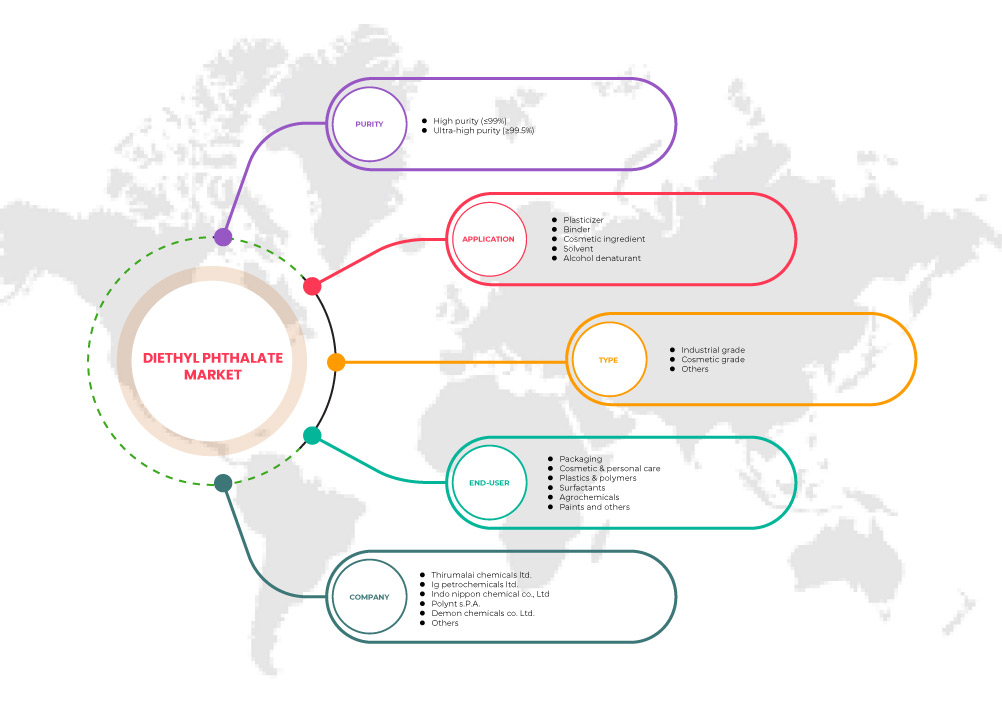

The diethyl phthalate market is categorized based on purity type, type, application, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Purity Type

- High Purity (≤99%)

- Ultra-High Purity (≥99.5%)

On the basis of Purity, the diethyl phthalate market is segmented into high Purity (≤99%) and ultra-high Purity (≥99.5%).

By Type

- Industrial grade

- Cosmetic grade

- Others

On the basis of type, the diethyl phthalate market is segmented into industrial grade, cosmetic grade and others.

Application

- Plasticizer

- Binder

- Cosmetic Ingredient

- Solvent

- Alcohol Denaturant

On the basis of application, the diethyl phthalate market is segmented into plasticizer, binder, cosmetic ingredient, solvent, and alcohol denaturant.

End User

- Packaging

- Cosmetic & Personal Care

- Plastics & Polymers

- Surfactants

- Agrochemicals

- Paints

- Others

On the basis of end-user, the diethyl phthalate market is segmented into packaging, cosmetic & personal care, plastics & polymers, surfactants, agrochemicals, paints and others.

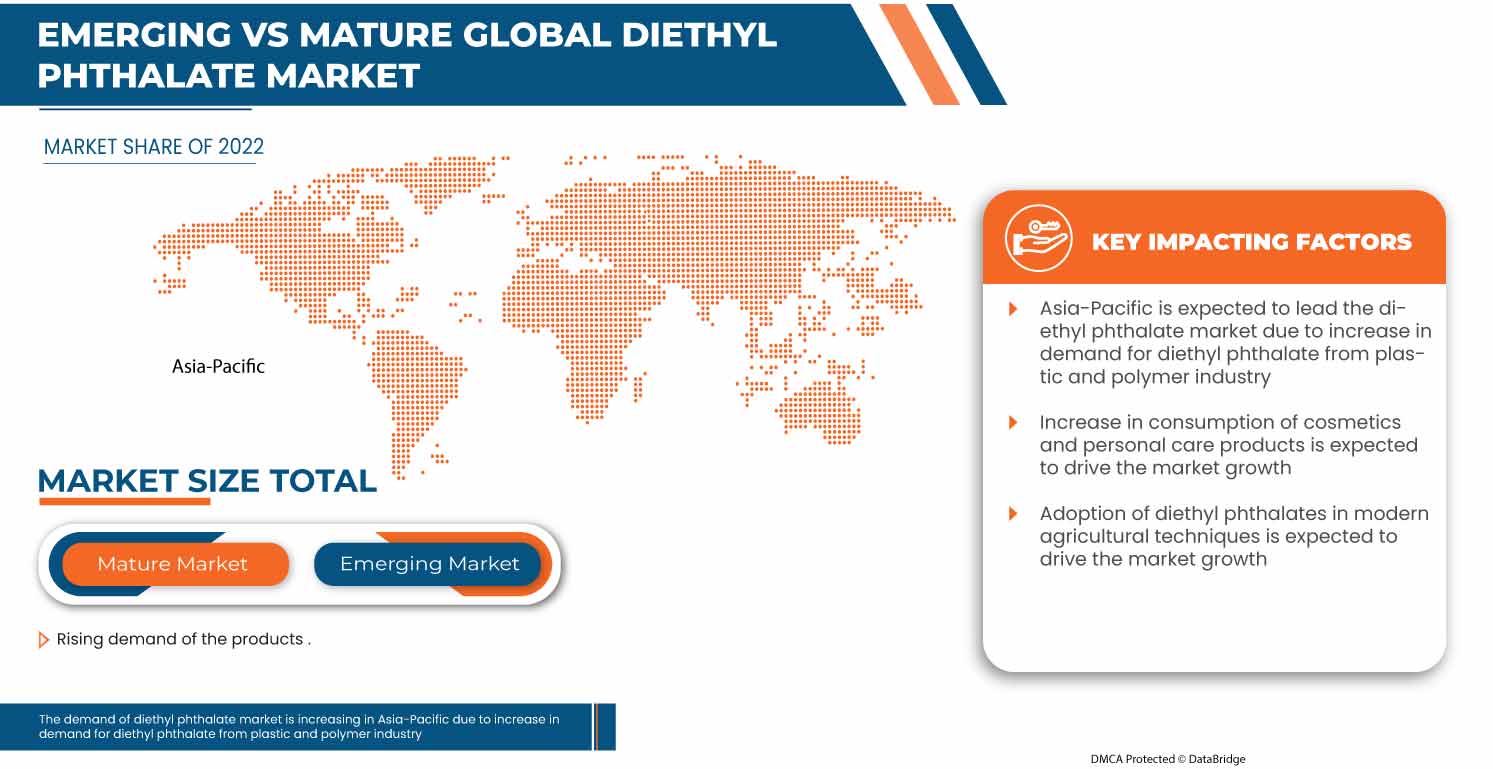

Diethyl Phthalate Market Regional Analysis/Insights

The diethyl phthalate market is segmented on the basis of purity type, type, applications, and end-user.

The countries in the diethyl phthalate market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxemburg, and Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel, and Rest of the Middle East & Africa.

China dominates in the Asia-Pacific region due to advanced development in technologies. In North America, the U.S. is expected to dominate the diethyl phthalate market because of the rising demand for diethyl phthalate as plasticizers to produce plastics for automotive industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Diethyl Phthalate Market Share Analysis

The diethyl phthalate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the diethyl phthalate market.

Some of the major market players operating in the market are Thirumalai Chemicals Ltd, I G Petrochemicals Ltd., T.C.I. Chemicals (India) Pvt. Ltd., Indo Nippon Chemical Co., Ltd., Agro Extracts Limited., Maharashtra Aldehydes & Chemicals Ltd., MaaS Pharma Chemicals, Nishant Organics Pvt. Ltd., Spectrum Chemical, LobaChemie Pvt. Ltd., Polynt S.p.A., K.L.J. Group, Demon Chemicals Co., Ltd, PCIPL, West India Chemical International among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL DIETHYL PHTHALATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS

5.1.2 RISING DEMAND FOR DIETHYL PHTHALATE FROM THE PLASTIC & POLYMER INDUSTRY

5.1.3 ADOPTION OF DIETHYL PHTHALATES IN MODERN AGRICULTURAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HAZARDS ASSOCIATED WITH EXCESSIVE AND LONG-TERM USE OF DIETHYL PHTHALATE

5.2.2 STRICT REGULATIONS REGARDING THE TOXICITY OF DIETHYL PHTHALATE

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF DIETHYL PHTHALATE TO PRODUCE PLASTICIZERS FOR THE AUTOMOTIVE INDUSTRY

5.3.2 EXPANSION OF THE PACKAGING INDUSTRY

5.4 CHALLENGE

5.4.1 AVAILABILITY OF ALTERNATIVES TO DIETHYL PHTHALATES IN THE MARKET

6 GLOBAL DIETHYL PHTHALATE MARKET, BY PURITY

6.1 OVERVIEW

6.2 HIGH PURITY (≤99%)

6.3 ULTRA HIGH PURITY (≥99.5%)

7 GLOBAL DIETHYL PHTHALATE MARKET, BY TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL GRADE

7.3 COSMETIC GRADE

7.4 OTHERS

8 GLOBAL DIETHYL PHTHALATE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PLASTICIZER

8.3 BINDER

8.4 COSMETIC INGREDIENT

8.5 SOLVENT

8.6 ALCOHOL DENATURANT

9 GLOBAL DIETHYL PHTHALATE MARKET, BY END-USER

9.1 OVERVIEW

9.2 PACKAGING

9.3 COSMETIC & PERSONAL CARE

9.3.1 COSMETIC & PERSONAL CARE, BY TPE

9.3.1.1 BATH PRODUCTS

9.3.1.2 PERFUMES

9.3.1.3 HAIR CARE

9.3.1.4 NAIL ENAMEL & REMOVERS

9.3.1.5 SKIN CARE PRODUCTS

9.3.1.6 PERSONAL HYGIENE

9.3.1.7 OTHERS

9.4 PLASTICS & POLYMERS

9.5 SURFACTANTS

9.6 AGROCHEMICALS

9.7 PAINTS

9.8 OTHERS

10 GLOBAL DIETHYL PHTHALATE MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 INDIA

10.2.3 JAPAN

10.2.4 SOUTH KOREA

10.2.5 SINGAPORE

10.2.6 INDONESIA

10.2.7 THAILAND

10.2.8 AUSTRALIA & NEW ZEALAND

10.2.9 PHILIPPINES

10.2.10 MALAYSIA

10.2.11 REST OF ASIA-PACIFIC

10.3 EUROPE

10.3.1 GERMANY

10.3.2 U.K.

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 RUSSIA

10.3.7 TURKEY

10.3.8 SWITZERLAND

10.3.9 BELGIUM

10.3.10 NETHERLANDS

10.3.11 LUXEMBURG

10.3.12 REST OF EUROPE

10.4 NORTH AMERICA

10.4.1 U.S.

10.4.2 CANADA

10.4.3 MEXICO

10.5 MIDDLE EAST AND AFRICA

10.5.1 SAUDI ARABIA

10.5.2 UNITED ARAB EMIRATES

10.5.3 EGYPT

10.5.4 SOUTH AFRICA

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL DIETHYL PHTHALATE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 AWARDS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 THIRUMALAI CHEMICALS LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 I G PETROCHEMICALS LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 INDO NIPPON CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 POLYNT S.P.A.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DEMON CHEMICALS CO. LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 AGRO EXTRACTS LIMITED.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 KLJ GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 LOBACHEMIE PVT. LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAHARASHTRA ALDEHYDES & CHEMICALS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 MAAS PHARMA CHEMICALS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 NISHANT ORGANICS PVT. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

13.12 PCIPL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

13.13 SPECTRUM CHEMICAL

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 TCI CHEMICALS (INDIA) PVT. LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 WEST INDIA CHEMICAL INTERNATIONAL

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 GLOBAL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 5 GLOBAL HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 GLOBAL ULTRA HIGH PURITY (≥99.5%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 GLOBAL DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL INDUSTRIAL GRADE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL COSMETIC GRADEIN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL PLASTICIZER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL BINDER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL COSMETIC INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL SOLVENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL ALCOHOL DENATURANT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL PACKAGING IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL PLASTICS & POLYMERS INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL SURFACTANTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL AGROCHEMICALS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL PAINTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 30 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 32 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 34 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 39 CHINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 40 CHINA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 CHINA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 CHINA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 INDIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 45 INDIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 46 INDIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 INDIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 INDIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 49 INDIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 JAPAN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 51 JAPAN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 52 JAPAN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 JAPAN DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 JAPAN DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 55 JAPAN COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 58 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SINGAPORE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 63 SINGAPORE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 64 SINGAPORE DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SINGAPORE DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 66 SINGAPORE DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 INDONESIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 69 INDONESIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 70 INDONESIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 72 INDONESIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 73 INDONESIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 THAILAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 76 THAILAND DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 82 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 PHILIPPINES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 87 PHILIPPINES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 88 PHILIPPINES DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 PHILIPPINES DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 PHILIPPINES DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 91 PHILIPPINES COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MALAYSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 94 MALAYSIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 REST OF ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 99 REST OF ASIA-PACIFIC DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 100 EUROPE DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 101 EUROPE DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 102 EUROPE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 103 EUROPE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 104 EUROPE DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 EUROPE DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 EUROPE DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 107 EUROPE COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 GERMANY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 109 GERMANY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 110 GERMANY DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 GERMANY DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 112 GERMANY DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 113 GERMANY COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 U.K. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 115 U.K. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 116 U.K. DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 U.K. DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 U.K. DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 119 U.K. COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 FRANCE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 121 FRANCE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 122 FRANCE DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 FRANCE DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 124 FRANCE DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 125 FRANCE COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 ITALY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 127 ITALY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 128 ITALY DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 ITALY DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 130 ITALY DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 131 ITALY COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 SPAIN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 133 SPAIN DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 134 SPAIN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 SPAIN DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 136 SPAIN DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 137 SPAIN COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 RUSSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 139 RUSSIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 140 RUSSIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 141 RUSSIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 RUSSIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 143 RUSSIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 TURKEY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 145 TURKEY DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 146 TURKEY DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 TURKEY DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 148 TURKEY DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 149 TURKEY COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 SWITZERLAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 151 SWITZERLAND DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 152 SWITZERLAND DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SWITZERLAND DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 154 SWITZERLAND DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 155 SWITZERLAND COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 BELGIUM DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 157 BELGIUM DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 158 BELGIUM DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 BELGIUM DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 160 BELGIUM DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 161 BELGIUM COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 NETHERLANDS DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 163 NETHERLANDS DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 164 NETHERLANDS DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 NETHERLANDS DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 166 NETHERLANDS DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 167 NETHERLANDS COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 LUXEMBURG DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 169 LUXEMBURG DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 170 LUXEMBURG DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 LUXEMBURG DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 172 LUXEMBURG DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 173 LUXEMBURG COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 REST OF EUROPE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 175 REST OF EUROPE DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 176 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 177 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 178 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 179 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 180 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 182 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 183 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 185 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 186 U.S. DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 U.S. DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 188 U.S. DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 189 U.S. COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 191 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 192 CANADA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 CANADA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 194 CANADA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 195 CANADA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 197 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 198 MEXICO DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 MEXICO DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 200 MEXICO DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 201 MEXICO COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 203 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 204 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 205 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 206 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 208 MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 209 MIDDLE EAST & AFRICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 SAUDI ARABIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 211 SAUDI ARABIA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 212 SAUDI ARABIA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 SAUDI ARABIA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 214 SAUDI ARABIA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 215 SAUDI ARABIA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 216 UNITED ARAB EMIRATES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 217 UNITED ARAB EMIRATES DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 218 UNITED ARAB EMIRATES DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 UNITED ARAB EMIRATES DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 220 UNITED ARAB EMIRATES DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 221 UNITED ARAB EMIRATES COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 EGYPT DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 223 EGYPT DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 224 EGYPT DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 EGYPT DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 226 EGYPT DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 227 EGYPT COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 228 SOUTH AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 229 SOUTH AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 230 SOUTH AFRICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 SOUTH AFRICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 232 SOUTH AFRICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 233 SOUTH AFRICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 ISRAEL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 235 ISRAEL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 236 ISRAEL DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 ISRAEL DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 238 ISRAEL DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 239 ISRAEL COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 REST OF MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 241 REST OF MIDDLE EAST & AFRICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 242 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 243 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 244 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 245 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 246 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 247 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 248 SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 249 SOUTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 BRAZIL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 251 BRAZIL DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 252 BRAZIL DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 BRAZIL DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 254 BRAZIL DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 255 BRAZIL COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 ARGENTINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 257 ARGENTINA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 258 ARGENTINA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 ARGENTINA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 260 ARGENTINA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 261 ARGENTINA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 REST OF SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 263 REST OF SOUTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

List of Figure

FIGURE 1 GLOBAL DIETHYL PHTHALATE MARKET

FIGURE 2 GLOBAL DIETHYL PHTHALATE MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL DIETHYL PHTHALATE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL DIETHYL PHTHALATE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL DIETHYL PHTHALATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL DIETHYL PHTHALATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL DIETHYL PHTHALATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL DIETHYL PHTHALATEMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL DIETHYL PHTHALATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL DIETHYL PHTHALATE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL DIETHYL PHTHALATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL DIETHYL PHTHALATEMARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL DIETHYL PHTHALATE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL DIETHYL PHTHALATE MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS IS EXPECTED TO DRIVE THE GLOBAL DIETHYL PHTHALATE MARKET IN THE FORECAST PERIOD

FIGURE 16 HIGH PURITY (≤99%) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL DIETHYL PHTHALATE MARKET IN 2022 & 2029

FIGURE 17 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR DIETHYL PHTHALATE MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL DIETHYL PHTHALATE MARKET

FIGURE 19 GLOBAL DIETHYL PHTHALATE MARKET: BY PURITY, 2022

FIGURE 20 GLOBAL DIETHYL PHTHALATE MARKET: BY TYPE, 2022

FIGURE 21 GLOBAL DIETHYL PHTHALATE MARKET: BY APPLICATION, 2022

FIGURE 22 GLOBAL DIETHYL PHTHALATE MARKET: BY END-USER, 2022

FIGURE 23 GLOBAL DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 24 GLOBAL DIETHYL PHTHALATE MARKET: BY REGION (2022)

FIGURE 25 GLOBAL DIETHYL PHTHALATE MARKET: BY REGION (2023 & 2030)

FIGURE 26 GLOBAL DIETHYL PHTHALATE MARKET: BY REGION (2022 & 2030)

FIGURE 27 GLOBAL DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 28 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 29 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 30 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 ASIA-PACIFIC DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 33 EUROPE DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 34 EUROPE DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 35 EUROPE DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 EUROPE DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 EUROPE DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 38 NORTH AMERICA DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 39 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 40 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 43 MIDDLE EAST AND AFRICA DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 44 MIDDLE EAST AND AFRICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 45 MIDDLE EAST AND AFRICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 46 MIDDLE EAST AND AFRICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 47 MIDDLE EAST AND AFRICA DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 48 SOUTH AMERICA DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 49 SOUTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 50 SOUTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 SOUTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 SOUTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 53 GLOBAL DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022 (%)

FIGURE 55 EUROPE DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022(%)

FIGURE 56 ASIA- PACIFIC DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022(%)

Global Diethyl Phthalate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diethyl Phthalate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diethyl Phthalate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.