Global Digital Pcr Market

Market Size in USD Billion

CAGR :

%

USD

7.58 Billion

USD

17.61 Billion

2024

2032

USD

7.58 Billion

USD

17.61 Billion

2024

2032

| 2025 –2032 | |

| USD 7.58 Billion | |

| USD 17.61 Billion | |

|

|

|

|

Digital Polymerase Chain Reaction (PCR) Market Size

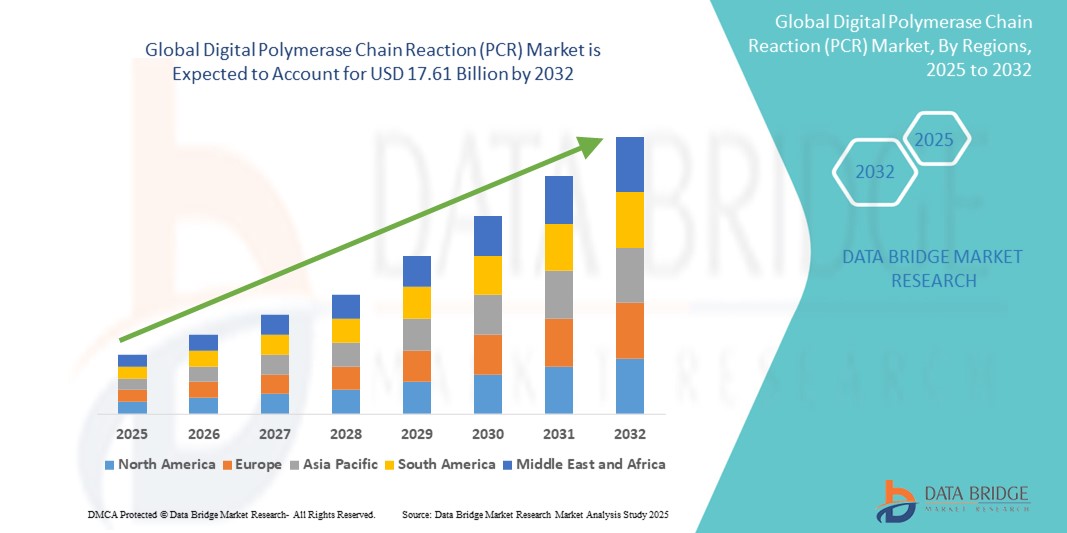

- The global digital polymerase chain reaction (PCR) market size was valued at USD 7.58 billion in 2024 and is expected to reach USD 17.61 billion by 2032, at a CAGR of 11.1% during the forecast period

- The market growth is primarily driven by the rising demand for precise and highly sensitive nucleic acid quantification in research, clinical diagnostics, and infectious disease testing, especially in oncology and genetic disorders

- In addition, advancements in microfluidic technologies and increased adoption of digital PCR over traditional PCR due to its superior accuracy and reproducibility are reinforcing the shift towards digital solutions. These factors are collectively accelerating market expansion and shaping digital PCR as a cornerstone tool in modern molecular diagnostics

Digital Polymerase Chain Reaction (PCR) Market Analysis

- Digital PCR, a highly precise and sensitive molecular diagnostic technique, is gaining traction across clinical diagnostics, research laboratories, and pharmaceutical industries due to its superior ability to detect low-abundance nucleic acids and provide absolute quantification without the need for standard curves

- The increasing demand for advanced genetic testing, early cancer detection, and pathogen identification—especially in infectious disease management—is a key driver behind the accelerated adoption of digital PCR technologies

- North America dominated the digital polymerase chain reaction (PCR) market with the largest revenue share of 39.2% in 2024, underpinned by strong healthcare infrastructure, significant R&D investments, and the presence of leading biotech and diagnostic companies actively innovating in the molecular diagnostics space

- Asia-Pacific is anticipated to witness the fastest growth in the digital polymerase chain reaction (PCR) market over the forecast period, driven by expanding healthcare access, rising awareness of genetic disorders, and increased governmental focus on precision medicine initiatives

- The droplet digital polymerase chain reaction (PCR) segment dominated the market with a 47% share in 2024, owing to its enhanced sensitivity, scalability, and growing application in oncology, rare mutation detection, and environmental monitoring

Report Scope and Digital Polymerase Chain Reaction (PCR) Market Segmentation

|

Attributes |

Digital Polymerase Chain Reaction (PCR) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Polymerase Chain Reaction (PCR) Market Trends

“Increased Precision and Integration with AI-driven Diagnostic Platforms”

- A major and emerging trend in the global digital PCR market is the integration of digital PCR technology with artificial intelligence (AI)-driven diagnostic platforms, enabling enhanced data interpretation, real-time analysis, and improved clinical decision-making. This synergy is transforming how genetic data is utilized across research and healthcare settings

- For instance, companies such as Bio-Rad Laboratories have introduced digital PCR systems that leverage AI algorithms for automated data processing and mutation analysis, reducing manual workload and increasing throughput. Similarly, Thermo Fisher Scientific’s QuantStudio Absolute Q dPCR system incorporates cloud-based software for remote monitoring and AI-powered analytics

- AI integration allows digital PCR instruments to detect rare mutations with high accuracy and provide advanced analytics for applications such as liquid biopsy, minimal residual disease (MRD) detection, and infectious disease surveillance. This has vast implications in oncology, where precision and early detection are critical

- The convergence of AI with digital PCR also facilitates large-scale population genomics studies and epidemiological tracking by providing scalable, reproducible, and automated workflows. Integration with laboratory information systems (LIS) and cloud platforms ensures real-time data accessibility for clinicians and researchers

- This trend is reshaping expectations for diagnostics, as end-users increasingly demand precise, automated, and data-rich solutions. Companies such as Stilla Technologies and QIAGEN are enhancing their dPCR systems with user-friendly interfaces, intelligent quality control features, and seamless compatibility with genomic databases, thus driving demand across research and clinical diagnostics

- As personalized medicine continues to expand, the demand for AI-enhanced digital PCR solutions is growing rapidly, providing healthcare providers with highly specific, actionable insights and contributing to the evolution of precision diagnostics

Digital Polymerase Chain Reaction (PCR) Market Dynamics

Driver

“Surging Demand for Precision Diagnostics and Targeted Therapies”

- The growing need for high-accuracy molecular diagnostic tools in areas such as oncology, infectious disease detection, and rare genetic disorder testing is a key driver behind the rising demand for digital PCR systems. These systems offer absolute quantification, greater sensitivity, and reproducibility compared to traditional qPCR methods

- For instance, in March 2024, QIAGEN launched its QIAcuity digital PCR system with expanded multiplexing capability, supporting cancer researchers and clinicians in identifying mutations with superior precision. Such product innovations are fueling the adoption of dPCR technology across research and clinical labs

- Digital PCR is playing a critical role in liquid biopsy testing, MRD detection, and pathogen surveillance, offering critical insights for disease monitoring and treatment optimization. These capabilities are particularly relevant in the current landscape of precision medicine and individualized treatment plans

- Furthermore, the widespread availability of commercial dPCR platforms, combined with the rising prevalence of chronic diseases and government investments in molecular diagnostics infrastructure, is propelling market growth

- The user-friendly nature, high throughput, and remote accessibility features of next-generation digital PCR systems make them suitable for both centralized labs and decentralized point-of-care settings, further broadening their utility

Restraint/Challenge

“High Equipment Costs and Technical Complexity”

- One of the major challenges hindering broader digital PCR adoption is the relatively high cost of instrumentation and reagents compared to traditional PCR methods. The initial investment required for digital PCR platforms remains a barrier, particularly for smaller laboratories and institutions in low- and middle-income countries

- For instance, droplet-based digital PCR systems with advanced multiplexing features and AI-enabled analytics often require significant capital expenditure, making cost-effectiveness a critical consideration for budget-constrained healthcare systems

- Moreover, the technical complexity associated with operating digital PCR platforms and interpreting results can be a hurdle for laboratories lacking specialized personnel or training. Although automation and AI are simplifying workflows, skilled professionals are still needed to manage system calibration, assay design, and data quality control

- To overcome these challenges, key players such as Bio-Rad and Thermo Fisher Scientific are investing in developing cost-effective, scalable, and more user-friendly dPCR solutions. The introduction of compact benchtop systems and bundled software tools for analysis is helping to reduce adoption barriers

- Continued focus on reducing system costs, simplifying operation, and expanding user education will be crucial to achieving broader adoption and unlocking the full potential of digital PCR in mainstream clinical diagnostics and research environments

Digital Polymerase Chain Reaction (PCR) Market Scope

The market is segmented on the basis of product type, technology, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the digital polymerase chain reaction (PCR) market is segmented into digital PCR instruments, consumables and reagents, and software and services. The consumables and reagents segment dominated the market with the largest market revenue share in 2024, driven by the repetitive usage of reagents such as master mixes, chips, cartridges, and reaction vessels in every dPCR run. Consistent demand from diagnostic laboratories and research institutions makes this segment a key revenue generator. The increasing frequency of clinical and genomic testing also contributes to strong sales volume of consumables and reagents.

The digital PCR instruments segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the adoption of next-generation, automated systems with integrated software and cloud connectivity. Rising demand for portable, high-throughput platforms for point-of-care and decentralized testing environments also supports the expansion of this segment.

- By Technology

On the basis of technology, the digital polymerase chain reaction (PCR) market is segmented into droplet digital PCR and beaming digital PCR. The droplet digital PCR segment held the largest market revenue share of 47% in 2024, driven by its high accuracy, sensitivity, and minimal cross-contamination risks. Widely used in mutation detection, copy number variation analysis, and infectious disease diagnostics, ddPCR is increasingly adopted by clinical and life science laboratories. Its scalable nature and cost-efficiency also make it a preferred choice across research applications.

The beaming digital PCR segment is anticipated to witness the fastest growth rate from 2025 to 2032, particularly in oncology and rare mutation detection. Its hybrid approach, combining magnetic beads and flow cytometry, provides an edge in high-resolution genomic analysis for academic research and pharmaceutical development.

- By Application

On the basis of application, the digital polymerase chain reaction (PCR) market is segmented into clinical, life science and research, and others. The clinical segment dominated the market with the largest market revenue share in 2024, due to rising utilization of digital PCR in non-invasive prenatal testing (NIPT), cancer diagnostics, infectious disease detection, and genetic disorder screening. The increasing emphasis on personalized medicine and early disease diagnosis further propels demand from clinical laboratories and hospitals.

The life science and research segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising government and private investments in genomic research. Widespread use in basic and translational research, such as gene expression studies, gene editing validation, and microbial detection, contributes to the strong growth outlook.

- By End User

On the basis of end user, the digital polymerase chain reaction (PCR) market is segmented into pharmaceutical and biotechnology companies, hospitals and clinics, diagnostic laboratories, academic and research organizations, reference laboratories, and others. The diagnostic laboratories segment dominated the market with the largest market revenue share in 2024, owing to their significant role in clinical testing and routine diagnostics involving high sample throughput. Adoption of dPCR technologies in diagnostic labs is driven by the need for precise quantification and reliable detection of pathogens and genetic anomalies.

The pharmaceutical and biotechnology companies segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increased application of digital PCR in drug development, biomarker discovery, and clinical trials. Its use in quantifying low-level DNA mutations and assessing treatment efficacy enhances the research and regulatory value for pharma and biotech firms.

- By Distribution Channel

On the basis of distribution channel, the digital polymerase chain reaction (PCR) market is segmented into direct tenders, retail sales, and others. The direct tenders segment held the largest market revenue share in 2024, driven by institutional procurement by hospitals, laboratories, and academic organizations, often for high-value capital equipment and bulk reagent orders. This channel is dominant in large-scale healthcare networks and government-funded research bodies.

The retail sales segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the rise of e-commerce platforms and authorized distributors offering faster delivery, competitive pricing, and easier access for smaller labs and independent researchers. Retail sales also benefit from increasing demand for consumables and lower-cost, compact digital PCR systems for decentralized use.

Digital Polymerase Chain Reaction (PCR) Market Regional Analysis

- North America dominated the digital PCR market with the largest revenue share of 39.2% in 2024, underpinned by strong healthcare infrastructure, significant R&D investments, and the presence of leading biotech and diagnostic companies actively innovating in the molecular diagnostics space

- Healthcare providers and research institutions in the region prioritize highly accurate and sensitive diagnostic tools such as digital PCR for applications including liquid biopsy, infectious disease detection, and rare mutation analysis

- This dominance is further supported by a well-established healthcare infrastructure, high R&D spending, and early adoption of cutting-edge genomic technologies, making digital PCR a preferred solution across clinical, academic, and pharmaceutical sectors

U.S. Digital Polymerase Chain Reaction (PCR) Market Insight

The U.S. digital polymerase chain reaction (PCR) market captured the largest revenue share of 79% in 2024 within North America, driven by extensive investments in precision medicine, genomic research, and cancer diagnostics. The strong presence of key players, coupled with growing clinical applications such as non-invasive prenatal testing (NIPT) and infectious disease monitoring, significantly boosts adoption. Increasing use of digital PCR in academic and pharmaceutical research, along with favorable healthcare infrastructure and government funding, continues to propel the market’s expansion.

Europe Digital Polymerase Chain Reaction (PCR) Market Insight

The Europe digital polymerase chain reaction (PCR) market is projected to expand at a substantial CAGR throughout the forecast period, supported by advanced laboratory infrastructure and increasing prevalence of chronic diseases requiring precision diagnostics. Regulatory support for molecular testing and strong academic research capabilities are driving the demand for digital PCR technologies. The region is witnessing increased utilization of digital PCR in oncology, virology, and pharmacogenomics across hospitals, diagnostic centers, and research institutions.

U.K. Digital Polymerase Chain Reaction (PCR) Market Insight

The U.K. digital polymerase chain reaction (PCR) market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising adoption of precision diagnostic tools and government initiatives supporting genomic research. The NHS’s emphasis on early disease detection and personalized healthcare contributes to growing demand for digital PCR in clinical and academic settings. Furthermore, strong research collaboration between universities and biotech firms enhances the country’s role in driving innovation within the digital PCR space.

Germany Digital Polymerase Chain Reaction (PCR) Market Insight

The Germany digital polymerase chain reaction (PCR) market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s leadership in biomedical research and technological innovation. Increasing demand for high-sensitivity diagnostic tools for cancer and rare diseases supports widespread adoption of dPCR in both clinical and life science applications. Germany’s commitment to healthcare digitization and integration of AI-based analytical tools with molecular diagnostics strengthens the appeal of digital PCR systems.

Asia-Pacific Digital Polymerase Chain Reaction (PCR) Market Insight

The Asia-Pacific digital polymerase chain reaction (PCR) market is poised to grow at the fastest CAGR of 26.3% during the forecast period of 2025 to 2032, driven by rising healthcare expenditure, improving diagnostic capabilities, and expanding research infrastructure in countries such as China, India, and Japan. Government-led healthcare reforms, increasing adoption of molecular diagnostics, and growing investment in biopharmaceutical R&D are accelerating the demand for digital PCR systems across the region.

Japan Digital Polymerase Chain Reaction (PCR) Market Insight

The Japan digital polymerase chain reaction (PCR) market is gaining momentum due to its strong biomedical innovation ecosystem and high standards for clinical diagnostics. With a growing elderly population and a strong focus on early disease detection, Japan is witnessing increased use of digital PCR in cancer screening and genetic testing. Technological advancements and integration with other smart laboratory systems are further enhancing dPCR adoption in research and healthcare institutions.

India Digital Polymerase Chain Reaction (PCR) Market Insight

The India digital polymerase chain reaction (PCR) market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid advancements in healthcare infrastructure, increased focus on disease detection, and rising demand for molecular testing. The country’s expanding biotechnology sector and growing participation in global clinical research are fueling demand for affordable, high-performance digital PCR systems. Government initiatives promoting diagnostics and local manufacturing are also key factors supporting market growth in India.

Digital Polymerase Chain Reaction (PCR) Market Share

The digital polymerase chain reaction (PCR) industry is primarily led by well-established companies, including:

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN N.V. (Netherlands)

- Stilla (France)

- Standard BioTools (U.S.)

- Jiangsu Cowin Biotech Co., Ltd. (China)

- Sysmex Corporation (Japan)

- Standard BioTools Inc. (U.S.)

- Combinati, Inc. (U.S.)

- Formulatrix, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Jinan Zhonghui Technology Co., Ltd. (China)

- Takara Bio Inc. (Japan)

- Techne Corporation (U.K.)

- Analytik Jena GmbH (Germany)

- Origene Technologies, Inc. (U.S.)

What are the Recent Developments in Global Digital Polymerase Chain Reaction (PCR) Market?

- In April 2023, Bio-Rad Laboratories, Inc. announced the release of its enhanced QX ONE Droplet Digital PCR System, designed for automated, high-throughput applications in clinical research and molecular diagnostics. The system offers streamlined workflows and improved multiplexing capabilities, addressing the growing demand for precise and scalable quantification in oncology, infectious disease testing, and gene expression studies. This innovation reflects Bio-Rad's continued commitment to advancing digital PCR solutions for both clinical and research users

- In March 2023, QIAGEN N.V. expanded its digital PCR portfolio with the introduction of new assays for liquid biopsy-based cancer detection. These assays are optimized for QIAcuity systems and support highly sensitive mutation detection in circulating tumor DNA. This development enhances QIAGEN's precision diagnostics offerings and demonstrates its strategic focus on personalized medicine and minimally invasive testing technologies

- In March 2023, Stilla Technologies unveiled its new Naica Prism system at the Molecular Med Tri-Con 2023 conference. The next-generation digital PCR system provides high-resolution imaging and multiplex detection for applications in oncology, infectious diseases, and environmental testing. With improved automation and AI-integrated software, the Naica Prism addresses the growing demand for efficient and user-friendly dPCR platforms, reinforcing Stilla’s innovation-driven growth in the diagnostics space

- In February 2023, Thermo Fisher Scientific Inc. announced the launch of new digital PCR reagents compatible with its QuantStudio Absolute Q system. These reagents enhance sensitivity and assay performance for detecting rare genetic events and low-level pathogens. This advancement is part of Thermo Fisher’s strategy to provide end-to-end solutions in the molecular diagnostics market, meeting the evolving needs of clinical laboratories and pharmaceutical researchers

- In January 2023, RainDance Technologies (acquired by Bio-Rad) partnered with academic institutions to explore ultra-sensitive detection of viral pathogens using digital PCR in wastewater surveillance. This initiative highlights the increasing relevance of digital PCR in public health monitoring and environmental applications, illustrating its versatility beyond traditional clinical diagnostics. The collaboration underscores the broader application potential of dPCR as global health systems strengthen surveillance capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.