Global Digital Video Content Market

Market Size in USD Billion

CAGR :

%

USD

197.37 Billion

USD

259.90 Billion

2024

2032

USD

197.37 Billion

USD

259.90 Billion

2024

2032

| 2025 –2032 | |

| USD 197.37 Billion | |

| USD 259.90 Billion | |

|

|

|

|

Digital Video Content Market Size

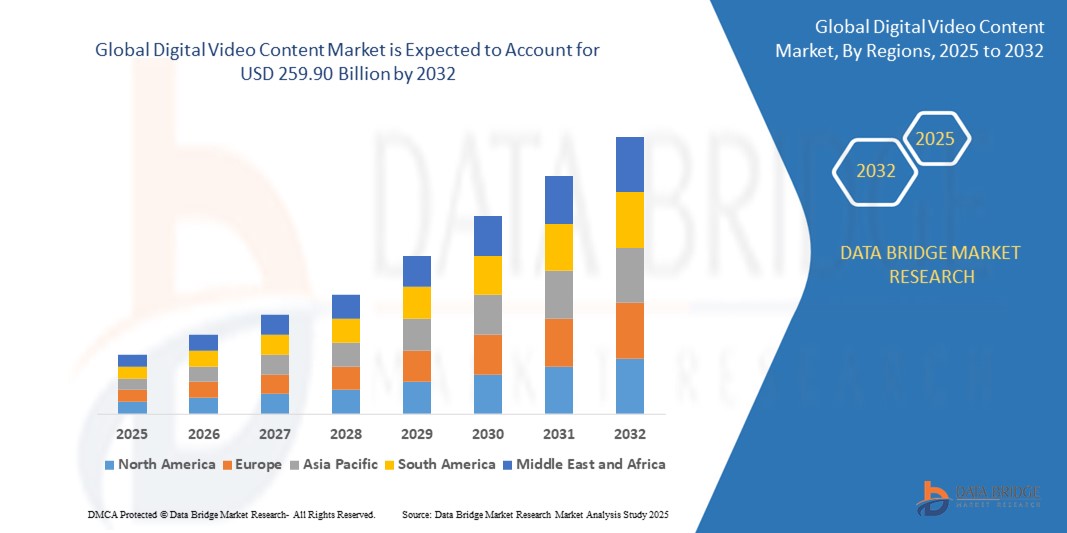

- The global digital video content market was valued at USD 197.37 billion in 2024 and is expected to reach USD 259.90 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.50%, primarily driven by rapid growth of internet penetration and smartphone adoption

- This growth is driven by rising consumer demand for on-demand, high-quality content across diverse genres and languages

Digital Video Content Market Analysis

- The digital video content market is experiencing rapid growth due to the increasing global demand for high-quality, on-demand entertainment across diverse platforms. This market is witnessing significant investments driven by advancements in streaming technologies, rising internet penetration, smartphone adoption, and regulatory support for digital media distribution and copyright protection

- The market's growth is fueled by factors such as the shift from traditional TV to over-the-top (OTT) platforms, the growing popularity of short-form and interactive videos, and the increasing availability of affordable mobile data and smart devices, which make digital content more accessible to a broader audience

- For instance, in 2024, AnyMind Group launched a new AI-driven feature on its AnyManager platform, enabling online publishers to generate short-form videos from existing website content, highlighting the importance of innovative solutions in expanding digital video content consumption

- The digital video content market is still evolving, but its potential to reshape the global entertainment and advertising landscapes is immense. As consumers demand more personalized, engaging, and interactive content experiences, the market is expected to expand rapidly in the coming years, with early innovators and technology adopters leading the transformation across multiple sectors

Report Scope and Digital Video Content Market Segmentation

|

Attributes |

Digital Video Content Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Digital Video Content Market Trends

“Rising Popularity of Short-Form Video Content”

- A significant trend in the digital video content market is the rising popularity of short-form video content, driven by platforms such as YouTube Shorts, Instagram Reels, and TikTok, which cater to rapidly decreasing attention spans and demand for quick, engaging entertainment

- Short-form videos are highly shareable, promote higher user engagement, and allow brands and creators to experiment with creative storytelling, making them a preferred format for digital marketing and audience retention

- For instance, in 2024, AnyMind Group launched a new AI-based feature that enables publishers to generate short-form videos from existing web content, highlighting the growing significance of brief, impactful videos in capturing audience attention

- This trend is revolutionizing the digital video content sector by reshaping content strategies, encouraging innovations in mobile-first video production, and opening up new monetization opportunities across industries such as advertising, media, and e-commerce

Digital Video Content Market Dynamics

Driver

“Growing Demand for Personalized and Interactive Content Experiences”

- The increasing consumer preference for personalized and interactive digital experiences is driving the growth of the digital video content market. Audiences today expect content tailored to their interests, viewing habits, and engagement patterns, pushing companies to leverage AI and data analytics for content personalization

- Digital video content platforms are integrating interactive elements such as polls, clickable links, and choose-your-own-adventure storylines to enhance user engagement, making content more immersive and participatory

- Businesses and content creators are investing heavily in technologies that enable real-time content customization, aiming to boost viewer satisfaction, brand loyalty, and conversion rates

For instance,

- In February 2025, Knocksense launched Dreamvideos, a platform that blends video content with interactive gaming, highlighting the growing trend toward immersive and personalized content experiences

- In August 2024, AnyMind Group enhanced its AnyManager platform with AI-driven tools to automatically generate short-form, personalized videos from website content, catering to the need for tailored media experiences

- In April 2024, Axel Springer SE and Microsoft expanded their partnership to focus on AI-driven content experiences, showcasing the industry's shift toward smarter, personalized digital offerings

- The push for more customized and engaging content is expected to significantly drive the growth of the digital video content market, as businesses strive to meet evolving consumer expectations and differentiate themselves in a competitive landscape

Opportunity

“Rising Popularity of Short-Form and Mobile Video Content”

- The explosive growth of short-form video platforms and increased mobile device usage presents a major opportunity for the digital video content market. Consumers, especially younger audiences, prefer easily consumable, engaging videos that fit their on-the-go lifestyles.

- Brands, publishers, and content creators are rapidly adapting their strategies to prioritize mobile-first, short-duration content formats, opening doors for innovative digital video content production and distribution technologies

- The integration of AI tools to automate and optimize short-form video creation further amplifies this opportunity, enabling businesses to efficiently scale personalized content across multiple platforms

For instance,

- In August 2024, AnyMind Group launched a new feature on its AnyManager platform that uses AI to automatically generate short-form videos from existing website content, tapping into the booming mobile video trend

- In February 2025, Knocksense introduced Dreamvideos, blending short video content with interactive gaming, catering to the increasing demand for quick and engaging digital experiences

- In June 2023, Google LLC unveiled its Demand Gen and Video View campaigns, designed to optimize video and image assets across YouTube and YouTube Shorts, emphasizing the growing importance of short-form video strategies

- With mobile video consumption continuing to surge globally, the opportunity for digital video content providers to capture audience attention through short, personalized, and mobile-optimized formats is expected to drive significant market growth in the coming years

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance”

- The digital video content market faces considerable challenges due to growing concerns over data privacy and the need to comply with complex and evolving regulations across different regions. Ensuring that content management, distribution, and user data handling practices align with strict legal requirements has become increasingly difficult

- Regulations such as the GDPR in Europe, CCPA in California, and upcoming AI and digital content laws globally require digital video content providers to implement robust data governance, privacy protections, and transparent content moderation practices

- Failure to comply with these standards leads to heavy financial penalties and damages brand reputation, making it essential for companies to invest heavily in compliance frameworks, legal counsel, and secure content delivery systems

For instance,

- In February 2024, Meta faced regulatory scrutiny from the Irish Data Protection Commission for alleged breaches of GDPR rules in handling personalized video content, highlighting the compliance pressure on global digital content providers

- The challenge of navigating an increasingly fragmented and strict regulatory landscape is expected to remain a major hurdle for the digital video content market. Addressing privacy concerns and achieving compliance will be essential for companies seeking sustainable and scalable growth

Digital Video Content Market Scope

The market is segmented on the basis of video type, deployment model, business model, and device type.

|

Segmentation |

Sub-Segmentation |

|

By Video Type

|

|

|

By Deployment Model

|

|

|

By Business Model |

|

|

By Device Type |

|

Digital Video Content Market Regional Analysis

“North America is the Dominant Region in the Digital Video Content Market”

- North America is leading the global digital video content market, driven by the high penetration of internet services, growing demand for streaming platforms, and strong presence of major content creators and distributors

- U.S. plays a pivotal role in the expansion of digital video content, with leading companies such as Netflix, Amazon Prime Video, and Disney+ continuously innovating and investing in original content production and advanced streaming technologies

- Government support, investments in broadband infrastructure, and strategic partnerships between media companies and tech giants further strengthen the region’s dominance, enhancing content accessibility across diverse devices and demographics

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to experience the highest growth in the digital video content market, driven by rapid internet penetration, increasing smartphone usage, and a surge in demand for regional and mobile-friendly content

- The region’s growing focus on digital entertainment, rising disposable incomes, and the expansion of affordable data services will further fuel market expansion across countries such as India, China, and Southeast Asia

- Governments and private players in Asia-Pacific are actively investing in digital infrastructure, promoting local content creation, and supporting partnerships between telecom providers and OTT platforms, accelerating the adoption of digital video content services

Digital Video Content Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Google LLC (U.S.)

- Apple Inc. (U.S.)

- Amazon.com, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- STAR (India)

- Hulu, LLC (U.S.)

- Comcast (U.S.)

- BT (U.K.)

- Cox Communications, Inc. (U.S.)

- Meta (U.S.)

- Verizon (U.S.)

- TalkTalk (U.K.)

- Deutsche Telekom AG (Germany)

- Akamai Technologies (U.S.)

- Fandango (U.S.)

- Snagfilms Inc. (U.S.)

- iMPACTFUL Group Inc. (U.S.)

- XPERI INC. (U.S.)

- Crackle Technologies PTE Ltd. (Singapore)

- Brightcove Inc. (U.S.)

Latest Developments in Global Digital Video Content Market

- In February 2025, Knocksense, a leading name in hyperlocal digital media, launched Dreamvideos, a new platform that blends video content with interactive gaming to deliver an engaging and rewarding user experience, concluding that this innovation is expected to reshape how audiences consume digital content

- In October 2024, Adobe introduced the Adobe Content Authenticity web app, a free tool that allows creators to attach Content Credentials to their digital work to safeguard content integrity and ensure proper attribution, concluding that this move strengthens transparency and trust in the digital ecosystem

- In August 2024, AnyMind Group, a BPaaS company specializing in marketing, e-commerce, and digital transformation, launched a new feature on its AnyManager platform that uses AI to generate short-form videos from existing website content, concluding that this advancement simplifies content repurposing and boosts publisher engagement

- In April 2024, Axel Springer SE and Microsoft Corp. expanded their partnership by focusing on advertising, AI, content, and cloud services, aiming to enhance user experiences and support independent journalism through AI-driven innovations and premium content distribution, concluding that this collaboration will significantly impact digital media and advertising landscapes

- In June 2023, Google LLC launched two AI-powered campaigns, Demand Gen and Video View campaigns, to connect with consumers and improve content recommendations by integrating high-performing video and image assets across YouTube and YouTube Shorts, concluding that this initiative helps marketers reach audiences more effectively on visual-first platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.