Global Disabled Assistive Devices Market

Market Size in USD Billion

CAGR :

%

USD

26.64 Billion

USD

42.14 Billion

2024

2032

USD

26.64 Billion

USD

42.14 Billion

2024

2032

| 2025 –2032 | |

| USD 26.64 Billion | |

| USD 42.14 Billion | |

|

|

|

|

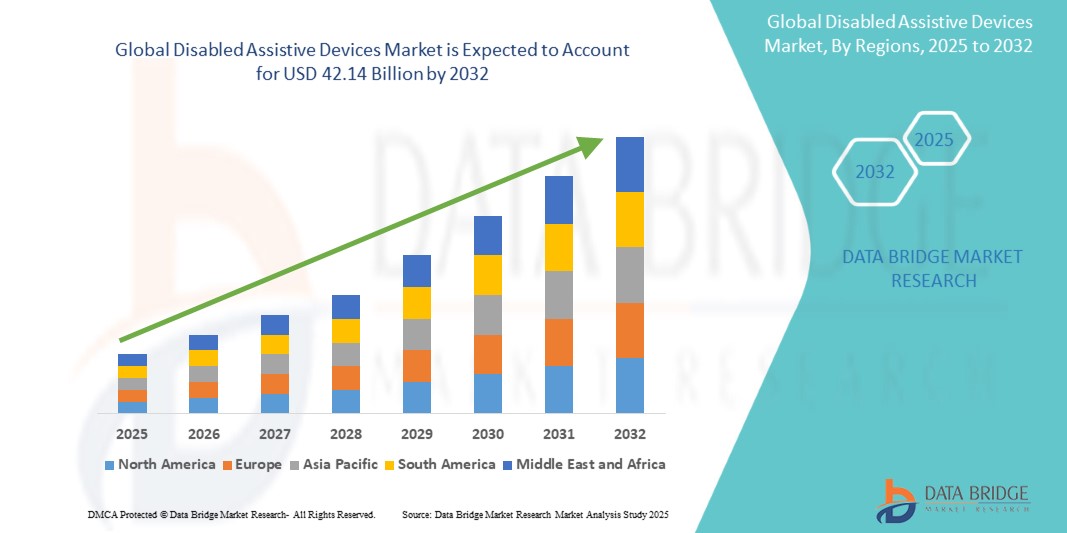

What is the Global Disabled Assistive Devices Market Size and Growth Rate?

- The global disabled assistive devices market size was valued at USD 26.64 billion in 2024 and is expected to reach USD 42.14 billion by 2032, at a CAGR of 5.90% during the forecast period

- The disabled assistive devices market is experiencing a surge fueled by the latest technological advancements. Innovations such as brain-computer interfaces, AI-driven prosthetics, and smart mobility aids are revolutionizing accessibility

- With a growing emphasis on user-centric design and inclusive assistive technology devices for disabled, this market is poised for exponential growth. These advancements enhance independence for individuals with disabilities but also redefine societal perceptions towards inclusivity

What are the Major Takeaways of Disabled Assistive Devices Market?

- The surge in telehealth and remote monitoring technologies is revolutionizing healthcare accessibility for people with disabilities. Through remote consultations and monitoring, individuals can access assistive device fitting, instructions, and support from anywhere, particularly benefiting underprivileged areas with limited healthcare resources

- For instance, remote consultations via specialized apps enable wheelchair users to receive expert guidance on adjustments, enhancing their mobility and quality of life, thereby driving the assistive devices market forward

- North America dominated the disabled assistive devices market with the largest revenue share of 36.25% in 2024, primarily driven by strong healthcare infrastructure, growing elderly population, and early adoption of assistive technologies

- Asia-Pacific disabled assistive devices market is projected to grow at the fastest CAGR of 11.25% from 2025 to 2032, owing to increasing aging population, rapid urbanization, and growing healthcare awareness

- The mobility aids devices segment dominated the disabled assistive devices market with the largest market revenue share of 46.8% in 2024, primarily due to the rising prevalence of physical disabilities, musculoskeletal disorders, and the growing elderly population requiring mobility support solutions

Report Scope and Disabled Assistive Devices Market Segmentation

|

Attributes |

Disabled Assistive Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Disabled Assistive Devices Market?

“Enhanced Independence through AI and Voice-Controlled Technologies”

- A prominent trend in the global disabled assistive devices market is the integration of AI and voice-controlled technologies (such as Amazon Alexa, Google Assistant, Apple Siri) to empower individuals with disabilities through hands-free, intelligent control of assistive devices such as wheelchairs, hearing aids, and smart home interfaces

- For instance, OrCam MyEye uses AI-powered visual recognition to help visually impaired users read text and recognize faces, while Google’s Project Euphonia is advancing speech recognition for users with speech impairments, increasing accessibility via voice commands

- Devices such as smart wheelchairs, AI-enabled hearing aids, and voice-activated environmental controls allow users to manage lighting, temperature, doors, and digital communication tools independently

- These technologies are increasingly being designed with personalization capabilities, adapting to users’ voice patterns and preferences, which reduces reliance on caregivers and enhances autonomy

- Companies such as Tobii Dynavox, Sonova, and Inclusive Technology Ltd are investing in AI-powered communication aids and mobility tools that integrate seamlessly with smart homes and connected environments

- As voice control and AI become more embedded in assistive solutions, the market is shifting toward more intuitive, adaptive, and inclusive designs that elevate quality of life and personal independence for disabled individuals

What are the Key Drivers of Disabled Assistive Devices Market?

- Rising global disability prevalence including conditions related to aging, chronic illnesses, and neurodevelopmental disorders is significantly boosting demand for mobility, hearing, and communication aids

- In February 2024, Oticon (Demant A/S) introduced its next-gen AI-powered hearing aid "Intent" that learns user behavior and adjusts automatically, enabling personalized sound experiences in real time

- Supportive government initiatives, growing healthcare expenditure, and improvements in rehabilitation infrastructure across developed and developing economies are further driving adoption

- Advancements in wearable technology, sensor integration, and Internet of Medical Things (IoMT) enable real-time health tracking and feedback, making devices smarter and more effective in promoting independence

- In addition, the growing emphasis on inclusive design and universal accessibility standards is compelling manufacturers to innovate across various segments—from prosthetics to augmentative and alternative communication (AAC) devices—making assistive technology more versatile and user-centric

Which Factor is challenging the Growth of the Disabled Assistive Devices Market?

- One of the primary challenges hindering market expansion is the high cost of advanced assistive devices, particularly those powered by AI, robotics, or voice technology, which limits accessibility for many users in low- and middle-income regions

- For instance, bionic limbs, advanced powered exoskeletons, or AI-based AAC systems can cost tens of thousands of dollars, often beyond the reach of individuals without comprehensive insurance or government support

- Lack of awareness and limited reimbursement coverage further restrain adoption, particularly in countries where disability support systems are underdeveloped or fragmented

- Moreover, concerns over data privacy and cybersecurity—especially in devices with internet connectivity—raise caution around smart assistive tools. Consumers and healthcare providers remain wary of risks related to personal health data breaches

- Companies such as Cochlear Ltd and Starkey are working to mitigate these concerns by strengthening data encryption, offering financing options, and advocating for broader insurance inclusion

- To overcome these hurdles, manufacturers must focus on cost-effective innovation, public-private partnerships, and consumer education to ensure equitable access and long-term growth across global markets

How is the Disabled Assistive Devices Market Segmented?

The market is segmented on the basis of product type and end user.

• By Product Type

On the basis of product type, the disabled assistive devices market is segmented into Living Aids, Mobility Aids Devices, Medical Furniture, and Bathroom Safety Equipment. The Mobility Aids Devices segment dominated the disabled assistive devices market with the largest market revenue share of 46.8% in 2024, primarily due to the rising prevalence of physical disabilities, musculoskeletal disorders, and the growing elderly population requiring mobility support solutions. Devices such as wheelchairs, walkers, and mobility scooters remain essential in enhancing independence and quality of life for users. The increasing availability of smart and electric-powered variants is also fueling segment growth.

The Bathroom Safety Equipment segment is anticipated to witness the fastest growth rate of 22.5% from 2025 to 2032, driven by the growing focus on fall prevention in elderly and mobility-impaired individuals. Rising investments in home modifications and assistive bathroom technologies such as grab bars, safety rails, and non-slip shower systems are boosting adoption, particularly in residential and long-term care settings.

• By End User

On the basis of end user, the disabled assistive devices market is segmented into Hospital, Home Care Setting, and Others. The Hospital segment held the largest market revenue share in 2024, owing to the high volume of patients with temporary or permanent disabilities receiving rehabilitation services, post-operative care, or long-term treatment. Hospitals often serve as the first point of exposure to assistive devices, supported by institutional budgets and medical infrastructure.

The Home Care Setting segment is projected to witness the fastest CAGR during the forecast period, fueled by the rising trend of home-based care, increased patient preference for aging in place, and government support for home healthcare initiatives. Home care users increasingly rely on a range of assistive devices to perform daily activities independently and maintain comfort, thereby driving segment expansion.

Which Region Holds the Largest Share of the Disabled Assistive Devices Market?

- North America dominated the disabled assistive devices market with the largest revenue share of 36.25% in 2024, primarily driven by strong healthcare infrastructure, growing elderly population, and early adoption of assistive technologies. The region also benefits from favorable reimbursement policies and high consumer awareness about accessibility solutions

- Rising investments in R&D and supportive regulatory frameworks have accelerated innovation in assistive mobility, living aids, and smart healthcare tools. In addition, increasing home care needs and the trend toward independent living are fueling market growth

- Government support for disability inclusion programs, combined with a robust distribution network, continues to reinforce North America’s leadership in the assistive devices market

U.S. Disabled Assistive Devices Market Insight

The U.S. held the largest revenue share in North America in 2024, propelled by rapid technological innovation, strong insurance coverage, and growing demand for home-based care solutions. Key players such as Permobil, Pride Mobility, and Starkey are continuously investing in advanced mobility aids, hearing devices, and communication technologies. Furthermore, a strong focus on inclusivity, regulatory compliance (ADA), and consumer spending capacity drives consistent demand across hospitals, rehabilitation centers, and home care settings.

Europe Disabled Assistive Devices Market Insight

The Europe disabled assistive devices market is projected to grow at a significant CAGR during the forecast period, backed by strong public healthcare systems, aging demographics, and rising emphasis on patient independence. Countries such as Germany, France, and the U.K. are leading in adopting modern assistive technologies for elderly and differently-abled individuals. European policies supporting disability access, such as the European Accessibility Act, are also encouraging procurement of advanced aids in residential and institutional settings.

U.K. Disabled Assistive Devices Market Insight

The U.K. market is set to expand steadily due to its increasing focus on independent living and assistive care innovation. Government-funded programs, such as Personal Independence Payment (PIP), support the adoption of mobility devices, medical furniture, and communication tools. In addition, private care providers and the NHS are prioritizing technology-integrated solutions for improving patient autonomy in long-term care environments.

Germany Disabled Assistive Devices Market Insight

Germany continues to witness solid demand growth, driven by its robust medical technology ecosystem, rising elderly population, and proactive health insurance providers. Local manufacturers are investing in ergonomic and AI-enhanced solutions for rehabilitation and daily assistance. The integration of assistive devices into smart home systems is also gaining traction, supported by Germany’s strong focus on privacy, safety, and sustainable technology development.

Which Region is the Fastest Growing in the Disabled Assistive Devices Market?

Asia-Pacific disabled assistive devices market is projected to grow at the fastest CAGR of 11.25% from 2025 to 2032, owing to increasing aging population, rapid urbanization, and growing healthcare awareness. Rising income levels, expanding middle class, and government-led health inclusion policies are enhancing access to assistive solutions across countries such as China, Japan, and India. Local innovation and manufacturing hubs in the region are making assistive devices more affordable, while global companies are entering the market through partnerships and expansions.

Japan Disabled Assistive Devices Market Insight

Japan is gaining momentum in this market due to its rapidly aging population and advanced healthcare infrastructure. Technological excellence and a strong focus on robotic and AI-based mobility and care solutions are fostering demand for devices such as smart wheelchairs, automated lifts, and hearing aids. Government funding and elderly care programs further support adoption across both home care and institutional settings.

China Disabled Assistive Devices Market Insight

China held the largest market revenue share in Asia-Pacific in 2024, driven by a large population base, improving healthcare access, and strong domestic production capabilities. The Chinese government’s emphasis on elderly care and disability inclusion policies is accelerating investments in assistive technology. Expanding e-commerce and digital health platforms are also enhancing the availability and affordability of devices across urban and rural areas.

Which are the Top Companies in Disabled Assistive Devices Market?

The disabled assistive devices industry is primarily led by well-established companies, including:

- Sunrise Medical (U.S.)

- Sonova (India)

- Freedom Scientific, Inc. (U.S.)

- Demant A/S (Denmark)

- Blue Chip Medical (U.S.)

- Medical Device Depot, Inc. (India)

- Starkey Laboratories, Inc. (U.S.)

- MED-EL Medical Electronics (Austria)

- Permobil (U.S.)

- Midline Industries Inc. (U.S.)

- Nordic Capital (Sweden)

- Ottobock (Germany)

- Pride Mobility Products Corp. (U.S.)

- Cochlear Ltd. (Australia)

- Inclusive Technology Ltd (U.K.)

- Tobii Dynavox AB (U.S.)

- Bausch & Lomb Pvt Ltd. (U.S.)

- GN Store Nord A/S (India)

- Wintriss Engineering (U.S.)

- Siemens Healthcare Private Limited (Germany)

- Invacare Corporation (U.S.)

What are the Recent Developments in Global Disabled Assistive Devices Market?

- In August 2022, GF Health Products Inc. introduced the Pure Tilt-in-space wheelchair, focusing on enhancing user comfort and safety, while showcasing the company’s ongoing commitment to innovation in mobility aids. This launch strengthens GF Health's position in delivering high-performance assistive solutions

- In May 2022, the first Centre for Technology Intervention for the Elderly and Disabled (CTIED) was inaugurated at the National Institute of Technology Srinagar, representing a landmark initiative to develop assistive technologies for aging and differently-abled populations. This milestone marks India’s growing emphasis on inclusive innovation and accessibility

- In June 2021, Demant A/S announced plans for a new manufacturing and distribution facility, aimed at boosting the production of hearing aids and improving regional supply chain efficiency. This strategic expansion underlines Demant’s effort to meet rising global demand and improve access to hearing solutions

- In April 2020, GN Hearing A/S launched ReSound Assist Live, a pioneering tele-audiology service that enables patients to receive hearing aid support and fine-tuning remotely from their homes. This innovation redefined convenience in hearing healthcare, especially during the height of the COVID-19 pandemic

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.