Global Dish Antennas Market

Market Size in USD Billion

CAGR :

%

USD

5.57 Billion

USD

9.44 Billion

2024

2032

USD

5.57 Billion

USD

9.44 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 9.44 Billion | |

|

|

|

|

Dish Antennas Market Size

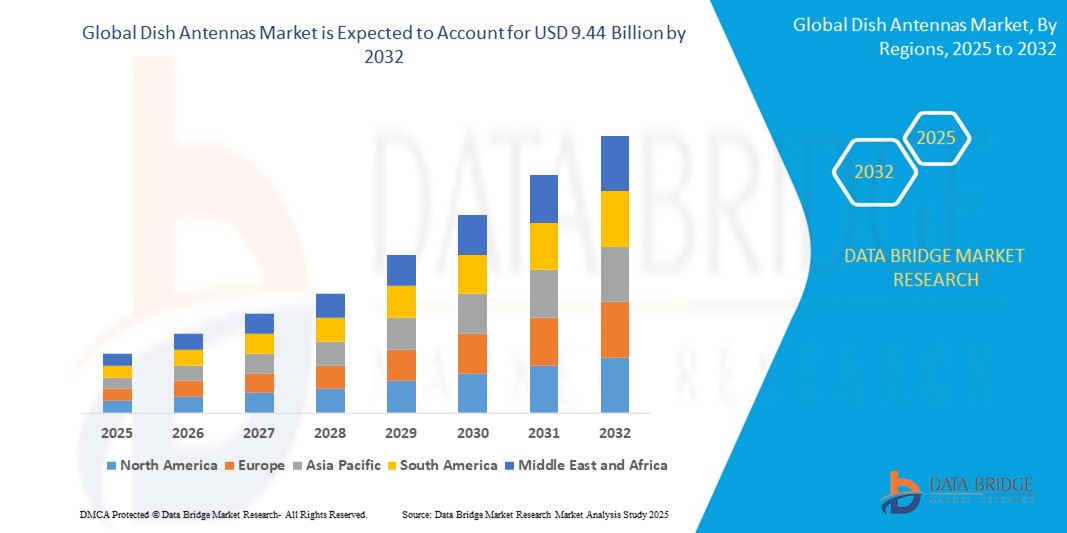

- The global dish antennas market size was valued at USD 5.57 billion in 2024 and is expected to reach USD 9.44 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-speed satellite communication and growing adoption of advanced broadcasting technologies across defence, telecommunications, and space sectors

- Rising investments in space exploration and satellite deployment by both government and private entities are further accelerating the demand for dish antennas across global markets

Dish Antennas Market Analysis

- The dish antennas market is experiencing steady growth due to increased reliance on satellite connectivity in industries such as aviation, maritime, and broadcasting

- Companies are focusing on product innovation with compact and lightweight dish antennas to support portable and mobile communication systems

- North America dominates the global dish antennas market, accounting for approximately 35% of the total revenue in 2024. This leadership is driven by advanced technological adoption, high satellite communication requirements, and significant investments in satellite infrastructure, especially in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the dish antennas market during the forecast period due to rapid satellite deployments, expanding telecom infrastructure, and growing demand for remote connectivity

- The reflector antennas segment dominated the market with the largest revenue share of 45% in 2024, owing to their high gain and efficiency in long-range satellite communication. These antennas are widely used in broadcast, space, and defence sectors due to their strong directional focus

Report Scope and Dish Antennas Market Segmentation

|

Attributes |

Dish Antennas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Dish Antennas Market Trends

“Growing Integration of Phased Array Technology in Dish Antennas”

- Phased array antennas enable electronic beam steering without moving parts, allowing for faster signal adjustments and increased reliability in dynamic environments

- These antennas are increasingly used in aerospace and defense sectors due to their ability to maintain stable, high-speed communication under motion and stress

- For instance, SpaceX’s Starlink uses phased array antennas in its terminals to provide low-latency broadband services in remote and rural areas

- The U.S. military leverages this technology in mobile operations, ensuring seamless communication even in rapidly changing field conditions

- Growing investment in phased array systems is transforming satellite communication networks, making them more adaptable and efficient for expanding data demands

Dish Antennas Market Dynamics

Driver

“Demand for Reliable and High-Speed Satellite Communication across Various Industries”

- Growing demand for reliable, high-speed satellite communication is driving the need for dish antennas across various industries, especially where terrestrial infrastructure is limited

- Dish antennas enable seamless data, voice, and video transmission, supporting broadband satellite services in rural areas, maritime, aviation, and defense sectors

- Advancements such as low Earth orbit satellite constellations require more sophisticated antennas that can track fast-moving satellites and maintain continuous connectivity

- For instance, Starlink’s broadband network relies on advanced dish antennas to provide internet access in remote locations around the world

- Government initiatives for digital inclusion and smart city projects are accelerating satellite infrastructure deployment, boosting demand for durable, precise dish antennas

Restraint/Challenge

“High Cost of Advanced Antenna Systems”

- The high cost of advanced dish antenna systems, especially those with phased array or electronically steerable features, limits accessibility for smaller operators and budget-constrained regions

- Installation and maintenance require skilled technicians and specialized equipment, adding to operational expenses and complexity

- For instance, during severe storms in coastal regions, dish antennas used for maritime communications often suffer physical damage and signal disruption, leading to costly repairs and service downtime, highlighting the challenges posed by harsh environmental conditions.

- Alternative technologies such as fiber optics and 5G create competition by offering faster speeds or lower latency in some cases

- Continuous upgrades to match evolving satellite systems and compatibility issues with existing infrastructure complicate deployment and slow market penetration

Dish Antennas Market Scope

The market is segmented on the basis of antenna type, wireless network, component, frequency, antenna size, application, and end-user.

- By Antenna Type

On the basis of antenna type, the dish antennas market is segmented into reflector antennas, aperture antennas, and wire antennas. The reflector antennas segment dominated the market with the largest revenue share of 45% in 2024, owing to their high gain and efficiency in long-range satellite communication. These antennas are widely used in broadcast, space, and defence sectors due to their strong directional focus.

The aperture antennas segment is expected to witness the fastest growth rate from 2025 to 2032 period, driven by their compact size and high directivity. These antennas are ideal for applications requiring high-frequency precision, such as in aerospace and next-generation satellite constellations. Their flat-panel design also supports easy integration into mobile and space-constrained platforms.

- Wireless Network

On the basis of wireless network, the market is segmented into licensed and unlicensed. The licensed segment held the largest revenue share in 2024, supported by its critical role in providing interference-free, regulated communication for sectors such as defence, aviation, and broadcast. Licensed frequency bands offer reliability, making them preferable for high-performance applications.

The unlicensed segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use in consumer applications, low-power IoT setups, and areas with minimal regulatory requirements. Cost-efficiency and ease of deployment also support growth in unlicensed bands.

- By Component

On the basis of component, the market is segmented into reflectors, feed horn, feed network, low noise block (LNB) converter, multiplexers, encoders, and others. The reflectors segment held the largest market share in 2024, accounting for around 38%, due to their central role in directing electromagnetic signals in dish antennas.

The LNB converters segment is expected to witness the fastest growth rate from 2025 to 2032 period, due to crucial in amplifying and down-converting signals from satellite to receiver, making them widely used in both residential and commercial satellite systems.

- By Frequency

On the basis of frequency, the market is segmented into X Band, C Band, L and S Band, VHF/UHF Band, K/Ka/Ku Band, and others. The K/Ka/Ku Band segment dominated the market in 2024 with a 35% share, attributed to its extensive use in high-throughput satellites and broadband services. These frequencies support high-speed data transfer and are critical for consumer internet and enterprise communications.

The C Band segment is expected to witness the fastest growth rate from 2025 to 2032 period, particularly in broadcast and satellite television services, due to its reliable signal performance under adverse weather conditions. Its ability to support long-distance transmission with minimal interference makes it a preferred choice for content distributors and broadcasters in both developed and developing regions.

- By Antenna Size

On the basis of antenna size, the market is segmented into small-sized dish, medium-sized dish, and large-sized dish. The small-sized dish segment accounted for the largest revenue share of around 50% in 2024, driven by widespread residential usage and direct-to-home satellite services. These antennas are favoured for their cost-effectiveness and ease of installation.

The medium-sized dish segment is expected to witness the fastest growth rate from 2025 to 2032 period, offering a balance between signal strength and ease of deployment. These dishes are popular in enterprise and commercial networks for internet, television, and data services. Their moderate size allows installation in urban and semi-urban locations without requiring extensive infrastructure.

- By Application

On the basis of application, the dish antennas market is segmented into marine, land, space, and airborne. The land segment dominated with over 45% revenue share in 2024, due to its use in satellite TV, broadband, and ground-based communication stations.

The marine applications segment is expected to witness the fastest growth rate from 2025 to 2032 period, as vessels increasingly adopt stabilized dish antennas for uninterrupted connectivity at sea. These antennas ensure consistent internet and communication links for navigation, entertainment, and operations in offshore oil rigs, shipping fleets, and luxury yachts, even in dynamic oceanic environments.

- By End-User

On the basis of end-user, the market is segmented into aerospace and defence, media and entertainment, and industrial. Aerospace and defence held the largest market share of approximately 40% in 2024, supported by investments in satellite-based surveillance and secure communication.

The media and entertainment segment holds a strong 35% market share, driven by the global rise in satellite-based content distribution. Dish antennas are widely used for direct-to-home services, live broadcasting, and event coverage, enabling high-definition transmission across geographically dispersed audiences.

Dish Antennas Market Regional Analysis

- North America dominates the global dish antennas market, accounting for approximately 35% of the total revenue in 2024

- This leadership is driven by advanced technological adoption, high satellite communication requirements, and significant investments in satellite infrastructure, especially in the U.S.

- The region benefits from robust infrastructure and technological advancements, particularly in satellite communication systems

U.S. Dish Antennas Market Insight

The U.S. holds a significant share within North America, contributing to the region's leading position in the dish antennas market. This is attributed to the country's advanced technological infrastructure, substantial investments in space exploration, and the presence of major market players. The U.S. market is characterized by increasing adoption of satellite antennas for broadband internet access in remote areas, growing demand for reliable long-distance communication, and broadcasting services.

Europe Dish Antennas Market Insight

The Europe accounts for around 25% of the global dish antennas market share. The region's focus on broadcasting, data connectivity, and industrial applications drives demand for satellite dishes. Europe Space Agency (ESA) initiatives to enhance satellite technology and connectivity solutions further support market growth. The region's extensive use of satellite communication for transportation, maritime services, and enterprise networks underscores its commitment to expanding satellite infrastructure and services.

U.K. Dish Antennas Market Insight

The U.K. is a significant contributor to Europe's dish antennas market, accounting for a notable share due to its advanced telecom infrastructure and increasing focus on IoT and satellite connectivity. The country's investments in 5G, satellite broadband, and digital transformation initiatives are key drivers of market growth. In addition, the rising demand for connected vehicles and smart transportation systems fuels the adoption of dish antennas. The U.K.’s strong presence of technology firms, research institutions, and government support for innovation also enhances its competitive edge. Robust sales channels and rapid technological upgrades further solidify its position in the Europe market.

Germany Dish Antennas Market Insight

The Germany plays a crucial role in Europe's dish antennas market, with a focus on enhancing telecommunications infrastructure and expanding satellite communication services. The country's commitment to innovation and sustainability promotes the adoption of dish antennas, particularly in residential and commercial buildings. The integration of dish antennas with home automation systems is also becoming increasingly prevalent in Germany.

Asia-Pacific Dish Antennas Market Insight

The Asia-Pacific region leads the market with a share of approximately 35% in 2023. Rapid urbanization, industrialization, and increasing investments in satellite communication infrastructure drive demand for satellite dishes in countries such as China, India, Japan, and Southeast Asia. The region's large population, coupled with rising demand for high-speed internet, direct-to-home broadcasting, and IoT connectivity, creates significant market opportunities. Government initiatives to expand digital connectivity and enhance remote communication solutions further propel market growth.

China Dish Antennas Market Insight

The China maintains its position as the largest market in the Asia-Pacific region, demonstrating strong capabilities in satellite antenna technology and manufacturing. The country's market leadership is driven by active government support for space programs, increasing investments in satellite communication infrastructure, and growing demand for advanced antenna systems. China's focus on developing indigenous satellite technology capabilities and expanding its satellite constellation networks contributes to its market dominance.

Japan Dish Antennas Market Insight

The Japan's advanced telecommunications infrastructure and high-speed connectivity requirements drive the adoption of cutting-edge satellite antenna solutions to meet the growing demand for data-intensive applications. The country's emphasis on technological innovation and the integration of smart technologies in various sectors support the growth of the dish antennas market in Japan.

Dish Antennas Market Share

The dish antennas industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- L3Harris Technologies, Inc. (U.S.)

- Cobham Limited (U.K.)

- Airbus S.A.S. (France)

- C-COM Satellite Systems Inc. (Canada)

- Challenger Communications (Canada)

- CPI International (U.S.)

- Eravant (U.S.)

- Eyecom Telecommunications Group (U.K.)

- Global Invacom (U.K.)

- Helander (U.S.)

- Infinite Electronics International, Inc. (U.S.)

- KebNi AB (Sweden)

- MARS Antennas and RF Systems, Ltd. (Israel)

- MTI WIRELESS EDGE LTD. (Israel)

- mWAVE Industries LLC (A Subsidiary of Alaris Holdings) (U.S.)

- Radio Frequency Systems (Germany)

- Shaanxi Probecom Microwave Technology Co., Ltd. (China)

- Ventev (U.S.)

Latest Developments in Global Dish Antennas Market

- In August 2020, C-COM Satellite Systems Inc. secured a USD 1 million grant from the Canadian Space Agency to develop advanced phased array antenna technology. This funding supported the creation of a next-generation Ka-band flat panel antenna designed to improve high-throughput mobility for land, maritime, and airborne applications. The innovation is set to enhance performance and reliability in various sectors, driving technological advancement within the dish antennas market. This development positions C-COM as a key player in expanding mobile satellite communication capabilities

- In June 2020, CPI International Inc. completed the acquisition of General Dynamics' satellite antenna system business, significantly expanding its portfolio in radio frequency engineering. This strategic acquisition enhances CPI’s product offerings and market presence, allowing for greater innovation and competitiveness in the dish antennas sector. The move strengthens CPI’s ability to serve diverse applications, fostering growth and broader market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dish Antennas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dish Antennas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dish Antennas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.