Global Disk Encryption Market

Market Size in USD Billion

CAGR :

%

USD

14.89 Billion

USD

34.21 Billion

2024

2032

USD

14.89 Billion

USD

34.21 Billion

2024

2032

| 2025 –2032 | |

| USD 14.89 Billion | |

| USD 34.21 Billion | |

|

|

|

|

Disk Encryption Market Size

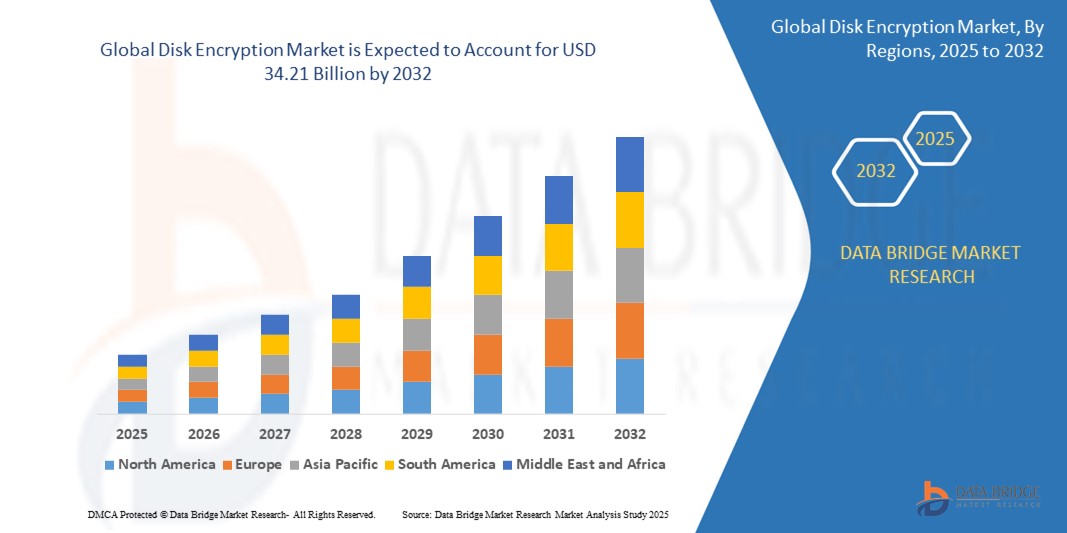

- The global disk encryption market size was valued at USD 14.89 billion in 2024 and is expected to reach USD 34.21 billion by 2032, at a CAGR of 10.96% during the forecast period

- The market growth is largely fuelled by the increasing volume of sensitive data generated by organizations, the rising number of data breaches, growing regulatory compliance requirements (such as GDPR, HIPAA, and CCPA), and heightened concerns over data privacy and cybersecurity

- In addition, the rapid adoption of cloud computing, bring your own device (BYOD) policies, and remote work models has amplified the need for robust data protection mechanisms such as disk encryption

Disk Encryption Market Analysis

- The disk encryption market is witnessing consistent expansion due to increasing reliance on data protection solutions across sectors, with businesses prioritizing secure storage and access management of confidential information

- Growing awareness of internal and external threats has pushed organizations to adopt advanced encryption tools, driving demand for scalable and integrated disk encryption technologies

- North America leads the global disk encryption market with the largest market share of 40.5% in 2024, driven by stringent data protection regulations and heightened cybersecurity awareness among enterprises and government agencies

- Asia-Pacific is expected to be the fastest growing region in the disk encryption market during the forecast period due to rapid digitalization, increasing cybersecurity awareness, and government initiatives promoting data protection across emerging economies

- Large enterprises hold the largest market revenue share of 60.5% in 2024, driven by their substantial need to protect vast volumes of sensitive data and comply with stringent regulatory requirements. These organizations often invest heavily in advanced encryption technologies to secure critical assets across multiple departments and global locations. The adoption is further supported by the presence of dedicated IT security teams and budgets aimed at comprehensive data protection strategies

Report Scope and Disk Encryption Market Segmentation

|

Attributes |

Disk Encryption Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Disk Encryption Market Trends

“Rising Integration of Disk Encryption with Endpoint Security Solutions”

- Organizations are increasingly integrating disk encryption with endpoint security to create a unified defense mechanism that secures data both at rest and in use

- This trend reflects a shift from standalone encryption tools toward holistic cybersecurity platforms that combine encryption, antivirus, and threat detection capabilities for stronger protection

- For instance, Microsoft BitLocker is now often deployed alongside Windows Defender, providing seamless encryption and threat monitoring across enterprise systems

- For instance, Sophos SafeGuard, which integrates with Sophos Endpoint Protection to ensure that devices remain encrypted and continuously monitored for vulnerabilities

- The growing preference for integrated solutions is driven by the need for simplified management, centralized policy enforcement, and reduced operational complexity in securing enterprise endpoints

Disk Encryption Market Dynamics

Driver

“Rising Cybersecurity Threats and Data Breaches”

- The growing frequency of cybersecurity threats and data breaches has significantly increased the demand for disk encryption, as organizations seek to protect sensitive personal, financial, and business data from unauthorized access

- Disk encryption transforms stored data into an unreadable format accessible only through proper authentication, minimizing the impact of device theft or hacking attempts

- High-profile data breaches, such as the Capital One data breach, have raised awareness and urgency for encryption at both the hardware and software levels to protect against internal and external threats

- The shift toward remote work and widespread use of mobile devices has led to broader deployment of encryption tools to secure endpoints beyond traditional office networks

- Businesses are now adopting full-disk encryption not only to meet compliance requirements but also as part of a proactive strategy

- For instance, Microsoft BitLocker is widely used in enterprises to secure internal drives on employee laptops and desktops

Restraint/Challenge

“High Implementation and Operational Costs”

- The high cost of implementing and maintaining disk encryption solutions remains a major challenge, especially for small and medium-sized enterprises that operate under tight IT budgets

- These costs go beyond initial software or hardware investments and often include integration, training, and necessary infrastructure upgrades, which can be difficult to manage for limited-resource organizations

- Encryption tools usually require specialized setup and management skills, leading to additional expenses for hiring skilled personnel or external consultants

- For instance, CIO Tech, small businesses often outsource IT services to experts who assist in selecting, installing, and configuring encryption technologies to safeguard sensitive business data, financial records, and client information

- Full-disk encryption can strain older or low-performance devices by increasing processing demands, which may slow down operations and create friction among users who prioritize speed and usability

- Key management adds another layer of complexity and cost, as encryption keys must be securely stored and handled, if mismanaged, they can result in critical data becoming inaccessible or vulnerable to threats

Disk Encryption Market Scope

The market is segmented on the basis of organization size and industry verticals.

- By Organization Size

On the basis of organization size, the disk encryption market is segmented into large enterprises and small and medium-sized enterprises. Large enterprises hold the largest market revenue share of 60.5% in 2024, driven by their substantial need to protect vast volumes of sensitive data and comply with stringent regulatory requirements. These organizations often invest heavily in advanced encryption technologies to secure critical assets across multiple departments and global locations. The adoption is further supported by the presence of dedicated IT security teams and budgets aimed at comprehensive data protection strategies.

Small and medium-sized enterprises is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing awareness of cybersecurity risks and the rising availability of cost-effective encryption solutions tailored to their scale. SMEs are progressively prioritizing encryption to safeguard customer data and maintain business continuity, especially as cyber threats become more sophisticated.

- By Industry Verticals

On the basis of industry verticals, the disk encryption market is segmented into banking, financial services, and insurance, telecom and information technology, government and public utilities, healthcare, retail, aerospace and defence, and others. The banking, financial services, and insurance segment dominates the market revenue share of 31.1% in 2024, driven by the critical need to protect highly sensitive financial data and comply with regulatory mandates such as GDPR and PCI-DSS. Financial institutions deploy disk encryption to secure endpoints and prevent data breaches, which could lead to severe financial and reputational damage.

The telecom and information technology sector is expected to witness the fastest growth rate from 2025 to 2032, attributed to the increasing volume of data handled, rising cyberattacks, and the growing adoption of cloud-based infrastructures. Government and public utilities also represent a significant segment due to national security concerns and the need to protect citizen data. Healthcare is increasingly adopting disk encryption to safeguard patient records and meet HIPAA compliance. Retail and aerospace and defence sectors continue to expand their encryption use to secure transactional data and classified information, respectively.

Disk Encryption Market Regional Analysis

- North America leads the global disk encryption market with the largest market share of 40.5% in 2024, driven by stringent data protection regulations and heightened cybersecurity awareness among enterprises and government agencies

- Organizations in the region prioritize safeguarding sensitive data due to frequent cyberattacks and regulatory mandates such as HIPAA, GDPR, and CCPA, encouraging widespread disk encryption adoption

- The presence of major technology vendors, advanced IT infrastructure, and significant investments in cybersecurity solutions support market growth across both large enterprises and small and medium-sized businesses

U.S. Disk Encryption Market Insight

The U.S. disk encryption market accounted for the largest revenue share within North America in 2024, fuelled by the growing demand for robust data protection in sectors such as healthcare, financial services, and government. The increasing shift to remote work and cloud computing has further accelerated disk encryption adoption to secure endpoints and protect sensitive corporate data from breaches. Strong regulatory frameworks and increasing cyberattack incidents motivate enterprises to implement comprehensive encryption strategies, often integrating disk encryption with endpoint security solutions.

Europe Disk Encryption Market Insight

The Europe disk encryption market with the market share of 25.5% in 2024, supported by stringent data privacy regulations such as GDPR and increasing concerns about cybercrime. The region is witnessing growing adoption across industries including banking, government, and healthcare, driven by regulatory compliance and rising digital transformation initiatives. Europe organizations are also focusing on encryption to protect data stored on mobile devices and remote endpoints, enhancing overall cybersecurity posture.

U.K. Disk Encryption Market Insight

The U.K. disk encryption market is expected to witness the fastest growth rate significantly, backed by rising awareness of data security and regulatory requirements under frameworks such as the Data Protection Act and GDPR. Both public sector organizations and private enterprises are adopting encryption technologies to prevent data leaks and cyberattacks. The growing trend of cloud adoption and hybrid IT environments also drives demand for disk encryption solutions to secure data at rest.

Germany Disk Encryption Market Insight

Germany holds a prominent position in the Europe disk encryption market, with increasing focus on data security driven by strict privacy laws and high cyber risk awareness. German enterprises prioritize encryption to secure sensitive industrial and government data, aligning with the country’s emphasis on innovation and data sovereignty. Integration of disk encryption with broader cybersecurity frameworks is becoming common, particularly in sectors such as automotive, manufacturing, and finance.

Asia-Pacific Disk Encryption Market Insight

The Asia-Pacific disk encryption market with the market share of 20.5% in 2024, propelled by rapid digitalization, rising cybersecurity investments, and regulatory advancements in countries such as China, Japan, and India. Increasing cyber threats and the expanding IT infrastructure in the region encourage both large enterprises and SMEs to adopt encryption solutions. Government initiatives aimed at enhancing cybersecurity resilience and the rise of cloud computing further support market expansion.

Japan Disk Encryption Market Insight

The Japan’s disk encryption market is gaining traction due to its advanced IT landscape and heightened focus on protecting sensitive data amid increasing cyberattacks. The country’s aging population and adoption of smart technologies in healthcare and manufacturing are driving demand for secure data storage solutions. Japanese enterprises are integrating disk encryption as part of comprehensive data protection strategies, supported by government policies promoting cybersecurity awareness.

China Disk Encryption Market Insight

The China holds a significant market share in the Asia-Pacific region, driven by rapid urbanization, the growth of the digital economy, and increasing cybersecurity investments. The rise of smart cities, e-commerce, and financial technology sectors fuel the demand for disk encryption to protect critical infrastructure and consumer data. Local manufacturers and technology providers are contributing to the availability of cost-effective disk encryption solutions, boosting adoption across industries.

Disk Encryption Market Share

The disk encryption industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Microsoft (U.S.)

- Broadcom (U.S.)

- Sophos Ltd. (U.K.)

- Thales (France)

- McAfee (U.S.)

- Trend Micro Incorporated. (Japan)

- Dell (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Micro Focus (U.K.)

- PKWare (U.S.)

- ESET (Slovakia)

- Secomba GmbH (Germany)

- WinMagic. (U.S.)

- Cryptomathic (Denmark)

- Bitdefender (Romania)

- Cisco Systems, Inc. (U.S.)

- HPE (U.S.)

- Bitglass (U.S.)

- Baffle (U.S.)

- Fortanix (U.S.)

- Enveil (U.S.)

- Nord Security (Panama)

- PreVeil. (U.S.)

Latest Developments in Global Disk Encryption Market

- In May 2025, NordVPN announced the launch of its post-quantum encryption feature across all supported platforms, including Windows, macOS, iOS, Android, and smart TVs. This development integrates quantum-resistant cryptographic algorithms into its NordLynx protocol to future-proof user data against potential quantum computing threats. The feature ensures long-term privacy by safeguarding encrypted internet traffic even if intercepted now and decrypted years later using advanced quantum technology. The benefit lies in offering users a higher level of security and peace of mind amid rising concerns about quantum decryption. This move sets a new benchmark in the virtual private network industry, likely prompting competitors to adopt similar encryption enhancements, thereby driving innovation and trust within the broader disk encryption market

- In May 2025, Microsoft introduced post-quantum cryptographic algorithms into Windows 11's SymCrypt library. This integration enables developers to implement quantum-resistant encryption directly through standard Windows APIs. The new algorithms, ML-KEM and ML-DSA, are designed to withstand potential future quantum computing threats. By embedding these algorithms into the operating system, Microsoft aims to future-proof data security and facilitate a smoother transition for developers adopting quantum-safe practices. This initiative sets a precedent in the industry, encouraging other technology providers to consider similar advancements in their systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.