Global Dna And Genomic Profiling Kits Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

2.70 Billion

2025

2033

USD

1.27 Billion

USD

2.70 Billion

2025

2033

| 2026 –2033 | |

| USD 1.27 Billion | |

| USD 2.70 Billion | |

|

|

|

|

DNA and Genomic Profiling Kits Market Size

- The Global DNA and Genomic Profiling Kits Market size was valued at USD 1.27 billion in 2025 and is expected to reach USD 2.70 billion by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced genomic technologies, rising applications of DNA profiling in clinical diagnostics, forensics, research, and direct-to-consumer testing, along with continuous technological advancements in PCR, NGS, and SNP-based profiling kits

- Furthermore, growing demand for personalized medicine, precision diagnostics, and accurate genetic identification, coupled with expanding investments in genomics research and biobanking initiatives, is establishing DNA & genomic profiling kits as essential tools across healthcare, forensic, and research settings. These converging factors are accelerating the uptake of genomic profiling solutions, thereby significantly boosting the industry’s growth

DNA & Genomic Profiling Kits Market Analysis

- DNA & genomic profiling kits, which enable the analysis and identification of genetic material for clinical, forensic, research, and consumer applications, are increasingly vital components of modern healthcare, life sciences, and forensic infrastructures due to their accuracy, scalability, and compatibility with advanced molecular technologies

- The escalating demand for DNA & genomic profiling kits is primarily fueled by the growing adoption of precision medicine, rising use of genetic testing in disease diagnosis and risk assessment, expanding forensic and paternity testing applications, and continuous technological advancements in PCR- and NGS-based profiling platforms

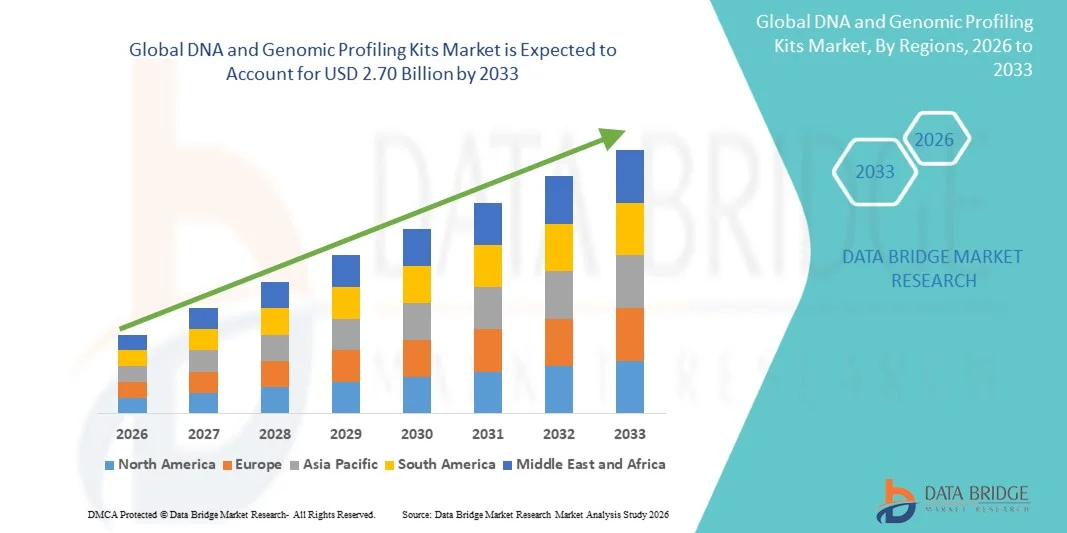

- North America dominated the DNA & genomic profiling kits market with the largest revenue share of 38.6% in 2025, characterized by strong genomic research funding, advanced healthcare infrastructure, and the presence of major biotechnology companies, with the U.S. witnessing robust demand driven by widespread clinical genomics adoption, forensic DNA databases, and the rapid expansion of direct-to-consumer genetic testing service

- Asia-Pacific is expected to be the fastest growing region in the DNA & genomic profiling kits market during the forecast period due to increasing investments in genomics research, expanding healthcare access, growing awareness of genetic testing, and rising applications in population genomics and personalized medicine

- STR profiling segment dominated the DNA & genomic profiling kits market with a market share of 41.8% in 2025, driven by their extensive use in forensic investigations, criminal identification, and paternity testing, along with their established reliability, standardization, and regulatory acceptance

Report Scope and DNA & Genomic Profiling Kits Market Segmentation

|

Attributes |

DNA & Genomic Profiling Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

DNA & Genomic Profiling Kits Market Trends

“Integration of Next-Generation Sequencing and Advanced Bioinformatics”

- A significant and accelerating trend in the Global DNA and Genomic Profiling Kits Market is the rapid integration of next-generation sequencing (NGS) technologies with advanced bioinformatics platforms, enabling deeper genetic insights and high-throughput analysis across clinical, forensic, and research applications

- For instance, Illumina’s TruSight Oncology and Thermo Fisher Scientific’s Oncomine genomic profiling kits combine NGS-based panels with integrated data analysis pipelines, allowing comprehensive variant detection and streamlined interpretation workflows

- The integration of advanced bioinformatics within genomic profiling kits enables faster data processing, improved variant accuracy, and automated reporting, supporting complex applications such as whole-exome sequencing and population-scale genomics studies. For instance, some QIAGEN QIAseq kits incorporate optimized informatics workflows to enhance data reliability and turnaround time

- The seamless coupling of genomic profiling kits with cloud-based analytics platforms facilitates centralized data management, remote collaboration, and scalability across laboratories. Through unified platforms, users can manage sequencing data, interpretation tools, and reporting systems within a single digital ecosystem

- This trend toward more integrated, data-driven, and scalable genomic solutions is reshaping expectations for genetic testing and molecular diagnostics. Consequently, companies such as Agilent Technologies are developing genomics kits paired with AI-enabled analytics to support precision medicine and translational research

- The demand for DNA & genomic profiling kits offering seamless NGS and bioinformatics integration is growing rapidly across healthcare, research, and forensic sectors, as end users increasingly prioritize accuracy, speed, and comprehensive genomic insight

DNA & Genomic Profiling Kits Market Dynamics

Driver

“Rising Demand for Precision Medicine and Advanced Genetic Testing”

- The increasing emphasis on precision medicine, coupled with the expanding use of genetic testing in disease diagnosis, treatment selection, and risk assessment, is a significant driver for the growing demand for DNA & genomic profiling kits

- For instance, in March 2025, Thermo Fisher Scientific expanded its clinical genomics portfolio with enhanced NGS-based profiling kits designed to support oncology diagnostics and targeted therapy selection, reinforcing market growth momentum

- As healthcare providers and researchers become more focused on personalized treatment approaches, DNA & genomic profiling kits enable accurate identification of genetic variants, biomarkers, and hereditary risks, offering clear advantages over conventional diagnostic methods

- Furthermore, the growing adoption of genomics in drug discovery, pharmacogenomics, and clinical trials is making genomic profiling kits an essential component of modern life sciences research and development workflows

- The increasing availability of user-friendly, standardized, and regulatory-compliant genomic kits, along with declining sequencing costs, is accelerating adoption across clinical laboratories, research institutes, and biotechnology companies

- Expanding government-funded genomics initiatives and national precision medicine programs are accelerating the adoption of DNA & genomic profiling kits across public healthcare systems and research institutions

- The increasing prevalence of cancer, rare genetic disorders, and inherited diseases is driving sustained demand for accurate and early-stage genetic profiling, reinforcing the role of genomic kits in routine diagnostics and screening

Restraint/Challenge

“High Cost, Data Complexity, and Regulatory Compliance Barriers”

- Concerns surrounding the high cost of advanced genomic profiling kits and the complexity of managing and interpreting large-scale genetic data pose a significant challenge to broader market adoption, particularly in resource-limited settings

- For instance, reports highlighting the financial and infrastructure burden of implementing NGS-based genomic testing have made some small laboratories and healthcare facilities hesitant to adopt comprehensive profiling solutions

- Addressing these challenges through cost optimization, simplified workflows, and improved data interpretation tools is crucial for wider adoption. Companies such as Illumina and QIAGEN are emphasizing scalable kit designs, automation compatibility, and user training to reduce operational complexity and cost barriers

- While prices of genomic technologies are gradually decreasing, the perceived expense of advanced profiling kits, along with regulatory and reimbursement uncertainties in some regions, continues to limit uptake among price-sensitive end users

- Limited availability of skilled genomics professionals and bioinformatics expertise in developing regions restricts effective utilization of advanced DNA & genomic profiling kits, slowing market penetration

- Ethical concerns related to genetic data privacy, consent, and long-term data storage continue to pose regulatory and adoption challenges, particularly for direct-to-consumer and population genomics applications

- Overcoming these challenges through clearer regulatory pathways, expanded reimbursement frameworks, workforce training, and the development of affordable, application-specific genomic profiling kits will be vital for sustained market growth

DNA & Genomic Profiling Kits Market Scope

The market is segmented on the basis of product, technology, application, and end user.

- By Product

On the basis of product, the DNA & genomic profiling kits market is segmented into kits, instruments, and software & services. The kits segment dominated the market in 2025, driven by their recurring consumable nature and widespread use across forensic, clinical, and research laboratories. DNA and genomic profiling kits are essential for sample preparation, amplification, sequencing, and analysis, resulting in continuous demand as laboratories conduct routine and large-scale testing. The increasing adoption of standardized and ready-to-use kits has improved workflow efficiency and reduced variability, further strengthening their dominance. In addition, rising applications in forensic investigations, oncology diagnostics, and population genomics programs continue to fuel kit consumption globally. The availability of application-specific kits, such as oncology panels and forensic STR kits, has also supported sustained market leadership.

The software & services segment is expected to witness the fastest growth during the forecast period, driven by the increasing complexity of genomic data and the need for advanced bioinformatics interpretation. As NGS and high-throughput profiling generate massive datasets, laboratories are increasingly relying on integrated software platforms and analytical services for variant interpretation, reporting, and data management. Cloud-based genomics platforms, AI-driven analytics, and subscription-based bioinformatics services are gaining strong traction, particularly among clinical labs and research institutes. The growing demand for end-to-end genomic solutions is accelerating the expansion of this segment.

- By Technology

On the basis of technology, the market is segmented into STR profiling, real-time PCR, next-generation sequencing (NGS), and Y-STR analysis. The STR profiling segment dominated the market in 2025 with a market share of 41.8%, primarily due to its extensive use in forensic and criminal investigations and paternity testing. STR profiling is considered a gold standard in forensic DNA analysis owing to its high accuracy, reproducibility, and regulatory acceptance across global law enforcement agencies. Established forensic databases and standardized STR panels continue to support consistent demand for these kits. In addition, the relatively lower cost and faster turnaround time compared to advanced sequencing technologies contribute to sustained adoption, particularly in forensic laboratories.

The next-generation sequencing (NGS) segment is anticipated to be the fastest growing during the forecast period, driven by its ability to provide comprehensive genomic insights across clinical, research, and population genomics applications. NGS enables high-throughput analysis, detection of rare variants, and multiplex testing from a single sample, making it increasingly valuable for oncology, rare disease diagnosis, and pharmacogenomics. Continuous declines in sequencing costs, coupled with improvements in accuracy and workflow automation, are further accelerating adoption. The growing shift toward precision medicine is positioning NGS as a key growth engine within the market.

- By Application

On the basis of application, the market is segmented into forensic & criminal investigation, paternity & relationship testing, direct-to-consumer (DTC) testing, clinical & diagnostic, research & biobanking, and animal identification. The forensic & criminal investigation segment held the largest market share in 2025, supported by long-standing use of DNA profiling in law enforcement, criminal identification, and national DNA databases. Governments across multiple regions continue to invest in forensic infrastructure and database expansion, sustaining consistent demand for profiling kits. The reliability and legal admissibility of DNA evidence further reinforce the dominance of this segment. Ongoing advancements in forensic genomics, including improved STR and NGS-based forensic kits, are enhancing investigative capabilities.

The clinical & diagnostic segment is projected to grow at the fastest rate during the forecast period, driven by the rising adoption of genomic testing in disease diagnosis, oncology, and personalized medicine. DNA and genomic profiling kits are increasingly used for identifying genetic mutations, hereditary risks, and treatment response markers. The expansion of precision medicine initiatives, companion diagnostics, and pharmacogenomics is significantly boosting clinical demand. Growing awareness among healthcare providers and patients regarding genetic testing benefits is further accelerating growth in this segment.

- By End User

On the basis of end user, the market is segmented into forensic laboratories, clinical & diagnostic laboratories, direct-to-consumer genetic testing companies, academic & research institutes, pharmaceutical & biotechnology companies, and animal labs. The forensic laboratories segment dominated the market in 2025, driven by routine DNA profiling requirements for criminal investigations, missing person identification, and legal proceedings. High and recurring test volumes, along with mandatory forensic standards, ensure steady consumption of DNA profiling kits. Government-funded forensic programs and law enforcement agencies remain key contributors to revenue generation. The continued modernization of forensic laboratories is further strengthening this segment’s dominance.

The clinical & diagnostic laboratories segment is expected to be the fastest growing during the forecast period, fueled by the integration of genomic testing into routine clinical workflows. Increasing use of genomic profiling for cancer diagnostics, inherited disease screening, and therapy selection is driving rapid adoption among hospitals and diagnostic centers. Improvements in test accessibility, declining costs, and regulatory approvals for clinical genomic assays are supporting growth. As precision medicine becomes more mainstream, clinical laboratories are emerging as a major growth driver for the market.

DNA & Genomic Profiling Kits Market Regional Analysis

- North America dominated the DNA & genomic profiling kits market with the largest revenue share of 38.6% in 2025, characterized by strong genomic research funding, advanced healthcare infrastructure, and the presence of major biotechnology companies, with the U.S. witnessing robust demand driven by widespread clinical genomics adoption, forensic DNA databases, and the rapid expansion of direct-to-consumer genetic testing service

- End users in the region place high value on the accuracy, scalability, and clinical relevance offered by DNA & genomic profiling kits, particularly for applications such as oncology diagnostics, forensic identification, and direct-to-consumer genetic testing

- This strong market position is further supported by substantial government funding, the presence of leading biotechnology and genomics companies, and early adoption of advanced technologies such as next-generation sequencing, establishing DNA & genomic profiling kits as essential tools across healthcare and life sciences in the region

U.S. DNA & Genomic Profiling Kits Market Insight

The U.S. DNA & genomic profiling kits market captured the largest revenue share of 79% in 2025 within North America, fueled by strong investments in genomics research, widespread adoption of precision medicine, and advanced forensic infrastructure. Healthcare providers and research institutions are increasingly prioritizing genetic testing for oncology, rare disease diagnosis, and pharmacogenomics applications. The growing presence of direct-to-consumer genetic testing companies, combined with robust funding from government and private organizations, further propels market growth. Moreover, early adoption of next-generation sequencing technologies and advanced bioinformatics platforms is significantly contributing to the expansion of the U.S. market.

Europe DNA & Genomic Profiling Kits Market Insight

The Europe DNA & genomic profiling kits market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing adoption of genomic diagnostics and stringent regulatory standards supporting quality genetic testing. Rising awareness of personalized medicine and the growing prevalence of genetic disorders are fostering demand across healthcare systems. European research initiatives, biobanks, and population genomics projects are also supporting market growth. The region is witnessing strong uptake across clinical diagnostics, research, and forensic applications, with genomic profiling increasingly integrated into routine healthcare and translational research.

U.K. DNA & Genomic Profiling Kits Market Insight

The U.K. DNA & genomic profiling kits market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong government support for genomics programs and the integration of genetic testing into the National Health Service. Rising demand for cancer genomics, rare disease screening, and personalized treatment approaches is accelerating adoption. In addition, the U.K.’s robust academic research ecosystem and expanding biobank initiatives are supporting sustained demand for advanced profiling kits. The country’s focus on data-driven healthcare and innovation continues to stimulate market growth.

Germany DNA & Genomic Profiling Kits Market Insight

The Germany DNA & genomic profiling kits market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure and strong emphasis on biomedical research and innovation. Increasing use of genomic testing in oncology and inherited disease diagnostics is driving adoption across clinical laboratories. Germany’s focus on precision medicine, coupled with strict quality and data protection standards, supports the uptake of reliable and validated profiling kits. The growing collaboration between research institutes and biotechnology companies is further strengthening market growth.

Asia-Pacific DNA & Genomic Profiling Kits Market Insight

The Asia-Pacific DNA & genomic profiling kits market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by expanding healthcare access, rising awareness of genetic testing, and increasing investments in genomics research across countries such as China, Japan, and India. Rapid adoption of precision medicine initiatives and population genomics projects is supporting market expansion. In addition, the region’s emergence as a hub for biotechnology manufacturing and research is improving the affordability and accessibility of genomic profiling kits for a broader user base.

Japan DNA & Genomic Profiling Kits Market Insight

The Japan DNA & genomic profiling kits market is gaining momentum due to the country’s strong technological capabilities, advanced healthcare system, and growing focus on precision medicine. The increasing use of genomic testing for cancer diagnostics and rare diseases is driving demand across clinical and research settings. Integration of genomic profiling with digital health platforms and bioinformatics tools is further fueling growth. Moreover, Japan’s aging population is expected to increase demand for genetic screening and personalized healthcare solutions.

India DNA & Genomic Profiling Kits Market Insight

The India DNA & genomic profiling kits market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to expanding healthcare infrastructure, growing genomics research initiatives, and rising awareness of genetic testing. India is emerging as a key market for clinical genomics, forensic DNA analysis, and population-scale studies. Government-led genomics programs, increasing investments from biotechnology companies, and the availability of cost-effective profiling kits are key factors propelling market growth. The country’s large population base and rising adoption of precision diagnostics continue to support strong market expansion.

DNA & Genomic Profiling Kits Market Share

The DNA & Genomic Profiling Kits industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Promega Corporation (U.S.)

- New England Biolabs (U.S.)

- Eurofins Genomics LLC (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Pacific Biosciences of California, Inc. (U.S.)

- 10x Genomics, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- Twist Bioscience Corporation (U.S.)

- Zymo Research Corporation (U.S.)

- BGI Genomics Co., Ltd. (China)

- Novogene Co., Ltd. (China)

- Element Biosciences, Inc. (U.S.)

- Helix OpCo LLC (U.S.)

- PerkinElmer (U.S.)

What are the Recent Developments in Global DNA and Genomic Profiling Kits Market?

- In October 2025, Illumina launched a novel 5-base solution supporting simultaneous genomic and epigenomic profiling, unlocking broader multiomic insights from a single workflow. This innovation reduces complexity and enhances detection of genomic variants and DNA methylation for research and precision medicine applications

- In July 2025, QIAGEN expanded its NGS portfolio with the launch of QIAseq xHYB Long Read Panels designed for high-resolution analysis of complex genomic regions on long-read sequencing platforms. These panels enable deeper insights into structural variants and other challenging genomic contexts, advancing research and clinical genomics capabilities

- In April 2025, QIAGEN announced the launch of new QIAseq panels capable of analyzing over 700 genes for comprehensive genomic profiling at the AACR Annual Meeting, enhancing cancer research and clinical applications. The expanded portfolio also includes digital PCR assays and bioinformatics resources that improve precision medicine workflows

- In August 2024, Illumina’s TruSight™ Oncology Comprehensive assay received FDA approval as the first comprehensive genomic profiling IVD kit with pan-cancer companion diagnostic claims, enabling clinicians to profile over 500 cancer-related genes for personalized treatment guidance. This milestone expands access to next-generation sequencing (NGS)-based genomic profiling in clinical oncology and supports targeted therapy decisions across multiple solid tumor types

- In November 2023, Illumina introduced the next-generation TruSight™ Oncology 500 ctDNA v2 liquid biopsy assay enabling noninvasive comprehensive genomic profiling of circulating tumor DNA with improved sensitivity and streamlined workflow. This launch broadens genomic profiling beyond tissue analysis, supporting cancer research and diagnostics when tissue is not available

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.