Global Door And Window Automation Market

Market Size in USD Billion

CAGR :

%

USD

18.91 Billion

USD

29.02 Billion

2024

2032

USD

18.91 Billion

USD

29.02 Billion

2024

2032

| 2025 –2032 | |

| USD 18.91 Billion | |

| USD 29.02 Billion | |

|

|

|

|

What is the Global Door and Window Automation Market Size and Growth Rate?

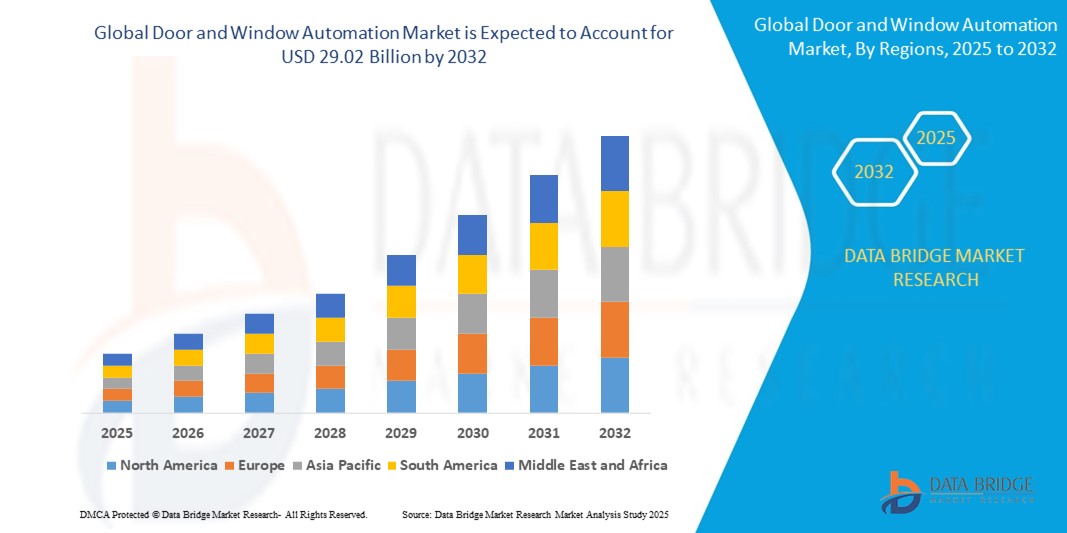

- The global door and window automation market size was valued at USD 18.91 billion in 2024 and is expected to reach USD 29.02 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market is witnessing robust growth due to the surge in smart home adoption, advances in IoT-enabled automation, and increasing consumer inclination toward energy-efficient, touchless, and secure solutions

- Furthermore, innovations in access control, the expansion of infrastructure projects, and demand for integrated building management systems are collectively driving the widespread adoption of door and window automation globally

What are the Major Takeaways of Door and Window Automation Market?

- Door and window automation systems are becoming indispensable in modern architecture, offering hands-free, smart access control that enhances security and convenience across residential, commercial, and industrial settings

- The market is rapidly expanding, fueled by the rising demand for connected living, emphasis on contactless entry post-COVID, and integration with AI-driven surveillance and energy optimization systems

- As consumers prioritize safety, comfort, and seamless integration with smart home ecosystems, automated doors and windows are emerging as the preferred solution for modern access control, driving industry transformation

- North America dominated the door and window automation market with the largest revenue share of 47.58% in 2024, driven by high demand for smart security and automation solutions in residential and commercial spaces

- Asia-Pacific is poised to grow at the fastest CAGR of 9.47% between 2025 and 2032, led by rapid urbanization and smart home adoption in China, Japan, and India. Government-backed digitalization and strong manufacturing presence are improving affordability and accessibility

- The fully automatic segment held the largest market revenue share of 47.5% in 2024, driven by the demand for seamless, touchless operations in high-traffic zones such as airports, malls, and office buildings

Report Scope and Door and Window Automation Market Segmentation

|

Attributes |

Door and Window Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Door and Window Automation Market?

“Enhanced Convenience Through AI and Voice Integration”

- A prominent trend in the global door and window automation market is the integration of AI and voice assistant compatibility, including Amazon Alexa, Google Assistant, and Apple HomeKit, enhancing real-time user interaction and control

- For instance, the August Wi-Fi Smart Lock supports all major voice platforms, enabling voice-controlled access. Similarly, Level Lock+ pairs with Siri via Apple HomeKit, offering a sleek, smart security solution

- AI enables smart features like behavior-based automation, predictive access suggestions, and intelligent alerts. Ultraloq devices, for instance, enhance fingerprint recognition over time and issue real-time notifications for abnormal access

- These systems seamlessly integrate with smart home ecosystems, allowing users to manage door locks alongside lighting, thermostats, and surveillance through centralized platforms

- Companies such as WELOCK are releasing locks with auto-unlock/lock features based on proximity and compatibility with leading virtual assistants, making home automation smoother

- This trend is reshaping consumer expectations, with rising demand across residential and commercial sectors for smart systems that prioritize convenience, automation, and connected living

What are the Key Drivers of Door and Window Automation Market?

- Rising security concerns, increasing urbanization, and growing awareness of smart home ecosystems are primary drivers for the growing demand for door and window automations

- For instance, in April 2024, Onity, Inc. (Honeywell) introduced IoT-enabled Passport Locking with advanced sensors, showcasing how innovation is pushing market growth

- Consumers are demanding systems with remote access, activity tracking, and tamper detection, as these features offer more robust and convenient security than traditional mechanical locks

- The popularity of smart homes and IoT ecosystems encourages adoption, with Door and Window Automations becoming essential components for managing access control

- Features like keyless entry, smartphone-controlled access, and integration with other devices make these solutions attractive for both residential users and commercial facilitie

- DIY installation trends and the introduction of user-friendly, app-integrated systems from brands like Schlage, Kwikset, and Yale further broaden consumer appeal and market penetration

Which Factor is challenging the Growth of the Door and Window Automation Market?

- Cybersecurity concerns are a major obstacle to the widespread adoption of door and window automations, especially as these systems depend heavily on connectivity and software

- Notable cases of IoT device vulnerabilities have led to hesitancy among users, who worry about potential hacks, data theft, or compromised home security systems

- To address this, brands like August and Level Home emphasize AES encryption and multi-factor authentication in their devices and offer frequent security updates to build consumer trust

- Moreover, the high initial cost of smart locking systems—particularly models with advanced features such as cameras and biometrics—poses a financial barrier to mass-market adoption

- While budget-friendly options like Wyze Lock are gaining traction, premium systems still remain out of reach for price-sensitive markets or developing regions

- Future growth depends on educating consumers, improving system affordability, and ensuring devices follow strict cybersecurity protocols to promote user confidence and accessibility

How is the Door and Window Automation Market Segmented?

The market is segmented on the basis of control systems, component, product, and end-users.

- By Control Systems

On the basis of control systems, the door and window automation market is segmented into fully automatic, push and go, power assist, and low energy. The fully automatic segment held the largest market revenue share of 47.5% in 2024, driven by the demand for seamless, touchless operations in high-traffic zones such as airports, malls, and office buildings. Fully automatic systems enhance hygiene and convenience, especially in post-pandemic infrastructure upgrades.

The low energy segment is expected to witness the fastest growth rate from 2025 to 2032 due to its suitability for facilities requiring accessibility compliance, such as hospitals and senior care centers. These systems require minimal force to activate and consume less energy, making them eco-friendly and ADA-compliant.

- By Component

On the basis of component, the door and window automation market is segmented into operators, sensors & detectors, access control systems, motors & actuators, control panels, switches, and others. The operators segment dominated the market with the largest revenue share of 28.6% in 2024, owing to their critical role in enabling door movement across various systems.

The access control systems segment is projected to register the highest CAGR during the forecast period, driven by rising integration with biometric and smartphone-based systems. These systems offer enhanced tracking, authentication, and customization, gaining traction in security-focused commercial and residential applications.

- By Product

On the basis of product, the door and window automation market is segmented into industrial doors, pedestrian doors, and windows. The pedestrian doors segment held the dominant market share of 51.9% in 2024, attributed to their extensive use in commercial complexes, healthcare facilities, hotels, and public transit stations. Their ability to provide seamless entry and exit, especially in automatic sliding and swing door configurations, fuels their widespread adoption.

The window automation segment is anticipated to witness the fastest CAGR from 2025 to 2032, spurred by demand for smart ventilation, energy-saving solutions, and natural lighting optimization in residential and green buildings.

- By End-Users

On the basis of end-users, the door and window automation market is segmented into residential buildings, airports, education buildings, healthcare facilities, hotels & restaurants, industrial production units, public transit systems, commercial buildings, entertainment centers, and others. The commercial buildings segment led the market in 2024 with the largest market revenue share of 26.8%, driven by growing investments in modern office infrastructure, smart access management, and employee safety.

The healthcare facilities segment is projected to grow at the fastest rate from 2025 to 2032, as hospitals and clinics increasingly adopt automated solutions to ensure hygienic, contactless access and enhanced patient mobility, while complying with health and safety regulations.

Which Region Holds the Largest Share of the Door and Window Automation Market?

- North America dominated the door and window automation market with the largest revenue share of 47.58% in 2024, driven by high demand for smart security and automation solutions in residential and commercial spaces

- The region’s tech-savvy population embraces seamless integration of doors and windows with smart ecosystems, including lighting and climate control

- Widespread adoption is fueled by high disposable incomes, robust smart home infrastructure, and growing preference for remote monitoring, cementing North America's leadership in the market

U.S. Door and Window Automation Market Insight

The U.S. dominated the shares of the North American market in 2024, owing to the surge in connected devices and smart home setups. There is growing consumer preference for keyless entry, voice-control integration, and DIY-friendly automation systems. Integration with platforms like Alexa, Google Assistant, and Apple HomeKit enhances convenience, bolstering adoption across residential and light commercial properties.

Europe Door and Window Automation Market Insight

Europe is projected to expand at a strong CAGR, backed by strict security regulations and increasing urbanization. High demand for connected, energy-efficient solutions in both new and retrofit projects supports market expansion. Strong traction is noted across residential and office spaces, with key markets like Germany, U.K., and France leading regional adoption.

U.K. Door and Window Automation Market Insight

The U.K. market is set to grow notably due to rising concerns around burglary and the need for secure, contactless access. Consumers are increasingly opting for keyless entry systems, smart integrations, and touchless solutions. The country’s strong e-commerce and tech infrastructure further facilitates adoption, especially in smart residential buildings.

Germany Door and Window Automation Market Insight

Germany is expected to witness significant growth due to a heightened focus on digital security and eco-friendly automation. Demand is rising for integrated smart home systems that emphasize privacy, efficiency, and sustainability. Advanced infrastructure and consumer interest in innovation support the widespread use of door and window automation solutions.

Which Region is the Fastest Growing Region in the Door and Window Automation Market?

Asia-Pacific is poised to grow at the fastest CAGR of 9.47% between 2025 and 2032, led by rapid urbanization and smart home adoption in China, Japan, and India. Government-backed digitalization and strong manufacturing presence are improving affordability and accessibility. APAC’s expansion is driven by a rising middle class, smart city initiatives, and the increasing popularity of IoT-based automation systems.

Japan Door and Window Automation Market Insight

Japan is gaining traction due to its tech-driven society, demand for smart homes, and focus on convenience. High adoption is seen in IoT-integrated systems combining doors, windows, security, and lighting. An aging population is also contributing to the need for accessible and automated entry systems across residential and public spaces.

China Door and Window Automation Market Insight

China accounted for the largest APAC market share in 2024, supported by its large consumer base and booming smart home industry. Demand is rising in residential, commercial, and rental sectors, with automation embedded in modern housing. The country’s focus on smart cities, presence of domestic manufacturers, and affordability are major growth enablers.

Which are the Top Companies in Door and Window Automation Market?

The door and window automation industry is primarily led by well-established companies, including:

- ASSA ABLOY (Sweden)

- BEA (Belgium)

- Bosch Security Systems (Germany)

- CAME Group (Italy)

- dormakaba Group (Switzerland)

- GEZE GmbH (Germany)

- Honeywell International Inc. (U.S.)

- Insteon (U.S.)

- Legrand (France)

- NABCO Entrances Inc. (U.S.)

- Panasonic Corporation (Japan)

- Record USA (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- Stanley Black & Decker (U.S.)

- Boon Edam (Netherlands)

- Nabtesco Corporation (Japan)

- Allegion Plc. (Ireland)

What are the Recent Developments in Global Door and Window Automation Market?

- In November 2022, ASSA ABLOY introduced Yale Assure Lock 2 and August Smart Lock Pro, while Honeywell enabled HomeKit integration, Legrand launched the Netatmo Smart Door Lock, Schneider unveiled its Wiser smart window shades, and Somfy expanded the Connex Smart Home System, highlighting the growing pace of innovation in door and window automation. This wave of product launches underscores a significant push toward integrated and smart access control solutions

- In March 2022, ASSA ABLOY completed the acquisition of JOTEC Service & Vertriebsges. mbh, a major provider of industrial door services in Germany, to expand its portfolio of entrance automation systems. This acquisition enhances ASSA ABLOY’s strategic presence in the European industrial access market

- In March 2022, GEZE GmbH unveiled the GC 342+ safety sensor for automatic swing doors, leveraging laser technology to improve hygiene, safety, and comfort within smart buildings. This innovation marks a significant advancement in intelligent safety systems for modern infrastructure

- In November 2021, dormakaba Group finalized its acquisition of Fermatic Group, a France-based specialist in automatic door and gate services, broadening dormakaba’s service capabilities in France and offering strong cross-selling opportunities. This move strengthens dormakaba's market position and expands its footprint in the European entrance systems segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Door And Window Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Door And Window Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Door And Window Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.