Global Dopamine Agonist Drug Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

4.21 Billion

2024

2032

USD

2.90 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.90 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Dopamine Agonist Drug Market Size

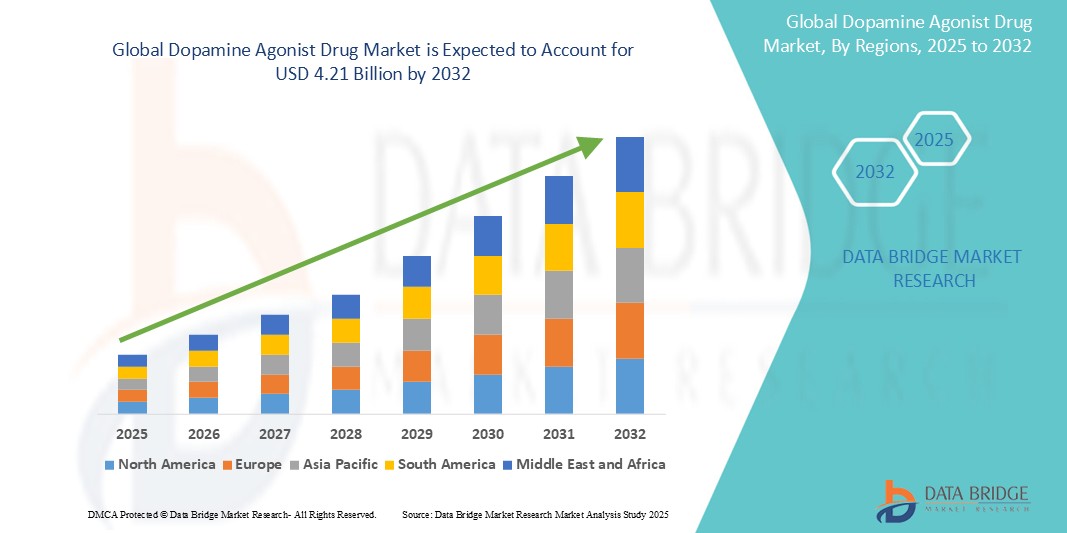

- The global dopamine agonist drug market size was valued at USD 2.9 billion in 2024 and is expected to reach USD 4.21 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is primarily driven by rising prevalence of neurological disorders such as Parkinson’s disease and restless leg syndrome, coupled with increasing geriatric population and advancements in pharmacological research

- In addition, growing awareness regarding early diagnosis and treatment of dopamine-related disorders, along with favorable reimbursement policies and expanding healthcare infrastructure, are expected to further accelerate market growth throughout the forecast period

Dopamine Agonist Drug Market Analysis

- Dopamine agonist drug therapy is primarily used to stimulate dopamine receptors and manage symptoms of neurological disorders such as Parkinson’s disease, restless leg syndrome (RLS), and hyperprolactinemia. It plays a critical role in improving patient mobility, reducing motor symptoms, and enhancing quality of life, making it a cornerstone treatment in neurology

- The escalating demand for dopamine agonist drugs is primarily fueled by the growing prevalence of Parkinson's disease globally, increasing aging population, and continuous advancements in drug formulations and delivery mechanisms

- North America dominates the dopamine agonist drug market with the largest revenue share of 42.21% in 2024, attributed to well-established healthcare infrastructure, high diagnosis rates, presence of major pharmaceutical companies, and favorable reimbursement policies

- Asia-Pacific is expected to be the fastest growing region in the dopamine agonist drug market during the forecast period, with a projected CAGR of 7.5%, fueled by expanding healthcare access, growing geriatric population, increased investments in neurology care, and rising regulatory emphasis on treatment standardization in countries

- Non-ergoline dopamine agonists segment is expected to dominate the dopamine agonist drug market with a market share of 48.2% in 2024, owing to patient preference for non-invasive administration routes, wide availability, and consistent demand for chronic condition management

Report Scope and Dopamine Agonist Drug Market Segmentation

|

Attributes |

Dopamine Agonist Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dopamine Agonist Drug Market Trends

“Increasing Focus on Personalized and Advanced Dopamine Agonist Therapies”

- A significant and accelerating trend in the global dopamine agonist drug market is the growing emphasis on personalized medicine and advanced drug formulations tailored to individual patient needs, improving therapeutic outcomes and minimizing side effects

- For instance, development of targeted non-ergoline dopamine agonists with fewer adverse effects and customizable dosing regimens is gaining traction among neurologists and patients managing Parkinson’s disease and restless leg syndrome

- Technological advancements such as extended-release formulations, transdermal patches, and novel drug delivery systems are enhancing drug bioavailability and patient compliance, expanding treatment options beyond traditional oral medications

- The integration of digital health tools—including telemedicine platforms, mobile apps for symptom tracking, and AI-based dosage optimization—is enabling real-time monitoring and adjustment of therapy, fostering a more dynamic and responsive care model

- This shift toward patient-centric, technology-enabled therapies is reshaping the dopamine agonist treatment landscape, encouraging pharmaceutical companies to invest in R&D focused on safer, more effective, and more convenient therapeutic options

- As healthcare systems increasingly prioritize precision medicine and value-based care, dopamine agonist drugs aligned with these trends are witnessing robust adoption and fueling market growth globally

Dopamine Agonist Drug Market Dynamics

Driver

“Rising Prevalence of Neurological Disorders and Aging Population”

- The increasing global prevalence of neurological disorders such as Parkinson’s disease, restless leg syndrome, and other dopamine-related conditions, alongside a rapidly aging population, is a major driver for the dopamine agonist drug market

- For instance, dopamine agonists are widely prescribed to manage motor symptoms and improve quality of life in Parkinson’s patients, while also being used to alleviate symptoms in patients with restless leg syndrome and hyperprolactinemia. The aging demographic is particularly vulnerable to these disorders, driving sustained demand for effective therapies

- As healthcare systems focus on chronic disease management and improving patient outcomes, dopamine agonist drugs offer a targeted, pharmacological solution that helps delay disease progression and reduce symptom severity, making them highly valuable in neurological care

- The growing geriatric population worldwide, with increased life expectancy and rising incidence of neurodegenerative diseases, further fuels the need for innovative, safe, and long-term treatment options such as dopamine agonists

- In addition, ongoing advancements in drug formulations, such as extended-release and non-ergoline compounds with improved safety profiles, are expanding patient acceptance and driving broader adoption across clinical settings

Restraint/Challenge

“Side Effects and Safety Concerns Associated with Dopamine Agonist Drugs”

- One of the key challenges in the dopamine agonist drug market is the risk of side effects and safety concerns linked to the use of dopamine agonist medications, which can limit patient compliance and physician prescribing.

- For instance, ergoline-derived dopamine agonists have been associated with adverse effects such as cardiac valvulopathy, fibrosis, hallucinations, and impulse control disorders, raising caution among healthcare providers. Even non-ergoline dopamine agonists, while safer, can cause nausea, dizziness, hypotension, and somnolence, impacting patient quality of life

- In addition, long-term use of dopamine agonists may lead to tolerance or diminished efficacy, requiring careful dose management and monitoring that can complicate treatment regimens

- These safety concerns necessitate rigorous regulatory oversight and patient education, increasing the complexity and cost of therapy management

- Consequently, such adverse effects and the need for close monitoring hinder wider adoption, especially in geriatric patients or those with comorbidities

- Overcoming these barriers through the development of safer drug formulations, enhanced monitoring tools, and physician awareness programs will be crucial to improving market growth and patient outcomes globally

Dopamine Agonist Drug Market Scope

The market is segmented on the basis of type, indication, drugs, route of administration, distribution channel, and end user.

By Type

On the basis of type, the dopamine agonist drug market is segmented into non-ergoline dopamine agonists, ergot-derived dopamine agonists, recombinant factor VIII, and others. The non-ergoline dopamine agonists segment dominated the market with an estimated revenue share of 48.2% in 2024, driven by a better safety profile and increasing preference over ergot derivatives, which have been linked to adverse effects.

The ergot-derived dopamine agonists segment is anticipated to witness the fastest growth rate of 30.7%% from 2025 to 2032 due to the progressive nature of the disease and the continuous need for long-term pharmacological and supportive care.

• By Indication

On the basis of indication, the market is segmented into Parkinson’s disease, restless leg syndrome (RLS), and others. Parkinson’s disease leads the market with 65% revenue share in 2024, driven by the high prevalence of the disease and extensive clinical use of dopamine agonists for motor symptom management.

The restless leg syndrome (RLS) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by improved awareness, early diagnosis, and growing availability of targeted dopaminergic therapies. As RLS increasingly gains recognition as a serious neurological disorder affecting quality of life, treatment demand is expected to rise steadily.

• By Drugs

On the basis of drugs, the market is categorized into carbidopa and levodopa, ropinirole, pramipexole, cabergoline, bromocriptine, and others. The carbidopa and levodopa combination dominated the market share of with 35% share in 2024, as it remains the gold standard for Parkinson’s disease treatment.

The pramipexole segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its favorable safety profile and dual indication for both Parkinson's and RLS. Its neuroprotective potential and extended-release formulations support its growing adoption among clinicians and patients.

• By Route of Administration

On the basis of route of administration, the market is divided into oral and injectable. The Oral route dominated the market in 2024, owing to ease of administration and patient preference.

The injectable segment is expected to witness the fastest CAGR from 2025 to 2032, due to its importance in advanced-stage treatment, especially for patients with swallowing difficulties or requiring continuous dopaminergic stimulation. Innovations such as subcutaneous pumps and long-acting injectables are further fueling growth in this segment.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies and retail pharmacies. Retail pharmacies held the majority share of 56% in 2024, as oral dopamine agonists are widely dispensed for outpatient use.

The Hospital Pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the demand for acute care interventions, inpatient dosing, and access to specialty injectable therapies, particularly for advanced Parkinson’s disease

• By End User

On the basis of end user, the market is classified into hospitals, homecare, specialty clinics, and others. The hospitals segment dominated the market with share in 2024, being primary centers for diagnosis and management of neurological disorders.

The homecare segment is expected to witness the fastest CAGR from 2025 to 2032, reflecting a rising preference for personalized care at home, advancements in home-administered therapies, and a growing elderly population that benefits from managed home-based neurological care.

Dopamine Agonist Drug Market Regional Analysis

- North America dominates the global dopamine agonist drug market with the largest revenue share of 42.21% in 2024, driven by stringent regulatory frameworks, high healthcare expenditure, and a strong presence of leading pharmaceutical and medical device companies

- The region’s well‑established healthcare infrastructure, emphasis on quality care, and early adoption of advanced dopamine agonist drug technologies contribute to its market leadership

U.S. Dopamine Agonist Drug Market Insight

The U.S. dopamine agonist drug market captured 83% of North America’s revenue in 2024, fueled by the increasing prevalence of chronic neurological disorders, a rising geriatric population, and growing demand for safe, effective medical treatments. The presence of numerous leading solution providers drives continuous innovation in drug formulations and delivery systems. Moreover, stringent FDA oversight and the rising focus on personalized medicine further bolster market expansion.

Europe Dopamine Agonist Drug Market Insight

The Europe dopamine agonist drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the adoption of advanced dopamine agonist drugs, growing healthcare expenditure, and rising awareness of non-invasive and targeted treatment alternatives. Stringent regulatory standards set by the European Medicines Agency (EMA) and robust healthcare systems also enhance market growth.

U.K. Dopamine Agonist Drug Market Insight

The U.K. dopamine agonist drug market is anticipated to grow at a noteworthy rate, driven by a strong emphasis on patient safety, rising incidence of neurodegenerative disorders, and expansion of private healthcare facilities. Government-led health improvement initiatives and growing acceptance of advanced therapeutics in neurological care are boosting adoption.

Germany Dopamine Agonist Drug Market Insight

The Germany dopamine agonist drug market is expected to expand at a considerable CAGR, fueled by strong demand for quality-driven medical care, innovation in drug therapies, and a thriving pharmaceutical manufacturing sector. The country’s focus on R&D and healthcare digitization supports the uptake of advanced dopamine agonist drugs, while a growing geriatric population and high incidence of Parkinson’s disease and related disorders further drive utilization.

Asia-Pacific Dopamine Agonist Drug Market Insight

The Asia-Pacific dopamine agonist drug market is poised to grow at the fastest CAGR of 7.5% during the forecast period of 2025 to 2032, driven by rapid expansion of the pharmaceutical and healthcare sectors, rising healthcare investment, and greater regulatory focus on medical innovation in key markets such as China, Japan, and India. Rising disposable incomes, growing awareness of alternative therapies, and increasing medical tourism also underpin strong regional growth.

Japan Dopamine Agonist Drug Market Insight

The Japan dopamine agonist drug market is gaining momentum due to technological advancement in healthcare, a rapidly aging population, and increasing preference for non-invasive treatments. High standards for clinical precision and safety are driving adoption of advanced dopamine agonist drugs. A growing prevalence of neurodegenerative diseases such as Parkinson’s and Alzheimer’s further fuels demand.

China Dopamine Agonist Drug Market Insight

The China dopamine agonist drug market is experiencing substantial growth, supported by rapid industrialization of the healthcare sector, increased government funding, and rising consumer awareness of advanced medical therapies. An expanding middle class and growing healthcare needs are pushing adoption of dopamine agonist drugs in hospitals, specialty clinics, and rehabilitation centers. China’s role as a pharmaceutical manufacturing hub and a high incidence of chronic neurological disorders further bolster market development.

Dopamine Agonist Drug Market Share

The dopamine agonist drug industry is primarily led by well-established companies, including:

- Intas Pharmaceuticals Ltd (India)

- Amarin Corporation plc (U.S.)

- USWM, LLC. (U.S.)

- Kirin Holdings Company, Limited (Japan)

- UCB S.A. (Belgium)

- Bausch Health Companies Inc. (Canada)

- Boehringer Ingelheim International GmbH (Germany)

- Merck & Co., Inc (U.S.)

- Novartis AG (Switzerland)

- Apotex Inc. (Canada)

- Teva Pharmaceutical Industries Ltd (Israel)

- GLENMARK PHARMACEUTICALS LTD. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd (India)

Latest Developments in Global Dopamine Agonist Drug Market

- In December 2024, AbbVie Inc. announced positive topline results from its pivotal Phase III TEMPO-2 trial evaluating tavapadon, a first-in-class D1/D5 partial dopamine agonist, as a flexible-dose monotherapy for early Parkinson’s disease. Tavapadon is being investigated as a once-daily treatment, potentially offering a novel approach to PD management

- In October 2024, Supernus Pharmaceuticals has received FDA approval for ONAPGO, a continuous subcutaneous infusion device delivering apomorphine hydrochloride. This device is designed to manage motor fluctuations in adults with advanced Parkinson’s disease

- In May 2021, AffaMed Therapeutics announced that China's National Medical Products Administration (NMPA) has approved the Clinical Trial Application (CTA) for a Phase IIb global clinical trial led by AffaMed, to evaluate the safety and efficacy of AM006 in patients with early Parkinson’s Disease (PD)

- In January 2019, Ligand Pharmaceuticals Incorporated partner with Seelos Therapeutics, Inc. The companies will focus on the development and commercialization of central nervous system (CNS) therapeutics including dopamine agonists with known mechanisms of action in areas with high unmet medical need

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DOPAMINE AGONIST DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DOPAMINE AGONIST DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DOPAMINE AGONIST DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 INDUSTRY INSIGHTS

7 EPIDEMIOLOGY

8 REGULATORY FRAMEWORK: GLOBAL DOPAMINE AGONIST DRUGS MARKET

9 PIPELINE ANALYSIS

9.1 PHASE III CANDIDATES

9.2 PHASE II CANDIDATES

9.3 PHASE I CANDIDATES

9.4 OTHERS (PRE-CLINICAL AND RESEARCH)

10 IMPACT OF COVID-19 PANDEMIC ON GLOBAL DOPAMINE AGONIST DRUGS MARKET

10.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

10.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

10.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

10.4 PRICE IMPACT

10.5 IMPACT ON DEMAND

10.6 IMPACT ON SUPPLY CHAIN

10.7 CONCLUSION

11 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY TYPE

11.1 OVERVIEW

11.2 D-1 LIKE DOPAMINE RECEPTORS

11.2.1 D1 RECEPTOR SUBTYPE

11.2.2 D5 RECEPTOR SUBTYPE

11.3 D-2 LIKE DOPAMINE RECEPTORS

11.3.1 D2 RECEPTOR SUBTYPE

11.3.2 D3 RECEPTOR SUBTYPE

11.3.3 D4 RECEPTOR SUBTYPE

12 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY DRUGS TYPE

12.1 OVERVIEW

12.2 ERGOLINE

12.2.1 BROMOCRIPTINE

12.2.2 CABERGOLINE

12.2.3 LISURIDE

12.2.4 PERGOLIDE

12.2.5 DIHYDROERGOCRYPTINE

12.2.6 OTHERS

12.3 NON-ERGOLINE

12.3.1 CARBIDOPA & LEVODOPA

12.3.2 ROPINIROLE

12.3.3 PRAMIPIXOLE

12.3.4 ROTIGOTINE

12.3.5 APOMORPHINE

12.3.6 PIRIBEDIL

12.3.7 FENOLDOPAM

12.3.8 OTHERS

12.4 OTHERS

13 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY INDICATION

13.1 OVERVIEW

13.2 PARKINSON’S DISEASE

13.2.1 FAMILIAL PARKINSON’S

13.2.2 EARLY-ONSET PARKINSON’S

13.2.3 SECONDARY PARKINSONISM

13.2.3.1. DEMENTIA WITH LEWY BODIES

13.2.3.2. COTICOABASAL DEGENERATION

13.2.3.3. PROGRESSIVE SUPRANUCLEAR PALSY

13.2.3.4. MULTIPLE SYSTEM ATROPHY

13.3 RESTLESS LEG SYNDROME

13.3.1 MOVEMENT DISORDERS

13.3.2 SLEEP DISORDERS

13.3.3 HYPERKINETIC DISORDERS

13.4 DEPRESSION

13.5 DIABETES

13.6 NEUROLEPTIC MALIGNANT SYNDROME

13.7 HYPERPROLACTINEMIA

13.8 HYPERTENSION

13.9 SCHIZOPHRENIA

13.1 OTHERS

14 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 ORAL

14.2.1 LIQUID

14.2.2 CAPSULES

14.2.3 TABLETS

14.3 INJECTABLE

14.3.1 SUBCUTANEOUS (UNDER THE SKIN)

14.3.2 INTRAMUSCULAR (IN A MUSCLE)

14.3.3 INTRAVENOUS (IN A VEIN)

15 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITAL

15.3 HOMECARE

15.4 SPECIALTY CLINICS

15.5 OTHERS

16 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 PHARMACIES

16.2.1 HOSPITAL

16.2.2 RETAIL

16.2.3 OTHERS

16.3 ONLINE STORES

16.4 OTHERS

17 GLOBAL DOPAMINE AGONIST DRUGS MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL DOPAMINE AGONIST DRUGS MARKET, BY REGION

GLOBAL DOPAMINE AGONIST DRUGS MARKET, (GLOBAL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 FRANCE

18.2.3 U.K.

18.2.4 ITALY

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 TURKEY

18.2.8 BELGIUM

18.2.9 HUNGARY

18.2.10 NETHERLANDS

18.2.11 SWITZERLAND

18.2.12 LITHUANIA

18.2.13 AUSTRIA

18.2.14 IRELAND

18.2.15 NORWAY

18.2.16 POLAND

18.2.17 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 MALAYSIA

18.3.9 INDONESIA

18.3.10 PHILIPPINES

18.3.11 VIETNAM

18.3.12 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 PERU

18.4.4 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 SAUDI ARABIA

18.5.3 UAE

18.5.4 EGYPT

18.5.5 ISRAEL

18.5.6 KUWAIT

18.5.7 REST OF MIDDLE EAST AND AFRICA

18.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL DOPAMINE AGONIST DRUGS MARKET, SWOT ANALYSIS

20 GLOBAL DOPAMINE AGONIST DRUGS MARKET, COMPANY PROFILE

20.1 GLAXOSMITHKLINE

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT UPDATES

20.2 INTAS PHARMACEUTICALS LTD

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT UPDATES

20.3 AMARIN PHARMACEUTICLAS

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT UPDATES

20.4 ACORDA THERAPEUTICS INC

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT UPDATES

20.5 US WORLDMEDS

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT UPDATES

20.6 KIRIN HOLDINGS COMPANY LTD

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT UPDATES

20.7 UCB

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT UPDATES

20.8 BAUSCH HEALTH COMPANIES INC

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT UPDATES

20.9 BOEHRINGER INGELHEIMCOMPANY OVERVIEW

20.9.1 REVENUE ANALYSIS

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT UPDATES

20.1 INTEC PHARMA

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT UPDATES

20.11 MERCK

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT UPDATES

20.12 NOVARTIS AG

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT UPDATES

20.13 SERINA THERAPEUTICS

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT UPDATES

20.14 APOTEX INC

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT UPDATES

20.15 TEVA PHARMACEUTICALS INDUSTRIES LTD

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT UPDATES

20.16 MYLAN NV

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT UPDATES

20.17 GLENMARK PHARMACEUTICALS

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT UPDATES

20.18 SUN PHARMACEUTICALS

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT UPDATES

20.19 DR REDDYS LABORATORIES.

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT UPDATES

20.2 CIPLA LTD

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT UPDATES

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.