Global Driving Simulator Market

Market Size in USD Billion

CAGR :

%

USD

1.97 Billion

USD

3.38 Billion

2024

2032

USD

1.97 Billion

USD

3.38 Billion

2024

2032

| 2025 –2032 | |

| USD 1.97 Billion | |

| USD 3.38 Billion | |

|

|

|

|

Driving Simulator Market Size

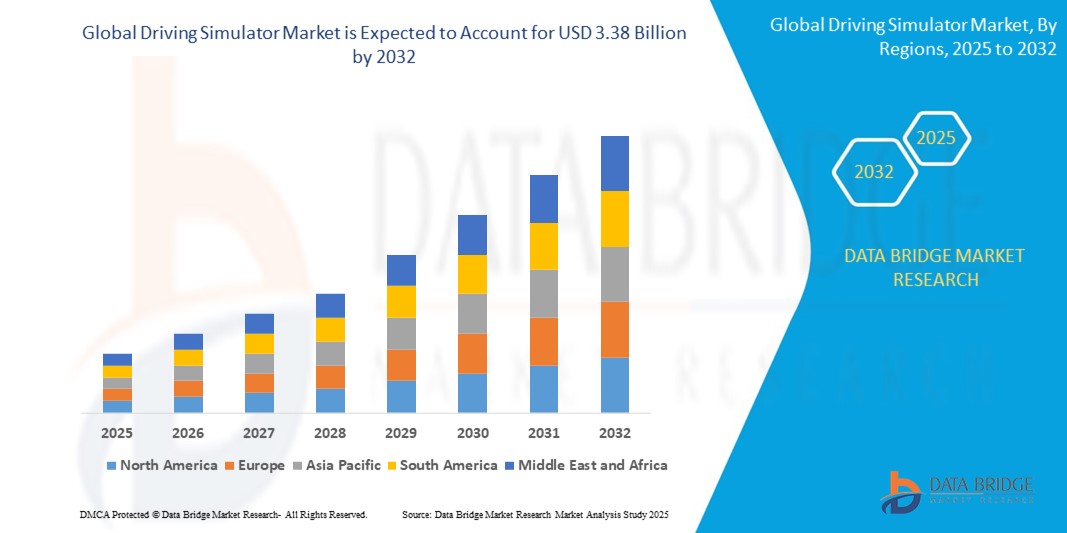

- The global driving simulator market size was valued at USD 1.97 billion in 2024 and is expected to reach USD 3.38 billion by 2032, at a CAGR of 7.00% during the forecast period

- Market growth is primarily driven by the increasing demand for advanced driver training, autonomous vehicle testing, and the need for safe, cost-effective simulation-based research in automotive development

- Rising adoption of driving simulators by automotive OEMs, driving schools, and research institutions, coupled with advancements in virtual reality (VR) and augmented reality (AR) technologies, is further fueling market expansion

Driving Simulator Market Analysis

- The driving simulator market is experiencing robust growth due to the rising focus on driver safety, regulatory mandates for advanced driver training, and the growing need for testing autonomous and semi-autonomous vehicle system

- The training segment holds the largest market revenue share of 65% in 2024, driven by the widespread adoption of simulators in driving schools and professional training programs to enhance driver skills and road safety awareness

- Europe dominates the driving simulator market with the largest revenue share of 35.7% in 2024, fueled by a mature automotive OEM market, stringent safety regulations, and high adoption of advanced simulation technologies

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing vehicle production, and growing investments in autonomous vehicle research, particularly in countries such as China, Japan, and India

- The training driving simulator segment dominated with a revenue share of 69.4% in 2024, driven by its extensive use in driving schools, government training programs, and corporate fleet training for improving driver safety and efficiency

Report Scope and Driving Simulator Market Segmentation

|

Attributes |

Driving Simulator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Driving Simulator Market Trends

“Growing Adoption of Advanced Driving Simulators for Autonomous Vehicle Development”

- Advanced driving simulators are increasingly utilized for testing and developing autonomous vehicle technologies, offering a safe and controlled environment to simulate complex driving scenarios

- These simulators provide high-fidelity virtual environments, replicating real-world conditions such as adverse weather, traffic patterns, and pedestrian interactions, which are critical for validating self-driving systems

- In regions with significant autonomous vehicle research, such as Europe and North America, companies such as NVIDIA and Waymo are investing in advanced simulators to accelerate development while reducing real-world testing costs

- Luxury and premium automakers, such as BMW and Audi, are incorporating driving simulators in their R&D facilities to enhance vehicle safety systems and driver-assistance technologies

- For instance, BMW’s Driving Simulation Centre in Munich uses advanced simulators to test next-generation autonomous driving features

- The rise of electric and connected vehicles is driving demand for simulators that can model energy efficiency, battery performance, and vehicle-to-everything (V2X) communication systems

Driving Simulator Market Dynamics

Driver

“Increasing Demand for Cost-Effective and Safe Training Solutions”

- Growing awareness of road safety and the need for skilled drivers is boosting the demand for driving simulators, particularly for training novice drivers and commercial vehicle operators

- Simulators provide a risk-free environment to practice hazardous scenarios, such as emergency braking or adverse weather conditions, without endangering lives or damaging vehicles

- In regions with high traffic congestion and accident rates, such as Asia Pacific, driving simulators are gaining traction for driver education and professional training

- Automakers and fleet operators, such as Volvo and DHL, are partnering with simulator providers to train drivers on fuel-efficient driving techniques, improving operational efficiency

- The rise of electric vehicles (EVs) and autonomous vehicles is driving demand for simulators to train drivers on new vehicle dynamics, such as regenerative braking and automated systems, enhancing both safety and energy efficiency

Restraint/Challenge

“High Initial Costs and Infrastructure Requirements”

- The high cost of advanced driving simulators, particularly full-scale and high-fidelity systems, poses a significant barrier to widespread adoption, especially for smaller training institutions and developing regions

- These simulators require substantial infrastructure, including high-performance computing systems, motion platforms, and immersive displays, which increase setup and maintenance costs

- In some markets, particularly in Asia Pacific and Latin America, budget constraints limit the scalability of simulator-based training programs, despite growing demand

- For instance, while Europe leads in revenue due to established OEMs and R&D facilities, smaller markets face challenges in justifying the investment for advanced simulators

- Compatibility issues between simulator software and evolving vehicle technologies, such as next-generation ADAS or V2X systems, can create technical challenges for manufacturers and end users

Driving Simulator Market Scope

The market is segmented on the basis of application, vehicle type, simulator type, training simulator type, and end user.

- By Application

On the basis of application, the market is segmented into training and research and testing. The training segment held the largest market revenue share of 62.8% in 2024, driven by its widespread adoption in driver education programs, commercial fleet training, and law enforcement training for safe driving practices. Driving simulators provide a risk-free environment to practice various scenarios, improving driver skills and road safety awareness.

The research and testing segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand from automotive OEMs and research institutions for testing advanced driver assistance systems (ADAS), autonomous vehicle technologies, and human-machine interface (HMI) designs. The integration of AI and virtual reality (VR) technologies further enhances the accuracy and scope of simulator-based testing.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into car simulator and truck and bus simulator. The car simulator segment dominated the market with a revenue share of 69.2% in 2024, driven by the high demand for passenger vehicle driver training and the development of connected and autonomous car technologies. Simulators for cars are widely used in driving schools, automotive R&D, and consumer-focused testing.

The truck and bus simulator segment is anticipated to grow at a significant rate of 16.2% from 2025 to 2032, fueled by the rising need for skilled commercial vehicle drivers and the adoption of simulators for training in logistics, public transportation, and heavy-duty vehicle operations. Enhanced focus on fuel efficiency, driver safety, and regulatory compliance further drives demand.

- By Simulator Type

On the basis of simulator type, the market is segmented into training simulator and advanced driving simulator. The training simulator segment accounted for the largest revenue share of 60.6% in 2024, owing to its cost-effectiveness and widespread use in driving schools, fleet management, and professional training programs. These simulators offer realistic scenarios for novice and experienced drivers, supporting safe and efficient learning.

The advanced driving simulator segment is expected to experience the fastest growth from 2025 to 2032, driven by its use in high-fidelity testing environments for autonomous vehicles, ADAS, and vehicle dynamics. These simulators leverage cutting-edge technologies such as VR, motion platforms, and real-time data analytics, catering to OEMs and research facilities.

- By Training Simulator Type

On the basis of training simulator type, the market is segmented into compact simulator and full-scale simulator. The compact simulator segment held the largest market share of 55.9% in 2024, attributed to its affordability, portability, and suitability for small-scale training facilities and driving schools. Compact simulators provide essential features for driver training at a lower cost.

The full-scale simulator segment is projected to grow significantly from 2025 to 2032, driven by demand for immersive and realistic training environments in professional and commercial settings. Full-scale simulators, equipped with advanced motion systems and high-definition visuals, are increasingly adopted by large fleet operators and specialized training centers.

- By End User

On the basis of end user, the market is segmented into advanced driving simulator, training driving simulator, and professional training simulator. The training driving simulator segment dominated with a revenue share of 69.4% in 2024, driven by its extensive use in driving schools, government training programs, and corporate fleet training for improving driver safety and efficiency.

The professional training simulator segment is expected to witness rapid growth from 2025 to 2032, fueled by increasing adoption in specialized training for emergency services, heavy vehicle operations, and military applications. These simulators provide tailored scenarios to enhance skills in high-stakes driving conditions.

Driving Simulator Market Regional Analysis

- Europe dominates the driving simulator market with the largest revenue share of 35.7% in 2024, fueled by a mature automotive OEM market, stringent safety regulations, and high adoption of advanced simulation technologies

- Consumers and industries in the region are increasingly adopting driving simulators for a wide range of applications, including driver education, vehicle testing, and the development of autonomous vehicle technology

- This widespread adoption is supported by a burgeoning technologically inclined population and a strong focus on enhancing road safety and reducing accidents

U.S. Driving Simulator Market Insight

The U.S. is expected to lead growth in the North America driving simulator market, driven by strong demand for driver training programs, advancements in autonomous vehicle testing, and increasing adoption in commercial fleet management. The integration of VR and AI technologies, coupled with regulatory emphasis on road safety, supports market growth. Both OEM-installed and aftermarket simulator solutions contribute to a robust market ecosystem.

Europe Driving Simulator Market Insight

Europe’s driving simulator market is experiencing significant growth, propelled by regulatory mandates for driver safety and the region’s leadership in automotive innovation. Germany and France are key markets, with high adoption in OEM testing facilities and professional training centers. The focus on autonomous vehicle development and eco-friendly driving practices further drives demand for advanced simulators.

U.K. Driving Simulator Market Insight

The U.K. market is witnessing healthy growth, driven by demand for enhanced driver training, fleet management solutions, and research into connected vehicle technologies. Increasing awareness of simulator benefits, such as cost-effective training and improved safety outcomes, encourages adoption. Regulatory focus on reducing road accidents and improving driver competency further supports market expansion.

Germany Driving Simulator Market Insight

Germany is a key contributor to Europe’s driving simulator market, driven by its advanced automotive industry and focus on innovation in ADAS and autonomous driving technologies. German OEMs and research institutions heavily invest in advanced simulators for testing and training, while consumer demand for high-quality training solutions supports market growth in driving schools and commercial sectors.

Asia-Pacific Driving Simulator Market Insight

The Asia-Pacific region holds the fastest-growing market share, projected to expand significantly from 2025 to 2032. China, India, and Japan lead due to rising vehicle production, increasing road safety awareness, and government initiatives for smart mobility. The region’s expanding middle class and focus on professional driver training further boost demand for both compact and advanced simulators.

Japan Driving Simulator Market Insight

Japan’s driving simulator market is growing robustly, driven by consumer demand for high-quality training solutions and the integration of simulators in OEM vehicle development. The country’s focus on advanced automotive technologies, including autonomous driving and ADAS, accelerates market penetration. Aftermarket simulator solutions and professional training programs also contribute to growth.

China Driving Simulator Market Insight

China dominates the Asia-Pacific driving simulator market, fueled by rapid urbanization, increasing vehicle ownership, and a growing emphasis on road safety. The country’s expanding automotive industry and government support for intelligent transportation systems drive demand for simulators in training and R&D. Competitive pricing and domestic manufacturing capabilities enhance market accessibility.

Driving Simulator Market Share

The driving simulator industry is primarily led by well-established companies, including:

- Cruden BV (Netherlands)

- Moog Inc. (U.S.)

- Bosch Rexroth AG (Germany)

- NVIDIA Corporation (U.S.)

- IPG Automotive GmbH (Germany)

- DALLARA (Italy)

- Ansible Motion Limited (U.K.)

- Waymo LLC (U.S.)

- Daimler Truck AG (Germany)

- BMW AG (Germany)

- Volkswagen AG (Germany)

- Anthony Best Dynamics Limited (U.K.)

- Toyota Kirloskar Motor (India)

- AIRBUS (Netherlands)

- MTS Systems (U.S)

Latest Developments in Global Driving Simulator Market

- In January 2024, Valeo partnered with Applied Intuition to develop digital twin technology for ADAS simulation. This collaboration focuses on creating high-fidelity virtual environments to test and validate ADAS systems, improving safety and performance in autonomous vehicles. The partnership enhances Valeo’s simulation capabilities, aligning with the industry’s push toward advanced vehicle safety technologies

- In September 2023, Volvo Group collaborated with NVIDIA to develop AI-based decision-making systems for autonomous commercial vehicles. Leveraging NVIDIA’s end-to-end AI platform, the partnership focuses on advanced training, simulation, and in-vehicle computing capabilities. This collaboration drives innovation in autonomous vehicle simulation, enabling Volvo to enhance testing efficiency and accelerate market deployment

- In August 2023, Ansible Motion introduced the Delta S3 dynamic driving simulator, incorporating advanced stratiform motion systems and scalable architectures. This product enhances testing capabilities for autonomous vehicles and advanced driver assistance systems (ADAS), offering realistic simulation of complex driving scenarios. The launch strengthens Ansible Motion’s position in the global market, catering to automotive manufacturers seeking cutting-edge simulation solutions

- In June 2023, Dynisma launched its DMG-1 Carbon and DMG-1 advanced driving simulators, designed for motorsport applications and vehicle development. These simulators feature enhanced motion generators and sophisticated software integration, enabling precise testing of vehicle dynamics and driver behavior. The launch meets the growing demand for high-fidelity simulation systems in automotive R&D, particularly for autonomous vehicle testing and performance optimization

- In December 2021, Honda R&D Co. strengthened its partnership with Ansible Motion, commissioning the Delta S3 Driver-in-the-Loop (DIL) simulator at its Sakura engineering facility. Featuring expanded motion space and enhanced dynamic range, the simulator enables precise testing for future road and race vehicles, supporting advanced powertrain, chassis, and driver-assistance technology development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Driving Simulator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Driving Simulator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Driving Simulator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.