Global Dry Milling Market

Market Size in USD Billion

CAGR :

%

USD

110.35 Billion

USD

149.86 Billion

2024

2032

USD

110.35 Billion

USD

149.86 Billion

2024

2032

| 2025 –2032 | |

| USD 110.35 Billion | |

| USD 149.86 Billion | |

|

|

|

|

Dry Milling Market Size

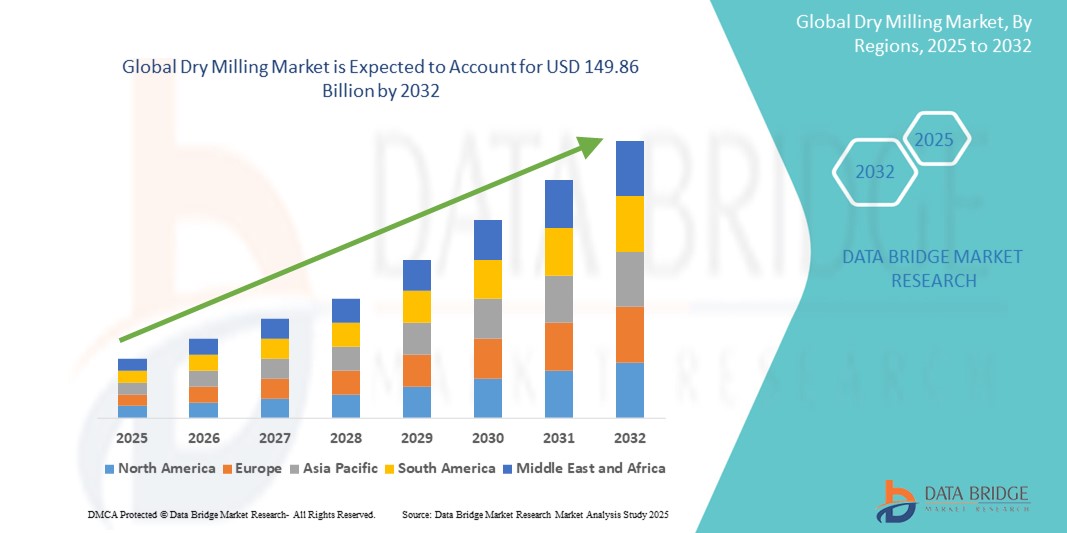

- The global dry milling market size was valued at USD 110.35 billion in 2024 and is expected to reach USD 149.86 billion by 2032, at a CAGR of 3.9% during the forecast period

- The market growth is largely fueled by the increasing global demand for biofuels, particularly ethanol, and the growing consumption of corn-based food and feed products, driven by expanding populations, industrial applications, and evolving dietary preferences

- Furthermore, advancements in milling technology, government mandates promoting ethanol blending, and the rising use of DDGS in livestock nutrition are accelerating the adoption of dry milling processes, thereby significantly boosting the industry's growth

Dry Milling Market Analysis

- Dry milling is a grain processing technique primarily used to convert corn into value-added products such as ethanol, DDGS, cornmeal, corn grits, and corn flour. It involves grinding corn kernels to separate the endosperm and facilitate efficient production of fuel, food, and feed components

- The growing demand for sustainable energy sources, coupled with the increasing use of corn-derived ingredients in packaged food and animal feed, is driving market expansion. Supportive government policies, expanding livestock sectors, and rising health awareness are further propelling the adoption of dry milling solutions across key markets

- North America dominated the dry milling market with a share of 41.6% in 2024, due to the region’s extensive corn production capacity and well-established ethanol industry

- Asia-Pacific is expected to be the fastest growing region in the dry milling market during the forecast period due to surging demand for corn-based food, fuel, and feed across high-growth economies such as China, India, and Japan

- Fuel segment dominated the market with a market share of 67.2% in 2024, due to strong demand for ethanol as a renewable fuel alternative. As governments push for reduced greenhouse gas emissions, fuel-grade ethanol remains at the forefront of decarbonization strategies in the transportation sector. The integration of ethanol into gasoline blends, coupled with advancements in flex-fuel vehicles, further supports the segment’s dominance

Report Scope and Dry Milling Market Segmentation

|

Attributes |

Dry Milling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dry Milling Market Trends

“Increasing Demand for Corn-Based Products”

- The dry milling market is undergoing robust expansion, largely fueled by surging demand for corn-based products such as cornmeal, corn grits, corn flour, and derived snacks, which are staples in diverse global diets

- For instance, reports from the U.S. Department of Agriculture highlight that per capita availability of corn flour and related products reached 35.5 pounds in the United States in 2022, indicating growth in both traditional and snack-oriented applications

- Expansion in bioethanol production is further contributing to the rise in corn dry milling, as yellow corn continues to serve as a core feedstock for both food and industrial purposes, including ethanol and dried distillers' grains (DDGS)

- The food industry is capitalizing on increased consumer preference for convenient, ready-to-eat cereals, baked goods, and snack foods made from corn, all of which utilize flour and meal sourced from the dry milling process

- Diversification into fortified and premium corn-based products, targeting health-conscious and urban populations, is also shaping market trends, with manufacturers innovating around added nutrition and cleaner labeling

- Ongoing technological advancement in milling efficiency, yield optimization, and product quality is improving profitability and supporting greater application expansion in regions such as Asia-Pacific and North America, alongside established markets in the U.S. and Europe

Dry Milling Market Dynamics

Driver

“Rising Demand for Processed Foods”

- There is a significant surge in demand for processed foods—such as ready-to-eat cereals, snacks, and bakery items—that rely heavily on milled grain inputs, particularly cornmeal and flour from dry milling

- For instance, the Asia-Pacific region has shown rapid growth in urbanization and changing dietary habits, fueling market potential for processed food that depends on consistent dry milling supply chains

- Foodservice and convenience food industries are expanding their product portfolios, using dry-milled grains as a base for innovative new offerings, contributing to steady demand growth

- The versatility of dry milling extends its applications beyond food, reaching into pharmaceuticals, animal feed, and even the beverage sector, further diversifying market opportunity and enhancing resilience during demand fluctuations

- Rising consumer awareness about the nutritional value and functional properties of processed grain products is prompting companies to invest in marketing and development, leveraging dry-milled corn and other grains as healthy and appealing ingredients

Restraint/Challenge

“High Energy Consumption”

- The dry milling process is energy-intensive, especially compared to some alternative grain processing methods, resulting in relatively high operational costs for manufacturers

- For instance, the need for continuous grinding, fractionation, and operation of large-scale equipment drives substantial electricity and fuel usage in mills producing high volumes of processed cornmeal and flour

- Fluctuations in global energy prices, as well as local grid reliability issues, further impact production economics, challenging the profitability of small and medium-sized milling operations

- Environmental regulations and pressure to minimize carbon emissions are pushing manufacturers to invest in energy-efficient technologies and sustainable practices, which may entail high upfront costs and ongoing capital expenditures

- Achieving cost-effective scaling without sacrificing energy savings or product consistency remains an ongoing technical and financial barrier for operators seeking to meet rising market demand

Dry Milling Market Scope

The market is segmented on the basis of end product, source, and application.

- By End Product

On the basis of end product, the dry milling market is segmented into ethanol, dried distillers grain with solubles (DDGS), corn grits, cornmeal, corn flour, and others. The ethanol segment dominated the largest market revenue share in 2024, driven by the rising demand for biofuels as a cleaner alternative to fossil fuels. Government mandates and blending regulations across major economies, particularly in the U.S. and Brazil, have accelerated ethanol production from corn, making it the primary output of the dry milling process. Ethanol's extensive use as a fuel additive, along with technological advancements in fermentation and distillation, continues to strengthen its position in the market.

The DDGS segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of high-protein animal feed ingredients. As a co-product of ethanol production, DDGS has gained prominence due to its rich nutritional profile and cost-effectiveness, particularly in livestock and poultry diets. The growing global demand for protein-rich feed in developing economies and sustainable practices in feed formulation further drive the uptake of DDGS in animal nutrition.

- By Source

On the basis of source, the dry milling market is segmented into yellow corn and white corn. The yellow corn segment accounted for the largest market revenue share in 2024, attributed to its widespread cultivation, high starch content, and suitability for ethanol production and animal feed. Yellow corn is extensively used in North America and Asia-Pacific due to its versatility and higher yield per acre, making it a staple input for dry milling operations. Its dominance is further supported by well-established supply chains and favorable pricing dynamics.

The white corn segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand from the food processing industry, especially in snack foods and tortillas. White corn is preferred for its softer texture and neutral flavor, making it ideal for high-quality food-grade applications. The segment’s growth is particularly evident in Latin America and parts of Africa where white corn is a dietary staple and where demand for processed food items continues to rise.

- By Application

On the basis of application, the dry milling market is segmented into fuel, feed, and food. The fuel segment led the market with the largest revenue share of 67.2% in 2024, underpinned by strong demand for ethanol as a renewable fuel alternative. As governments push for reduced greenhouse gas emissions, fuel-grade ethanol remains at the forefront of decarbonization strategies in the transportation sector. The integration of ethanol into gasoline blends, coupled with advancements in flex-fuel vehicles, further supports the segment’s dominance.

The food segment is projected to register the fastest growth rate from 2025 to 2032, propelled by rising consumer demand for corn-based food products, such as cornmeal, corn flour, and grits. Changing dietary preferences, growth in gluten-free and plant-based food trends, and increasing global consumption of snacks and processed foods are major factors driving demand in this segment. Enhanced milling technologies that preserve the nutritional value of corn further contribute to the growing adoption of dry-milled corn in human food applications.

Dry Milling Market Regional Analysis

- North America dominated the dry milling market with the largest revenue share of 41.6% in 2024, driven by the region’s extensive corn production capacity and well-established ethanol industry

- The U.S. and Canada have robust agricultural infrastructure and favorable government policies supporting biofuel blending mandates, which fuel consistent demand for dry-milled corn products

- Technological advancements in milling processes, strong export potential for DDGS, and increasing demand for plant-based food ingredients further strengthen the region’s market position

U.S. Dry Milling Market Insight

The U.S. accounted for the largest revenue share in 2024 within North America, owing to its dominance in global corn output and ethanol production. Federal policies such as the Renewable Fuel Standard (RFS) continue to drive ethanol demand, reinforcing the U.S.’s leadership in dry milling operations. The country also exports substantial volumes of DDGS for animal feed, driven by high protein content and cost-effectiveness. In addition, evolving consumer preferences toward gluten-free and plant-based food products are increasing the domestic use of dry-milled corn ingredients in food applications.

Europe Dry Milling Market Insight

The dry milling market in Europe is poised to grow steadily, supported by the region’s focus on sustainable agriculture, clean energy initiatives, and circular economy principles. Rising demand for ethanol as a biofuel alternative, combined with efforts to reduce dependency on fossil fuels, is boosting the use of corn for fuel production. DDGS is gaining ground as a nutrient-rich livestock feed component, particularly in countries with large dairy and poultry industries. The integration of corn-based ingredients into packaged and health-conscious food offerings is also contributing to market expansion, particularly in Western Europe.

U.K. Dry Milling Market Insight

The U.K. dry milling market is expected to witness consistent growth, primarily driven by the increasing adoption of alternative protein sources and gluten-free food options. Corn flour and cornmeal are gaining popularity as staple ingredients in the baking and processed food sectors. Moreover, the government’s sustainability objectives are encouraging the exploration of ethanol as a low-carbon fuel, leading to interest in domestic dry milling capabilities. The combination of rising health awareness and policy-led energy transition is positioning the U.K. as a promising market within Europe.

Germany Dry Milling Market Insight

Germany is projected to emerge as one of the key contributors to Europe’s dry milling market, owing to its robust agricultural processing sector and emphasis on sustainable energy. The country’s strong demand for premium livestock feed supports the use of DDGS, while bioenergy regulations continue to incentivize ethanol production from corn. In addition, increasing demand for plant-based food alternatives is encouraging the food processing industry to diversify into corn-based products. Germany’s innovation-driven approach and commitment to eco-friendly manufacturing are likely to sustain long-term growth in the dry milling space.

Asia-Pacific Dry Milling Market Insight

Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, driven by surging demand for corn-based food, fuel, and feed across high-growth economies such as China, India, and Japan. Rapid urbanization, growing populations, and rising disposable incomes are fueling the consumption of convenience foods and packaged snacks that often incorporate corn flour and corn grits. Simultaneously, expanding livestock sectors are generating strong demand for cost-effective, high-protein feed such as DDGS. Government-led initiatives to promote biofuel adoption and domestic corn processing further enhance the market’s growth prospects across the region.

Japan Dry Milling Market Insight

Japan’s dry milling market is steadily growing, supported by strong demand for functional food ingredients and a preference for safe, high-quality feed products. Corn-based flours and grits are increasingly used in ready-to-eat meals, aligning with the country’s busy lifestyle and shifting dietary habits. Japan’s clean energy focus is also driving interest in corn-derived ethanol as part of its decarbonization efforts. In addition, the country’s advanced food processing technologies and commitment to product innovation are helping integrate dry-milled corn into both traditional and modern food applications.

China Dry Milling Market Insight

China captured the largest revenue share in the Asia-Pacific dry milling market in 2024, underpinned by its massive corn cultivation, expanding ethanol capacity, and growing animal husbandry sector. The government’s push to replace coal-based fuels with cleaner biofuels is driving ethanol demand, leading to large-scale investments in dry milling facilities. At the same time, the rise of packaged and processed foods, coupled with an increasing focus on protein-rich livestock feed, is propelling the use of corn-based ingredients and DDGS. China’s large consumer base and strong domestic manufacturing ecosystem position it as a dominant force in the regional market.

Dry Milling Market Share

The dry milling industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Bunge Limited (U.S.)

- SunOpta (Canada)

- Didion, Inc. (U.S.)

- Semo Milling, LLC (U.S.)

- LifeLine Foods (U.S.)

- Alto Ingredients, Inc. (U.S.)

- Green Plains Inc. (U.S.)

- Flint Hills Resources -(U.S.)

- C.H. Guenther & Son (U.S.)

- Valero -(U.S.)

Latest Developments in Global Dry Milling Market

- In April 2024, digital dentistry company UP3D launched the P55D high-end dry milling machine, marking a significant advancement in the dental dry milling segment. By integrating precision servo control and all-weather stable production technology, the P55D enables 24-hour continuous milling, enhancing productivity and efficiency for dental professionals. This innovation is expected to strengthen the adoption of advanced dry milling solutions in dental labs, driving growth in the high-precision segment of the market

- In March 2023, Planmeca introduced the PlanMill 35 chairside milling unit, equipped with both dry and wet milling capabilities. Designed for in-house fabrication of dental restorations, particularly using zirconium dioxide, this unit offers versatility and precision. Its ability to handle a wide range of materials positions it as a comprehensive solution for dental practices, contributing to increased adoption of integrated milling technologies and boosting market penetration in clinical dental settings

- In March 2023, Columbia Grain International (CGI) established Enrich Foods, LLC by acquiring Great River Milling in Fountain City, Wisconsin. This acquisition included the milling operations and a new state-of-the-art packaging and distribution facility, expanding CGI's capabilities in the food industry and enhancing their operational efficiency in packaging and logistics

- In October 2020, Archer Daniels Midland decided to keep its two dry ethanol mills in the US idle temporarily. These mills, with a combined annual production capacity of 575 million gallons, were expected to remain inactive through the end of 2020, with potential plans to resume operations in the first half of 2021

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.