Global Dual Chamber Syringe Dcs Filling Machine Market

Market Size in USD Million

CAGR :

%

USD

392.59 Million

USD

727.73 Million

2025

2033

USD

392.59 Million

USD

727.73 Million

2025

2033

| 2026 –2033 | |

| USD 392.59 Million | |

| USD 727.73 Million | |

|

|

|

|

Dual Chamber Syringe (DCS) Filling Machine Market Size

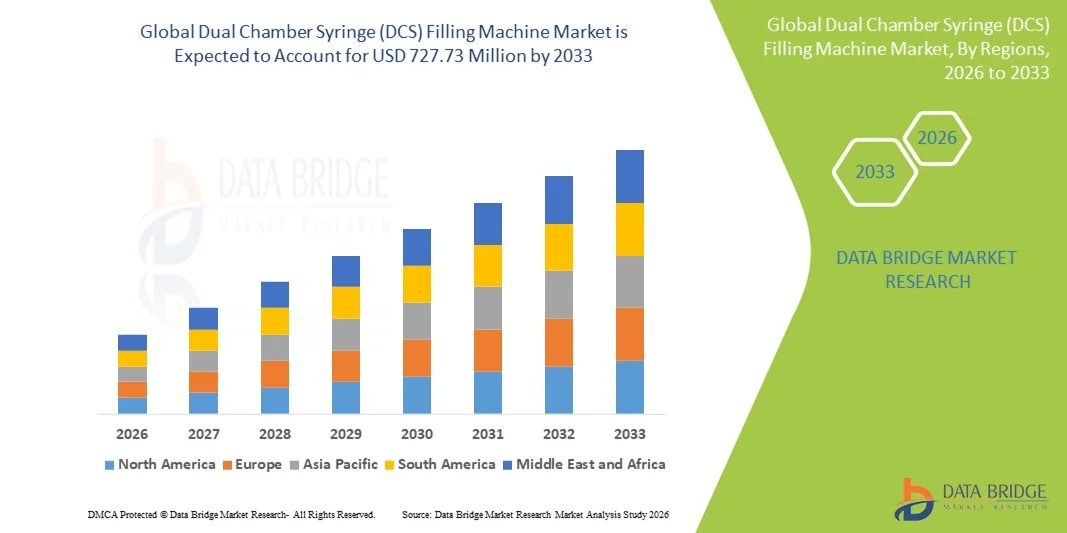

- The global Dual Chamber Syringe (DCS) filling machine market size was valued at USD 392.59 million in 2025 and is expected to reach USD 727.73 million by 2033, at a CAGR of 8.02% during the forecast period

- The market growth is largely fueled by the growing demand for prefilled and lyophilized injectable drug formats, technological advancements in precision filling systems, and expanding production of biologics and combination therapies, which collectively boost the uptake of DCS filling machines in both large pharmaceutical firms and contract manufacturers

- Furthermore, rising healthcare expenditure, stringent regulatory requirements for contamination‑free manufacturing, and the increasing role of contract development and manufacturing organizations (CDMOs) seeking flexible, high‑throughput fill‑finish solutions are driving dual chamber syringe filling systems as essential components in modern sterile production environments and accelerating industry growth

Dual Chamber Syringe (DCS) Filling Machine Market Analysis

- Dual Chamber Syringe (DCS) filling machines, designed for aseptic and precise filling of combination injectable drugs, are increasingly critical in modern pharmaceutical and biotech manufacturing environments due to their ability to maintain sterility, improve dosing accuracy, and support prefilled and lyophilized drug formats

- The escalating demand for Dual Chamber Syringe (DCS) filling machines is primarily fueled by the growing production of biologics, vaccines, and combination therapies, rising adoption of prefilled injectable drug delivery systems, and stringent regulatory requirements for contamination-free and reliable drug filling processes

- North America dominated the Dual Chamber Syringe (DCS) filling machine market with the largest revenue share of 52.9% in 2025, supported by the presence of major pharmaceutical manufacturers, advanced biopharmaceutical production infrastructure, and early adoption of automated aseptic filling technologies, particularly in the U.S., where contract manufacturing organizations (CMOs) and biotech firms are increasingly investing in high-throughput DCS filling systems

- Asia-Pacific is expected to be the fastest-growing region in the Dual Chamber Syringe (DCS) filling machine market during the forecast period due to expanding pharmaceutical manufacturing capacity, increasing biologics production, and growing investments in contract development and manufacturing organizations (CDMOs) across countries such as China and India

- Automatic segment dominated the market with a market share of 62.9% in 2025, driven by their high efficiency, precision, and suitability for large-scale pharmaceutical and biotech manufacturing operations, which are increasingly adopting automated solutions to meet rising demand and regulatory standards

Report Scope and Dual Chamber Syringe (DCS) Filling Machine Market Segmentation

|

Attributes |

Dual Chamber Syringe (DCS) Filling Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dual Chamber Syringe (DCS) Filling Machine Market Trends

Advancement in Automation and AI-Enabled Precision Filling

- A significant and accelerating trend in the global Dual Chamber Syringe (DCS) filling machine market is the increasing adoption of fully automated systems integrated with AI-based monitoring, enabling precise and consistent aseptic filling for sensitive injectable drugs

- For instance, the Bosch DCS Filling Line incorporates AI-driven monitoring to adjust filling volumes in real-time, reducing product wastage and maintaining compliance with strict sterility standards. Similarly, the Optima Pharma DCS line integrates automated vision systems for in-line quality inspection

- AI integration in DCS filling machines enables predictive maintenance, detection of filling anomalies, and optimization of throughput, improving operational efficiency. For instance, some Tetra Pak models use AI to detect minute deviations in syringe fill levels and provide intelligent alerts to operators. Furthermore, automation reduces manual handling, lowering contamination risks and improving overall product safety

- The seamless integration of DCS filling machines with other automated packaging and labeling systems facilitates a fully connected production workflow. Through a single interface, manufacturers can manage filling, sealing, inspection, and labeling operations, enhancing process efficiency and compliance

- This trend towards more intelligent, automated, and interconnected filling systems is fundamentally transforming expectations in injectable drug manufacturing. Consequently, companies such as Sejong Pharmatech are developing AI-enabled DCS filling solutions with features such as automatic volume adjustment and real-time defect detection

- The demand for Dual Chamber Syringe (DCS) filling machines that offer automated, AI-enabled precision filling is growing rapidly across both large-scale pharmaceutical and biotech manufacturing facilities, as companies increasingly prioritize efficiency, sterility, and regulatory compliance

- Moreover, adoption of modular DCS filling systems that can be scaled or reconfigured quickly is gaining traction, enabling manufacturers to meet fluctuating production demands without significant infrastructure overhaul

Dual Chamber Syringe (DCS) Filling Machine Market Dynamics

Driver

Increasing Demand from Biologics and Combination Therapy Production

- The growing global production of biologics, vaccines, and combination injectable therapies is a major driver for the heightened demand for Dual Chamber Syringe (DCS) filling machine

- For instance, in March 2025, Bosch Packaging Technology launched an advanced aseptic DCS filling line tailored for combination vaccines, aiming to meet rising global demand while maintaining sterility and dosage accuracy

- As manufacturers expand production of high-value biologics and prefilled dual chamber syringes, DCS filling machines offer precise dosing, reduced contamination risks, and consistent quality, making them essential for modern pharmaceutical operations

- Furthermore, the rising adoption of prefilled injectable formats in hospitals and outpatient care settings is driving the need for automated DCS filling solutions capable of high-throughput and consistent performance

- The ability to integrate with upstream formulation processes and downstream packaging systems, combined with reduced manual intervention, further enhances the adoption of Dual Chamber Syringe (DCS) filling machines across pharmaceutical and biotech facilities

- For instance, partnerships between DCS filling machine manufacturers and biotech companies are increasing to deliver custom solutions for complex injectable therapies, driving market growth

- Growing investments in emerging markets for vaccine and biologics production are creating new opportunities for DCS filling machine manufacturers to expand their regional footprint

Restraint/Challenge

High Initial Costs and Stringent Regulatory Compliance

- The relatively high capital investment required for advanced Dual Chamber Syringe (DCS) filling machines poses a significant challenge for small-scale manufacturers and emerging market facilities

- For instance, reports of budget constraints in small biotech labs indicate delayed adoption of fully automated DCS filling solutions despite their operational advantages

- Meeting stringent regulatory requirements, including aseptic processing standards, sterilization validation, and process documentation, adds complexity and cost, limiting broader market penetration in price-sensitive regions

- Furthermore, ongoing maintenance, calibration, and operator training requirements increase the total cost of ownership, discouraging smaller players from investing in automated DCS filling lines

- Overcoming these challenges through modular, scalable solutions, leasing or contract manufacturing models, and enhanced operator training programs will be crucial for wider adoption and sustained growth of the Dual Chamber Syringe (DCS) filling machine market

- For instance, differences in regional regulatory standards can slow down international expansion for manufacturers of DCS filling machines, requiring additional certifications and validations

- In addition, supply chain constraints for specialized components, such as precision pumps and sterile connectors, can delay production and increase costs, creating a barrier to rapid market adoption

Dual Chamber Syringe (DCS) Filling Machine Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Dual Chamber Syringe (DCS) filling machine market is segmented into automatic, semi-automatic, and manual. The automatic segment dominated the market with the largest market revenue share of 62.9% in 2025, driven by its high efficiency, precision, and ability to handle large-scale production of dual chamber syringes with minimal human intervention. Automatic DCS filling machines provide consistent fill volumes, reduced contamination risk, and integration with downstream packaging and inspection systems. They are widely preferred by large pharmaceutical and biotech manufacturers who require high-throughput and sterile aseptic filling operations. The machines’ ability to support prefilled combination therapies and lyophilized products makes them essential in modern injectable drug production. Furthermore, automatic systems often feature AI-enabled monitoring and predictive maintenance, improving operational reliability. The segment’s dominance is reinforced by increasing investments in biologics and vaccine manufacturing facilities, where efficiency and compliance are critical.

The semi-automatic segment is expected to witness the fastest growth rate of 8.9% CAGR from 2026 to 2033, fueled by its cost-effectiveness and flexibility for small to mid-sized pharmaceutical firms. Semi-automatic DCS filling machines offer many benefits of automation while requiring lower capital investment compared to fully automatic systems. They are particularly suitable for hospitals, specialized contract development and manufacturing organizations (CDMOs), and R&D labs where moderate production volumes are sufficient. Semi-automatic systems allow manual oversight and control over critical processes, providing a balance between precision and operational flexibility. Manufacturers increasingly adopt semi-automatic machines for pilot production, clinical trial batches, and small-scale biologics production. In addition, these systems are easier to maintain and adapt for multiple drug formulations, further driving their adoption in emerging markets and specialized applications.

- By Application

On the basis of application, the Dual Chamber Syringe (DCS) filling machine market is segmented into industrial pharmacy, hospital pharmacy, and others. The industrial pharmacy segment dominated the market with the largest share in 2025 due to the high demand for mass production of dual chamber syringes in pharmaceutical and biotech manufacturing facilities. These machines enable precise dosing, maintain aseptic conditions, and support large-scale production of biologics, vaccines, and combination therapies. Industrial pharmacy applications benefit from fully automated DCS filling lines that integrate with downstream packaging, labeling, and quality inspection systems. Companies increasingly prioritize efficiency, sterility, and regulatory compliance, which automatic DCS filling machines provide. The segment also sees growth from prefilled syringe production for hospitals and outpatient care, where high-volume and consistent quality are critical. Industrial pharmacy remains the dominant application due to its central role in supplying global healthcare markets with injectable therapies.

The hospital pharmacy segment is expected to witness the fastest growth during the forecast period due to the increasing use of prefilled dual chamber syringes for safe, ready-to-use injectable medications in clinical and emergency settings. Hospitals and specialty clinics adopt DCS filling machines for small-batch production and on-demand customization of drug dosages, reducing medication errors and improving patient safety. Semi-automatic and compact filling systems are particularly preferred in this segment for their operational flexibility and lower space requirements. The segment growth is also supported by rising awareness of aseptic handling protocols and regulatory encouragement for prefilled combination therapies. Hospital pharmacies increasingly invest in automated solutions to meet growing patient demand and minimize manual handling risks.

- By End User

On the basis of end user, the Dual Chamber Syringe (DCS) filling machine market is segmented into pharmaceutical & biotech manufacturers, contract development & manufacturing organizations (CDMOS), and small biotech & R&D labs. Pharmaceutical & Biotech Manufacturers segment dominated the market with the largest revenue share in 2025, driven by large-scale production requirements for biologics, vaccines, and combination injectable drugs. These manufacturers rely on fully automated DCS filling machines to ensure high throughput, sterility, and regulatory compliance. Integration with downstream packaging, labeling, and inspection systems further enhances operational efficiency. Pharmaceutical and biotech manufacturers also invest in AI-enabled monitoring systems to minimize errors and predict equipment maintenance needs. The dominance is reinforced by the increasing global demand for prefilled dual chamber syringes and the need to support high-volume supply chains. In addition, these end users have the capital and technical expertise to implement advanced DCS filling lines efficiently.

CDMOs are expected to witness the fastest growth rate from 2026 to 2033 due to rising outsourcing of injectable drug production and combination therapy filling services. CDMOs increasingly invest in semi-automatic and flexible DCS filling machines that can handle multiple product formats and batch sizes efficiently. This end-user segment benefits from automation without excessive upfront capital investment, allowing rapid adaptation to client requirements. Growth is driven by pharmaceutical companies seeking cost-effective outsourcing solutions, faster time-to-market, and compliance with stringent sterility standards. CDMOs also leverage DCS filling machines for clinical trial batches, pilot production, and specialized therapies, further boosting market adoption.

Dual Chamber Syringe (DCS) Filling Machine Market Regional Analysis

- North America dominated the Dual Chamber Syringe (DCS) filling machine market with the largest revenue share of 52.9% in 2025, supported by the presence of major pharmaceutical manufacturers, advanced biopharmaceutical production infrastructure, and early adoption of automated aseptic filling technologies

- Manufacturers in the region prioritize advanced automation, aseptic processing, and AI-enabled monitoring in DCS filling machines to ensure high throughput, consistent dosage, and regulatory compliance for biologics, vaccines, and combination injectable therapies

- This widespread adoption is further supported by substantial R&D investments, early technology adoption, and the growing outsourcing of complex injectable drug production to contract development and manufacturing organizations (CDMOs), establishing Dual Chamber Syringe (DCS) filling machines as a preferred solution for large-scale pharmaceutical operations

U.S. Dual Chamber Syringe (DCS) Filling Machine Market Insight

The U.S. Dual Chamber Syringe (DCS) filling machine market captured the largest revenue share of 82% in 2025 within North America, driven by the presence of leading pharmaceutical and biotech manufacturers and high adoption of automated aseptic filling technologies. Manufacturers increasingly prioritize precision, sterility, and regulatory compliance for biologics, vaccines, and combination therapies. The growing trend of outsourcing to contract development and manufacturing organizations (CDMOs) further propels demand. Moreover, the integration of AI-enabled monitoring, real-time defect detection, and automated packaging solutions significantly contributes to the market’s expansion.

Europe Dual Chamber Syringe (DCS) Filling Machine Market Insight

The Europe Dual Chamber Syringe (DCS) filling machine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards for aseptic processing and the increasing demand for prefilled dual chamber syringes in hospitals and industrial pharmacy. Rising urbanization, investment in biologics manufacturing, and growing focus on quality and safety are fostering market adoption. European pharmaceutical manufacturers are incorporating automated DCS filling lines in both new facilities and retrofitted production setups.

U.K. Dual Chamber Syringe (DCS) Filling Machine Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the trend of adopting automated aseptic filling solutions and the rising demand for combination injectable therapies. Concerns over contamination control and dosage precision are encouraging pharmaceutical companies and CDMOs to invest in advanced DCS filling machines. The U.K.’s strong biotech sector, supportive regulatory framework, and adoption of modern production technologies are expected to continue stimulating market growth.

Germany Dual Chamber Syringe (DCS) Filling Machine Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by high awareness of sterile manufacturing, precision dosing, and quality assurance. Germany’s well-established pharmaceutical and biotech infrastructure, along with a focus on innovation, supports the adoption of automated and semi-automatic DCS filling systems. The integration of these machines with other production and quality control systems is becoming increasingly prevalent, meeting local standards for safety, efficacy, and regulatory compliance.

Asia-Pacific Dual Chamber Syringe (DCS) Filling Machine Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 25% during 2026–2033, fueled by rapid expansion of pharmaceutical and biotech manufacturing in countries such as China, India, and Japan. Increasing government initiatives to support biologics and vaccine production, growing adoption of prefilled dual chamber syringes, and rising investments in CDMOs are driving market growth. In addition, the region’s emergence as a hub for affordable manufacturing of DCS filling machines is expanding accessibility for both large and small-scale manufacturers.

Japan Dual Chamber Syringe (DCS) Filling Machine Market Insight

The Japanese market is gaining momentum due to high technological adoption, advanced pharmaceutical manufacturing practices, and rising demand for combination injectable therapies. Manufacturers prioritize automated and AI-enabled DCS filling machines to ensure precise dosing, sterility, and operational efficiency. Integration with downstream packaging and inspection systems is increasing, while hospitals and biotech firms seek flexible solutions for clinical and commercial production.

India Dual Chamber Syringe (DCS) Filling Machine Market Insight

The Indian market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid growth in domestic pharmaceutical manufacturing, adoption of prefilled injectable formats, and increasing investments in vaccine and biologics production. India’s expanding middle-class population, urbanization, and push towards smart manufacturing practices are boosting demand. Availability of cost-effective DCS filling solutions and a growing network of domestic suppliers further propels market expansion across hospitals, CDMOs, and pharmaceutical firms.

Dual Chamber Syringe (DCS) Filling Machine Market Share

The Dual Chamber Syringe (DCS) Filling Machine industry is primarily led by well-established companies, including:

- Syntegon Technology GmbH (Germany)

- Prosys Servo Filling Systems (U.S.)

- Dara Pharmaceutical Packaging (Spain)

- TurboFil Packaging Machines LLC (U.S.)

- Optima Machinery Corporation (Germany)

- Dymax Corporation (U.S.)

- Ashby Cross (U.S.)

- Wenzhou Zhonguan Packaging Machinery (China)

- Mutual Corporation (Japan)

- Shanghai Packaging Machinery (China)

- Inno4Life (Netherlands)

- Groninger Group (Germany)

- DEC Group (Switzerland)

- Comecer (Italy)

- IMA Group (Italy)

- Marya Pharmaceutical (China)

- Vetter Pharma Fertigung GmbH & Co. KG (Germany)

- Romaco Group (Germany)

- Marchesini Group S.p.A. (Italy)

What are the Recent Developments in Global Dual Chamber Syringe (DCS) Filling Machine Market?

- In September 2025, Pyramid Pharma Services celebrated the grand opening of its new Groninger sterile fill‑finish line in California, reinforcing expanded sterile manufacturing capacity and demonstrating continued investment in automated fill‑finish infrastructure that supports complex injectable production, including dual chamber syringes at commercial scale

- In April 2025, Syntegon launched its new MLD Advanced filling machine for ready‑to‑use (RTU) syringes, designed to meet increasing industry demands for high throughput with 100 % in‑process control (IPC) and robotic transfer, enabling flexible, automated transfer of syringes without glass‑to‑glass contact and improving sterile filling efficiency

- In March 2025, Syntegon showcased its new MLD Advanced platform at INTERPHEX 2025, highlighting innovative functions such as robotic handling, 100 % IPC, and a patented clip transport system designed to support aseptic filling of high‑output nested syringes, signaling strong industry interest in automation for fill‑finish operations

- In June 2024, Groninger and SKAN unveiled a strategic partnership to equip nonprofit pharmaceutical Civica’s new facility with advanced filling lines including a nest filling line capable of handling ready‑to‑use formats representing a technological leap in flexible aseptic processing and injectable drug production

- In April 2024, Comecer unveiled an innovative robotic aseptic filling line for dual‑chamber syringes (DCS) and pharmaceutical vials, featuring multiple integrated chambers for washing, depyrogenation, sterile filling, sterilization, and final packaging, setting new standards in aseptic pharmaceutical manufacturing technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.