Global E Bike Market

Market Size in USD Billion

CAGR :

%

USD

53.78 Billion

USD

75.68 Billion

2024

2032

USD

53.78 Billion

USD

75.68 Billion

2024

2032

| 2025 –2032 | |

| USD 53.78 Billion | |

| USD 75.68 Billion | |

|

|

|

|

Electric Bike Market Size

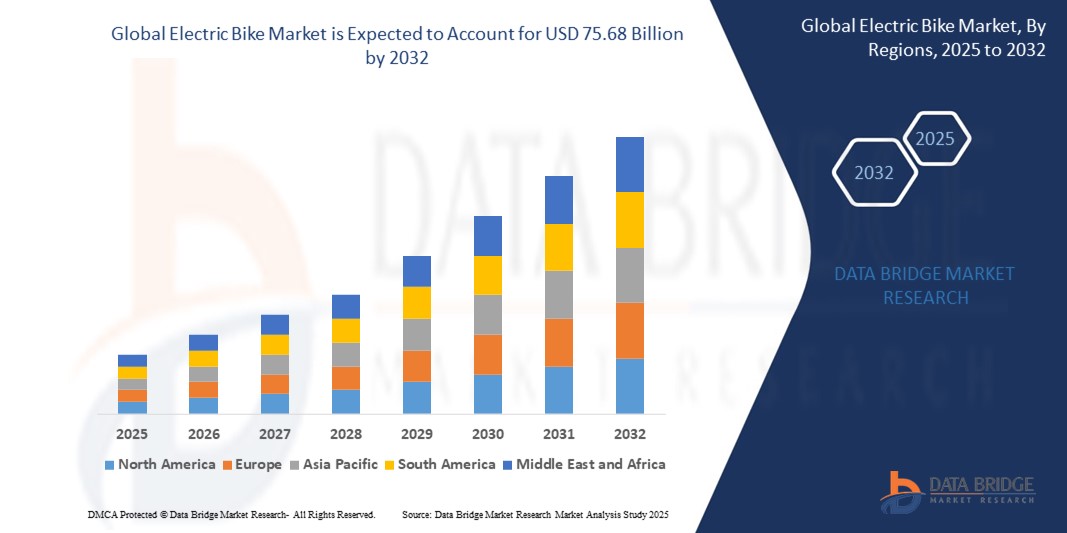

- The global electric bike market size was valued at USD 53.78 billion in 2024 and is expected to reach USD 75.68 billion by 2032, at a CAGR of 4.36% during the forecast period

- The market growth is largely fueled by the increasing demand for sustainable transportation solutions, rising fuel prices, and government initiatives promoting e-mobility and reducing carbon emissions

- Furthermore, advancements in battery technology, extended riding ranges, and improved charging infrastructure are making electric bikes a practical alternative to conventional vehicles for urban commuting. These converging factors are driving the widespread adoption of electric bikes across both developed and emerging economies, thereby significantly boosting the industry's growth

Electric Bike Market Analysis

- Electric bikes (e-bikes), which combine battery-powered propulsion with traditional pedaling, are becoming essential for modern mobility solutions due to their eco-friendliness, cost efficiency, and ability to ease urban congestion

- The accelerating demand for electric bikes is primarily fueled by rising environmental concerns, growing traffic in urban areas, increasing fuel costs, and greater consumer inclination toward sustainable and health-conscious transportation alternatives

- North America dominates the electric bike market, accounting for a market share of 38.4% in 2025, driven by increasing demand for micro-mobility solutions, favorable tax incentives, and robust investments in cycling infrastructure. The U.S. leads the region with a growing preference for e-bikes in both recreational and commuting segments

- Asia-Pacific is expected to be the fastest growing region, with a projected CAGR of 6.2% during the forecast period, supported by rapid urbanization, expanding middle-class demographics, and strong government support for electric mobility, particularly in China, India, and Southeast Asia

- The pedal-assisted segment is projected to dominate the electric bike market with a market share of 61.5% in 2025, favored for its energy efficiency, extended range, and appeal to both fitness-conscious consumers and daily commuters

Report Scope and Electric Bike Market Segmentation

|

Attributes |

Electric Bike Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electric Bike Market Trends

“Enhanced Performance and Personalization Through AI and Smart Connectivity”

- A key and rapidly emerging trend in the global electric bike market is the integration of artificial intelligence (AI) and smart connectivity features, significantly enhancing rider experience, safety, and bike performance. These technologies are transforming e-bikes into intelligent mobility solutions

- For instance, several leading e-bike models now offer real-time ride data analysis, predictive maintenance alerts, and battery optimization powered by AI algorithms. Riders can receive customized performance suggestions based on their riding patterns and terrain

- AI-enabled systems also enhance navigation and theft prevention through GPS-based tracking and geofencing. Some models, such as those from VanMoof and Cowboy, feature anti-theft systems that automatically lock the bike and alert the owner via smartphone if unauthorized movement is detected

- Smartphone apps now serve as central hubs, allowing riders to remotely adjust motor support levels, monitor battery health, and track location in real time. Integration with voice assistants such as Google Assistant and Alexa is emerging, enabling hands-free control for navigation and ride stats

- Electric bikes are also being incorporated into smart city ecosystems, where real-time data from connected e-bikes supports urban planning and eco-transport initiatives. This connectivity is paving the way for more sustainable, intelligent, and rider-friendly mobility networks

- This trend of integrating AI and smart features into e-bikes is reshaping consumer expectations. Manufacturers such as Bosch, Shimano, and Giant are continuously innovating to offer personalized, data-driven, and connected riding experiences, making e-bikes not only efficient but also smarter and more intuitive

Electric Bike Market Dynamics

Driver

“Rising Demand for Eco-Friendly Mobility and Urban Transportation Solutions”

- The growing global focus on sustainability, combined with rising fuel prices and urban traffic congestion, is a major driver behind the increasing demand for electric bikes. Governments and municipalities are actively promoting e-bikes as a green mobility solution through subsidies, incentives, and infrastructure development

- For instance, in February 2024, the U.S. Department of Transportation announced funding support for local e-bike incentive programs to reduce carbon emissions and promote urban micromobility. Similar programs are active in Europe and Asia

- As environmental concerns become more pressing, consumers are increasingly turning to electric bikes as a practical alternative to cars for short- and medium-distance travel. E-bikes provide the benefits of traditional cycling with less physical effort, making them suitable for a wider demographic, including older adults and daily commuters

- Furthermore, the rise in health consciousness, combined with the convenience of pedal-assist technology, is expanding the appeal of electric bikes. Riders enjoy fitness benefits without overexertion, especially in hilly or long-distance commutes

- The rapid growth of e-commerce, food delivery, and courier services is also driving demand for electric bikes in the commercial segment, where businesses seek low-maintenance, cost-effective last-mile delivery options

Restraint/Challenge

“High Initial Costs and Battery Limitations”

- The relatively high upfront cost of electric bikes, driven by expensive lithium-ion batteries and motor components, remains a significant barrier to adoption, especially in price-sensitive markets. While long-term savings on fuel and maintenance are notable, initial affordability continues to impact buyer decisions

- For instance, premium electric bikes with advanced features and extended range can cost upwards of USD 2,000–3,000, making them less accessible to lower-income consumers or first-time buyers

- In addition to cost, concerns over battery performance and longevity are another challenge. Battery degradation, long charging times, and limited range can affect user confidence, particularly among commuters who rely on consistent performance

- Recycling and environmental disposal of used batteries also pose challenges, especially as e-bike adoption scales up globally. Manufacturers are under pressure to improve battery sustainability and offer better warranty and support programs

- Overcoming these challenges will require continued innovation in battery efficiency, mass production to lower costs, and consumer education on the total cost-of-ownership benefits of electric bikes compared to traditional vehicles

Electric Bike Market Scope

The market is segmented on the basis of battery type, hub motor location, mode, battery power, class, and usage.

By Battery Type

On the basis of battery type, the electric bike market is segmented into lithium-ion, lithium-ion polymer, nickel metal hydride, lead acid, sealed lead acid, and others. The lithium-ion segment dominates the largest market revenue share in 2025, driven by its high energy density, longer lifecycle, and lightweight design. These batteries are preferred for their performance efficiency and lower environmental impact, making them ideal for both urban commuters and off-road enthusiasts

The lithium-ion polymer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its flexible form factor, improved safety features, and adoption in compact and foldable e-bike models. Manufacturers are increasingly adopting this technology to meet evolving consumer preferences for sleek and portable electric bike designs

• By Hub Motor Location

On the basis of hub motor location, the electric bike market is segmented into mid drive hub motor, rear hub motor, front hub motor, and others. The mid drive hub motor segment held the largest market revenue share in 2025, owing to its superior weight distribution, torque efficiency, and performance on hilly terrains. mid-drive motors are favored for mountain, trekking, and cargo e-bikes where power and balance are critical

The rear hub motor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its quiet operation, lower cost, and ease of integration into traditional bike frames. rear hub motors are popular among entry-level and city commuting electric bikes

• By Mode

On the basis of mode, the electric bike market is segmented into pedal assist, throttle, and others. the pedal assist mode dominated the market with the highest revenue share in 2025, as it offers a natural biking experience with the added benefit of power support, helping riders conserve energy on longer commutes

The Throttle segment held a significant share in 2025 and is projected to grow steadily, favored for its ease of use and suitability for users seeking a no-pedal, scooter-like experience. It is especially popular in North America and parts of Asia where flexible commuting solutions are in demand

• By Battery Power

On the basis of battery power, the market is segmented into Under 750W, Over 750W, and Others. The Under 750W segment led the market in 2025, widely adopted in city and urban e-bikes due to regulatory compliance in several countries and balanced power output suitable for daily commuting

The Over 750W segment is anticipated to grow at the fastest pace during the forecast period, fueled by demand for high-performance electric bikes in mountain biking, cargo transport, and racing applications where additional torque and acceleration are essential

• By Class

On the basis of class, the market is segmented into class i (pedal assist/pedelec), class ii (throttle), and class iii (speed pedelec). class i bikes held the largest revenue share in 2025 due to favorable regulatory treatment in many regions and their broad compatibility with cycling infrastructure. these bikes are often preferred by first-time users and urban commuters

Class III (speed pedelec) is expected to witness rapid growth from 2025 to 2032, driven by increasing interest in high-speed mobility for longer-distance commuters, especially in Europe and North America where cycling is promoted as a car replacement

• By Usage

On the basis of usage, the electric bike market is segmented into city/urban, cruise, mountain/trekking bikes, racing, cargo, and others. The city/urban segment dominated the market in 2025 due to rising urbanization, increasing traffic congestion, and demand for cost-effective, eco-friendly transport alternatives. These e-bikes are widely adopted by daily commuters and casual riders

The mountain/trekking segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by advancements in rugged frame designs, high-torque motors, and suspension systems that cater to off-road enthusiasts and adventure riders

Electric Bike Market Regional Analysis

- North America dominates the electric bike market with the largest revenue share of 38.5% in 2024, driven by rising environmental awareness, government incentives, and the growing adoption of sustainable transportation solutions

- Consumers in the region increasingly prefer electric bikes for urban commuting and recreational purposes, appreciating their convenience, cost-effectiveness, and eco-friendly benefits compared to traditional vehicles

- This widespread adoption is further supported by advanced infrastructure, high disposable incomes, and a strong presence of key manufacturers and retailers, making electric bikes a popular choice for both daily commuters and leisure riders across residential and commercial sectors

U.S. Electric Bike Market Insight

The U.S. electric bike market captured a dominant revenue share within North America in 2025, fueled by increasing consumer focus on sustainable transportation and the adoption of micro-mobility solutions. Urban congestion and environmental awareness are driving demand for e-bikes as alternatives to traditional vehicles. Supportive government policies, tax incentives, and infrastructure investments in bike lanes are boosting market adoption. In addition, technological advancements such as improved battery life, lightweight frames, and integrated smart features are enhancing the appeal of e-bikes to both recreational and commuter riders

Europe Electric Bike Market Insight

The European electric bike market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong regulatory support for carbon neutrality and urban mobility. The region’s commitment to reducing greenhouse gas emissions has resulted in generous subsidies and cycling infrastructure improvements. Countries such as the Netherlands, Germany, and France are seeing a surge in e-bike usage across all age groups. The market is also benefiting from innovations in e-bike design and the growing popularity of e-bikes for delivery and logistics in urban environments

U.K. Electric Bike Market Insight

The U.K. electric bike market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rising preference for eco-friendly transport and government-backed cycling initiatives. Increasing fuel costs and a strong focus on reducing traffic congestion in major cities are encouraging adoption. E-bikes are gaining traction among commuters, students, and older adults seeking accessible and sustainable mobility options. Furthermore, retailers are expanding their offerings and financing options, making e-bikes more accessible to a wider audience

Germany Electric Bike Market Insight

The German electric bike market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong cycling culture and emphasis on environmental sustainability. As one of the largest markets for e-bikes in Europe, Germany benefits from a mature infrastructure, a wide network of cycling paths, and consumer trust in local and premium brands. Demand is high across both urban and rural areas, with notable growth in the use of cargo e-bikes for family and commercial purposes. Government incentives and environmental awareness continue to reinforce growth

Asia-Pacific Electric Bike Market Insight

The Asia-Pacific electric bike market is poised to grow at the fastest CAGR of over 25% in 2025, driven by rapid urbanization, worsening traffic congestion, and rising environmental concerns in countries such as China, India, and Vietnam. Affordable pricing, combined with government support and public transportation integration, is accelerating adoption. The region is also a manufacturing hub, leading to economies of scale and widespread availability. Shared e-bike services and the growing middle class further contribute to the sector’s strong growth outlook

Japan Electric Bike Market Insight

The Japan electric bike market is gaining momentum due to an aging population, compact urban areas, and a strong emphasis on convenience and safety. Japanese consumers favor high-quality, technologically advanced e-bikes, particularly for commuting and daily errands. The integration of smart features such as GPS tracking, theft prevention systems, and mobile connectivity is enhancing consumer appeal. Additionally, government programs supporting senior mobility and eco-friendly transport options are driving steady growth in both residential and commercial segments

China Electric Bike Market Insight

The China electric bike market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by high population density, aggressive pollution control policies, and strong domestic production capabilities. China’s e-bike industry is highly competitive, with a wide range of models catering to various income groups and use cases. The government's focus on green mobility, combined with bans on gasoline-powered scooters in major cities, has led to rapid market penetration. Continued urbanization and the rise of e-commerce logistics are also sustaining strong demand for electric bikes

Electric Bike Market Share

The electric bike industry is primarily led by well-established companies, including:

- Accell Group (Netherlands)

- Merida Industry Co., Ltd. (Taiwan)

- Giant Bicycles (Taiwan)

- Yamaha Motor Corporation (Japan)

- Derby Cycle (Germany)

- JIANGSU XINRI E-VEHICLE CO.,LTD. (China)

- AIMA TECHNOLOGY CO.,LTD (China)

- Karbon Kinetics Ltd (U.K.)

- Solex Cycle North America Inc. (Canada)

- ITALJET SPA (Italy)

- GenZe (U.S.)

- A2B (London)

- Amego Electric Vehicles Inc. (Canada)

- Pedego Electric Bikes (U.S.)

- Riese & Müller GmbH (Germany)

- Sporttechnik GmbH & Co. KG (Germany)

- F.I.V. E. Bianchi S.p.A. (Italy)

- Kawasaki Motors Corp. (U.S.)

- Trek Bicycle Corporation (U.S.)

- myStromer AG (Switzerland)

- Specialized Bicycle Components, Inc. (U.S.)

Latest Developments in Global Electric Bike Market

- In July 2024, VanMoof launched its latest high-performance e-bike model, which incorporates advanced security features, including a unique anti-theft alarm and a new battery system designed to extend riding distance by 30%. This release aims to strengthen its position as a premium brand in the U.S. market

- In June 2024, Rad Power Bikes introduced its new cargo e-bike designed for last-mile delivery services. This model includes an upgraded motor and enhanced load capacity to cater to the growing demand for electric delivery solutions in urban areas

- In November 2023, Giant Group unveiled its first throttle-enabled electric bike, the Momentum Cito E+, under its Momentum sub-brand, which focuses on affordable bikes for street, utility, and commuter use. This model stands out with its 750W rear hub motor, a 780Wh battery, and a glovebox for added convenience. It offers a top speed of 28 mph and a range of up to 75 miles on pedal assist mode

- In March 2023, Bharat Forge Limited, through its E-Mobility subsidiary Kalyani Powertrain Limited, inaugurated its first e-bike factory at MIDC Chakan. The facility has an initial production capacity of 60,000 units per year, with the potential to scale up to 100,000 units annually. The plant primarily focuses on assembling electric bicycles for Tork Motors Private Limited, which is 64.29% owned by Kalyani Powertrain Limited

- In December 2022, Hero Motors and Yamaha Motor Co. signed an agreement to establish a Global E-Cycle Drive Unit company at Hero E-Cycle Valley in Ludhiana. This 100-acre facility already produces conventional and electric cycles for global OEMs, along with key components such as alloy rims, aluminum frames, and handlebars. The new venture will also manufacture HYM Drive Systems, with an annual production capacity of one million units

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.