Global E Cigarette Kits Market

Market Size in USD Billion

CAGR :

%

USD

26.71 Billion

USD

90.64 Billion

2024

2032

USD

26.71 Billion

USD

90.64 Billion

2024

2032

| 2025 –2032 | |

| USD 26.71 Billion | |

| USD 90.64 Billion | |

|

|

|

|

E-Cigarette Kits Market Size

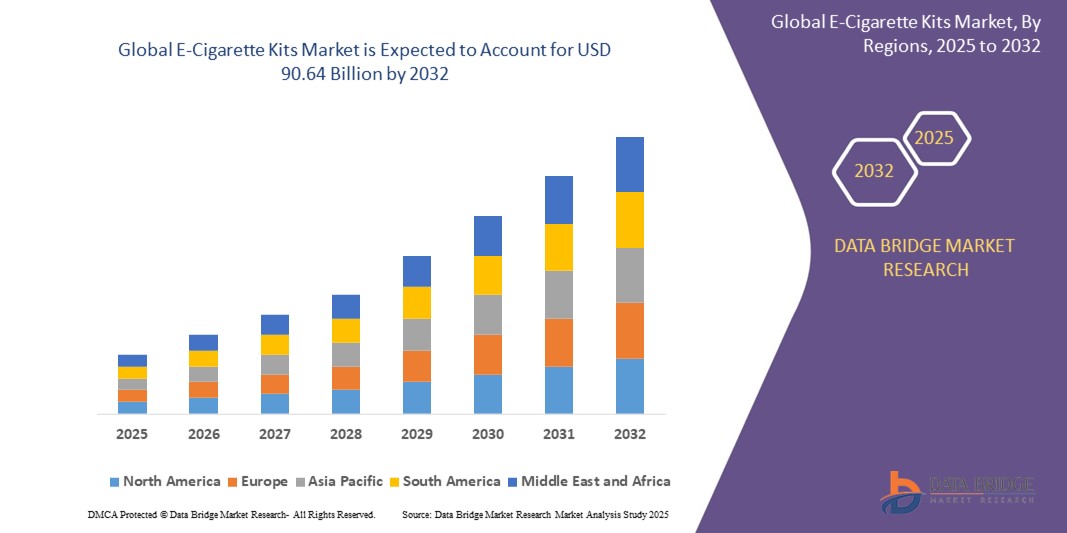

- The global e-cigarette kits market size was valued at USD 26.71 billion in 2024 and is expected to reach USD 90.64 billion by 2032, at a CAGR of 16.5% during the forecast period

- The market growth is largely fueled by the increasing shift from traditional tobacco products to vaping alternatives, driven by rising health awareness and consumer perception of e-cigarettes as a less harmful option

- Furthermore, continuous innovation in product design and technology, including customizable kits, longer battery life, and diverse flavor offerings, is enhancing user experience and attracting a broader demographic of adult smokers and new users

E-Cigarette Kits Market Analysis

- E-cigarette kits are comprehensive packages designed for users to start vaping. These kits typically include a range of components necessary for vaping, such as the e-cigarette device itself, which comprises a battery and an atomizer or vaporizer. The atomizer is responsible for heating the e-liquid and turning it into vapor. Most kits also come with one or more refillable or replaceable tanks or cartridges for holding the e-liquid, as well as a charger for the battery

- The escalating demand for e-cigarette kits is primarily driven by rising health consciousness, growing support from harm reduction policies, and advancements in device technology that enhance user convenience, portability, and overall experience

- North America dominated the e-cigarette kits market with a share of 40.5% in 2024, due to widespread acceptance of vaping as a smoking alternative and a robust retail infrastructure for both hardware and e-liquids

- Asia-Pacific is expected to be the fastest growing region in the e-cigarette kits market during the forecast period due to rapid urbanization, rising disposable incomes, and growing tech-savvy youth populations in countries such as China, Japan, and South Korea

- E-cigarette device segment dominated the market with a market share of 61.8% in 2024, due to the continuous technological innovation and rising consumer interest in safer smoking alternatives. These devices appeal to both transitioning smokers and tech-savvy users due to their customizable features, rechargeable capabilities, and increasing integration with digital controls. Consumer preference for advanced vapor production, adjustable settings, and long-term cost-effectiveness has sustained demand for reusable and refillable devices

Report Scope and E-Cigarette Kits Market Segmentation

|

Attributes |

E-Cigarette Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

E-Cigarette Kits Market Trends

“Increasing Product Innovation”

- A significant and accelerating trend in the global e-cigarette kits market is the continuous innovation in product design and functionality, including compact form factors, long-lasting batteries, leak-proof mechanisms, and user-friendly features tailored to beginners and advanced users alike

- For instance, in December 2024, Select Vape introduced beginner-focused starter kits from brands such as GeekVape, Vaporesso, and Lost Vape, aiming to simplify the vaping experience and attract new users through intuitive design and convenience

- Manufacturers are also introducing kits with adjustable wattage, smart chipsets, and safety features such as overheat protection and short-circuit prevention, enhancing both safety and personalization

- The growing popularity of modular systems and refillable pods is reshaping user preferences, allowing consumers to tailor their vaping experience through customizable coils, airflow settings, and e-liquid choices

- Furthermore, innovation in material quality and aesthetics—such as sleek metallic finishes and ergonomic designs—is influencing consumer purchase decisions, positioning e-cigarette kits as both a lifestyle product and a smoking alternative

- This ongoing trend toward smarter, safer, and more stylish devices is elevating user expectations and pushing brands to compete on both technological performance and consumer appeal

E-Cigarette Kits Market Dynamics

Driver

“Availability of Variety of E-Liquid Flavors”

- The widespread availability of e-liquid flavors—ranging from traditional tobacco to fruity and dessert-inspired profiles—is a key driver fueling demand for e-cigarette kits globally

- For instance, in March 2025, Imperial Brands introduced new fruit-flavored pods in the U.K. ahead of the disposable vape ban, appealing to consumers seeking both flavor variety and compliance-friendly reusable solutions

- Flavor diversity plays a crucial role in attracting adult smokers looking to switch from combustible cigarettes by offering a more enjoyable and less harsh alternative

- The ability to pair different e-liquids with refillable kits enhances customization, making the experience more satisfying and encouraging user retention. Moreover, flavor preferences vary significantly by region, and brands are increasingly localizing flavor offerings to suit cultural and regional tastes, expanding their reach in global markets

- This flavor-driven engagement supports product differentiation and creates opportunities for innovation in e-liquid formulation, including nicotine salts and reduced-risk ingredients

Restraint/Challenge

“High Costs of E-Cigarette Kits”

- The relatively high cost of e-cigarette kits compared to traditional tobacco products remains a significant barrier to mass adoption, particularly among price-sensitive consumers and those in developing markets. Premium kits often include advanced features such as refillable tanks, variable wattage, and digital displays, which contribute to elevated price points

- For instance, while disposable e-cigarettes or basic pod systems are more affordable, customizable kits from brands such as SMOK and Vaporesso can cost several times more upfront, making them less accessible to first-time users or those switching from cigarettes to save money

- This pricing gap can discourage potential consumers, especially those in regions where disposable income is low or traditional cigarettes are heavily subsidized

- Bridging the affordability gap will be crucial for the long-term growth of the market, particularly in developing economies where health awareness is growing but price remains a dominant factor in consumer decision-making

- Addressing this challenge will require manufacturers to diversify offerings with entry-level kits, emphasize long-term cost savings, and potentially work with retailers to offer installment plans or promotions to reduce initial purchase friction

E-Cigarette Kits Market Scope

The market is segmented on the basis of product type, category, and distribution channel.

• By Product Type

On the basis of product type, the e-cigarette kits market is segmented into e-cigarette device and e-liquid. The e-cigarette device segment dominates the largest market revenue share 61.8% in 2024, driven by the continuous technological innovation and rising consumer interest in safer smoking alternatives. These devices appeal to both transitioning smokers and tech-savvy users due to their customizable features, rechargeable capabilities, and increasing integration with digital controls. Consumer preference for advanced vapor production, adjustable settings, and long-term cost-effectiveness has sustained demand for reusable and refillable devices.

The e-liquid segment is projected to witness the fastest growth rate from 2025 to 2032, owing to expanding flavor portfolios and growing demand for personalized vaping experiences. The rise of nicotine salt-based formulations, improved vapor consistency, and innovations in flavor intensity are fueling consumption across regular and new users. Additionally, the recurring purchase cycle of e-liquids supports strong market growth through both online and offline channels.

• By Category

On the basis of category, the market is segmented into open vaping system and closed vaping system (disposable devices). The open vaping system segment held the largest market revenue share in 2024, favored for its refillability, component modularity, and cost savings over long-term use. Enthusiast users prefer open systems for their ability to adjust wattage, coil resistance, and flavor mix, supporting a customized and economical vaping routine. This segment’s dominance is reinforced by a growing community of experienced users seeking higher performance and device longevity.

The closed vaping system (disposable devices) segment is expected to register the fastest CAGR from 2025 to 2032, driven by rising adoption among first-time users and youth demographics. These devices are pre-filled, compact, and require no maintenance, making them highly convenient for casual use and travel. The growing popularity of sleek, single-use products combined with aggressive marketing and flavor innovation makes disposables increasingly attractive in urban and youth-driven markets.

• By Distribution Channel

On the basis of distribution channel, the e-cigarette kits market is segmented into offline retail and online retail. The offline retail segment accounted for the largest market revenue share in 2024, supported by strong product visibility, immediate availability, and consumer trust in physical store purchases. Vape shops, convenience stores, and specialty tobacconists offer a tactile and informed buying experience, often including in-store testing, product demonstrations, and expert recommendations, which drive consumer engagement.

The online retail segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by growing e-commerce penetration, discreet purchasing preferences, and broader product variety. Digital platforms provide access to exclusive flavors, competitive pricing, subscription models, and doorstep delivery, aligning with the purchasing behavior of tech-savvy and privacy-conscious users. Regulatory flexibility in certain regions further supports the rise of online sales channels.

E-Cigarette Kits Market Regional Analysis

- North America dominated the e-cigarette kits market with the largest revenue share of 40.5% in 2024, driven by widespread acceptance of vaping as a smoking alternative and a robust retail infrastructure for both hardware and e-liquids

- Consumers in the region are increasingly drawn to vaping due to health risk reduction perceptions, variety in flavor options, and technological advancements in devices that enhance user experience

- Strong brand presence, regulatory adaptation, and high purchasing power support sustained product demand, especially among young adults and former smokers seeking less harmful nicotine delivery methods

U.S. E-Cigarette Kits Market Insight

The U.S. e-cigarette kits market captured the largest revenue share in 2024 within North America, fueled by the shift away from combustible tobacco, growing millennial user base, and the rise of flavored and disposable devices. Vaping culture is strongly embedded among U.S. youth and adult users, and aggressive product innovation and marketing strategies contribute to market expansion. The presence of major manufacturers such as JUUL and Vuse, along with evolving FDA regulations, continues to shape product accessibility and innovation in the U.S. market.

Europe E-Cigarette Kits Market Insight

The Europe e-cigarette kits market is projected to grow at a substantial CAGR over the forecast period, supported by increasing governmental support for harm reduction and widespread public awareness campaigns on smoking cessation. Countries across Europe, particularly France and Germany, are witnessing a shift toward e-cigarettes, especially among former smokers seeking less harmful alternatives. Stringent product quality standards and flavor regulation are pushing brands to enhance product safety and transparency, further fostering consumer trust.

U.K. E-Cigarette Kits Market Insight

The U.K. e-cigarette kits market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong support from public health institutions promoting vaping as a smoking cessation tool. The National Health Service (NHS) endorses e-cigarettes for tobacco harm reduction, creating a favorable regulatory climate. Rising demand for both open-system devices and regulated nicotine salts, combined with extensive retail presence, is further boosting market penetration across urban centers.

Germany E-Cigarette Kits Market Insight

The Germany e-cigarette kits market is expected to expand at a considerable CAGR during the forecast period, driven by rising health consciousness, increased restrictions on combustible tobacco, and a growing base of vape-focused retail outlets. German consumers show a preference for customizable open-system kits and are responding positively to the expanding range of tobacco-free and nicotine-free options. The country’s strong emphasis on product safety and ingredient transparency supports a steady shift toward regulated e-cigarette products.

Asia-Pacific E-Cigarette Kits Market Insight

The Asia-Pacific e-cigarette kits market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing tech-savvy youth populations in countries such as China, Japan, and South Korea. Government initiatives encouraging alternatives to smoking and a growing demand for compact, discreet vaping devices are supporting adoption. Local players are increasingly dominating the regional landscape, offering affordable kits and flavored e-liquids tailored to regional preferences.

Japan E-Cigarette Kits Market Insight

The Japan e-cigarette kits market is gaining momentum, driven by the country's cultural emphasis on cleanliness and reduced-harm alternatives. Heated tobacco and e-cigarette products are widely accepted, especially in urban areas. Japan’s market is characterized by demand for sleek, efficient, and high-tech vaping devices, and the absence of nicotine-containing e-liquids has led to strong demand for non-nicotine and heat-not-burn products. Consumer interest in convenience and modern design continues to drive market innovation.

China E-Cigarette Kits Market Insight

The China e-cigarette kits market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a rising middle-class population, strong manufacturing base, and government efforts to regulate and license e-cigarette production. China is a major consumer market and also the global manufacturing hub for vaping products, with cities such as Shenzhen housing leading OEM and ODM players. The government's evolving regulatory framework and push for standardized products are reshaping the domestic and export market for e-cigarette kits.

E-Cigarette Kits Market Share

The e-cigarette kits industry is primarily led by well-established companies, including:

- Philip Morris International (U.S.)

- Healthier Choices Management Corp. (U.S.)

- British American Tobacco (U.K.)

- Japan Tobacco (Japan)

- J WELL FRANCE (France)

- Vaporesso (China)

- Ezee e-cigarettes (India)

- Ovale USA (U.S.)

- Altria Group, Inc. (U.S.)

- Imperial Brands plc (U.K.)

- International Vapor Group, Inc. (U.S.)

- Nicquid (U.S.)

- Juul Labs, Inc. (U.S.)

- Joy Technology Shenzhen Company, Ltd. (China)

- NJOY (U.S.)

- Innokin Technology (China)

- Ritchy Group Ltd. (China)

Latest Developments in Global E-Cigarette Kits Market

- In March 2025, Imperial Brands launched new e-cigarette kits and fruit-flavored pods in anticipation of the U.K.'s upcoming ban on disposable e-cigarettes, effective June 1. This strategic move is expected to boost demand for reusable vape kits, positioning the company to capture market share from consumers transitioning away from disposables. The introduction reinforces the market shift toward sustainable, compliant vaping alternatives and strengthens Imperial Brands’ foothold in the evolving regulatory landscape

- In December 2024, Select Vape introduced a new line of vape starter kits from brands such as GeekVape, Vaporesso, and Lost Vape, targeting beginner users. These all-in-one kits simplify the vaping experience, making it more accessible for first-time users. This product launch is likely to expand the customer base for e-cigarette kits, supporting market growth by addressing the needs of novice vapers and encouraging long-term product adoption through ease of use and trusted brand offerings

- In June 2022, Supreme agreed to acquire the vaping brand Liberty Flights Holdings for GBP 14.75 million. The acquisition includes an initial payment of GBP 7.75 million, GBP 2 million in deferred consideration, and up to GBP 5 million in performance-related earn-out payments

- In August 2021, Philip Morris International Inc. launched the IQOS ILUMA in Japan. This new addition to the IQOS line is the brand's first tobacco-heating system to feature induction-heating technology, eliminating the need for a blade and requiring no cleaning

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.