Global E Pharma Market

Market Size in USD Billion

CAGR :

%

USD

73.31 Billion

USD

309.78 Billion

2024

2032

USD

73.31 Billion

USD

309.78 Billion

2024

2032

| 2025 –2032 | |

| USD 73.31 Billion | |

| USD 309.78 Billion | |

|

|

|

|

E-Pharma Market Analysis

In general, there are three types of e-pharmacies available on the market, organized e-pharmacies, non-organized e-pharmacies, and e-pharmacies used for illegal international commerce. The general public benefits from e-pharmacy in a number of ways, including customer convenience, access, education, data records, and medicine legitimacy.

E-Pharma Market Size

Global E-pharma market size was valued at USD 73.31 billion in 2024 and is projected to reach USD 309.78 billion by 2032, with a CAGR of 19.74% during the forecast period of 2025 to 2032.

Report Scope and E-Pharma Market Segmentation

|

Attributes |

E-Pharma Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Boehringer Ingelheim International GmbH (Germany), AbbVie Inc (U.S.), Aurobindo Pharma (India), Pfizer Inc. (U.S.), Walmart Inc. (U.S.), Walgreen Co. (U.S.), Express Scripts (U.S.), The Kroger Co. (U.S.), L Rowland & Co (U.K.), DocMorris (Germany), Giant Eagle, Inc. (U.S.), OptumRx, Inc. (U.S.), CVS Health (U.S.), Merck & Co., Inc. (U.S.) and Thermo Fisher Scientific Inc. (U.S.) |

|

Market Opportunities |

|

Global E-Pharma Market Definition

The definition of the "e-Pharma market" is the mode of exchange between pharmacies and pharmaceutical firms. One of the most recent inventions that has emerged as the most practical means to order medications is the e-pharma industry.

E-Pharma Market Dynamics

Drivers

- Increasing government initiatives

Rising emerging technologies like artificial intelligence (AI) and machine learning (ML) help in ensuring customer satisfaction by recommendation engines, increasing internet penetration due to cheap data rate, rising government initiatives, changing regulations, increasing internet penetration in urban as well as rural areas, and rising prevalence for e-prescriptions are all key factors escalating the market growth.

- Rising research and development activities

Additionally, rising emerging markets with an increasing geriatric population base, rising research and development activities in the healthcare sector, and rising technological advancements and modernization in the healthcare sector will further create new opportunities for the E-pharma market in the anticipated period of 2025–2032.

- Rise in the geriatric population

The rising prevalence rates of lifestyle disorders like as diabetes and obesity, rising health-care spending, and the fast-growing diagnostic industry are driving the worldwide e-pharma market expansion. In addition, the growing elderly population, increased demand for laboratory automation, and more awareness of preventative healthcare are all driving the E-pharma market forward.

Opportunities

The pharmaceutical industry's expanding use of e-commerce platforms is now fuelling market expansion. Additionally, the market expansion is being fuelled by expanding internet connectivity and the widespread use of smart gadgets.

Restraints/Challenges

However, the market would be constrained by an increase in illicit online pharmacies and the availability of bogus medications online, which will further hinder the growth of the e-pharma industry throughout the forecast period.

This e-pharma market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the e-pharma market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on E-Pharma Market

Additionally, an increasing variety of in-app features, like special discounts, personalised purchases, expedited delivery, etc., are supporting the global market expansion. As a result of the rapid COVID-19 epidemic, brick-and-mortar pharmacies are gradually giving way to online pharmacy platforms in an effort to reduce the danger of coronavirus infection through human contact. Predictive analytics, artificial intelligence (AI), health information technology (HIT), and other cutting-edge technologies will increasingly be combined with e-pharmacy solutions to drive the global market in the years to come.

E-Pharma Market Scope

The e-pharma market is segmented on the basis of product type, application and type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Hospitals

- Personal Use

- Government Research

Type

- Pharmacy Benefit Manager

- Legitimate Internet Pharmacy

- Illegal or Unethical Internet Pharmacy

Product Type

- Generic

- Branded

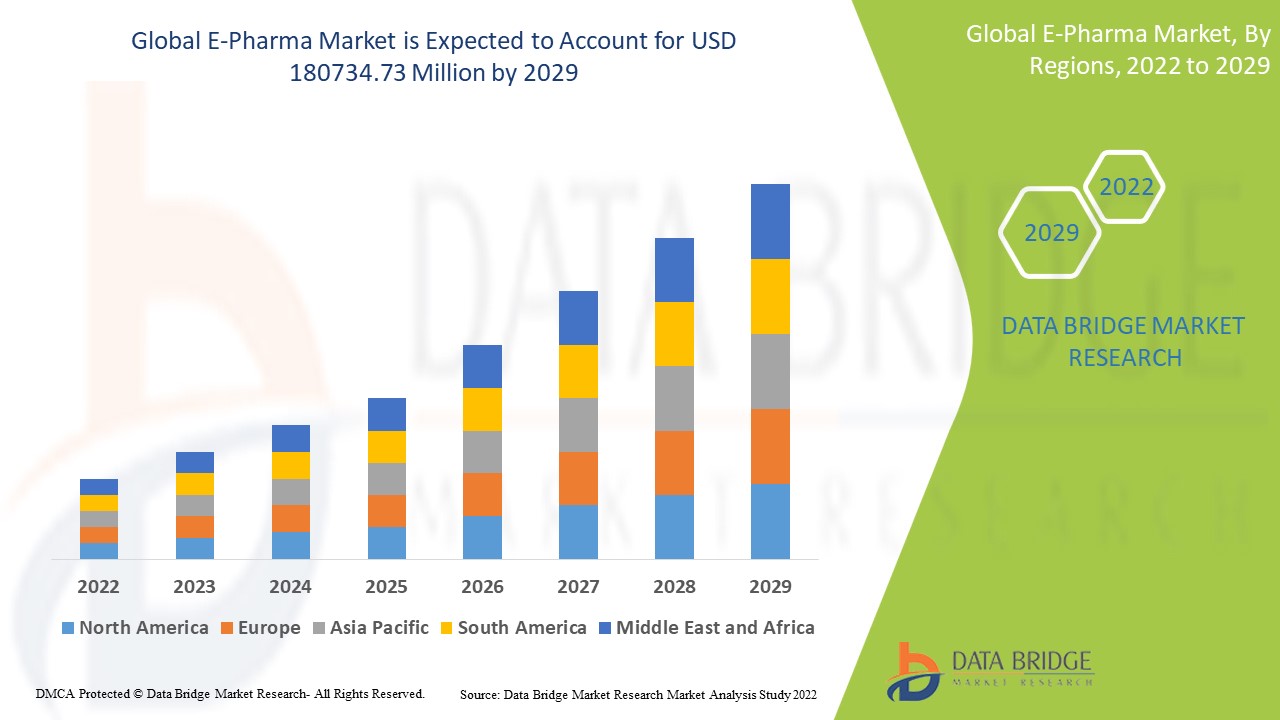

E-Pharma Market Regional Analysis

The e-pharma market is analyzed and market size insights and trends are provided by country, product type, application and type as referenced above.

The countries covered in the e-pharma market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the e-pharma market due to rise in the number of patients due to unhealthy lifestyle, rising government initiatives, changing regulations, and increasing internet penetration in urban as well as rural areas in this region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2025 to 2032 due to rising aging population and rising government initiatives in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

E-Pharma Market Share

The e-pharma market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to e-pharma market.

E-Pharma Market Leaders Operating in the Market Are:

- Boehringer Ingelheim International GmbH (Germany)

- AbbVie Inc (U.S.)

- Aurobindo Pharma (India)

- Pfizer Inc. (U.S.)

- Walmart Inc. (U.S.)

- Walgreen Co. (U.S.)

- Express Scripts (U.S.)

- The Kroger Co. (U.S.)

- L Rowland & Co (U.K.)

- DocMorris (Germany)

- Giant Eagle, Inc. (U.S.)

- OptumRx, Inc. (U.S.)

- CVS Health (U.S.)

- Merck & Co., Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL E PHARMA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 GLOBAL E PHARMA MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL E PHARMA MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL E PHARMA MARKET, BY PRODUCT

16.1 OVERVIEW

16.2 PRESCRIPTION MEDICINE

16.2.1 ANALGESICS

16.2.1.1. PARACETAMOL

16.2.1.2. FENTANYL

16.2.1.3. TRAMADOL

16.2.1.4. ACETAMINOPHEN

16.2.1.5. OTHERS

16.2.2 IMMUNOSUPPRESSIVES

16.2.2.1. AZATHIOPRINE

16.2.2.2. CICLOSPORIN

16.2.2.3. MYCOPHENOLATE MOFETIL

16.2.2.4. OTHERS

16.2.3 ANTIDEPRESSANT

16.2.3.1. RISPERIDONE

16.2.3.2. OLANZAPINE

16.2.3.3. TRIFLUOPERAZINE

16.2.3.4. CHLORDIAZEPOXIDE

16.2.3.5. OTHERS

16.2.4 ANTI-INFECTIVES

16.2.4.1. ANTIBIOTICS

16.2.4.1.1. AMOXICILLIN

16.2.4.1.2. METRONIDAZOLE

16.2.4.1.3. DOXYCYCLINE

16.2.4.1.4. CIPROFLOXACIN

16.2.4.1.5. LEVOFLOXACIN

16.2.4.1.6. OTHERS

16.2.4.2. ANTIVIRAL

16.2.4.2.1. ACICLOVIR

16.2.4.2.2. ABACAVIR

16.2.4.2.3. LOPINAVIR

16.2.4.2.4. OSELTAMIVIR

16.2.4.2.5. OTHERS

16.2.4.3. ANTIFUNGAL

16.2.4.3.1. CLOTRIMAZOLE

16.2.4.3.2. ITRACONAZOLE

16.2.4.3.3. NYSTATIN

16.2.4.3.4. VORICONAZOLE

16.2.4.3.5. FLUCONAZOLE

16.2.4.3.6. OTHERS

16.2.4.4. OTHERS

16.2.5 ANTI-INFLAMMATORY

16.2.5.1. DICLOFENAC

16.2.5.2. IBUPROFEN

16.2.5.3. NAPROXEN

16.2.5.4. PREDNISOLONE

16.2.5.5. OTHERS

16.2.6 DIURETICS

16.2.6.1. SPIRONOLACTONE

16.2.6.2. HYDROCHLOROTHIAZIDE

16.2.6.3. FUROSEMIDE

16.2.6.4. OTHERS

16.2.7 GASTROINTESTINAL

16.2.7.1. ESOMOPRAZOLE

16.2.7.2. OMEPRAZOLE

16.2.7.3. RANITIDINE

16.2.7.4. LOPERAMIDE

16.2.7.5. OTHERS

16.2.8 CARDIOVASCULAR

16.2.8.1. ATENOLOL

16.2.8.2. MOLSIDOMINE

16.2.8.3. DIGOXIN

16.2.8.4. VERAPAMIL

16.2.8.5. OTHERS

16.2.9 OTHERS

16.3 OVER THE COUNTER

16.3.1 ANTACIDS

16.3.1.1. ALUMINUM CARBONATE ANTACIDS

16.3.1.2. CALCIUM CARBONATE ANTACIDS

16.3.1.3. MAGNESIUM OXIDE ANTACIDS

16.3.1.4. SODIUM BICARBONATE ANTACIDS

16.3.1.5. SODIUM CITRATE ANTACIDS

16.3.1.6. ALUMINUM HYDROXIDE ANTACIDS

16.3.1.7. MAGNESIUM HYDROXIDE ANTACIDS

16.3.1.8. OTHERS

16.3.2 PAIN RELIEF

16.3.2.1. ASPIRIN

16.3.2.2. NAPROXEN

16.3.2.3. IBUPROFEN

16.3.2.4. ACETAMINOPHEN

16.3.2.5. OTHERS

16.3.3 VITAMINS

16.3.3.1. BIOTIN

16.3.3.2. FOLIC ACID

16.3.3.3. THIAMIN

16.3.3.4. RIBOFLAVIN

16.3.3.5. PANTOTHENIC ACID

16.3.3.6. ASCORBIC ACID

16.3.3.7. COBALAMIN

16.3.3.8. PYRIDOXINE

16.3.3.9. NIACIN

16.3.3.10. RETINOIDS AND CAROTENE

16.3.3.11. CHOLINE

16.3.3.12. CALCIFEROL

16.3.3.13. ALPHA-TOCOPHEROL

16.3.3.14. PHYLLOQUINONE

16.3.3.15. MENADIONE

16.3.3.16. OTHERS

16.3.4 MINERALS

16.3.4.1. CALCIUM

16.3.4.2. CHLORIDE

16.3.4.3. CHROMIUM

16.3.4.4. COPPER

16.3.4.5. FLUORIDE

16.3.4.6. IODINE

16.3.4.7. IRON

16.3.4.8. MAGNESIUM

16.3.4.9. MANGANESE

16.3.4.10. MOLYBDENUM

16.3.4.11. PHOSPHORUS

16.3.4.12. POTASSIUM

16.3.4.13. SELENIUM

16.3.4.14. SODIUM

16.3.4.15. SULFUR

16.3.4.16. ZINC

16.3.4.17. OTHERS

16.3.5 DIETARY SUPPLEMENTATION

16.3.5.1. FISH OIL

16.3.5.2. HYDROCIL

16.3.5.3. REGULOID

16.3.5.4. PSYLLIUM

16.3.5.5. METAMUCIL

16.3.5.6. OTHERS

16.3.6 OTHERS

17 GLOBAL E PHARMA MARKET, BY TYPE

17.1 OVERVIEW

17.2 IN-PATIENT DRUG

17.3 OUT-PATIENT DRUG

18 GLOBAL E PHARMA MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 BRANDED

18.3 GENERIC

18.4 OTHERS

19 GLOBAL E PHARMA MARKET, BY THERAPEUTICS APPLICATION

19.1 OVERVIEW

19.2 ISCHEMIC HEART DISEASE

19.2.1 PRESCRIPTION MEDICINE

19.2.2 OVER THE COUNTER

19.3 CHRONIC OBSTRUCTIVE PULMONARY DISEASE

19.3.1 PRESCRIPTION MEDICINE

19.3.2 OVER THE COUNTER

19.4 DIARRHEAL DISEASES

19.4.1 PRESCRIPTION MEDICINE

19.4.2 OVER THE COUNTER

19.5 LOWER RESPIRATORY INFECTION

19.5.1 PRESCRIPTION MEDICINE

19.5.2 OVER THE COUNTER

19.6 CEREBROVASCULAR DISEASES

19.6.1 PRESCRIPTION MEDICINE

19.6.2 OVER THE COUNTER

19.7 IRON-DEFICIENCY ANAEMIA

19.7.1 PRESCRIPTION MEDICINE

19.7.2 OVER THE COUNTER

19.8 NEONATAL PRETERM BIRTH

19.8.1 PRESCRIPTION MEDICINE

19.8.2 OVER THE COUNTER

19.9 TUBERCULOSIS

19.9.1 PRESCRIPTION MEDICINE

19.9.2 OVER THE COUNTER

19.1 SENSE ORGAN DISEASES

19.10.1 PRESCRIPTION MEDICINE

19.10.2 OVER THE COUNTER

19.11 CANCER

19.11.1 PRESCRIPTION MEDICINE

19.11.2 OVER THE COUNTER

19.12 INJURIES

19.12.1 PRESCRIPTION MEDICINE

19.12.2 OVER THE COUNTER

19.13 OPHTHALMOLOGY

19.13.1 PRESCRIPTION MEDICINE

19.13.2 OVER THE COUNTER

19.14 DERMATOLOGY

19.14.1 PRESCRIPTION MEDICINE

19.14.2 OVER THE COUNTER

19.15 NEUROLOGY

19.15.1 PRESCRIPTION MEDICINE

19.15.2 OVER THE COUNTER

19.16 ENDOCRINOLOGY

19.16.1 PRESCRIPTION MEDICINE

19.16.2 OVER THE COUNTER

19.17 GASTROINTESTINAL DISORDERS

19.17.1 PRESCRIPTION MEDICINE

19.17.2 OVER THE COUNTER

19.18 AUTOIMMUNE

19.18.1 PRESCRIPTION MEDICINE

19.18.2 OVER THE COUNTER

19.19 OTHERS

20 GLOBAL E PHARMA MARKET, BY ROUTE OF ADMINISTRATION

20.1 OVERVIEW

20.2 ORAL

20.2.1 TABLETS

20.2.2 CAPSULES

20.2.3 POWDER

20.2.4 PILLS

20.2.5 SYRUPS

20.2.6 OTHERS

20.3 TOPICAL

20.3.1 SOLUTIONS

20.3.2 CREAM

20.3.3 OINTMENT

20.3.4 GELS

20.3.5 LOTIONS

20.3.6 POWDERS

20.3.7 OTHERS

20.4 PARENTERAL

20.5 INTRANASAL

20.5.1 DROPS

20.5.2 SPRAYS

20.5.3 POWDERS

20.5.4 GELS

20.5.5 OTHERS

20.6 OCULAR

20.6.1 EYE DROPS

20.6.2 SPRAYS

20.6.3 OINTMENTS

20.6.4 OTHERS

20.7 OTHERS

21 GLOBAL E PHARMA MARKET, BY MODEL TYPE

21.1 OVERVIEW

21.2 INVENTORY-BASED MODEL

21.3 MARKETPLACE-BASED MODEL

21.4 GENERIC ECOMMERCE MODEL

22 GLOBAL E PHARMA MARKET, BY END USER

22.1 OVERVIEW

22.2 B2B

22.2.1 PHYSICIANS

22.2.2 CLINICS

22.2.3 HOSPITALS

22.2.4 HMO'S

22.2.5 PHARMACEUTICAL COMPANIES

22.2.6 OTHERS

22.3 B2C

23 GLOBAL E PHARMA MARKET, BY GEOGRAPHY

GLOBAL E PHARMA MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 HUNGARY

23.2.5 LITHUANIA

23.2.6 AUSTRIA

23.2.7 IRELAND

23.2.8 NORWAY

23.2.9 POLAND

23.2.10 ITALY

23.2.11 SPAIN

23.2.12 RUSSIA

23.2.13 TURKEY

23.2.14 NETHERLANDS

23.2.15 SWITZERLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 TAIWAN

23.3.4 SOUTH KOREA

23.3.5 INDIA

23.3.6 AUSTRALIA

23.3.7 SINGAPORE

23.3.8 THAILAND

23.3.9 MALAYSIA

23.3.10 INDONESIA

23.3.11 PHILIPPINES

23.3.12 VIETNAM

23.3.13 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ECUADOR

23.4.3 CHILE

23.4.4 COLOMBIA

23.4.5 VENEZUELA

23.4.6 ARGENTINA

23.4.7 PERU

23.4.8 CURAÇAO

23.4.9 PARAGUAY

23.4.10 URUGUAY

23.4.11 TRINIDAD AND TOBAGO

23.4.12 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 KUWAIT

23.5.6 ISRAEL

23.5.7 BOLIVIA

23.5.8 REST OF MIDDLE EAST AND AFRICA

23.6 CENTRAL AMERICA

23.6.1 COSTA RICA

23.6.2 HONDURAS

23.6.3 EL SALVADOR

23.6.4 GUATEMALA

23.6.5 NICARAGUA

23.6.6 REST OF CENTRAL AMERICA

23.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL E PHARMA MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL E PHARMA MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL E PHARMA MARKET, COMPANY PROFILE

26.1 CVS HEALTH

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 SHOP APOTHEKE EUROPE N.V.

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 ZUR ROSE GROUP AG

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 WALGREENS BOOTS ALLIANCE, INC.

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 FEDEX

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 WALMART

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 THE BOOTS COMPANY PLC

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 SUPERDOG

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 APO-ROT

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 HOLLAND & BARRETT RETAIL LIMITED

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 EXPRESS SCRIPTS HOLDING COMPANY

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 LLOYDSPHARMACY

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 PHARMACY2U LTD

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 MEDIKAMENTE-PER-KLICK

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 MEDPEX

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 APONEO

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 SANTÉDISCOUNT

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 PHARMA GDD

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 NEWPHARMA SRL

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 EFARMA

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 SHOP FARMACIA

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 IAF NETWORK S.P.A.

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 AMAVITA PHARMACIES

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 PROMOFARMA ECOM, S.L.

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 EAPTEKA

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 1 MG

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 APOLLO 247

26.27.1 COMPANY OVERVIEW

26.27.2 REVENUE ANALYSIS

26.27.3 GEOGRAPHIC PRESENCE

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 PHARMEASY

26.28.1 COMPANY OVERVIEW

26.28.2 REVENUE ANALYSIS

26.28.3 GEOGRAPHIC PRESENCE

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

26.29 NETMEDS

26.29.1 COMPANY OVERVIEW

26.29.2 REVENUE ANALYSIS

26.29.3 GEOGRAPHIC PRESENCE

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.