Global Edible Cutlery Market

Market Size in USD Million

CAGR :

%

USD

38.20 Million

USD

76.79 Million

2024

2032

USD

38.20 Million

USD

76.79 Million

2024

2032

| 2025 –2032 | |

| USD 38.20 Million | |

| USD 76.79 Million | |

|

|

|

|

Edible Cutlery Market Size

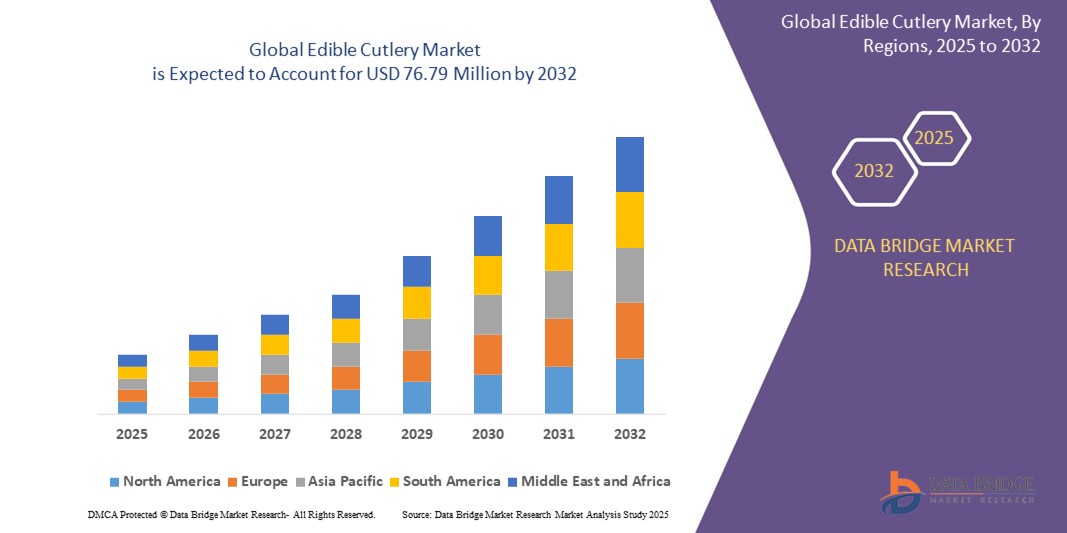

- The global edible cutlery market size was valued at USD 38.20 million in 2024 and is expected to reach USD 76.79 million by 2032, at a CAGR of 9.12% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of environmental sustainability, growing demand for eco-friendly alternatives to single-use plastic cutlery, and advancements in edible material technologies

- The rising preference for biodegradable and sustainable products, coupled with stringent government regulations on plastic usage, is accelerating the adoption of edible cutlery across various sectors, significantly boosting industry growth

Edible Cutlery Market Analysis

- Edible cutlery, made from edible materials such as wheat bran, rice bran, and sorghum, serves as an eco-friendly alternative to traditional plastic cutlery, offering sustainability and convenience for food service and household applications

- The demand for edible cutlery is fueled by growing environmental concerns, the global push to reduce plastic waste, and increasing consumer preference for sustainable and biodegradable products

- North America dominated the edible cutlery market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness of sustainability, stringent regulations on single-use plastics, and the presence of key manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing environmental consciousness, and rising disposable incomes in countries such as India and China

- The spoon segment dominated the largest market revenue share of 38.3% in 2024, attributed to its widespread use across various cultures, particularly in countries such as India, Bhutan, and Myanmar, where eating with hands is common, and spoons are a familiar utensil

Report Scope and Edible Cutlery Market Segmentation

|

Attributes |

Edible Cutlery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Edible Cutlery Market Trends

“Increasing Integration of Innovative Materials and Production Technologies”

- The global edible cutlery market is experiencing a significant trend toward the integration of innovative materials and advanced production technologies

- Manufacturers are leveraging materials such as wheat bran, rice bran, sorghum, corn, millet, and novel options such as celery and potato starch to create durable, biodegradable, and edible utensils

- Advanced production techniques, such as the Frenvi process and improved molding technologies, enhance the efficiency, scalability, and quality of edible cutlery, making it more appealing to consumers and businesses

- For instances, companies such as EATlery and EdiblePRO are introducing products such as flavored spoons and sporks with enhanced durability and unique flavor profiles, such as chocolate, sesame, and sweet-salty variants

- These innovations improve the functionality and consumer appeal of edible cutlery, aligning with sustainability goals and increasing adoption across food service and household sectors

- Technologies are also enabling the customization of product textures, flavors, and ergonomic designs to cater to diverse culinary preferences and cultural dining habits

Edible Cutlery Market Dynamics

Driver

“Rising Demand for Sustainable and Eco-Friendly Alternatives”

- Increasing consumer awareness of environmental issues, particularly plastic pollution, is a major driver for the global edible cutlery market

- Edible cutlery, made from natural materials such as wheat bran, rice bran, sorghum, corn, and millet, offers a biodegradable and edible alternative to single-use plastic utensils, reducing waste in landfills and oceans

- Government regulations, such as bans on single-use plastics in regions such as the European Union and parts of Asia-Pacific, are accelerating the adoption of edible cutlery

- The proliferation of eco-conscious consumer trends and corporate sustainability initiatives is driving demand across various end-use sectors, including food service outlets, hotels, restaurants, cafes, quick service restaurants, institutional food services, cinemas, airline and railway catering, schools, offices, hospitals, and household use

- Manufacturers are increasingly offering a variety of product types to meet diverse consumer needs, further boosting market growth

Restraint/Challenge

“High Production Costs and Cultural Resistance”

- The high initial costs associated with sourcing natural materials, developing specialized manufacturing processes, and ensuring product durability pose a significant barrier to widespread adoption, particularly in cost-sensitive markets

- The production of edible cutlery, especially with premium materials such as organic multigrain flour or flavored variants, can be more expensive than traditional plastic or compostable alternatives such as bamboo or paper

- Cultural and culinary preferences present another challenge, as some regions with strong traditions of using specific utensils may resist adopting edible cutlery, requiring targeted education and marketing efforts

- Data from reports indicate that competition from other eco-friendly alternatives, such as compostable utensils, and infrastructure challenges for disposal in regions lacking composting facilities can hinder market growth

- These factors may limit market expansion, particularly in emerging markets where cost sensitivity and cultural norms play a significant role

Edible Cutlery market Scope

The market is segmented on the basis of product type, material type, flavor, end-use, and sales channel.

- By Product Type

On the basis of product type, the global edible cutlery market is segmented into spoon, fork, knife, spork, and chopstick. The spoon segment dominated the largest market revenue share of 38.3% in 2024, attributed to its widespread use across various cultures, particularly in countries such as India, Bhutan, and Myanmar, where eating with hands is common, and spoons are a familiar utensil. The rising focus on health-conscious and sustainable lifestyles further boosts the demand for edible spoons, made from natural ingredients such as sorghum, rice, and wheat.

The spork segment is expected to witness the fastest growth rate of 9.2% from 2025 to 2032, driven by its hybrid functionality as both a spoon and fork, making it highly convenient for consumers, especially in travel and quick-service settings. Its eco-friendly appeal and compatibility with diverse food types, such as soups and salads, enhance its adoption, particularly in the airline industry.

- By Material Type

On the basis of material type, the global edible cutlery market is segmented into wheat bran, rice bran, sorghum, corn, millet, and others. The corn segment dominated with a revenue share of 44.0% in 2024, owing to its abundant availability, cost-effectiveness, and high starch content, which ensures sturdy and durable edible cutlery. Corn-based cutlery is biodegradable, compostable, and aligns with global initiatives to reduce plastic waste.

The wheat bran segment is anticipated to grow at the fastest CAGR of 11.1% from 2025 to 2032, driven by its high fiber and nutrient content, making it a healthier option for eco-conscious consumers. Its cost-effective sourcing and integration into the agricultural value chain further support its rapid growth.

- By Flavor

On the basis of flavor, the global edible cutlery market is segmented into plain, sweet, and spicy flavors. The sweet flavor segment, particularly chocolate-flavored spoons and bowls, held the largest market share in 2024, driven by its universal appeal across all age groups and its use in restaurants and catering for appetizers and desserts.

The spicy flavor segment is expected to witness significant growth from 2025 to 2032, fueled by consumer interest in innovative flavors such as peri peri, ginger-garlic, and masala, which enhance the dining experience without compromising the utensil’s functionality.

- By End-Use

On the basis of end-use, the global edible cutlery market is segmented into food service outlets, hotels, restaurants and cafes, quick service restaurants, institutional food service, cinema, airline and railway catering, schools and offices, hospitals, and household use. The commercial segment, encompassing food service outlets, restaurants, and cafes, held the largest revenue share of 81.4% in 2024, driven by the food service industry’s adoption of edible cutlery to reduce environmental footprints and align with sustainability goals.

The household segment is projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, fueled by increasing consumer awareness of plastic pollution and a preference for eco-friendly products. The rise in home food delivery, particularly post-COVID-19, has further accelerated the demand for edible cutlery in households.

- By Sales Channel

On the basis of sales channel, the global edible cutlery market is segmented into manufacturers (direct sales), distributors, retailers, hypermarkets, supermarkets, convenience stores, specialty stores, and e-retail. The online stores segment held the largest market revenue share in 2024, driven by the convenience of e-commerce platforms for bulk purchases and the growing availability of edible cutlery through online retailers.

The specialty stores segment is expected to witness the fastest growth from 2025 to 2032, as these stores focus on eco-friendly and sustainable products, appealing to environmentally conscious consumers. The rise in partnerships between manufacturers and specialty retailers further enhances product visibility and adoption.

Edible Cutlery Market Regional Analysis

- North America dominated the edible cutlery market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness of sustainability, stringent regulations on single-use plastics, and the presence of key manufacturers

- Consumers prioritize edible cutlery for its eco-friendly benefits, reducing plastic waste, and enhancing dining experiences with biodegradable and edible options, particularly in regions with strong sustainability initiatives

- Growth is supported by advancements in edible cutlery production, including the use of natural materials such as corn, wheat bran, and rice bran, alongside increasing adoption in both commercial and household segments

U.S. Edible Cutlery Market Insight

The U.S. edible cutlery market captured the largest revenue share of 84.6% in 2024 within North America, fueled by strong consumer demand for sustainable dining solutions and growing awareness of environmental concerns. The trend towards eco-conscious lifestyles and regulatory measures promoting biodegradable alternatives further boost market expansion. The integration of edible cutlery in food service outlets and household use, combined with robust retail networks, creates a diverse product ecosystem.

Europe Edible Cutlery Market Insight

The Europe edible cutlery market is expected to witness significant growth, supported by stringent regulations on plastic waste and a focus on sustainable dining solutions. Consumers seek edible cutlery that aligns with environmental goals while offering convenience and functionality. The growth is prominent in both commercial applications and household use, with countries such as Germany and France showing notable uptake due to increasing environmental awareness and urban dining trends.

U.K. Edible Cutlery Market Insight

The U.K. market for edible cutlery is expected to witness rapid growth, driven by demand for sustainable and innovative dining solutions in urban and suburban settings. Increased consumer interest in eco-friendly products and rising awareness of plastic pollution encourage adoption. Evolving regulations balancing environmental impact with product functionality further influence consumer choices, boosting the use of edible cutlery across various applications.

Germany Edible Cutlery Market Insight

Germany is expected to witness rapid growth in the edible cutlery market, attributed to its advanced food and beverage sector and high consumer focus on sustainability and health-conscious dining. German consumers prefer edible cutlery made from natural materials such as wheat bran and corn, which contribute to reducing plastic waste and align with eco-friendly practices. The integration of these products in restaurants, cafes, and aftermarket channels supports sustained market growth.

Asia-Pacific Edible Cutlery Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, rising disposable incomes, and increasing environmental awareness in countries such as China, India, and Japan. Growing demand for sustainable dining solutions, coupled with cultural preferences for eco-friendly products, boosts market expansion. Government initiatives promoting plastic waste reduction and the availability of abundant agricultural resources further encourage the adoption of edible cutlery.

Japan Edible Cutlery Market Insight

Japan’s edible cutlery market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainable dining solutions that enhance convenience and align with environmental goals. The presence of major food service providers and the integration of edible cutlery in commercial applications accelerate market penetration. Rising interest in innovative flavors and materials also contributes to growth in both household and institutional segments.

China Edible Cutlery Market Insight

China holds the largest share of the Asia-Pacific edible cutlery market, propelled by rapid urbanization, increasing consumer awareness of plastic pollution, and a growing middle class with a focus on sustainable consumption. The country’s robust agricultural base supports the production of edible cutlery using materials such as rice bran and millet. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving adoption across food service outlets and household use.

Edible Cutlery Market Share

The edible cutlery industry is primarily led by well-established companies, including:

- Biotrem (France)

- BrightVibes B.V. (Netherlands)

- EdiblePRO (India)

- Edibles by Jack (U.S.)

- Frenvi UG (Germany)

- Greenhome Farms & Resorts P Ltd. (India)

- IPPINKA (Canada)

- KDD (India) Private Limited (India)

- KOOVEE (India)

- Mede Cutlery Company (India)

- Wisefood (India)

- Mede Cutlery Company (India)

- Oriqa Groups (India)

- Tate & Lyle (India)

- Trishula (India)

- Vegware Ltd (U.K.)

What are the Recent Developments in Global Edible Cutlery Market?

- In May 2024, Google advanced its sustainability efforts by piloting innovative solutions through its Single-Use Plastics Challenge, selecting nine companies to test their products in campus cafes and kitchens across the U.S. Among the winners was Incredible Eats, a startup offering edible cutlery made from non-GMO ingredients such as wheat, oat, corn, chickpeas, and brown rice. These utensils are designed to hold their shape for up to 30 minutes in hot or cold dishes, offering a practical and eco-friendly alternative to plastic. This initiative reflects a broader shift toward corporate adoption of sustainable dining practices

- In May 2024, MAGGI added a sustainable twist to its ‘Desh ke liye 2 minute’ initiative by launching edible forks made from wheat flour alongside its Masala Cuppa noodles in major Indian metro cities. Developed in collaboration with Nestlé R&D India and Indian startup Trishula, the forks are designed to be fully consumable, offering a plastic-free alternative that enhances the soupy, slurpy experience of MAGGI noodles. This limited-period offering reflects MAGGI’s broader commitment to environmental responsibility, following earlier efforts such as foldable, compostable forks introduced in 2023, which aimed to reduce plastic waste by approximately 35 metric tons annually

- In April 2024, Frenvi Private Limited was honored as the 2nd runner-up in the Plastic-Free Orders Packathon, a sustainability-focused initiative organized by Zomato in collaboration with Startup India. The event spotlighted innovative startups tackling plastic pollution in food delivery. Frenvi’s recognition stemmed from its development of edible cutlery, a creative and eco-conscious alternative to single-use plastics. Among over 85 participating startups from across India, Frenvi stood out for its functionality, design, and environmental impact, reinforcing its growing influence in the sustainable dining and packaging ecosystem

- In March 2024, KOOVEE, a French startup known for its edible and biodegradable cutlery, launched a temperature-resistant line of utensils designed to withstand hot meals. Made from a blend of flour, rapeseed oil, salt, and natural flavors, the new cutlery maintains its structure for over five minutes in 70°C water, making it ideal for soups and other hot dishes. With a texture similar to crackers and flavors such as natural, almond, and Herbs de Provence, KOOVEE’s innovation enhances both sustainability and dining experience, offering a practical alternative to single-use plastics in restaurants and retail

- In February 2024, Iberostar, a leading hotel chain based in Mallorca, partnered with Gloop, a Spanish startup specializing in edible cutlery, to supply spoons, straws, and coffee stirrers across its 35 establishments in Spain and Portugal. The initiative aims to eliminate single-use plastics and reduce reliance on wood and cardboard utensils, aligning with Iberostar’s broader sustainability goals. Made from rice flour and food industry by-products, Gloop’s cutlery is vegan, gluten-free, and available in flavors such as chocolate, biscuit, strawberry, and mint. This collaboration reflects the hospitality sector’s growing embrace of eco-friendly innovations that enhance both guest experience and environmental responsibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL EDIBLE CUTLERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL EDIBLE CUTLERY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL EDIBLE CUTLERY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL EDIBLE CUTLERY MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION) (UNITS)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

11.1 OVERVIEW

11.2 SPOON

11.2.1 ASP (USD)

11.2.2 MARKET VALUE (USD MILLION)

11.2.3 MARKET VOLUME (UNITS)

11.3 FORK

11.4 SPORK

11.5 PLATES

11.6 BOWLS

11.7 CUPS

11.8 STRAW

11.9 CONTAINER

11.1 KNIVES

11.11 CHOPSTICKS

11.12 STIRRERS

11.13 OTHERS

12 GLOBAL EDIBLE CUTLERY MARKET, BY SOURCE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 PLANT BASED

12.3 ANIMAL BASED

13 GLOBAL EDIBLE CUTLERY MARKET, BY MATERIAL TYPE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 WHEAT BRAN

13.3 RICE BRAN

13.4 SORGHUM

13.5 CORN

13.6 MILLET

13.7 SEAWEEDS & ALGAE

13.8 POLYSACCHARIDES

13.8.1 SUGARCANE

13.8.2 BAGASSE

13.9 LIPIDS

13.1 OTHERS

14 GLOBAL EDIBLE CUTLERY MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 PLAIN

14.3 SWEET

14.4 SPICY

14.5 SAVORY

14.6 OTHERS

15 GLOBAL EDIBLE CUTLERY MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 FOOD

15.2.1 FOOD, BY TYPE

15.2.1.1. DAIRY PRODUCTS

15.2.1.2. DAIRY ALTERNATIVES

15.2.1.3. BAKERY

15.2.1.4. PROCESSED FOOD

15.2.1.5. READY MEALS

15.2.1.6. OTHERS

15.2.2 FOOD, BY PRODUCT TYPE

15.2.2.1. SPOON

15.2.2.2. FORK

15.2.2.3. SPORK

15.2.2.4. PLATES

15.2.2.5. BOWLS

15.2.2.6. CUPS

15.2.2.7. STRAW

15.2.2.8. CONTAINER

15.2.2.9. KNIVES

15.2.2.10. CHOPSTICKS

15.2.2.11. STIRRERS

15.2.2.12. OTHERS

15.3 BEVERAGES

15.3.1 BEVERAGES, BY TYPE

15.3.1.1. NON-ALCOHOLIC

15.3.1.1.1. JUICES

15.3.1.1.2. SMOOTHIES

15.3.1.1.3. EDIBLE OILS

15.3.1.1.4. POWDER BEVERAGES

15.3.1.1.5. RTD TEA

15.3.1.1.6. RTD COFFEE

15.3.1.1.7. FLAORED DRINKS

15.3.1.1.8. FUNCTIONAL DRINKS

15.3.1.1.9. OTHERS

15.3.1.2. ALCOHOLIC

15.3.2 BEVERAGES, BY PRODUCT TYPE

15.3.2.1. SPOON

15.3.2.2. FORK

15.3.2.3. SPORK

15.3.2.4. PLATES

15.3.2.5. BOWLS

15.3.2.6. CUPS

15.3.2.7. STRAW

15.3.2.8. CONTAINER

15.3.2.9. KNIVES

15.3.2.10. CHOPSTICKS

15.3.2.11. STIRRERS

15.3.2.12. OTHERS

16 GLOBAL EDIBLE CUTLERY MARKET, BY END USER, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 HOUSEHOLD

16.2.1 HOUSEHOLD, BY PRODUCT TYPE

16.2.1.1. SPOON

16.2.1.2. FORK

16.2.1.3. SPORK

16.2.1.4. PLATES

16.2.1.5. BOWLS

16.2.1.6. CUPS

16.2.1.7. STRAW

16.2.1.8. CONTAINER

16.2.1.9. KNIVES

16.2.1.10. CHOPSTICKS

16.2.1.11. STIRRERS

16.2.1.12. OTHERS

16.3 COMMERCIAL AND FOOD SERVICE OUTLETS

16.3.1 COMMERCIAL AND FOOD SERVICE OUTLETS, BY TYPE

16.3.1.1. HOTELS

16.3.1.2. RESTAURANTS & CAFES

16.3.1.3. INSTITUTIONAL FOOD SERVICE

16.3.1.4. CINEMA

16.3.1.5. AIRLINE AND RAILWAY CATERING

16.3.1.6. SCHOOLS & OFFICES

16.3.1.7. CRUISE LINERS

16.3.1.8. HOSPITALS

16.3.2 COMMERCIAL AND FOOD SERVICE OUTLETS, BY PRODUCT TYPE

16.3.2.1. SPOON

16.3.2.2. FORK

16.3.2.3. SPORK

16.3.2.4. PLATES

16.3.2.5. BOWLS

16.3.2.6. CUPS

16.3.2.7. STRAW

16.3.2.8. CONTAINER

16.3.2.9. KNIVES

16.3.2.10. CHOPSTICKS

16.3.2.11. STIRRERS

16.3.2.12. OTHERS

17 GLOBAL EDIBLE CUTLERY MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 B2B

17.2.1 ONLINE

17.2.2 WHOLESALE TRADERS

17.2.3 OTHERS

17.3 B2C

17.3.1 ONLINE / E-COMMERCE

17.3.2 HYPERMARKETS / SUPERMARKETS

17.3.3 CONVEINIENCE STORES

17.3.4 GROCERY STORES

17.3.5 SPECIALTY STORES

17.3.6 OTHERS

18 GLOBAL EDIBLE CUTLERY MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (UNITS)

GLOBAL EDIBLE CUTLERY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 DENMARK

18.2.11 SWEDEN

18.2.12 POLAND

18.2.13 TURKEY

18.2.14 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 NEW ZEALAND

18.3.12 VIETNAM

18.3.13 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 UAE

18.5.4 SAUDI ARABIA

18.5.5 ISRAEL

18.5.6 OMAN

18.5.7 QATAR

18.5.8 KUWAIT

18.5.9 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL EDIBLE CUTLERY MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

19.6 MERGERS & ACQUISITIONS

19.7 NEW PRODUCT DEVELOPMENT & APPROVALS

19.8 EXPANSIONS & PARTNERSHIP

19.9 REGULATORY CHANGES

20 GLOBAL EDIBLE CUTLERY MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL EDIBLE CUTLERY MARKET, COMPANY PROFILE

21.1 GRUPO NUTRESA

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 FRENVI

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 EDIBLE PRO

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 FLAVORFULZ (A DBA OF CHARLTON BECKER CATERING)

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 IPPINKA

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 WISEFOOD GMBH

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 INCREDIBLE EATS INC.

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 MY SPOON EDIBLE CUTLERY

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 EDIBLE CUTLERY

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 WILTON BRANDS LLC (ACQUIRED BY DR. AUGUST OETKER)

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 STROODLES

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 KRAZY KREATIONZ SWEETS

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 GREENAURACO

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENTS

21.14 EDIBLE INNOVATIONS PTE LTD (CRUNCH CUTLERY)

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 EDIBLE BOSTON

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.