Global Eicosapentaenoic Acid Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

5.27 Billion

2024

2032

USD

2.20 Billion

USD

5.27 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 5.27 Billion | |

|

|

|

|

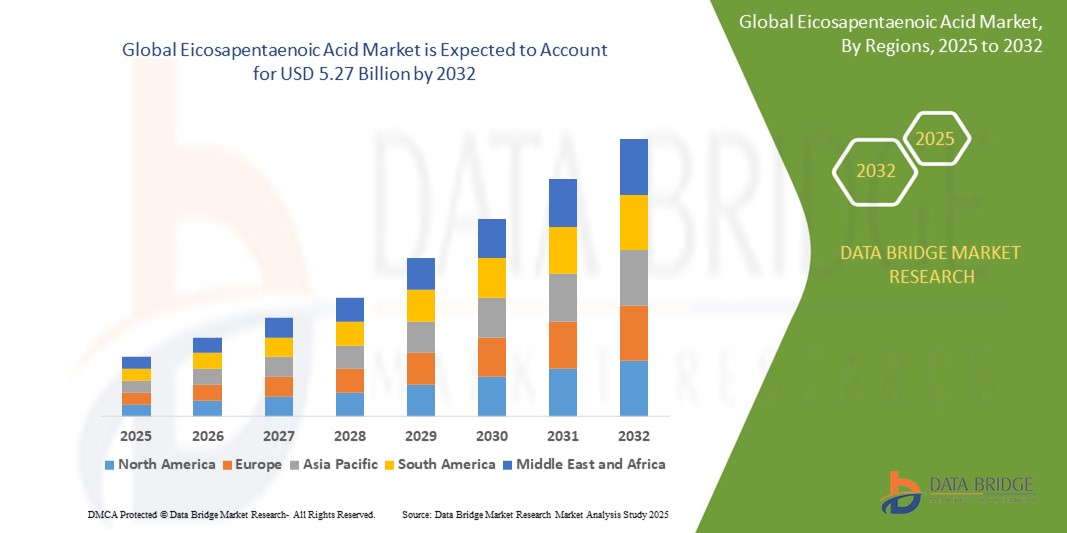

What is the Global Eicosapentaenoic Acid Market Size and Growth Rate?

- The global eicosapentaenoic acid market size was valued at USD 2.20 billion in 2024 and is expected to reach USD 5.27 billion by 2032, at a CAGR of 11.50% during the forecast period

- In the eicosapentaenoic acid market, the demand for innovative applications and extraction methods is growing. Novel formulations integrating EPA in functional foods drive market growth

- Advanced extraction techniques such as supercritical fluid extraction enhance purity and efficiency, meeting consumer demands for high-quality EPA products with improved bioavailability

What are the Major Takeaways of Eicosapentaenoic Acid Market?

- Eicosapentaenoic Acid's versatility and ability to enhance a wide range of food and beverage products make it a sought-after ingredient in the culinary world. Moreover, the perception of Eicosapentaenoic Acid as a timeless and comforting flavor contributes to its enduring popularity among consumers. Manufacturers and retailers respond to this demand by incorporating eicosapentaenoic acid into a diverse array of products, driving market growth and innovation

- North America dominated the eicosapentaenoic acid market with the largest revenue share of 39.4% in 2024, driven by strong consumer preference for omega-3 enriched supplements, growing demand for heart health products, and the widespread use of EPA in dietary, pharmaceutical, and fortified food applications

- Europe eicosapentaenoic acid market is expected to grow at the fastest CAGR of 14.2% from 2025 to 2032, driven by stringent regulatory support for natural, sustainable, and health-promoting ingredients across food, pharmaceutical, and personal care sectors

- The Triglycerides segment dominated the market with the largest revenue share of 59.2% in 2024, attributed to its superior bioavailability, natural composition, and higher absorption rates in comparison to other forms

Report Scope and Eicosapentaenoic Acid Market Segmentation

|

Attributes |

Eicosapentaenoic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Eicosapentaenoic Acid Market?

“Shift Toward Algae-Based and Plant-Derived Eicosapentaenoic Acid as a Sustainable Alternative”

- A key and rapidly growing trend in the global eicosapentaenoic acid (EPA) market is the increasing adoption of algae-based and plant-derived EPA sources, driven by rising environmental concerns and the need to reduce dependency on traditional fish oil

- Consumers and manufacturers are prioritizing EPA products that offer similar health benefits to marine-derived options but with lower ecological impact, avoiding overfishing and ocean biodiversity concerns

- For instance, in 2024, Corbion expanded its algae-based EPA production capacity to meet growing demand from the food, nutraceutical, and personal care industries, promoting a sustainable, vegan-friendly alternative to fish oil

- Technological advancements in microalgae cultivation, fermentation, and lipid extraction are enabling scalable, cost-efficient production of high-purity EPA, aligning with clean-label and plant-based consumer preference

- Furthermore, major brands are integrating algae-sourced EPA into functional foods, dietary supplements, and clinical nutrition, enhancing product offerings while addressing regulatory pressures related to marine sustainability

- As the global focus intensifies on reducing the environmental footprint and meeting the demand for ethical, plant-based nutrition, algae-derived EPA is expected to redefine product innovation, market differentiation, and long-term growth

What are the Key Drivers of Eicosapentaenoic Acid Market?

- The rising awareness of EPA’s scientifically backed health benefits, particularly its role in cardiovascular support, cognitive health, and inflammation reduction, is a significant driver for market growth

- For instance, in March 2025, DSM launched a new range of algae-based EPA formulations designed for heart health supplements, addressing both consumer health needs and sustainability concerns

- Increasing prevalence of lifestyle diseases, coupled with a growing aging population, is fueling demand for EPA-enriched dietary supplements and functional foods across global markets

- The plant-based and vegan nutrition trend is accelerating the need for non-fish EPA sources, with algae-derived products emerging as a preferred solution for consumers avoiding animal-based ingredient

- In addition, regulatory bodies across North America and Europe are supporting research, product approvals, and health claims related to EPA, enhancing consumer trust and market penetration

- Expanding applications of EPA in pharmaceuticals, infant nutrition, and sports supplements are creating new opportunities, with manufacturers innovating to deliver high-purity, bioavailable EPA solutions

Which Factor is challenging the Growth of the Eicosapentaenoic Acid Market?

- The high production costs and technical complexities associated with algae cultivation and EPA extraction present key challenges to the scalability of sustainable EPA solutions

- For instance, limited global infrastructure, expensive photobioreactor systems, and supply chain inefficiencies contribute to higher price points for algae-based EPA compared to traditional fish oil sources

- Market adoption is further hindered by consumer price sensitivity, particularly in emerging markets where affordability remains a major factor in health supplement consumption

- Quality standardization and ensuring consistent EPA concentrations across batches also remain challenging, especially for newer production facilities scaling up algae-derived solutions

- Moreover, regulatory variations, complex approval processes, and labeling requirements, particularly for novel food ingredients in regions such as the European Union and Asia-Pacific, can delay product launches and increase compliance cost

- To address these barriers, industry players must invest in R&D for cost-efficient production technologies, global supply chain expansion, and education initiatives to build consumer awareness and trust in algae-based EPA product

How is the Eicosapentaenoic Acid Market Segmented?

The market is segmented on the basis of form, application, and source.

• By Form

On the basis of form, the eicosapentaenoic acid market is segmented into Triglycerides and Ethyl Esters. The Triglycerides segment dominated the market with the largest revenue share of 59.2% in 2024, attributed to its superior bioavailability, natural composition, and higher absorption rates in comparison to other forms. Triglyceride-based EPA is widely preferred for dietary supplements and pharmaceutical applications due to its effectiveness in delivering health benefits, especially for heart and brain health.

The Ethyl Esters segment is projected to witness steady growth during the forecast period, driven by its affordability, high EPA concentration potential, and increasing use in clinical nutrition and specialized pharmaceutical formulations requiring purified EPA content.

• By Application

On the basis of application, the eicosapentaenoic acid market is segmented into Infant Formulae, Dietary Supplements, Fortified Food and Beverages, Pharmaceuticals, and Others. The Dietary Supplements segment dominated the market with the largest revenue share of 46.8% in 2024, fueled by rising consumer awareness of omega-3 benefits, increasing demand for heart health products, and growing adoption of EPA supplements for preventive healthcare worldwide.

The Pharmaceuticals segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by expanding research on EPA’s therapeutic role in cardiovascular, neurological, and inflammatory conditions, along with increasing regulatory approvals for EPA-based pharmaceutical products.

• By Source

On the basis of source, the eicosapentaenoic acid market is segmented into Anchovy/Sardine Oil, High Concentrates, Medium Concentrates, Low Concentrates, Algae Oil, Tuna Oil, Cod Liver Oil, Salmon Oil, Krill Oil, and Menhaden Oil. The Anchovy/Sardine Oil segment dominated the market with the largest revenue share of 38.1% in 2024, owing to its abundant availability, cost-effectiveness, and well-established use in producing EPA-rich oils for supplements and fortified foods. This source remains a key contributor to global EPA production due to its scalability and consistent quality.

The Algae Oil segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for plant-based, sustainable, and vegan-friendly EPA alternatives, particularly in premium dietary supplements and functional foods targeting environmentally conscious consumers.

Which Region Holds the Largest Share of the Eicosapentaenoic Acid Market?

- North America dominated the eicosapentaenoic acid market with the largest revenue share of 39.4% in 2024, driven by strong consumer preference for omega-3 enriched supplements, growing demand for heart health products, and the widespread use of EPA in dietary, pharmaceutical, and fortified food applications

- The region's advanced healthcare infrastructure, increasing focus on preventive healthcare, and rising awareness about the health benefits of EPA contribute significantly to market growth

- Major market players, ongoing R&D in high-purity EPA production, and a robust distribution network for nutraceuticals and functional foods further cement North America’s leading position in the EPA market

U.S. Eicosapentaenoic Acid Market Insight

U.S. eicosapentaenoic acid market accounted for the largest share within North America in 2024, supported by the country’s leadership in dietary supplements, functional foods, and pharmaceutical applications. Rising awareness of cardiovascular health, cognitive benefits, and anti-inflammatory properties of EPA is fueling demand, particularly among aging populations and health-conscious consumers. Increased investment in algae-derived and concentrated EPA products is further driving market expansion.

Canada Eicosapentaenoic Acid Market Insight

Canada eicosapentaenoic acid market is witnessing steady growth, fueled by increasing consumer interest in preventive health, rising demand for omega-3 supplements, and the country’s emphasis on sustainable marine-based ingredients. Government regulations promoting health claims for EPA, coupled with growing adoption of EPA-fortified products in mainstream food categories, support the market’s steady upward trajectory.

Which Region is the Fastest Growing Region in the Eicosapentaenoic Acid Market?

Europe eicosapentaenoic acid market is expected to grow at the fastest CAGR of 14.2% from 2025 to 2032, driven by stringent regulatory support for natural, sustainable, and health-promoting ingredients across food, pharmaceutical, and personal care sectors. Increasing consumer demand for plant-based omega-3 alternatives, clean-label supplements, and fortified functional products is fueling market expansion, particularly in countries such as Germany, France, and the U.K. Europe’s push toward sustainability, coupled with innovation in algae-derived and concentrated EPA formulations, positions the region as the fastest-growing global market for EPA.

Germany Eicosapentaenoic Acid Market Insight

Germany eicosapentaenoic acid market is experiencing robust growth, supported by rising demand for vegan, algae-based EPA products, growing health awareness, and regulatory initiatives promoting heart and brain health supplements. Local manufacturers are focusing on sustainable sourcing, high-purity concentrates, and advanced delivery formats, enhancing EPA adoption across pharmaceutical, nutraceutical, and fortified food sectors.

U.K. Eicosapentaenoic Acid Market Insight

U.K. eicosapentaenoic acid market is projected to grow at a significant CAGR, driven by consumer focus on preventive healthcare, increased demand for natural, sustainable ingredients, and the rising popularity of omega-3 enriched supplements. Expansion of the functional food and beverage industry, along with growing investment in algae-derived EPA, further supports the market’s upward momentum.

France Eicosapentaenoic Acid Market Insight

France eicosapentaenoic acid market is gaining traction, fueled by strong demand for premium dietary supplements, high awareness of cardiovascular and cognitive health, and the country's growing emphasis on sustainable, marine-based nutritional solutions. Regulatory frameworks supporting health claims and clean-label formulations continue to drive EPA adoption across health and wellness product categories.

Which are the Top Companies in Eicosapentaenoic Acid Market?

The eicosapentaenoic acid industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- BASF SE (Germany)

- Lonza (Switzerland)

- Glanbia Plc (Ireland)

- ADM (U.S.)

- Farbest Brands (U.S.)

- SternVitamin GmbH & Co. KG (Germany)

- Adisseo (France)

- BTSA Biotechnologias Aplicadas S.L. (Spain)

- Rabar Pty Ltd (Australia)

- Orkla (Norway)

- Epax (Norway)

- BioProcess Algae LLC (U.S.)

- Croda International plc (U.K.)

What are the Recent Developments in Global Eicosapentaenoic Acid Market?

- In September 2024, BASF SE introduced a new range of high-concentrate EPA supplements designed to support cardiovascular health, as part of the company’s broader strategy to leverage the rising consumer demand for potent omega-3 solutions. This development is expected to enhance BASF’s position in the growing eicosapentaenoic acid market

- In August 2024, Koninklijke DSM N.V. announced the expansion of its algal oil production facilities to meet the surging demand for plant-based omega-3 products, especially among vegan and environmentally conscious consumers. This strategic move reinforces DSM’s commitment to offering sustainable alternatives within the global omega-3 market

- In July 2024, Cargill, Inc. unveiled a new EPA and DHA omega-3 blend specifically designed for fortified beverages, catering to the rapidly expanding functional food and drink segment. With a focus on cardiovascular and cognitive health, this launch is expected to broaden Cargill’s product portfolio and market reach

- In September 2021, KD Pharma Group launched Alga3, a vegan omega-3 formulation created using advanced technology to customize EPA and DHA ratios. This innovation offers a sustainable, plant-based alternative to traditional fish oil, strengthening KD Pharma's role in diversifying the eicosapentaenoic acid market

- In June 2021, Polaris introduced Omegavie DHA 800 Sensory Qualitysilver 5, a premium algae oil rich in vitamins and proteins, designed as a sustainable source of PUFAs. This plant-based solution enhances the sensory quality of omega-3 products, contributing to the market’s shift toward environmentally friendly alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Eicosapentaenoic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Eicosapentaenoic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Eicosapentaenoic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.