Global Elderly Care Market

Market Size in USD Billion

CAGR :

%

USD

1,942.51 Billion

USD

3,288.02 Billion

2024

2032

USD

1,942.51 Billion

USD

3,288.02 Billion

2024

2032

| 2025 –2032 | |

| USD 1,942.51 Billion | |

| USD 3,288.02 Billion | |

|

|

|

|

Elderly Care Market Size

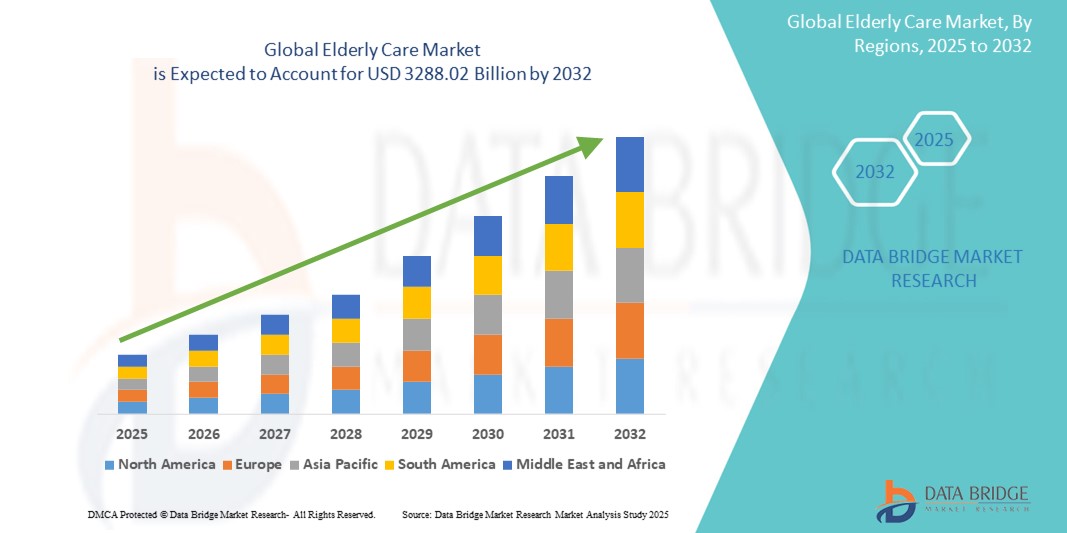

- The global elderly care market size was valued at USD 1,942.51 billion in 2024 and is expected to reach USD 3,288.02 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing elderly cares as the modern access control system of choice. These converging factors are accelerating the uptake of elderly care solutions, thereby significantly boosting the industry's growth

Elderly Care Market Analysis

- Elderly cares, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for elderly cares is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominates the elderly care market with the largest revenue share of 42.26% in 2024, driven by a rapidly aging population, rising healthcare expenditures, and an increasing focus on personalized in-home care solutions

- Asia-Pacific is expected to be the fastest growing region in the elderly care market during the forecast period with a CAGR of 18.22% from 2025 to 2032, supported by large aging populations and rising economic development in countries such as China, Japan, and India. Rapid urbanization and increased healthcare spending are facilitating the expansion of elderly care infrastructure, including nursing homes, assisted living, and geriatric hospitals

- The pharmaceuticals segment dominates the market with the largest revenue share of 51.3% in 2024, driven by the high demand for medications to manage chronic and age-related conditions such as cardiovascular diseases, diabetes, and neurological disorders

Report Scope and Elderly Care Market Segmentation

|

Attributes |

Elderly Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Elderly Care Market Trends

Embracing Technology for Enhanced Care and Independence

- A significant and accelerating trend in the global elderly care market is the increasing integration of technology to enhance the quality of care and promote independence for seniors. This includes the adoption of smart home technologies, wearable devices, and telehealth solutions to monitor health, provide assistance, and facilitate remote care

- For instance, in 2023, Philips launched its "Philips Lifeline" service expansion, which integrates wearable alert devices with AI-driven predictive analytics to provide proactive care and emergency response for seniors living alone

- Smart home devices such as Amazon Echo Show and Google Nest Hub are also becoming popular tools among elderly users for hands-free communication and control

- Another key trend is the innovation in integrated care models that focus on providing holistic and person-centered care. This involves coordinating various healthcare services, social support, and community resources to meet the individual needs and preferences of older adults. The development of personalized care plans, tailored to specific health conditions and lifestyle, is also becoming increasingly prevalent

- Telehealth and remote monitoring technologies are transforming the delivery of elderly care, enabling healthcare professionals to monitor patients' health remotely, provide virtual consultations, and deliver timely interventions. This trend is particularly important for seniors residing in remote areas or those with mobility limitations. Furthermore, advancements in medical devices, such as hearing and visual aids, are significantly improving the quality of life for the elderly

- This trend towards leveraging technology and adopting person-centered care models is fundamentally reshaping the elderly care landscape. Consequently, there is a growing demand for innovative solutions that enhance the well-being, safety, and independence of older adults

- The demand for elderly care services and products that incorporate technological advancements and personalized care approaches is growing rapidly, driven by the increasing aging population and a greater focus on providing high-quality and accessible care options

Elderly Care Market Dynamics

Driver

Growing Aging Population and Increasing Healthcare Awareness

- The increasing global aging population is the primary driver for the heightened demand for elderly care services and products. As the number of seniors continues to rise, so does the need for support in healthcare, daily living activities, and mobility. Increased life expectancy also contributes to this growing demand

- For instance, in 2022, Amedisys, a U.S.-based home health care provider, reported a 15% year-on-year increase in elderly patient enrollments, reflecting growing demand for home care services among aging populations. Governments are also actively investing in elderly care infrastructure. For instance, the European Commission allocated funds in 2023 to support aging-in-place initiatives across EU member states

- The shift from institutional care to home-based care is another significant driver. Many seniors prefer to receive care in the comfort of their own homes, leading to a rise in demand for home care services, remote monitoring technologies, and home health products. Changing societal attitudes that emphasize the well-being and dignity of older adults also contribute to this trend

- The increasing focus on preventive care and mental health awareness among the elderly is further driving the demand for specialized services and products aimed at promoting overall health and well-being. Rising collaborative care approaches, involving family members, healthcare professionals, and caregivers, are also becoming more common

- The combination of a growing aging population, increasing healthcare awareness, advancements in technology, and a preference for home-based and personalized care models is strongly driving the expansion of the elderly care market

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns over cybersecurity vulnerabilities of connected elderly care devices represent a major challenge to wider market adoption. Since these systems rely heavily on internet connectivity and software platforms, they are at risk of hacking, data breaches, and unauthorized access, which raises significant privacy and safety concerns among potential users

- For instance, reports of security flaws in IoT-enabled healthcare devices have made some elderly users and their families hesitant to fully embrace smart elderly care technologies

- Tackling these cybersecurity issues by implementing strong encryption, multi-factor authentication, and regular software patches is essential to build consumer confidence

- Companies such as Philips and Medtronic highlight their rigorous security protocols to assure customers. Moreover, the relatively high upfront costs of advanced elderly care solutions can be a barrier, particularly in price-sensitive markets or among budget-conscious families. While basic elder care services and devices have become more accessible, premium features such as remote monitoring with AI analytics or robotic assistance remain expensive

- Although prices for elderly care technologies are gradually decreasing, the perception of high costs coupled with concerns over complexity may limit widespread adoption, especially among older adults less comfortable with technology

- Overcoming these restraints through stronger cybersecurity frameworks, comprehensive user education, and the development of affordable, user-friendly elderly care products will be critical to sustaining robust market growth

Elderly Care Market Scope

The market is segmented on the basis of product type, service, and application.

- By Product Type

On the basis of product type, the elderly care market is segmented into pharmaceuticals, housing, and assistive devices. The pharmaceuticals segment dominates the market with the largest revenue share of 51.3% in 2024, driven by the high demand for medications to manage chronic and age-related conditions such as cardiovascular diseases, diabetes, and neurological disorders. The consistent need for prescription drugs, coupled with the expansion of geriatric-specific formulations and government reimbursement programs, supports the dominance of this segment.

The assistive devices segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness and adoption of mobility aids, hearing aids, and vision-enhancement technologies. Innovations in sensor-based devices and AI-powered monitoring tools are also transforming how elderly individuals manage their daily routines, enhancing independence and safety.

- By Service

On the basis of service, the elderly care market is segmented into institutional care, homecare, and adult day care. The institutional care segment accounted for the largest market share of 47.8% in 2024, due to the high demand for skilled nursing facilities, assisted living centers, and rehabilitation services for elderly individuals with severe or chronic health conditions. The availability of professional care staff and specialized infrastructure contributes to the segment’s leadership.

The homecare segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing preference for aging-in-place and the expansion of home-based care services supported by remote monitoring technologies and telehealth. Family-centric care models and personalized service plans are also enhancing the attractiveness of homecare services, particularly in developed economies.

- By Application

On the basis of application, the elderly care market is segmented into heart diseases, cancer, kidney diseases, diabetes, arthritis, osteoporosis, neurological, respiratory, and others. The heart diseases segment dominates the market with the largest revenue share of 23.6% in 2024, driven by the high global prevalence of cardiovascular conditions among the elderly population. The need for long-term care, medication adherence, and regular monitoring significantly drives this segment.

The neurological disorders segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by the rising incidence of Alzheimer’s disease, Parkinson’s disease, and other cognitive impairments. The development of digital cognitive therapies, memory care programs, and assistive technologies focused on mental health is creating new growth avenues within this application category.

Elderly Care Market Regional Analysis

- North America dominates the elderly care market with the largest revenue share of 42.26% in 2024, driven by a rapidly aging population, rising healthcare expenditures, and an increasing focus on personalized in-home care solutions

- The region benefits from a well-developed healthcare infrastructure, widespread insurance coverage for senior care services, and significant investments in digital health and telemedicine technologies

- The preference for aging in place, along with growing awareness of the benefits of professional elder care, is encouraging families to opt for home-based services, fueling further market expansion

U.S. Elderly Care Market Insight

The U.S. elderly care market captured the largest share within North America in 2024, primarily due to the country’s advanced healthcare ecosystem, high life expectancy, and increasing demand for independent living solutions for seniors. With rising chronic disease prevalence and caregiver shortages, the market is witnessing strong growth in home healthcare, palliative care, and telehealth services. In addition, government initiatives such as Medicare and Medicaid support, along with funding for senior wellness programs, are pivotal in driving market momentum.

Europe Elderly Care Market Insight

The Europe elderly care market is expected to witness robust growth during the forecast period, propelled by an aging population, supportive public healthcare policies, and strong regulatory oversight for elderly well-being. Countries across Europe are increasingly investing in smart elder care facilities and integrating assistive technologies to enhance care quality and efficiency. The growing trend of community-based care and early discharge from hospitals is pushing demand for professional home and nursing care services.

U.K. Elderly Care Market Insight

The U.K. elderly care market is projected to grow significantly, backed by a well-established healthcare system (NHS) and a rising number of people aged over 65. Increased funding for social care and national strategies aimed at supporting older adults in independent living are shaping the market dynamics. Technological innovations such as remote monitoring, fall detection, and AI-based health tracking are being rapidly adopted, further accelerating growth.

Germany Elderly Care Market Insight

The Germany elderly care market is forecasted to expand steadily, driven by its aging demographic, high healthcare spending, and strong focus on elder autonomy. Government subsidies and statutory long-term care insurance are enabling access to professional care services both at home and in institutional settings. Germany’s leadership in healthcare technology integration is enhancing the effectiveness and reach of elderly care providers across the country.

Asia-Pacific Elderly Care Market Insight

The Asia-Pacific elderly care market is expected region for the fastest growth at a CAGR of 18.22% from 2025 to 2032, supported by large aging populations and rising economic development in countries such as China, Japan, and India. Rapid urbanization and increased healthcare spending are facilitating the expansion of elderly care infrastructure, including nursing homes, assisted living, and geriatric hospitals. Government initiatives such as Japan’s “Community-based Integrated Care System” and China’s policies for senior welfare are further reinforcing the regional market.

Japan Elderly Care Market Insight

The Japan elderly care market is expanding rapidly due to the country’s super-aged society, with over 28% of the population aged 65 or older. The government is heavily investing in robotic care assistants, remote health monitoring, and AI-based diagnostics to support aging in place and reduce caregiver strain. The integration of smart home systems with elder care services and a high focus on dementia and mobility support solutions are driving market penetration.

China Elderly Care Market Insight

The China elderly care market held the largest revenue share in the Asia-Pacific region in 2024, fueled by a growing middle class, extended life expectancy, and rising demand for professional care. Policies such as the “Healthy China 2030” initiative and large-scale infrastructure projects for elderly communities are central to market growth. The expansion of domestic elder care brands and the affordability of services, along with partnerships with foreign players, are enhancing access to quality care solutions across the country.

Elderly Care Market Share

The elderly care industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Amedisys (U.S.)

- ECON Healthcare Group (Singapore)

- Encompass Health Corporation (U.S.)

- EXTENDICARE (Canada)

- LHC Group, Inc. (U.S.)

- Medtronic (Ireland)

- ElderCareCanada (Canada)

- Exceptional Living Centers (U.S.)

- Right at Home, LLC (U.S.)

- BAYADA Home Health Care (U.S.)

- United Medicare Pte Ltd (Singapore)

- Trinity Health (U.S.)

- Rosewood Care Group (Australia)

- ST LUKE'S ELDERCARE LTD (Singapore)

- Compassus (U.S.)

- Home Instead, Inc. (U.S.)

- Interim HealthCare Inc. (U.S.)

- Living Assistance Services (Canada)

Latest Developments in Global Elderly Care Market

- In November 2024, Bangalore-based hospital chain Aster DM Healthcare and U.S.-based private equity firm Blackstone-owned Quality Care India reached the final stages of a merger, with Blackstone anticipated to acquire a majority stake in the merged entity. This strategic move is expected to create a major healthcare conglomerate in India, significantly broadening the operational scale and service capabilities of both entities. This merger is poised to transform the Indian healthcare landscape by enhancing accessibility and integrated care

- In May 2024, Kites Senior Care, a geriatric care service provider, raised USD 5.33 million in a Series A funding round led by Ranjan Pai, chairman of Manipal Education and Medical Group (MEMG). The company plans to utilize the funds to strengthen its presence in Hyderabad, Bengaluru, and Chennai, and to expand into three new cities across Southern India. This funding marks a pivotal step in Kites' mission to scale elderly care services in underserved urban markets

- In January 2023, Genesis Healthcare Inc. revealed plans to add 34 nursing homes in Pennsylvania as part of its expansion strategy. This move is expected to significantly enhance the company’s market share and boost overall revenue through broader regional coverage. This expansion reinforces Genesis Healthcare’s commitment to meeting increasing demand for elder care in the U.S.

- In March 2022, Ping An Insurance Company of China, Ltd., through its subsidiary Ping An Life, launched personalized home-based elderly care services. By integrating Ping An’s healthcare ecosystem and elderly care assets, the initiative provides comprehensive “one-stop” services paired with insurance protection for seniors. This service innovation aims to deliver accessible, affordable, and professional care solutions for China’s aging population

- In June 2021, Healthforce and Webrock Ventures announced a partnership to roll out telehealth services in South Africa, including scheduled and on-demand virtual consultations with healthcare professionals. This initiative was backed by a USD 3 million pre-Series A funding round. This venture is set to increase healthcare accessibility and modernize medical consultations in emerging African markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.