Global Electric Construction Equipment Market

Market Size in USD Billion

CAGR :

%

USD

13.82 Billion

USD

47.93 Billion

2024

2032

USD

13.82 Billion

USD

47.93 Billion

2024

2032

| 2025 –2032 | |

| USD 13.82 Billion | |

| USD 47.93 Billion | |

|

|

|

|

What is the Global Electric Construction Equipment Market Size and Growth Rate?

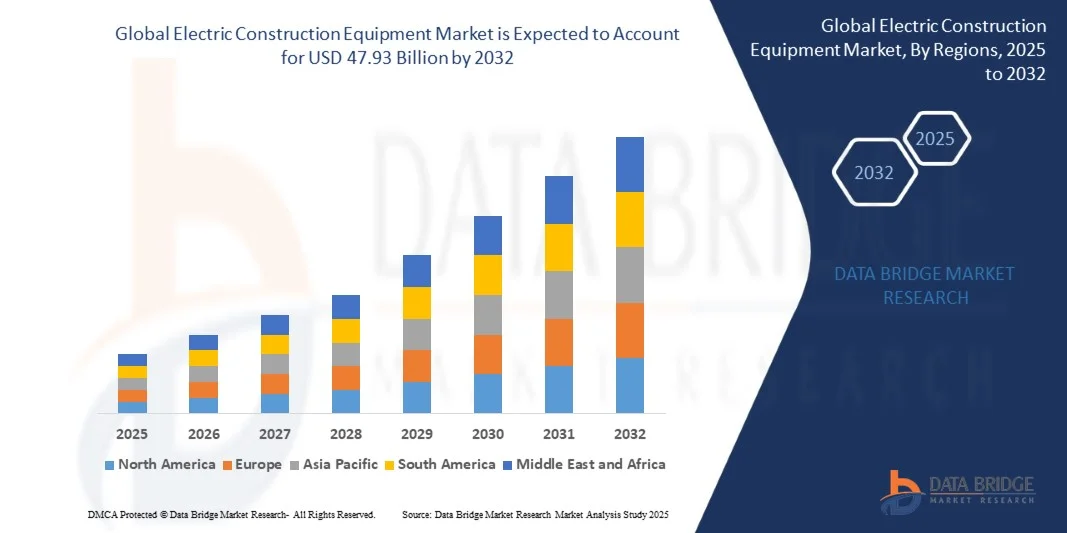

- The global electric construction equipment market size was valued at USD 13.82 billion in 2024 and is expected to reach USD 47.93 billion by 2032, at a CAGR of 16.82% during the forecast period

- The market expansion is primarily driven by the increasing adoption of smart and connected construction machinery, coupled with technological advancements in electric power systems and energy-efficient solutions

- In addition, the rising focus on reducing carbon emissions and improving operational efficiency in construction projects is positioning electric construction equipments as the preferred solution for modern construction operations, thereby significantly boosting industry growth

What are the Major Takeaways of Electric Construction Equipment Market?

- Electric construction equipments, offering electric or hybrid-powered construction machinery such as excavators, loaders, and cranes, are becoming essential in enhancing sustainability, reducing fuel dependency, and minimizing operational costs in construction sites

- The growing demand is propelled by the push towards green construction practices, stricter environmental regulations, and the need for quieter, low-emission, and energy-efficient construction operations in urban and industrial settings

- North America dominated the electric construction equipment market with the largest revenue share of 36.21% in 2024, driven by high adoption of technologically advanced construction machinery, increasing focus on energy efficiency, and awareness of sustainable solutions

- The Asia-Pacific electric construction equipment market is poised to grow at the fastest CAGR of 7.25% during the forecast period of 2025 to 2032, driven by rapid urbanization, infrastructure development, and rising investments in energy-efficient construction technologies across China, Japan, India, and South Korea

- The excavators segment dominated the market with a revenue share of 38.5% in 2024, driven by their extensive use in residential, industrial, and large-scale infrastructure projects

Report Scope and Electric Construction Equipment Market Segmentation

|

Attributes |

Electric Construction Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Construction Equipment Market?

“Electrification and Automation Driving Efficiency and Sustainability”

- A major and accelerating trend in the global electric construction equipment market is the adoption of electric powertrains combined with automation and smart control technologies. This shift is enhancing operational efficiency, reducing emissions, and lowering operational costs across construction projects

- For instance, Caterpillar’s electric excavators and Komatsu’s hybrid loaders feature advanced battery management and real-time monitoring systems, enabling operators to optimize performance while reducing energy consumption. Similarly, Volvo Construction Equipment is integrating telematics with electric machinery to improve predictive maintenance and workflow planning

- Electric construction equipment with automated operation capabilities supports features such as autonomous digging, precision loading, and adaptive speed control, increasing productivity while minimizing human error. Integration with fleet management platforms allows centralized control and monitoring across construction sites

- This trend toward electrified and intelligent construction machinery is reshaping industry standards for sustainability and operational excellence. Consequently, manufacturers such as Sany, Hitachi, and Liebherr are developing fully electric and semi-autonomous solutions with enhanced energy efficiency and smart connectivity

- The demand for electric and automated construction equipment is rising globally, particularly in regions emphasizing green construction practices and cost-effective, energy-efficient operations

What are the Key Drivers of Electric Construction Equipment Market?

- The increasing need to reduce carbon emissions and comply with environmental regulations is a major driver for the adoption of electric construction equipment. Companies and governments are pushing for cleaner, low-emission alternatives to traditional diesel-powered machinery

- For instance, in 2025, Komatsu and Caterpillar announced large-scale deployment of electric excavators and loaders in European construction projects to meet stringent emission targets, signaling a growing market opportunity

- Rising fuel costs and the desire for lower total cost of ownership are driving construction companies toward electric alternatives that offer energy savings, reduced maintenance requirements, and longer lifecycle performance

- Furthermore, growing awareness of sustainable construction practices among developers, coupled with incentives for green machinery, is accelerating market growth. Electric construction equipment also offers enhanced noise reduction, making them suitable for urban construction sites

- The integration of telematics, battery management systems, and automated functionalities adds convenience and efficiency, motivating wider adoption across residential, industrial, and infrastructure projects

Which Factor is Challenging the Growth of the Electric Construction Equipment Market?

- High upfront costs of electric construction machinery compared to conventional diesel-powered equipment pose a significant barrier, particularly for small and medium-sized enterprises in developing regions

- For instance, despite operational savings, electric excavators from Caterpillar or Komatsu remain expensive, making adoption slower in price-sensitive markets

- Limited charging infrastructure at construction sites and concerns over battery life and downtime are also key challenges, restricting widespread adoption

- While battery technology is improving, heavy-duty construction projects often demand extended operational hours, which current battery solutions may not fully support

- Overcoming these challenges through battery innovations, cost reductions, scalable charging infrastructure, and financing solutions will be essential for sustained growth of the electric construction equipment market

How is the Electric Construction Equipment Market Segmented?

The market is segmented on the basis of vehicles, source, and end use.

- By Vehicles

On the basis of vehicles, the electric construction equipment market is segmented into excavators, loaders, cranes, and others. The excavators segment dominated the market with a revenue share of 38.5% in 2024, driven by their extensive use in residential, industrial, and large-scale infrastructure projects. Excavators are increasingly preferred in electric variants due to their high energy efficiency, reduced operational costs, and lower emissions compared to traditional diesel models. They are widely adopted for digging, trenching, and earth-moving tasks, making them indispensable in construction and industrial operations.

The loaders segment is anticipated to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by growing demand for energy-efficient, versatile machinery capable of handling material transport, loading, and site clearance. Electric loaders also benefit from technological advancements such as regenerative braking and battery-powered operation, which improve productivity while minimizing environmental impact. These trends are driving robust growth across both urban and large-scale construction projects.

- By Source

On the basis of source, the electric construction equipment market is segmented into lithium-ion, lead-acid, and others. The lithium-ion segment dominated the market with a revenue share of 52.3% in 2024, owing to its high energy density, longer battery life, and ability to deliver consistent power for heavy-duty applications. Lithium-ion technology enables longer operational hours, faster charging cycles, and reduced maintenance requirements, making it the preferred choice for modern electric construction machinery.

The lead-acid segment is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by its cost-effectiveness and suitability for smaller or less energy-intensive equipment. Lead-acid batteries are still widely used in emerging markets where affordability is a key consideration, and manufacturers are improving their efficiency and lifespan. The growing focus on sustainability, energy efficiency, and operational savings is accelerating adoption across both developed and developing regions.

- By End Use

On the basis of end use, the electric construction equipment market is segmented into residential, construction, and industrial applications. The construction segment dominated the market with a revenue share of 45.7% in 2024, fueled by large-scale infrastructure projects, urban development, and the adoption of electrified machinery for reduced emissions and lower operating costs. Construction companies increasingly prefer electric machinery to meet regulatory requirements for sustainable operations and to reduce noise pollution in urban areas.

The industrial segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032, driven by the adoption of electric equipment in factories, warehouses, and logistics operations, where efficiency, precision, and environmental compliance are critical. Industrial end-users are increasingly leveraging battery-powered machinery to reduce operational expenses while maintaining high productivity, further accelerating market growth.

Which Region Holds the Largest Share of the Electric Construction Equipment Market?

- North America dominated the electric construction equipment market with the largest revenue share of 36.21% in 2024, driven by high adoption of technologically advanced construction machinery, increasing focus on energy efficiency, and awareness of sustainable solutions

- Consumers and industrial operators in the region value the operational cost savings, reduced emissions, and enhanced safety features offered by electric construction equipments, supporting widespread adoption

- This dominance is further bolstered by well-developed infrastructure, supportive government policies, and strong industrial investments, positioning North America as a key hub for electric construction machinery across residential, commercial, and industrial projects

U.S. Electric Construction Equipment Market Insight

The U.S. electric construction equipment market captured the largest revenue share of 71% in 2024 within North America, driven by rapid adoption of battery-powered machinery in construction and industrial applications. Companies and contractors are increasingly integrating electric excavators, loaders, and cranes to comply with emission regulations and lower operational costs. The focus on sustainability, safety, and energy efficiency, combined with strong government incentives for green construction initiatives, further propels the market. The integration of advanced telematics, AI, and IoT for predictive maintenance and operational monitoring is also significantly contributing to market expansion.

Europe Electric Construction Equipment Market Insight

The Europe electric construction equipment market is expected to expand at a substantial CAGR during the forecast period, driven by stringent emission regulations, government incentives for green machinery, and growing demand for energy-efficient construction solutions. Countries such as Germany, France, and Italy are witnessing increased adoption of electric excavators and loaders in both urban infrastructure and industrial projects. In addition, European companies are integrating smart monitoring systems for real-time operational efficiency, lowering carbon footprints and operational costs. The residential and commercial construction sectors are rapidly incorporating electric construction machinery into both new projects and renovation initiatives, further boosting regional growth.

U.K. Electric Construction Equipment Market Insight

The U.K. electric construction equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the country’s focus on sustainability, emissions reduction, and smart construction practices. Builders and contractors are increasingly opting for electric-powered excavators, loaders, and cranes due to lower operating costs, reduced noise, and zero-emission operations in urban settings. The rise in infrastructure projects, along with supportive policies for clean energy adoption in the construction sector, is expected to drive further growth.

Germany Electric Construction Equipment Market Insight

The Germany electric construction equipment market is projected to expand significantly during the forecast period, driven by advanced industrial infrastructure, technological innovation, and regulatory push toward low-emission construction equipment. German manufacturers and construction firms are increasingly deploying electric machinery for both commercial and industrial projects, leveraging automation, predictive maintenance, and IoT-enabled monitoring for operational efficiency. The emphasis on sustainability and eco-friendly construction practices positions Germany as a leading adopter of electric construction equipment in Europe.

Which Region is the Fastest Growing Region in the Electric Construction Equipment Market?

The Asia-Pacific electric construction equipment market is poised to grow at the fastest CAGR of 7.25% during the forecast period of 2025 to 2032, driven by rapid urbanization, infrastructure development, and rising investments in energy-efficient construction technologies across China, Japan, India, and South Korea. The growing focus on sustainability, government incentives, and increasing affordability of electric machinery are driving adoption. Moreover, APAC is emerging as a manufacturing hub for electric construction equipment components, enhancing accessibility and cost-effectiveness for regional buyers.

Japan Electric Construction Equipment Market Insight

The Japan electric construction equipment market is gaining momentum due to high technological adoption, a focus on energy efficiency, and the growing trend of smart infrastructure projects. Electric excavators, loaders, and cranes are increasingly deployed in residential, commercial, and industrial projects. The aging workforce also encourages the adoption of easier-to-operate electric machinery, integrating automation and telematics for enhanced productivity and safety.

China Electric Construction Equipment Market Insight

The China electric construction equipment market accounted for the largest revenue share in Asia-Pacific in 2024, supported by massive infrastructure projects, expanding industrial operations, and a strong push toward low-emission construction solutions. The increasing availability of affordable electric construction machinery, combined with local manufacturing capabilities and government policies supporting green construction, is driving widespread adoption across residential, commercial, and industrial applications.

Which are the Top Companies in Electric Construction Equipment Market?

The electric construction equipment industry is primarily led by well-established companies, including:

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- AB Volvo (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Deere & Company (U.S.)

- Sany Heavy Industry Co., Ltd. (China)

- JCB (UK)

- HD Hyundai Infracore Co., Ltd. (South Korea)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Liebherr (Switzerland)

- Xuzhou Construction Machinery Group Co., Ltd. (China)

What are the Recent Developments in Global Electric Construction Equipment Market?

- In April 2024, Volvo Construction Equipment (Volvo CE) announced plans to introduce the largest electric excavator in Japan, highlighting the company’s focus on sustainability and innovation in construction machinery. This launch is set to strengthen Volvo CE’s position in the eco-friendly equipment segment and cater to Japan’s growing demand for green construction solutions

- In March 2024, Sumitomo Corporation’s subsidiary, Sunstate Equipment Co., completed the full acquisition of Trench Shore Rentals, Inc., a leading U.S.-based trench safety equipment rental company, aiming to expand their construction equipment portfolio. This strategic move enhances their market presence and provides greater access to the North American construction sector

- In December 2021, Hitachi developed an electric excavator capable of operating for 10 hours on a single charge, representing a major technological advancement in construction machinery. This innovation is expected to significantly improve efficiency and sustainability in construction operations

- In September 2021, Volvo achieved a 45% reduction in CO2 emissions from their vehicles, reflecting the company’s strong commitment to electric and hybrid construction equipment. This achievement underlines Volvo’s leadership in environmentally responsible construction solutions

- In March 2021, Caterpillar Inc. launched the Cat 794AC, an electric drive articulated truck designed to enhance efficiency and productivity in construction projects. This launch strengthens Caterpillar’s position in the electric construction equipment market and supports the industry’s transition to sustainable operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.