Global Electric Pick Up Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

9.89 Billion

USD

80.70 Billion

2024

2032

USD

9.89 Billion

USD

80.70 Billion

2024

2032

| 2025 –2032 | |

| USD 9.89 Billion | |

| USD 80.70 Billion | |

|

|

|

|

What is the Global Electric Pick Up Vehicle Market Size and Growth Rate?

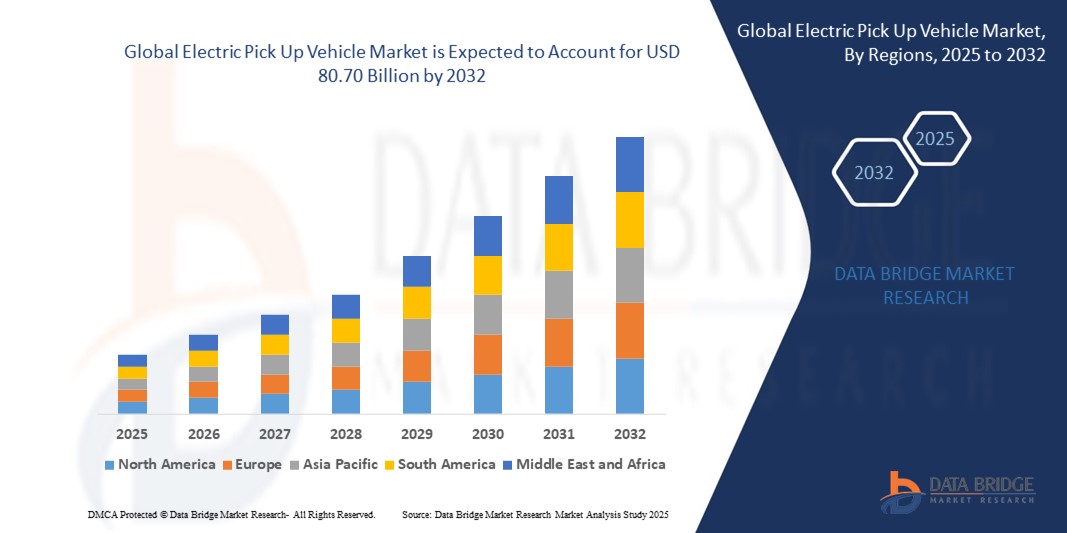

- The global Electric Pick Up Vehicle market size was valued at USD 9.89 billion in 2024 and is expected to reach USD 80.70 billion by 2032, at a CAGR of 30.00% during the forecast period

- The global electric pickup market is experiencing significant growth, driven by rising fuel costs, increasing environmental concerns, and advancements in battery technology. This market offers eco-friendly alternatives to traditional gasoline-powered trucks, catering to consumers and businesses seeking powerful and sustainable transportation. This report explores the market landscape, analyzes key segments, and identifies promising growth opportunities

What are the Major Takeaways of Electric Pick Up Vehicle Market?

- Rising awareness of climate change serves as a significant driver for the global electric pick-up vehicle market. As the adverse effects of climate change become increasingly apparent, there is a growing recognition of the urgent need to reduce greenhouse gas emissions and transition towards sustainable transportation solutions

- Electric pick-up vehicles offer a promising alternative to traditional fuel-powered trucks, as they produce lower emissions and contribute to mitigating climate change. The escalating awareness of environmental issues among consumers, businesses, and governments drives demand for electric pick-up vehicles, incentivizing manufacturers to innovate and expand their electric vehicle offerings

- North America dominated the electric pick up vehicle market with the largest revenue share of 41.47% in 2024, driven by the rapid adoption of electric mobility solutions, favorable government incentives, and growing investments in EV infrastructure

- Asia-Pacific (APAC) market is poised to record the fastest CAGR of 9.14% from 2025 to 2032, attributed to rapid urbanization, rising disposable incomes, and aggressive EV adoption policies in China, Japan, and India

- The Battery Electric Vehicle (BEV) segment dominated the electric pick-up vehicle market with the largest market revenue share of 64.5% in 2024, driven by strong adoption in the U.S., China, and Europe due to declining battery costs, supportive charging infrastructure, and zero-emission policies

Report Scope and Electric Pick Up Vehicle Market Segmentation

|

Attributes |

Electric Pick Up Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Electric Pick Up Vehicle Market?

Enhanced Convenience Through AI and Voice Integration

- A major emerging trend in the global electric pick up vehicle market is the adoption of artificial intelligence (AI) and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple CarPlay. These technologies are reshaping driving experiences by enhancing comfort, safety, and hands-free functionality

- For instance, Rivian’s R1T integrates with Alexa for voice commands, allowing drivers to adjust vehicle settings or navigation without distraction. Similarly, Ford’s F-150 Lightning features voice-enabled smart assistant functions for seamless infotainment and system control

- AI-powered features such as predictive route planning, battery optimization, and driver behavior analysis are increasingly embedded into electric pickup vehicles, making them smarter and more adaptive

- The integration with connected ecosystems allows owners to control vehicle functions alongside smart home devices, offering centralized convenience

- This rising demand for AI-enabled, voice-assisted pickups is setting a new benchmark for innovation in the automotive industry, driving both consumer adoption and competition among manufacturers

What are the Key Drivers of Electric Pick Up Vehicle Market?

- The growing adoption of electric mobility, driven by sustainability goals and government incentives, is a major factor fueling demand for electric pickup vehicles. Increasing focus on reducing carbon emissions is pushing automakers to expand EV pickup portfolios

- For instance, in March 2024, Tesla, Inc. began large-scale deliveries of its Cybertruck, marking a key milestone for EV pickup adoption in the U.S. Such developments highlight the shift towards eco-friendly yet performance-driven vehicles

- Rising consumer interest in smart, connected, and high-performance pickups is accelerating the transition from traditional ICE pickups to electric alternatives, particularly in North America and China

- The convenience of fast charging, long-range capabilities, and advanced connectivity is making electric pickups attractive to both individual buyers and commercial fleets

- In addition, growing infrastructure support for EV charging stations, along with falling battery prices, is expected to further accelerate market penetration in the forecast period

Which Factor is Challenging the Growth of the Electric Pick Up Vehicle Market?

- A major challenge hindering adoption is the limited charging infrastructure in rural and long-haul regions, where pickup trucks are most widely used. Despite improvements, range anxiety continues to be a concern for many consumers

- For instance, reports of insufficient fast-charging networks in the U.S. Midwest and remote Canadian regions have raised doubts among potential EV pickup buyers

- Another key challenge is the high upfront cost of electric pickup vehicles compared to traditional ICE models. Premium EV pickups with advanced features and long-range capabilities remain expensive, limiting adoption among cost-sensitive buyers

- In addition, battery weight and durability concerns pose challenges, as heavy-duty users often require vehicles capable of towing and hauling under demanding conditions

- Overcoming these issues will require expanded charging infrastructure, affordable EV pickup options, and battery innovation to ensure long-term durability and accessibility for mainstream consumers

How is the Electric Pick Up Vehicle Market Segmented?

The market is segmented on the basis of propulsion, vehicle type, range, and automation level.

- By Propulsion

On the basis of propulsion, the electric pick-up vehicle market is segmented into Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV), and Plug-in Hybrid Electric Vehicles (PHEV). The Battery Electric Vehicle (BEV) segment dominated the electric pick-up vehicle market with the largest market revenue share of 64.5% in 2024, driven by strong adoption in the U.S., China, and Europe due to declining battery costs, supportive charging infrastructure, and zero-emission policies. BEVs are increasingly favored by consumers and fleet operators for their lower running costs and enhanced driving ranges.

The Fuel Cell Electric Vehicle (FCEV) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by government incentives in Japan, South Korea, and the U.S., along with the growing development of hydrogen refueling infrastructure. Their longer range and quick refueling make them an attractive option for commercial and long-haul applications.

- By Vehicle Type

On the basis of vehicle type, the electric pick-up vehicle market is segmented into Medium & Heavy Commercial Vehicles (MHCV) and Light Commercial Vehicles (LCV). The Light Commercial Vehicle (LCV) segment dominated the Electric Pick-Up Vehicle market with the largest revenue share of 57.8% in 2024, driven by high demand in logistics, e-commerce deliveries, and small fleet operations. LCVs are more cost-effective, benefit from government subsidies, and have quicker adoption rates due to flexible usage across both urban and semi-urban routes.

The Medium & Heavy Commercial Vehicle (MHCV) segment is anticipated to register the fastest CAGR from 2025 to 2032, propelled by fleet electrification programs in the logistics and construction industries. Governments pushing for net-zero emissions in heavy-duty transport are also accelerating the adoption of MHCV electric pick-ups.

- By Range

On the basis of range, the electric pick-up vehicle market is segmented into Less than 200 Miles and More than 200 Miles. The More than 200 Miles segment dominated the Electric Pick-Up Vehicle market with the largest revenue share of 68.9% in 2024, driven by technological advancements in battery chemistry and increasing consumer preference for long-range vehicles, particularly in the U.S. and Europe. Leading automakers are introducing extended-range models to cater to both urban and intercity transport demands.

The Less than 200 Miles segment is expected to witness the fastest CAGR from 2025 to 2032, supported by affordability, lower battery requirements, and adoption in last-mile delivery fleets. This category is particularly attractive in emerging markets where cost sensitivity drives purchase decisions.

- By Automation Level

On the basis of automation level, the electric pick-up vehicle market is segmented into Semi-Autonomous and Fully Autonomous vehicles. The Semi-Autonomous segment held the largest market revenue share of 71.2% in 2024, driven by the integration of advanced driver assistance systems (ADAS), lane-keeping, adaptive cruise control, and partial automation technologies widely available in current electric pick-up models. These features balance affordability with enhanced safety and convenience for drivers.

The Fully Autonomous segment is projected to witness the fastest CAGR from 2025 to 2032, backed by rapid advancements in AI, machine learning, and sensor technologies. Partnerships between automakers and tech companies, along with pilot projects for autonomous logistics and ride-sharing fleets, are expected to fuel growth in this category.

Which Region Holds the Largest Share of the Electric Pick Up Vehicle Market?

- North America dominated the electric pick up vehicle market with the largest revenue share of 41.47% in 2024, driven by the rapid adoption of electric mobility solutions, favorable government incentives, and growing investments in EV infrastructure

- Consumers in the region are increasingly inclined towards sustainable transportation, enhanced vehicle performance, and seamless integration of EVs with advanced digital technologies

- This growth is further supported by strong purchasing power, a robust EV manufacturing ecosystem, and the rising demand for zero-emission fleets, positioning Electric Pick Up Vehicles as a mainstream mobility option

U.S. Electric Pick Up Vehicle Market Insight

U.S. captured the largest revenue share in 2024 within North America, fueled by early adoption of EVs and growing popularity of electric pickup models among both personal and commercial users. Consumers value high-performance EVs with extended range, fast-charging capabilities, and smart connectivity features. Moreover, leading automakers such as Tesla, Ford, and Rivian are spearheading innovation and expanding production capacity, which is significantly driving market growth in the country.

Europe Electric Pick Up Vehicle Market Insight

Europe electric pick up vehicle market is projected to grow at a substantial CAGR throughout the forecast period, supported by stringent emission regulations and strong government support for EV adoption. Rising urbanization, combined with increased investments in EV charging networks, is encouraging adoption across both personal and fleet applications. European consumers are also highly receptive to the sustainability and energy efficiency offered by electric pickups, driving demand in residential, commercial, and industrial sectors.

U.K. Electric Pick Up Vehicle Market Insight

U.K. market is expected to grow at a noteworthy CAGR, propelled by the country’s push towards achieving net-zero emissions and rapid development of EV infrastructure. Rising concerns about environmental sustainability and fuel cost savings are motivating consumers and businesses to switch to electric pickups. In addition, strong government policies, tax incentives, and the expansion of last-mile delivery services are expected to further accelerate market growth in the U.K.

Germany Electric Pick Up Vehicle Market Insight

Germany market is anticipated to expand at a considerable CAGR, driven by the country’s engineering excellence and focus on green mobility solutions. The strong presence of leading automakers and suppliers, coupled with innovation in EV technology, is fueling adoption. Germany’s advanced charging infrastructure and sustainability-focused policies are also encouraging integration of electric pick up vehicles into both private and commercial fleets, supporting long-term growth.

Which Region is the Fastest Growing Region in the Electric Pick Up Vehicle Market?

Asia-Pacific (APAC) market is poised to record the fastest CAGR of 9.14% from 2025 to 2032, attributed to rapid urbanization, rising disposable incomes, and aggressive EV adoption policies in China, Japan, and India. The region is becoming a global hub for EV manufacturing, with strong government backing, cost-effective production, and expanding charging infrastructure. This is making electric pick up vehicles more affordable and accessible, driving mass adoption across diverse consumer groups.

Japan Electric Pick Up Vehicle Market Insight

Japan market is experiencing strong growth, supported by the country’s tech-savvy culture, rapid urbanization, and strong environmental goals. Japanese consumers are prioritizing advanced, convenient, and secure electric mobility solutions. The integration of electric pickups with smart city initiatives and IoT-based vehicle systems is fueling adoption, while the country’s aging population is further boosting demand for user-friendly, low-maintenance EVs.

China Electric Pick Up Vehicle Market Insight

China market held the largest revenue share within APAC in 2024, driven by the nation’s expanding EV ecosystem, rising middle-class population, and aggressive government mandates for green mobility. With strong domestic manufacturing capabilities and cost-efficient EV production, China is a global leader in the adoption of electric pickups. The expansion of smart city projects and availability of affordable EV options are further accelerating widespread adoption across both consumer and commercial applications.

Which are the Top Companies in Electric Pick Up Vehicle Market?

The electric pick up vehicle industry is primarily led by well-established companies, including:

- Tesla, Inc. (U.S.)

- General Motors Company (U.S.)

- Ford Motor Company (U.S.)

- Rivian Automotive, Inc. (U.S.)

- Bollinger Motors (U.S.)

- Lordstown Motors Corp. (U.S.)

- Workhorse Group Inc. (U.S.)

- Nikola Corporation (U.S.)

- Atlis Motor Vehicles (U.S.)

- Canoo Inc. (U.S.)

- Fisker Inc. (U.S.)

- Arrival Ltd. (U.K.)

- Ford Otosan (Turkey)

- BYD Company Limited (China)

- Xpeng Inc. (China)

- NIO Inc. (China)

- Great Wall Motors Company Limited (China)

- Mahindra & Mahindra Limited (India)

- Tata Motors Limited (India)

- Rivian Automotive Canada Inc. (Canada)

What are the Recent Developments in Global Electric Pick Up Vehicle Market?

- In March 2024, Rivian, the American electric vehicle manufacturer, announced plans to launch its popular R1T electric pickup truck in European markets. The R1T is recognized for its exceptional range, performance, and off-road capabilities, and this expansion strengthens Rivian’s global market presence

- In February 2024, Ford revealed an extended-range battery option for its best-selling F-150 Lightning electric pickup truck, expected to deliver over 300 miles on a single charge. This upgrade directly addresses range concerns of potential buyers and further consolidates the F-150 Lightning’s position in the competitive electric pickup segment

- In May 2023, Freightliner introduced the series production eM2 for pickup and delivery applications, ready for orders with production commencing in fall 2023. This move highlights Freightliner’s commitment to expanding electric options for commercial fleets and enhancing customer adoption

- In April 2023, Daimler Truck launched a new electric medium-duty truck brand in the U.S., named Rizon, featuring Class 4 and 5 trucks equipped with lithium iron phosphate batteries. The introduction of Rizon marks Daimler’s strategic entry into the U.S. medium-duty EV market, broadening its product portfolio

- In May 2022, Daimler and Sysco signed a contract to purchase 800 Freightliner eCascadia electric trucks, with the first deliveries scheduled by year-end and full deployment by 2026. This large-scale order represents a significant step toward electrifying 35% of Sysco’s fleet and accelerating the transition to sustainable logistics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.