Global Electrochromic Glass And Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.50 Billion

USD

9.17 Billion

2024

2032

USD

3.50 Billion

USD

9.17 Billion

2024

2032

| 2025 –2032 | |

| USD 3.50 Billion | |

| USD 9.17 Billion | |

|

|

|

|

Electrochromic Glass and Devices Market Size

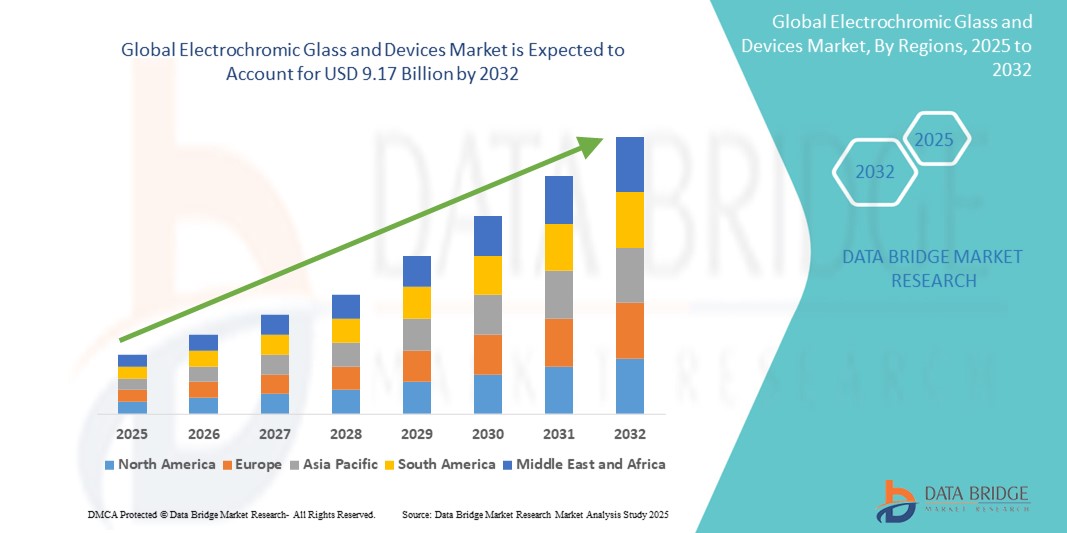

- The global electrochromic glass and devices market size was valued at USD 3.5 billion in 2024 and is expected to reach USD 9.17 billion by 2032, at a CAGR of 12.80% during the forecast period

- This growth is driven by factors such as rising demand for energy-efficient smart glass solutions in the construction and transportation sectors, real-world adoption in commercial infrastructure, and advancements in electrochromic material technology

Electrochromic Glass and Devices Market Analysis

- Electrochromic glass and devices are advanced materials that can reversibly change their light transmission properties when a voltage is applied. These smart glass technologies are increasingly used in applications such as building facades, automotive windows, aircraft cabins, and interior partitions to control light, glare, and heat

- The demand for electrochromic glass is significantly driven by growing concerns over energy consumption in buildings and vehicles, increased preference for green construction, and integration of IoT-based dynamic glazing systems

- North America is expected to dominate the electrochromic glass and devices market with a market share of 38.50%, due to the rapid adoption of smart building technologies, strong government initiatives for energy-efficient infrastructure, and increasing installations in commercial and residential sectors

- Asia-Pacific is expected to be the fastest-growing region in the electrochromic glass and devices market during the forecast period, holding a market share of 27.60%, driven by growing urbanization, increasing smart city projects, and rising investments in modern transportation systems.

- Windows segment is expected to dominate the market with a market share of 48.65% due to their widespread use in architectural and transportation applications. As the primary product in smart glass installations, electrochromic windows enable precise control over light and solar heat gain, enhancing both energy efficiency and user comfort. With growing emphasis on green building design and net-zero energy structures, continuous innovations in window-integrated electrochromic technologies are expanding adoption across commercial, residential, and institutional buildings

Report Scope and Electrochromic Glass and Devices Market Segmentation

|

Attributes |

Electrochromic Glass and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrochromic Glass and Devices Market Trends

“Advancements in Smart Glass Technologies for Sustainable Architecture”

- One prominent trend in the evolution of electrochromic glass and devices is the increasing integration of IoT and AI technologies for enhanced functionality in building management systems

- These innovations allow for automated light and heat control based on real-time environmental data, significantly improving the energy efficiency of commercial and residential buildings

- For instance, smart glasses systems are now designed to automatically adjust to optimal light levels, reducing the need for artificial lighting and HVAC energy consumption. This is especially beneficial in high-rise buildings and office complexes where window positioning and natural light play a crucial role in energy savings

- These advancements are transforming the architecture and construction industries, enabling the development of net-zero energy buildings, and driving the demand for electrochromic glass in green building projects

- The integration of electrochromic glass with smart building technologies is expected to become a significant trend as governments and corporations continue to push for sustainability and energy-efficient building solutions

Electrochromic Glass and Devices Market Dynamics

Driver

“Growing Awareness of Environmental Impact and Carbon Footprint Reduction”

- The increasing global awareness of environmental concerns, such as climate change and carbon emissions, is driving the demand for energy-efficient solutions like electrochromic glass

- As governments, businesses, and consumers become more environmentally conscious, there is a growing emphasis on reducing carbon footprints and adopting sustainable practices in construction and architecture

- Electrochromic glass contributes significantly to reducing energy usage by minimizing the need for artificial lighting and temperature regulation, thus lowering the carbon footprint of buildings

For instance,

- In September 2023, the European Union introduced new building standards aimed at reducing carbon emissions in the construction sector, further encouraging the adoption of sustainable technologies like electrochromic glass

- Architectural firms in North America are increasingly incorporating electrochromic glass in their green building projects to comply with Building Research Establishment Environmental Assessment Method (BREEAM) standards, which focus on minimizing environmental impact and promoting energy efficiency

Opportunity

“Integration of Smart Building Technologies with Electrochromic Glass”

- The growing demand for smart building technologies presents a significant opportunity for the electrochromic glass market. By integrating electrochromic glass with advanced building management systems, energy usage can be optimized automatically based on environmental data such as light levels, temperature, and occupancy

- These integrations enable real-time control of window tinting and glare reduction, leading to energy conservation, improved occupant comfort, and reduced operational costs for building owners. Smart glass technologies are crucial in achieving LEED certifications and smart city initiatives, both of which are gaining momentum globally

- In addition, IoT-based electrochromic glass allows for better data analytics on building performance, providing valuable insights into energy consumption patterns and helping building owners improve efficiency

For instance,

- In February 2024, Saint-Gobain introduced a new line of electrochromic glass that integrates with smart home automation systems. The glass adapts to changes in natural light and temperature, working in synergy with HVAC and lighting systems to optimize energy use across residential and commercial properties

- The continued evolution of IoT, AI, and data analytics in building design presents a strong growth opportunity for electrochromic glass, positioning it as an essential component in the future of energy-efficient, sustainable, and smart buildings

Restraint/Challenge

“High Initial Costs and Installation Barriers”

- The high upfront costs associated with electrochromic glass and devices pose a significant challenge, particularly for smaller businesses and residential property owners who may find it difficult to justify the initial investment

- Electrochromic glass installations can be expensive, often ranging from thousands to tens of thousands of dollars, depending on the application and scale. In addition, retrofitting existing buildings with smart glass involves significant labor and material costs, further increasing the financial barrier

- These substantial costs may deter some commercial property owners, particularly in developing markets, from adopting electrochromic glass technologies, slowing down market penetration in these regions

For instance,

- In December 2023, an article published by Guardian Glass highlighted the challenge of integrating electrochromic glass into existing buildings, noting that the high installation and maintenance costs are often a hurdle for developers, especially in markets where energy-efficient technologies are not yet mandatory

- Consequently, the high financial outlay required for electrochromic glass adoption can lead to slower market growth in certain regions and among smaller industry players, delaying the widespread adoption of this technology

Electrochromic Glass and Devices Market Scope

The market is segmented on the basis product, application, operation, and materials.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Operation |

|

|

By Materials

|

|

In 2025, the windows segment is projected to dominate the market with a largest share in application segment

In 2025, the windows segment is expected to dominate the electrochromic glass and devices market, accounting for around 48.65% of the market share. This growth is driven by the increasing demand for energy-efficient building solutions, especially in North America, which is projected to hold a 39.7% share. The region's focus on sustainability, along with rising adoption in commercial and residential buildings, fuels this demand. Meanwhile, Asia Pacific is anticipated to be the fastest-growing region, with a projected CAGR of 14.73%, driven by rapid urbanization and increasing environmental awareness

The commercial segment is expected to account for the largest share during the forecast period in technology market

In 2025, the Commercial segment is expected to dominate the global electrochromic glass and devices market, holding the largest market share of 42.5%. This is driven by the growing adoption of smart glass technologies in office buildings, retail spaces, and other commercial structures to improve energy efficiency and occupant comfort. The demand is particularly strong in North America, which is projected to capture a significant share of the market due to its focus on sustainable building practices. The Transmittance operation is also expected to lead, driven by the increased emphasis on dynamic light control in commercial and residential applications

Electrochromic Glass and Devices Market Regional Analysis

“North America Holds the Largest Share in the Electrochromic Glass and Devices Market”

- North America is expected to dominate the electrochromic glass and devices market with a market share of 38.50%, due to the rapid adoption of smart building technologies, strong government initiatives for energy-efficient infrastructure, and increasing installations in commercial and residential sectors

- U.S. is expected to dominate the global electrochromic glass and devices market, holding 39.7% market share in 2025, driven by high adoption of energy-efficient solutions and sustainable infrastructure investments

- The presence of key market players and the growing trend of smart windows in corporate and residential sectors further contribute to North America's dominance in this market

- In addition, stringent regulations promoting environmental sustainability and reducing carbon footprints are strengthening market growth across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Electrochromic Glass and Devices Market”

- Asia-Pacific is expected to be the fastest-growing region in the electrochromic glass and devices market during the forecast period, holding a market share of 27.60%, driven by growing urbanization, increasing smart city projects, and rising investments in modern transportation systems

- Countries such as China, India, and Japan are emerging as key markets due to their focus on smart city projects, urban development, and the growing demand for energy-efficient solutions in residential, commercial, and transportation sectors

- China and India, with their large populations and expanding infrastructure projects, are driving the adoption of electrochromic glass for energy efficiency in buildings and transportation systems

- Japan, known for its technological advancements and eco-friendly initiatives, continues to lead in the adoption of innovative smart glass solutions for architectural and automotive applications, further contributing to market growth in the region

Electrochromic Glass and Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SAGE Electrochromics (U.S.)

- Gentex Corporation (U.S.)

- AGC Inc. (Japan)

- Ubiquitous Energy (U.S.)

- Nippon Electric Glass Co., Ltd. (Japan)

- View Inc. (U.S.)

- Saint-Gobain (France)

- PPG Industries (U.S.)

- Chromogenics AB (Sweden)

- EControl-Glas GmbH & Co. KG (Germany)

- Smartglass International Ltd (Ireland)

- Asahi Glass Co. Ltd. (Japan)

- Guardian Industries (U.S.)

- RavenWindow (U.S.)

- Research Frontiers Inc. (U.S.)

Latest Developments in Global Electrochromic Glass and Devices Market

- In February 2024, View, Inc. introduced the View Smart Building Cloud, a cutting-edge software platform designed to integrate its electrochromic glass with smart building management systems. This innovative solution aims to optimize light, energy, and air quality control within buildings, enhancing sustainability and occupant comfort. By leveraging advanced technology, the platform enables seamless management of environmental factors, contributing to energy-efficient and healthier spaces. View Smart Building Cloud represents a significant step forward in smart building innovation

- In November 2023, Continental AG introduced its Intelligent Glass Control system at the Automotive Interiors Expo Europe. This innovative technology utilizes electrochromic glass to enhance vehicle functionality, offering applications in side windows and sunroofs. The system allows for dynamic control of transparency, improving privacy, reducing glare, and optimizing energy efficiency. By integrating advanced features, Intelligent Glass Control aims to elevate passenger comfort and vehicle sustainability. This launch highlights Continental AG's commitment to pioneering automotive solutions

- In June 2023, Asahi Glass Company (AGC) increased production capacity at its electrochromic materials facility in Japan to address the growing global demand, particularly from the Asia-Pacific construction industry. This expansion reflects AGC's commitment to supporting the rising adoption of electrochromic glass in sustainable architecture and energy-efficient buildings. By enhancing its manufacturing capabilities, AGC aims to meet the needs of the rapidly evolving market and strengthen its position as a leader in advanced glass technologies

- In April 2023, Halio Inc. collaborated with NSG Group to develop ultra-fast tinting electrochromic glass solutions tailored for commercial skyscrapers and airports. This partnership aims to enhance energy efficiency and occupant comfort through advanced glass technology. The innovative solutions are designed to provide dynamic light control, reducing glare and optimizing natural light. Pilot deployments of these cutting-edge glass systems commenced in Hong Kong and California, showcasing their potential in modern architectural projects

- In May 2023, leading automotive manufacturers such as Mercedes-Benz and Lucid Motors embraced panoramic electrochromic sunroofs and windshields to redefine cabin experiences in luxury electric vehicles (EVs). These advanced features enhance passenger comfort by offering dynamic light control, reducing glare, and improving energy efficiency. The adoption of electrochromic technology reflects the growing demand for innovative solutions in the luxury EV market, catering to both aesthetic and functional needs. This trend underscores the commitment of manufacturers to deliver futuristic and sustainable automotive designs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.